Engineering Plastics Market By Type (Polyamide, ABS, Thermoplastic Polyesters, Polycarbonates, Polyacetals, Other engineering plastics), By Application (Packaging, Building & Construction, Electrical & Electronics, Automotive, Consumer Products, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

2469

-

August 2024

-

300

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

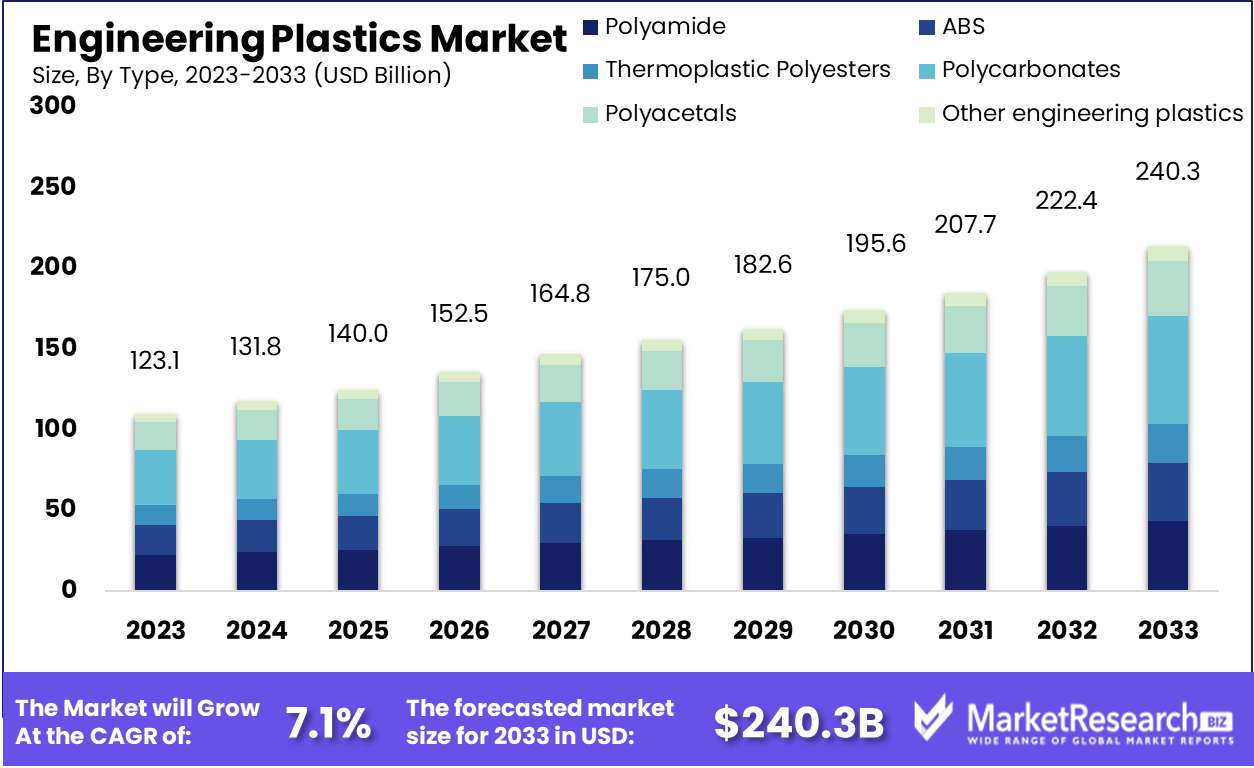

The Engineering Plastics Market was valued at USD 123.1 billion in 2023. It is expected to reach USD 240.3 billion by 2033, with a CAGR of 7.1% during the forecast period from 2024 to 2033.

The Engineering Plastics Market encompasses a broad range of high-performance materials known for their superior mechanical, thermal, and chemical properties compared to conventional plastics. These plastics are engineered for applications requiring enhanced durability, strength, and resistance to heat and chemicals.

