Generative AI In Law Market Based on the Service Provider(AI Technology Companies, Legal Technology Startups, Law Firms with In-house AI Capabilities, AI Consulting and Implementation Services), Based on Firm Size(Large Law Firms, Mid-Sized Law Firms, Small Law Firms and Solo Practitioners), Based on the Deployment Model(On-premise, Cloud), Based on Application(Document Review, Legal Research, Contract Analysis, Prediction of Legal Outcomes, Other Applications), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scena

-

37665

-

April 2024

-

300

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

- Report Overview

- Key Takeaways

- Driving factors

- Restraining Factors

- Based on the Service Provider Analysis

- Based on Firm Size Analysis

- Based on the Deployment Model Analysis

- Based on Application Analysis

- Key Market Segments

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Development

- Report Scope

Report Overview

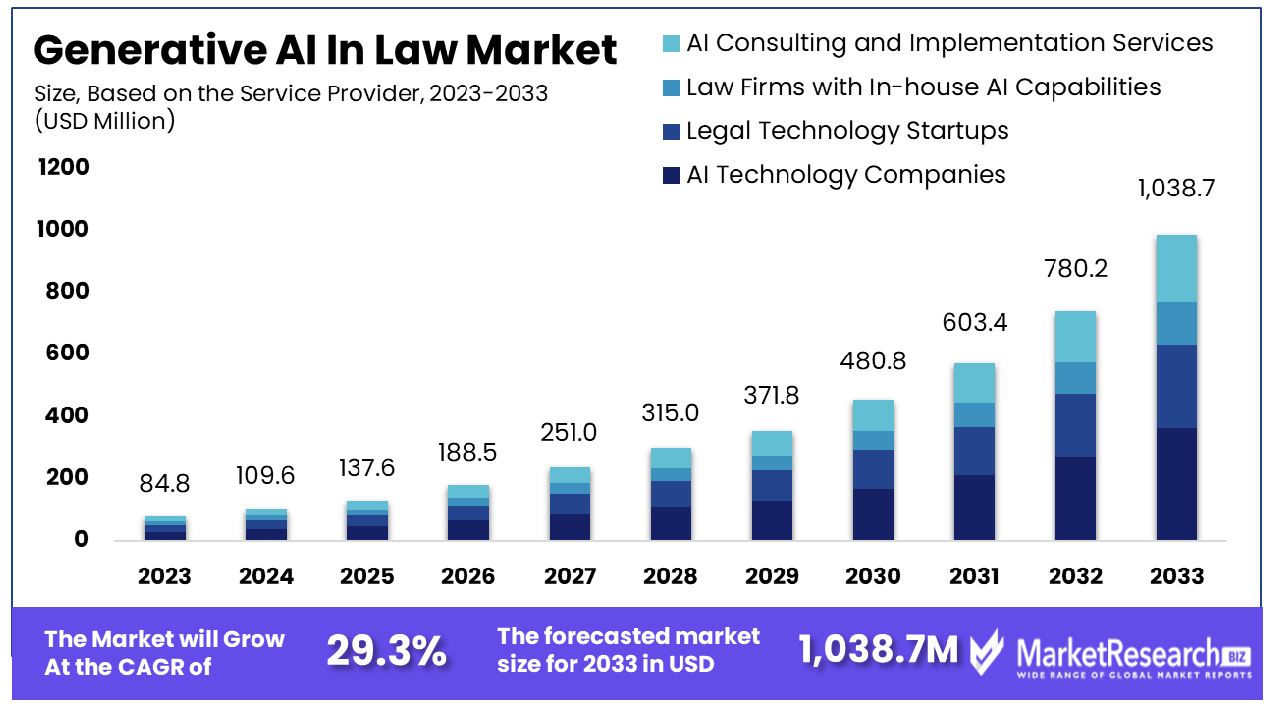

The Generative AI In Law Market was valued at USD 84.8 Million in 2023. It is expected to reach USD 1,038.7 Million by 2033, with a CAGR of 29.3% during the forecast period from 2024 to 2033. The surge in demand for new advanced technologies and the rise in legal cases and firms are some of the main key driving factors for the generative AI in law.

