Global Herbal Toothpastes Market By Distribution Channel (hypermarkets and supermarkets, pharmacy and online retail), By End Users (Adult, Children), By Ingredient Type (Neem, Mint, Basil And Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

14770

-

May 2023

-

186

-

-

This report was compiled by Research Team Research team of over 50 passionate professionals leverages advanced research methodologies and analytical expertise to deliver insightful, data-driven market intelligence that empowers businesses across diverse industries to make strategic, well-informed Correspondence Research Team Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

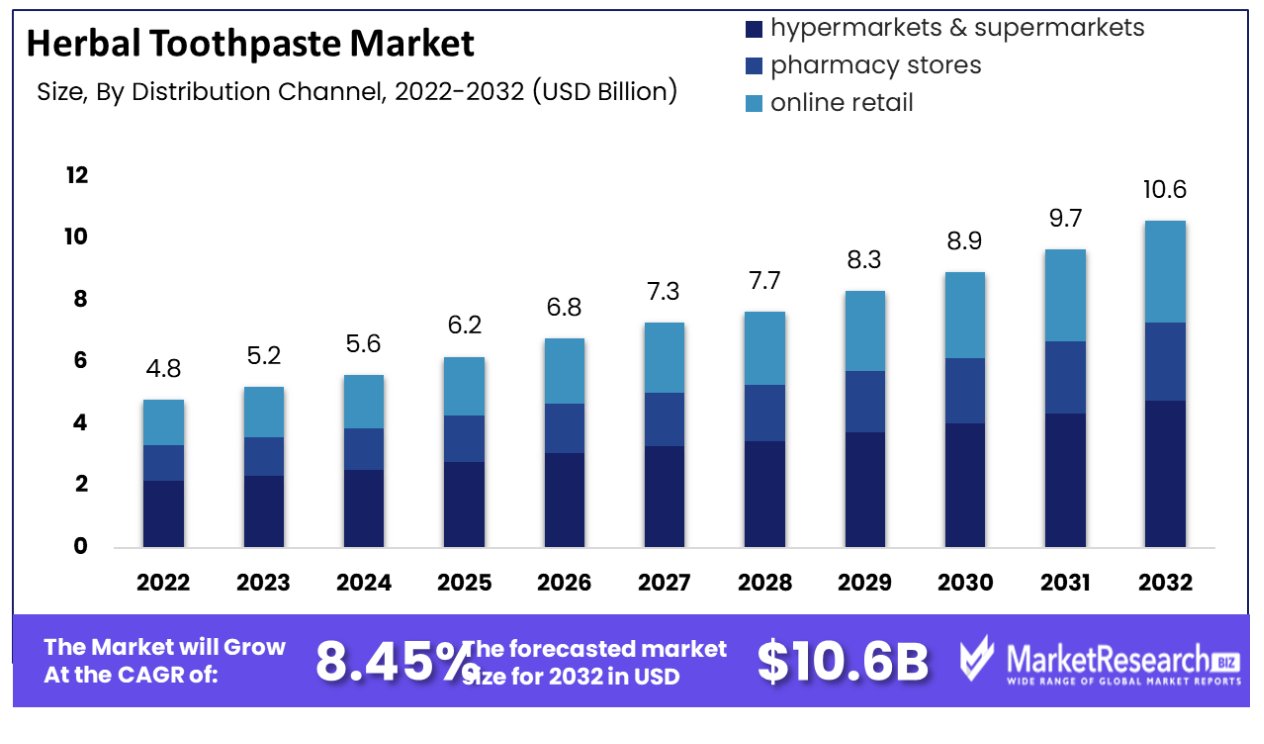

The herbal toothpaste market was valued at USD 4.8 billion in 2022. It is expected to reach USD 10.8 billion by 2032, with a CAGR of 8.45% during the forecast period from 2023 to 2032.

The surge in demand for natural herbal products and concerns regarding oral hygiene are some of the key factors for the herbal toothpaste market. Herbal toothpaste is used for keeping the teeth clean, preserving oral health, and helping to prevent bad smells. These herbal toothpastes also help in preventing oral diseases such as plague and halitosis. Consumers are majorly concerned about the dental plaque deposits over the teeth. Dental caries, halitosis, gingivitis, and other oral complications are all caused by the plague.

