Generative AI In Fintech Market Based on Component (Service, Software), Based on Deployment (On-Premises, Cloud), Based on Application (Credit Scoring, Compliance & Fraud Detection, Personal Assistants, and Others), Based on End-Use Industry, By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

38918

-

July 2023

-

137

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

- Report Overview

- Driving factors

- Restraining Factors

- Covid-19 Impact on Generative AI In Fintech Market

- Component Analysis

- Deployment Analysis

- Application Analysis

- End-Use Industry

- Key Market Segments

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Market Share & Key Players Analysis

- Recent Development

- Report Scope:

Report Overview

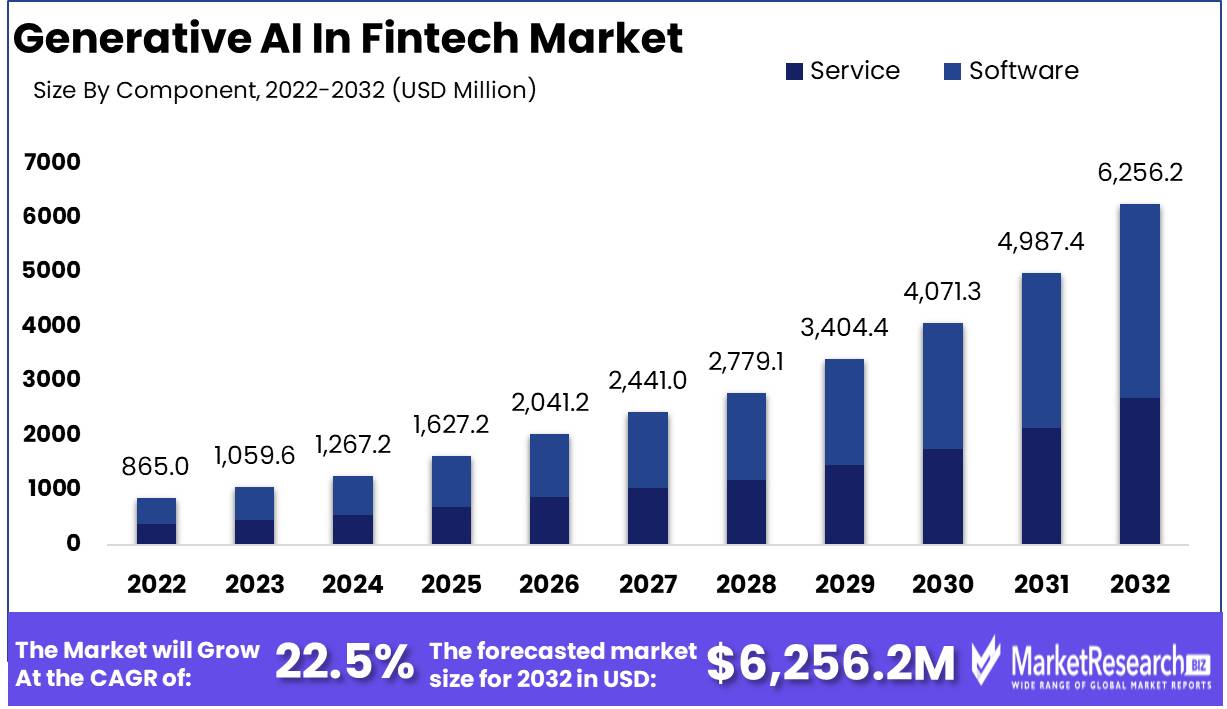

Generative AI In Fintech Market size is expected to be worth around USD 6,256.2 Mn by 2032 from USD 865.0 Mn in 2022, growing at a CAGR of 22.5% during the forecast period from 2023 to 2032.

The Generative AI In Fintech Market is a rapidly expanding industry that integrates the power of artificial intelligence and finance to transform the way we interact with financial services. This market report intends to provide an overview of the various facets of Generative AI in Fintech, including its definition, objectives, and significance. In addition, it emphasizes the benefits of employing generative AI in the financial sector, including increased efficiency, enhanced consumer experience, and improved risk management.

