Hydrogen Cyanide Market By Product (Hydrogen Cyanide Liquid and Hydrogen Cyanide Gas), By Application (Sodium Cyanide and Potassium Cyanide, Adiponitrile, Acetone Cyanohydrin, Cyanogen Chloride, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

5860

-

July 2024

-

300

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

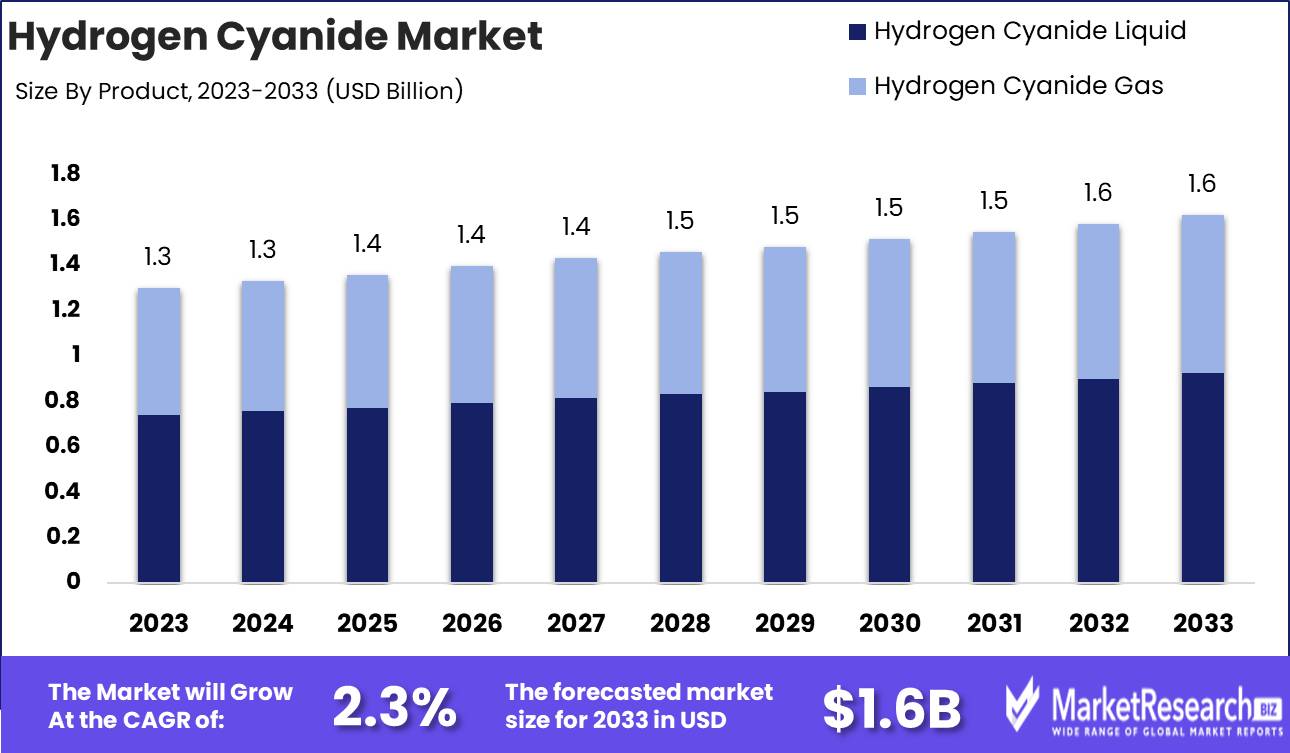

The Hydrogen Cyanide Market was valued at USD 1.3 billion in 2023. It is expected to reach USD 1.6 billion by 2033, with a CAGR of 2.3% during the forecast period from 2024 to 2033.

The Hydrogen Cyanide Market involves the production, distribution, and consumption of hydrogen cyanide (HCN), a highly reactive and versatile chemical compound. Used primarily in the manufacture of synthetic fibers, plastics, and pesticides, hydrogen cyanide is a critical raw material in various industrial processes. The market dynamics are influenced by factors such as regulatory policies on chemical safety, fluctuations in demand from key end-use industries, and technological advancements in production methods. Market trends are shaped by shifts in industrial applications, emerging regulations, and the development of safer, more efficient manufacturing practices.

