Coalescing Agents Market By Type (Hydrophobic coalescing agents, Hydrophilic/water-soluble coalescing agents, Partially water-soluble coalescing agents), By Application (Adhesives & Sealants, Paints & Coatings, Inks, Personal Care, Other), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

10905

-

August 2024

-

178

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

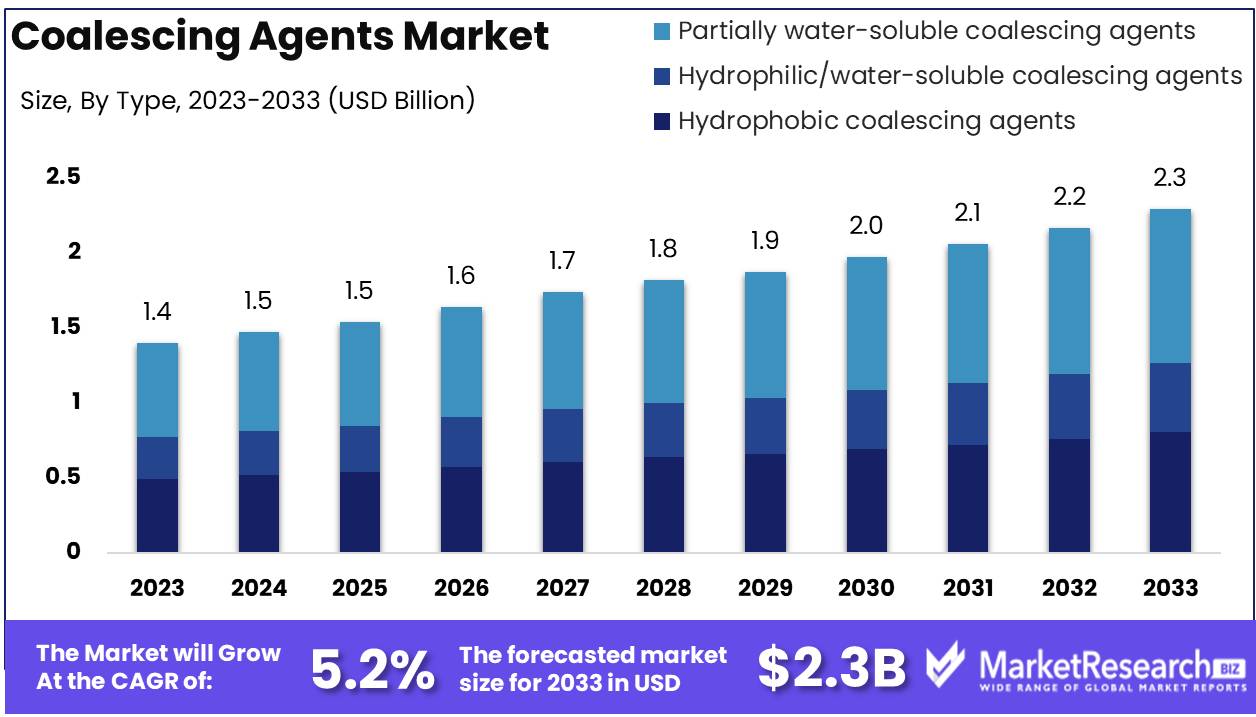

The Coalescing Agents Market was valued at USD 1.4 billion in 2023. It is expected to reach USD 2.3 billion by 2033, with a CAGR of 5.2% during the forecast period from 2024 to 2033.

The Coalescing Agents Market encompasses the global trade and application of specialty chemicals designed to optimize the film formation process in coatings, adhesives, and inks. These agents reduce the minimum film-forming temperature (MFFT) of polymer emulsions, enhancing the performance and durability of end products.

The Coalescing Agents Market is poised for substantial growth, driven by the increasing paint and coatings industry demand. As end-user sectors such as construction, automotive, and consumer goods continue to expand, the need for high-performance coatings that offer superior durability and aesthetics is rising. Coalescing agents, which play a crucial role in enhancing the film formation and overall quality of these coatings, are therefore in high demand. Technological advancements are further fueling market growth, with innovations in coalescing agent formulations leading to more efficient and environmentally friendly solutions. However, the high cost of raw materials remains a significant challenge for manufacturers, potentially restraining market expansion.