Significant advances in Generative AI in Fintech have paved the way for innovative developments. From fraud detection algorithms to personalized investment recommendations, these innovations have revolutionized the operations of financial institutions. Companies such as Sigmoidal, DataRobot, and ZestFinance have made substantial contributions to the industry by revolutionizing decision-making processes and optimizing financial operations.

In the fintech industry, numerous business applications for generative AI have enormous potential. For example, it can be used to create chatbots that provide personalized customer support, automate repetitive duties, and provide answers to frequently asked queries. In addition, Generative AI In Fintech Market can be used to predict market trends, evaluate creditworthiness, and detect fraudulent activities, thereby improving business operations as a whole.

Several examples from the real world demonstrate the successful implementation of Generative AI In Fintech Market. The use of automated investment platforms that employ AI algorithms to generate personalized investment portfolios based on an individual's risk preferences is one example of this. The use of generative AI to enhance fraud detection by analyzing patterns and anomalies in financial transactions is another illustration. These examples illustrate the transformative power of generative AI in the fintech industry and its capacity to drive innovation and expansion.

Driving factors

The Computerization of Financial Procedures

Automation has emerged as a propelling force in the ever-changing world of finance, revolutionizing financial processes across the industry. The incorporation of technology-enabled solutions has not only revolutionized the way we manage financial transactions, but it has also paved the way for personalized recommendations, enhanced customer experiences, and data analysis via the power of Generative AI in Fintech.

Enhanced Productivity via Automation

Automation is crucial for streamlining financial processes, eliminating manual errors, and enhancing overall operational efficiency. By automating repetitive tasks like data entry, account reconciliation, and document generation, businesses can significantly reduce human error and time-consuming manual labor. Financial institutions can now utilize sophisticated software solutions to automate complex calculations and processes, allowing them to concentrate on higher-value tasks.

Personalized Suggestions

In the era of data-driven decision making, personalized recommendations have become a fundamental aspect of the financial landscape. With the assistance of Generative AI, financial institutions can analyze vast quantities of customer data, such as transaction history, preferences, and risk profiles, in order to provide individualized and pertinent product suggestions. The incorporation of AI-powered recommendation engines enables financial institutions to comprehend customers' specific financial requirements and provide them with individualized investment strategies, insurance options, and loan products.

Superior Customer Service

Rising consumer expectations have compelled financial institutions to transfer their focus from transaction processing to relationship building. Automation and AI-powered technologies have enabled financial institutions to provide seamless, intuitive, and personalized services across multiple touchpoints, paving the way for improved consumer experiences. As a result of the automation of customer onboarding, account opening, and loan application procedures, interactions with customers are now more efficient and convenient.

Seizing Opportunities

The Generative AI in Fintech market has become a hotbed of innovation and opportunity as the fintech industry continues to experience accelerated growth. Companies that provide AI-powered solutions are flourishing because they allow financial institutions to remain ahead of the curve and meet customers' changing demands. In this flourishing market, it is essential for financial institutions to adopt automation and Generative AI in order to enhance operational efficiency and consumer experiences. By doing so, they can maintain competitiveness, expand revenue streams, and establish a sustainable future in the fintech landscape's rapid evolution.

Restraining Factors

Data Security Concerns

Data is often referred to as the new energy in the modern era. Its significance cannot be overstated, particularly in terms of fintech. With Generative AI In Fintech Market, a substantial quantity of data is involved. This raises questions about data privacy, security, and ethics. As more and more sensitive financial data is processed and analyzed, it becomes imperative to implement stringent data privacy safeguards. In addition, the General Data Protection Regulation (GDPR) and other international data protection laws add another layer of complication.

Navigating Regulatory Challenges

At the intersection of fintech and AI, complex regulatory challenges arise. Globally, governments and regulatory bodies are perpetually modifying their regulatory frameworks to keep up with the rapid rate of technological development. Nonetheless, achieving the optimal equilibrium between innovation and compliance remains a persistent obstacle. Regulators endeavor to safeguard consumers and preserve the integrity of financial systems. Alternatively, they must foster innovation and avoid impeding the development of the fintech industry.

