Performance Enhancing Substance Market By Type (Anabolic Steroids, Stimulants, Human Growth Hormones, Erythropoietin, Others), By Products (Pills, Injections, Patches, Others), By Application (Sports, Bodybuilding, Military, Others), By Distribution Channel (Online Pharmacies, Offline Pharmacies, Fitness Centers, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

50370

-

Aug 2024

-

309

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

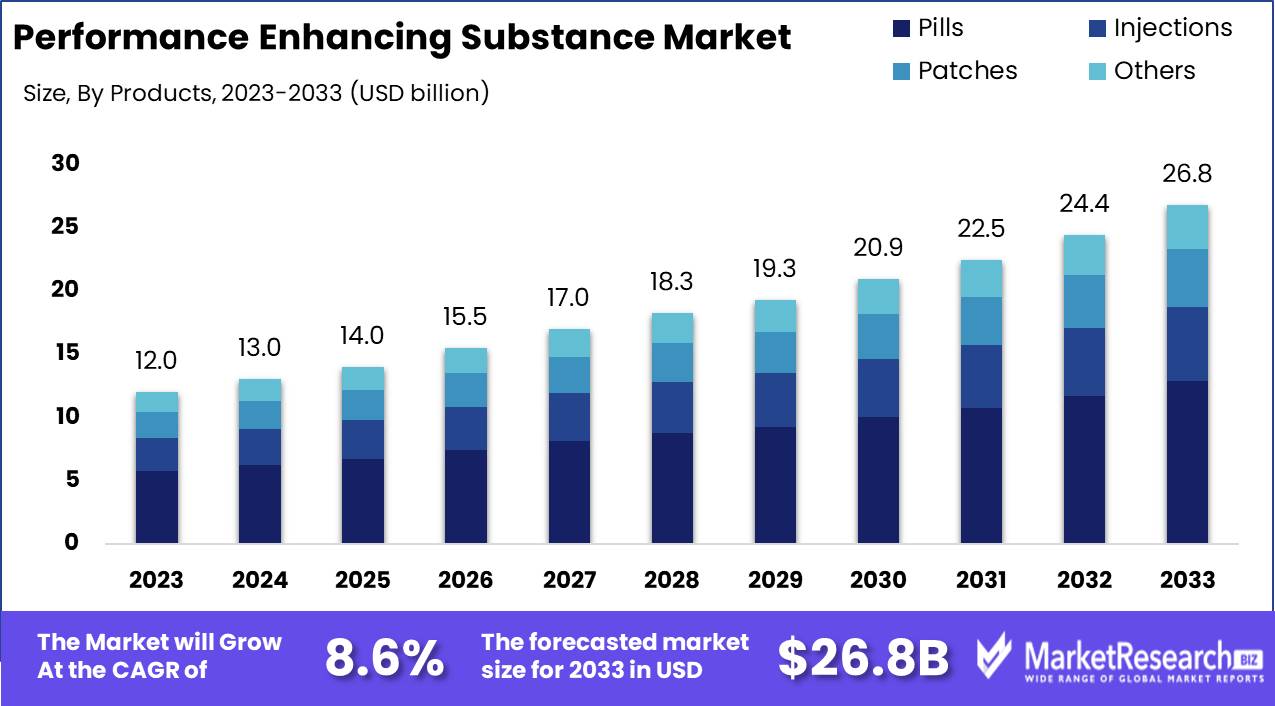

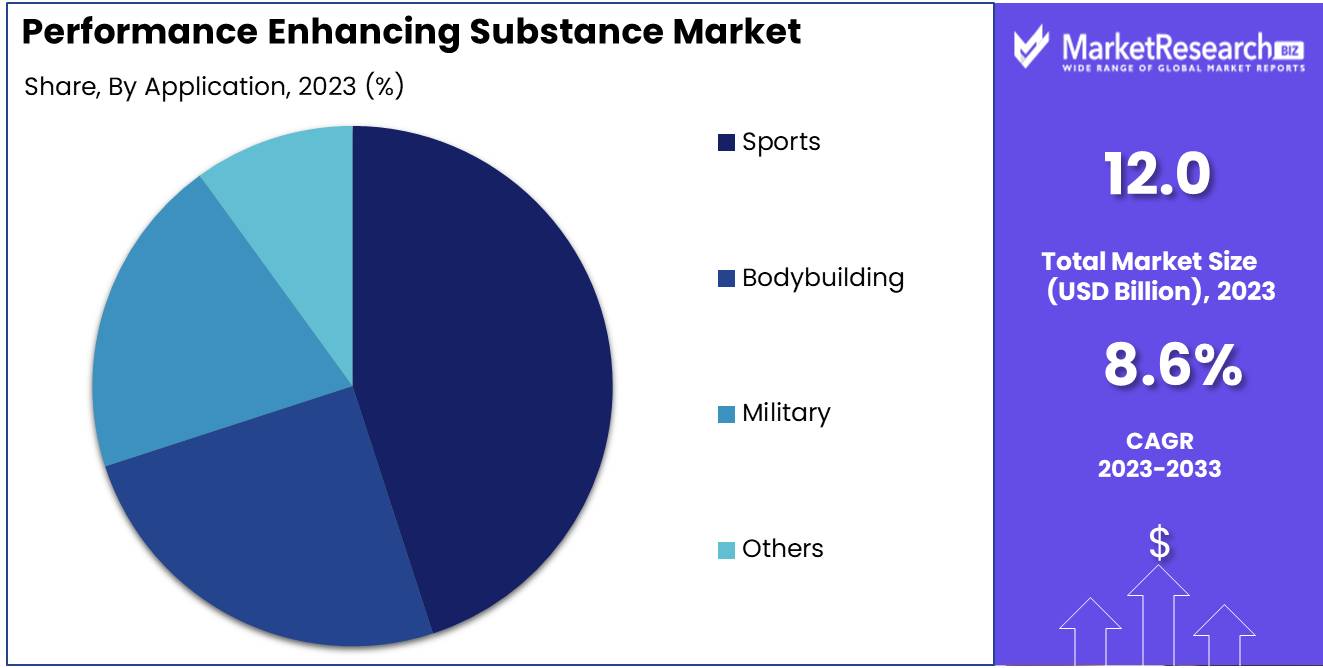

The Global Performance Enhancing Substance Market was valued at USD 12 Bn in 2023. It is expected to reach USD 26.8 Bn by 2033, with a CAGR of 8.6% during the forecast period from 2024 to 2033.

The Performance Enhancing Substance Market encompasses a broad range of products, including anabolic steroids, human growth hormone (hGH), and various supplements, aimed at improving physical performance, endurance, and muscle mass. These substances are widely used in sports and fitness industries, despite stringent regulations and ethical concerns. The market is driven by the continuous demand for competitive advantage and the pursuit of physical excellence. However, increasing scrutiny and advancements in detection methods have also influenced market dynamics, leading to a complex landscape of innovation, regulation, and ethical debate.

The Performance Enhancing Substance Market has evolved significantly, particularly since the late 20th century when substances like testosterone gained prominence among athletes seeking competitive advantages. The market's expansion is closely tied to the rise of organized sports and the pursuit of peak physical performance, with testosterone emerging as a key substance that led to the establishment of anti-doping regulations by 1968. This regulatory response marked a turning point in the market, introducing a more controlled environment that continues to evolve.

Human Growth Hormone (hGH) represents another critical aspect of this market, widely adopted by athletes for its ability to increase lean body mass through the release of Insulin-like Growth Factor 1 (IGF-1). Despite its effectiveness, hGH's usage is fraught with challenges, including detection difficulties and significant health risks, which have prompted ongoing debates within both the medical and sports communities. These factors underscore the market's complexity, where innovation and ethical concerns are in constant tension.

Looking forward, the Performance Enhancing Substance Market is likely to remain a dynamic field, shaped by advancements in detection technologies and changing societal attitudes toward performance enhancement. As regulations continue to tighten and public awareness of health risks increases, the market may see a shift toward safer, more transparent alternatives. However, the underlying demand for performance enhancement in competitive sports ensures that this market will continue to experience growth, albeit within an increasingly regulated framework.

Key Takeaways

- Market Value: The Global Performance Enhancing Substance Market was valued at USD 12 Bn in 2023. It is expected to reach USD 26.8 Bn by 2033, with a CAGR of 8.6% during the forecast period from 2024 to 2033.

- By Type: Anabolic Steroids represent 40% of the market, widely used for muscle growth and performance improvement.

- By Products: Pills dominate with 48%, preferred for their convenience and ease of use.