According to WHO in 2023, oral diseases are caused by a wide range of different risk factors which are common to several non-communicable diseases that include consuming sugar, tobacco usage, consuming alcohol, and poor hygiene, and some of the social and commercial factors.

In the 2022 global oral health status report, it was stated more than 3.5 billion people globally are affected with different types of oral disease, with 3 out of 4 people being affected from the middle-income regions. Worldwide, more than 3 billion individuals are affected with caries of permanent teeth and 514 million children suffer from caries of primary teeth.

Many scientific research and studies have been conducted and it showed the connection between oral health and cardiovascular diseases, diabetes, and death.

According to WHO, periodontal disease affects the tissues that both surround and provide support to the teeth. There are over 19% of periodontal diseases have impacted the worldwide adult population, which signifies more than 1 billion cases globally.

Moreover, oral cancer comprises lip cancer and also affects other parts of the mouth and the oropharynx, it is ranked 13th as the most common cancer globally. It is estimated that globally there are over 3,77,713 new cases and 1,77,757 deaths due to lip cancer and oral cavity in 2020. It is commonly seen in older people as well and it is more deadly in men as compared to women and it is strongly socio-economic situations.

Manufacturers are focusing more on the distribution of herbal toothpaste due to the consumer’s demand as they have become more cautious about oral hygiene. Manufacturers of herbal toothpaste have widened their reach over online platforms as well so that consumers can get their desired products easily and at an affordable price.

These herbal toothpastes are also available in several offline stores. The demand for herbal toothpaste will increase gradually due to its several unique benefits which will contribute to market expansion in the coming years.

Driving Factors

Natural Ingredients Surge Fuels Herbal Toothpaste Market

The growing demand for natural ingredient-based products, spurred by increasing awareness of the harmful effects of artificial ingredients, is a major driver for the herbal toothpaste market. Consumers are progressively turning towards products with organic, non-toxic ingredients, reflecting a broader trend towards health and wellness.

This shift is prompting toothpaste manufacturers to innovate and expand their herbal product lines. The market is thus experiencing a significant shift towards formulations that are perceived as safer and more beneficial for long-term health, indicating sustained market growth aligned with evolving consumer preferences.

Dental Hygiene Awareness Elevates Market Growth

Increasing awareness about dental hygiene and the rising incidence of dental caries is driving significant growth in the herbal toothpaste market. With more information available on oral health, consumers are seeking effective solutions to prevent and treat dental issues.

Herbal toothpaste, often perceived as more effective in maintaining oral health due to natural ingredients, is gaining popularity. This trend is not only increasing the market size but also encouraging product innovation, with a focus on herbal formulations that address specific dental concerns, suggesting a future market characterized by specialized oral care products.

Consumer Preference for Remineralizing Toothpaste Boosts Market

The consumer preference for multinational toothpaste that assists in the remineralization of teeth is shaping the herbal toothpaste market. This demand reflects an increased consumer understanding of dental health, specifically the need for enamel protection and restoration.

Herbal toothpastes that include natural remineralizing agents are becoming popular, as they align with both health and environmental consciousness. This preference is likely to drive further market expansion and innovation in herbal formulations focused on dental health improvement, marking a shift towards more functional oral care products.

Demand for Convenient Oral Care Products Propels Market Dynamics

The increasing demand for convenient and easy-to-use oral care products is contributing to the growth of the herbal toothpaste market. In a fast-paced world, consumers seek products that are not only effective but also easy to incorporate into their daily routines.

Herbal toothpastes, with their natural appeal and perceived efficacy, meet this need. The combination of convenience and natural ingredients is resonating with modern consumers, likely leading to a sustained preference for herbal toothpaste in daily oral hygiene practices. This trend suggests a continued market expansion, with a focus on user-friendly and health-oriented products.

Restraining Factors

Economic Constraints in Emerging Countries Restrain Herbal Toothpaste Market Growth

Economic constraints in emerging countries significantly impede the growth of the herbal toothpaste market. In these regions, limited consumer purchasing power restricts the ability of individuals to opt for premium or niche products like herbal toothpaste, which are often priced higher than conventional toothpaste.

