Generative AI in Insurance Market By Component(Solutions, Services), By Deployment(On-Premise, Cloud-based), By Application(Claims Processing, Underwriting, Customer Service, Fraud Detection, Risk Assessment, Document Extraction & Classification, Others), By Enterprise Size(Large Enterprises, SMEs), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

-

36875

-

September 2024

-

300

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

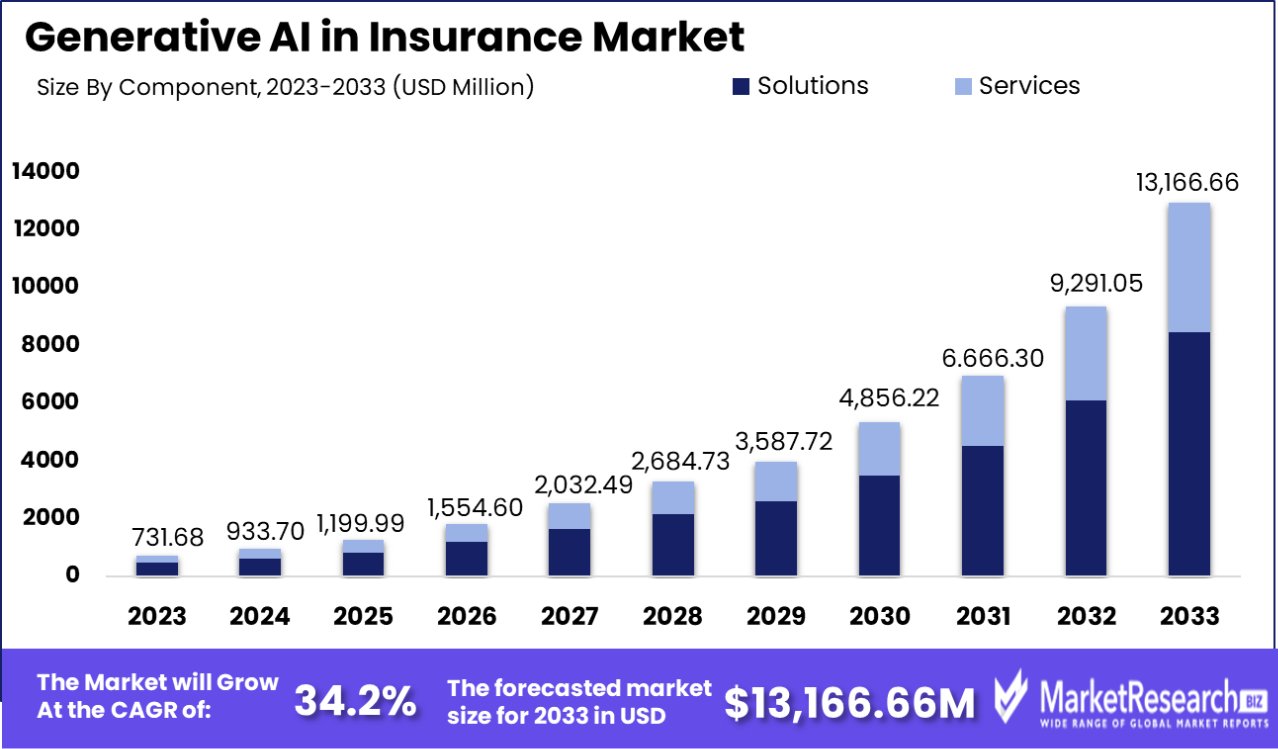

Global Generative AI in Insurance Market size is expected to be worth around USD 13,166.66 Mn by 2033 from USD 731.68 Mn in 2023, growing at a CAGR of 34.2% during the forecast period from 2024 to 2033.

The surge in demand for advanced new technologies and the rise in banking sectors are some of the main key driving factors for generative AI in insurance.

The generative AI in insurance is defined as the application of artificial intelligence methods predominantly generative models like generative adversarial networks and variational autoencoders, to change different aspects of the banking sectors. This application also comprises using generative algorithms to examine huge amounts of data, including past claims, customer behavior, and potential risk factors to produce insights and enhance insurance techniques.

