Generative AI in Banking Market By Technology (Natural Language Processing, Deep Learning, and others), By End-User (Retail Banking Customers, Small and Medium Enterprises, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

37972

-

April 2024

-

300

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

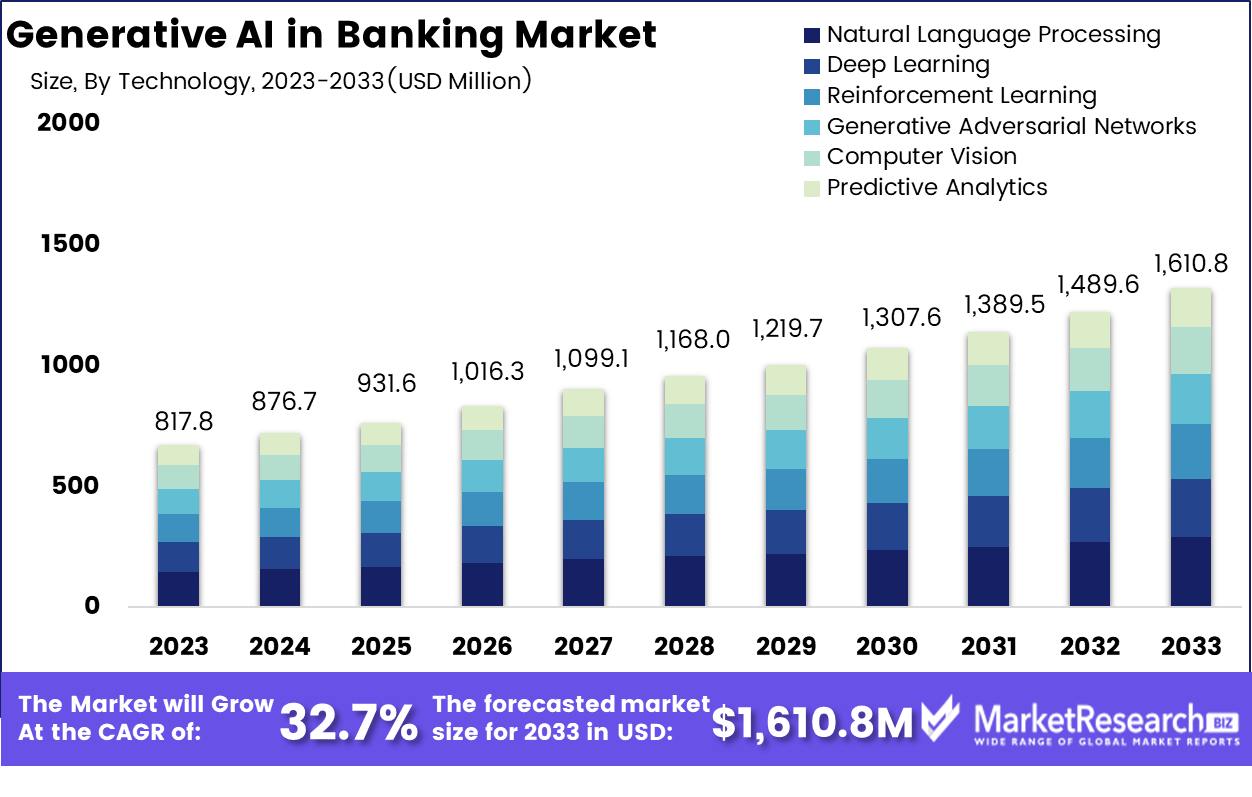

Generative AI in Banking Market size is expected to be worth around USD 1,610.8 Mn by 2033 from USD 817.8 Mn in 2023, growing at a CAGR of 32.7%. during the forecast period from 2024 to 2033.

The surge in demand for new advanced technologies and higher interest rates in the banking sector are some of the main key driving factors for generative AI in the banking market. GenAI is powered by machine learning models and is rapidly transforming the banking market. The banking sector is a huge field with various vertical sectors within it. In the banking sector, customers expect good satisfaction and higher interest rates. To fulfill the requirement of exceptional customer satisfaction, GenAI provides good customer service through an AI-based Chatbot, that uses GenAI for detecting fraud. It is also used for predicting financial trends with the help of ML and personalizing banking services for all individual requirements.