Generative AI in law is defined as the application of artificial intelligence methods, predominantly generative models to understand different legal risks, challenges, and tasks. Such models as generative adversarial networks and natural language processing algorithms produce synthetic legal documents, case summaries, and legal arguments. As per legal research, generative AI can develop summaries of case law, produce hypothetical situations for analysis, and even forecast case outcomes related to past information.

Additionally, in contract management and drafting, it can help in producing contract clauses, reviewing agreements, and recognizing potential legal risks. By implementing generative AI, legal experts can use monotonous tasks, enhance research efficacy, and improve the quality of legal analysis and decision-making. generative AI uses the designing of virtual legal supports to offer legal guidance and automate daily legal procedures. generative AI holds substantial promise in changing different legal experts, ultimately augmenting access to justice and legal services.

According to Tech Monitor30 in February 2024, highlights that 26% of legal experts are now using generative AI in law firms more than once a month as compared to 11% in the previous year. The study, which surveyed more than 1,200 legal professionals across the UK, also found that basic awareness of the technology had grown in the sector since last year, as had apprehensions about the potential of generative AI applications to have delusions responses or leak confidential data.

Moreover, legal experts are likely to use generative AI tools every month if they work at larger law forms (32%) or academic institutions (33%). Legal experts have planned to use generative AI, 91% and 90% mentioned that they would use it to draft legal documents and research legal matters respectively, up from 59% and 66%. Meanwhile, 73% stated that they would likely use it to help draft emails, up from a third in July 2023.

Generative AI in law provides new advantages by automating legal document generation by briefing and summarizing case law and forecasting case results. It improves legal research efficacy, simplifies contract management, and enhances decision-making methods. Furthermore, it makes the development of virtual legal supports, ultimately growing accessibility and efficacy in the legal domain. The demand for generative AI in law will increase due to its requirement in the many legal firms that will help in market expansion in the coming years.

Key Takeaways

- Market Growth: The Generative AI In Law Market was valued at USD 84.8 Million in 2023. It is expected to reach USD 1,038.7 Million by 2033, with a CAGR of 29.3% during the forecast period from 2024 to 2033.

- Based on the Service Provider: AI technology companies dominate the market landscape comprehensively.