The Hydrogen Cyanide (HCN) market is poised for significant growth, driven primarily by industrial demand and economic development. Industrial applications of HCN, notably in the production of acrylonitrile, synthetic fibers, and pharmaceuticals, are robust, underpinning a steady demand for the compound. As economies in emerging markets expand, industrial activities are set to increase, creating further demand for HCN. These regions, particularly in Asia Pacific and Latin America, are experiencing rapid industrialization, which is expected to bolster HCN consumption in various sectors.

However, the growth of the HCN market must be navigated with caution due to safety and environmental concerns. Hydrogen cyanide is highly toxic, necessitating stringent safety protocols and effective management practices to mitigate risks associated with its handling and use. Regulatory compliance is another crucial factor shaping the market. Governments worldwide are implementing rigorous regulations to ensure safe handling and environmental protection, influencing market dynamics. The interplay of these factors industrial demand, economic development, safety concerns, and regulatory requirements will drive the market’s trajectory. Emerging markets, while presenting opportunities, also require careful consideration of these regulatory frameworks to ensure sustainable growth and adherence to international safety standards.

Key Takeaways

- Market Growth: The Hydrogen Cyanide Market was valued at USD 1.3 billion in 2023. It is expected to reach USD 1.6 billion by 2033, with a CAGR of 2.3% during the forecast period from 2024 to 2033.

- By Product: Hydrogen Cyanide Liquid dominated for stability, Hydrogen Cyanide Gas for reactivity.

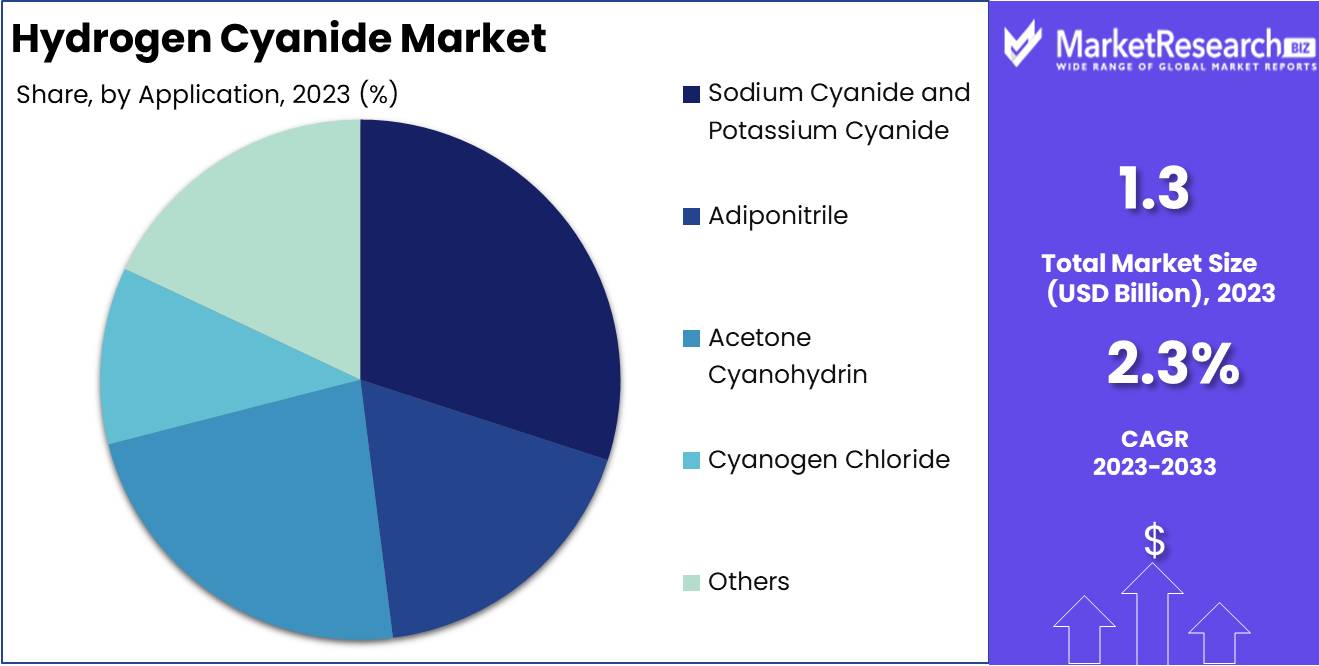

- By Application: Sodium and Potassium Cyanide dominated the Hydrogen Cyanide market.