The preference in these markets leans towards more affordable, basic oral care products. This economic limitation reduces the potential market size for herbal toothpaste in these regions, where a significant portion of the global population resides. As a result, the overall expansion of the herbal toothpaste market is constrained by the purchasing power in these emerging economies.

Competition Among Large Businesses Impacts on Herbal Toothpaste Market Dynamics

Intense competition and rivalry among large businesses in the oral care sector present a formidable challenge to the herbal toothpaste market. Established brands with extensive product lines and significant market shares dominate the industry, making it difficult for herbal toothpaste brands, especially newer or smaller ones, to gain a foothold.

These large companies often have substantial resources for marketing, research and development, and distribution, advantages that many herbal toothpaste brands lack. This competitive landscape can lead to market saturation in certain segments and inhibit the growth potential of herbal toothpaste brands, particularly in markets already dominated by well-known conventional toothpaste brands.

Segmentation Analysis

Distribution Channel

Hypermarkets and supermarkets are the leading distribution channels for herbal toothpaste. Their dominance is attributed to their wide reach, variety of choices, and convenience of access for consumers. These channels benefit from high foot traffic, which increases product visibility and consumer awareness. The variety of herbal toothpaste brands and formulations available in these retail spaces caters to a broad consumer base with diverse preferences. The growth of this segment is further bolstered by aggressive marketing strategies and in-store promotions.

Pharmacy stores, offering a curated selection of health-focused products, play a significant role in the distribution of herbal toothpaste, especially for brands emphasizing therapeutic benefits. Online retail is rapidly growing, driven by the convenience of home shopping, ease of product comparison, and the rising trend of digital consumerism. This channel is particularly appealing for niche brands and for reaching consumers in areas where physical retail presence is limited.

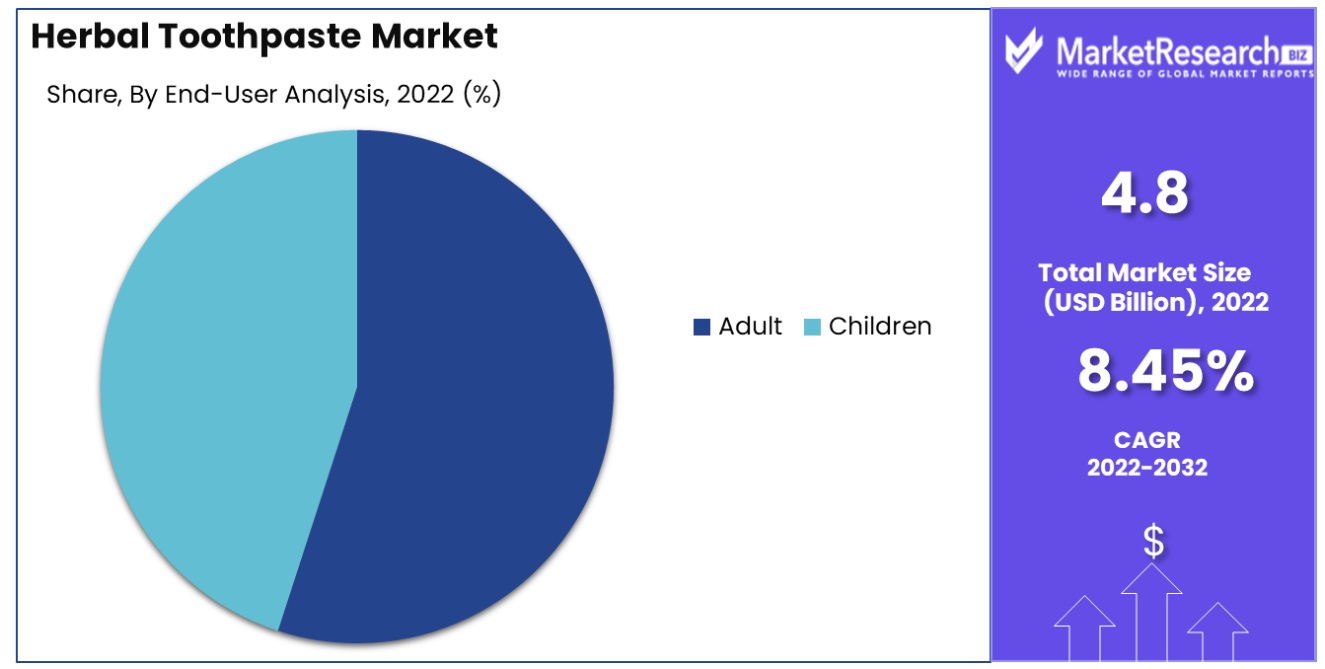

End Users

Adults constitute the primary end-user segment for herbal toothpaste, driven by increasing health consciousness and preference for natural products. This segment's dominance is underpinned by the wide range of herbal formulations catering to various oral health concerns prevalent among adults, such as gum health, tooth sensitivity, and whitening.