- By Application: Sports accounts for 45%, highlighting the demand for substances that enhance athletic performance.

- By Distribution Channel: Offline Pharmacies hold 35%, providing direct access to performance-enhancing products.

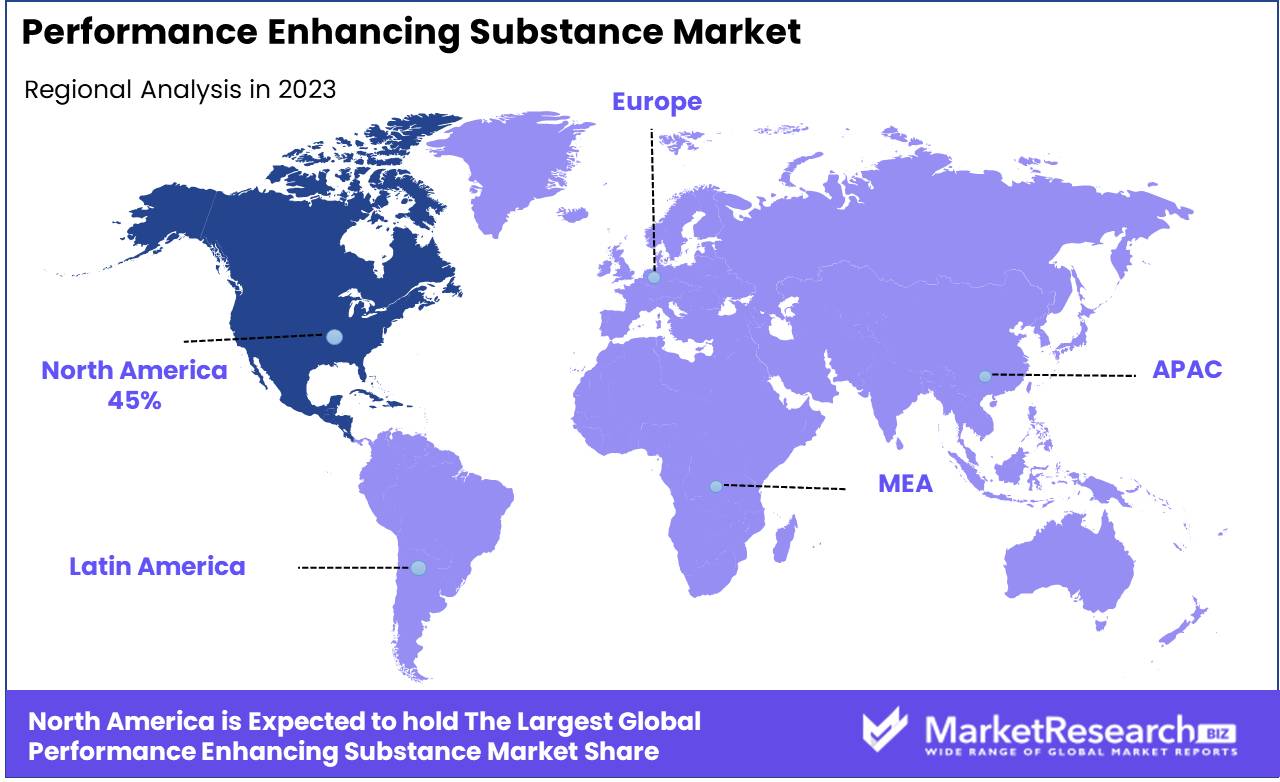

- Regional Dominance: North America holds a 45% market share, driven by high demand in competitive sports.

- Growth Opportunity: Developing safer and regulated alternatives to anabolic steroids could attract a broader user base, driving market growth.

Driving factors

Growing Demand for Improved Athletic Performance

The demand for improved athletic performance has been a significant driver of the Performance Enhancing Substance Market. As athletes continuously seek to surpass their limits and achieve new milestones, the appeal of substances that can boost physical and mental abilities becomes more pronounced.

This trend is not limited to professional athletes; amateur and recreational sports enthusiasts are also increasingly turning to performance enhancers to gain a competitive edge. The pursuit of peak physical performance has thus fueled the market's growth, as consumers are willing to invest in substances that promise enhanced stamina, strength, and recovery.