Generative AI simplifies tasks like fraud detection, risk assessment, and customized underwriting by producing synthetic data and simulating multiple situations. It allows insurers to enhance pricing precision by augmenting customer experience through customized products and services and streamlining claims methods.

Furthermore, gen AI helps in the creation of innovative insurance products and the automation of daily tasks, by leading to more efficacy operations and better risk management. Generative AI in insurance focuses on propelling profitability, alleviating risks, and improving competitiveness in the growing insurance landscape.

According to Medium in November 2023, highlights that in 2022, more than 22% of customers stated dissatisfaction with their P&C insurance providers. The American Customer Satisfaction Index (ACSI) discloses a pressing requirement for improvement, particularly in areas like the availability of discounts, speed of claims processing, and clarity of billing statements. BCG highlights that gen AI applications provide substantial efficacy and cost savings all across the insurance value chain.

One of the most notable revelations is the potential 40% to 60% savings in customer service productivity. Insurance agents currently spend about 35% of their time navigating through policies and terms. With Generative AI, this can be drastically decreased by permitting swift and accurate document queries. Moreover, 87% of customers believe their claims experiences influence their loyalty to an insurer.

Generative AI in insurance offers several benefits enhanced fraud detection through synthetic data generation, augmented risk assessment through scenario simulation, and customized underwriting for customers.

It makes easy claims processing, enhances pricing precision, and nurtures new innovations, ultimately leading to better customer experience, satisfaction, and a rise in operational efficiency for insurers. The demand for generative AI in insurance will increase due to its requirement in the banking sectors which will help in market expansion in the coming years.

Key Takeaways

- Market Value: Global Generative AI in Insurance Market size is expected to be worth around USD 13,166.66 Mn by 2033 from USD 731.68 Mn in 2023, growing at a CAGR of 34.2% during the forecast period from 2024 to 2033.

- By Component: In 2023, Solutions held a dominant market position in the By Component segment of Generative AI in Insurance Market, with a 65.7% share.