The Engineering Plastics Market is poised for substantial growth, driven by its expanding applications in the automotive and electronics industries. As automotive manufacturers seek to reduce vehicle weight for better fuel efficiency and lower emissions, the demand for engineering plastics, known for their strength, durability, and lightweight properties, is surging. Simultaneously, the growth of the electronics and electrical industry, particularly in emerging markets, is further propelling the market. Engineering plastics are increasingly used in electronic components due to their excellent insulating properties, heat resistance, and dimensional stability, making them indispensable in the production of next-generation electronic devices.

However, this growth is tempered by challenges such as high raw material costs, which continue to pressure margins across the industry. Companies are responding by investing heavily in innovation and R&D, focusing on developing cost-effective and sustainable alternatives to traditional materials. These efforts are expected to yield new formulations and applications that could offset the impact of rising costs. As the market evolves, the ability to balance the rising demand in key industries with the challenges of raw material pricing and innovation will be crucial. Companies that can successfully navigate these dynamics will be well-positioned to lead in the competitive landscape of the Engineering Plastics Market.

Key Takeaways

- Market Growth: The Engineering Plastics Market was valued at USD 123.1 billion in 2023. It is expected to reach USD 240.3 billion by 2033, with a CAGR of 7.1% during the forecast period from 2024 to 2033.

- By Type: Polyamide dominated the Engineering Plastics Market, leading all segments.

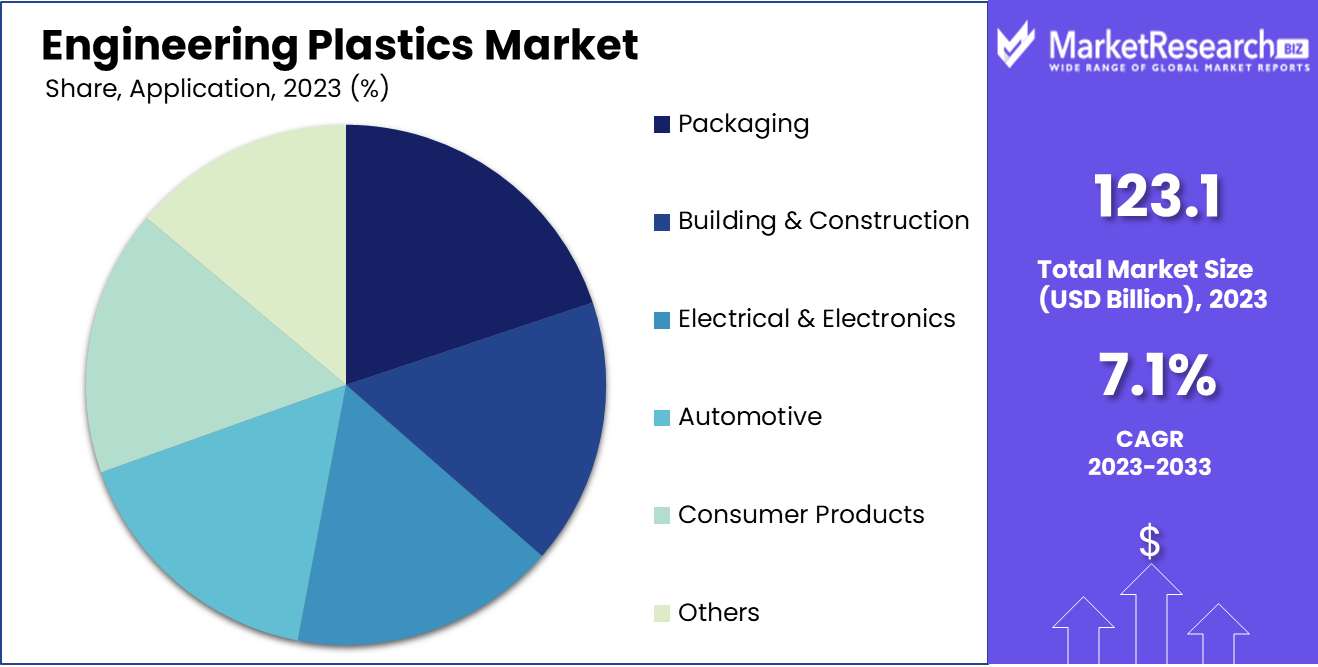

- By Application: The Packaging segment dominated the Engineering Plastics Market.

