Generative AI In BFSI Market Report Based on Organization Type (Banks, Insurance companies, Financial service providers, Other Organization Types), Based on Application (Fraud detection, Risk assessment, Customer experience, Algorithmic trading, Other Applications), Based on Deployment Mode (On-premise, Cloud-based), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

37954

-

April 2024

-

285

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

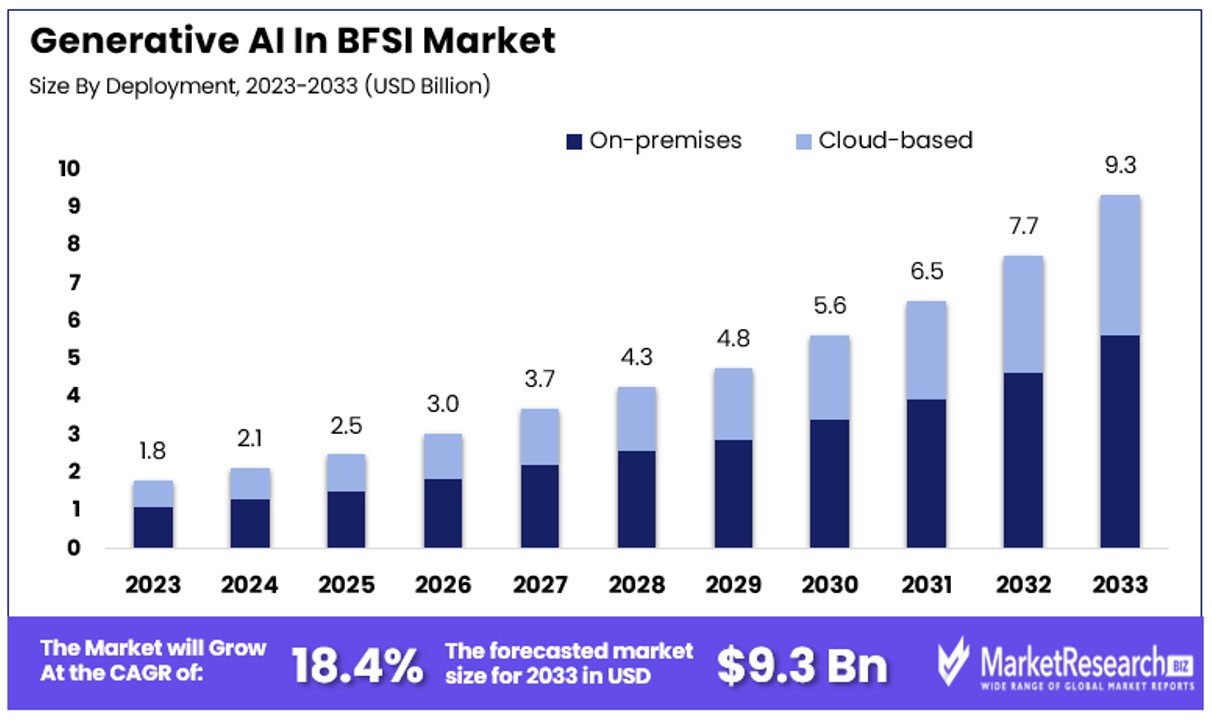

The Global Generative AI In BFSI Market size is expected to be worth around USD 9.3 Billion by 2033, from USD 1.8 Billion in 2023, growing at a CAGR of 18.40% during the forecast period from 2024 to 2033.

The surge in demand for advanced technologies and rise in FinTech sectors are some of the main key driving factors for the generative AI in BFSI.

Generative AI in the banking, financial services and insurance sector is defined as the application of AI methods, specifically generative models like generative adversarial networks and variational autoencoders to innovate and enhance different techniques in these sectors. Such technologies make the development of synthetic data resembling real-world monetory scenarios, permitting augments risk assessment, identifying fraud and customer behaviour predictions.