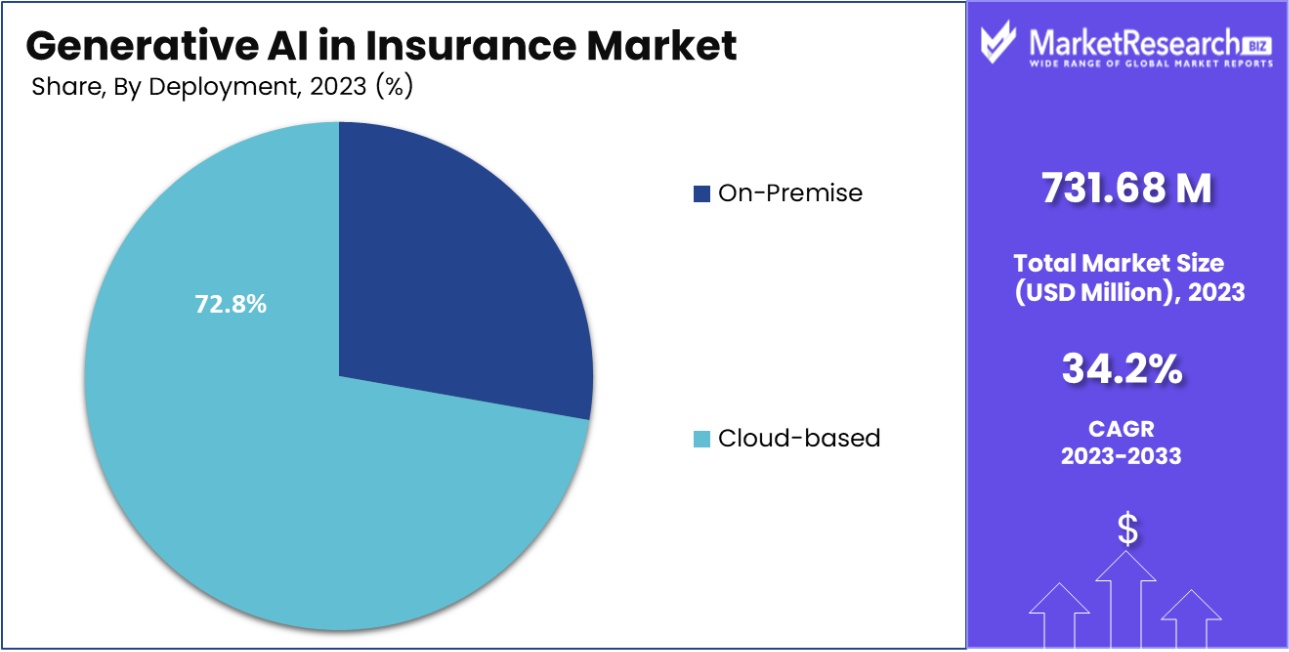

- By Deployment: In 2023, Cloud-based held a dominant market position in the By Deployment segment of Generative AI in Insurance Market, with a 72.8% share.

- By Application: In 2023, Claims Processing held a dominant market position in the By Application segment of Generative AI in Insurance Market , with a 25.9% share.

- By Enterprise Size: In 2023, Large Enterprises held a dominant market position in the By Enterprise Size segment of Generative AI in Insurance Market, with a 70.3% share.

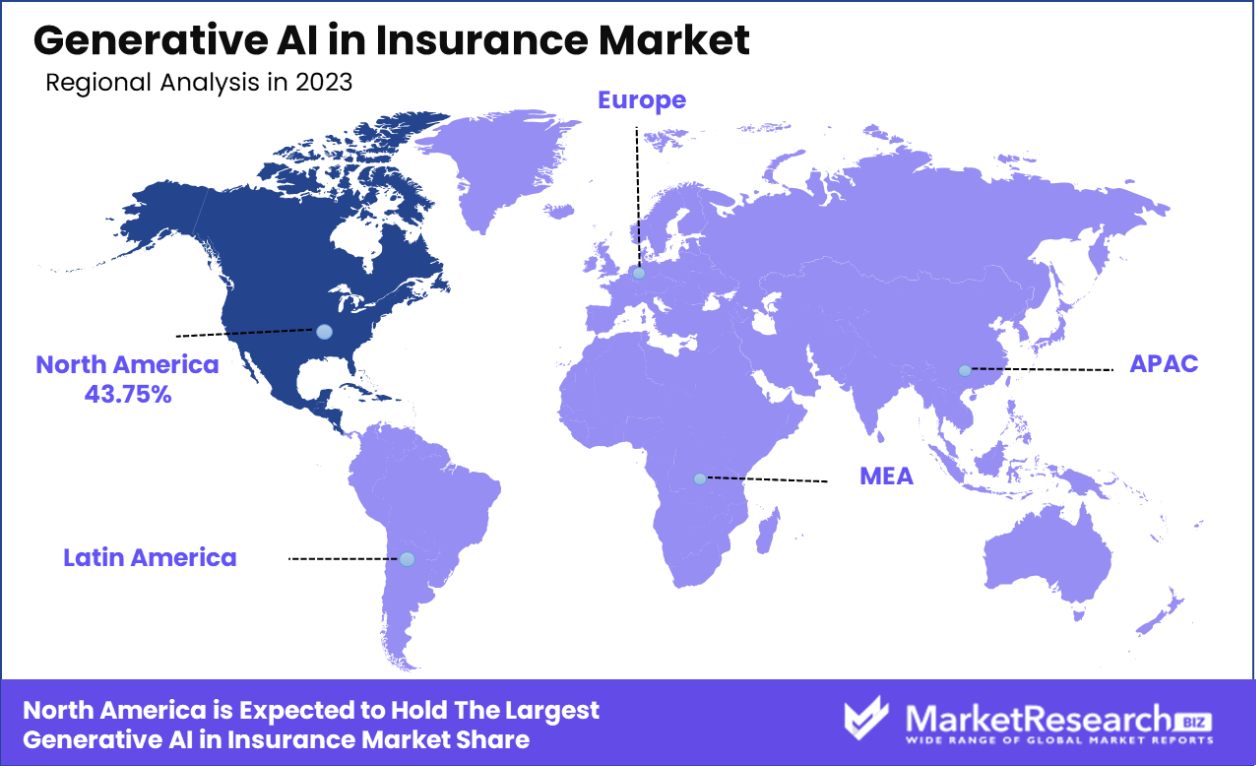

- Regional Analysis: North America holds a dominant 43.75% share in the Generative AI insurance market, leading innovation.