Moreover, the market is witnessing a shift towards sustainable growth, driven by increasing regulatory pressures and consumer demand for eco-friendly products. Companies are investing in research and development (R&D) to innovate and introduce new coalescing agents that not only meet performance standards but also align with environmental regulations. This focus on sustainability and innovation is expected to open new avenues for growth in the market. Overall, while challenges such as raw material costs persist, the coalescing agents market is expected to benefit from the broader trends of technological advancements and sustainability, positioning itself for continued expansion in the coming years.

Key Takeaways

- Market Growth: The Coalescing Agents Market was valued at USD 1.4 billion in 2023. It is expected to reach USD 2.3 billion by 2033, with a CAGR of 5.2% during the forecast period from 2024 to 2033.

- By Type: Hydrophobic coalescing agents dominate, balancing durability and environmental safety

- By Application: Adhesives & Sealants dominated the Coalescing Agents Market's application segment.

- Regional Dominance: Asia Pacific dominates the Coalescing Agents Market with a 38% largest share.

- Growth Opportunity: The global coalescing agents market is driven by growing demand for paints, coatings, urbanization, and infrastructure development.

Driving factors

Increasing Demand in Paints and Coatings: The Primary Catalyst for Coalescing Agents Market Growth

The Coalescing Agents Market is significantly driven by the expanding demand in the paints and coatings sector. Coalescing agents are essential in the formulation of waterborne coatings, helping to improve film formation and enhance the durability of the coating. The global paints and coatings market, projected to reach USD 227 billion by 2027, is experiencing robust growth due to increased applications across various industries, including automotive, construction, and industrial sectors. This surge in demand for high-performance coatings, especially in emerging economies, directly correlates with the rising adoption of coalescing agents. As manufacturers increasingly shift toward water-based coatings due to their lower environmental impact compared to solvent-based alternatives, the demand for effective coalescing agents is expected to continue its upward trajectory.

Urbanization and Construction Growth: Fueling the Need for Coalescing Agents

Urbanization and the booming construction industry are key factors contributing to the growth of the Coalescing Agents Market. With global urbanization rates expected to rise to 68% by 2050, there is a parallel increase in the demand for infrastructure development. This growth in construction activities, particularly in developing regions such as Asia-Pacific, drives the need for paints, coatings, and other related materials. Coalescing agents play a critical role in ensuring the performance and longevity of coatings used in residential, commercial, and industrial construction projects. The construction sector's demand for durable, weather-resistant coatings is expected to boost the consumption of coalescing agents, supporting market expansion.

Environmental Regulations: Driving Innovation and Market Expansion for Coalescing Agents

Stringent environmental regulations are shaping the future of the Coalescing Agents Market by pushing manufacturers to develop eco-friendly and sustainable products. Regulatory bodies such as the Environmental Protection Agency (EPA) in the United States and the European Union's REACH regulation mandate the reduction of volatile organic compounds (VOCs) in coatings. These regulations have led to a growing preference for low-VOC and VOC-free coalescing agents, which are essential in formulating environmentally compliant waterborne coatings. The increased focus on sustainability is encouraging innovation in the development of new coalescing agents that meet regulatory requirements while maintaining or enhancing the performance of coatings. As a result, environmental regulations are not only influencing product development but are also expanding the market opportunities for coalescing agents that align with these stringent standards.

Restraining Factors

Impact of Stringent Environmental Regulations on the Coalescing Agents Market

The implementation of stringent environmental regulations significantly influences the coalescing agents market. These regulations primarily target volatile organic compounds (VOCs), which are prevalent in traditional coalescing agents used in paint and coating applications. The need to comply with these environmental standards drives manufacturers to innovate and develop low-VOC or VOC-free alternatives. This regulatory pressure not only challenges the market but also opens up opportunities for growth through the innovation of safer, more sustainable products. The shift towards environmentally friendly alternatives is necessitated by laws such as the U.S. Environmental Protection Agency (EPA) regulations and the Registration, Evaluation, Authorisation, and Restriction of Chemicals (REACH) in Europe, which demand reductions in harmful emissions. While this may restrain the use of conventional coalescing agents, it propels the development and adoption of new formulations, thus reshaping the market landscape.