Generative AI algorithms can produce realistic monetory information by helping in the creation and testing of new financial products, customized customer experiences and algorithms trading tactics. By implementing generative models, BFSI institutions can augments decision-making tactics, mitigating risks and automate daily tasks like document methods and customer service interactions. Moreover, generative AI nurtures the development of simulated surroundings for regulatory compliance testing and scenario analysis by contributing to the resilience and agility of the BFSI sector in an ever-changing and growing market landscape.

According to an article published by Medium in March 2024, highlights that 82% of BFSI respondents surged investments in AI and ML in the historical 1 to 2 years. 87% planned to invest in AI and ML in the coming years. The global generative AI market in BFSI is projected to reach around USD 12,337.87 million by 2032, underlining the profound impact of this technology in using the power of data analytics and automation to streamline operations, improve efficacy and decrease expenses.

For example, HSBC’s virtual assistant, associated by Gen AI, offers modified investment advice, refining customer engagement and satisfaction. Moreover, according to an article published by India AI in August 2022, highlights that 83% of survey respondents stated better customer experience as the great justification for AI implementation.

Generative AI in BFSI improves fraud detection by producing synthetic data to simulate fraudulent behaviors, by enhancing precision and scalability. It also permits customized monetory services through data synthesis, augmenting customer experiences and product recommendations. Furthermore, generative models help in regulatory compliance testing, making adherence to growing financial regulations. The demand for the gen AI in BFSI will increase due to its requirement in FinTech companies that will help in market expansion in the coming years.

Key Takeaways

- Market Value Projection: The Global Generative AI In BFSI Market is anticipated to reach USD 9.3 Billion by 2033, exhibiting a robust CAGR of 18.40% during the forecast period from 2024 to 2033.

- Organization Type: Banks hold the largest market share, driven by their substantial investment capacity and urgent need for innovation, followed by insurance companies and financial service providers.