Opposition from Institutions

While Generative AI offers tremendous potential for the fintech industry, its adoption by conventional financial institutions has been met with opposition. Several factors, including legacy systems, risk aversion, and cultural barriers, contribute to this. As the benefits of Generative AI become more evident, however, organizations are beginning to recognize the need to adopt this disruptive technology.

Potential Biases

One of the difficulties associated with Generative AI In Fintech Market is the possibility of algorithmic bias. Bias within AI systems can have far-reaching effects, especially in the fintech industry, where decisions influenced by AI algorithms can affect the financial well-being of individuals. Multiple sources can generate bias, including biased training data, algorithmic design, and inadvertent biases inherent in financial systems.

Covid-19 Impact on Generative AI In Fintech Market

Financial technology (fintech) has grown and innovated. The introduction of generative artificial intelligence (AI) technology is one of the most interesting advances in this area. Financial institutions might be transformed by generative AI. However, the COVID-19 epidemic has had a major influence on the global economy, including fintech. The pandemic's impact on the fintech industry's generative AI market will be examined in this piece.

The COVID-19 epidemic has hit fintech hard. As the globe went into lockdown and businesses closed, financial services demand changed. Traditional banks struggled to meet clients' shifting expectations, driving the introduction of digital financial alternatives. Generative AI's capacity to analyze massive volumes of data and provide real-time insights was important for fintech organizations facing pandemic difficulties.

The epidemic accelerated banking sector digitalization, which was already underway. Fintech organizations using generative AI were better able to handle remote operations and provide safe, efficient financial services. The rise of contactless and online transactions emphasized the need for cutting-edge AI solutions to automate operations and customize experiences. During these difficult times, fintech demand for generative AI surged tremendously.

Due to market volatility caused by COVID-19, financial institutions needed strong risk management methods. Generative AI helped fintech firms analyze and manage risks. Companies used AI systems to evaluate market trends, monitor consumer behavior, and uncover fraud and financial hazards. To preserve stability and business continuity throughout the pandemic, generative AI has to be integrated into risk management frameworks.

Component Analysis

The Generative AI in Fintech Market has witnessed significant growth in recent years, and one of the key factors driving this growth is the dominance of the software segment. The software segment has emerged as a major force, revolutionizing the fintech industry with its innovative solutions and applications.

Consumer trends and behavior also contribute to the dominance of the software segment. Consumers are increasingly embracing digital solutions and are demanding more personalized experiences. The software segment offers fintech companies the ability to develop customized solutions that cater to individual customers' needs and preferences. The software segment is anticipated to register the fastest growth rate over the forthcoming years due to its inherent flexibility and scalability. Software-based generative AI platforms can easily adapt to changing market demands and accommodate growing data volumes.

