Lipstick Market By Type(Matte, Crème, Long-wearing, Shimmer), By Form(Stick, Liquid, Others), By Distribution Channel(Supermarkets / Hypermarkets, E-commerce, Multi Branded Retail Stores, Departmental/Grocery Stores, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

7016

-

Feb 2024

-

157

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

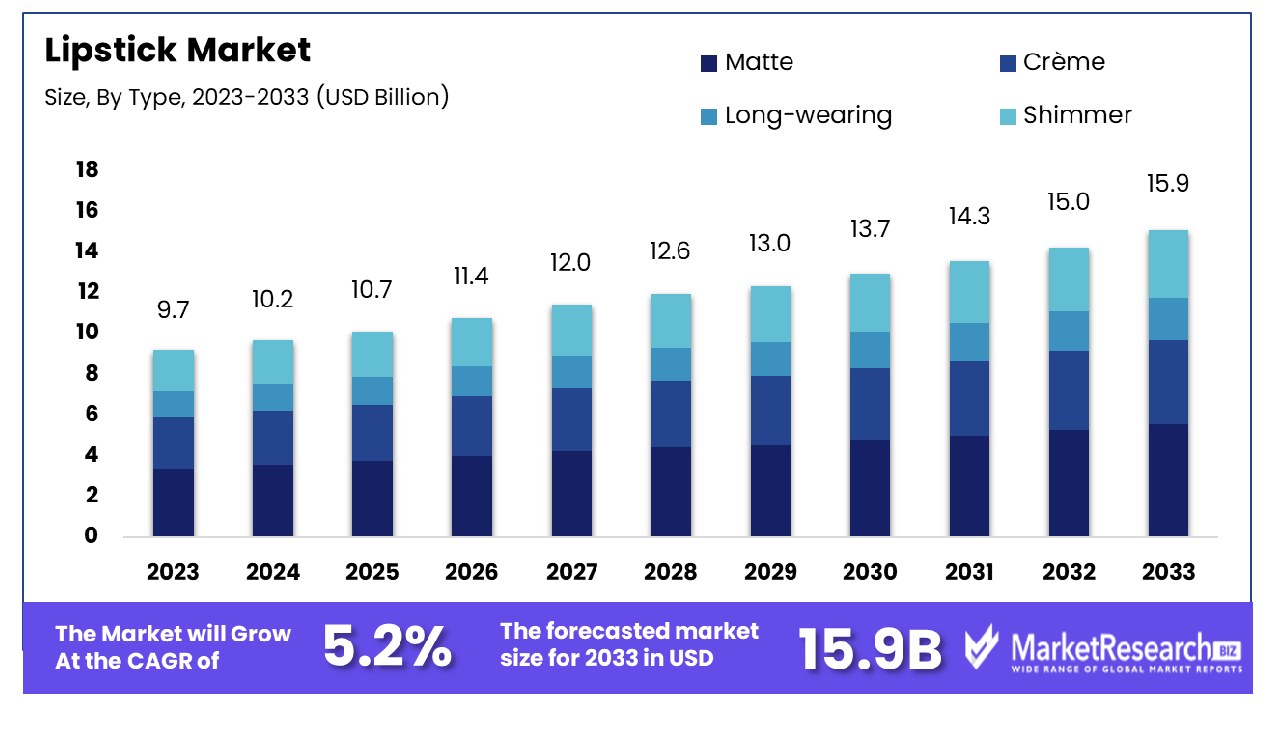

The lipstick market was valued at USD 9.7 billion in 2023. It is expected to reach USD 15.9 billion by 2033, with a CAGR of 5.2% during the forecast period from 2024 to 2033. The surge in consciousness about physical appearance, rise in demand for organic lipsticks and expansion of online and e-commerce platforms are some of the main key driving factors for the lipsticks market.

Lipstick is defined as a cosmetic product which is mainly used to improve the appearance of the lips. It is commonly made up of pigments, waxes, emollients, and oils that offer color, hydration, and texture. Lately, back in ancient civilizations, individuals used different types of substances to color their lips but interestingly, the modern lipsticks that we got to know were used in the late 19th century.

