Thermal Interface Material Market By Material Type (Tapes and films, Elastomeric pads, Greases and adhesives, Phase change materials, Metal-based materials), By Application (Telecommunication, Computer, Medical devices, Industrial machinery, Consumer durables, Automotive electronics, Others), By Chemistry (Silicone, Epoxy, Polyimide), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

-

49730

-

July 2024

-

300

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

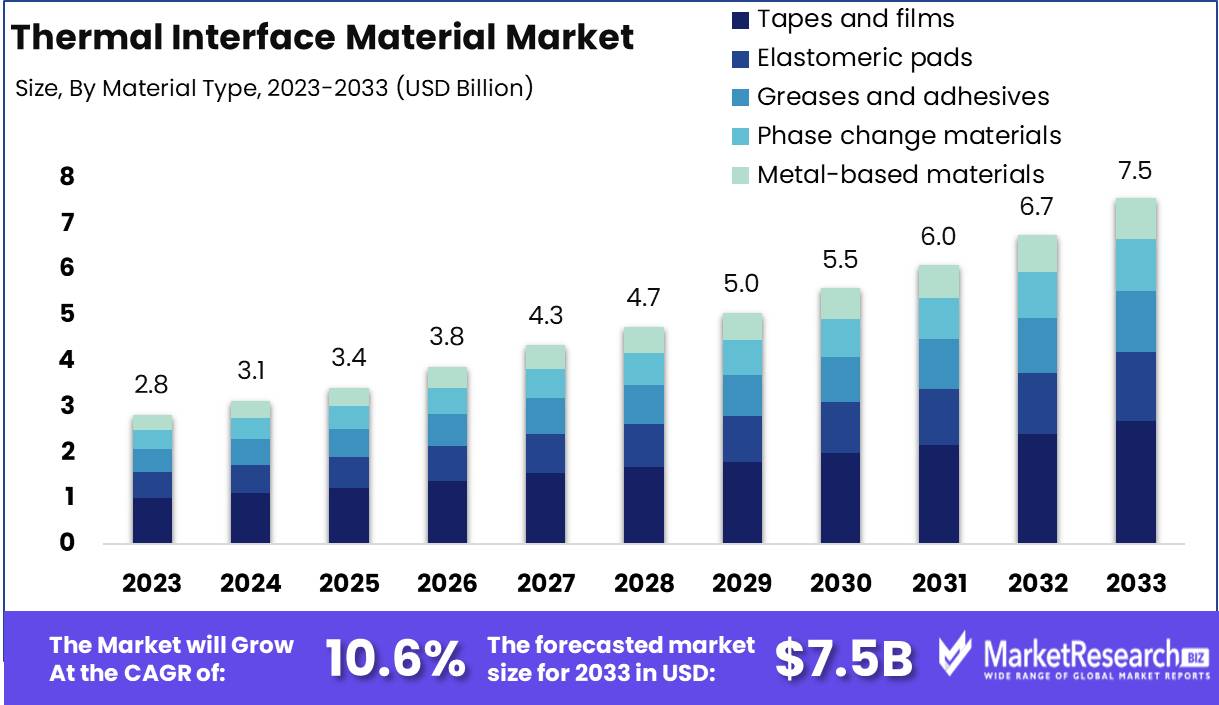

The Thermal Interface Material Market was valued at USD 2.8 billion in 2023. It is expected to reach USD 7.5 billion by 2033, with a CAGR of 10.6% during the forecast period from 2024 to 2033.

The Thermal Interface Material (TIM) Market encompasses a range of materials designed to enhance thermal conductivity between electronic components and heat sinks. These materials, which include thermal pastes, pads, and tapes, play a critical role in managing heat dissipation in electronic devices, ensuring optimal performance and longevity. The market's growth is driven by the increasing demand for high-performance electronic devices, advancements in miniaturization, and the proliferation of data centers.

