-

-

March 2025

-

Pages: 300

-

Price: 3200.00 Onwards

-

Formats:

-

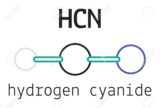

Category: Chemicals & Materials