According to IBEF report published in November 2023, Indian Fintech sector is estimated to be reach USD 150 billion by 2025. Presently, there are more than 2,000 DPIIT- recognized financial technology which is known as FinTech businesses in India and this number will rapidly grow. Moreover, according to the BCG banking sector roundup report of 9M FY23, the credit growth is projected to rise by 18.1% in 2022 to 2023. In December 30, 2022 bank credit was at USD 1,610.31 billion. As per the RBI’s scheduled bank statement, the deposits of all scheduled banks up surged by USD 24.32 billion as on May 5,2023 at a significant growth of 10.2%. Additionally, On August 30, 2023 as per the data published by NPCI, UPI transactions reached USD 10.241 billion.

The adoption of generative AI in banking is about using smart computer programs to make banking services more effective, efficacy and customized which will help in making the financial life easier and safe. GenAI produces several innovative ideas and solutions for general banking tasks. For example, GenAI generates customized investment tactics based on individual’s financial goals that helps to develop new financial products that can provide to particular customer requirement.

There are several well-known financial giants who use GenAI application in banking such as Bank of America has implemented the use of GenAI to create virtual chatbot that resolve any customer’s query related to their account and money transactions. Similarly, Goldman Sachs executed the usage of GenAI to create innovative investment products that are personalized to the individual’s requirement of its customers. Moreover, Wells Fargo has carry out the usage of GenAI to automate the method of producing banking statements for its customers. The demand for the GenAI in banking will rapidly surge due to its requirement in many financial companies that will help in market expansion in the coming years.

Key Takeaways

- Market Value: Generative AI in Banking Market size is expected to be worth around USD 1,610.8 Mn by 2033 from USD 817.8 Mn in 2023, growing at a CAGR of 32.7%. during the forecast period from 2024 to 2033.

- Based on Technology: Generative AI revolutionizes banking with advanced natural language processing technology.

- Based on End-User: Retail banking customers benefit from generative AI's personalized financial solutions.

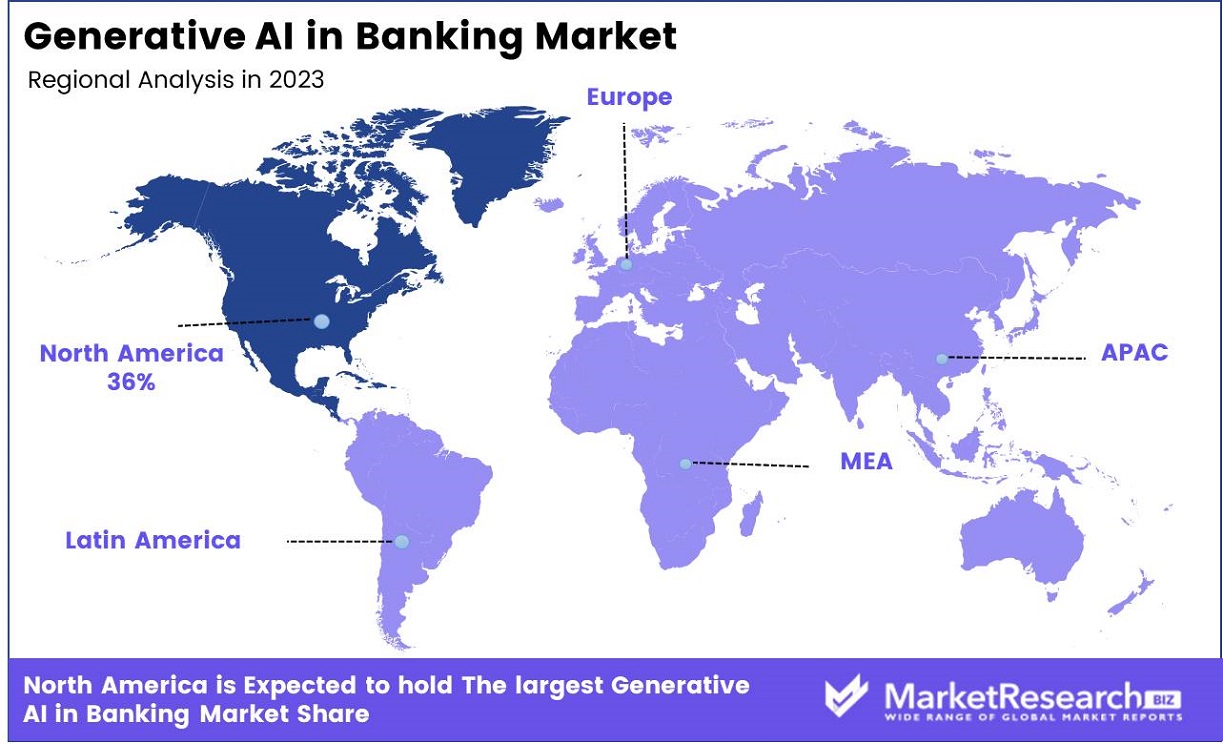

- Regional Analysis: North America holds a 36% share in the Generative AI in Banking Market segment.