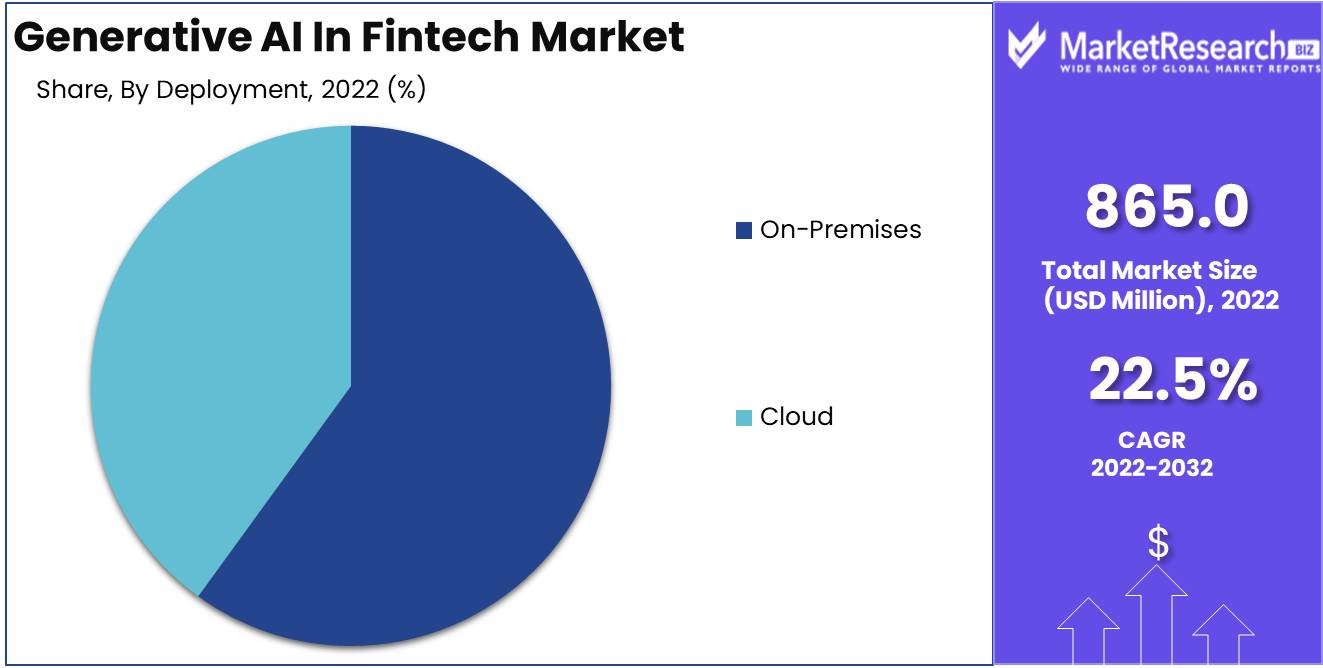

Deployment Analysis

In the Generative AI in Fintech Market, the on-premises segment holds a dominant position. Many fintech companies opt for on-premises deployment of generative AI solutions due to various reasons, including data security concerns, regulatory compliance requirements, and the need for greater control over their systems.

Consumer trends and behavior also influence the adoption of on-premises generative AI solutions. Customers are becoming more conscious of data privacy and are concerned about where their data is stored. They prefer solutions that allow them to maintain control over their data, and on-premises deployment meets this requirement. The on-premises segment is projected to register the fastest growth rate in the years to come due to the increasing demand for data security and compliance. Many organizations are recognizing the importance of protecting sensitive customer data and are investing in on-premises generative AI solutions to meet these requirements.

Application Analysis

Compliance and fraud detection are the dominant segments in the Generative AI in Fintech Market. The use of generative AI technology has revolutionized these areas, allowing fintech companies to effectively manage and mitigate risks associated with compliance and fraud.

Consumer trends and behavior also influence the adoption of compliance and fraud detection generative AI solutions. Customers are increasingly concerned about the security of their financial transactions and demand robust measures to protect their sensitive information. By implementing compliance and fraud detection generative AI solutions, fintech companies can provide customers with a secure and trustworthy platform, enhancing their confidence in online financial services. The compliance and fraud detection segment is anticipated to register the fastest growth rate in the forthcoming years due to the escalating need for enhanced security and regulatory compliance.

End-Use Industry

The retail banking segment dominates the Generative AI in Fintech Market. Retail banks are at the forefront of utilizing generative AI technology to enhance customer experiences, streamline operations, and stay competitive in the dynamic fintech industry.

Consumer trends and behavior also impact the dominance of the retail banking segment. Customers are increasingly turning to online and mobile banking services for convenience and ease of use. Retail banks are leveraging generative AI solutions to develop intuitive and user-friendly interfaces, offer personalized recommendations, and provide seamless digital banking experiences. The retail banking segment is expected to register the fastest growth rate in the forthcoming years due to the increasing demand for digital banking services and the need for seamless customer experiences.