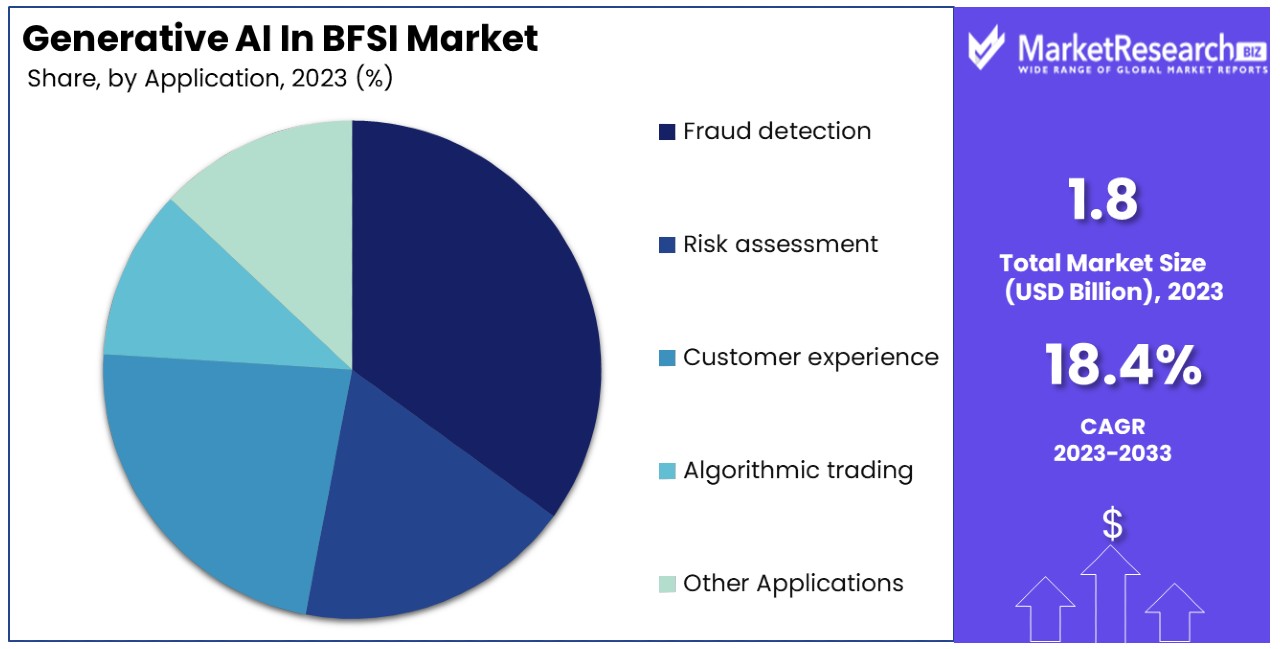

- Application: Fraud detection accounts for the largest segment with 35% market share, emphasizing its critical role in safeguarding assets and maintaining customer trust.

- Deployment Mode: On-premise deployment dominates due to concerns over data security and regulatory compliance, although cloud-based deployment is steadily growing.

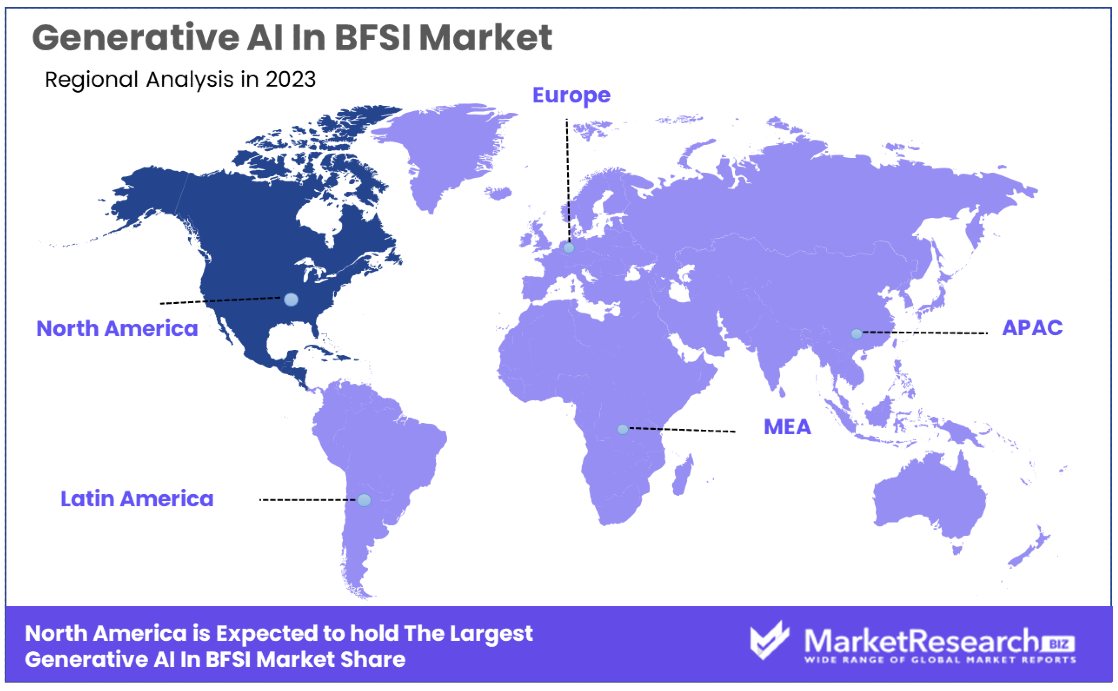

- North America: Holds a commanding 42% share, driven by a strong technology ecosystem, significant investments in AI R&D, and a robust financial sector.

- Europe: Follows with a significant market share of 30%, propelled by a strong focus on data protection and AI ethics, particularly influenced by the GDPR framework.

- Key players include DataRobot, Quantifind, OpenAI, Accenture, and SAS, each contributing unique strengths to the sector, such as automating data science, AI-driven financial crime detection, and global consultancy expertise.

- Growth Opportunities: Investing in sophisticated AI technologies for predictive analytics and automated risk evaluations empowers BFSI companies to preemptively address threats, thereby safeguarding assets and strengthening market positioning.