- Growth Opportunity: In 2023, the integration of generative AI in the insurance industry is set to enhance operational efficiency through cost-saving automation of routine tasks and revolutionize customer interactions by offering personalized experiences that boost satisfaction and loyalty.

Driving factors

Cloud Adoption: Catalyzing Flexibility and Speed in Insurance

Cloud adoption is a pivotal driver in the generative AI insurance market. By migrating core systems to cloud infrastructure, insurance companies gain remarkable agility, which is crucial in adapting to market changes and consumer demands quickly. This flexibility also facilitates the rapid deployment of innovative products, which is essential in a competitive landscape.

Moreover, cloud computing enhances customer service capabilities by enabling more responsive and personalized interactions through advanced generative data analytics powered by AI. These advancements not only streamline operational processes but also improve the efficiency and accuracy of claims processing and risk assessment, thereby reducing costs and increasing customer satisfaction.

Ecosystem Integration: Enhancing Connectivity and Insight

The integration of ecosystems in the insurance sector is transforming traditional business models. By forming strategic alliances and integrating diverse data sources—such as IoT devices, public records, and third-party services—insurers can obtain a more holistic view of risks. This comprehensive data environment enhances predictive capabilities and risk management, allowing insurers to offer more tailored products and engage in proactive risk mitigation.

Furthermore, ecosystem integration supports the implementation of generative AI tools that require vast, diverse data sets to generate insights, predict trends, and automate customer interactions, thus enriching the overall customer experience and operational resilience.

Next-Level Automation: Redefining Risk and Efficiency

The push towards automation in the insurance industry is reshaping the landscape, particularly in areas that were traditionally labor-intensive such as underwriting and claims processing. Generative AI contributes significantly to this shift by automating complex processes and decisions that typically require human judgment.

This not only speeds up operations but also helps in managing and pricing risks more effectively, as AI systems can analyze large datasets quickly and with greater accuracy than humans. Additionally, automation through AI reduces the likelihood of human error and biases, leading to fairer and more consistent decision-making. As a result, insurers can offer more competitive pricing and better service, ultimately enhancing their market position and growth prospects.

Restraining Factors

Moral Hazard: Navigating the Pitfalls of Information Asymmetry

The deployment of generative AI in the insurance sector introduces a significant challenge in the form of moral hazard due to information asymmetry. In the insurance context, this occurs when there is a discrepancy between the information available to the AI systems and the users, which can lead to unpredicted or undesirable behaviors from the AI after policies are issued. This risk is particularly acute in scenarios where AI systems make decisions based on incomplete or biased data sets, potentially leading to unfair policy terms or pricing.

Such issues not only undermine customer trust but also pose regulatory risks, as insurers are held accountable for the actions of their AI systems. Managing this requires rigorous IoT data management, transparency in AI decision processes, and continuous monitoring to ensure outcomes align with ethical standards and regulatory requirements. Addressing these challenges is crucial for maintaining the integrity of insurance offerings and for the sustainable growth of AI applications in this sector.

Professional Responsibility: Upholding Standards with AI Integration

As generative AI becomes more integrated into the insurance industry, there is an increasing need to address the concerns regarding professional responsibility. Insurance professionals and attorneys are bound by ethical obligations to provide competent, accurate, and fair services. The use of AI tools must align with these duties, necessitating a deep understanding and oversight of how AI algorithms function and are applied in practice.

Missteps in AI deployment can lead to incorrect assessments, biased decision-making, or even legal liabilities if they fail to meet professional standards. Ensuring that AI tools are reliable and their outputs are verifiable becomes imperative to uphold professional integrity and protect consumer rights. These constraints are significant as they dictate the pace and manner in which AI technology can be ethically and effectively integrated into professional practices within the industry.