The children’s segment, while smaller, is growing, with an emphasis on mild, safe, and appealing formulations. This segment is crucial for instilling early habits of oral hygiene and catering to the specific oral health needs of children.

Ingredient Type

Neem is a dominant ingredient in herbal toothpaste, renowned for its antibacterial and gum health-promoting properties. Its prevalence in the market is due to its long-standing recognition in traditional medicine and its effectiveness in oral care.

Mint is widely used for its refreshing taste and breath-freshening properties. Basil, spice extracts, and meshwork are other popular ingredients, each bringing unique benefits like anti-inflammatory properties and plaque reduction. The 'Others' category encompasses a variety of herbal ingredients, each adding to the market's diversity and appeal to different consumer preferences.

Distribution Channel

- hypermarkets & supermarkets

- pharmacy stores

- online retail

End Users

- Adult

- Children

Ingredient Type

- Neem

- Mint

- Basil

- Spice Extract

- Meswak

- Others

Growth Opportunities

Rising Oral Health Issues Among Growing Population Offers Growth Opportunity for Herbal Toothpaste Market

The continuous increase in oral health issues among the growing global population presents a significant growth opportunity for the herbal toothpaste market. With rising awareness of oral hygiene and the associated health benefits, consumers are increasingly seeking natural and effective alternatives to conventional toothpaste.

Herbal toothpastes, known for their natural ingredients and oral health benefits, cater to this growing demand. Recent trends indicate a heightened consumer preference for products with organic and health-centric formulations, which positions the herbal toothpaste market for considerable expansion, especially as global awareness and focus on oral health continue to rise.

Tariff Wars Boosting Herbal Toothpaste Market Offer Expansion Opportunities

The ongoing tariff wars, leading countries to reduce imports of chemical-based toothpaste, offer a unique growth opportunity for the herbal toothpaste market. As import tariffs make foreign chemical-based toothpaste more expensive, there is an increasing inclination towards locally produced, natural alternatives, including herbal toothpaste.

This shift is further supported by a growing global trend towards organic and chemical-free personal care products. Recent trade policies have inadvertently fostered a more favorable market environment for herbal toothpaste, both by reducing competition from imported chemical-based products and by encouraging local production and consumption of natural oral care solutions.

