Generative AI In Financial Services Market Based on Type(Solutions, Services), Based on Application(Forecasting & Reporting, Credit Scoring, Fraud Detection, Risk Management, Other Applications), Based on the Deployment Mode(On-premises, Cloud), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

36923

-

April 2024

-

300

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

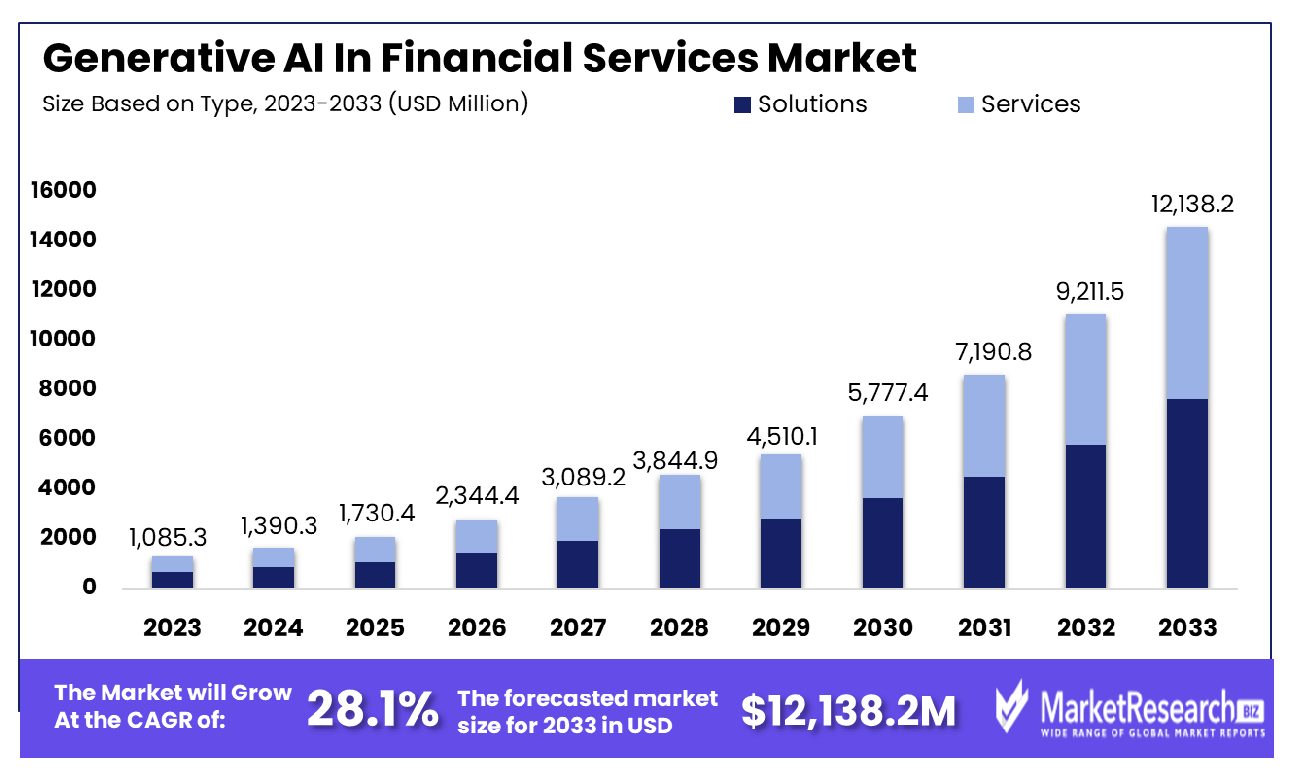

The Generative AI In Financial Services Market was valued at USD 1,085.3 Million in 2023. It is expected to reach USD 12,138.2 Million by 2033, with a CAGR of 28.1% during the forecast period from 2024 to 2033.

The surge in demand for new advanced technology and digitalization are some of the main key driving factors for generative AI in the financial service market. The generative AI uses a natural language processing method to generate text and pictures based on easy prompts. Financial institutions utilize GenAI applications for a variety of use cases. It comprises enabling customer-facing interactions, making stronger fraud detection, and automating back-office methodology like reporting and monitoring fulfillment. Banks have already implemented GenAI for such purposes.

