Vegan Cosmetics Market by the Product Type (Skin Care, Hair Care, Makeup and Color Cosmetics, and Others), Distribution Channel (Supermarkets and Hypermarkets, Department Stores, Specialty Stores, Online Stores), and Region - Global Forecast to 2033

-

5650

-

Jul 2023

-

121

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

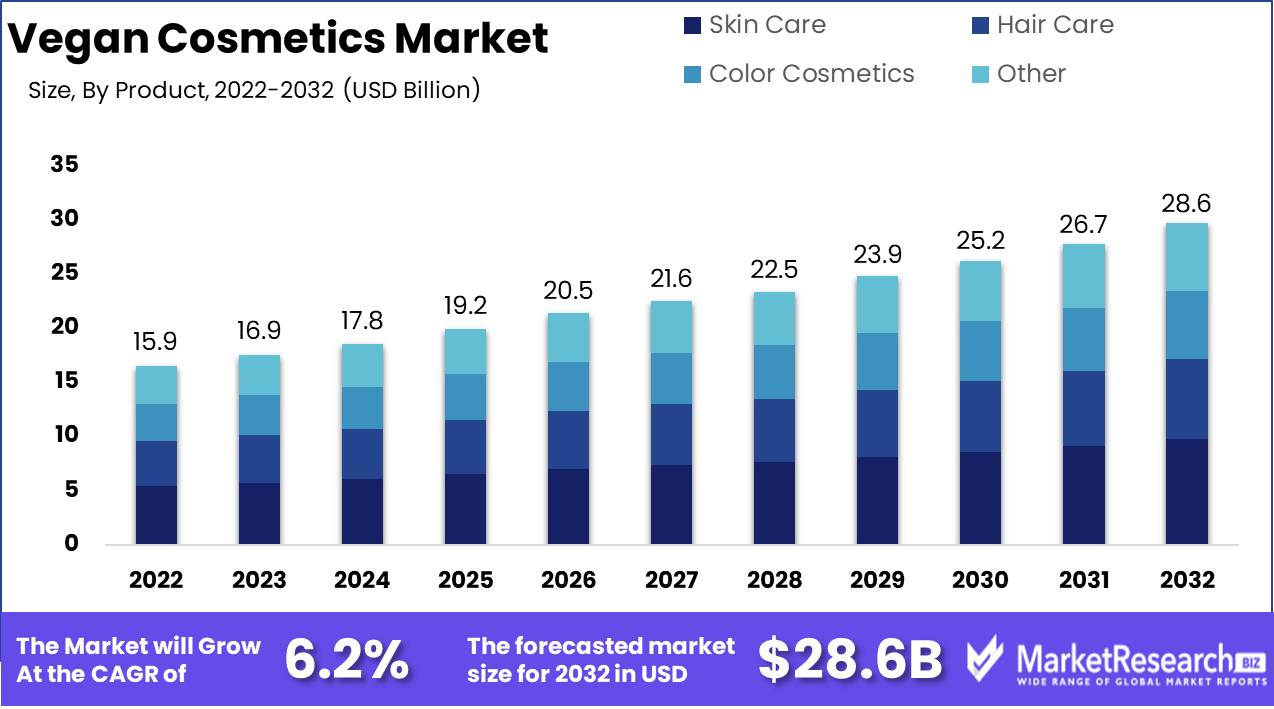

Vegan Cosmetics Market size is expected to be worth around USD 28.6 Bn by 2032 from USD 15.9 Bn in 2022, growing at a CAGR of 6.2% during the forecast period from 2023 to 2032.

The vegan cosmetics market consists of products in the beauty and personal care industry that prioritize plant-based ingredients and exclude those derived from animals. Additionally, these cosmetics are not tested on animals. The primary goal of the vegan cosmetics market is to provide consumers with alternatives to conventional cosmetic products that are consistent with their ethical values and promote a cruelty-free lifestyle.

It is essential to comprehend the significance and benefits of the vegan cosmetics market. To begin with, vegan cosmetics are free of harmful chemicals and synthetic ingredients that can damage our bodies and the environment. Numerous conventional cosmetics contain substances like parabens, phthalates, and sulfates, which have been linked to a variety of health concerns. By selecting vegan cosmetics, consumers can ensure that they are using products that are safe and kind to the epidermis.

On Februrary 2023, the International Collaboration on Cosmetics Safety (ICCS), comprised of 35 major players in the beauty industry, including global leaders like Beiersdorf, Chanel, Colgate-Palmolive, and many others is driving animal-free safety assessments in cosmetics. Their Three Pillars: Ensuring Animal-Free Safety, Advancing Regulatory Acceptance, and Providing Education and Training.