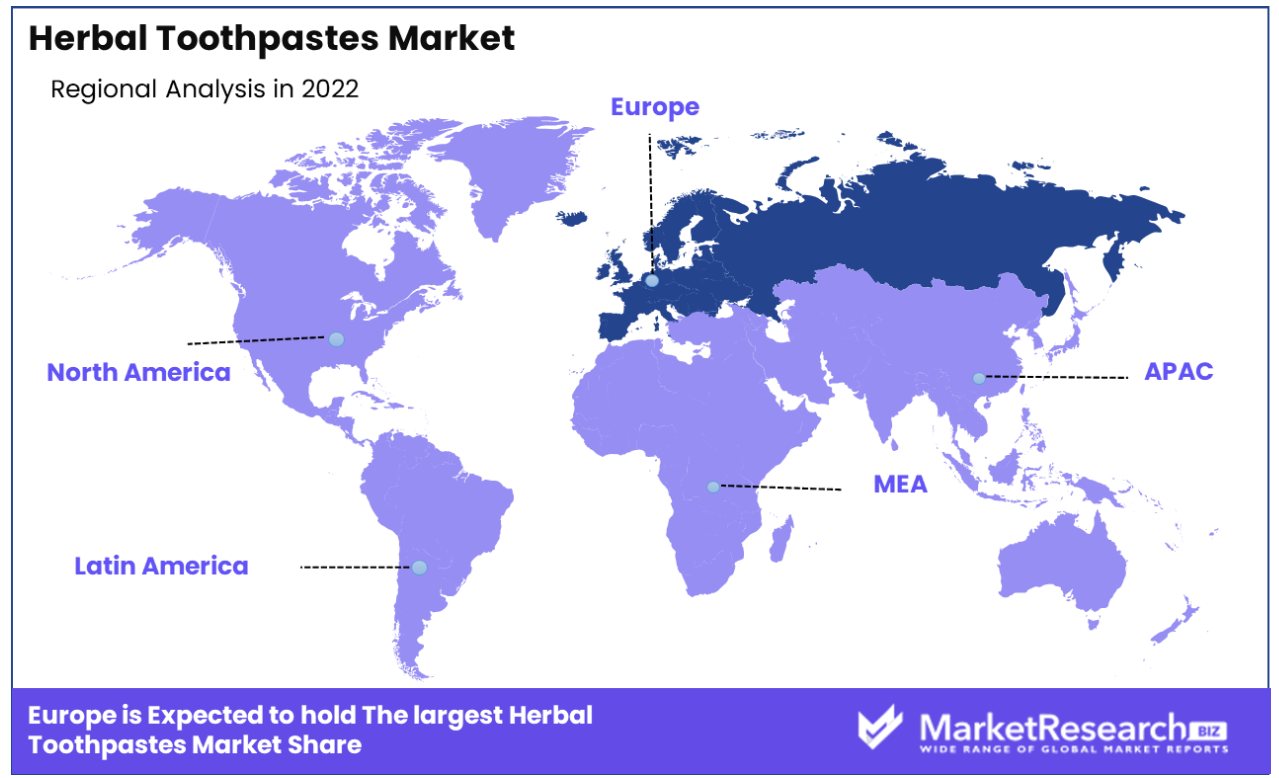

Regional Analysis

Asia-Pacific Region Dominates with 89.90% Market Share

The staggering 89.90% market share of the herbal toothpaste market in the Asia-Pacific region is largely due to cultural factors and consumer preferences. In countries like India, China, and Thailand, there is a long-standing tradition of using natural and herbal products for oral hygiene.

The widespread belief in the efficacy of herbal ingredients, coupled with a growing awareness of the potential side effects of synthetic chemicals, has fueled this preference. Additionally, the availability of a diverse range of medicinal plants and herbs in this region supports the production of various types of herbal toothpaste.

Local manufacturers have capitalized on this trend by offering a wide range of products, often incorporating traditional herbs known for their oral health benefits. Moreover, the expanding retail and online distribution channels in the region make these products more accessible to a broader audience.

Looking forward, the Asia-Pacific region is expected to maintain its dominance in the herbal toothpaste market. The increasing emphasis on natural and holistic wellness is likely to continue driving consumer preferences toward herbal products. Additionally, the region's growing economic strength and expanding middle class will further boost demand. Innovations in product formulation and marketing, along with the expansion of international brands into this market, are also expected to contribute to sustained growth.

Europe: Growing Interest in Natural Oral Care

Europe’s herbal toothpaste market is growing, driven by the region's increasing focus on organic and natural products. European consumers, known for their health-conscious and environmentally friendly lifestyles, are showing a rising interest in herbal toothpaste, viewing it as a safer and more sustainable alternative to conventional products. This shift is further supported by stringent EU regulations promoting the use of natural ingredients in personal care products.

North America: A Market Poised for Expansion

In North America, the herbal toothpaste market is poised for significant growth. The region's increasing awareness of health and wellness, along with a growing preference for organic and natural products, is driving demand. Consumers are becoming more educated about the benefits of herbal ingredients and are seeking products that align with a holistic approach to health. The presence of major global brands, along with innovative marketing strategies, is likely to propel market growth in this region.

Herbal Toothpaste Industry by Region

North America

- The US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of the Middle East & Africa

Key Player Analysis

In the herbal toothpaste market, the diverse strategies of the listed companies collectively shape the sector's landscape. Colgate-Palmolive Company and Procter & Gamble, with their extensive global presence, demonstrate the integration of herbal offerings into mainstream oral care, highlighting the market's shift towards natural ingredients.