Lipsticks come in different choices, preferences, and key market trends. It also consists of natural ingredients such as sunscreen or moisturizers for extra advantages. The lipstick applications include changing the product directly onto the lips by using a brush or tube. It has become a sign of beauty and self-expression, with a wide range of shades and finishes permitting customers to experiment with multiple looks and styles.

Many leading organic cosmetic manufacturers focus on providing excellent quality lipstick to customers. BeautyPackaging in October 2023, highlights that Revlon, a leading organic cosmetic and lipstick manufacturer has completed its financial restricting methods. It has also highlighted that in December 2022, Revlon had a net sales of USD 1,980.4 million, a USD 98.3 million decrease or 4.7% as compared to USD 2,078.7 million in the previous year.

Lipstick preserves social, cultural, and personal importance by offering versatile equipment for self-expression, beauty, and confidence. Moreover, it improves the attractive look of lips, it encourages individuals to deliver their personality and style. It also augments self–esteem by permitting wearers to feel more put together and polished. In different styles of cultures, it signifies femininity and professionalism which plays a crucial role in societal norms and individual identity.

The cosmetic industry has been continuously innovating new lipstick formulations and shades that mirror its lasting importance as a fashion accessory that means creative and new expression and a product that supports the overall well-being and confidence of its consumers. The demand for the lipstick market will grow due to its requirement in the cosmetic industry which will help in market expansion in the coming years.

Key Takeaways

- Market Growth: Lipstick Market was valued at USD 9.7 billion in 2023, It is expected to reach USD 15.9 billion by 2033, with a CAGR of 5.2% during the forecast period from 2024 to 2033.

- By Type: In the Lipstick industry, matte finishes reign supreme over other types.

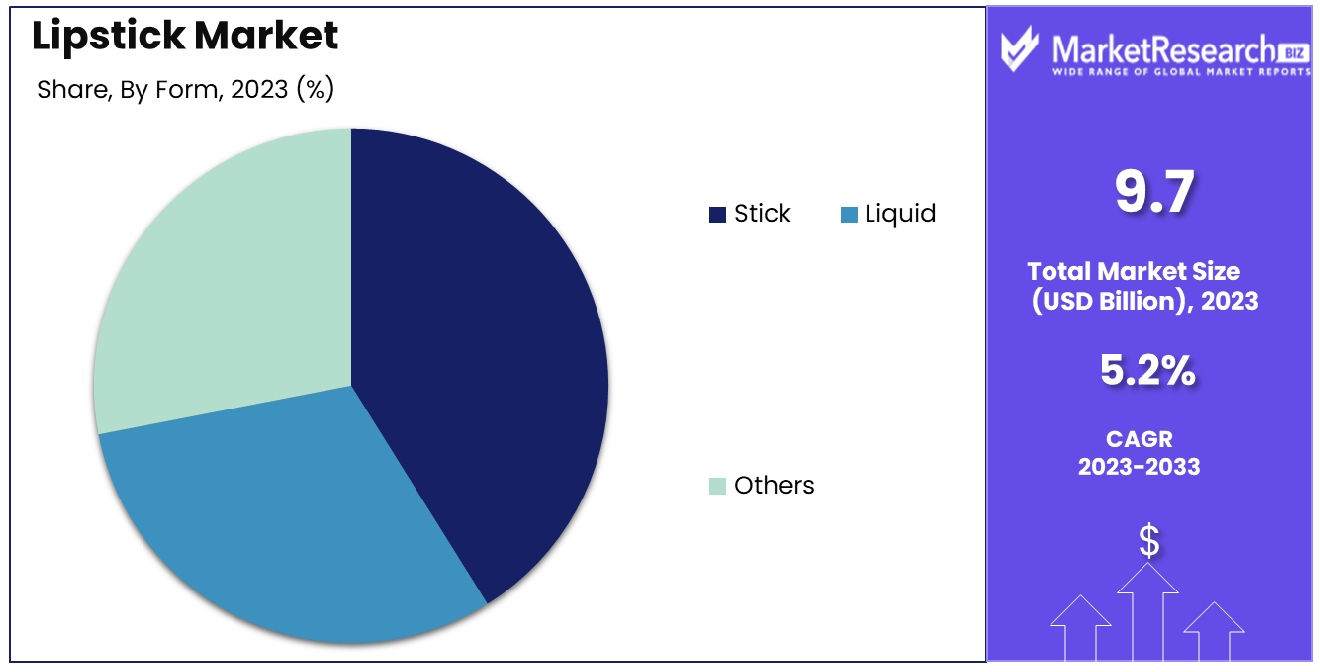

- By Form: Stick formulations stand out as the preferred choice among consumers.