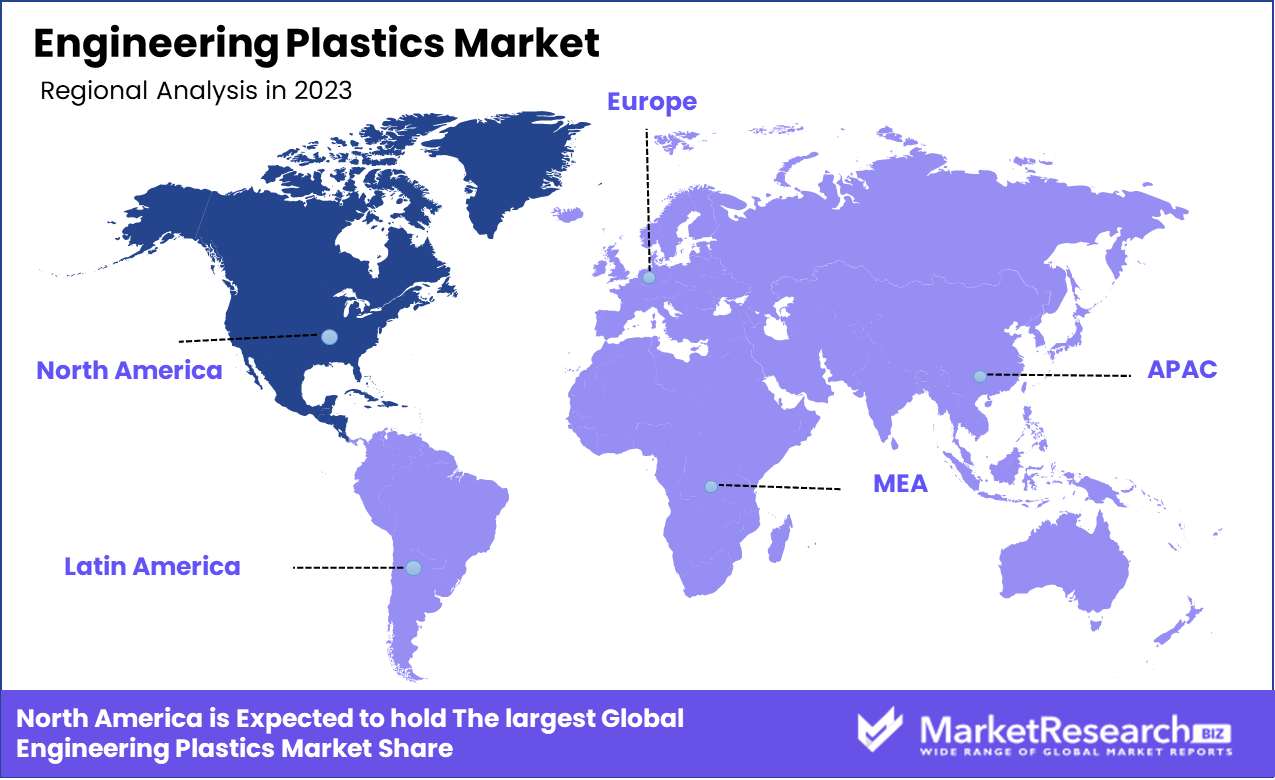

- Regional Dominance: North America dominates the Engineering Plastics Market with a 35% largest share.

- Growth Opportunity: The global engineering plastics market will grow significantly, driven by rising automotive and electric vehicle demand.

Driving factors

Automotive Sector Demand: Fueling the Expansion of Engineering Plastics

The automotive industry remains a significant driver of the Engineering Plastics Market. The demand for engineering plastics has surged with the ongoing shift towards lighter, more fuel-efficient vehicles. These materials are increasingly favored over traditional metals due to their superior strength-to-weight ratio, corrosion resistance, and design flexibility. This shift is particularly evident in the production of electric vehicles (EVs), where reducing weight to maximize battery efficiency is crucial. According to recent industry data, the automotive sector accounts for approximately 35% of the total demand for engineering plastics, reflecting its pivotal role in market growth.

