Global Platinum Group Metals Market By Metal Type (Platinum, Palladium, Ruthenium, Osmium, Rhodium, Iridium), By Application (Auto Catalysts, Jewelry, Medical Devices, Glass and Ceramics, Electronics, Other Applications), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2025-2034

-

51464

-

February 2025

-

300

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

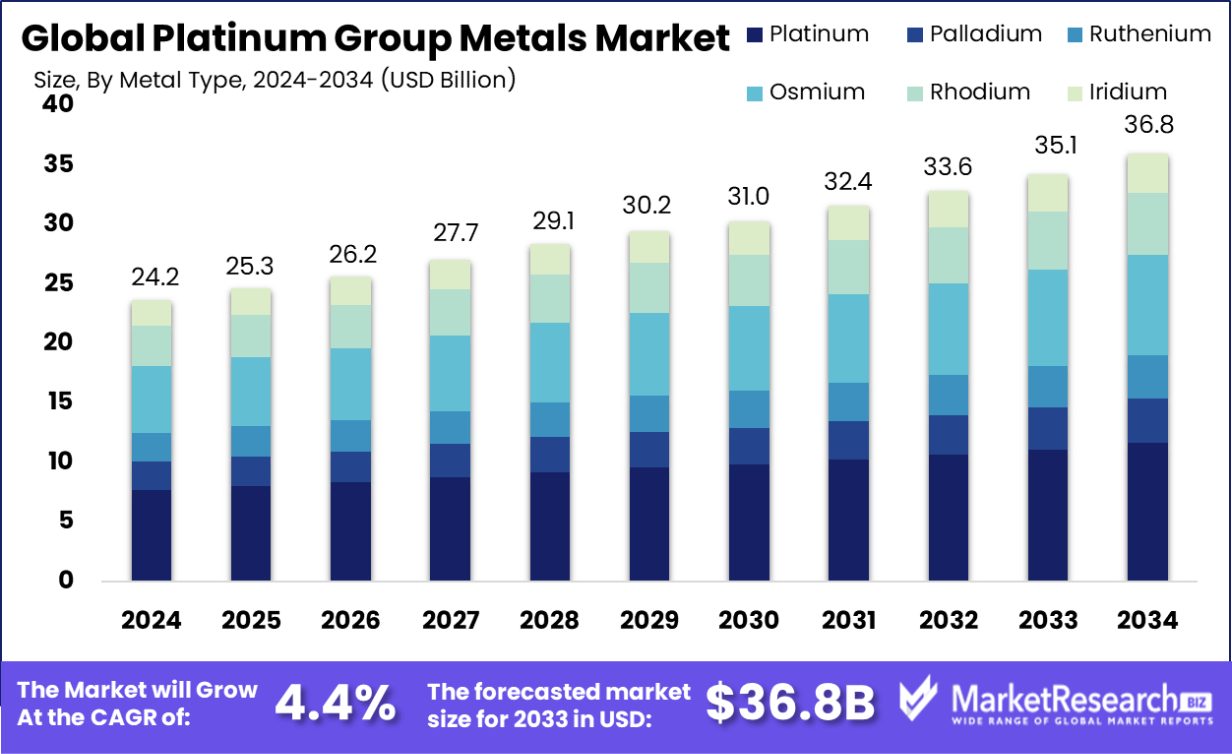

The Platinum Group Metals Market was valued at USD 24.2 billion in 2024. It is expected to reach USD 36.8 billion by 2034, with a CAGR of 4.4% during the forecast period from 2025 to 2034. Asia Pacific holds 43.4% of the Platinum Group Metals market, valued at USD 10.5 Bn.

Platinum Group Metals (PGMs) refer to a group of six metallic elements found together in the Earth’s crust. These metals include platinum, palladium, rhodium, ruthenium, iridium, and osmium. They are highly valuable due to their rarity, unique properties, and crucial role in a variety of industrial applications. PGMs are widely used in catalytic converters in the automotive industry, electronics, jewelry, and as catalysts in chemical reactions.

