Hair Care Market By Product(Shampoo, Conditioner, Hair Oil, Hair Spray, Others), By Distribution Channel(Hypermarkets and Supermarkets, Specialty Stores, Online Stores, Salons and Spas, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

4548

-

Dec 2023

-

169

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Hair Care Market Size, Share, Trends Analysis

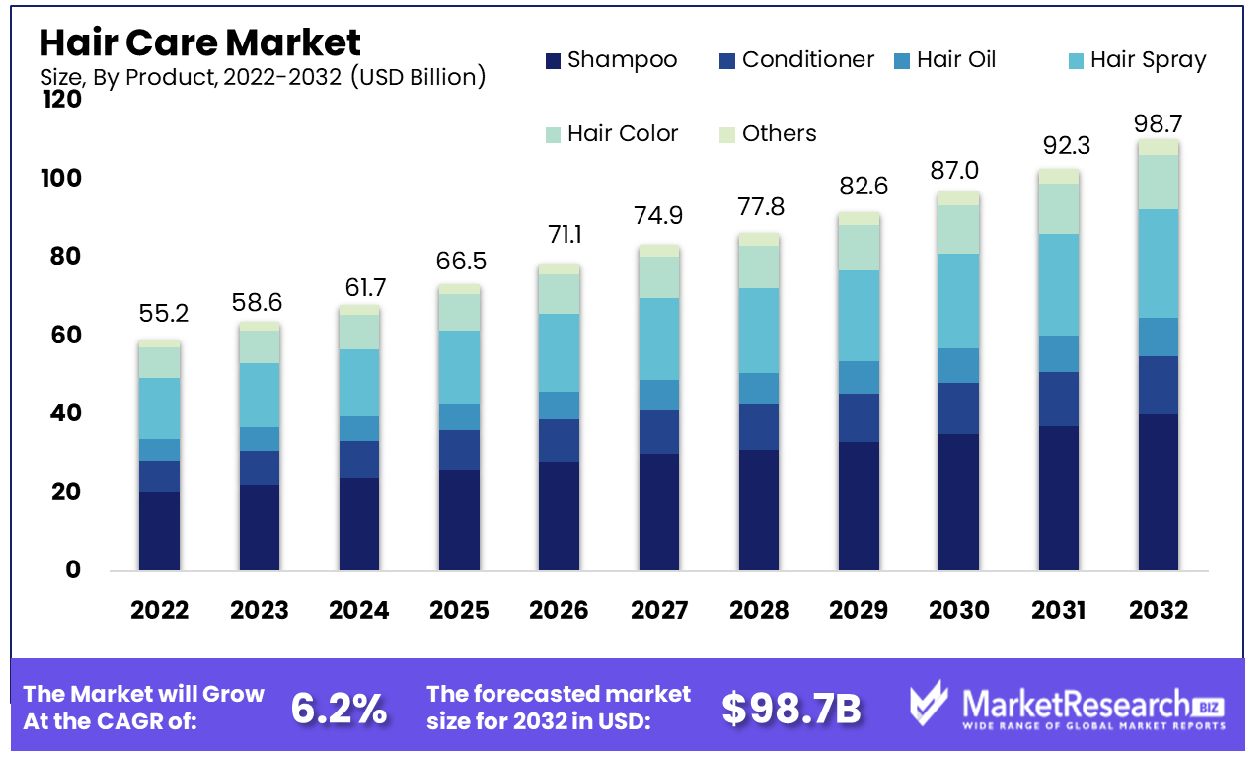

The global hair care market was valued at USD 55.2 billion in 2022. It is estimated to reach USD 98.7 billion by 2032, with a projected CAGR of 6.2% during the forecast period from 2023 to 2032.

The surge in problems of various hair issues and the rise in demand for natural and organic hair care products are some of the main driving factors for the hair care market. Hair care products help individuals strengthen their protect themselves from damage. These products consist of shampoo, hair conditioner, oil, and hair masks. There are various social factors in hair loss. This is challenging for people who have a genetic disease or any kind of disorder related to hair loss.