Aerospace Applications: Engineering Plastics Take Flight

The aerospace industry’s stringent requirements for materials that offer high performance under extreme conditions have driven the adoption of engineering plastics. These materials are utilized in various aerospace components, including structural parts, interior fittings, and fuel systems, due to their high heat resistance, durability, and lightweight properties. The growing demand for commercial and military aircraft, coupled with the aerospace sector's focus on reducing overall aircraft weight to improve fuel efficiency, has significantly boosted the use of engineering plastics. This sector is expected to contribute to a compound annual growth rate (CAGR) of around 6% in the Engineering Plastics Market over the next five years.

Electrical and Electronics Growth: Powering the Demand for Engineering Plastics

The rapid expansion of the electrical and electronics sector has become a crucial factor in the growth of the Engineering Plastics Market. As the demand for consumer electronics, electric appliances, and advanced electronic systems in the automotive and aerospace industries continues to rise, so does the need for materials that can withstand high temperatures, provide electrical insulation, and offer mechanical strength. Engineering plastics, such as polycarbonates, polyamides, and ABS, are integral to manufacturing components like circuit boards, connectors, and housings. This sector’s growth is expected to drive a significant portion of the market, with an anticipated contribution to a CAGR of over 5% in the next few years.

Restraining Factors

Competition from Other Polymers: A Key Challenge in Market Penetration

The Engineering Plastics Market faces significant challenges due to intense competition from other polymers, particularly commodity plastics such as polyethylene, polypropylene, and PVC. These alternatives often offer lower costs, which can be appealing for industries seeking to minimize expenses, particularly in high-volume applications. Despite engineering plastics' superior mechanical properties, thermal stability, and chemical resistance, their higher price point can be a deterrent, especially in markets where cost efficiency is prioritized over performance. This competition from lower-cost polymers constrains the growth of engineering plastics, as manufacturers and end-users may opt for less expensive alternatives unless high-performance characteristics are essential.

Environmental Concerns: A Growing Barrier to Market Expansion

Environmental concerns are increasingly influencing the Engineering Plastics Market, as global awareness of sustainability and environmental impact continues to rise. Engineering plastics, while offering excellent performance, are primarily derived from petrochemical sources, leading to concerns about their carbon footprint and contribution to plastic waste. Regulations aimed at reducing plastic pollution, such as bans on single-use plastics and stringent recycling mandates, further exacerbate these concerns.

Additionally, the push towards a circular economy and the development of bio-based or recyclable alternatives puts additional pressure on the engineering plastics market. For example, the European Union's regulations on plastic waste management have forced companies to reconsider the use of traditional engineering plastics, thereby restraining market growth. This environmental scrutiny not only impacts demand but also drives companies to invest in R&D for sustainable alternatives, which may eventually displace traditional engineering plastics.

By Type Analysis

In 2023, Polyamide dominated the Engineering Plastics Market, leading all segments.

In 2023, Polyamide held a dominant market position in the By Type segment of the Engineering Plastics Market, driven by its superior mechanical properties, including high strength, durability, and resistance to wear and chemicals. Polyamide's versatility in applications across automotive, electronics, and industrial sectors contributed significantly to its market leadership. The demand for lightweight and high-performance materials in these industries further bolstered its growth.

ABS (Acrylonitrile Butadiene Styrene) followed closely, favored for its excellent impact resistance and ease of processing, making it a preferred choice in automotive interiors, consumer electronics, and home appliances.

Thermoplastic Polyesters, known for their high dimensional stability and chemical resistance, gained traction in electrical and electronics applications.

Polycarbonates, with their outstanding transparency and impact resistance, were extensively used in automotive glazing, optical lenses, and medical devices.

Polyacetals (POM) were preferred for precision parts requiring low friction and high stiffness.

The Other Engineering Plastics category included specialized materials such as PEEK and PPS, catering to niche applications with specific performance requirements. These materials collectively shaped the competitive landscape of the engineering plastics market in 2023.

By Application Analysis

The Packaging segment dominated the Engineering Plastics Market in 2023.