Driving Factors

Fraud Detection and Prevention Drives Market Growth

Generative AI significantly enhances the capabilities of the Banking, Financial Services, and Insurance (BFSI) market to detect and prevent fraud. By sifting through massive datasets, including transactional records, user behavior, and previous instances of fraud, AI algorithms can identify anomalies that indicate potential fraud in real-time. This technological advancement is not only pivotal for reducing financial losses but also for adhering to regulatory mandates and preserving customer trust.

JPMorgan Chase's implementation of generative AI for scrutinizing transaction data to thwart fraudulent activities is a prime example. This application demonstrates the potential for AI to offer timely interventions, thereby preventing fraud. The adoption of such technologies is essential for BFSI entities looking to safeguard their operations and enhance security measures, contributing to market growth by minimizing losses and ensuring compliance with legal standards.

Personalized Customer Experiences Propel Market Expansion

The adoption of generative AI within the BFSI sector is revolutionizing how personalized customer experiences are delivered. According to a KPMG survey, 66% of financial services leaders are exploring generative AI for their organizations, underscoring its significant impact. By leveraging AI to analyze customer data, preferences, and behaviors, BFSI companies can offer customized product recommendations, personalized financial advice, and automated customer support.

Bank of America's Erica is a standout example, utilizing generative AI to provide users with tailored financial insights and assistance, markedly enhancing customer satisfaction and loyalty. This shift towards personalized engagement not only fosters deeper customer relationships but also serves as a key differentiator in a competitive market, driving business growth and innovation.

Risk Management and Compliance Elevate Market Integrity

In the realm of risk management and compliance, generative AI stands out as a transformative force within the BFSI industry. By automating the analysis of regulatory documents and risk assessment processes, AI enables firms to navigate the complex landscape of compliance requirements and identify potential violations swiftly.

HSBC's application of generative AI for regulatory document analysis exemplifies this trend, facilitating enhanced risk management and adherence to compliance standards. This capability is vital for mitigating risks, averting regulatory fines, and sustaining a reputable market presence. Furthermore, the proactive approach to compliance and risk management facilitated by generative AI reinforces the industry's commitment to integrity and reliability, key factors that contribute to sustained market growth and stability.

Algorithmic Trading and Investment Strategies Secure Competitive Advantage

Generative AI is redefining algorithmic trading and investment strategies within the BFSI sector. The IBM Institute for Business Value report highlights that 75% of global leaders believe competitive advantage hinges on advanced AI technologies. AI's ability to parse through extensive market data, pinpoint trading opportunities, and execute trades with unparalleled speed and accuracy empowers BFSI entities to maximize investment returns and reduce risk exposure.

Goldman Sachs’ adoption of generative AI for high-frequency trading demonstrates the technology's capacity to leverage market inefficiencies for optimized trading outcomes. This not only enhances trading volumes and liquidity but also elevates portfolio performance, securing a competitive edge in the market. The integration of generative AI in trading strategies underscores a pivotal shift towards more efficient, data-driven investment methodologies that promise to drive future market growth.

Restraining Factors

Data Privacy and Security Concerns Restrains Market Growth

Data privacy and security are paramount in the Banking, Financial Services, and Insurance (BFSI) sector, especially when implementing generative AI technologies. These systems process vast amounts of sensitive information, including financial details and personal identities. If generative AI algorithms are not meticulously designed and managed, they risk exposing this confidential data, either by revealing it directly or by introducing security flaws.

An instance where AI-driven chatbots could potentially disclose sensitive customer information highlights the delicate balance between innovation and privacy. Such breaches not only harm customers but also place BFSI companies at risk of regulatory non-compliance, inviting financial penalties and damaging their reputation. Therefore, while generative AI holds great promise for enhancing service delivery and operational efficiency, data privacy and security concerns significantly limit its adoption and growth potential in the BFSI market.

Regulatory Compliance Challenges Restrains Market Growth

Navigating the complex landscape of regulatory compliance presents a significant hurdle for the incorporation of generative AI within the BFSI industry. Financial institutions are subject to a myriad of regulations like GDPR, PCI DSS, and Basel III, which dictate stringent standards for data handling, security, and risk management. Ensuring that generative AI systems adhere to these diverse and evolving regulations is both challenging and resource-intensive.