The Thermal Interface Material (TIM) market is experiencing substantial growth, driven primarily by the increased demand for miniaturized and high-performance electronic devices. The proliferation of smartphones, tablets, and other compact electronic gadgets necessitates efficient heat dissipation solutions, propelling the adoption of advanced TIMs.

Additionally, the automotive sector's growing embrace of electric vehicles (EVs) and the continuous advancements in automotive electronics are further fueling market expansion. EVs require efficient thermal management systems to ensure optimal performance and longevity, thus elevating the importance of high-quality TIMs. However, the market faces challenges, notably the high cost of advanced materials and the complexity of manufacturing processes. These factors could potentially hinder the rapid adoption of cutting-edge TIM solutions, especially among cost-sensitive manufacturers.

Moreover, advancements in material science are playing a pivotal role in the development of next-generation TIMs, enhancing their thermal conductivity and reliability. The market is poised to benefit from ongoing research and development efforts aimed at improving the performance and cost-efficiency of these materials. As manufacturers strive to meet the growing demand for miniaturized electronic devices, the innovation in TIMs is expected to accelerate. The integration of novel materials and manufacturing techniques promises to address current limitations, paving the way for broader applications across various industries. In conclusion, while the TIM market holds significant growth potential, stakeholders must navigate the challenges of high costs and manufacturing complexities to fully capitalize on emerging opportunities.

Key Takeaways

- Market Growth: The Thermal Interface Material Market was valued at USD 2.8 billion in 2023. It is expected to reach USD 7.5 billion by 2033, with a CAGR of 10.6% during the forecast period from 2024 to 2033.

- By Material Type: Tapes and Films dominated the Thermal Interface Material Market segments.

- By Application: Telecommunication dominated the Thermal Interface Material Market applications.