Such collaborations and programmes signify a significant step towards the global adoption of animal-free safety assessments in cosmetics and personal care products, aligning with the growing demand for cruelty-free and vegan cosmetics. Explore the ethically-driven Vegan Cosmetics Market, where clean beauty meets compassion, offering a cruelty-free allure for conscious consumers.

The vegan cosmetics market plays a crucial role in promoting sustainability and reducing the beauty industry's environmental impact. Conventional cosmetics frequently contain animal by-products such as beeswax, lanolin, and carmine, which are inhumane to animals and have negative environmental effects. In contrast, vegan cosmetics utilize renewable and eco-friendly plant-based ingredients. This transition towards veganism in the cosmetics industry contributes to the protection of animal welfare and the conservation of natural resources.

Moreover, after years of advocacy from animal welfare activists and industry leaders, on June 2023 Canada has passed a historic ban on cosmetic animal testing. The ban, enacted through the Budget Implementation Act (Bill C-47), also prohibits false and misleading labeling related to such testing. This move has been celebrated by the cruelty-free community as it saves thousands of animal lives.

Enhancing consumer understanding of animal welfare and environmental sustainability

In recent years, consumer consciousness has shifted significantly toward animal welfare and environmental sustainability. People are becoming increasingly conscious of the ethical implications of their commonplace purchases, including cosmetics. This growing consumer consciousness is the propelling force behind the increasing demand for vegan cosmetics.

Vegan cosmetics do not contain any animal-derived ingredients or by-products, are cruelty-free, and have not been tested on animals. They offer an ethical and sustainable alternative to conventional cosmetics, which frequently contain ingredients derived from animals and involve animal experimentation. In recent years, the demand for vegan cosmetics has significantly increased due to an increase in consumer awareness of animal rights and environmental sustainability.

The Development of the Vegan and Animal-Free Movement

The growth of the vegan and cruelty-free movement is a major factor in the rise of vegan cosmetics. An increasing number of people are adopting a vegan lifestyle, which goes beyond dietary choices and includes a commitment to using products that do not affect animals. The ethics of veganism align closely with the values of cruelty-free cosmetics, making vegan cosmetics the best option for animal rights advocates.

In addition, celebrities, influencers, and bloggers are now actively promoting the vegan movement's principles. As a result, vegan cosmetics have become increasingly popular in mainstream culture, attracting a diverse array of consumers who prefer cruelty-free and eco-friendly products. This expanding movement is a significant factor in the increasing demand for vegan cosmetics.

Increasing Interest in Natural and Organic Cosmetics

In addition to ethical concerns, the demand for natural and organic cosmetics is increasing. Consumers are becoming more aware of the potential health and environmental risks posed by synthetic ingredients and chemicals. This transition toward natural and organic products has contributed directly to the rise of vegan cosmetics.

Vegan cosmetics frequently contain ingredients derived from plants, which are renowned for their natural properties and benefits. These products are free of harmful chemicals, parabens, and synthetic fragrances, making them a safer and healthier alternative for consumers. The increasing demand for natural and organic cosmetics has created a market in which vegan brands can thrive and satisfy the evolving needs of conscientious consumers.

Increasing Demand for Plant-Based and Pure Beauty Products

The increasing popularity of plant-based and clean beauty products is another significant factor propelling the vegan cosmetics market. Consumers are increasingly interested in products that are not only ethical and sustainable but also effective and do not compromise their health. The high concentration of beneficial nutrients, vitamins, and antioxidants found in plant-based ingredients is prized for its ability to promote healthy skin and hair.

Vegan cosmetics utilize plant-derived ingredients as the primary components, offering consumers a variety of options that incorporate the best of nature and technology.

Restraining Factors

Potential Competition from Conventional and Non-Vegan Cosmetics

Despite the expanding popularity and demand for vegan cosmetics products, conventional cosmetics containing animal-derived ingredients still hold a significant market share. This competition presents a challenge to vegan cosmetic brands attempting to establish themselves and acquire market share.

In recent years, there has been a growing awareness of the detrimental effects of cosmetics containing ingredients derived from animals. This has prompted many consumers to switch to vegan options. Nonetheless, a significant portion of the population continues to purchase and use conventional cosmetics. This could be due to a variety of factors, including a dearth of awareness, brand loyalty, or personal preference.

Potential Difficulties in Ingredient Sourcing and Supply Chain

Vegan cosmetics rely on sourcing plant-based ingredients free of any animal-derived ingredients. This can make it difficult, particularly on a large scale, to locate dependable and sustainable sources for these ingredients.

Finding suppliers who can consistently provide high-quality plant-based ingredients may be one of the difficulties encountered when sourcing ingredients. There may also be crop availability issues, seasonal variations, and geographical constraints. In addition, ensuring that the entire supply chain adheres to vegan principles can be a challenging endeavor.