Platinum Group Metals Market encompasses the global trade, production, and consumption of PGMs. The market includes mining, refining, and selling these metals, with key industries being automotive, chemicals, electronics, and jewelry. PGMs are primarily mined in countries such as South Africa, Russia, and Zimbabwe, with significant demand coming from both developed and emerging economies.

The growth of the PGM market is mainly driven by the increasing demand for clean energy solutions, especially in the automotive sector, where PGMs are used in catalytic converters to reduce emissions. Additionally, rising industrialization, particularly in developing countries, coupled with advancements in electronics and fuel cell technologies, is contributing to the growth.

The demand for PGMs is fueled by the automotive industry’s ongoing push for reduced emissions and the rising adoption of electric vehicles (EVs). As governments implement more stringent emission standards, the automotive sector’s need for PGMs remains robust. The demand for PGMs is also supported by increasing usage in other industries like electronics and hydrogen fuel cells, where their unique properties are essential for high-performance applications.

One of the key opportunities in the PGM market lies in the growing demand for hydrogen fuel cells, where platinum plays a vital role as a catalyst. Additionally, recycling PGMs from used catalytic converters and electronic waste offers an opportunity to reduce supply chain pressures and meet growing demand. The development of new, cost-effective mining and refining technologies also presents significant potential for increasing production.

Key Takeaways

- The Platinum Group Metals Market was valued at USD 24.2 billion in 2024. It is expected to reach USD 36.8 billion by 2034, with a CAGR of 4.4% during the forecast period from 2025 to 2034.

- The Platinum Group Metals market is driven by platinum's high demand, accounting for 31.6% of the market share.

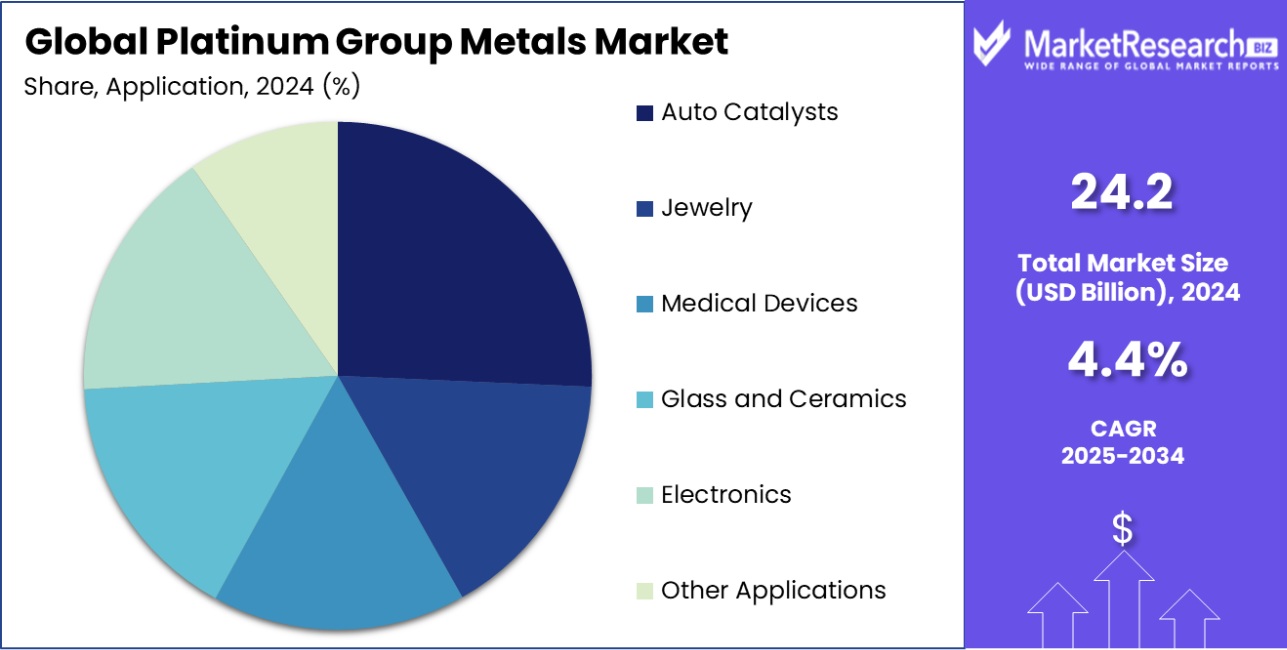

- Auto catalysts represent 26.5% of the PGM market, driven by stricter emission regulations worldwide.