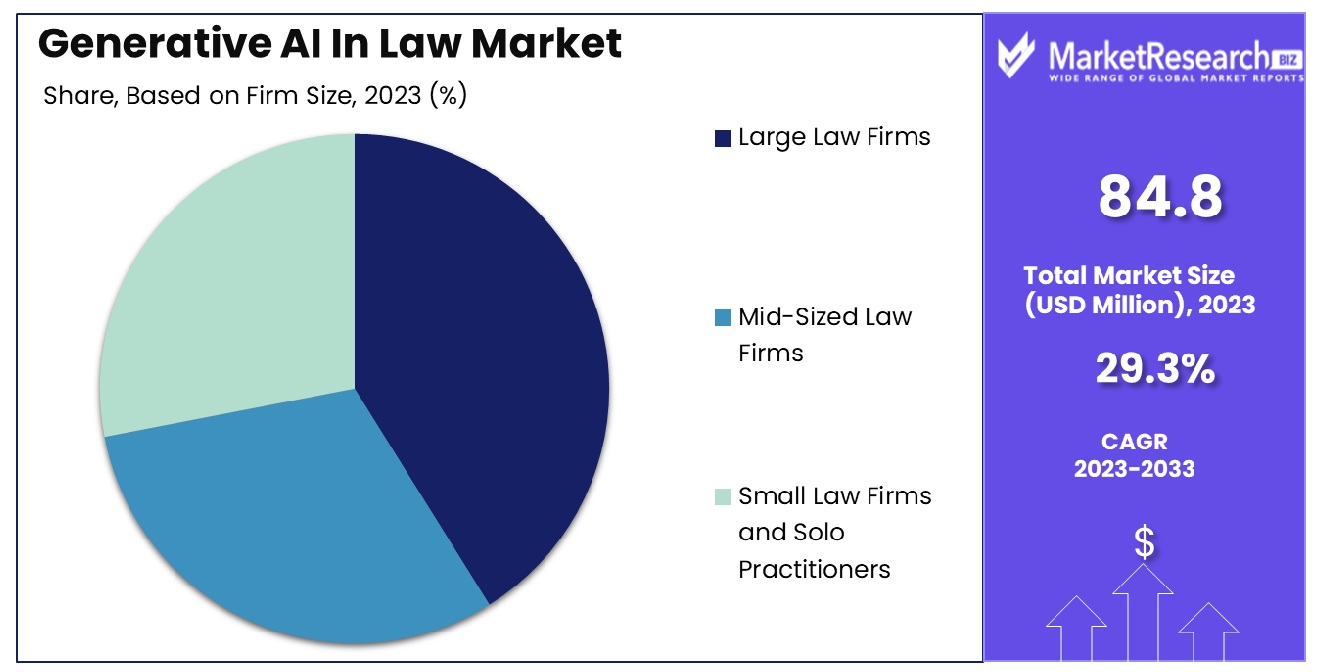

- Based on Firm Size: Large law firms command significant influence within the industry sector.

- Based on the Deployment Model: On-premise solutions maintain dominance in the market infrastructure paradigm.

- Based on Application: Document review holds sway as the primary use case application.