Hair is the reflection of our lifestyle and preferences. It is a pointer that the body receives and processes enough types of nutrients and vitamins that are good and beneficial. Excessive exposure to harmful UV rays, usage of styling machines, lack of nutrients, essential vitamins, environmental factors, and other mineral deficits can hamper growth.

Consumers are getting more conscious about their hair and are seeking organic hair care products to provide nourishment. Organic products have several benefits such as providing glowing, longer, and healthier. Natural and healthy products for haircare such as water, shea butter, glycerine, and aloe Vera should always be chosen over synthetic ones as these do not contain harmful chemicals that could otherwise wreak havoc on health. Organic products must be utilized, as synthetic ones often contain dangerous toxins that could have long-term health impacts on our bodies.

For example, Virgin Coconut oil makes an effective cleansing agent in shampoo as it contains keratin that keeps hair nourished and hydrated. Manufacturers are aiming to enhance their hair care products to meet consumer’s requirements. Anti-dandruff organic products are marking their presence in the hair care sector and contributing to boosting the market expansion.

These days’ e-commerce and online shopping have gained much popularity. People are getting more comfortable with buying hair care products online. The surge in popularity of e-commerce and online shopping is due to its offering of a wide range of organic products that are not easily available in offline stores as well and it is very convenient.

These products can reach customers easily and they can also choose their desired products as well. E-commerce and online shopping have boosted the market revenue of the haircare industry and it will rapidly expand during the forecast period.

Hair Care Market Dynamics

Concerns Over Hair Health Fuel Hair Care Market Growth

The growing concerns about hair fall, damage, and dandruff are significantly driving the global hair care market. As individuals become more conscious of health issues, demand for products designed to address specific concerns has grown rapidly. This trend has spurred the development and marketing of tailored solutions from shampoos to conditioners as well as serums and treatments. The emphasis on combating problems not only meets immediate consumer needs but also indicates a long-term market expansion of health continues to be a priority for consumers worldwide.

Consumer Focus on Appearance Boosts Hair Care Industry

Elevated consumer awareness about personal appearance, grooming, and self-care is profoundly impacting the market. Social media and personal branding have created an increased focus on maintaining an immaculate appearance, including haircare. This shift has spurred the creation of numerous products tailored specifically toward styling, maintenance, and grooming needs. The trend underscores a broader cultural shift towards self-care and wellness, suggesting a sustained growth trajectory for the hair care market focused on personalization and efficacy.

Natural and Organic Products Trend Energizes Hair Care Market

Natural and organic hair care products have become a key growth driver of the market in recent years, driven by growing consumer preference for health-conscious, eco-friendly options. As awareness of the potential side effects of chemical-based products grows, consumers increasingly opt for safer natural/organic alternatives that offer both safety and sustainability. This shift is not only influencing product formulations but also marketing strategies and brand positioning. The long-term implication of this trend is a market increasingly leaning towards green and clean beauty, with natural and organic hair care products becoming a mainstay.

High Cost Involved in Hair Care Products Restrains Market Growth

The high cost associated with premium hair care products significantly limits the global hair care market's expansion. Quality haircare often demands the use of expensive ingredients, advanced formulation technologies, and substantial marketing efforts, all of which contribute to higher retail prices. This pricing places premium products beyond the reach of a considerable segment of the global market, particularly in economically developing regions. As a result, many potential consumers choose more cost-cutting, lower-quality alternatives reducing market share for higher-end products. Therefore, the industry must find ways to balance quality with affordability to reach out and capture a wider consumer base.

Economic Slowdowns Impacting Consumer Spending on Hair Care Restrains Market Growth

Economic downturns and slowdowns have a pronounced impact on consumer spending habits, notably in the healthcare sector. During economic contractions, consumers often prioritize essential over discretionary spending, categorizing products as non-essential. Consumer behavior changes lead to decreased demand for hair care products categorized as luxury or non-essential items, especially in markets with more volatile economic environments where consumers adjust spending quickly in response to economic fluctuations. This phenomenon is most evident when markets with increased volatility experience rapid economic fluctuations where spending patterns quickly adapt accordingly. This scenario underscores the market's vulnerability to broader economic cycles, hindering steady market growth.