Vicco Laboratories and Dabur India Ltd, rooted in traditional herbal formulations, underscore the growing consumer preference for ayurvedic and natural products. Vitro Naturals and Alacer Corporation, though smaller in scale, contribute significantly through specialized, niche offerings, reflecting the market's appreciation for unique herbal blends.

Patanjali Ayurved and Himalaya Holdings Ltd., with their strong focus on authenticity and herbal expertise, have significantly influenced consumer perceptions towards herbal oral care. Glaxo Smith Kline plc and Unilever, as major players in the broader personal care market, leverage their brand strength and distribution networks to expand the herbal toothpaste segment.

Boka and Himalaya Herbal Healthcare, known for their focus on combining modern science with herbal remedies, illustrate the market's drive towards innovative and scientifically-backed herbal products. Burt’s Bees, Dr. Bronner’s, and Kopari, with their commitment to natural and organic ingredients, highlight the industry's response to the clean beauty trend.

LEBON, Uncle Harry’s Natural Products, and Weleda Natural Products, specializing in premium and organic toothpaste, showcase the market's diversification into luxury and specialized health-conscious segments. Credo Beauty, GSK, Amorepacific, and Henkel, each with their unique approach to herbal and natural formulations, further contribute to the market's dynamic evolution, catering to a broad range of consumer preferences and needs.

Overall, these companies not only drive growth in the herbal toothpaste market but also exemplify a range of strategies - from leveraging traditional knowledge to embracing modern marketing and scientific research - crucial in navigating this increasingly popular sector.

Key Players

- Patanjali Ayurveda

- Colgate-Palmolive Company

- Vicco Laboratories

- Dabur India Ltd

- Vitro Naturals

- Alacer Corporation

- Himalaya Holdings Ltd.

- Glaxo Smith Kline plc

- Procter & Gamble

- Boka

- Himalaya Herbal Healthcare

- Dr. Bronner’s

- Kopari

- LEBON

- Uncle Harry’s Natural Products

- Unilever

- Weleda Natural Products

- Credo Beauty

- GSK

Recent Development

- In May 2023, Dabur India launched Dabur Herb’lActivated Charcoal toothpaste to attract younger consumers. Charcoal is known as a cleanser, detoxifier, and good absorbent. The company aimed to enhance its product portfolio with the launch of whitening toothpaste and cater to the demand of urban consumers.

- In November 2022, Vitro Naturals launched herb-rich and fluoride-free toothpaste. The product uses herbs like neem, cloves, babool, and mint leaves. The toothpaste protects against teeth and gum infections, bad breath, toothache, and cavities and reduces gum and tooth pain.

- In July 2022, Alacer Corp., a GlaxoSmithKline (GSK) consumer healthcare subsidiary, launched the eco-conscious toothpaste brand Natean. The toothpaste is made with botanicals, natural flavors, and fruit extracts.

Report Scope

Report Features Description Market Value (2022) USD 4.8 Billion Forecast Revenue (2032) USD 10.8 Billion CAGR (2023-2032) 8.45% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Distribution Channel(hypermarkets & supermarkets, pharmacy stores, online retail), End Users(adult, children), Ingredient Type(Neem, Mint, Basil, Spice Extract, , Others) Regional Analysis North America - The US, Canada, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Patanjali Ayurveda, Colgate-Palmolive Company, Vicco Laboratories, Dabur India Ltd, Alacer Corporation, Himalaya Holdings Ltd., Glaxo Smith Kline plc, Procter & Gamble, Boka, Himalaya Herbal Healthcare, Dr. Bronner’s, Kopari, LEBON, Uncle Harry’s Natural Products, Unilever, Weleda Natural Products, Credo Beauty, GSK Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) - hypermarkets & supermarkets

-

-

- Patanjali Ayurveda

- Colgate-Palmolive Company

- Vicco Laboratories

- Dabur India Ltd

- Vitro Naturals

- Alacer Corporation

- Himalaya Holdings Ltd.

- Glaxo Smith Kline plc

- Procter & Gamble

- Boka

- Himalaya Herbal Healthcare

- Dr. Bronner’s

- Kopari

- LEBON

- Uncle Harry’s Natural Products

- Unilever

- Weleda Natural Products

- Credo Beauty

- GSK