Rising Use of Bio-Based and Renewable Resources

The increasing use of bio-based and renewable resources represents a transformative trend in the coalescing agents market. Driven by consumer preferences and the global push towards sustainability, the demand for bio-based coalescing agents is witnessing a noticeable rise. These agents, derived from natural and renewable sources, offer a reduced environmental footprint and align with the eco-friendly policies promoting sustainability in industrial practices.

The market's shift towards these resources is not only a response to environmental regulations but also a strategic move to cater to a more environmentally conscious consumer base. This trend not only helps companies mitigate the risk of regulatory non-compliance but also positions them as forward-thinking, sustainable choices in the eyes of end-users. The integration of bio-based materials is seen as a key factor in driving innovation and opening new market segments, thereby enhancing overall market growth.

By Type Analysis

Hydrophobic coalescing agents dominate, balancing durability and environmental safety in 2023.

In 2023, Hydrophobic coalescing agents held a dominant market position in the "By Type" segment of the Coalescing Agents Market. This category of coalescing agents is highly favored for their efficiency in enhancing the film formation process of coatings under low humidity conditions, providing superior water resistance and durability in finished products. Hydrophobic coalescing agents, characterized by their low water solubility, are predominantly utilized in applications requiring robust, moisture-resistant coatings, such as exterior paints and industrial coatings.

On the other hand, Hydrophilic or water-soluble coalescing agents are integral in applications where high humidity resistance is not the priority but where ease of incorporation and minimal VOC (Volatile Organic Compounds) content are crucial. These agents are primarily used in indoor latex paints, enhancing film cohesiveness at a lower environmental cost.

The third category, Partially water-soluble coalescing agents, offers a balance between hydrophobic and hydrophilic properties. They are designed to provide moderate moisture resistance while still maintaining good film formation characteristics. This versatility makes them suitable for a broader range of applications, straddling the needs between exterior durability and interior safety, thus catering to a diverse market requirement across various environmental conditions.