Hair Care Market Segmentation Analysis

By Product Analysis

Shampoo holds a dominant position in the hair care market. Its ubiquity and essential role in hygiene are key to its dominance. The evolution of shampoo from a basic cleansing agent to a product with various formulations for different types and concerns (like dandruff, hair fall, and color protection) has broadened its appeal. The segment's growth is further fueled by innovations in natural and organic ingredients, catering to the rising consumer demand for sustainable and health-conscious products.

Conditioners, offering benefits like moisture retention and softening, complement the shampoo segment and are essential in routines. Hair oils are gaining popularity for their nourishing properties, particularly in markets with a tradition of oil-based. Hair sprays and hair colors cater to styling and aesthetic preferences, with hair color experiencing growth due to trends in fashion and personal grooming. The 'Others' category, including serums, masks, and leave-in treatments, is vital for addressing specific haircare needs and is an area of rapid innovation and growth.

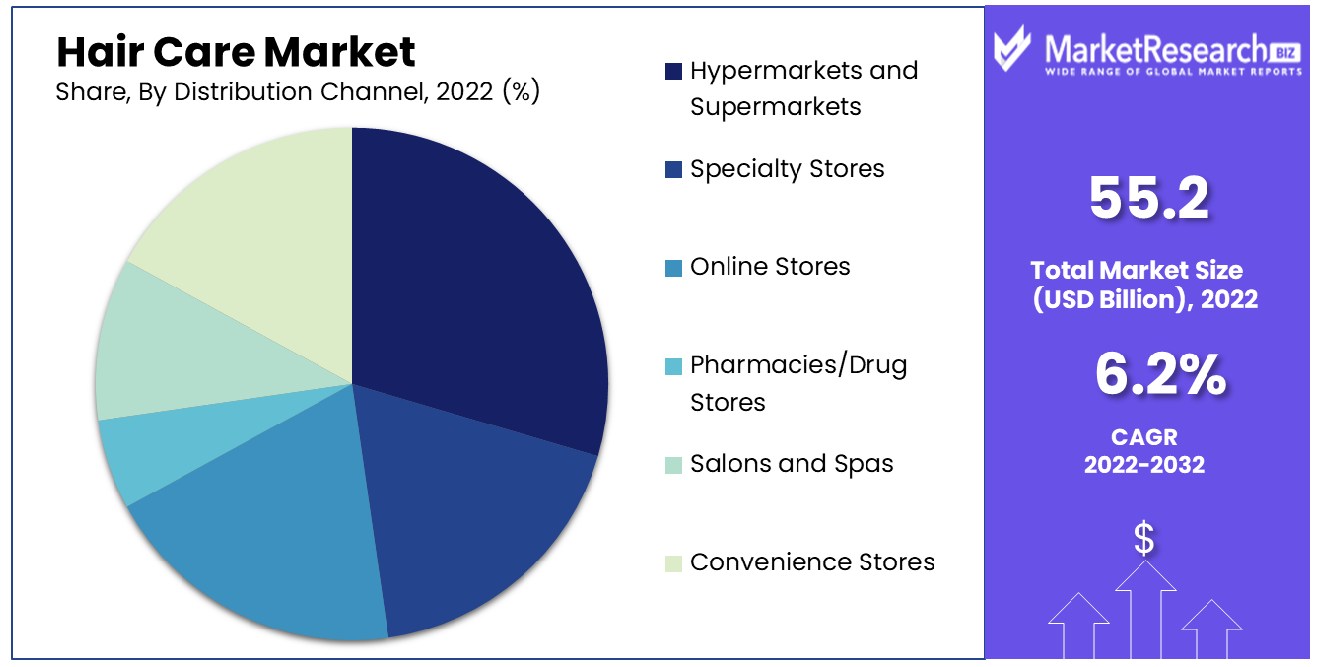

By Distribution Channel Analysis

Hypermarkets and supermarkets are the principal channels for product distribution. Their wide reach, extensive product range, and the convenience of one-stop shopping contribute to their dominance. These outlets benefit from high foot traffic and the ability to offer competitive pricing due to economies of scale.