Key Market Segments

Based on Component

- Service

- Software

Based on Deployment

- On-Premises

- Cloud

Based on Application

- Credit Scoring

- Compliance & Fraud Detection

- Personal Assistants

- Digital assistants

- Financial assistants

- Asset Management

- Predictive Analysis

- Insurance

- Debt Collection

- Business Analytics & Reporting

- Customer Behavioral Analytics

Based on End-Use Industry

- Retail Banking

- Investment Banking

- Stock Trading Firms

- Hedge Funds

- Other Industries

Growth Opportunity

Implementation of Blockchain

In numerous industries, including finance, blockchain technology has attracted considerable interest. Its decentralized nature and capacity to offer an immutable ledger make it an ideal fit for Generative AI In Fintech Market. This integration can facilitate secure and transparent financial transactions and strengthen mechanisms for detecting and preventing deception. The combination of generative AI and blockchain enables financial institutions to optimize operations, reduce costs, and increase overall efficacy.

Future of Financial Counseling

Robo-advisors have emerged as a game-changing instrument for financial planning and investment management as the fintech industry continues to evolve. These robo-advisors are empowered by generative AI, which enables them to provide highly personalized recommendations based on enormous quantities of data. Using generative AI algorithms, robo-advisors are able to analyze market trends, risk profiles, and investment objectives to provide customized investment strategies for each client. This technology revolutionizes the delivery of financial advice, granting individuals from all walks of life access to sophisticated financial planning.

Growth in Emerging Markets

Emerging markets offer a plethora of opportunities for the fintech industry, and the incorporation of generative AI can assist in realizing their maximum potential. These markets frequently lack access to conventional financial services, making them ideal for fintech innovation. This chasm can be bridged by generative AI solutions that are tailored to the specific requirements of these markets. By adapting their offerings to the cultural, linguistic, and regulatory characteristics of emerging economies, fintech companies can delve into new consumer bases and promote global financial inclusion.

Partnership with Fintech Platforms

The fintech ecosystem flourishes on collaboration, and generative AI can facilitate increased synergy between various stakeholders. Fintech platforms are an indispensable link between clients and financial services. By incorporating generative AI into these platforms, financial institutions are able to provide more personalized experiences, streamline operations, and enhance consumer engagement. In addition, collaboration between fintech platforms and specialists in generative AI can result in the creation of innovative products, such as AI-powered chatbots for customer support or fraud detection systems.

Latest Trends

Innovative Possibilities

Prepare to witness an unprecedented paradigm transition in the ever-changing financial technology industry landscape. Prepare for the emergence of generative artificial intelligence (AI) as the driving force behind the multifaceted transformation of Generative AI In Fintech Market. Explore the uncharted territories of AI-powered fraud detection, the credit scoring revolution, the marvel of natural language processing (NLP), the audacity of voice recognition, and the security of biometrics as we venture into the profound future shaped by generative AI.

Identifying Financial Fraud

The unraveling of the complex web of financial crime has become a thrilling game of intellect. Once believed invincible, conventional methods of fraud detection now fail in the face of the ever-evolving strategies employed by cunning fraudsters. Nevertheless, observe the disruptive power of generative AI! Observe the emergence of sophisticated algorithms that continuously learn and adapt to fraudulent patterns. With their insatiable appetite for data, these algorithms detect suspicious transactions or activities with unrivaled accuracy, forming an impregnable shield to protect businesses and consumers from potential losses.

Credit Scoring and Insurance

Observe the transformation of creditworthiness evaluation as it occurs before your eyes. Credit assessment and underwriting, formerly constrained by limited data points and laborious manual processes, undergo a radical transformation. In the domain of AI integration, financial institutions bask in the grandeur of sophisticated algorithms capable of harnessing immense datasets and even venturing into the realms of unconventional data sources. Behold the emergence of a more comprehensive and accurate evaluation of creditworthiness, which expedites loan approval procedures while minimizing risks.

Sentiment Analysis Released

Explore the domains of sentiment monitoring, where the fintech industry is undergoing a revolutionary transformation. Observe as the powerful NLP algorithms emerge, equipped to analyze vast amounts of textual data. Customer feedback, social media posts, and online evaluations are woven into a magnificent tapestry that accurately depicts sentiment. Through this miraculous prism, financial institutions are able to gain invaluable insights into their customers' very souls. Armed with this knowledge, they skillfully customize their products and services, creating an experience that is unparalleled. Customer gratification reverberates, paving the way for prosperous business growth.