By Component Analysis

In 2023, Solutions held a dominant market position in the "By Component" segment of the Generative AI in Insurance Market, with a 65.7% share. This prominence can be attributed to the extensive integration of AI solutions in claims processing, risk assessment, customer service, and fraud detection. These applications are critical in enhancing operational efficiencies and improving customer engagement strategies.

The Services segment also exhibited significant growth, driven by the rising demand for customization and integration services that support the deployment of AI solutions. As insurance companies continue to invest in digital transformation, the need for expert services that facilitate the adoption of AI technologies has become imperative. This has resulted in a compounded annual growth rate (CAGR) for Services estimated at 18.3% over the forecast period.

Overall, the integration of Generative AI into the insurance sector is transforming traditional operations, enabling companies to harness predictive analytics and improve decision-making processes. The strategic deployment of both Solutions and Services is instrumental in refining risk models and enhancing the precision of customer insights, thereby fostering a more robust and responsive insurance marketplace.

By Deployment Analysis

In 2023, Cloud-based solutions held a dominant market position in the "By Deployment" segment of the Generative AI in Insurance Market, with than a 72.8% share. The substantial market preference for cloud-based platforms can be attributed to their scalability, cost-effectiveness, and ease of integration with existing digital infrastructure. These platforms facilitate rapid deployment and seamless updates, which are crucial for leveraging generative AI capabilities in dynamic market conditions.

On-Premise solutions, while maintaining a smaller market share, continue to be relevant for organizations prioritizing data control, security, and regulatory compliance. However, the agility and reduced overhead costs associated with cloud environments significantly contribute to their larger market share.

The market dynamics indicate a continuing trend towards cloud deployments, driven by the growing recognition of their strategic benefits in processing large datasets and implementing AI-driven analytical tools. This trend is anticipated to accelerate as insurance companies increasingly adopt cloud-first strategies to enhance their competitive edge in utilizing generative AI for customer service, personalized insurance offerings, and risk management.

By Application Analysis

In 2023, Claims Processing held a dominant market position in the By Application segment of the Generative AI in Insurance Market, with a 25.9% share. This segment has been pivotal due to the integration of AI technologies that streamline and automate the evaluation and management of insurance claims, thereby reducing processing time and costs while increasing accuracy and customer satisfaction.

Underwriting followed closely, leveraging Generative AI to enhance risk assessment capabilities and customize insurance policies more effectively. This segment used sophisticated algorithms to analyze vast data sets, leading to more accurate risk predictions and premium determinations.

Customer Service also greatly benefited from Generative AI, which enabled the deployment of advanced chatbots and virtual assistants. These AI tools are capable of handling a wide range of customer inquiries and issues around the clock, improving customer engagement and operational efficiencies.

Fraud Detection utilizes Generative AI to identify and prevent fraudulent activities by analyzing patterns and anomalies that deviate from normal behaviors. AI-driven systems in this segment have become essential in safeguarding against losses and maintaining trust in insurance services.

Risk Assessment employed Generative AI to delve deeper into predictive analytics, helping insurers understand potential risks better and make informed decisions. This segment saw significant application in anticipating future claims and determining viable policy terms.

Document Extraction & Classification utilized AI to automatically extract and classify data from various document types, reducing manual efforts and errors associated with data entry and processing. This segment is crucial for improving the accuracy and efficiency of paperwork in insurance operations.

Others in the application segments included areas like policy renewal and cancellation processes, where AI tools provide significant operational improvements and customer satisfaction enhancements. These segments collectively contribute to a holistic application of Generative AI across the insurance industry, driving forward the digital transformation of traditional practices.

By Enterprise Size Analysis

In 2023, Large Enterprises held a dominant market position in the "By Enterprise Size" segment of the Generative AI in Insurance Market, with a 70.3% share. This dominance is largely driven by the significant resources that large enterprises can allocate toward advanced AI technologies, including substantial investments in generative AI for automating processes, enhancing customer experience, and optimizing risk management.