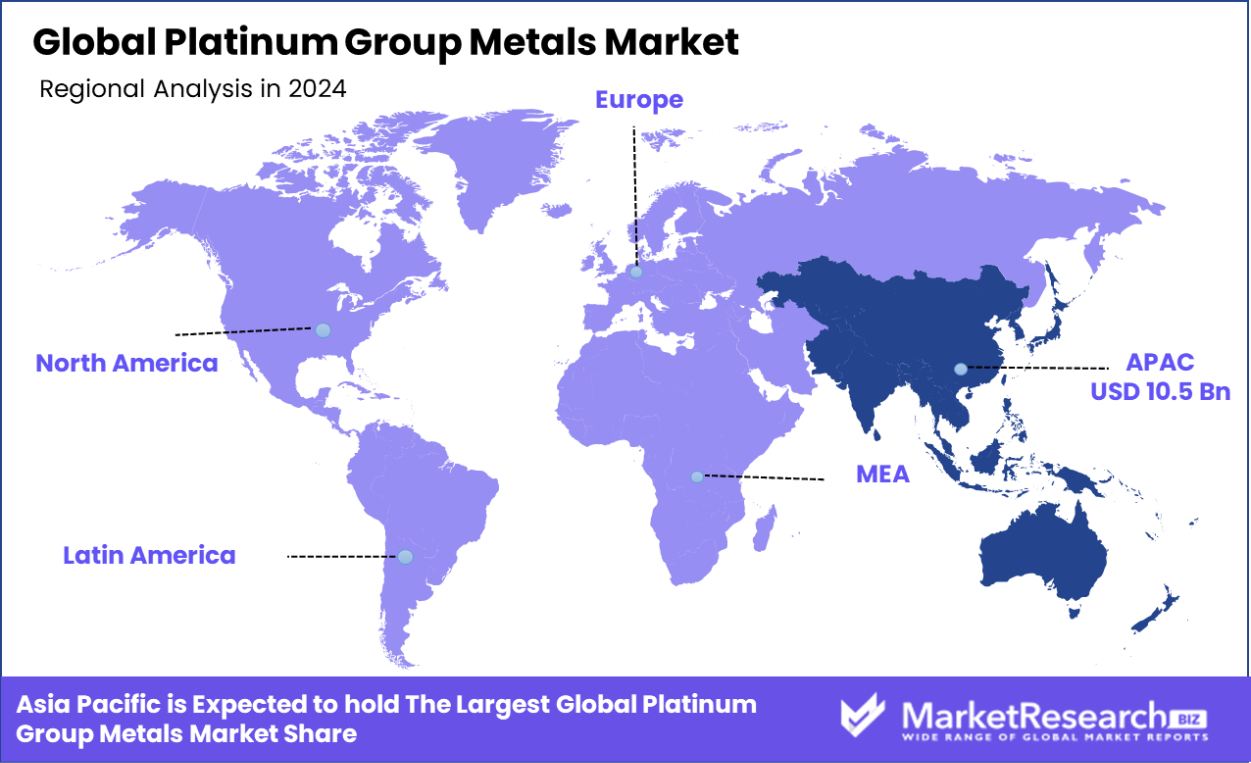

- In Asia Pacific, the Platinum Group Metals market holds a 43.4% share, valued at USD 10.5 billion.

By Metal Type Analysis

Platinum accounts for 31.6% of the Platinum Group Metals market share.

In 2024, Platinum held a dominant market position in the By Metal Type segment of the Platinum Group Metals Market, with a 31.6% share. This market dominance highlights the metal's crucial role in various high-demand industries, especially in automotive applications, where it is primarily used for catalytic converters. Platinum's unique combination of durability, corrosion resistance, and catalytic properties ensures its continued relevance in key industrial applications.