Increasing Awareness and Availability of Supplements

With the proliferation of information through digital platforms, there is a growing awareness of the benefits and risks associated with performance-enhancing substances. This awareness, coupled with the increased availability of these products, has significantly contributed to market expansion. The rise of e-commerce platforms has made it easier for consumers to access a wide variety of supplements, often with detailed descriptions and user reviews that guide purchasing decisions.

The endorsement of these substances by fitness influencers and athletes has further normalized their use, driving market demand. As a result, the accessibility and informed consumer base are collectively pushing the market forward.

Rising Adoption of Performance Enhancers in Recreational Sports

The adoption of performance-enhancing substances is no longer confined to elite athletes; recreational sports participants are increasingly incorporating these products into their routines. This shift reflects a broader cultural acceptance of supplement use, driven by a desire to improve personal fitness and performance in everyday sports activities.

Whether it’s for bodybuilding, endurance sports, or even casual gym workouts, individuals are turning to these substances to achieve faster results. This rising trend within the recreational sports community has broadened the market’s consumer base, contributing to its steady growth.

Restraining Factors

Regulatory Restrictions and Bans on Certain Substances

Regulatory restrictions and bans on certain performance-enhancing substances serve as a significant restraining factor for the market. Governments and sports organizations worldwide impose strict regulations to maintain fair competition and safeguard athletes' health. These regulations often include banning specific substances considered harmful or unfair, limiting the market’s growth potential.

The rigorous approval processes required for new products to enter the market can delay or prevent their availability, further restricting growth. These regulatory barriers create an environment where only a limited number of substances can be legally sold, impacting the overall market dynamics.

Health Risks and Side Effects Associated with Misuse

Health risks and side effects associated with the misuse of performance-enhancing substances are another critical factor restraining market growth. Reports of adverse effects, such as cardiovascular issues, hormonal imbalances, and psychological impacts, have raised concerns among consumers and healthcare providers. These risks can deter potential users from adopting these substances, particularly in the absence of proper guidance and medical supervision.

Negative media coverage and public awareness campaigns highlighting these dangers contribute to a cautious approach among consumers, ultimately slowing market expansion. The potential for severe health consequences thus serves as a significant deterrent, limiting the market’s appeal and growth trajectory.

By Type Analysis

In 2023, Anabolic Steroids held a dominant market position in the By Type segment of the Performance Enhancing Substance Market, capturing more than a 40% share.

Anabolic steroids continue to lead the performance-enhancing substances market due to their well-established effectiveness in promoting muscle growth and strength. They are widely used by athletes and bodybuilders seeking significant physical enhancement and competitive advantages. Despite being highly regulated and associated with severe health risks, anabolic steroids maintain a strong market presence, particularly in regions where regulatory enforcement is less stringent or where black markets thrive.

Stimulants, human growth hormones (HGH), and erythropoietin are other notable types within the market. Stimulants are commonly used for their ability to enhance focus and endurance, making them popular among athletes in high-intensity sports. HGH is valued for its role in muscle recovery and anti-aging, while erythropoietin, primarily used to increase red blood cell production, is favored in endurance sports. The market for these substances is bolstered by ongoing demand despite the potential legal and health repercussions, as users prioritize performance gains.

By Products Analysis

In 2023, Pills held a dominant market position in the By Products segment of the Performance Enhancing Substance Market, capturing more than a 48% share.

Pills remain the most popular form of performance-enhancing substances due to their convenience, ease of use, and widespread availability. They are often preferred by users seeking discreet consumption and straightforward administration. The dominance of pills in this market is further supported by the variety of substances available in this form, including anabolic steroids, stimulants, and other supplements aimed at boosting physical performance.

Injections, while less convenient, also hold a significant share in the market. They are often chosen for their faster and more potent effects, particularly in delivering human growth hormones and anabolic steroids directly into the bloodstream. Patches and other alternative delivery methods, such as sprays and gels, are gaining traction among users who prefer non-invasive options, though they still account for a smaller portion of the market. These products cater to niche segments that seek sustained release of substances over time, offering a competitive edge in specific applications such as endurance sports or long-term bodybuilding regimens.

By Application Analysis

In 2023, Sports held a dominant market position in the By Application segment of the Performance Enhancing Substance Market, capturing more than a 45% share.

The use of performance-enhancing substances is most prevalent in sports, driven by the high stakes of competitive athletics where enhanced strength, endurance, and recovery can significantly impact outcomes. Athletes across various disciplines utilize these substances to gain a competitive edge, despite ongoing regulatory scrutiny and potential health risks. The prominence of sports in this market is reinforced by continuous demand from both amateur and professional athletes seeking to improve their performance levels.