Voice Recognition

Cast off the shackles of antiquated authentication techniques and immerse yourself in the world of voice recognition technology. The seamless interweaving of generative AI algorithms unravels the mystery of customer identities through voice biometrics. A symphony of secure and convenient authentication is replacing the era of burdensome passwords and PINs. As the digital landscape rapidly evolves, the pursuit of seamless and secure authentication becomes increasingly crucial. Voice recognition emerges as the virtuoso in this innovation symphony, composing a masterpiece for fintech companies.

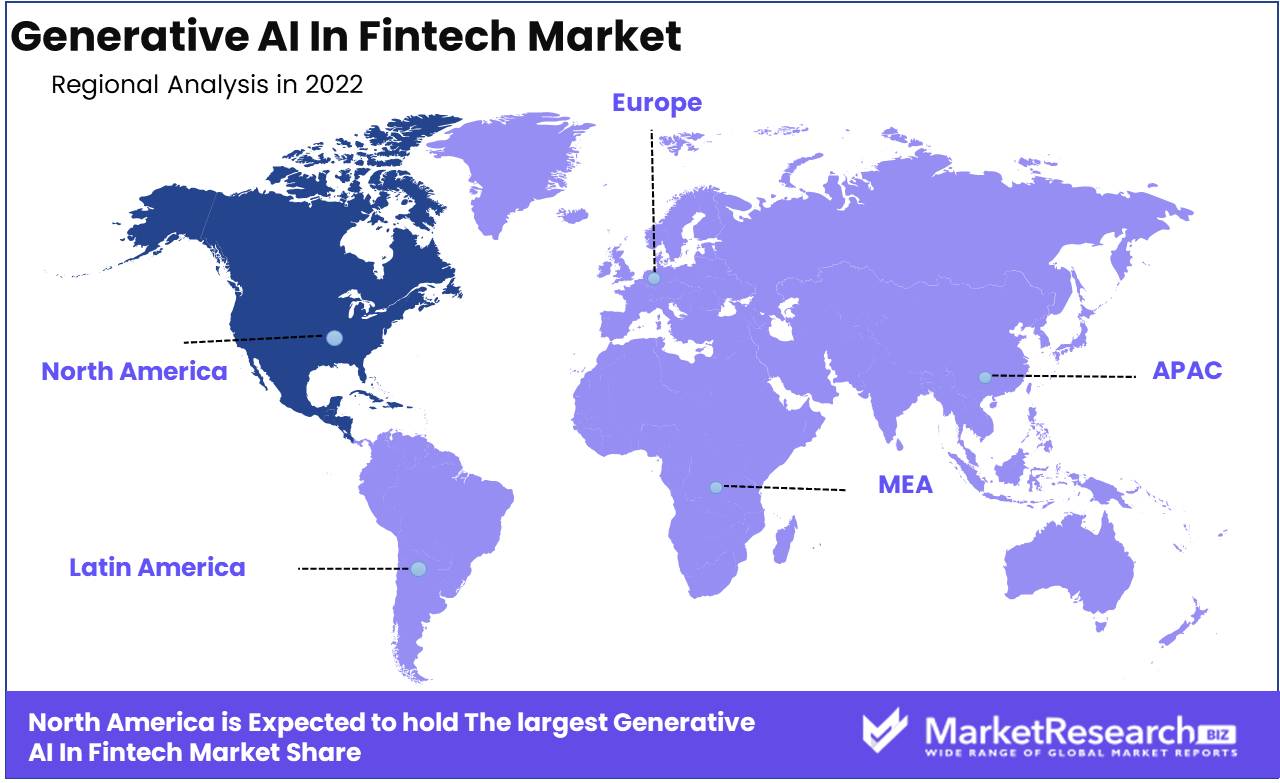

Regional Analysis

Generative AI In Fintech Market Is Dominated By North America. In the world of fast-paced financial technology, one technology has been creating waves: Generative AI. With its ability to generate, learn, and adapt, revolutionizing Generative AI In Fintech Market. In this Report, we will delve into North America's dominance in the Generative AI space and investigate the reasons for this remarkable accomplishment.