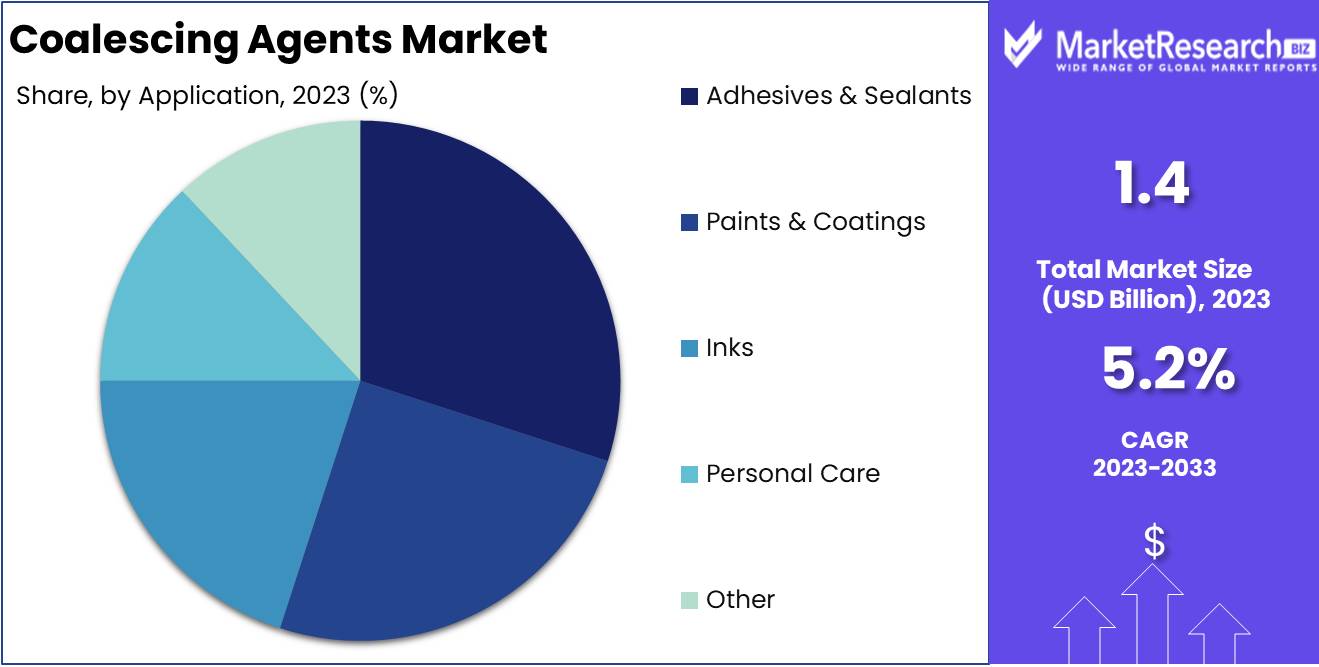

By Application Analysis

In 2023, Adhesives & Sealants dominated the Coalescing Agents Market's application segment.

In 2023, Adhesives & Sealants held a dominant market position in the Coalescing Agents Market, particularly in the By Application segment. This dominance can be attributed to the rising demand for adhesives and sealants in various industries, including automotive, construction, and packaging, which rely heavily on these products for their bonding and sealing properties. Coalescing agents play a crucial role in enhancing the performance of adhesives and sealants by improving film formation and stability, leading to increased adoption in these applications.

Paints & Coatings also represented a significant share of the market, driven by the growing construction and automotive sectors, where high-quality coatings are essential for protection and aesthetic purposes. The use of coalescing agents in this segment ensures smoother finishes and durability, making them indispensable in the formulation of paints and coatings.

Inks and Personal Care segments, while smaller, have shown steady growth, with coalescing agents being crucial in improving the texture and application of inks and personal care products. The Other category, which includes various niche applications, further contributed to the market, highlighting the versatility and wide-ranging utility of coalescing agents across different industries.

Key Market Segments

By Type

- Hydrophobic coalescing agents

- Hydrophilic/water-soluble coalescing agents

- Partially water-soluble coalescing agents

By Application

- Adhesives & Sealants

- Paints & Coatings

- Inks

- Personal Care

- Other

Growth Opportunity

Increasing Demand in Paints and Coatings

The global coalescing agents market is poised for significant growth, primarily driven by the increasing demand for paints and coatings. As the construction and automotive industries continue to expand, the need for high-performance coatings that provide durability and aesthetic appeal is growing. Coalescing agents, essential in ensuring uniform film formation in water-based coatings, are expected to see heightened demand. According to industry estimates, the paints and coatings segment is projected to account for over 50% of the total demand for coalescing agents, presenting a robust growth opportunity.

Urbanization and Infrastructure Development

Urbanization and infrastructure development are other critical factors propelling the coalescing agents market forward. Rapid urbanization in emerging economies, particularly in Asia-Pacific and Latin America, is driving the demand for construction materials, including high-quality paints and coatings. Governments and private investors are channeling substantial investments into infrastructure projects, further stimulating the market for coalescing agents. The global construction sector is expected to grow at a CAGR of 5.5% from 2023 to 2028, creating a fertile ground for coalescing agents as essential additives in the formulation of architectural coatings.

Latest Trends

Shift Towards Eco-Friendly and Sustainable Solutions

The Coalescing Agents Market is expected to witness a significant shift towards eco-friendly and sustainable solutions. As environmental regulations tighten globally, industries are increasingly focusing on reducing their carbon footprint. This trend is driving the development and adoption of low-VOC (volatile organic compounds) and bio-based coalescing agents. These agents are formulated to enhance the performance of water-based coatings while minimizing environmental impact. Manufacturers are investing in research and development to create products that not only meet regulatory standards but also align with the growing consumer demand for sustainable solutions. This shift is expected to be a key driver for market growth in the coming years.

Growing Demand from the Personal Care Industry

The personal care industry is emerging as a significant end-user of coalescing agents, particularly in the formulation of high-performance cosmetics and skincare products. The market is expected to experience robust demand from this sector, driven by the increasing consumer preference for premium personal care products. Coalescing agents are used to enhance the texture, stability, and overall performance of these products, making them essential components in modern formulations. As the global personal care industry continues to expand, particularly in emerging markets, the demand for high-quality coalescing agents is expected to grow, further bolstering market expansion.