For example, JP Morgan Chase is a well-known banking institute who have implemented a large number of language models to detect fraud. This implementation was done far earlier before the declaration that financial and banking institutes could use cautiously with GenAI technology in financial services.

There are several financial giants such as Ally Bank, Lending Club, SoFi, Vanguard, and many more, who have applied GenAI to their banking services to boost customized customer interaction. Adopting such technology has given rise to new modern banking services such as Virtual assistants or Chatbots, enhanced service messages, and customized marketing messages. Virtual assistants are one of the important services in financial services as manage many tasks that comprise implementing monetary transactions and chatbots are used to answer all the banking sector service-related queries.

For example, Bank of America has its own virtual assistant called Erica, which helps to execute money transactions and flags irregularities. Similarly, Wells Fargo collaborates work with AI company, Kasisto and its proprietary huge language model to offer exclusive and related content to financial customers.

Moreover, the introduction of GenAI plays a vital role in digitalization. All the financial institutes have digitalized their services. The monetary transactions have upgraded their techniques by implementing high data security provided by EMV chips and PIN cards as compared to old magnetic stripe cards. According to a PYMNTS, in August 2023, states that EMVCo, the implementation of EMV chip card technology is in demand in the banking sector and financial services. It also stated that by the end of 2022, 12.8 billion EMV chip cards will be distributed globally which represents a 7% surge as compared to last year.

Additionally, 69% are all EMV-enabled cards and 93% of all card transactions have used EMV chip technology. There are several advantages of adopting GenAI in financial services such as it helps in financial predictions, according to an IBM study, AI-based financial prediction has decreased prediction error by over 20% for several firms. It also helps in maintaining strong data privacy, handles risk management, and does document analysis. The demand for GenAI in financial services will rise due to its requirement in the banking industries and financial sectors which will help in market expansion in the coming years.

Key Takeaways

- Market Growth: The Generative AI In Financial Services Market was valued at USD 1,085.3 Million in 2023. It is expected to reach USD 12,138.2 Million by 2033, with a CAGR of 28.1% during the forecast period from 2024 to 2033.

- Based on Type: Solutions dominated with 76.4% market share based on type.

- Based on Application: Forecasting & Reporting led with a 30% share by application.