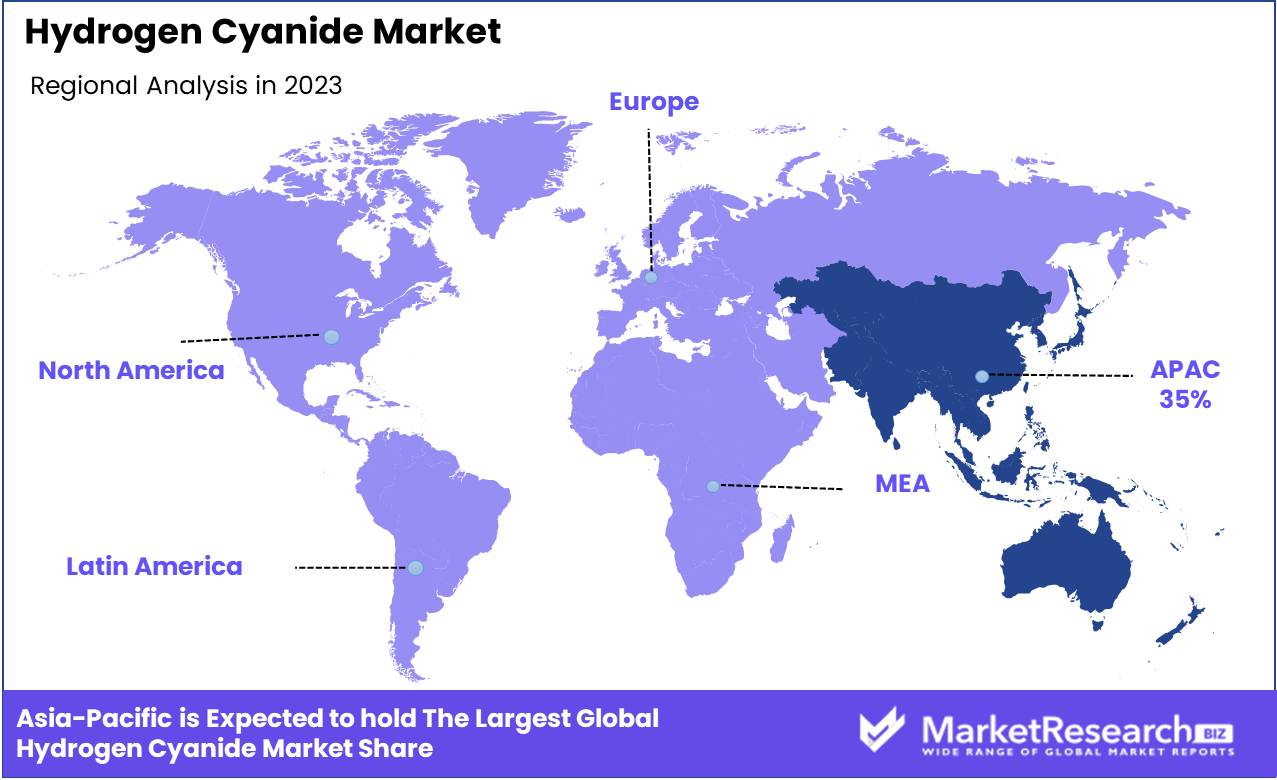

- Regional Dominance: Asia Pacific dominates the Hydrogen Cyanide market with a 35% largest share.

- Growth Opportunity: The global Hydrogen Cyanide market is poised for substantial growth in 2024, driven by increasing demand for adiponitrile and rising production of sodium and potassium cyanide.

Driving factors

Growing Demand for Manufacturing Sodium Cyanide and Potassium Cyanide

The escalating demand for sodium cyanide and potassium cyanide significantly bolsters the Hydrogen Cyanide (HCN) market. Sodium cyanide, primarily used in gold mining for ore extraction, and potassium cyanide, utilized in various industrial applications, both rely on HCN as a critical raw material. The burgeoning mining sector, driven by increasing gold prices and exploration activities, directly translates to heightened consumption of sodium cyanide. Similarly, the expanding use of potassium cyanide in electroplating and organic synthesis further stimulates HCN demand. As these industries grow, the need for HCN to produce these cyanides proportionately increases, thereby propelling the market.