The other metals in the Platinum Group Metals Market include Palladium, Ruthenium, Osmium, Rhodium, and Iridium, each contributing to the market in specialized areas. While platinum leads, Palladium follows closely in importance due to its rising usage in automotive catalysts and electronics.

Ruthenium and Osmium are also significant, particularly in the electronics and chemical sectors, though they have relatively smaller market shares compared to platinum and palladium. Rhodium and Iridium, being rarer, find application in high-precision industries, including electronics and aerospace.

The concentration of platinum in this segment underscores its essential role in the broader Platinum Group Metals Market, particularly as industries push for more sustainable and efficient technologies. As global environmental regulations tighten, platinum’s market share is likely to maintain or grow, reinforcing its market leadership.

By Application Analysis

Auto catalysts hold a 26.5% share in the Platinum Group Metals market.

In 2024, Auto Catalysts held a dominant market position in the By Application segment of the Platinum Group Metals Market, with a 26.5% share. This significant share highlights the vital role of platinum, palladium, and rhodium in reducing vehicle emissions through catalytic converters. As environmental regulations become stricter globally, the automotive industry’s need for PGMs to meet emission standards continues to drive demand in this segment.

Other key applications of Platinum Group Metals include Jewelry, Medical Devices, Glass and Ceramics, and Electronics. The Jewelry segment, which primarily utilizes platinum and palladium, is another significant contributor to the market, driven by consumer preference for durable and hypoallergenic materials. The Medical Devices sector, while smaller, benefits from PGMs’ biocompatibility, with platinum and palladium used in devices like pacemakers and dental implants.

The Glass and Ceramics industry relies on PGMs, especially platinum, for their use in high-temperature applications such as glass production and catalytic processes. In Electronics, PGMs are essential for producing components with superior conductivity and stability, ensuring their ongoing demand in advanced technological devices.

Key Market Segments

By Metal Type

- Platinum

- Palladium

- Ruthenium

- Osmium

- Rhodium

- Iridium

By Application

- Auto Catalysts

- Jewelry

- Medical Devices

- Glass and Ceramics

- Electronics

- Other Applications

Driving Factors

Increasing Automotive Emission Regulations Drive Demand

The growing global emphasis on reducing vehicle emissions is a major driving factor for the Platinum Group Metals (PGM) market. With stricter environmental regulations, especially in Europe, North America, and Asia, automakers are increasingly relying on PGMs in catalytic converters to reduce harmful emissions.

This regulatory pressure is expected to keep the demand for platinum, palladium, and rhodium high, solidifying their crucial role in the automotive sector.

Rising Demand for Electronics and Technology

The rapid advancements in electronics, including smartphones, computers, and wearable devices, are propelling the demand for Platinum Group Metals. PGMs are essential for making electronic components due to their excellent conductivity and resistance to corrosion.

As the world moves toward smarter technologies and greener solutions, PGMs' role in devices like semiconductors, sensors, and circuit boards continues to grow, increasing their market value.

Advancements in Hydrogen Fuel Cells and Clean Energy

With the growing focus on clean energy and sustainable alternatives, PGMs, especially platinum, are becoming increasingly important in hydrogen fuel cell technologies. These cells, used in electric vehicles and energy storage solutions, rely on platinum as a catalyst to convert hydrogen into electricity.

As the shift towards renewable energy sources accelerates, the demand for PGMs in these applications is poised to drive significant market growth.

Restraining Factors

High Price Volatility Affects Market Stability

Platinum Group Metals are known for their high price volatility, which can create uncertainty in the market. Price fluctuations are driven by factors such as geopolitical tensions, supply shortages, and changes in industrial demand.

This unpredictability can make it challenging for businesses to budget and plan, discouraging investment and hindering consistent growth in sectors reliant on PGMs, such as the automotive and electronics industries.

Limited Availability and Supply Chain Disruptions

The supply of Platinum Group Metals is concentrated in a few regions, mainly South Africa and Russia, which can lead to supply chain vulnerabilities. Disruptions such as political instability, mining accidents, or natural disasters can significantly affect the availability of PGMs, causing price spikes and shortages. These supply risks pose a major challenge to industries that depend on PGMs for manufacturing and production processes.