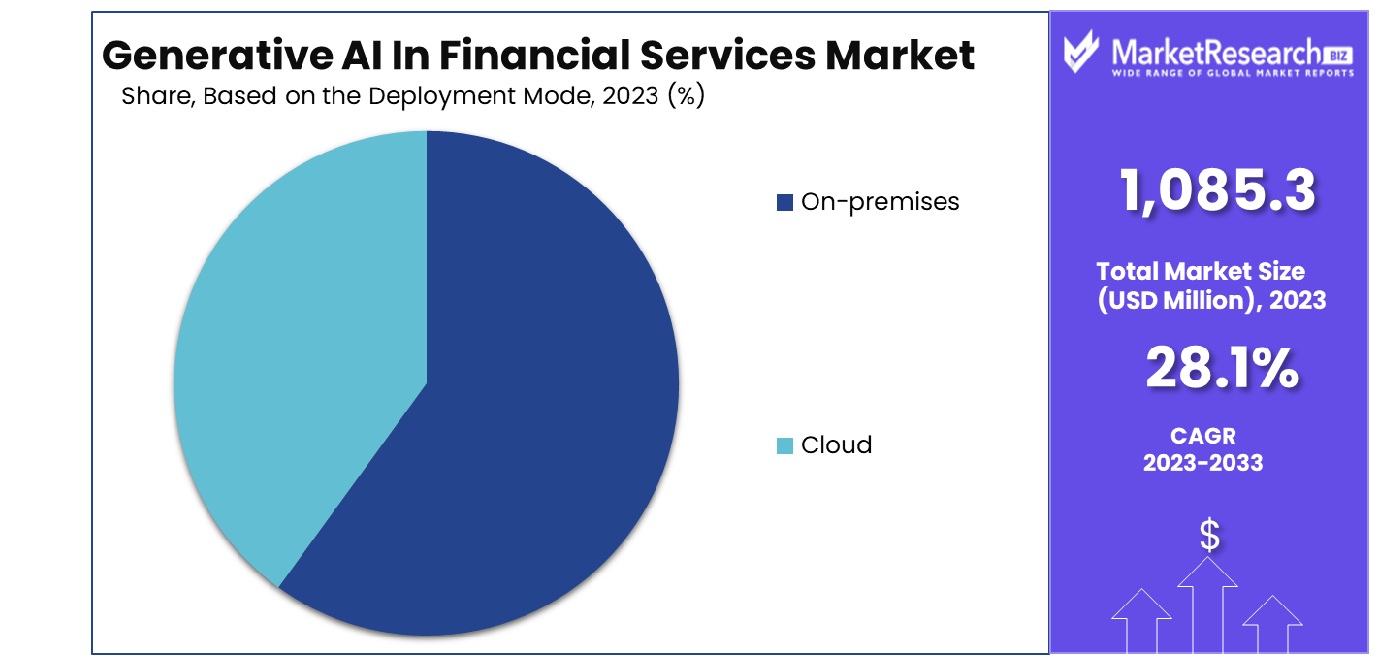

- Based on the Deployment Mode: On-premises deployment mode dominated with 57% market share.