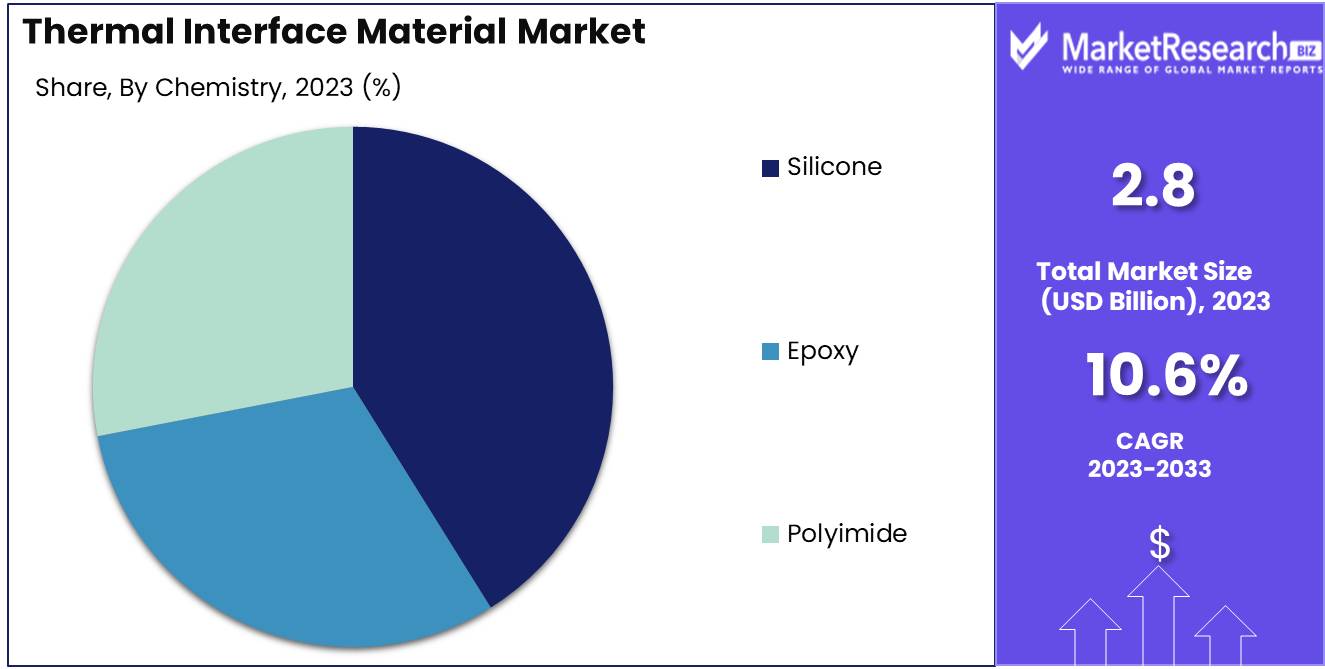

- By Chemistry: Silicone dominated the Thermal Interface Material Market chemistry segment.

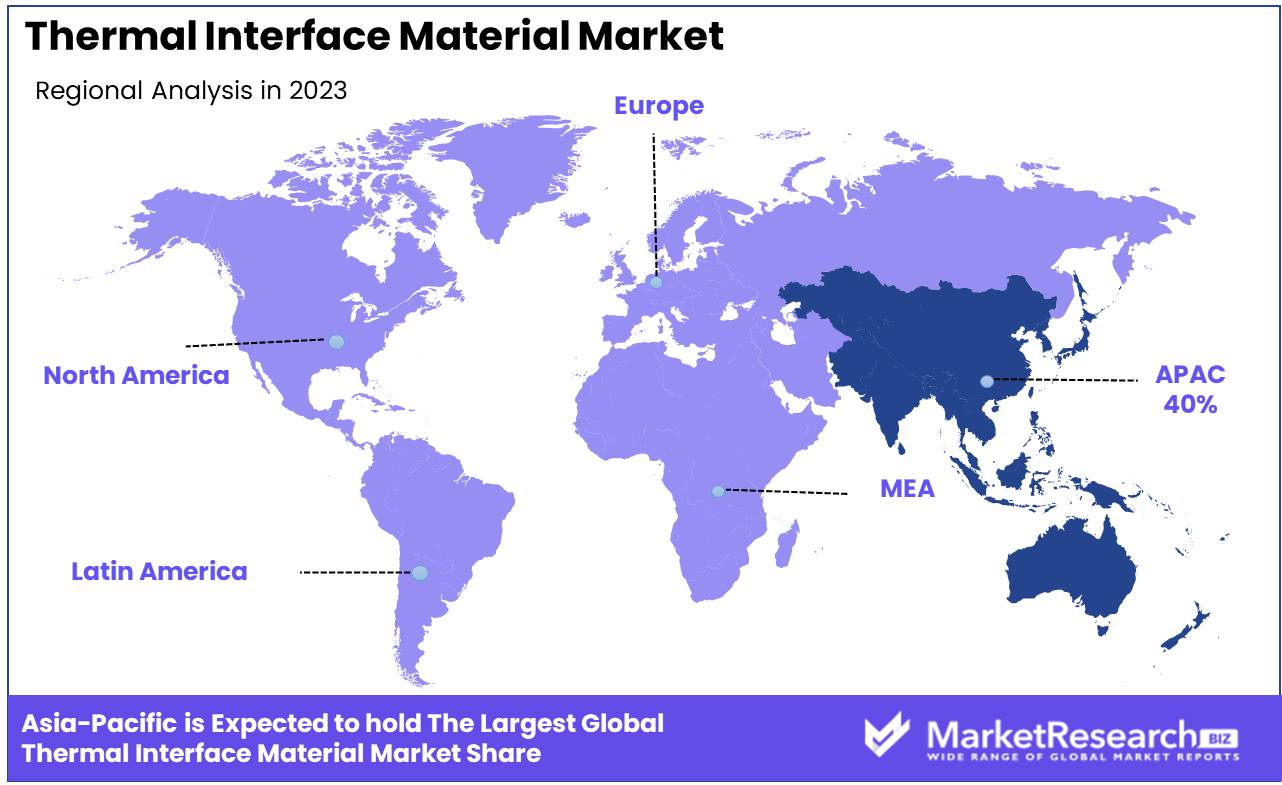

- Regional Dominance: Asia Pacific dominates the TIM market with a 40% largest share.