In 2023, The Packaging segment held a dominant market position in the Engineering Plastics Market, driven by the increasing demand for lightweight, durable, and recyclable materials across various industries. Engineering plastics have become crucial in the packaging sector due to their superior mechanical and thermal properties, which enhance the shelf life and safety of packaged goods. Additionally, the push toward sustainability and eco-friendly packaging solutions has led to a surge in the adoption of engineering plastics, particularly in the food and beverage industry.

The Building & Construction segment also contributed significantly, as engineering plastics are widely used for their robustness, weather resistance, and ease of installation in construction applications. The Electrical & Electronics segment saw substantial growth, fueled by the expanding consumer electronics market, where these plastics are essential for insulation and miniaturization.

In the Automotive sector, the drive for fuel efficiency and weight reduction propelled the use of engineering plastics. The Consumer Products segment benefited from the increasing demand for durable and aesthetic materials. Others, including medical and industrial applications, continued to support the overall market growth.

Key Market Segments

By Type

- Polyamide

- ABS

- Thermoplastic Polyesters

- Polycarbonates

- Polyacetals

- Other engineering plastics

By Application

- Packaging

- Building & Construction

- Electrical & Electronics

- Automotive

- Consumer Products

- Others

Growth Opportunity

Increasing Demand from Automotive & Transportation Industry

The global engineering plastics market is poised for significant growth, driven by the increasing demand from the automotive and transportation industries. Engineering plastics, known for their superior mechanical and thermal properties, are increasingly replacing traditional materials like metals in automotive components. This shift is largely due to the industry’s focus on reducing vehicle weight, enhancing fuel efficiency, and lowering carbon emissions. In 2023, the automotive sector accounted for approximately 30% of the total demand for engineering plastics, and this figure is expected to rise as manufacturers continue to innovate with lightweight materials.

Rising Popularity of Electric Vehicles (EVs)

The rising popularity of electric vehicles (EVs) presents another significant opportunity for the engineering plastics market. EV manufacturers are increasingly using engineering plastics in battery enclosures, charging ports, and other critical components due to their excellent electrical insulation properties and resistance to high temperatures. As the global EV market is projected to grow at a CAGR of 27% from 2023 to 2028, the demand for engineering plastics is expected to surge correspondingly. This trend is particularly evident in regions like Europe and Asia-Pacific, where EV adoption is accelerating rapidly, creating substantial opportunities for market expansion.

Latest Trends

Emerging Applications in Medical Devices

The Engineering Plastics Market is poised to experience significant growth driven by the expanding applications in the medical devices sector. Engineering plastics, known for their superior mechanical properties, chemical resistance, and biocompatibility, are increasingly being adopted in the production of surgical instruments, implants, and diagnostic devices. The rise in minimally invasive surgeries and the growing demand for lightweight, durable materials in medical applications are key factors accelerating this trend. Additionally, advancements in polymer technology are enabling the development of customized medical devices, further propelling the market forward.

Sustainability Concerns

Sustainability is becoming a central focus in the Engineering Plastics Market as industries increasingly prioritize eco-friendly materials. There is expected to be a surge in demand for bio-based and recycled engineering plastics, driven by stringent environmental regulations and consumer preference for sustainable products. Manufacturers are investing in research and development to produce engineering plastics with lower carbon footprints and enhanced recyclability. The shift towards a circular economy, where waste materials are reused and recycled, is anticipated to create new opportunities and challenges in the market. This trend aligns with global efforts to reduce plastic waste and promote sustainability across industries, positioning engineering plastics as a key component in achieving environmental goals.

Regional Analysis

North America dominates the Engineering Plastics Market with a 35% largest share.

The Engineering Plastics Market demonstrates a diverse regional landscape, with North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America each contributing uniquely to the market's growth. North America stands as a dominant region, accounting for approximately 35% of the global market share. This leadership is driven by robust demand across automotive, electronics, and construction sectors, particularly in the United States and Canada.

In Europe, the market benefits from a strong industrial base and stringent environmental regulations that favor the use of engineering plastics in the automotive and packaging industries. Germany, France, and the United Kingdom are key contributors, collectively holding around 25% of the market share. The Asia Pacific region is experiencing the fastest growth, with China, Japan, and India at the forefront, driven by rapid industrialization, urbanization, and increasing demand for electronics and automotive applications. This region accounts for approximately 30% of the market share.