Bodybuilding also represents a significant portion of the market. In this segment, the focus is on muscle growth, definition, and overall physical aesthetics. The use of anabolic steroids and human growth hormones is particularly common, as these substances directly contribute to the desired physique enhancements. The military application of performance-enhancing substances is gaining attention, with soldiers using them to improve stamina, alertness, and physical capabilities under extreme conditions. Other applications, though smaller in market share, include usage in professions or scenarios where physical or cognitive enhancement can provide a tactical advantage.

By Distribution Channel Analysis

In 2023, Offline Pharmacies held a dominant market position in the By Distribution Channel segment of the Performance Enhancing Substance Market, capturing more than a 35% share.

Offline pharmacies continue to be the primary distribution channel for performance-enhancing substances, driven by the accessibility and trust that consumers place in physical retail locations. Many users prefer the in-person purchasing experience for these products, especially when seeking advice from pharmacists or ensuring the authenticity of the substances. The established infrastructure of brick-and-mortar pharmacies allows them to maintain a strong foothold in the market, particularly in regions where regulations on the sale of such substances are stringent.

Online pharmacies are also growing rapidly, offering convenience and often a wider range of products than their offline counterparts. The rise of e-commerce platforms has made it easier for consumers to access performance-enhancing substances discreetly and at competitive prices. Fitness centers represent another significant distribution channel, particularly for products like supplements and legal steroids, which are often sold directly to athletes and bodybuilders at the point of use. Other channels, though less significant in market share, include specialty stores and direct sales, catering to niche markets and specific consumer needs.

Key Market Segments

By Type

- Anabolic Steroids

- Stimulants

- Human Growth Hormones

- Erythropoietin

- Others

By Products

- Pills

- Injections

- Patches

- Others

By Application

- Sports

- Bodybuilding

- Military

- Others

By Distribution Channel

- Online Pharmacies

- Offline Pharmacies

- Fitness Centers

- Others

Growth Opportunity

Development of Safer and Natural Performance Enhancers

The growing consumer preference for health-conscious and natural alternatives presents a significant opportunity for the Performance Enhancing Substance Market in 2024. As concerns over the safety and side effects of synthetic substances mount, the development of safer, natural performance enhancers is expected to drive market expansion.

Products derived from herbal and organic sources, which promise fewer adverse effects while still delivering the desired performance benefits, are gaining traction. This shift aligns with the broader trend towards wellness and natural products, creating a fertile ground for innovation and new product introductions in the market.

Expansion in Fitness and Bodybuilding Communities

The continuous expansion of fitness and bodybuilding communities worldwide is another critical factor poised to fuel market growth. With the rise of social media and digital platforms, these communities have grown exponentially, with influencers playing a pivotal role in promoting performance-enhancing substances.

As more individuals become engaged in fitness and bodybuilding, the demand for supplements that can enhance physical performance, muscle growth, and recovery is expected to increase. This trend not only broadens the market’s consumer base but also drives the diversification of product offerings to cater to varying needs within these communities.

Latest Trends

Rising Popularity of Nootropics and Cognitive Enhancers

In 2024, the Performance Enhancing Substance Market is witnessing a significant shift as the rising popularity of nootropics and cognitive enhancers reshapes the industry landscape. These substances, designed to boost mental functions such as memory, focus, and creativity, are gaining widespread acceptance beyond traditional physical performance enhancers.

As more individuals—ranging from professionals to students—seek to improve cognitive performance in competitive environments, the demand for nootropics is expected to surge. This trend broadens the market’s scope, attracting a new demographic of consumers interested in both mental and physical enhancement, thereby driving overall market growth.

Integration of AI for Personalized Supplement Recommendations

Another transformative trend in 2024 is the integration of artificial intelligence (AI) to offer personalized supplement recommendations. As consumers become more informed and demand products tailored to their specific needs, AI-driven platforms are emerging as critical tools in the market. These platforms analyze individual data—such as genetic information, lifestyle, and fitness goals—to recommend the most suitable performance-enhancing substances.

This level of personalization not only enhances consumer satisfaction but also encourages brand loyalty and repeat purchases, fostering long-term market growth. The integration of AI thus represents a cutting-edge approach that is revolutionizing the consumer experience in the Performance Enhancing Substance Market.