- Growth Opportunity: The global Thermal Interface Material market is poised for significant growth driven by the electrification of the transportation industry and the development of high-performance materials with nanodiamonds.

Driving factors

The Impact of Electronic Device Miniaturization on the Thermal Interface Material Market

The increasing demand for the miniaturization of electronic devices is a crucial driver for the Thermal Interface Material (TIM) market. As electronic devices become smaller and more compact, they generate more heat in constrained spaces. This escalation in heat production necessitates efficient heat management solutions to maintain device reliability and performance. Thermal interface materials play a pivotal role by enhancing heat dissipation between components, such as between processors and heat sinks.

The demand for high-performance TIMs grows as manufacturers aim to prevent overheating in smaller devices, thereby extending their operational life and efficiency. This trend is reflected in the market's growth projections, which are expected to rise in alignment with the surge in the production of compact electronics.

Expansion of the LED Market: A Bright Spot for Thermal Interface Materials

The burgeoning LED market significantly contributes to the growth of the thermal interface materials sector. LEDs, known for their energy efficiency and long lifespan, are increasingly used in automotive lighting, displays, and large-scale lighting installations. However, LEDs also generate substantial heat during operation, which can degrade their performance and shorten their lifespan. Efficient heat management through TIMs is critical to maintain the functionality and reliability of LED systems. As the adoption of LED technology accelerates, so does the demand for thermal interface materials that can sustain the performance of LEDs by effectively managing heat. This correlation underscores the symbiotic growth between LED advancements and TIM innovations.

Electrification of Vehicles: Fueling the Demand for Advanced Thermal Management

The electrification of vehicles is another significant growth lever for the Thermal Interface Material market. Electric vehicles (EVs), including hybrid and fully electric models, require robust thermal management systems to regulate battery temperatures and ensure optimal performance and safety. Thermal interface materials are essential in these applications, providing effective heat conduction pathways within battery management systems and between other critical electronic components. The push towards electric mobility, driven by global efforts to reduce carbon emissions, has led to increased production and adoption of EVs, thereby amplifying the demand for high-quality TIMs. The integration of advanced thermal solutions in electric vehicles illustrates the direct impact of automotive electrification on the expansion of the TIM market.

Restraining Factors

Performance Limitations: Impact on Market Expansion and Technological Adoption

The growth of the Thermal Interface Material (TIM) market is significantly restrained by performance limitations associated with current products. These materials, crucial for managing heat in electronic devices, must continuously evolve to handle higher thermal loads in increasingly compact spaces. The limitations in thermal conductivity, durability, and operational temperature range can impede their adoption in high-performance sectors such as automotive electronics, aerospace, and high-powered computing systems.

Without substantial improvements, these performance bottlenecks may deter potential users from integrating advanced TIM solutions, potentially slowing down market growth rates. While specific statistics detailing the extent of this impact are not provided, industry trends suggest a direct correlation between the enhancement of material properties and market adoption rates.

Volatility in Raw Material Prices: Creating Cost Uncertainties and Impacting Market Stability

Fluctuations in the prices of raw materials essential for manufacturing thermal interface materials, such as silicones, paraffin, and graphite, pose another significant challenge. Volatility in raw material costs can lead to inconsistent pricing of TIM products, making budget planning difficult for manufacturers and end-users. This unpredictability can restrain the market as manufacturers may pass increased costs onto consumers, potentially reducing demand.

Furthermore, companies might hesitate to invest in new production capacities or technological advancements during periods of high material cost uncertainty, which could slow down innovation and market growth. Although exact statistical impacts are not specified, the historical data from related markets suggests that raw material price stability is pivotal for sustaining growth and encouraging investment in the TIM sector.