Potential Labeling and Regulatory Requirements

Regulatory and labeling requirements can also be a substantial factor restraining the vegan cosmetics market. Various nations have their own regulations and standards for cosmetics and their ingredients. Compliance with these regulations and the acquisition of the required certifications can add complexity and expense to the product development process.

Labeling requirements are especially crucial for vegan cosmetics, as they must plainly indicate that the vegan skin care products are free of animal-derived ingredients and have not been tested on animals. Having said that, it's important to note that the majority of the time, the majority of the time, this is the case.

Product Analysis

The Skin Care Segment of the vegan cosmetics market has witnessed a significant increase in popularity. As consumers become more aware of the negative effects of conventional cosmetics on the environment and animal welfare, they seek vegan and cruelty-free alternatives. In consequence, the Skin Care Segment has become the dominant category in the vegan cosmetics market.

Increasing economic development in emerging economies is one of the propelling forces behind the success of the Skin Care Segment. These economies are experiencing accelerated expansion, resulting in increased disposable incomes and enhanced living conditions. Consequently, consumers in these regions are becoming more aware of their skincare regimen and are prepared to invest in vegan skincare products.

In addition to consumer trends and behavior, the Skin Care Segment's dominance is largely attributable to the segment's popularity. Consumers are becoming increasingly aware of the significance of skincare and are prioritizing products that are kind to their skin and free of hazardous chemicals. The perception that vegan skincare products are safer, more natural, and better for skin health has increased demand for the Skin Care Segment.

Price Point Analysis

The Economic Segment has become the dominant category within the vegan cosmetics market. Consumers are becoming increasingly conscious of their spending habits and are pursuing alternatives to conventional cosmetics that are both affordable and ethical. This change in consumer mentality has propelled the adoption of the Economic Segment in the vegan cosmetics market.

The rise in prominence of the Economic Segment has been substantially influenced by the economic growth in emerging economies. As these economies continue to expand and prosper, consumers have an increasing amount of disposable income to spend on cosmetics. However, affordability continues to play a significant role in their purchasing decisions. The Economic Segment offers a variety of vegan cosmetics that are affordable without sacrificing quality, making it an attractive option for price-conscious consumers.

In the vegan cosmetics market, both consumer trends and behavior favor the Economic Segment. With the rise of social media and beauty influencers, consumers pursue new products and trends constantly. However, affordability is a common concern among consumers, and the Economic Segment satisfies this demand by offering budget-friendly options that do not compromise ethical standards.

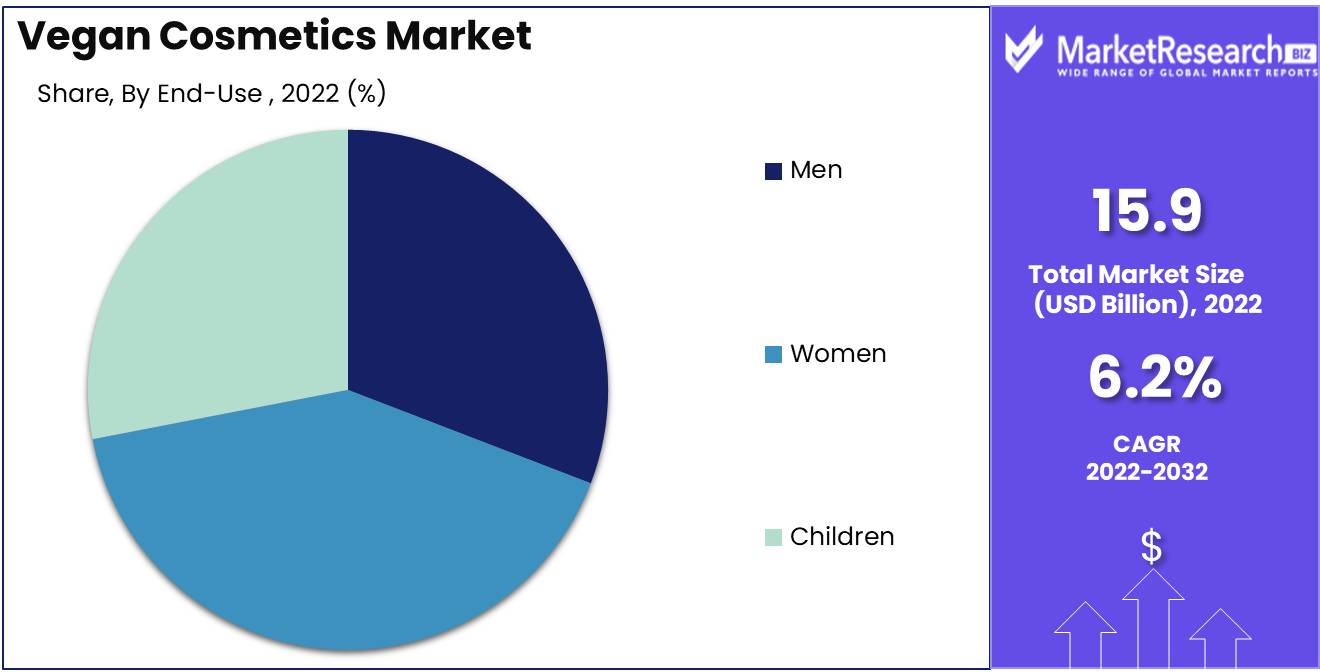

End-User Analysis

Reflecting the significance of gender-specific hygiene products, the Women Segment dominates the vegan cosmetics market. Women have historically been the leading consumers of hygiene and cosmetics, and this trend persists in the vegan cosmetics market.