Specialty stores provide specialized products and expert advice, appealing to discerning consumers. Online stores are witnessing significant growth, driven by the convenience of home shopping and a broader selection of products, including international brands. Pharmacies/drug stores are key for medicated or therapeutic products. Spas and beauty salons offer professional-grade products and are important for the premium segment. Convenience stores serve impulsive and immediate purchase needs. The 'Others' category includes various small and niche channels, each contributing to the overall diversity and accessibility of products.

Hair Care Industry Segments

By Product

- Shampoo

- Conditioner

- Hair Oil

- Hair Spray

- Hair Color

- Others

By Distribution Channel

- Hypermarkets and Supermarkets

- Specialty Stores

- Online Stores

- Pharmacies/Drug Stores

- Salons and Spas

- Convenience Stores

- Others

Hair Care Market Growth Opportunity

Technological Innovations in Product Manufacturing Offer Growth Opportunity in Hair Care Market

Technological advances in hair care product production represent a tremendous growth opportunity in the global market. Innovations in production technology have allowed for more effective, diverse, and customized solutions. This includes the development of products catering to specific types and concerns, utilizing advanced formulations and delivery systems. Recent trends indicate a rising consumer desire for technologically advanced products, including smart growth devices and customized shampoos and conditioners. Integrating technology in product development not only meets emerging consumer needs but also drives market expansion through differentiation and improved product performance.

Increasing Spending on HairCare Stimulates Market Expansion

The rise in consumer spending on hair care products is a key driver for market expansion. As disposable incomes increase globally, individuals are more inclined to invest in premium products and treatments. This trend is further reinforced by increasing awareness of health, as well as an array of products on the market. Recent data indicates a steady increase in spending for haircare, with consumers willing to pay more for products promising better results, such as salon-grade items or those made with organic ingredients. This increased spending behavior opens up opportunities for market growth, particularly in the luxury and specialized product segments.

Increasing Popularity of Herbal Hair Care Products Fuels Market Growth

The escalating popularity of herbal hair care products is fueling growth in the global market. Consumer awareness of herbal ingredients' advantages has prompted a significant move toward natural and organic products, leading to an increasing preference for chemical-free solutions. One indicator is a surge in interest in products containing extracts, essential oils, and herbal formulations. The shift towards herbal products is not just a niche trend but reflects a broader movement towards sustainability and wellness in personal care. This growing demand presents a substantial opportunity for market expansion, particularly for brands that focus on natural, eco-friendly solutions.