By Material Type Analysis

In 2023, Tapes and Films dominated the Thermal Interface Material Market segments.

In 2023, Tapes and Films held a dominant market position in the "By Material Type" segment of the Thermal Interface Material Market, which includes various materials such as elastomeric pads, greases and adhesives, phase change materials, and metal-based materials. Tapes and films were preferred for their ease of application and effective thermal conductivity, making them ideal for use in electronic cooling, particularly in compact and high-performance devices. Elastomeric pads, known for their compressibility and flexibility, also captured a significant market share, favored in applications requiring minimal thermal resistance and robust physical properties.

Greases and adhesives, while offering superior thermal conduction and lower thermal resistance, were widely utilized for their ability to fill air gaps, enhancing the overall thermal management system. Phase change materials emerged as a crucial component in temperature regulation, leveraging their ability to absorb and release heat at specific temperatures.

Lastly, metal-based materials were acknowledged for their high thermal conductivity and durability, primarily used in demanding environments where high heat flux management is critical. Collectively, these materials underscore the diverse approaches to optimizing thermal performance across various applications in the electronics sector.

By Application Analysis

In 2023, Telecommunication dominated the Thermal Interface Material Market applications.

In 2023, Telecommunication held a dominant market position in the "By Application" segment of the Thermal Interface Material Market, reflecting its pivotal role in enhancing connectivity and network infrastructure. The demand in this sector is primarily driven by the ongoing expansion of 5G technologies and the increasing need for high-performance thermal management solutions in communication equipment.

The Computer segment also showcased significant growth, propelled by the surge in cloud computing and advanced computing technologies, which require efficient heat dissipation to maintain system performance and reliability. In the realm of Medical devices, thermal interface materials are critical for ensuring the operational integrity of sensitive medical equipment, including imaging devices and patient monitoring systems, where precise temperature control is crucial.

Industrial machinery applications of thermal interface materials focus on maintaining machinery efficiency and safety in high-temperature environments, thus preventing equipment failure. Consumer durables, including household electronics, benefit from these materials by enhancing the longevity and performance reliability of devices.

In Automotive electronics, thermal interface materials are essential for managing the heat in increasingly complex and compact electronic systems, such as those found in electric vehicles, which are integral to vehicle safety and performance. Lastly, the "Others" category, which includes various niche applications, continues to explore the adaptability of thermal interface materials to new technological environments, underscoring their versatility across a broad spectrum of industries.

By Chemistry Analysis

In 2023, Silicone dominated the Thermal Interface Material Market chemistry segment.

In 2023, Silicone held a dominant market position in the "By Chemistry" segment of the Thermal Interface Material Market. Renowned for its excellent thermal conductivity and flexibility, silicone materials accounted for a significant market share, driven by their extensive application in electronics and automotive industries. Silicone's superior thermal management capabilities, coupled with its durability and resistance to environmental factors, solidified its market dominance.

Epoxy, another critical segment, demonstrated substantial growth due to its robust adhesive properties and high thermal performance. Epoxy-based thermal interface materials are extensively utilized in applications requiring strong bonding and thermal stability, particularly in aerospace and high-performance computing sectors.

Polyimide, known for its exceptional heat resistance and mechanical strength, also contributed notably to the market. This material is preferred in high-temperature environments, such as semiconductor manufacturing and advanced electronic devices. Its ability to maintain performance under extreme conditions makes polyimide a valuable component in the thermal interface material landscape.

Key Market Segments

By Material Type

- Tapes and films

- Elastomeric pads

- Greases and adhesives

- Phase change materials

- Metal-based materials

By Application

- Telecommunication

- Computer

- Medical devices

- Industrial machinery

- Consumer durables

- Automotive electronics

- Others

By Chemistry

- Silicone

- Epoxy

- Polyimide

Growth Opportunity

Electrification in the Transportation Industry

The ongoing electrification of the transportation industry presents a significant growth opportunity for the global Thermal Interface Materials Market. As electric vehicles (EVs) continue to gain traction, the demand for efficient thermal management solutions has surged. Thermal interface materials are critical in managing the heat generated by EV batteries and power electronics, ensuring optimal performance and longevity. This shift towards electric mobility is expected to drive substantial growth in the TIM market, as manufacturers seek advanced materials that can enhance thermal conductivity and reliability. The rising investment in EV infrastructure and the increasing consumer adoption of electric vehicles further underscore the potential for TIM market expansion.