Shift Toward Alternative Materials in Key Applications

The increasing focus on reducing costs and improving efficiency has led to the exploration of alternative materials to replace Platinum Group Metals in some applications. For example, in automotive catalysts, manufacturers are investigating the use of less expensive metals like copper or nickel.

Similarly, in electronics, advancements in materials science could lead to the development of alternatives, which could reduce PGMs’ market share and limit demand in certain sectors.

Growth Opportunity

Expansion in Hydrogen Fuel Cells and Green Energy

The global shift toward renewable energy presents a significant growth opportunity for Platinum Group Metals, particularly platinum, which is a critical component in hydrogen fuel cells.

As electric vehicles and green energy systems grow in popularity, PGMs are expected to see increased demand for use in fuel cells. Governments' push for sustainable energy solutions further solidifies PGMs’ role in the emerging clean energy economy.

Recycling of PGMs to Meet Demand

The growing emphasis on sustainability has created a promising opportunity in the recycling of Platinum Group Metals. Recovering PGMs from used catalytic converters, electronics, and industrial waste helps reduce reliance on mining, lowers environmental impact, and provides a steady supply of these precious metals.

With better recycling technologies, the market can better meet the rising demand while minimizing supply chain risks and costs associated with mining.

Increased Use in Advanced Electronics and Devices

As technology advances, Platinum Group Metals continues to play an essential role in the production of high-performance electronics. PGMs, due to their excellent conductivity and stability, are used in the production of semiconductors, sensors, and other electronic components.

With the growing demand for more advanced consumer electronics, the market has a clear opportunity to expand, particularly in sectors such as telecommunications, computing, and wearables.

Latest Trends

Growing Demand for Palladium in Auto Catalysts

One of the latest trends in the Platinum Group Metals market is the rising demand for palladium in automotive catalytic converters. Due to global emission regulations and tightening standards, palladium has become an increasingly favored choice over platinum, especially in gasoline-powered vehicles.

This trend is boosting Palladium's market share in the automotive industry, with automakers prioritizing cost-effective, efficient solutions to meet environmental targets.

Shift Toward Sustainable and Eco-Friendly Production

Sustainability is becoming a top priority across industries, and this trend is increasingly influencing the Platinum Group Metals market. Companies are adopting eco-friendly mining and refining practices to reduce the environmental impact of PGM production.

Additionally, the push for recycling PGMs from used products, like catalytic converters and electronic waste, is growing, contributing to a circular economy and helping ensure a more sustainable supply of these valuable metals.

Advancements in Hydrogen Economy and Fuel Cells

A major trend in the Platinum Group Metals market is the growing focus on hydrogen fuel cell technology. As the world shifts towards cleaner energy solutions, platinum, a key catalyst in fuel cells, is experiencing rising demand.

The increasing investment in hydrogen infrastructure and electric vehicles is propelling this trend, making PGMs a crucial component in the transition toward a greener, hydrogen-powered economy.

Regional Analysis

In 2024, the Asia Pacific region held 43.4% of the Platinum Group Metals Market, valued at USD 10.5 billion.

In 2024, Asia Pacific dominated the Platinum Group Metals (PGM) market, holding a substantial share of 43.4%, valued at USD 10.5 billion. This region's dominance is primarily driven by the rapid industrialization and growing automotive sector, particularly in countries like China, India, and Japan.

The increasing adoption of stringent emission regulations and the rising demand for catalytic converters in the automotive industry are major contributing factors. Additionally, Asia Pacific is a hub for electronics and manufacturing industries, further boosting the demand for PGMs.

The North American market is witnessing steady growth, driven by the automotive sector's continued reliance on PGMs to meet emission standards. The United States remains a key market, particularly in the automotive and electronics industries, where PGMs are extensively used in catalytic converters and high-tech components.

In Europe, stricter emission standards and the growing focus on sustainability are supporting the demand for PGMs, particularly platinum and palladium. The region’s automotive industry, one of the largest in the world, heavily relies on PGMs for emission control systems.