- Growth Opportunity: Generative AI in banking in 2024 is set to transform customer service through personalized experiences and efficient support, while also enhancing data handling capabilities for better compliance, risk management, and operational efficiency.

Driving Factors

Enhanced Compliance through Automated Regulatory Updates

Generative AI significantly enhances a bank’s ability to stay compliant with evolving regulations by automating the production of updates and summaries on regulatory changes. This technology can dissect the dense and often complex language of new regulations and deliver clear, actionable summaries tailored to the specific needs of the bank.

The ability to adapt swiftly and efficiently to regulatory changes not only minimizes the risk of compliance failures but also reduces the overhead costs associated with manual updates. By ensuring that compliance processes are both accurate and expedient, generative AI contributes to a more stable and reliable banking environment, fostering trust and reducing legal or financial repercussions.

Streamlining Client Interactions with Natural Language Interfaces

Incorporating generative AI to develop natural language interfaces revolutionizes customer interactions, particularly in the loan application process. By simplifying complex financial terminology and procedures, these AI-driven interfaces make banking services more accessible and user-friendly, enhancing customer experience and satisfaction.

This approach not only attracts a broader client base by demystifying financial services but also speeds up the loan approval process, thereby increasing operational efficiency. The improved customer journey directly translates into higher conversion rates and customer retention, bolstering the bank's market growth.

Advanced Fraud Detection Capabilities

Generative AI elevates a bank's ability to combat fraud through advanced pattern detection in textual data such as application forms. By identifying anomalies and potential fraud indicators, this technology can alert human supervisors to scrutinize certain applications more closely, thereby enhancing the security of financial transactions.

This proactive fraud detection helps in mitigating losses and maintaining the integrity of the banking system. The reduced incidence of fraud not only protects the bank’s assets but also secures its reputation, crucial for customer retention and attracting new business.

Restraining Factors

Addressing Bias to Foster Trust and Equity in AI Applications

The presence of bias in AI-generated financial advice represents a significant restraint in the adoption of generative AI within banking. Bias can skew AI decision-making, potentially leading to unfair treatment of customers based on incorrect or prejudiced data interpretations. This not only poses ethical issues but can also lead to reputational damage and legal challenges, which can deter market growth.

Banks must critically evaluate AI outputs and implement robust bias-mitigation strategies to ensure that their AI systems facilitate fair and equitable decision-making. This involves training AI with diverse data sets and continuously monitoring its advice for biases. Successfully addressing these challenges increases consumer trust and promotes wider acceptance of AI technologies in banking, thereby enhancing market growth through improved customer relations and retention.

Ensuring Transparency and Validation in AI Deployments

Transparency and validation in the development and deployment of generative AI are crucial to mitigating the growth restraints posed by potential uncertainties in AI responses. Banks prioritizing these aspects can significantly alleviate customer concerns about the reliability and understandability of AI operations. Transparent AI processes allow customers and regulators to understand how decisions are made, which is essential for building trust and accountability.

Meanwhile, strict validation processes ensure that AI systems are accurate and perform as expected under varying conditions. Implementing these practices not only reduces the operational risks associated with AI but also enhances customer confidence and satisfaction, thereby supporting sustained growth in the generative AI market within the banking sector.

By Technology Analysis

Natural Language Processing dominates with a 36% technology market share.

In 2023, Natural Language Processing (NLP) held a dominant market position in the "Based on Technology" segment of the Generative AI in the Banking Market, capturing more than a 36% share. This segment's prominence is underpinned by the critical role NLP plays in transforming customer interactions and enhancing operational efficiencies within financial institutions. NLP technologies facilitate advanced customer service bots, sentiment analysis, and automated document processing, thus driving significant cost reductions and improved service delivery.

Following NLP, Deep Learning accounted for a substantial portion of the market, providing foundational technologies for fraud detection systems and risk management through sophisticated pattern recognition and predictive capabilities. Meanwhile, Reinforcement Learning is gaining traction by optimizing banking decisions in real-time, a crucial feature for trading algorithms and personalized banking services.