High-Performance Thermal Interface Materials with Nanodiamonds

The development of high-performance thermal interface materials incorporating nanodiamonds represents a transformative innovation in the TIM market. Nanodiamonds, known for their exceptional thermal conductivity and mechanical strength, offer a significant enhancement in the performance of thermal interface materials. These advanced materials provide superior heat dissipation, enabling electronic devices to operate at higher efficiencies and with greater reliability.

The integration of nanodiamonds into TIMs addresses the growing demand for high-performance thermal management solutions in various applications, including consumer electronics, data centers, and renewable energy systems. This technological advancement is poised to create lucrative opportunities for market players, driving the adoption of nanodiamond-enhanced TIMs across diverse industries.

Latest Trends

Phase Change Materials Leading Growth

The thermal interface materials market is expected to witness significant advancements, with phase change materials (PCMs) playing a pivotal role in driving growth. PCMs, known for their superior heat management properties, are increasingly being integrated into various applications due to their ability to absorb, store, and release thermal energy. This trend is particularly prominent in the electronics sector, where efficient heat dissipation is critical for maintaining the performance and longevity of devices. The adoption of PCMs is anticipated to accelerate as industries seek innovative solutions to enhance thermal management systems, thereby ensuring optimal operation of high-performance electronic components.

Impact of Electric Vehicles

The burgeoning electric vehicle (EV) industry is another major factor influencing the thermal interface material market. As the demand for EVs escalates, the need for advanced thermal management systems becomes imperative to ensure battery efficiency and safety. TIMs are essential in managing the heat generated by EV batteries and power electronics, thereby enhancing overall vehicle performance. The focus on improving battery thermal management systems has spurred investments in the development of high-performance TIMs, which can effectively mitigate overheating issues. This trend is expected to propel market growth, as manufacturers prioritize innovative materials to meet the stringent thermal requirements of next-generation EVs.

Regional Analysis

Asia Pacific dominates the TIM market with a 40% largest share.

The Thermal Interface Materials Market is segmented into several key regions, including North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. North America, driven by significant advancements in electronics and semiconductor industries, holds a substantial market share, contributing to a robust demand for high-performance thermal management solutions. The region's market is characterized by increased investments in research and development, aiming at innovative TIM applications.

Europe follows closely, with a strong presence in the automotive and aerospace sectors, further propelling the market. Stringent regulatory standards regarding electronic component efficiency have bolstered the demand in this region.

Asia Pacific emerges as the dominant region, accounting for the largest market share of approximately 40%. This dominance is attributed to the rapid industrialization and urbanization in countries like China, Japan, and South Korea, which are major hubs for consumer electronics and automotive manufacturing. The presence of leading market players and extensive production facilities significantly enhances the market's growth prospects in this region.

Meanwhile, the Middle East & Africa, and Latin America are experiencing steady growth, driven by increasing investments in infrastructure and technological advancements in various industries. The TIM market in these regions is anticipated to witness gradual growth, supported by emerging applications and expanding end-use industries.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global Thermal Interface Material (TIM) market in 2024 is expected to exhibit significant growth, driven by increasing demand across various sectors such as electronics, automotive, and telecommunications. Key players in the market are leveraging their technological advancements and extensive product portfolios to maintain competitive advantage and meet the rising demand for efficient heat dissipation solutions.

Henkel Corporation and its subsidiary, Bergquist Company, continue to lead the market with innovative thermal management materials that cater to high-performance electronics and industrial applications. Indium Corporation and Parker Chomerics are also notable for their cutting-edge thermal interface materials, which address the stringent requirements of modern electronic devices.