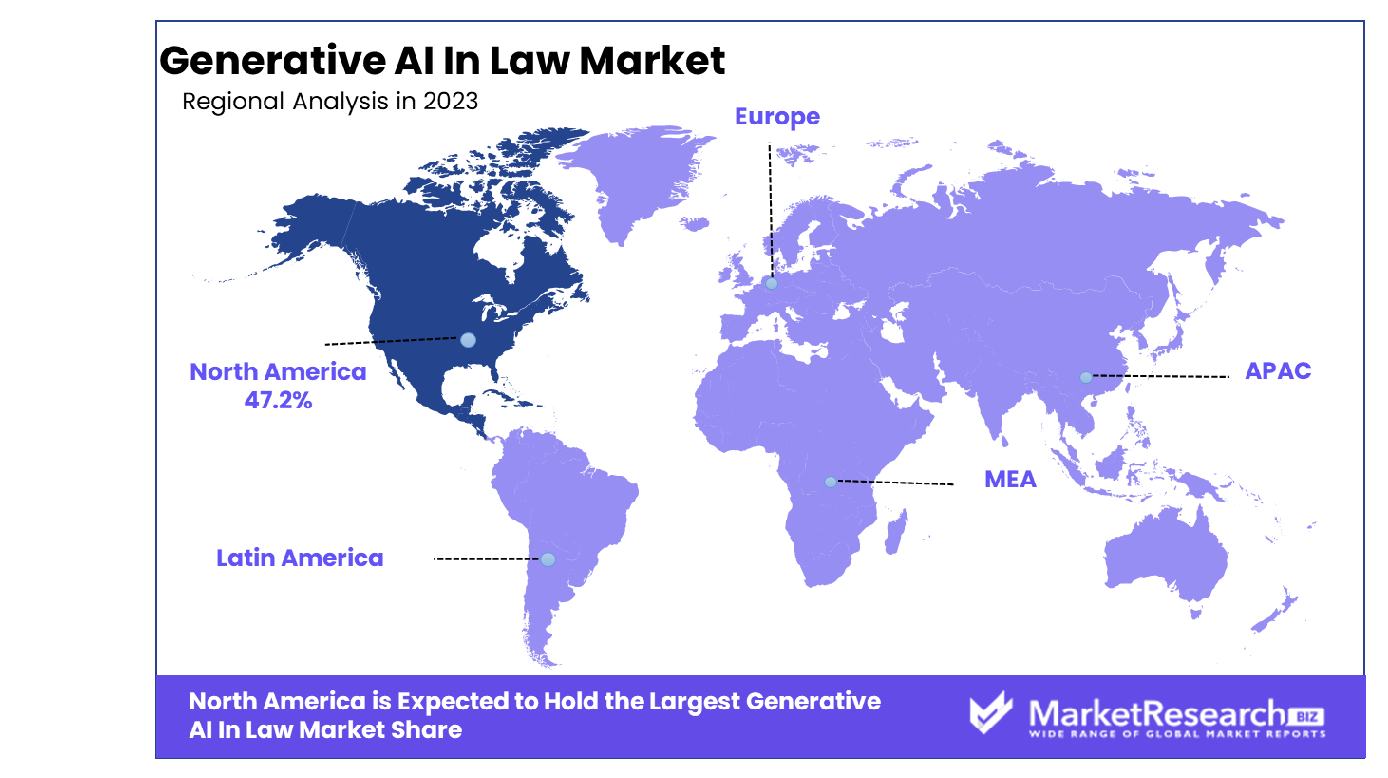

- Regional Dominance: In North America, the Generative AI in Law market dominates with a 47.2% share.

- Growth Opportunity: In 2023, the global Generative AI in Law market will offer growth opportunities through streamlined due diligence and compliance processes, as well as personalized legal advice, leveraging advanced algorithms for enhanced efficiency.

Driving factors

Growth in Legal Document Processing

The expansion of the Generative AI in Law Market is significantly propelled by advancements in legal document processing. Legal professionals are increasingly adopting AI technologies to manage voluminous documents efficiently, enabling faster review, drafting, and filing processes. The integration of AI not only automates mundane tasks but also minimizes human errors, leading to more accurate legal documentation.

This automation is crucial as it helps firms meet stringent compliance requirements and manage ever-growing document loads without corresponding increases in staffing. Consequently, the adoption of generative AI in legal document processing is viewed as a vital competitive advantage, fostering substantial market growth.

Enhanced Efficiency and Productivity

Generative AI significantly contributes to enhanced efficiency and productivity in legal practices. AI tools streamline complex workflows by automating case management and facilitating quicker decision-making processes. For instance, AI-driven analytics can predict case outcomes, assist in strategy formulation, and optimize resource allocation.

This enhancement in operational efficiency not only reduces the workload on legal professionals but also allows them to focus on more strategic tasks, thereby improving overall productivity. As law firms and legal departments seek to maximize output while curtailing operational costs, the demand for efficient AI solutions continues to rise, thereby driving market growth.

Rising Need for Legal Research Assistance

The increasing complexity of legal cases and the expanding volume of legal precedents and literature emphasize the need for advanced legal research assistance. Generative AI excels in sifting through extensive databases to provide precise, relevant case laws and statutes, significantly reducing research time. This capability is indispensable for legal professionals who need to stay updated with the latest legal developments and ensure thorough case preparation.

By enhancing the speed and accuracy of legal research, generative AI not only boosts the productivity of legal practitioners but also enhances the quality of legal services provided. This rising dependency on AI for legal research is a critical driver for the market's growth, as it addresses a core need within the legal industry.

Restraining Factors

Regulatory Compliance Challenges

The stringent regulatory environment in which the legal sector operates serves as a major restraint in the adoption of generative AI technologies. Legal firms must ensure that their use of AI complies with ethical standards and legal requirements to avoid potential liabilities and sanctions. This need for compliance can slow down the integration of AI systems as they must be tailored to operate within legal boundaries, requiring additional time and resources for development and testing.

Moreover, the evolving nature of regulations concerning data privacy and AI ethics demands ongoing adaptation and monitoring, further complicating the deployment and scaling of AI solutions in legal practices. These regulatory hurdles not only delay the implementation process but also increase the risk associated with adopting new technologies, potentially stifling innovation and market growth.