- By Distribution Channel: Supermarkets and hypermarkets emerge as the dominant distribution channels for sales.

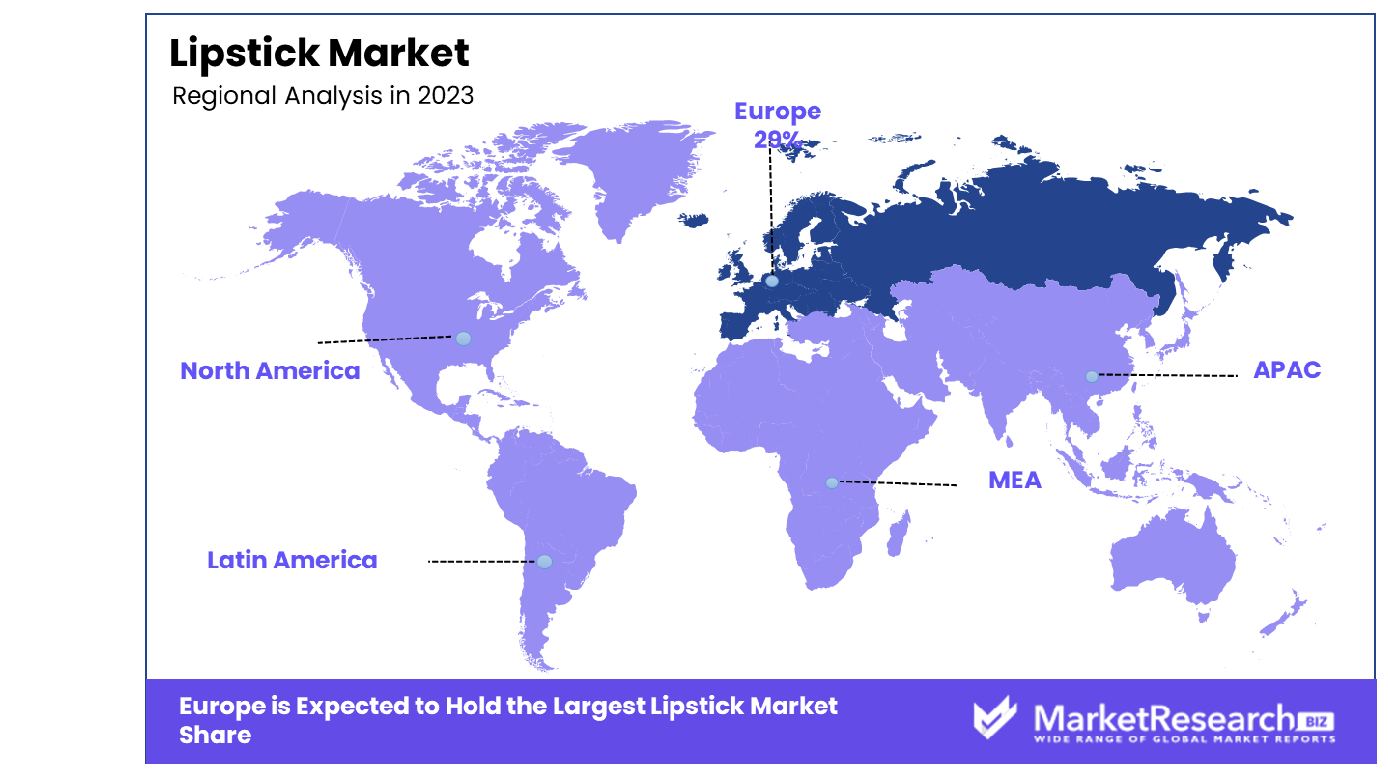

- Regional Dominance: Europe holds a dominant position in the lipstick market, capturing 29% of the global market share.

- Growth Opportunity: Natural and organic formulas cater to health-conscious consumers, while inclusive shade ranges tap into diverse demographics, driving growth in the lipstick market.