Due to a confluence of factors, North America has become a leader in the field of Generative AI. Together, visionary research institutions, cutting-edge technology firms, and a thriving start-up ecosystem have created an environment conducive to innovation. This has resulted in the development of revolutionary technologies that have placed North American companies at the vanguard of the revolution in Generative AI.

A flourishing culture of research and development is one of the primary factors for North America's preeminence. MIT, Stanford, and UC Berkeley have consistently produced ground-breaking research in the field of artificial intelligence. These research institutions foster a culture of innovation and exploration by attracting brilliant minds from around the world.

The robust funding and investment climate in North America has fueled the development of Generative AI in the fintech industry. Venture capital firms and angel investors actively seek out promising startups, providing them with the means to develop and scale innovative solutions. This influx of capital has enabled companies in North America to stretch the limits of what is possible with Generative AI.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

IBM Watson is a significant participant in the application of generative AI to the fintech market. IBM Watson's sophisticated natural language processing and machine learning capabilities have allowed it to create chatbots and virtual assistants that can comprehend and respond to complex financial queries. These intelligent virtual assistants can assist customers with account information, payments, and investment advice, among other duties.

Nvidia, a leader in GPU-based hardware and software solutions, is another significant participant in the industry. GPUs from Nvidia are designed to accelerate deep learning algorithms, making them ideal for generative AI applications. Diverse fintech companies are utilizing their technology to develop and deploy AI models capable of generating personalized investment strategies, fraud detection algorithms, and risk assessment models.

Alpaca and ForwardLane are also utilizing generative AI to revolutionize the fintech market. Alpaca, for example, offers a stock trading platform powered by AI that enables users to develop and deploy their own trading algorithms. ForwardLane, on the other hand, employs generative AI to provide wealth managers and financial advisors with personalized investment recommendations, enabling them to provide customized financial advice to their clients.

Top Key Players in Generative AI In Fintech Market

- Open AI

- Microsoft Corporation Company Profile

- Google LLC

- Genie AI Ltd.

- IBM Corporation

- MOSTLY AI Inc.

- Veesual AI

- Adobe Inc.

- Synthesis AI

- Air Products & Chemicals, Inc. Company Profile

- Other Key Players

Recent Development

- In 2023, Bank of America and Palantir's fraud detection system will use machine learning to analyze vast amounts of data and continuously learn from patterns. This will allow the system to identify suspicious activities and minimize financial fraud occurrences.

- In 2022, PayPal and Stripe's payment processing system will use machine learning algorithms to detect and prevent unauthorized activities. This will help to keep users' financial information safe and secure during online transactions.

- In 2022, Square and Affirm's lending platform will use machine learning to accurately assess the creditworthiness of borrowers. This will make it easier for individuals and businesses to get the credit they need, when they need it.

- In 2021, Chime and Sense Financial's financial management app will use machine learning to provide users with personalized budgeting tools and real-time spending tracking. This will help users to make informed financial decisions and stay on top of their finances.

Report Scope:

Report Features Description Market Value (2022) USD 865.0 Mn Forecast Revenue (2032) USD 6,256.2 Mn CAGR (2023-2032) 22.5% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Based on Component (Service, Software)

Based on Deployment (On-Premises, Cloud)

Based on Application (Credit Scoring, Compliance & Fraud Detection, Personal Assistants, Digital assistants, Financial assistants, Asset Management, Predictive Analysis, Insurance, Debt Collection, Business Analytics & Reporting, Customer Behavioral Analytics)

Based on End-Use Industry (Retail Banking, Investment Banking, Stock Trading Firms, Hedge Funds, Other Industries)Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Open AI, Microsoft Corporation Company Profile, Google LLC, Genie AI Ltd., IBM Corporation, MOSTLY AI Inc., Veesual AI, Adobe Inc., Synthesis AI, Air Products & Chemicals, Inc. Company Profile, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Open AI

- Microsoft Corporation Company Profile

- Google LLC

- Genie AI Ltd.

- IBM Corporation

- MOSTLY AI Inc.

- Veesual AI

- Adobe Inc.

- Synthesis AI

- Air Products & Chemicals, Inc. Company Profile

- Other Key Players