Hair Care Market Regional Analysis

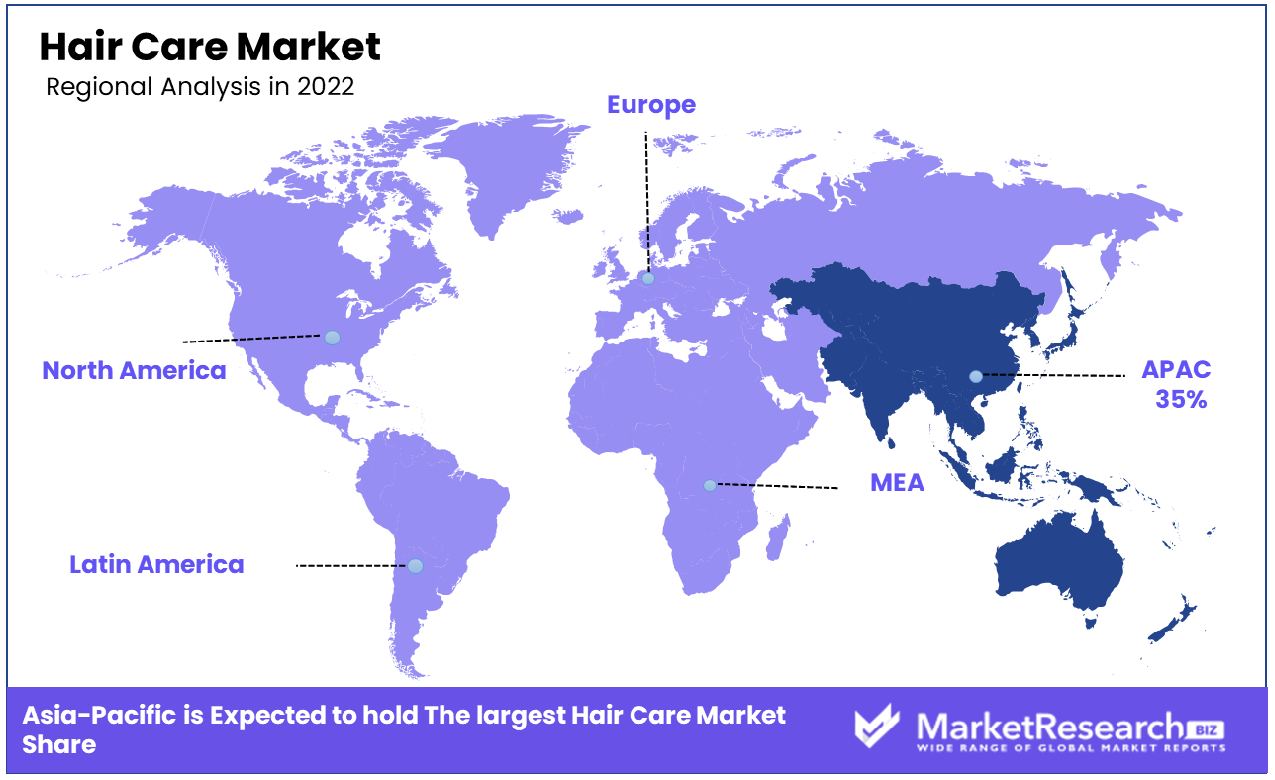

Asia-Pacific Dominates with 35% Market Share in the Global Hair Care Industry

The dominance of Asia-Pacific in the global hair care market is attributed to its large population and growing middle class. Increased disposable income and rising awareness about personal grooming among consumers drive demand.

Additionally, the region's cultural diversity leads to a variety of haircare needs, promoting a wide range of product offerings. The hot and humid climate in many parts of the region makes products like anti-frizz and oil-control shampoos popular. Traditional herbal and natural ingredients are highly preferred, reflecting the region's inclination towards natural and organic products. E-commerce growth also plays a crucial role, making products more accessible and widening consumer choice.

The presence of both global and local players, innovating in terms of product formulation and marketing strategies, further strengthens the region's market position.

North America

North America holds an expansive share of the global market, driven by high consumer spending power and strong industry players. This region is distinguished by high consumer spending power and an abundant presence of major industry players; there is high consumer demand for premium products as well as new product innovations in natural and organic formulations; further boosted by an extensive distribution network covering supermarkets, specialty stores, and online platforms. Looking forward, technological advancements in product development and a growing emphasis on personalized solutions are expected to further boost the market.

Europe

Europe's hair care market is distinguished by its focus on high-quality, luxury hair care products. The region's stringent regulations on product safety and a high consumer preference for natural ingredients drive the demand for organic and sustainable solutions. European consumers are drawn to products with specific benefits, including color protection and anti-aging capabilities. Future growth of this market should be driven by innovations in product formulations as well as an increase in vegan- and cruelty-free product sales.

Hair Care Industry By Region

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of Middle East & Africa

Hair Care Market Key Player Analysis

In the competitive hair care market, the companies listed contribute significantly through diverse strategies and market influences. L'Oréal S.A. and The Procter &; Gamble Company, as industry giants, lead with extensive product lines and global presence, emphasizing the market's focus on innovation, brand power, and consumer reach.

Kao Corporation and Unilever PLC, with their strong global footprints and varied product portfolios, reflect the industry's shift towards catering to diverse consumer needs and preferences, including natural and sustainable solutions. Shiseido Company, Limited and Johnson & Johnson Services, Inc., known for their premium and trusted products, underscore the market's trend towards high-quality, scientifically backed.

Avon Products, Inc. and Oriflame Cosmetics AG, utilizing direct selling models, demonstrate the effectiveness of personalized marketing and distribution strategies in these sectors. Henkel AG &Co. KGaA and Revlon, Inc., with their established brand names, contribute to the market through innovation and a strong emphasis on consumer trends.