Cost of Implementation Impediments

The high costs associated with implementing AI in legal settings pose another significant barrier, particularly impacting smaller law firms and independent practitioners. Initial expenses include not only the procurement of AI software and hardware but also significant investments in training and integrating these systems into existing workflows. For smaller entities, these costs can be prohibitive, limiting their ability to leverage AI for enhanced efficiency and competitiveness.

Consequently, while large firms may benefit from the efficiencies offered by AI, the high cost of entry prevents a broader market penetration, thus restraining the overall growth of the generative AI in Law Market. This economic barrier reinforces the divide between larger firms that can afford to invest in AI and smaller practices that might struggle to adopt new technologies, affecting the uniform adoption and benefits of AI across the industry.

Based on the Service Provider Analysis

AI technology companies predominantly offer cutting-edge solutions, enhancing service delivery across various sectors.

In 2023, AI Technology Companies held a dominant market position in the Service Provider segment of Generative AI In Law Market. This segment encompasses various entities crucial for the advancement and integration of generative AI technologies within the legal sector.

AI Technology Companies spearheaded innovation in generative AI within the legal domain, leveraging cutting-edge algorithms and machine learning techniques to develop solutions tailored to legal workflows. Their robust research and development initiatives ensured the delivery of sophisticated tools capable of automating document drafting, contract analysis, and legal research tasks with unprecedented efficiency and accuracy.

Complementing the efforts of AI Technology Companies were Legal Technology Startups, agile entities characterized by their entrepreneurial spirit and focus on disruptive innovation. These startups introduced novel generative AI solutions targeting niche legal challenges, offering customizable platforms and agile deployment options tailored to the evolving needs of law firms and corporate legal departments.

Law Firms with In-house AI Capabilities emerged as formidable players in the Generative AI In Law Market, leveraging their deep industry expertise to develop proprietary generative AI tools. By integrating AI capabilities directly into their operations, these firms gained a competitive edge, enhancing efficiency, reducing costs, and delivering superior legal services to clients.

Additionally, AI Consulting and Implementation Services providers played a pivotal role in facilitating the adoption of generative AI technologies across the legal landscape. Their expertise in AI strategy, implementation, and training empowered law firms and legal departments to navigate the complexities of AI integration successfully. Through comprehensive consulting services and tailored solutions, these providers accelerated the transformation of the legal industry, driving productivity gains and fostering innovation.

Based on Firm Size Analysis

Large law firms primarily dominate the market, offering extensive resources and specialized expertise.

In 2023, Large Law Firms held a dominant market position in the Firm Size segment of the Generative AI In Law Market. This segment delineates the landscape of generative AI adoption across law firms of varying sizes, each contributing uniquely to the evolution of legal practice through AI integration.

Large Law Firms, characterized by their extensive resources and expansive client portfolios, led the charge in embracing generative AI technologies. With dedicated teams focused on innovation and technology, these firms invested heavily in developing proprietary AI solutions tailored to their specific practice areas. Their robust infrastructure and institutional support facilitated the seamless integration of AI into legal workflows, enhancing efficiency and enabling large-scale automation of routine tasks such as document review and contract analysis.

In contrast, Mid-Sized Law Firms demonstrated a growing interest in harnessing the potential of generative AI to augment their capabilities and remain competitive in a rapidly evolving legal landscape. While facing resource constraints compared to larger counterparts, mid-sized firms capitalized on off-the-shelf AI solutions and strategic partnerships to leverage the benefits of AI-driven automation and streamline their operations.

Small Law Firms and Solo Practitioners, although lagging behind larger counterparts in AI adoption, exhibited increasing curiosity and willingness to explore generative AI tools. These entities often sought out affordable and user-friendly AI solutions tailored to their specific needs, aiming to enhance productivity and expand service offerings while maintaining cost-effectiveness.

Overall, the Firm Size segment of the Generative AI In Law Market witnessed a spectrum of adoption rates and strategies, with large firms leading the way, mid-sized firms catching up, and smaller entities gradually embracing the transformative potential of AI technology.

Based on the Deployment Model Analysis

On-premise solutions are primarily favored for their robust security and customizable capabilities.