Dow Corning Corporation, now part of Dow, offers advanced silicone-based TIMs that are widely adopted in automotive and consumer electronics. Laird Technologies Inc. and Momentive Performance Materials Inc. are recognized for their versatile and high-performing thermal management solutions, contributing significantly to market growth.

Zalman Tech Corporation Limited and 3M Company focus on providing reliable and efficient thermal interface solutions, reinforcing their strong market presence. Shin-Etsu Chemical Co., Ltd., Wakefield-Vette, Inc., and Panasonic Corporation are key players known for their comprehensive TIM product ranges catering to diverse industry needs.

Arctic Silver, Inc., Fujipoly America Corporation, Master Bond Inc., and Honeywell International Inc. are also instrumental in driving market innovation with their specialized thermal interface products. These companies' strategic initiatives, such as product development and expansion into emerging markets, are expected to propel the global TIM market forward in 2024.

Market Key Players

- Henkel Corporation

- Bergquist Company

- Indium Corporation

- Parker Chomerics

- Dow Corning Corporation

- Laird Technologies Inc.

- Momentive Performance Materials Inc

- Zalman Tech Corporation Limited.

- 3M Company

- Shin-Etsu Chemical Co., Ltd.

- Wakefield-Vette, Inc.

- Panasonic CorporationArctic Silver, Inc.

- Fujipoly America Corporation

- Master Bond Inc.

- Honeywell International Inc.

Recent Development

- In May 2024, Parker Hannifin announced the development of a novel hybrid TIM that combines the benefits of phase change materials and thermal greases. This hybrid solution offers enhanced thermal performance and ease of application, particularly suited for telecommunications and consumer electronics. The innovation reflects the ongoing trend towards multifunctional materials that simplify manufacturing processes while improving thermal management.

- In March 2024, 3M launched an advanced series of gap filler pads tailored for high-power computing applications. These new TIMs provide superior thermal conductivity and mechanical compliance, which are critical for maintaining the reliability and efficiency of data centers and high-performance computing systems. The product release underscores 3M's commitment to supporting the evolving needs of the IT and data management industries.

- In January 2024, Henkel introduced a new range of high-performance liquid TIMs aimed at the electric vehicle (EV) market. These materials are designed to enhance the thermal management of battery packs, ensuring better performance and longevity of EVs. This innovation addresses the growing need for efficient thermal management solutions in the rapidly expanding EV sector.

Report Scope

Report Features Description Market Value (2023) USD 2.8 Billion Forecast Revenue (2033) USD 7.5 Billion CAGR (2024-2032) 10.6% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Material Type (Tapes and films, Elastomeric pads, Greases and adhesives, Phase change materials, Metal-based materials), By Application (Telecommunication, Computer, Medical devices, Industrial Machinery, Consumer durables, Automotive electronics, Others), By Chemistry (Silicone, Epoxy, Polyimide) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Henkel Corporation, Bergquist Company, Indium Corporation, Parker Chomerics, Dow Corning Corporation, Laird Technologies Inc., Momentive Performance Materials Inc., Zalman Tech Corporation Limited., 3M Company, Shin-Etsu Chemical Co., Ltd., Wakefield-Vette, Inc., Panasonic Corporation, Arctic Silver, Inc., Fujipoly America Corporation, Master Bond Inc., Honeywell International Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Henkel Corporation

- Bergquist Company

- Indium Corporation

- Parker Chomerics

- Dow Corning Corporation

- Laird Technologies Inc.

- Momentive Performance Materials Inc

- Zalman Tech Corporation Limited.

- 3M Company

- Shin-Etsu Chemical Co., Ltd.

- Wakefield-Vette, Inc.

- Panasonic CorporationArctic Silver, Inc.

- Fujipoly America Corporation

- Master Bond Inc.

- Honeywell International Inc.