Generative Adversarial Networks (GANs) and Computer Vision are also notable contributors, albeit with smaller shares. GANs are particularly instrumental in simulating financial scenarios and data augmentation, whereas Computer Vision is increasingly adopted for security features like identity verification and document scanning.

Predictive Analytics rounds out the segment, offering banks the ability to forecast customer behavior, identify cross-selling opportunities, and anticipate market trends, thus enabling proactive strategic planning. The integration of these technologies signifies a robust inclination towards data-driven decision-making and automation in the banking sector, which is poised for continued growth and transformation as these technologies evolve.

By End-User Analysis

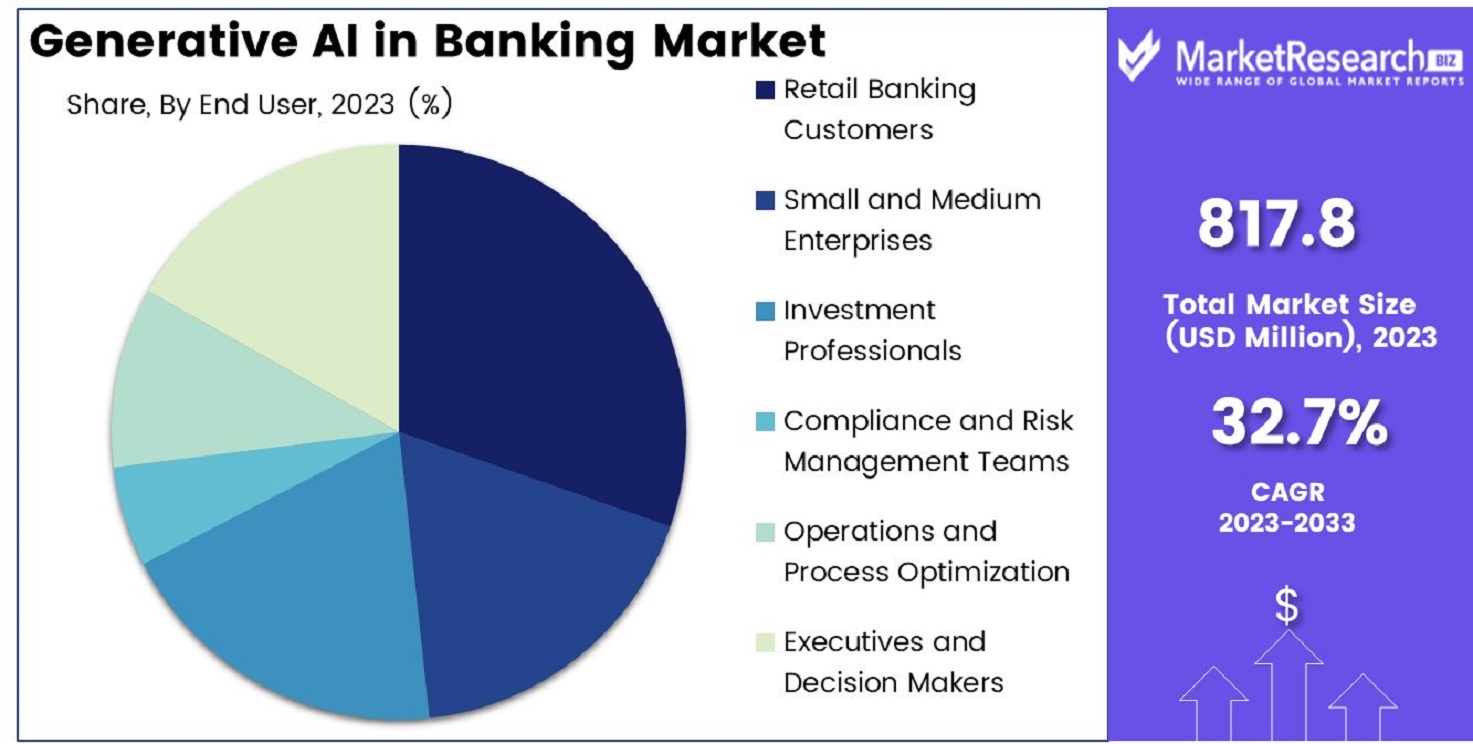

Retail banking customers constitute 27% of the end-user segment.

In 2023, Retail Banking Customers held a dominant market position in the "Based on End-User" segment of the Generative AI in Banking Market, capturing more than a 27% share. This segment's strong performance is driven by the increasing adoption of AI-driven solutions that enhance personalized banking experiences, offer tailored financial advice, and streamline transaction processes. The use of generative AI to create hyper-personalized financial products has notably improved customer engagement and satisfaction.