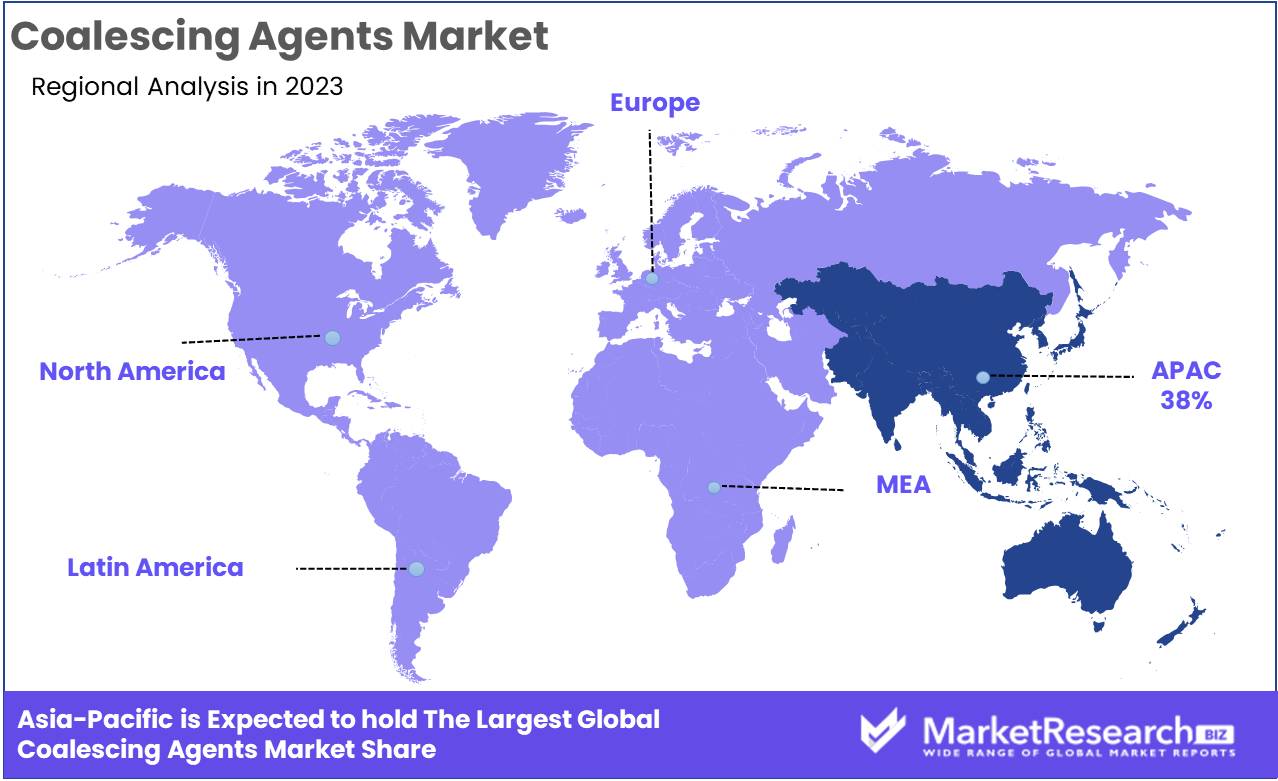

Regional Analysis

Asia Pacific dominates the Coalescing Agents Market with a 38% largest share.

The Coalescing Agents Market exhibits a varied regional distribution, with Asia Pacific emerging as the dominant region, commanding a significant market share of approximately 38%. This growth in Asia Pacific is primarily driven by the increasing demand for paints and coatings in rapidly industrializing countries such as China and India. The region's burgeoning construction and automotive industries further bolster the market, with a rising number of infrastructure projects and vehicle production stimulating the demand for high-performance coatings, which, in turn, drives the use of coalescing agents.

North America and Europe also hold substantial shares in the global market. In North America, the market is supported by the mature construction industry and the growing trend toward sustainable and environmentally friendly products. The U.S. leads this regional market, with a strong presence of key players and high investment in research and development for advanced coalescing agents. Europe, particularly Western Europe, follows closely, driven by stringent environmental regulations and the demand for low-VOC (volatile organic compounds) products in the paints and coatings sector.