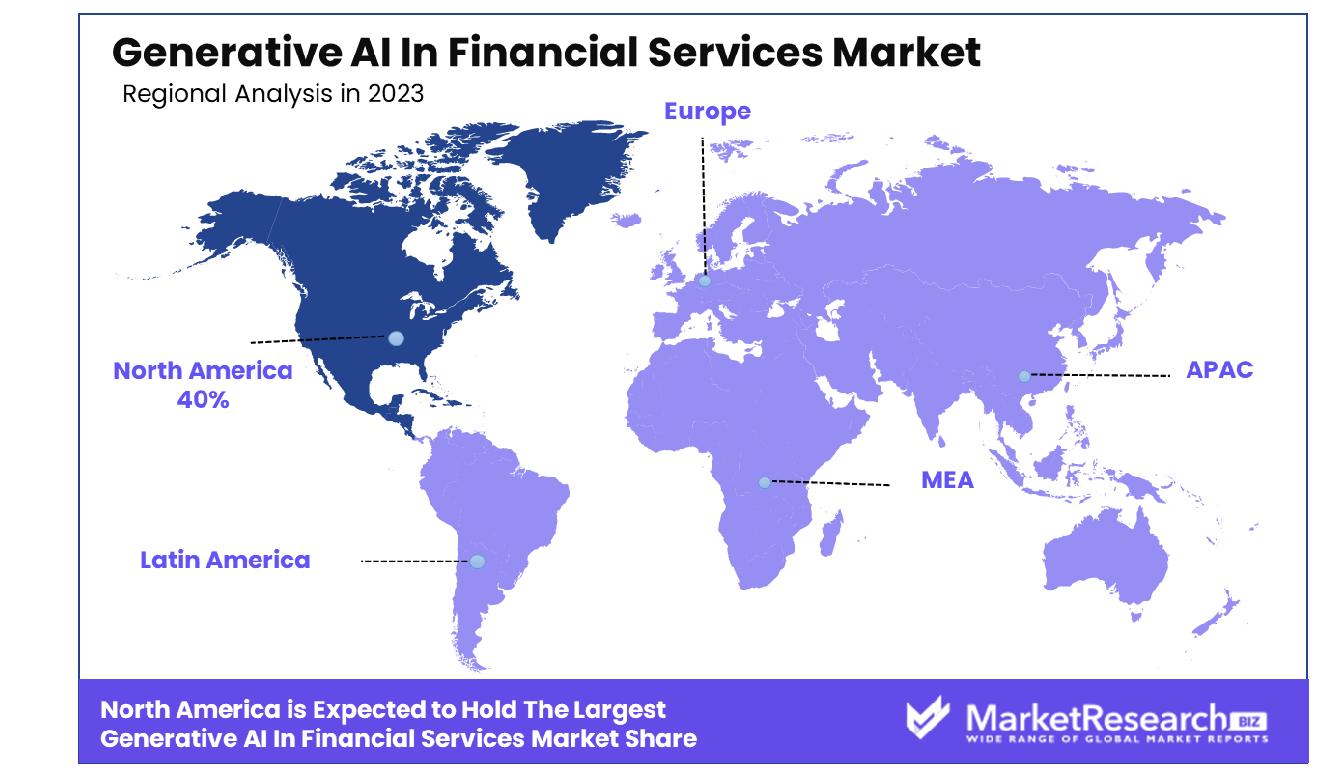

- Regional Dominance: North America dominates Generative AI in Financial Services Market by 40%.

- Growth Opportunity: In 2023, the global Generative AI in Financial Services Market is set for significant growth, driven by the need for enhanced risk assessment and fraud detection capabilities, as well as the rising demand for automated customer service solutions to meet evolving consumer expectations.

Driving factors

Enhanced Predictive Capabilities through Advanced Machine Learning Algorithms

The financial services industry has experienced significant transformation due to advancements in machine learning (ML) algorithms, notably deep learning and reinforcement learning. These sophisticated technologies have been integral in enabling highly accurate predictive models that are critical for risk assessment, investment decision-making, and fraud detection. For instance, deep learning techniques analyze vast arrays of historical data to identify patterns that would be imperceptible to human analysts.

This capability not only enhances decision accuracy but also optimizes financial operations by predicting market trends and customer behavior with remarkable precision. The integration of these advanced ML algorithms into generative AI applications propels the financial services market toward more robust, data-driven decision-making frameworks, thereby fostering growth and efficiency. The Generative AI in Financial Services Market, including the Generative AI in Banking Market, drives innovation and efficiency

Data Explosion Driving AI Integration

The financial sector is characterized by its generation of extensive volumes of data, encompassing transaction records, market data, customer interactions, and compliance documentation. Traditional data processing methods are often inadequate in handling such vast and complex datasets efficiently.

Generative AI steps in as a powerful tool to manage, analyze, and leverage this data, providing insights that significantly enhance operational efficiencies. By deploying generative AI, financial institutions can extract actionable insights from their data reservoirs, enabling personalized customer service, improved compliance, and enhanced predictive analytics. This not only streamlines workflows but also provides a competitive edge in a data-driven market environment.

Cost Reduction through Automation and Resource Optimization

Generative AI is revolutionizing the financial industry by automating routine tasks and optimizing resource allocation, which collectively contribute to significant cost reductions. Automation of processes such as report generation, risk assessment, and customer inquiries handling reduces the need for manual intervention, which in turn decreases labor costs and human error. Furthermore, generative AI enables the creation of virtual financial advisors and automated customer service agents, reducing operational costs and enhancing service delivery.

This automation extends to complex decision-making processes where AI models offer scalable solutions that improve efficiency and reduce expenditure on resources. The financial savings realized through these efficiencies are substantial, making generative AI a key driver in the financial sector's growth by contributing to leaner, more effective business models.

Restraining Factors

Data Privacy and Security Concerns in Generative AI Adoption

The deployment of generative AI within financial services is notably hampered by data privacy and security concerns. Financial institutions manage highly sensitive information, and the extensive data requirements for training generative AI models introduce significant risks regarding data breaches and unauthorized access. For example, the integration of AI that processes customer financial records and transaction histories raises substantial concerns about the protection of personal and financial data.

These concerns are not only regulatory in nature but also affect customer trust and institutional credibility. Consequently, the growth of generative AI in financial services is restrained as institutions must balance innovation with stringent compliance with data protection laws, such as GDPR and the CCPA, which dictate strict guidelines on data usage and consumer privacy.

Challenges of Limited Interpretability of Generative AI Models

Another major restraining factor in the adoption of generative AI within the financial sector is the limited interpretability of these models. Due to the intrinsic complexity of generative AI, particularly in models based on deep learning, it becomes challenging for users to understand how decisions are made or predictions are generated. This "black box" nature makes it difficult for financial institutions to fully trust and rely on AI outputs, especially in an industry where accountability is crucial.