Regional Analysis

North America dominates the Performance Enhancing Substance Market, accounting for approximately 45% of the global market share.

The North America region, with a market share of 45%, is the leading region in the Performance Enhancing Substance Market. The dominance of North America can be attributed to the high demand for performance-enhancing substances among athletes and bodybuilders, coupled with a well-established sports and fitness industry. The region's market value is further bolstered by the presence of key industry players and a strong regulatory framework that governs the sale and use of these substances.

In Europe, the market holds a significant share, driven by the growing awareness of fitness and health among the population. The European market is characterized by a stringent regulatory environment, which ensures the safe and controlled use of these substances.

The Asia Pacific region is experiencing rapid growth in the Performance Enhancing Substance Market, supported by an expanding middle class and increasing disposable incomes. The market in Asia Pacific is expected to continue its upward trajectory, driven by the increasing popularity of fitness and sports activities.

Latin America and the Middle East & Africa regions, although smaller in market size compared to North America and Europe, are showing promising growth prospects. The Middle East & Africa region is gradually adopting performance-enhancing substances, with a focus on improving athletic performance in competitive sports.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In 2024, the global Performance Enhancing Substance Market is significantly shaped by major pharmaceutical players such as Pfizer Inc., GlaxoSmithKline plc, Bayer AG, Sanofi S.A., Eli Lilly and Company, AstraZeneca, Novartis AG, AbbVie Inc., Endo Pharmaceuticals Inc., and Mallinckrodt Pharmaceuticals. These companies dominate the market through a combination of advanced R&D capabilities, extensive product portfolios, and robust global distribution networks.

Pfizer Inc. and GlaxoSmithKline plc are at the forefront, leveraging their extensive experience in drug development to enhance their performance-enhancing substances offerings. Pfizer's innovations, particularly in hormone therapies and anabolic steroids, continue to set industry standards. Similarly, GlaxoSmithKline's focus on novel performance enhancers and their application in sports medicine provides a competitive edge.

Bayer AG and Sanofi S.A. contribute to market dynamics with their broad-spectrum therapeutic solutions, including performance-enhancing substances that address various health conditions. Their strong clinical trial capabilities and global reach facilitate rapid market penetration and widespread adoption.

Eli Lilly and Company, AstraZeneca, and Novartis AG are notable for their emphasis on advanced pharmaceutical technologies and strategic partnerships, driving growth in performance-enhancing substances. AbbVie Inc. and Endo Pharmaceuticals Inc. add value through targeted therapies and innovative drug delivery systems.

Market Key Players

- Pfizer Inc.

- GlaxoSmithKline plc

- Bayer AG

- Sanofi S.A.

- Eli Lilly and Company

- AstraZeneca

- Novartis AG

- AbbVie Inc.

- Endo Pharmaceuticals Inc.

- Mallinckrodt Pharmaceuticals

Recent Development

In May 2024, Bayer AG launched an advanced formulation of their popular energy-boosting supplement, designed to improve endurance by 30%. This product launch is expected to strengthen Bayer’s position in the global market.

In January 2024, Pfizer Inc. introduced a new performance-enhancing supplement targeting athletes. This product aims to boost muscle recovery by 25% and is expected to increase Pfizer’s market share in the sports nutrition segment.

Report Scope

Report Features Description Market Value (2023) USD 12 Bn Forecast Revenue (2033) USD 26.8 Bn CAGR (2024-2033) 8.6% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Anabolic Steroids, Stimulants, Human Growth Hormones, Erythropoietin, Others), By Products (Pills, Injections, Patches, Others), By Application (Sports, Bodybuilding, Military, Others), By Distribution Channel (Online Pharmacies, Offline Pharmacies, Fitness Centers, Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Pfizer Inc., GlaxoSmithKline plc, Bayer AG, Sanofi S.A., Eli Lilly and Company, AstraZeneca, Novartis AG, AbbVie Inc., Endo Pharmaceuticals Inc., Mallinckrodt Pharmaceuticals Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Pfizer Inc.

- GlaxoSmithKline plc

- Bayer AG

- Sanofi S.A.

- Eli Lilly and Company

- AstraZeneca

- Novartis AG

- AbbVie Inc.

- Endo Pharmaceuticals Inc.

- Mallinckrodt Pharmaceuticals