Driving factors

Social Media Amplifies Lipstick Trends

The constant influence of social media and influencer marketing has become a pivotal driver in shaping consumer preferences within the lipstick market. The digital era has ushered in a new trend where 62% of women, guided by the allure of beauty influencers, find themselves swayed by social media, and fashion trends, especially within the 18-24 age bracket. This key market trend not only creates a vibrant setting for setting new styles but also greatly boosts the demand for particular lipstick colors, textures, and brands.

Innovation Spurs Market Diversification

The lipstick market is witnessing major innovations, with diverse textures, finishes, and packaging designs captivating consumer interest. The emergence of matte, metallic, velvet, and holographic finishes, coupled with novel applicator designs, serves to enrich the consumer experience. This evolution in product offering, underscored by the advent of unique packaging solutions, underscores the industry's commitment to innovation, thereby catalyzing market growth rate through enhanced consumer engagement.

Premiumization Elevates Market Value

The shift towards premiumization, marked by luxury brands introducing high-end lipstick products, caters to the affluent consumer segment, thereby augmenting market value. With 67% of U.S. adults inclined towards luxury clean beauty purchases, the lipstick segment is experiencing a surge in demand for premium products. This trend is particularly pronounced in the Asia Pacific region, signaling a global shift towards luxury cosmetics as symbols of status and quality, thereby driving market expansion.

Restraining Factors

Innovative Lip Formulas Challenge Traditional Lipstick Sales

The rise of long-wearing lip products, such as liquid lipsticks and lip stains, presents a significant challenge to the traditional bullet lipstick market. Brands like Anastasia Beverly Hills and Sephora Collection have capitalized on consumer demand for lip products that offer extended wear without the need for frequent reapplication.

This shift in consumer preference is impacting the sales growth potential of traditional lipsticks, as these innovative formulas provide both durability and a wider range of finishes and intensities. As a result, traditional lipstick manufacturers are compelled to innovate and expand their product lines to include long-lasting formulas, thereby increasing competition within the sector.

Health Concerns Over Lipstick Ingredients Limit Consumer Confidence

Growing health concerns over the use of potentially harmful ingredients in cosmetics, such as parabens, phthalates, and heavy metals, are making consumers increasingly wary of lipstick products, particularly those offered by mass-market brands.

The awareness of these synthetic ingredients' potential health impacts has led to heightened scrutiny of product labels and a preference for brands that offer "clean" beauty products free from such chemicals. This shift in consumer behavior poses a challenge for traditional lipstick brands, necessitating a reformulation of products to meet these new consumer expectations and retain market share in an increasingly health-conscious market environment.

By Type Analysis

In the realm of cosmetics, matte finishes reign supreme, captivating consumers with their understated elegance.

Matte lipsticks have emerged as the dominant type within the lipstick market. Esteemed for their long-lasting wear and high pigmentation, matte segment lipsticks offer a bold, non-shiny finish that has captivated a broad consumer base. The popularity of matte lipsticks is driven by their ability to provide intense color payoff and a modern look, which aligns with contemporary beauty trends.

Other types like Crème, Long-wearing, and Shaimmer also play significant roles in the market. Crème lipsticks, known for their moisturizing properties and slight sheen, cater to consumers seeking comfort and hydration. Long-wearing lipsticks appeal to those requiring durability and minimal touch-ups throughout the day, while shimmer lipsticks offer a luminous finish for consumers desiring a more glamorous look. These segments collectively contribute to the market's diversity, catering to varying consumer preferences and occasions.

By Form Analysis

Stick formulations, boasting convenience and portability, hold sway in the makeup landscape.

In terms of form, Stick lipsticks hold the dominant position in the market. The traditional stick format is favored for its convenience, ease of application, and portability. This form's enduring popularity is underpinned by its iconic status and the tactile experience it offers during application.

However, Liquid lipsticks have gained significant traction, favored for their precision application, variety in finishes (from matte to high gloss), and innovative formulations that combine long wear with comfort. The "Others" category, which includes glosses, balms, and tints, addresses niche consumer needs, offering subtle color, additional hydration, and natural-looking finishes. This diversification in form enables brands to target specific consumer segments, enhancing the overall appeal of their product ranges.