The ability of large enterprises to invest in cutting-edge technology and attract top talent enables them to leverage generative AI more effectively than their smaller counterparts. This includes deploying AI for predictive analytics, personalized insurance products, and sophisticated claim-handling processes, thereby not only improving operational efficiency but also enhancing customer satisfaction.

SMEs, while holding a smaller portion of the market share, are gradually recognizing the benefits of generative AI. The scalability of cloud-based AI solutions is lowering entry barriers for these smaller players, allowing them to compete more effectively by adopting technologies that were previously accessible only to larger corporations. As the technology becomes more mainstream and affordable, SMEs are expected to increase their adoption rates, potentially reshaping the competitive landscape in the insurance industry.

Key Market Segments

By Component

- Solutions

- Services

By Deployment

- On-Premise

- Cloud-based

By Application

- Claims Processing

- Underwriting

- Customer Service

- Fraud Detection

- Risk Assessment

- Document Extraction & Classification

- Others

By Enterprise Size

- Large Enterprises

- SMEs

Growth Opportunity

Enhanced Operational Efficiency through Cost Savings

In 2023, the insurance industry stands on the brink of transformation, primarily driven by the integration of generative AI technologies. These advanced systems promise significant cost savings by automating routine and low-risk tasks such as document processing and policy management.

This shift not only reduces the financial burden associated with manual operations but also reallocates human capital towards more strategic activities, enhancing overall productivity gains and operational efficiency. By streamlining workflows, insurers can minimize expenses and optimize resource allocation, setting a new standard in operational agility.

Revolutionizing Customer Interactions with Personalized Experiences

Generative AI is poised to redefine customer engagement within the insurance sector. By harnessing the power of AI to analyze vast amounts of data, insurers can offer highly personalized Insurance policies and dynamic customer interactions.

This capability enables insurance companies to exceed customer expectations through tailored communication and bespoke solutions, fostering a deeper connection with clients. The impact of such personalized experiences is profound, leading to increased customer satisfaction and loyalty, which are critical factors in an industry as competitive as insurance.

Latest Trends

Tailored Insurance Solutions through Personalized Policy Recommendations

As we look towards 2023, one of the most transformative trends in the insurance sector is the rise of personalized policy recommendations powered by generative AI. This technology enables insurers to design customized insurance products that align closely with individual customer needs and preferences.

By analyzing data from various touchpoints, generative AI systems can identify unique risk profiles and suggest insurance policies that are not only optimal but also competitively priced. This trend towards customization is set to enhance customer satisfaction and retention, as clients increasingly seek solutions that reflect their specific circumstances and lifestyle choices.

Enhancing Customer Support with AI-driven Chatbots and Virtual Assistants

Another significant trend reshaping the insurance industry is the widespread adoption of generative chatbots and virtual assistants. These AI-driven tools are revolutionizing customer service by providing round-the-clock support and handling a multitude of inquiries with precision and efficiency.

The capabilities of these virtual assistants go beyond mere communication; they are equipped to understand and process complex customer requests, offering solutions and assisting with claims processing. The impact of this trend is profound, as it not only improves operational efficiency but also elevates the customer experience, making interactions more engaging and responsive.

Regional Analysis

North America holds a dominant 43.75% share in the Generative AI insurance market, leading innovation.

The Generative AI market in the insurance sector demonstrates significant regional variations in adoption and growth dynamics. North America emerges as the dominating region, accounting for approximately 43.75% of the global market. This is primarily driven by substantial investments in AI technologies and robust regulatory frameworks that favor innovation.

In Europe, the market's expansion is supported by strong data protection regulations and increasing digital transformation initiatives across the insurance industry. The Asia Pacific region is witnessing rapid growth due to increasing technological adoption and the integration of AI with mobile platforms, which are highly prevalent in areas such as China and India.

In the Middle East & Africa, the market is still nascent but shows potential due to growing digital literacy and government initiatives aimed at digital transformation. Latin America, on the other hand, presents a smaller but growing segment, with generative AI beginning to make inroads into traditional markets, driven by increasing internet penetration and a youthful demographic more open to digital insurance solutions.