Amway Corporation and Estée Lauder Companies Inc., leveraging their network marketing and luxury brand positioning, showcase the importance of brand reputation and customer loyalty in the market. Coty Inc. and Godrej Consumer Products Limited, each with their distinct geographic strengths, highlight the significance of regional market understanding and product customization.

Beiersdorf AG and Natura & Co., focusing on natural and organic ingredients, reflect the growing consumer demand for sustainable and health-conscious products. Colgate-Palmolive Company, The Himalaya Drug Company, and The Body Shop International Limited, while more diversified, contribute to the hair care market through their specific product lines focusing on natural ingredients and ethical sourcing.

Lush Cosmetics, known for its eco-friendly and ethical products, underscores the market's shift towards environmentally responsible and transparent solutions. Collectively, these companies not only drive growth in the market but also represent diverse strategies - from leveraging brand heritage to embracing sustainability and innovation - crucial in meeting the evolving needs of global consumers.

Hair Care Industry Key Players

- L'Oréal SA

- The Procter &Gamble Company

- Kao Corporation

- Unilever PLC

- Shiseido Company, Limited

- Johnson & Johnson Services, Inc.

- Avon Products, Inc.

- Henkel AG & Co. KGaA

- Revlon, Inc.

- Amway Corporation

- Oriflame Cosmetics AG

- Estée Lauder Companies Inc.

- Coty Inc.

- Godrej Consumer Products Limited

- Beiersdorf AG

- Natura & Co.

- Colgate-Palmolive Company

- The Himalaya Drug Company

- The Body Shop International Limited

- Lush Cosmetics

- Procter & Gamble

Hair Care Market Recent Development

- In March of 2023, another major competitor, L'Oreal, introduced a line of vegan hair coloring products under the Garnier brand. This collection exemplifies L'Oreal's commitment to developing safe, non-toxic, cruelty-free, and sustainable products.

- In July 2022, The Johnson & Johnson Company launched its new skin and hair care brand VIVVI & BLOOM, specifically designed for babies and toddlers of all ages.

- In April 2022, The Wella Company, a global beauty company, acquired Briogeo, the fastest-growing scalp oil brand, to expand its eco-friendly cosmetic products portfolio globally. Briogeo’s shampoos and conditioners are made of formulations of natural oils, vitamins, and antioxidants.

- In April 2022, L’Oreal S.A.’s professional products division partnered with Myntra, an Indian online shopping platform, to build its capabilities of supplying salon-inspired hairdressing products in India.

Report Scope

Report Features Description Market Value (2022) USD 55.2 Bn Forecast Revenue (2032) USD 98.7 Bn CAGR (2023-2032) 6.2% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product(Shampoo, Conditioner, Hair Oil, Hair Spray, Hair Color, Others), By Distribution Channel(Hypermarkets and Supermarkets, Specialty Stores, Online Stores, Pharmacies/Drug Stores, Salons and Spas, Convenience Stores, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape L'Oréal SA, The Procter & Gamble Company, Kao Corporation, Unilever PLC, Shiseido Company, Limited, Johnson & Johnson Services, Inc., Avon Products, Inc., Henkel AG Co. KGaA, Revlon, Inc., Amway Corporation, Oriflame Cosmetics AG, Estée Lauder Companies Inc., Coty Inc., Godrej Consumer Products Limited, Beiersdorf AG, Natura & Co., Colgate-Palmolive Company, The Himalaya Drug Company, The Body Shop International Limited, Lush Cosmetics, Procter & Gamble Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- L'Oréal SA

- The Procter &Gamble Company

- Kao Corporation

- Unilever PLC

- Shiseido Company, Limited

- Johnson & Johnson Services, Inc.

- Avon Products, Inc.

- Henkel AG & Co. KGaA

- Revlon, Inc.

- Amway Corporation

- Oriflame Cosmetics AG

- Estée Lauder Companies Inc.

- Coty Inc.

- Godrej Consumer Products Limited

- Beiersdorf AG

- Natura & Co.

- Colgate-Palmolive Company

- The Himalaya Drug Company

- The Body Shop International Limited

- Lush Cosmetics

- Procter & Gamble