Increasing Use of HCN as a Raw Material for Producing Synthetic Fibers Like Nylon

Hydrogen cyanide’s role as a precursor in the production of synthetic fibers, such as nylon, underscores its importance in the textiles and polymers industries. Nylon, a versatile synthetic fiber used in a plethora of applications from clothing to industrial products, is derived from HCN through various chemical processes. The continuous growth in the textile and automotive industries, which utilize nylon for its durability and flexibility, amplifies the demand for HCN. This increased production of synthetic fibers, driven by expanding consumer markets and industrial applications, directly enhances the hydrogen cyanide market.

Rising Demand from the Chemical Industry for Manufacturing

The chemical industry’s diverse applications of HCN further contribute to its market expansion. Hydrogen cyanide is integral in synthesizing a variety of chemicals, including pesticides, pharmaceuticals, and specialty chemicals. The growth in agricultural activities and advancements in pharmaceutical research drive the demand for these chemicals. For instance, HCN is used in the production of cyanoacrylate adhesives and certain pharmaceuticals, both of which are witnessing increased demand. As industries expand and new applications for HCN are developed, the overall consumption of hydrogen cyanide rises, fostering market growth.

Restraining Factors

High Toxicity and Its Impact on Market Growth

Hydrogen cyanide (HCN) is recognized for its significant toxicity, which poses substantial challenges for its market expansion. The hazardous nature of this compound necessitates stringent safety measures during its production, storage, and transportation. This high toxicity translates into increased operational costs due to the need for specialized equipment, safety protocols, and training. For instance, facilities handling HCN must adhere to rigorous safety standards and invest in advanced containment systems to mitigate risks of exposure and accidents. Consequently, the elevated costs associated with these safety measures can deter new entrants and limit the market's growth potential.

Moreover, the health risks associated with HCN may also affect its demand in various applications. Industries such as chemical manufacturing and pharmaceuticals, which rely on HCN as an intermediate or reactant, must weigh the benefits against the safety concerns. This trade-off can slow down the adoption of HCN in new projects or lead to increased scrutiny and risk management, further constraining market growth.

Regulatory Challenges and Their Influence on Market Expansion

The hydrogen cyanide market faces considerable regulatory challenges that impact its growth trajectory. Governments and regulatory bodies impose stringent regulations to manage the risks associated with HCN's toxicity. These regulations often involve comprehensive compliance requirements, including detailed reporting, regular inspections, and adherence to environmental and safety standards. For example, the U.S. Environmental Protection Agency (EPA) and similar organizations in other regions enforce strict guidelines on the handling and disposal of HCN, which can complicate operational procedures for companies involved in its production and use.

These regulatory hurdles contribute to increased operational costs and extended timelines for obtaining necessary permits and approvals. Companies must navigate complex regulatory landscapes to ensure compliance, which can be resource-intensive and may delay market entry or expansion. Furthermore, frequent changes in regulations and the need for ongoing compliance can create uncertainty and additional costs for market participants, potentially stifling investment and innovation within the industry.

By Product Analysis

In 2023, Hydrogen Cyanide Liquid dominated for stability, Hydrogen Cyanide Gas for reactivity.

In 2023, Hydrogen Cyanide Liquid held a dominant market position in the Hydrogen Cyanide market, primarily due to its extensive use across various industrial applications. This form of hydrogen cyanide is integral in the production of synthetic fibers, plastics, and pharmaceuticals, contributing significantly to its high demand. The liquid form is preferred for its stability and ease of handling, which are crucial for manufacturing processes that require precise and controlled conditions.

On the other hand, Hydrogen Cyanide Gas also maintained a substantial presence in the market, driven by its application in the production of chemicals such as acrylonitrile and methyl methacrylate. The gas form is essential for processes where high reactivity and rapid reaction rates are necessary. Its use in fumigation and as an intermediate in chemical synthesis underscores its importance in diverse industrial sectors.

By Application Analysis

In 2023, Sodium and Potassium Cyanide dominated the Hydrogen Cyanide market.