Collectively, these regional dynamics underline the global heterogeneity in the adoption and impact of generative AI in the insurance industry, with North America continuing to lead in innovation and market share.

Key Regions and Countries

North America

- The US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

Amazon Web Services, Inc. (AWS) has established itself as a pivotal player in the global Generative AI in Insurance Market in 2023. AWS offers a robust suite of AI services that empower insurance companies to enhance their claims processing, risk assessment, and customer service. The scalability of AWS cloud solutions enables insurers to manage large volumes of data efficiently, driving innovations in personalized insurance policies and real-time risk management. Furthermore, AWS’s commitment to security and compliance aligns well with the stringent requirements of the insurance sector, reinforcing its strong market position.

IBM Corporation continues to be at the forefront of integrating AI into insurance. Its AI platform, Watson, is renowned for its deep learning capabilities and industry-specific solutions, particularly in underwriting and fraud detection. IBM’s expertise in data analytics and machine learning makes it a preferred partner for insurance companies looking to leverage advanced predictive models to drive decision-making and operational efficiencies. IBM's focus on hybrid cloud environments and AI ethics also enhances its appeal in the market, emphasizing responsible AI deployment in sensitive areas such as insurance.

Hexaware stands out for its targeted approach towards transforming legacy insurance systems through AI-driven innovations. Specializing in automation and data-driven insights, Hexaware helps insurers streamline operations and deliver enhanced customer experiences. The company’s solutions in document extraction and classification and customized AI services position it as a key enabler of digital transformation in the insurance industry. Hexaware’s strategic focus on AI integration into existing insurance frameworks showcases its capability to meet diverse client needs in the evolving market landscape.

Market Key Players

- Amazon Web Services, Inc.

- IBM Corporation

- Hexaware

- Shift Technology

- Lemonade

- GEICO

- Sixfold

- Snorkel

- Appian

- Microsoft Corporation

- Other Key Players

Recent Development

- In April 2024, Swiss Re launched an augmented version of its Life Guide manual, now featuring "Swiss Re Life Guide Scout," a Generative AI-powered underwriting assistant developed in collaboration with Microsoft Azure OpenAI Service to enhance the efficiency and quality of Life & Health insurance underwriting.

- In April 2024, Majesco announced the Spring '24 Release of its software solutions, highlighted by Majesco Copilot enhancements, which integrate Generative AI across its comprehensive insurance technology portfolio, enhancing operational efficiency and customer interaction for insurers.

- In April 2024, Investments in AI technology companies disrupting the insurance sector increased by 18% year-on-year, reaching nearly $2 billion through private equity and venture financing globally, with advancements in AI and Large Language Models driving a new phase of innovation in risk analysis and claims processing.

- In April 2024, The Worldwide Insurance 2024 Predictions report highlights that by 2027, 40% of AI algorithms used by insurers in the Asia/Pacific region will incorporate synthetic data to enhance fairness and compliance with evolving regulations such as the EU AI Act, amidst broader AI-driven innovations that are transforming the insurance industry.

Report Scope

Report Features Description Market Value (2023) USD 731.68 Million Forecast Revenue (2033) USD 13,166.66 Million CAGR (2024-2032) 34.2% Base Year for Estimation 2023 Historic Period 2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component(Solutions, Services), By Deployment(On-Premise, Cloud-based), By Application(Claims Processing, Underwriting, Customer Service, Fraud Detection, Risk Assessment, Document Extraction & Classification, Others), By Enterprise Size(Large Enterprises, SMEs) Regional Analysis North America - The US, Canada, Europe - Germany, France, The UK, Spain, Italy, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, Australia, New Zealand, Singapore, Rest of Asia Pacific, Latin America - Mexico, Brazil, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Amazon Web Services, Inc., IBM Corporation, Hexaware, Shift Technology, Lemonade, GEICO, Sixfold, Snorkel, Appian, Microsoft Corporation, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Amazon Web Services, Inc.

- IBM Corporation

- Hexaware

- Shift Technology

- Lemonade

- GEICO

- Sixfold

- Snorkel

- Appian

- Microsoft Corporation

- Other Key Players