The lack of transparency can lead to challenges in gaining regulatory approvals as well as resistance from stakeholders who are cautious about adopting technologies that do not provide clear insight into their decision-making processes. As a result, while generative AI holds the potential for transforming financial services, its complex, opaque models slow down its adoption and integration into critical decision-making areas.

Based on Type Analysis

In the realm of Type, Solutions hold a commanding 76.4% dominance, indicating market preference.

In 2023, Solutions held a dominant market position in the Based on Type segment of Generative AI In Financial Services Market, capturing more than a 76.4% share. Solutions within this segment encompass a spectrum of offerings tailored to meet the evolving demands of the financial services industry. These solutions integrate advanced algorithms and machine learning techniques to streamline operations, enhance decision-making processes, and drive innovation across various financial domains.

The prominence of Solutions within the Generative AI In Financial Services Market can be attributed to their versatility and adaptability in addressing a myriad of challenges faced by financial institutions. These solutions encompass a wide array of applications, including risk management, fraud detection, algorithmic trading, customer service automation, and personalized financial advice.

Furthermore, the increasing adoption of Solutions is fueled by the growing need for efficiency, accuracy, and agility in financial operations. Institutions are leveraging generative AI solutions to automate routine tasks, mitigate risks, and uncover valuable insights from vast volumes of data, thereby gaining a competitive edge in the market.

Moreover, the emergence of advanced technologies such as natural language processing (NLP), deep learning, and neural networks has significantly bolstered the capabilities of Solutions within the financial services sector. These technologies enable Solutions to analyze complex data sets, detect patterns, and generate actionable insights in real-time, empowering financial institutions to make informed decisions and capitalize on emerging opportunities.

Based on Application Analysis

Forecasting & Reporting governs the Application with a 30% stronghold, showcasing its significance.

In 2023, Forecasting & Reporting held a dominant market position in the Based on Application segment of the Generative AI In Financial Services Market, capturing more than a 30% share. Forecasting & Reporting solutions within this segment offer indispensable tools for financial institutions to predict market trends, analyze financial data, and generate comprehensive reports to guide strategic decision-making processes.

The prevalence of Forecasting & Reporting solutions can be attributed to their critical role in enhancing the accuracy and reliability of financial forecasts, optimizing resource allocation, and facilitating regulatory compliance. Financial institutions rely on these solutions to streamline budgeting processes, monitor performance metrics, and forecast future financial outcomes with precision and confidence.

Moreover, Forecasting & Reporting solutions are instrumental in enabling financial institutions to adapt to dynamic market conditions, anticipate potential risks, and seize emerging opportunities promptly. By leveraging advanced algorithms and data analytics techniques, these solutions empower organizations to gain actionable insights from vast volumes of data, leading to more informed and strategic decision-making.

Additionally, the versatility of Forecasting & Reporting solutions extends beyond traditional financial forecasting, encompassing a wide range of applications such as Credit Scoring, Fraud Detection, Risk Management, and other specialized areas within the financial services sector. These applications further amplify the value proposition of Forecasting & Reporting solutions, enabling financial institutions to address diverse business challenges and capitalize on untapped opportunities.

Based on the Deployment Mode Analysis

On-premises Deployment Mode asserts its lead with a commanding 57% share, highlighting its preference.

In 2023, On-premises held a dominant market position in the Based on the Deployment Mode segment of the Generative AI In Financial Services Market, capturing more than a 57% share. On-premises deployment refers to the installation and operation of Generative AI solutions within the premises of financial institutions, providing them with full control over their data, infrastructure, and security protocols.

The prevalence of On-premises deployment can be attributed to several factors, including data security concerns, regulatory compliance requirements, and the need for greater customization and control. Financial institutions, particularly those handling sensitive financial information, prioritize On-premises deployment to ensure the confidentiality, integrity, and availability of their data assets.

Furthermore, On-premises deployment offers financial institutions the flexibility to tailor Generative AI solutions to their specific business needs, integrate them seamlessly with existing IT infrastructure, and scale resources as required. This level of customization and control enables organizations to address unique operational challenges, optimize performance, and maximize the value derived from Generative AI technologies.