Emerging economies' economic growth has contributed to the dominance of the Women Segment. As women in these economies acquire greater financial autonomy and decision-making authority, they are more likely to invest in skincare products tailored to their specific requirements. The Women Segment provides a vast selection of vegan skincare products that address a variety of skin concerns, making it the segment of choice for female consumers.

Consumer trends and behavior also contribute to the Women Segment's dominance in the vegan cosmetics market. Generally, women are more concerned with their appearance and prioritize skincare in their cosmetic regimen. With a growing emphasis on natural, cruelty-free, and ethical products, female consumers are drawn to cosmetics that are vegan and consistent with their values.

Key Market Segments

By Product

- Skin Care

- Hair Care

- Color Cosmetics

- Other

By Price Point

- Premium

- Economic

By End-User

- Men

- Women

- Children

By Distribution Channel

- Hypermarkets & Supermarkets

- Specialty Stores

- E-commerce

- Other

Growth Opportunity

Innovative and High-Quality Vegan Cosmetic Formulation Development

The market for vegan cosmetics has experienced tremendous growth, which is anticipated to continue in the future years. Companies in this market must concentrate on the development of innovative and high-quality vegan cosmetic formulations in order to guarantee sustained growth and remain competitive. This includes investing in research and development to create innovative products that cater to consumers' changing requirements and preferences. By incorporating novel ingredients, employing cutting-edge technologies, and focusing on product performance, vegan cosmetic brands can distinguish themselves from the competition and appeal to a larger audience.

Expanding into Emerging Markets as Vegan and Natural Beauty Trends Gain Momentum

As the global demand for vegan and natural beauty products continues to rise, latent growth opportunities exist in emerging markets for the vegan cosmetics market. By expanding their presence in these markets, companies can tap into new consumer bases that are increasingly interested in cruelty-free and ethically sourced cosmetic products. Investing in market research, gaining comprehension of local preferences, and adapting marketing strategies accordingly will enable brands to connect with these consumers, thereby capturing their attention and loyalty.

Collaboration with E-commerce Platforms and Retailers

Vegan cosmetic brands can substantially expand their reach by collaborating with retailers and e-commerce platforms. Companies can expand their distribution networks and ensure that their products are readily available to consumers by collaborating with established retailers and utilizing the power of online marketplaces. In order to increase the likelihood of success, a company must first establish a solid reputation in the marketplace. Moreover, e-commerce platforms provide a platform for direct consumer interaction, enabling brands to build strong relationships and collect valuable feedback to improve their products and services.

Adoption of eco-friendly packaging and environmentally responsible practices.

Sustainable practices and eco-friendly packaging are now essential factors for consumers to consider when making purchases. As the vegan cosmetics market continues to expand, brands should prioritize incorporating sustainable practices. This includes the use of recyclable and biodegradable packaging materials, the reduction of pollution throughout the supply chain, and the adoption of responsible sourcing. In addition to attracting environmentally conscious consumers, meeting these expectations will reduce the environmental impact of the industry.

Latest Trends

Increase in Vegan Skincare and Cosmetics

Vegan skincare and makeup products have experienced a meteoric rise in demand worldwide. Consumers prefer cruelty-free alternatives that are both kind to animals and beneficial to their skin. The only way to know for sure if a product is safe is to test it out. In addition, the vegan skincare and cosmetics industry has evolved to provide a wide range of products, from cleansers and moisturizers to foundations and lipsticks, to meet the diverse requirements and preferences of consumers.

Animal-Friendly and Vegan-Certified Cosmetics are in high demand

As societal concern for animal welfare grows, demand for cruelty-free and vegan-certified cosmetics has skyrocketed. This trend demonstrates an increasing appreciation and compassion for animals. Consumers actively search out products that have not been tested on animals and that bear official vegan certifications. This enables them to make ethical decisions and aligns with their personal values. As a result, numerous cosmetic companies have reformulated their products to eliminate animal cruelty and obtained certifications from reputable organizations, reinforcing their dedication to cruelty-free practices.