For instance, AI-based credit scoring models are required to comply with fair lending laws, necessitating sophisticated algorithms that can demonstrate compliance without bias. Non-compliance not only leads to legal ramifications and hefty fines but also erodes trust among consumers and stakeholders. These regulatory challenges act as a brake on the broader deployment of generative AI technologies, limiting their potential to drive innovation and efficiency in the BFSI sector.

Based on Organization Type Analysis

Banks dominate with a significant market share due to their extensive adoption of generative AI for enhancing efficiency and customer service.

In the Generative AI in BFSI market, banks emerge as the dominant sub-segment, largely driven by their high investment capacity and urgent need to innovate in response to changing consumer expectations and stiff competition from FinTech companies. Banks utilize generative AI to streamline operations, enhance customer interactions, and optimize risk management processes. For instance, generative AI applications in banks are primarily focused on automating routine tasks such as document processing and customer inquiry handling, which significantly reduces operational costs and improves service delivery times.

Additionally, the rapid digitization of banking services has accelerated the adoption of advanced technologies, including AI, to offer personalized banking experiences. This personalization is crucial in retaining customer loyalty and attracting new clients in a highly competitive market. Banks are also at the forefront of employing generative AI for complex tasks like fraud detection and compliance, where AI systems analyze vast amounts of transaction data to identify and prevent potential frauds in real-time.

Other organization types in the BFSI sector, such as insurance companies and financial service providers, also integrate generative AI but on a smaller scale compared to banks. Insurance companies, for example, apply generative AI to customize insurance policies and handle claims more efficiently. Financial service providers use AI for personalized financial advice and portfolio management. These applications contribute to the overall growth of the market but are less dominant than the banking segment due to the latter's larger base of operations and more significant financial resources.

Based on Application Analysis

Fraud detection dominates with 35% due to its critical role in safeguarding assets and maintaining customer trust.

Fraud detection is the leading application of generative AI in the BFSI market, primarily because of the escalating need to combat increasingly sophisticated financial crimes. This segment captures a significant 35% share of the market, as financial institutions prioritize security measures to protect their operations and maintain consumer confidence. Generative AI enhances the ability of banks, insurance companies, and other financial service providers to detect unusual patterns and potential frauds by continuously learning from transaction data. This capability not only prevents losses but also helps institutions comply with tightening regulations around financial security.

Risk assessment and customer experience are other critical applications where generative AI is employed. In risk assessment, AI algorithms predict credit risk and operational risks by analyzing past data and market trends, helping institutions make informed decisions. For customer experience, generative AI is used to create interactive and personalized interfaces that respond to customer inquiries and feedback dynamically, enhancing satisfaction and engagement.

Algorithmic trading and other applications like regulatory compliance and asset management also benefit from AI but do not dominate the market as significantly as fraud detection. Algorithmic trading uses AI to execute high-frequency trades based on market data analysis, which is particularly popular among hedge funds and investment banks. Other applications, including compliance and asset management, leverage AI to ensure adherence to regulations and optimize portfolio returns, respectively, contributing to the sector’s overall growth and innovation.

Based on Deployment Mode Analysis

On-premise deployment dominates due to concerns over data security and regulatory compliance.

On-premise deployment is the preferred mode for BFSI institutions when it comes to implementing generative AI, mainly due to the sensitive nature of the financial data involved. This method allows institutions to retain full control over their AI infrastructures, thus ensuring that data security, privacy, and regulatory compliance are maintained. The dominance of on-premise solutions stems from these security concerns, as well as from the need for customized AI applications that align closely with individual business models and internal processes.

Cloud-based deployment, although less dominant, is growing steadily as it offers scalability, flexibility, and cost-efficiency, especially for smaller institutions and startups. Cloud solutions enable these entities to deploy advanced AI capabilities without the substantial upfront investment required for on-premise setups. Moreover, cloud technology has been improving in terms of security and compliance features, which gradually encourages more BFSI institutions to adopt this mode of deployment. The growth in the cloud segment reflects a broader shift towards digital transformation in the industry, highlighting its role in expanding the generative AI market by making the technology accessible to a wider array of companies.