Moreover, On-premises deployment aligns with the risk management strategies of financial institutions, enabling them to mitigate potential vulnerabilities associated with cloud-based solutions, such as data breaches, data residency issues, and dependency on third-party providers. By maintaining full ownership and oversight of their infrastructure, financial institutions can uphold stringent security standards and compliance regulations, safeguarding the trust and confidence of their stakeholders.

Key Market Segments

Based on Type

- Solutions

- Services

Based on Application

- Forecasting & Reporting

- Credit Scoring

- Fraud Detection

- Risk Management

- Other Applications

Based on the Deployment Mode

- On-premises

- Cloud

Growth Opportunity

Enhanced Risk Assessment and Fraud Detection

The global Generative AI In Financial Services Market is poised for significant growth opportunities in 2023, driven primarily by the increasing demand for enhanced risk assessment and fraud detection capabilities within the financial sector. Generative AI technologies offer advanced algorithms and predictive analytics models that empower financial institutions to identify and mitigate potential risks more effectively than ever before.

By analyzing vast volumes of data in real time, Generative AI solutions can detect anomalous patterns, suspicious transactions, and fraudulent activities with higher accuracy and efficiency, thereby safeguarding financial institutions against potential losses and reputational damage. As regulatory scrutiny intensifies and cyber threats evolve, the adoption of Generative AI for risk assessment and fraud detection is becoming imperative for financial institutions seeking to enhance their security posture and maintain regulatory compliance.

Automated Customer Service and Support

In 2023, the global Generative AI In Financial Services Market presents substantial growth opportunities in the realm of automated customer service and support. With the proliferation of digital channels and the rising expectations of tech-savvy consumers, financial institutions are increasingly turning to Generative AI technologies to deliver personalized and responsive customer experiences at scale. Generative AI-powered chatbots, virtual assistants, and automated service platforms enable financial institutions to engage with customers in real time, address inquiries, and provide assistance round-the-clock, thereby improving customer satisfaction, loyalty, and retention.

Moreover, by automating routine customer service tasks, financial institutions can streamline operations, reduce service delivery costs, and free up human agents to focus on more complex and high-value interactions. As customer expectations continue to evolve, the integration of Generative AI into customer service operations represents a compelling growth opportunity for financial institutions seeking to differentiate themselves in a competitive marketplace and drive long-term customer loyalty.

Latest Trends

Fraud Detection and Risk Management:

The integration of generative AI technology in fraud detection and risk management systems marks a significant advancement in fortifying the financial services sector against illicit activities. Leveraging sophisticated algorithms, these AI-powered systems meticulously analyze transactional data to unearth irregular patterns and suspicious behaviors. By swiftly identifying potential threats, financial institutions can preemptively mitigate risks and safeguard their assets.

In 2023, the global adoption of generative AI for fraud detection soared, propelled by the imperative need for robust security measures in an increasingly digitalized financial landscape. This trend underscores a paradigm shift towards proactive risk management strategies, reflecting the industry's unwavering commitment to maintaining trust and integrity amidst evolving cyber threats.

Generative AI and Large Language Models:

The ascendancy of generative AI and large language models heralds a transformative era in financial services, heralding unprecedented opportunities for innovation and efficiency. Empowered by cutting-edge technologies, financial organizations are harnessing generative AI for diverse applications, ranging from streamlining marketing campaigns to revolutionizing synthetic data generation processes. The proliferation of these advanced tools underscores the industry's relentless pursuit of optimization and adaptation in an era defined by rapid digitalization.

In 2023, the global uptake of generative AI and large language models in financial services witnessed a meteoric rise, as forward-thinking enterprises capitalized on the potential for enhanced productivity and competitiveness. This trend signifies a watershed moment in the industry's technological evolution, foreshadowing a future where AI-driven solutions become indispensable components of financial operations.

Regional Analysis

In North America, the Generative AI in Financial Services Market surged by 40% in 2023.

The Generative AI market in financial services demonstrates diverse dynamics and growth potential across different global regions. In North America, which dominates the market with a 40% share, the adoption of generative AI technologies is primarily driven by substantial investments from leading financial institutions aiming to enhance customer experience and automate risk management processes. This region benefits from advanced technological infrastructure and a robust regulatory framework that encourages innovation in financial services.