Utilization of natural and plant-based ingredients

The trend of veganism is now rampant. As consumers gain a better comprehension of the potentially harmful effects of synthetic chemicals, they favor products with organic and botanical ingredients. These include the nourishing properties of aloevera, the emollient effects of coconut oil, and the calming properties of chamomile. This shift towards natural ingredients not only improves the overall health of the skin but also aligns with the vegan cosmetics industry's sustainable and eco-friendly ethos.

Vegan haircare and personal care products are on the rise

Beyond skincare and makeup, the vegan movement has permeated the haircare and personal care industries as well. Vegan haircare products are gathering popularity because they deliver effective results without compromising their integrity. Today, consumers have access to a vast selection of shampoos, conditioners, and styling products that are vegan and designed for various hair conditions and concerns. In addition, the vegan personal care market has expanded to include deodorants, toothpaste, and body washes, providing consumers with an entirely plant-based and cruelty-free approach to their daily beautification regimens.

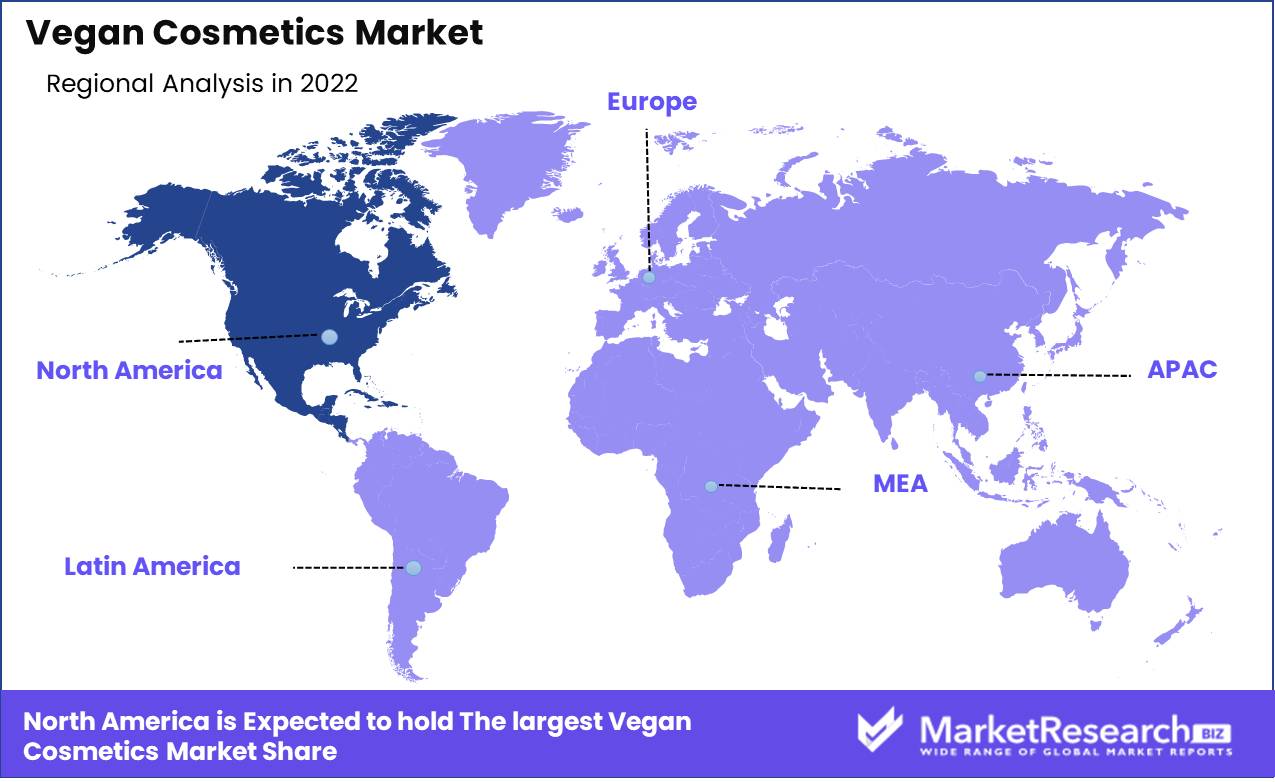

Regional Analysis

The Vegan Cosmetics Market is Dominated by the North American Region

North America dominates the vegan cosmetics market, accounting for over 38% of the global share in 2022. Leading national markets within North America include Canada and the United States. This North American stronghold is attributed to factors such as heightened consumer awareness of the benefits of vegan cosmetics, strong regulatory frameworks within the Food and Drug Administration defining and governing vegan product standards, and the presence of influential vegan cosmetics brands like The Body Shop, Lush, and Neal's Yard Remedies.

While regions like Europe and the Asia Pacific are also experiencing increased demand for vegan cosmetics, North America remains the primary driver of this market. Key trends fueling this growth in the region include growing awareness of ethical and environmental considerations in North American consumer choices and the rising popularity of vegan and vegetarian lifestyles.