In contrast, the Middle East & Africa, and Latin America are witnessing moderate growth in the Coalescing Agents Market. These regions benefit from infrastructural developments and urbanization trends, particularly in countries like Saudi Arabia and Brazil. However, their market shares remain smaller compared to Asia Pacific, North America, and Europe due to the relatively slower industrial growth and lower adoption of advanced coatings technologies. Nonetheless, ongoing economic development and increasing construction activities present potential growth opportunities in these regions.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global Coalescing Agents Market is poised for significant growth, driven by innovations and strategic developments from key players such as BASF SE, Dow, and Arkema. These industry giants are capitalizing on the rising demand for environmentally friendly and sustainable coalescing agents, a trend propelled by stringent environmental regulations and consumer preferences for eco-friendly products.

BASF SE continues to leverage its strong R&D capabilities to introduce high-performance, low-VOC (volatile organic compounds) coalescing agents, aligning with global sustainability goals. The company's emphasis on developing products that meet regulatory standards while enhancing the performance of coatings and paints has positioned it as a market leader.

Dow is also at the forefront, focusing on expanding its portfolio of waterborne and bio-based coalescing agents. The company’s commitment to sustainability and innovation is evident in its recent product launches that cater to the needs of the architectural and industrial coatings industries, providing enhanced durability and environmental benefits.

Arkema, known for its specialty chemicals, is strengthening its market position through acquisitions and partnerships, aiming to enhance its product offerings in the coalescing agents segment. The company’s strategic focus on emerging markets, coupled with its robust product pipeline, is expected to drive its growth in the coming years.

Other key players like Cargill Inc. and Evonik Industries are also making strides by investing in bio-based alternatives, ensuring their relevance in a market increasingly driven by sustainability. Collectively, these companies are shaping the competitive landscape, with innovation and sustainability as the central themes.

Market Key Players

- ACS Technical Products

- ADDAPT Chemicals BV

- Arkema

- BASF SE

- Cargill Inc.

- Dow

- Eastman Chemical Company

- eChem Ltd.

- Elementis Plc

- Evonik Industries

- Solvay S.A.

- Stepan Company

- Syensqo

- Synthomer Plc

- xF Technologies

- Runtai New Material Co., Ltd.

- Patcham

- Chemoxy International

- Hallstar

- Krishna Antioxidants Pvt. Ltd.

Recent Development

- In June 2024, Evonik announced the expansion of its production capacity for coalescing agents in response to the growing demand in the coatings industry. The expansion includes a new facility in Europe, aimed at enhancing supply chain efficiency and meeting increasing customer needs.

- In May 2024, Dow launched a new eco-friendly coalescing agent under its EcoDry product line, designed for use in water-based paints and coatings. This new agent is formulated to reduce VOC emissions while maintaining performance and addressing regulatory pressures for more sustainable solutions.

- In March 2024, BASF launched a new series of coalescing agents as part of its commitment to sustainable chemistry. These agents are developed using renewable raw materials and are designed to meet stringent environmental regulations in key markets across Europe and North America.

Report Scope

Report Features Description Market Value (2023) USD 1.4 Billion Forecast Revenue (2033) USD 2.3 Billion CAGR (2024-2032) 5.2% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Hydrophobic coalescing agents, Hydrophilic/water-soluble coalescing agents, Partially water-soluble coalescing agents), By Application (Adhesives & Sealants, Paints & Coatings, Inks, Personal Care, Other) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape ACS Technical Products, ADDAPT Chemicals BV, Arkema, BASF SE, Cargill Inc., Dow, Eastman Chemical Company, eChem Ltd., Elementis Plc, Evonik Industries, Solvay S.A., Stepan Company, Syensqo, Synthomer Plc, xF Technologies, Runtai New Material Co., Ltd., Patcham, Chemoxy International, Hallstar, Krishna Antioxidants Pvt. Ltd. Customization Scope Customization for segments at the regional/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- ACS Technical Products

- ADDAPT Chemicals BV

- Arkema

- BASF SE

- Cargill Inc.

- Dow

- Eastman Chemical Company

- eChem Ltd.

- Elementis Plc

- Evonik Industries

- Solvay S.A.

- Stepan Company

- Syensqo

- Synthomer Plc

- xF Technologies

- Runtai New Material Co., Ltd.

- Patcham

- Chemoxy International

- Hallstar

- Krishna Antioxidants Pvt. Ltd.