The Middle East & Africa and Latin America markets, while smaller, are growing steadily due to expanding construction activities and increased automotive production. These regions collectively contribute about 10% to the global market. Overall, North America's dominance is bolstered by technological advancements and high investment in research and development, making it a key player in the global engineering plastics landscape.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global engineering plastics market in 2024 is anticipated to witness intensified competition as leading companies strategically position themselves to leverage growing demand across the automotive, electronics, and construction sectors. BASF SE and DuPont continue to dominate, capitalizing on their vast product portfolios and innovation-driven strategies. BASF’s focus on sustainable plastics and DuPont’s advancements in high-performance polymers are expected to fortify their market leadership.

Covestro and SABIC are also pivotal players, emphasizing circular economy initiatives and expanding production capacities to meet the rising demand for lightweight, durable materials. Covestro’s investments in low-emission production technologies and SABIC’s strong presence in the Middle East provide them with a competitive edge.

In the Asia Pacific region, LG Chem and Mitsubishi Engineering-Plastics Corporation are likely to expand their market share due to robust demand from the automotive and electronics industries. LG Chem’s innovative material solutions and Mitsubishi’s focus on high-temperature resistant plastics are critical to their growth strategies.

Specialty players like Victrex Plc. and Solvay SA are expected to gain traction in niche markets, particularly in aerospace and medical applications, where high-performance engineering plastics are essential. These companies are investing in R&D to develop advanced materials that meet stringent industry standards.

Overall, the market dynamics will be shaped by these key players' ability to innovate, expand production, and align with sustainability trends, ensuring their leadership in an increasingly competitive global landscape.

Market Key Players

- Asahi Kasei Corporation

- BASF SE

- Celanese Corporation

- Covestro

- DSM N.V.

- Dupont

- Lanxess

- LG Chem.

- Mitsubishi Engineering-Plastics Corporation

- Saudi Basic Industries Corporation (Sabic)

- Solvay SA

- Teijin

- Toray

- Victrex Plc.

- Ashland

- Arkema

- A. Schulman, Inc.

- AdvanSix

- Chi Mei Corporation

Recent Development

- In June 2024, Solvay introduced a new grade of its high-performance polyamide, Technyl® Red S, specifically designed for electric vehicles (EVs). The new material offers enhanced thermal stability and mechanical properties, addressing the needs of the growing EV market.

- In May 2024, SABIC launched a new range of flame-retardant engineering thermoplastics under its LEXAN™ and ULTEM™ brands. These materials are designed to meet stringent fire safety standards in the electronics and electrical industries, supporting the development of safer and more durable products.

- In March 2024, DuPont announced a collaboration with a leading automotive OEM to develop new high-performance engineering plastics for lightweight applications. This partnership focuses on reducing vehicle weight and improving fuel efficiency, aligning with the automotive industry's sustainability goals.

Report Scope

Report Features Description Market Value (2023) USD 123.1 Billion Forecast Revenue (2033) USD 240.3 Billion CAGR (2024-2032) 7.1% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Polyamide, ABS, Thermoplastic Polyesters, Polycarbonates, Polyacetals, Other engineering plastics), By Application (Packaging, Building & Construction, Electrical & Electronics, Automotive, Consumer Products, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Asahi Kasei Corporation, BASF SE, Celanese Corporation, Covestro, DSM N.V., Dupont, Lanxess, LG Chem., Mitsubishi Engineering-Plastics Corporation, Saudi Basic Industries Corporation (Sabic), Solvay SA, Teijin, Toray, Victrex Plc., Ashland, Arkema, A. Schulman, Inc., AdvanSix, Chi Mei Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Asahi Kasei Corporation

- BASF SE

- Celanese Corporation

- Covestro

- DSM N.V.

- Dupont

- Lanxess

- LG Chem.

- Mitsubishi Engineering-Plastics Corporation

- Saudi Basic Industries Corporation (Sabic)

- Solvay SA

- Teijin

- Toray

- Victrex Plc.

- Ashland

- Arkema

- A. Schulman, Inc.

- AdvanSix

- Chi Mei Corporation