In 2023, On-premise held a dominant market position in the Deployment Model segment of the Generative AI In Law Market. This segment delineates the prevailing trends in the deployment of generative AI solutions within the legal industry, with On-premise solutions being favored for their reliability, security, and customization options.

On-premise deployment models gained prominence among law firms and legal departments seeking maximum control and security over their AI infrastructure and data. By hosting generative AI solutions locally on their servers, organizations could ensure compliance with stringent data privacy regulations and maintain confidentiality over sensitive legal information. Furthermore, On-premise deployments offered flexibility for customization, allowing firms to tailor AI algorithms to their specific workflows and integrate seamlessly with existing software systems.

While On-premise deployments boasted advantages in data control and customization, Cloud-based deployment models emerged as viable alternatives, particularly for smaller firms and solo practitioners. Cloud solutions provide accessibility, scalability, and cost-efficiency, enabling legal professionals to leverage AI capabilities without the need for extensive IT infrastructure investments. Additionally, Cloud deployments facilitated remote access to AI tools, fostering collaboration and enabling seamless integration across multiple devices and locations.

Despite the growing popularity of Cloud-based solutions, On-premise deployments remained the preferred choice for many established law firms and corporate legal departments, reflecting their commitment to data security, regulatory compliance, and tailored AI integration. However, as Cloud technology continues to mature and address security concerns, the balance between On-premise and Cloud deployments in the Generative AI In Law Market may shift, offering legal professionals more options to align AI strategies with their organizational priorities and preferences.

Based on Application Analysis

Document review applications lead the sector, significantly streamlining complex legal and administrative tasks.

In 2023, Document Review held a dominant market position in the Application segment of the Generative AI In Law Market. This segment highlights the diverse range of functions within the legal domain where generative AI technologies are applied, with Document Review emerging as a key area of focus due to its potential for automation and efficiency enhancement.

Document Review, traditionally a labor-intensive and time-consuming process, witnessed significant transformation with the integration of generative AI solutions. Leveraging advanced natural language processing (NLP) algorithms and machine learning techniques, AI-powered document review systems enabled rapid analysis and categorization of vast volumes of legal documents, including contracts, pleadings, and discovery materials. By automating routine tasks such as keyword extraction, sentiment analysis, and relevance assessment, generative AI streamlined the document review process, reducing errors, mitigating risks, and accelerating case preparation for legal professionals.

While Document Review held a prominent position within the Generative AI In Law Market, other applications also demonstrated notable traction and innovation. Legal Research benefited from AI-driven insights and analysis, empowering lawyers and researchers to access comprehensive legal databases, extract relevant case law, and identify precedents efficiently. Contract Analysis emerged as another critical application area, with generative AI tools facilitating the review, summarization, and comparison of contractual agreements, optimizing due diligence processes, and enhancing contract management practices.

Moreover, Prediction of Legal Outcomes garnered attention as AI algorithms leveraged historical case data and predictive analytics to forecast potential legal outcomes, enabling lawyers to make informed decisions and strategize effectively. Beyond these primary applications, the Generative AI In Law Market witnessed exploration into Other Applications, including virtual legal assistants, compliance monitoring, and regulatory analysis, reflecting ongoing innovation and diversification within the legal tech landscape.

Key Market Segments

Based on the Service Provider

- AI Technology Companies

- Legal Technology Startups

- Law Firms with In-house AI Capabilities

- AI Consulting and Implementation Services

Based on Firm Size

- Large Law Firms

- Mid-Sized Law Firms

- Small Law Firms and Solo Practitioners

Based on the Deployment Model

- On-premise

- Cloud

Based on Application

- Document Review

- Legal Research

- Contract Analysis

- Prediction of Legal Outcomes

- Other Applications

Growth Opportunity

Streamlined Due Diligence and Compliance

The year 2023 presents an auspicious growth opportunity for the global Generative AI in Law market, particularly in the realm of streamlined due diligence and compliance. With increasingly complex regulatory landscapes, legal professionals are burdened with the arduous task of navigating through vast amounts of data to ensure adherence to legal standards. Generative AI, leveraging advanced algorithms and natural language processing, emerges as a transformative solution, expediting due diligence processes and enhancing compliance efficiency.