By Distribution Channel Analysis

Supermarkets and hypermarkets emerge as the predominant purveyors, offering unparalleled accessibility to beauty enthusiasts.

Supermarkets / Hypermarkets stand as the dominant distribution channel for lipsticks, providing consumers with the convenience of accessing a wide range of cosmetic products during their routine shopping trips. The availability of a variety of brands and products in one location, coupled with the opportunity to physically sample products, drives consumer preference for this channel. Meanwhile, E-commerce has seen exponential growth, driven by the rise of digital platforms and the increasing consumer shift towards online shopping.

E-commerce offers a broader selection of products, competitive pricing, and the convenience of home delivery. Multi Branded Retail Stores, Departmental/Grocery Stores, and "Others" (including specialty beauty stores) complement the distribution landscape, offering unique shopping experiences, expert advice, and product exclusivity. The expansion of digital marketplaces and the integration of virtual try-on technologies in e-commerce platforms are set to redefine how consumers discover and purchase lipsticks.

Key Market Segments

By Type

- Matte

- Crème

- Long-wearing

- Shimmer

By Form

- Stick

- Liquid

- Others

By Distribution Channel

- Supermarkets / Hypermarkets

- E-commerce

- Multi Branded Retail Stores

- Departmental/Grocery Stores

- Others

Growth Opportunity

Natural and Organic Formulas: A Growth Opportunity in the Lipstick Market

The shift towards natural and organic beauty products mirrors a broader consumer trend of prioritizing health and sustainability. By developing lipstick formulas devoid of controversial ingredients such as parabens and palm oil, brands can cater to this growing segment of environmentally and health-conscious consumers. This approach not only aligns with the rising demand for transparency in beauty product formulations but also positions brands as leaders in ethical and sustainable practices.

As awareness and concern about the environmental impact and health implications of beauty products continue to rise, offering natural and organic lipstick options represents a substantial market opportunity. This trend is backed by a growing body of research indicating consumer willingness to pay a premium for products perceived as safer and more sustainable.

Inclusive Shade Ranges: A Growth Opportunity in the Lipstick Market

The success of brands like Fenty Beauty, which revolutionized the market with its inclusive approach to beauty, underscores the significant demand for products that cater to a diverse consumer base. Expanding lipstick shade ranges to include an array of tones suitable for all skin colors addresses a critical market gap. This inclusivity not only resonates with a broader audience but also fosters brand loyalty among demographics historically overlooked by the beauty industry.

Embracing diversity in product offerings not only meets a pressing consumer need but also enhances brand reputation, potentially leading to increased market share and sales. This strategy leverages the increasing global dialogue around diversity and inclusion, marking a pivotal growth opportunity within the lipstick market growth.

Latest Trends

Rise of Sustainable and Natural Formulations

The lipstick market is witnessing a significant shift towards sustainable and natural formulations. Consumers are increasingly prioritizing eco-friendly products, driving manufacturers to explore organic ingredients, biodegradable packaging, and cruelty-free production methods.

This trend aligns with growing environmental consciousness and a preference for products that promote health and wellness. Major companies are responding by introducing vegan lipsticks, devoid of harmful chemicals like parabens and phthalates, appealing to a broader consumer base concerned about personal health and environmental impact.

Innovative Packaging and Personalization

Another notable trend in the lipstick market is the emphasis on innovative packaging and personalized offerings. Brands are leveraging technology to offer customizable lipstick shades, allowing consumers to create unique colors tailored to their preferences. Moreover, packaging innovations such as refillable lipstick cases and magnetic closures are gaining traction, catering to sustainability-conscious consumers seeking reusable and aesthetically pleasing options.

This trend not only enhances the consumer experience but also fosters brand loyalty by providing a sense of exclusivity and individuality. As competition intensifies, major companies are investing in research and development to stay ahead of the curve and capitalize on evolving consumer preferences in the dynamic lipstick market landscape.

Regional Analysis

Europe Dominates with 29% Market Share in the Lipstick Market

Europe's leadership in the global lipstick market, with a commanding 29% share, is underpinned by its rich cosmetic history and a strong emphasis on beauty and personal care. The region's market is driven by high consumer spending power, a well-established beauty culture, and a penchant for luxury and premium beauty products. Additionally, Europe is home to some of the world's leading vegan cosmetic brands, which have a significant influence on global beauty trends and innovation in product development, including sustainability and organic ingredients, which resonate well with today's environmentally conscious consumers.