In 2023, Sodium Cyanide and Potassium Cyanide held a dominant market position in the Hydrogen Cyanide market's application segment. This category was notably significant due to the critical role these chemicals play in the mining industry, particularly in gold extraction processes. Sodium Cyanide and Potassium Cyanide are indispensable for their high efficacy in separating gold from ore, driving substantial demand within this segment.

Adiponitrile followed as a key application, utilized predominantly in the production of Nylon 6,6. The growth in automotive and textile industries contributed to its market prominence. Acetone Cyanohydrin also maintained a substantial share, driven by its use in manufacturing methyl methacrylate, which is integral to producing various polymers and plastics.

Cyanogen Chloride, used in the synthesis of various pharmaceuticals and agrochemicals, held a notable position due to its diverse applications across chemical manufacturing sectors. Lastly, the "Others" segment, encompassing niche applications and emerging uses of Hydrogen Cyanide, captured a smaller yet growing share of the market, reflecting ongoing innovations and expanding industrial applications. Each segment's market position reflects its specialized use and critical role in industrial processes.

Key Market Segments

By Product

- Hydrogen Cyanide Liquid

- Hydrogen Cyanide Gas

By Application

- Sodium Cyanide and Potassium Cyanide

- Adiponitrile

- Acetone Cyanohydrin

- Cyanogen Chloride

- Others

Growth Opportunity

Expanding Applications Drive Market Potential

The global Hydrogen Cyanide (HCN) market presents substantial growth opportunities, largely driven by its expanding applications across various industries. Hydrogen Cyanide, also known as prussic acid, is a critical intermediate in the production of various chemicals, notably adiponitrile, sodium cyanide, and potassium cyanide. The increasing demand for adiponitrile, a key precursor in the production of nylon, is a significant driver of HCN market growth. As industries continue to invest in the manufacturing of high-performance materials, the need for adiponitrile is expected to rise, consequently boosting the demand for HCN.

Rising Production of Sodium and Potassium Cyanide

Another notable growth opportunity in the HCN market is the rising production of sodium and potassium cyanide. These compounds are integral to mining operations, particularly in gold extraction, and their demand is anticipated to increase with the growth in global mining activities. The expansion of mining projects, particularly in developing regions, is expected to drive up the production of sodium and potassium cyanide, thereby creating a parallel increase in the demand for HCN.

Latest Trends

Demand from Textile Industry

The Hydrogen Cyanide (HCN) market is witnessing a significant upturn in demand from the textile industry. Hydrogen Cyanide is a crucial intermediate in the production of various synthetic fibers, including nylon and acrylic. The textile industry's increasing shift towards synthetic fibers, driven by their durability and cost-effectiveness, is propelling this demand. Innovations in textile processing and a surge in fashion and garment production globally further fuel this trend. As textile manufacturers seek to meet rising consumer preferences for synthetic materials, the demand for HCN is expected to rise correspondingly. This trend highlights the pivotal role of HCN in the textile supply chain and underscores its importance in supporting the industry's growth.

Sodium and Potassium Cyanide Production

Another prominent trend shaping the Hydrogen Cyanide market is its role in the production of sodium and potassium cyanide. HCN serves as a key raw material in manufacturing these cyanides, which are integral to various applications, including mining, electroplating, and chemical synthesis. The growing mining sector, particularly in gold extraction, and the expanding use of cyanides in industrial processes, are driving an increased demand for sodium and potassium cyanide. As industries continue to rely on these cyanides for their operational needs, the demand for Hydrogen Cyanide as a precursor is anticipated to rise. This trend reflects the broader industrial reliance on HCN and the interconnected nature of its applications in essential sectors.

Regional Analysis

Asia Pacific dominates the Hydrogen Cyanide market with a 35% largest share.

North America: The Hydrogen Cyanide market in North America is characterized by a significant industrial base, with the United States and Canada leading in production and consumption. The region’s market is bolstered by its robust chemical manufacturing sector and advanced technologies. As of 2023, North America held approximately 25% of the global market share, driven by high demand in agriculture and chemical industries.