Key Market Segments

By Organization Type

- Banks

- Insurance companies

- Financial service providers

- Other Organization Types

By Application

- Fraud detection

- Risk assessment

- Customer experience

- Algorithmic trading

- Other Applications

By Deployment Mode

- On-premise

- Cloud-based

Growth Opportunities

Risk Management and Fraud Detection Offers Growth Opportunity

Generative AI revolutionizes risk management and fraud detection for the BFSI market. By analyzing comprehensive data on transactions, customer behavior, and market dynamics, AI enables real-time identification of risks and fraudulent activities.

This not only helps in reducing financial losses but also ensures adherence to regulatory norms and secures customer trust. Investing in sophisticated AI technologies that provide predictive analytics and automated risk evaluations empowers BFSI companies to preemptively address threats. This strategic focus on advanced AI solutions for risk and fraud management signifies a major growth avenue, enhancing the ability of financial institutions to safeguard assets and strengthen market positioning.

Personalized Customer Experiences and Financial Services Offer Growth Opportunity

In the BFSI sector, generative AI paves the way for highly personalized customer experiences and financial services. Utilizing AI for customer data analysis enables the delivery of custom-tailored product suggestions, financial advice, and automated support, significantly boosting customer engagement and loyalty.

This bespoke approach not only differentiates BFSI companies in a competitive landscape but also fosters customer retention and opens up new revenue streams through cross-selling. The strategic application of generative AI to craft personalized financial solutions caters to the individual preferences of customers, underscoring a lucrative growth opportunity that promotes both customer satisfaction and business expansion.

Trending Factors

Integration of AI and Blockchain Technologies Are Trending Factors

The merging of AI and blockchain technologies is setting a trend in the generative AI BFSI market by fostering secure, efficient, and transparent financial operations. Blockchain's immutable ledgers and encryption, paired with AI's analytical prowess, create a robust framework for innovative financial solutions. This synergy is instrumental in streamlining processes like digital identity verification, smart contract execution, and enhanced fraud detection mechanisms.

An instance of this integration is seen in Ripple's deployment of AI algorithms to monitor blockchain transactions for unusual patterns, thereby elevating security and regulatory compliance, especially in international payments. The convergence of AI and blockchain is not just a technological advancement but a strategic move towards decentralized, secure, and user-centric financial services, making it a significant trend in the BFSI sector.

Rise of Explainable AI and Model Interpretability Are Trending Factors

Explainable AI (XAI) and model interpretability have become pivotal in the BFSI market as demand for transparent and accountable AI-driven decision-making escalates. The complexity of AI models often obscures their decision processes, raising concerns over bias, fairness, and compliance with stringent regulatory standards. The BFSI sector, in response, is gravitating towards AI solutions that not only predict and analyze but also elucidate their decision rationale.

Tools like IBM's AI Explainability 360 are pivotal in this trend, offering BFSI firms a means to demystify AI operations and align them with regulatory expectations. This trend underscores a broader shift towards building trust and reliability in AI applications by making their decisions understandable and justifiable, catering to both customer expectations and regulatory demands, thereby fostering a responsible and transparent AI ecosystem in the financial industry.

Regional Analysis

North America Dominates with 42% Market Share

North America's commanding 42% share in the Generative AI in BFSI Market is propelled by several key factors. A strong ecosystem of technology innovators, significant investments in AI research and development, and a robust financial sector keen on adopting the latest digital solutions drive this dominance. The region hosts some of the world's leading tech giants and innovative startups, providing a fertile ground for AI advancements. Additionally, stringent regulatory standards have necessitated the adoption of advanced AI solutions for compliance, fraud prevention, and risk management, further fueling growth.