In Europe, the market is propelled by stringent data protection regulations and a focus on innovative banking services. The European Union's investment in digital transformation and AI technologies supports this growth, facilitating new opportunities for generative AI applications in areas like fraud detection and compliance.

Asia Pacific is witnessing rapid growth in the generative AI sector due to the rising digitalization of financial services and the increasing acceptance of AI technologies among consumers and businesses. Countries like China, Japan, and South Korea are leading in technological advancements, contributing significantly to regional market expansion. The adoption of mobile banking industries and e-commerce platforms in this region also plays a crucial role in the integration of AI solutions.

The Middle East & Africa region shows promising growth with the increasing adoption of fintech solutions and government initiatives aimed at digital transformation. Financial institutions in this region are increasingly leveraging AI to enhance operational efficiencies and customer service.

Lastly, Latin America is experiencing a surge in fintech developments and a growing interest in AI, driven by the need to improve financial inclusion and tackle economic disparities. Innovations in mobile banking and personalized financial services are key factors fueling the adoption of generative AI in this region.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In the global Generative AI in Financial Services Market in 2023, several key players have demonstrated significant influence and innovation, notably IBM Corporation, Intel Corporation, Amazon Web Services, Inc., Narrative Science, Microsoft, Google LLC, and Salesforce, Inc.

IBM Corporation continues to be a pivotal force, leveraging its extensive expertise in AI and machine learning to offer advanced analytics and cognitive solutions that enhance decision-making processes in financial services.

Intel Corporation has capitalized on its hardware capabilities to support the high-performance computing demands of generative AI applications. Their technologies are critical in processing complex AI algorithms swiftly and efficiently, which is vital for real-time financial operations.

Amazon Web Services (AWS) plays a crucial role by providing robust cloud infrastructure and machine learning services that enable financial institutions to innovate and scale their AI operations without significant upfront investment in physical hardware.

Narrative Science stands out with its advanced natural language generation (NLG) technologies, which transform structured data into clear, human-like narratives. This capability is particularly valuable in generating automated financial reports and insights, enhancing transparency and comprehension.

Microsoft and Google LLC are at the forefront of generative AI research and cloud computing, offering comprehensive suites of AI tools and services that empower financial entities to enhance customer experiences and optimize operational efficiencies.

Salesforce, Inc. integrates AI into its customer relationship management (CRM) solutions, thus providing financial services institutions with enhanced analytical capabilities to predict customer needs and personalize service offerings effectively.

Market Key Players

- IBM Corporation

- Intel Corporation

- Narrative Science

- Amazon Web Services, Inc.

- Microsoft

- Google LLC

- Salesforce, Inc.

- Other Key Players

Recent Development

- In April 2024, GenAI is poised to revolutionize financial services with efficiency gains and personalized offerings. However, regulatory concerns loom over trust, accuracy, and data privacy. Organizations seek a balance between innovation and risk mitigation.

- In March 2024, Generative AI will transform FinTech with enhanced algorithmic trading, risk management, fraud detection, customer personalization, automated support, credit scoring, compliance, predictive analytics, and product innovation.

- In March 2024, Financial firms prioritize generative AI adoption 2024, transitioning from experimental to cross-enterprise integration. Accenture's FinTech Innovation Lab notes that 90% of finalists focus on generative AI solutions. Transformation requires cultural shifts and comprehensive strategies.

Report Scope

Report Features Description Market Value (2023) USD 1,085.3 Million Forecast Revenue (2033) USD 12,138.2 Million CAGR (2024-2032) 28.1% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Based on Type(Solutions, Services), Based on Application(Forecasting & Reporting, Credit Scoring, Fraud Detection, Risk Management, Other Applications), Based on the Deployment Mode(On-premises, Cloud) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape IBM Corporation, Intel Corporation, Narrative Science, Amazon Web Services, Inc., Microsoft, Google LLC, Salesforce, Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- IBM Corporation

- Intel Corporation

- Narrative Science

- Amazon Web Services, Inc.

- Microsoft

- Google LLC

- Salesforce, Inc.

- Other Key Players