Europe: Europe exhibits a mature Hydrogen Cyanide market, with notable contributions from Germany, France, and the United Kingdom. The market in Europe is influenced by stringent environmental regulations and a shift towards sustainable practices. In 2023, Europe accounted for around 20% of the global market share, with growth supported by the region’s chemical and pharmaceutical industries.

Asia Pacific: The Asia Pacific region dominates the global Hydrogen Cyanide market, holding approximately 35% of the market share as of 2023. This dominance is attributed to the region’s expansive industrial sector, particularly in China and India, where hydrogen cyanide is crucial for various applications including agriculture, plastics, and chemicals. Rapid industrialization and economic growth are major drivers of this market.

Middle East & Africa: The market in the Middle East & Africa is smaller compared to other regions, contributing about 10% to the global market share. The region’s market is largely driven by its growing industrial base and increasing investments in chemical manufacturing.

Latin America: Latin America represents a developing market for Hydrogen Cyanide, accounting for approximately 10% of the global share. The growth is driven by expanding industrial activities and agricultural applications in countries like Brazil and Argentina.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global Hydrogen Cyanide (HCN) market is characterized by significant competition among key players, each leveraging their strengths to capture market share. INEOS stands out as a major force, with its robust production capabilities and extensive distribution network, positioning it as a leader in the market. SUMITOMO CHEMICAL CO., LTD. and Asahi Kasei Corporation are also influential, benefiting from their advanced technological innovations and established industry presence, which support their competitive edge in HCN production and supply.

Cornerstone Chemical Company and Kuraray Co., Ltd. are noteworthy for their strategic focus on operational efficiency and product quality, enhancing their market positioning. Ascend Performance Materials LLC and Cyanco International, LLC are recognized for their specialized applications of HCN, contributing to their prominence in niche segments of the market.

Evonik Industries AG and Air Liquide S.A. leverage their extensive global networks and strong R&D capabilities to drive innovation and maintain competitive advantages. Mitsubishi Gas Chemical Company, Inc. and INEOS Group Holdings S.A. further reinforce their market leadership through their significant production capacities and strategic investments in HCN technologies.

Market Key Players

- INEOS

- SUMITOMO CHEMICAL CO., LTD.

- Asahi Kasei Corporation

- Cornerstone Chemical Company

- Kuraray Co., Ltd.

- Ascend Performance Materials LLC

- Cyanco International, LLC

- Evonik Industries AG

- Air Liquide S.A.

- Mitsubishi Gas Chemical Company, Inc.

- INEOS Group Holdings S.A.

Recent Development

- In May 2024, Solvay S.A. entered into a strategic partnership with a major chemical manufacturer to enhance its hydrogen cyanide production capabilities. This collaboration focuses on advancing technologies for safer and more efficient production methods.

- In March 2024, Tata Chemicals Limited launched a new hydrogen cyanide production line at its manufacturing plant in India. This expansion is intended to meet the growing demand for hydrogen cyanide in the agricultural and chemical sectors.

- In January 2024, GFL Environmental Inc. announced the expansion of its hydrogen cyanide recovery and recycling facility in North America. This move is aimed at increasing the company's capacity to manage hazardous materials more efficiently and support sustainable practices in the industry.

Report Scope

Report Features Description Market Value (2023) USD 1.3 Billion Forecast Revenue (2033) USD 1.6 Billion CAGR (2024-2032) 2.3% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Hydrogen Cyanide Liquid and Hydrogen Cyanide Gas), By Application (Sodium Cyanide and Potassium Cyanide, Adiponitrile, Acetone Cyanohydrin, Cyanogen Chloride, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape INEOS, SUMITOMO CHEMICAL CO., LTD., Asahi Kasei Corporation, Cornerstone Chemical Company, Kuraray Co., Ltd., Ascend Performance Materials LLC, Cyanco International, LLC , Evonik Industries AG, Air Liquide S.A., Mitsubishi Gas Chemical Company, Inc., INEOS Group Holdings S.A. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- INEOS

- SUMITOMO CHEMICAL CO., LTD.

- Asahi Kasei Corporation

- Cornerstone Chemical Company

- Kuraray Co., Ltd.

- Ascend Performance Materials LLC

- Cyanco International, LLC

- Evonik Industries AG

- Air Liquide S.A.

- Mitsubishi Gas Chemical Company, Inc.

- INEOS Group Holdings S.A.