Some of the notable vegan cosmetics brands in North America include The Body Shop, Lush, Catrice, Essence, NYX Professional Makeup, MAC Cosmetics, Urban Decay, Charlotte Tilbury, Huda Beauty, Fenty Beauty, and Anastasia Beverly Hills, reflecting the region's commitment to ethical and sustainable beauty products.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the Vegan Cosmetics Market, there are established giants such as Estee Lauder Companies Inc., Groupe Rocher, L'Occitane Group, L'Oréal S.A., Unilever, and Coty Inc. These industry leaders have made their mark in the market. On the other hand, there is a rising wave of emerging brands like Pacifica Beauty, Weleda, MuLondon, Zuzu Luxe, Ecco Bella, Bare Blossom, and Arbonne. These companies are gaining attention for their diverse range of vegan cosmetics, spanning skincare, makeup, haircare, and body care, while also earning praise for their dedication to sustainability and ethical practices.

Besides the major players, there are also smaller independent vegan cosmetics brands that specialize in niche products, innovative ingredients, sustainability, organic materials, or catering to sensitive skin. Investments in brand marketing are substantial across the board, as companies strive to bolster brand recognition and customer loyalty. For instance, in 2022, Pacifica Beauty initiated a marketing campaign spotlighting its unwavering commitment to vegan and cruelty-free cosmetics.

Anticipated growth lies ahead for the vegan cosmetics market in the forthcoming years. As an increasing number of consumers opt for cruelty-free and vegan products, the market is poised for expansion. Key players in this sector are well-positioned to harness this growth by diversifying their product portfolios and reaching out to new customer bases.

Top Key Players in Vegan Cosmetics Market

- GABRIEL COSMETICS

- MO MI BEAUTY

- Urban Decay

- Pacifica Beauty

- Beauty Without Cruelty

- Unilever

- Cover FX

- LVMH

- PHB Ethical Beauty Ltd

- ColourPop Cosmetics

- Gemdo Cosmetics

- EcoTrail Personal Care

- Nutriglow Cosmetics

- Emami Limited

- MOSSA Certified Skincare

- Coty Inc.

- Debenhams

- KOSÉ Corporation

- Natura&Co

- Shiseido Company Limited

- Zuzu Luxe

Recent Development

- In August 2023, Lush cosmetics formed a partnership with Mattel to design a special limited-edition collection known as the Barbie x Lush Collection. This collection first premiered exclusively on the Lush app on August 9 and was subsequently made available for online purchase on August 10.

- On August 2023, Florence By Mills emerged as the leading vegan beauty brand on social media, renowned for its captivating content and the influence of Millie Bobby Brown. The brand boasts 3.3 million Instagram followers and 3 million TikTok followers.

- In January 2023, Governor Kathy Hochul signed the New York Cruelty-Free Cosmetics Act into law, immediately prohibiting the sale of newly animal-tested cosmetics in the state. New York became the 10th U.S. state to take this compassionate step, reflecting the increasing demand for cruelty-free beauty products.

- In March 2023, "Lamik Beauty" took a prominent role in this movement. Founded by Kim Roxie, this brand gained recognition for its dedication to offering natural and organic makeup options tailored to multicultural women.

- In 2023, responding to the increasing demand for vegan beauty products in the USA, The Vegan Society published the "Vegan Beauty Takeover: USA Edition" report. This report offers insights into the vegan beauty landscape, the role of animals in supply chains, and the definitions of 'vegan' and 'cruelty-free' labeling.

Report Scope

Report Features Description Market Value (2022) USD 15.9 Bn Forecast Revenue (2032) USD 28.6 Bn CAGR (2023-2032) 6.2% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product(Skin Care, Hair Care, Other), By Price Point(Premium, Economic), By End-User(Men, Women), By Distribution Channel(Hypermarkets & Supermarkets, Specialty Stores, Other) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape GABRIEL COSMETICS, MO MI BEAUTY, Urban Decay, Pacifica Beauty, Beauty Without Cruelty, Unilever, Cover FX, LVMH, PHB Ethical Beauty Ltd, ColourPop Cosmetics, Gemdo Cosmetics, EcoTrail Personal Care, Nutriglow Cosmetics, Emami Limited, MOSSA Certified Skincare, Coty Inc., Debenhams, KOSÉ Corporation, Natura&Co, Shiseido Company Limite Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