The European lipstick market benefits from a sophisticated distribution network that encompasses both traditional brick-and-mortar luxury retailers and a robust e-commerce platform. This dual-channel distribution ensures wide accessibility and convenience for consumers across various demographics. Furthermore, the market is characterized by a diverse consumer base with a keen interest in the latest beauty trends, such as the growing demand for cruelty-free and vegan products. This has led to increased product innovation among European cosmetic brands to meet evolving consumer preferences.

North America: A Hub of Innovation and Diversity

Holding a significant share of the global lipstick market, North America's strength lies in its innovative product formulations and diverse range of shades catering to a multicultural consumer base. The region's market is propelled by a strong culture of self-expression and individuality, with consumers eager to experiment with new textures, formats, and colors. The presence of both established and indie brands stimulates a highly competitive environment, fostering continuous innovation.

Asia Pacific: Riding the Wave of K-Beauty and J-Beauty

The Asia Pacific region, influenced by the global popularity of K-beauty and J-beauty, has seen a surge in its lipstick market share. The focus on high-quality ingredients, innovative packaging, and unique product benefits, such as lip care combined with color, appeals to a wide audience. The region benefits from rapid urbanization, a growing middle class, and the viral spread of Asian beauty trends through social media. However, it must address the challenge of catering to diverse beauty standards and preferences within the region.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In the dynamic and highly competitive landscape of the global lipstick market, several key players stand out for their strategic positioning, market influence, and profound impact on consumer preferences and key market trends. L'Oréal S.A., with its extensive portfolio of iconic brands, leads the charge by leveraging innovation and extensive research to create a diverse range of products that cater to a global audience. Their commitment to sustainability and inclusive beauty further strengthens their market presence and appeal.

Shiseido Company Limited, a beacon of luxury and innovation in cosmetics, distinguishes itself through its fusion of traditional wisdom and cutting-edge science, delivering products that embody sophistication and efficacy. This strategic blend of heritage and innovation positions Shiseido as a pivotal player in the market, appealing to consumers seeking premium beauty experiences.

Revlon Inc., Coty, and Estée Lauder Companies Inc. are recognized for their historical significance and continuous evolution within the beauty industry. These key companies have adeptly navigated market shifts by embracing digital transformation and engaging with younger demographics through social media, thus remaining relevant and influential in a rapidly changing landscape.

Market Key Players

- L'Oréal S.A.

- Shiseido Company Limited

- Revlon Inc.

- Coty

- Estée Lauder Companies Inc.

- Christian Dior SE

- Unilever

- Guerlain

- Inglot Sp. Z. O. O

- Relouis

- Procter & Gamble

- Chanel LTD

- Natura &Co

- Beiersdorf

- LVMH

Recent Developement

- In October 2023, FounderSix, the beauty brand incubator behind YouTuber Allie Glines’ Ravie Beauty, secured US$12m in funding.

- In September 2023, L’Oréal signed an agreement to acquire Skinbetter Science, a physician-dispensed American skincare brand backed by dermatological science.

Report Scope

Report Features Description Market Value (2023) USD 9.7 Billion Forecast Revenue (2033) USD 15.9 Billion CAGR (2024-2032) 5.2% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Matte, Crème, Long-wearing, Shimmer), By Form(Stick, Liquid, Others), By Distribution Channel(Supermarkets / Hypermarkets, E-commerce, Multi Branded Retail Stores, Departmental/Grocery Stores, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape L'Oréal S.A., Shiseido Company Limited, Revlon Inc., Coty, Estée Lauder Companies Inc., Christian Dior SE, Unilever, Guerlain, Inglot Sp. Z. O. O, Relouis, Procter & Gamble, Chanel LTD, Natura &Co, Beiersdorf, LVMH Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- L'Oréal S.A.

- Shiseido Company Limited

- Revlon Inc.

- Coty

- Estée Lauder Companies Inc.

- Christian Dior SE

- Unilever

- Guerlain

- Inglot Sp. Z. O. O

- Relouis

- Procter & Gamble

- Chanel LTD

- Natura &Co

- Beiersdorf

- LVMH