Small and Medium Enterprises (SMEs) represent the second-largest group leveraging generative AI, using these technologies to optimize financial operations, access improved lending propositions, and enhance risk assessment processes. This segment benefits significantly from AI's ability to generate reliable insights and predictions based on complex data sets.

Investment Professionals also utilize generative AI extensively to gain deeper insights into market trends and to generate automated trading strategies. This technology aids in sophisticated analysis and decision-making that are crucial for maintaining competitive advantage in volatile markets.

Compliance and Risk Management Teams are increasingly reliant on generative AI for monitoring and managing regulatory requirements and for predictive risk management, thereby reducing potential financial losses and enhancing operational compliance.

Operations and Process Optimization is another key area where generative AI contributes to efficiency improvements through automation and predictive maintenance, ensuring smoother and more efficient bank operations.

Key Market Segments

Based on Technology

- Natural Language Processing

- Deep Learning

- Reinforcement Learning

- Generative Adversarial Networks

- Computer Vision

- Predictive Analytics

Based on End-User

- Retail Banking Customers

- Small and Medium Enterprises

- Investment Professionals

- Compliance and Risk Management Teams

- Operations and Process Optimization

- Executives and Decision Makers

Growth Opportunity

Revolutionizing Customer Service and Personalization

One of the most significant opportunities for generative AI in banking in 2024 lies in its potential to revolutionize customer service and personalization. By leveraging AI, banks can offer personalized banking experiences, tailored financial advice, and real-time customer support, transforming how services are delivered. AI-driven chatbots and virtual assistants can handle a range of customer inquiries without human intervention, significantly reducing wait times and increasing customer satisfaction.

Moreover, generative AI can analyze customer data to provide customized product recommendations and financial advice, enhancing customer engagement and loyalty. This personalized approach not only improves customer satisfaction but also increases the potential for upselling and cross-selling products.

Enhancing Data Collection, Reporting, and Monitoring

Generative AI also presents a vast opportunity to enhance data collection, reporting, and monitoring within the banking sector. The ability of AI to process and analyze large volumes of data in real-time can lead to more accurate risk assessments, better compliance with evolving regulations, and enhanced fraud detection capabilities. Banks can utilize generative AI to automate complex data collection and reporting processes, ensuring accuracy and efficiency.

This capability is particularly crucial as banks face increasing amounts of data amidst growing regulatory requirements. Improved monitoring and reporting facilitated by AI not only minimize risks but also optimize operational efficiencies, leading to cost savings and improved regulatory compliance.

Latest Trends

Advancements in Automated Document Generation

A significant trend in the generative AI space within the banking sector for 2024 is the automation of financial document generation. This application of AI technology streamlines the creation of complex banking documents, ensuring they are produced with high accuracy and compliance.

Generative AI systems are capable of analyzing a wide array of inputs including market trends, historical performance data, and macroeconomic factors, to produce relevant documents such as loan agreements, risk assessments, and compliance reports. The efficiency brought about by automated document generation not only reduces human error but also significantly cuts down on the time and resources spent on manual document preparation, enhancing overall operational efficiency within banks.

Enhanced Fraud Detection and Prevention Capabilities

Another pivotal trend is the improved fraud detection and prevention facilitated by generative AI. Banks are expected to leverage AI to analyze transaction patterns and flag anomalies that may indicate fraudulent activities. With the capability to reduce fraud by 20-30% annually, this application of generative AI could save the banking industry billions of dollars in potential losses each year.

By continuously learning from new transaction data, AI systems become increasingly adept at identifying sophisticated fraud scenarios before they materialize, thus bolstering the security of financial operations and protecting customer assets.

Regional Analysis

North America, leading with a dominant share of 36%, continues to be at the forefront of implementing Generative AI in banking. This region's significant investment in AI and ML technologies, coupled with stringent regulatory frameworks promoting innovation in financial services, drives its leading position. U.S. banks are leveraging these technologies for personalized banking services, risk management, and compliance automation, thereby enhancing operational efficiencies and customer experiences.

In Europe, there is a strong emphasis on leveraging AI to enhance data security and customer engagement, reflecting the region's stringent data protection laws such as GDPR. European banks are increasingly adopting AI-driven solutions to combat fraud and enhance digital transactions, which is critical given the high volume of cross-border transactions within the EU.