- 1.0 Chapter 1

- 1.1 Preface

- 1.2 Assumptions

- 1.3 Abbreviations

- 2.0 Chapter 2

- 2.1 Report Description

- 2.1.1 Market Definition and Scope

- 2.2 Executive Summary

- 2.2.1 Market Snapshot, By Product Type

- 2.2.2 Market Snapshot, By Distribution Channel

- 2.2.3 Market Snapshot, By Region

- 2.2.4 Prudour Opportunity Map Analysis

- 2.1 Report Description

- 3.0 Chapter 3

- 3.0.1 Global Vegan Cosmetics Market Dynamics

- 3.0.2 Drivers

- 3.0.3 Restraints

- 3.0.4 Opportunities

- 3.0.5 Trends

- 3.0.6 PEST Analysis

- 3.0.7 PORTER’S Five Forces Analysis

- 3.0.8 Vegan Cosmetics: Introduction

- 3.0.9 Regulations & Standards

- 3.0.10 Consumer Insights

- 3.0.11 Supply Chain Overview

- 3.0.12 Supplier/Distributor List

- 4.0 Chapter 4

- 4.0.1 Global Vegan Cosmetics Market Analysis, by Product Type

- 4.0.2 Overview

- 4.0.3 Segment Trends

- 4.0.4 Market Value (US$) and Forecast, 2018–2028

- 4.1 Skin Care

- 4.1.1 Overview

- 4.1.2 Market Value (US$) and Forecast, and Y-o-Y Growth, 2018–2028

- 4.2 Hair Care

- 4.2.1 Overview

- 4.2.2 Market Value (US$) and Forecast, and Y-o-Y Growth, 2018–2028

- 4.3 Makeup and Color Cosmetics

- 4.3.1 Overview

- 4.3.2 Market Value (US$) and Forecast, and Y-o-Y Growth, 2018–2028

- 4.4 Others

- 4.4.1 Overview

- 4.4.2 Market Value (US$) and Forecast, and Y-o-Y Growth, 2018–2028

- 5.0 Chapter 5

- 5.0.1 Global Vegan Cosmetics Market Analysis, by Distribution Channel

- 5.0.2 Overview

- 5.0.3 Segment Trends

- 5.0.4 Market Value (US$) and Forecast, 2018–2028

- 5.1 Supermarkets and Hypermarkets

- 5.1.3 Segment Trends

- 5.1.4 Market Value (US$) and Forecast, and Y-o-Y Growth, 2018–2028

- 5.2 Department Stores

- 5.2.1 Segment Trends

- 5.2.2 Market Value (US$) and Forecast, and Y-o-Y Growth, 2018–2028

- 5.3 Specialty Stores

- 5.3.1 Segment Trends

- 5.3.2 Market Value (US$) and Forecast, and Y-o-Y Growth, 2018–2028

- 5.4 Online Stores

- 5.4.1 Segment Trends

- 5.4.2 Market Value (US$) and Forecast, and Y-o-Y Growth, 2018–2028

- 6.0 Chapter 6

- 6.0.1 Global Vegan Cosmetics Market Analysis, by Region

- 6.0.2 Market Attractiveness Index

- 6.0.3 Overview

- 6.0.4 Regional Trends

- 6.0.5 Market Value (US$) and Forecast, 2018–2028

- 6.1 Global Vegan Cosmetics Market Analysis, by North America

- 6.1.1 Overview

- 6.1.2 Country Trends

- 6.1.3 Market Value (US$) and Forecast, and Y-o-Y Growth, 2018–2028

- 6.1.4 US

- 6.1.4.1 Market Value (US$ Mn) and Forecast, 2018–2028

- 6.1.5 Canada

- 6.1.5.1 Market Value (US$ Mn) and Forecast, 2018–2028

- 6.2 Global Vegan Cosmetics Market Analysis, by Europe

- 6.2.1 Overview

- 6.2.2 Country Trends

- 6.2.3 Market Value (US$ Mn) and Forecast, and Y-o-Y Growth, 2018–2028

- 6.2.4 Germany

- 6.2.4.1 Market Value (US$ Mn) and Forecast, 2018–2028

- 6.2.5 UK

- 6.2.5.1 Market Value (US$ Mn) and Forecast, 2018–2028

- 6.2.6 France

- 6.2.6.1 Market Value (US$ Mn) and Forecast, 2018–2028

- 6.2.7 Russia

- 6.2.7.1 Market Value (US$ Mn) and Forecast, 2018–2028

- 6.2.8 Italy

- 6.2.8.1 Market Value (US$ Mn) and Forecast, 2018–2028

- 6.2.9 Rest of Europe

- 6.2.9.1 Market Value (US$ Mn) and Forecast, 2018–2028

- 6.3 Global Vegan Cosmetics Market Analysis, by Asia Pacific

- 6.3.1 Overview

- 6.3.2 Country Trends

- 6.3.3 Market Value (US$ Mn) and Forecast, and Y-o-Y Growth, 2018–2028