The regional dynamics of North America, characterized by a highly competitive banking sector, advanced technological infrastructure, and a favorable regulatory environment, significantly influence the industry's performance. The presence of tech-savvy consumers and businesses eager to embrace digital transformations has led to early and widespread adoption of generative AI applications in BFSI. This tech-forward culture, combined with substantial investments in AI, contributes to the region's leading position.

Other Regions:

- Europe: Europe follows with a significant market share, propelled by its strong focus on data protection and AI ethics, influencing a 30% market growth. The GDPR framework encourages transparent and secure AI implementations, fostering trust and adoption.

- Asia Pacific: Showcasing rapid growth, the Asia Pacific region is marked by a 25% market share, with its burgeoning tech hubs and digitalization efforts across emerging economies. Investments in digital infrastructure and a growing fintech sector contribute to its expanding influence.

- Middle East & Africa: With a burgeoning fintech scene and digital transformation initiatives, the Middle East & Africa region is gradually marking its presence, holding a 5% market share. Investments in innovation hubs and partnerships for AI development are key growth drivers.

- Latin America: Latin America is emerging as a region to watch with a 3% market share, as digital banking and fintech adoption surge. Though nascent, the region's focus on financial inclusion and tech innovation presents significant growth opportunities.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the Generative AI in BFSI (Banking, Financial Services, and Insurance) market, companies like DataRobot, Quantifind, OpenAI, Accenture, and SAS are key players, each bringing unique strengths to the sector. DataRobot excels in automating data science, enabling banks and financial institutions to build and deploy predictive models quickly, enhancing decision-making processes. Quantifind stands out by offering AI-driven financial crime detection, helping institutions mitigate risks and comply with regulations. OpenAI, known for its cutting-edge research and development in artificial intelligence, provides foundational models that can be adapted for financial forecasting, customer service automation, and more.

Accenture leverages its global consultancy expertise to implement AI solutions in BFSI, focusing on operational efficiency, customer experience, and innovation strategy. SAS offers advanced analytics, which are crucial for risk management, fraud detection, and personalized banking services. Together, these players are significantly influencing the BFSI sector, driving the adoption of AI to not only streamline operations but also to create new value propositions, improve risk management, and enhance customer engagement, signaling a transformative shift towards more intelligent, efficient, and customer-centric financial services.

Market Key Players

- DataRobot

- Quantifind

- OpenAI

- Accenture

- SAS

- Other Market Players

Recent Developments

- In October 2023, 'Google for India,' the company has unveiled a series of initiatives and partnerships across various sectors, including banking, finance, and cyber safety organizations. This has notable implications for the Generative AI landscape within the Banking, Financial Services, and Insurance (BFSI) market.Google's collaboration in India's digital financial journey, involving AI integration, indicates a potential avenue for the application of Generative AI in enhancing various aspects of financial services, including data analysis, customer interactions, and risk management.

- In 20 July 2023, The recently secured $320k funding by Vodex, a generative AI-powered outbound calling solution, in a pre-seed round led by 100X.VC is poised to have a significant impact on Generative AI within the BFSI (Banking, Financial Services, and Insurance) market. Vodex, founded by Anshul Shrivastava and Kumar Saurav, aims to utilize the capital infusion for product development and business expansion.

- In February 2023, The report reveals that Indian AI startups secured a total funding of $1.11 Billion across 47 funding rounds in 2022, showcasing a marginal increase of 0.1% compared to the previous year. The BFSI (Banking, Financial Services, and Insurance) sector has been a key driver in this growth, with rapid digitalization fueling the demand for AI-integrated systems.

Report Scope

Report Features Description Market Value (2023) USD 1.8 Billion Forecast Revenue (2033) USD 9.3 Billion CAGR (2024-2033) 18.40% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Based on Organization Type (Banks, Insurance companies, Financial service providers, Other Organization Types), Based on Application (Fraud detection, Risk assessment, Customer experience, Algorithmic trading, Other Applications), Based on Deployment Mode (On-premise, Cloud-based) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape DataRobot, Quantifind, OpenAI, Accenture, SAS, Other Market Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- DataRobot

- Quantifind

- OpenAI

- Accenture

- SAS

- Other Market Players