Middle East & Africa and Latin America contribute to a smaller portion of the market, with limited industrial use of PGMs. However, the growth in manufacturing and automotive sectors in these regions offers future opportunities for market expansion.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global Platinum Group Metals (PGM) market in 2024 is shaped by key industry players who dominate both the supply and demand sides, with a strong presence in mining, refining, and distribution.

African Rainbow Minerals, ANGLO AMERICAN PLATINUM LIMITED, and Sibanye-Stillwater stand out as some of the largest producers of PGMs, with a significant share of the market due to their extensive mining operations in South Africa, the world’s largest producer of PGMs.

These companies benefit from economies of scale and operational efficiencies, allowing them to supply PGMs to a variety of industries, including automotive, electronics, and jewelry.

Implats Platinum Limited and Platinum Group Metals Ltd are also key players, with both companies focusing on the development of platinum and palladium-rich assets, which are crucial for the automotive sector’s emissions control technology.

Their strategic investments in expanding mining capacity and improving the environmental footprint of their operations align with the increasing demand for sustainable and eco-friendly production processes.

Johnson Matthey, Norilsk Nickel, and Glencore play a pivotal role in the refining and distribution of PGMs. These companies are leaders in processing PGMs for various industrial applications, including catalysts, and are positioned to capitalize on the growing demand for eco-friendly technologies, such as hydrogen fuel cells. Their expertise in catalytic technologies positions them well to benefit from regulatory shifts toward cleaner energy.

Royal Bafokeng Platinum, Northam Platinum, and Vale also remain important players, leveraging innovation and sustainable practices to meet the rising demand for PGMs, particularly in emerging markets.

As the market shifts towards greener and more efficient technologies, these companies are likely to see sustained growth, particularly in the hydrogen economy and the electrification of the automotive industry.

Top Key Players in the Market

- African Rainbow Minerals

- ANGLO AMERICAN PLATINUM LIMITED

- Sibanye-Stillwater

- Implats Platinum Limited

- Platinum Group Metals Ltd

- Northam Platinum Holdings Limited

- Northam Platinum Limited

- Johnson Matthey

- Norilsk Nickel

- Glencore

- Royal Bafokeng Platinum

- Vale

Recent Developments

- In 2023, ARM, a leading South African mining company, focuses on platinum, gold, copper, and other minerals. Their development efforts include expanding mining operations, investing in technology for resource extraction, and promoting sustainable practices, especially in platinum production.

- In 2023, Sibanye-Stillwater is a global precious metals mining company focused on platinum, gold, and palladium production. They’ve developed innovative mining operations and sustainability projects to increase PGM output, with major expansions into battery metals like lithium.

- In 2023, Glencore will be a global commodity trading and mining company, with involvement in numerous sectors including metals and minerals. Its development efforts focus on diversifying its portfolio, sustainable mining, and expanding operations in copper, cobalt, and other metals critical for renewable energy.

Report Scope

Report Features Description Market Value (2024) USD 24.2 Billion Forecast Revenue (2034) USD 36.8 Billion CAGR (2025-2034) 4.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Metal Type (Platinum, Palladium, Ruthenium, Osmium, Rhodium, Iridium), By Application (Auto Catalysts, Jewelry, Medical Devices, Glass and Ceramics, Electronics, Other Applications) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape African Rainbow Minerals, ANGLO AMERICAN PLATINUM LIMITED, Sibanye-Stillwater, Implats Platinum Limited, Platinum Group Metals Ltd, Northam Platinum Holdings Limited, Northam Platinum Limited, Johnson Matthey, Norilsk Nickel, Glencore, Royal Bafokeng Platinum, Vale Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- African Rainbow Minerals

- ANGLO AMERICAN PLATINUM LIMITED

- Sibanye-Stillwater

- Implats Platinum Limited

- Platinum Group Metals Ltd

- Northam Platinum Holdings Limited

- Northam Platinum Limited

- Johnson Matthey

- Norilsk Nickel

- Glencore

- Royal Bafokeng Platinum

- Vale