- 6.3.4 China

- 6.3.4.1 Market Value (US$ Mn) and Forecast, 2018–2028

- 6.3.5 India

- 6.3.5.1 Market Value (US$ Mn) and Forecast, 2018–2028

- 6.3.6 Japan

- 6.3.6.1 Market Value (US$ Mn) and Forecast, 2018–2028

- 6.3.7 Australia

- 6.3.7.1 Market Value (US$ Mn) and Forecast, 2018–2028

- 6.3.8 Rest of Asia Pacific

- 6.3.8.1 Market Value (US$ Mn) and Forecast, 2018–2028

- 6.4 Global Vegan Cosmetics Market Analysis, by Latin America

- 6.4.1 Overview

- 6.4.2 Country Trends

- 6.4.3 Market Value (US$ Mn) and Forecast, and Y-o-Y Growth, 2018–2028

- 6.4.4 Brazil

- 6.4.4.1 Market Value (US$ Mn) and Forecast, 2018–2028

- 6.4.5 Mexico

- 6.4.5.1 Market Value (US$ Mn) and Forecast, 2018–2028

- 6.4.6 Rest of Latin America

- 6.4.6.1 Market Value (US$ Mn) and Forecast, 2018–2028

- 6.5 Global Vegan Cosmetics Market Analysis, by Middle East & Africa

- 6.5.1 Overview

- 6.5.2 Country Trends

- 6.5.3 Market Value (US$ Mn) and Forecast, and Y-o-Y Growth, 2018–2028

- 6.5.4 GCC

- 6.5.4.1 Market Value (US$ Mn) and Forecast, 2018–2028

- 6.5.5 Israel

- 6.5.5.1 Market Value (US$ Mn) and Forecast, 2018–2028

- 6.5.6 South Africa

- 6.5.6.1 Market Value (US$ Mn) and Forecast, 2018–2028

- 6.5.7 Rest of Middle East & Africa

- 6.5.7.1 Market Value (US$ Mn) and Forecast, 2018–2028

- 7.0 Chapter 7

- 7.0.1 Heat Map Analysis

- 7.0.2 Company Profiles

- 7.1 The Unilever Group

- 7.1.1 Company Overview

- 7.1.2 Product Portfolio

- 7.1.3 Financial Overview

- 7.1.4 SWOT Analysis

- 7.1.5 Recent Developments

- 7.1.6 Contact Information

- 7.2 Cover FX

- 7.2.1 Company Overview

- 7.2.2 Product Portfolio

- 7.2.3 Recent developments

- 7.2.4 Contact Information

- 7.3 LVMH Moët Hennessy - Louis Vuitton S.E. (Kendo Holdings, Inc.)

- 7.3.1 Company Overview

- 7.3.2 Product Portfolio

- 7.3.3 Financial Overview

- 7.3.4 Recent Developments

- 7.3.5 Contact Information

- 7.4 L'Oréal S.A. (Urban Decay Cosmetics)

- 7.4.1 Company Overview

- 7.4.2 Product Portfolio

- 7.4.3 Financial Overview

- 7.4.4 Recent Developments

- 7.4.5 Contact Information

- 7.5 PHB Ethical Beauty Ltd

- 7.5.1 Company Overview

- 7.5.2 Product Portfolio

- 7.5.3 Contact Information

- 7.6 Arbonne International, LLC

- 7.6.1 Company Overview

- 7.6.2 Product Portfolio

- 7.6.3 Contact Information

- 7.7 ColourPop Cosmetics LLC (ColourPop)

- 7.7.1 Company Overview

- 7.7.2 Product Portfolio

- 7.7.3 Recent Developments

- 7.7.4 Contact Information

- 7.8 Total Beauty Network Pty Ltd.

- 7.8.1 Company Overview

- 7.8.2 Product Portfolio

- 7.8.3 Recent Developments

- 7.8.4 Contact Information

- 7.9 e.l.f. Beauty, Inc.

- 7.9.1 Company Overview

- 7.9.2 Product Portfolio

- 7.9.3 Recent Developments

- 7.9.4 Contact Information

- 7.10 Pacifica Beauty LLC

- 7.10.1 Company Overview

- 7.10.2 Product Portfolio

- 7.10.3 Recent Developments

- 7.10.4 Contact Information

- 8.0 Chapter 8

- 8.0.1 Research Methodology

- 8.0.2 About Us

- 1.0 Chapter 1

-

- GABRIEL COSMETICS

- MO MI BEAUTY

- Urban Decay

- Pacifica Beauty

- Beauty Without Cruelty

- Unilever

- Cover FX

- LVMH

- PHB Ethical Beauty Ltd

- ColourPop Cosmetics

- Gemdo Cosmetics

- EcoTrail Personal Care

- Nutriglow Cosmetics

- Emami Limited

- MOSSA Certified Skincare

- Coty Inc.

- Debenhams

- KOSÉ Corporation

- Natura&Co

- Shiseido Company Limited