Asia Pacific presents a rapidly growing segment, characterized by a robust adoption of digital banking solutions among its large, tech-savvy population. Countries like China, Japan, and South Korea are investing heavily in AI to modernize financial services, which includes everything from credit scoring systems to automated customer service and blockchain integration. This region benefits from governmental support in technology advancements and a vibrant fintech startup ecosystem pushing the boundaries of traditional banking.

The Middle East & Africa region is experiencing gradual growth in adopting Generative AI in banking, driven by digital transformation initiatives in countries like the UAE and Saudi Arabia. These countries are focusing on smart banking solutions to enhance financial inclusion and streamline banking operations, aiming to position themselves as global hubs for technological innovation.

Lastly, Latin America is witnessing a surge in digital banking, facilitated by widespread mobile penetration and improving internet infrastructure. Banks in this region are focusing on AI to enhance customer relationship management and fraud detection systems, which is critical given the socio-economic dynamics and the increasing demand for more accessible banking services.

Key Regions and Countries

North America

- The US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

OpenAI has emerged as a frontrunner, particularly due to its advanced language models that enhance customer service and automate complex financial advisory services. Its collaborations with fintech and traditional banks have set standards in deploying AI-driven solutions that personalize customer interactions and optimize regulatory compliance.

Google, through its AI and cloud divisions, provides robust data analytics and machine learning tools that banks use for risk assessment and fraud detection. Google's edge lies in its ability to integrate vast datasets to refine customer insights and operational efficiency, which is crucial in the data-driven banking environment.

IBM continues to build on its legacy in enterprise computing by offering AI solutions tailored for financial services. Its focus on security and regulatory compliance makes it a preferred partner for banks that prioritize trust and reliability in their AI deployments.

Microsoft and Salesforce are enhancing their platforms to support AI-driven CRM systems in banking. Microsoft's Azure AI and Salesforce's Einstein AI are pivotal in helping banks forecast customer needs and provide proactive services.

Amazon Web Services (AWS) plays a critical role by hosting and processing AI solutions, enabling banks to scale operations with reliability and speed. AWS's broad suite of services supports various AI applications, from credit decisioning to real-time payment processing.

Traditional Banking Institutions are increasingly adopting generative AI to maintain competitiveness. Their focus is on integrating AI into existing infrastructures to improve service delivery without compromising on security or customer trust.

Other Key Players in the market include startups and niche software providers who introduce innovative solutions like AI-driven wealth management and predictive banking analytics. Their agile approaches often pilot novel applications that larger players later adopt or adapt.

Market Key Players

- OpenAI

- IBM

- Microsoft

- Salesforce

- Amazon Web Services

- Traditional Banking Institutions

- Other Key Players

Recent Developments

- In December 2023, McKinsey & Company outlines that successful scaling of generative AI in banking hinges on a comprehensive approach, emphasizing strategic alignment, talent development, robust operating models, technology integration, data management, risk control, and adaptive change management to fully leverage the technology's potential for transformative impact and substantial economic gains.

- In April 2024, The integration of AI in banking is significantly transforming the sector by enhancing customer experiences, improving security, and increasing operational efficiency, according to insights from Professor Marcin Kawiński of the Warsaw School of Economics and Alex Kreger of UXDA, supported by data predicting substantial market growth and evolving industry trends.

- In April 2024, The transformative impact of generative AI in the BFSI sector, as evidenced by advancements in customer interactions, automated content generation, synthetic data, and anti-fraud measures, is revolutionizing operations and enabling companies like HSBC, Bank of America, and JPMorgan to enhance efficiency, improve customer satisfaction, and achieve significant cost savings, setting a dynamic pace for global financial services.

Report Scope

Report Features Description Market Value (2023) US$ 817.8 Mn Forecast Revenue (2032) US$ 1,610.8 Mn CAGR (2023-2032) 32.7% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Technology (Natural Language Processing, Deep Learning, Reinforcement Learning, Generative Adversarial Networks, Computer Vision, and Predictive Analytics), By End-User (Retail Banking Customers, Small and Medium Enterprises, Investment Professionals, Compliance and Risk Management Teams, Operations & Process Optimization, and Executives & Decision Makers) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape OpenAI, Google, IBM, Microsoft, Salesforce, Amazon Web Services, Traditional Banking Institutions, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- OpenAI

- IBM

- Microsoft

- Salesforce

- Amazon Web Services

- Traditional Banking Institutions

- Other Key Players