By automating document analysis, contract review, and risk assessment, Generative AI enables legal practitioners to allocate their expertise toward higher-value tasks, thus optimizing resource utilization and mitigating compliance risks. This technology not only accelerates the pace of legal operations but also ensures accuracy and consistency, bolstering regulatory compliance frameworks across industries.

Personalized Legal Advice and Recommendations

In the dynamic landscape of legal practice, the demand for personalized legal advice and recommendations has reached unprecedented levels. The advent of Generative AI in Law heralds a new era of bespoke legal services tailored to individual client needs. By harnessing vast repositories of legal knowledge and leveraging machine learning algorithms, Generative AI platforms analyze case precedents, statutes, and regulations to offer tailored legal guidance and strategic insights.

This personalized approach not only enhances client satisfaction but also augments the efficacy of legal strategies, thereby fostering positive outcomes for stakeholders. Furthermore, Generative AI empowers legal professionals to anticipate client needs, anticipate potential challenges, and proactively devise innovative solutions, thereby cementing its position as a cornerstone of modern legal practice. As the market embraces the paradigm shift towards personalized legal services, the global Generative AI in Law market is poised for exponential growth, fueled by the convergence of technology and legal expertise.

Latest Trends

Adoption of Machine Learning in E-Discovery Processes

In 2023, the global Generative AI in Law market witnessed a significant surge in the adoption of machine learning (ML) within e-discovery processes. As legal firms and corporate legal departments grapple with the exponential growth of electronic data, ML algorithms have emerged as indispensable tools for streamlining e-discovery workflows.

By automating data categorization, relevance ranking, and document clustering, ML-powered e-discovery solutions have enhanced efficiency and accuracy while reducing the time and resources required for document review. This trend reflects a strategic shift towards data-driven decision-making and proactive risk management within the legal industry.

Integration of AI in Regulatory Compliance Monitoring

Another notable trend in the global Generative AI in Law market in 2023 was the integration of artificial intelligence (AI) in regulatory compliance monitoring. Amidst an increasingly complex regulatory landscape, organizations across industries have turned to AI technologies to enhance compliance oversight and mitigate regulatory risks. AI-powered compliance monitoring solutions leverage advanced algorithms to analyze vast data sets in real time, identifying patterns, anomalies, and non-compliant behaviors.

This proactive approach enables organizations to address compliance gaps promptly, reducing exposure to regulatory fines and reputational damage. The adoption of AI in regulatory compliance monitoring reflects a strategic imperative for organizations to uphold regulatory standards while optimizing operational efficiency and risk management practices.

Regional Analysis

In North America, the Generative AI in Law market holds a dominant share of 47.2%.

In North America, the Generative AI in Law market stands as the dominant force, capturing a substantial share of 47.2%. This region benefits from a robust technological infrastructure and a high level of adoption of AI solutions across various industries, including legal services. Additionally, the presence of leading AI technology providers and legal firms leveraging advanced technologies for e-discovery and compliance monitoring further fuels market growth.

In Europe, the Generative AI in Law market exhibits steady growth, driven by increasing investments in AI technologies and regulatory compliance initiatives. Countries such as the UK, Germany, and France are at the forefront of adopting AI-powered legal solutions to enhance efficiency and address regulatory complexities. Market players are focusing on strategic partnerships and product innovation to gain a competitive edge in this evolving landscape.

The Asia Pacific region emerges as a promising market for Generative AI in Law, fueled by rapid digitization, regulatory reforms, and the adoption of AI in legal processes. Countries like China, Japan, and India witness significant demand for AI-powered e-discovery, contract analysis, and compliance monitoring solutions.

In the Middle East & Africa and Latin America, the Generative AI in Law market is nascent but poised for growth. These regions are witnessing increasing awareness among legal practitioners regarding the benefits of AI in improving operational efficiency and mitigating legal risks. However, challenges related to data privacy, regulatory constraints, and technological infrastructure pose barriers to market expansion.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In 2023, the global Generative AI in Law market witnessed the emergence of several key players shaping the landscape of AI-powered legal solutions. Among these key companies, IBM Corporation stands out as a formidable force, leveraging its extensive expertise in artificial intelligence and cognitive computing to offer innovative solutions tailored to the legal sector. IBM's comprehensive suite of AI tools, including Watson Legal, empowers legal professionals with advanced capabilities for contract analysis, e-discovery, and legal research, thereby driving efficiency and accuracy in legal processes.

Open Text Corporation also commands a prominent position in the Generative AI in Law market, offering a range of AI-powered solutions for information management and legal discovery. With its AI-driven e-discovery platform, Open Text enables organizations to efficiently identify, collect, and analyze electronically stored information (ESI), thereby streamlining the e-discovery process and reducing litigation costs.

Thomson Reuters Corporation is another key player contributing to the advancement of AI in the legal domain. Through its flagship product, Westlaw Edge, Thomson Reuters delivers cutting-edge AI capabilities for legal research, case analysis, and predictive analytics. By harnessing the power of AI, Thomson Reuters empowers legal professionals to make informed decisions, navigate complex legal landscapes, and deliver superior client outcomes.

Veritone Inc. is at the forefront of AI innovation in legal technology, offering an AI-driven platform for legal discovery, compliance monitoring, and contract analysis. Veritone's aiWARE platform leverages machine learning and natural language processing to extract insights from audio, video, and text data, enabling legal teams to uncover valuable information and accelerate case preparation.

ROSS Intelligence Inc. is renowned for its AI-powered legal research platform, ROSS. By harnessing natural language understanding and machine learning algorithms, ROSS enables legal professionals to conduct comprehensive legal research, analyze case law, and obtain actionable insights in real time.

Market Key Players

- IBM Corporation

- Open Text Corporation

- Thomson Reuters Corporation

- Veritone Inc.

- ROSS Intelligence Inc.

- Luminance Technology Ltd.

- LexisNexis Group Inc.

- Neota Logic Inc.

- Kira Inc.

- Casetext Inc.

- Other Market Players

Recent Development

- In March 2024, The European Union passes groundbreaking AI regulations, addressing risks and fostering innovation. The AI Act sets rules for high-risk AI models like ChatGPT, ensuring human-centric development

- In February 2024, Clifford Chance, a global law firm, pioneers AI integration with Copilot for Microsoft 365 and Viva Suite. This enhances productivity and client service, reflecting their commitment to digital innovation.

- In February 2024, The University of Alberta Faculty of Law's Legal Innovation Conference on March 1 delves into the impact of generative AI on law. Legal professionals discuss benefits, risks, and regulatory concerns.

Report Scope

Report Features Description Market Value (2023) USD 84.8 Million Forecast Revenue (2033) USD 1,038.7 Million CAGR (2024-2032) 29.3% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Based on the Service Provider(AI Technology Companies, Legal Technology Startups, Law Firms with In-house AI Capabilities, AI Consulting and Implementation Services), Based on Firm Size(Large Law Firms, Mid-Sized Law Firms, Small Law Firms and Solo Practitioners), Based on the Deployment Model(On-premise, Cloud), Based on Application(Document Review, Legal Research, Contract Analysis, Prediction of Legal Outcomes, Other Applications) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape IBM Corporation, Open Text Corporation, Thomson Reuters Corporation, Veritone Inc., ROSS Intelligence Inc., Luminance Technology Ltd., LexisNexis Group Inc., Neota Logic Inc., Kira Inc., Casetext Inc., Other Market Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- IBM Corporation

- Open Text Corporation

- Thomson Reuters Corporation

- Veritone Inc.

- ROSS Intelligence Inc.

- Luminance Technology Ltd.

- LexisNexis Group Inc.

- Neota Logic Inc.

- Kira Inc.

- Casetext Inc.

- Other Market Players