Clean Beauty Market By Product Type(Skin Care, Hair Care, Face Products, Oral Care, Makeup), By Product Form(Powder, Liquid, Gel, Cream), By Age Group(Millennials, Gen Z, Gen X , Baby Boomers), By Gender(Women, Men, Kids), By Distribution Channel(Speciality Stores, Online, Retail, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

42942

-

Jan 2024

-

179

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Clean Beauty Market Size, Share, Trends Analysis

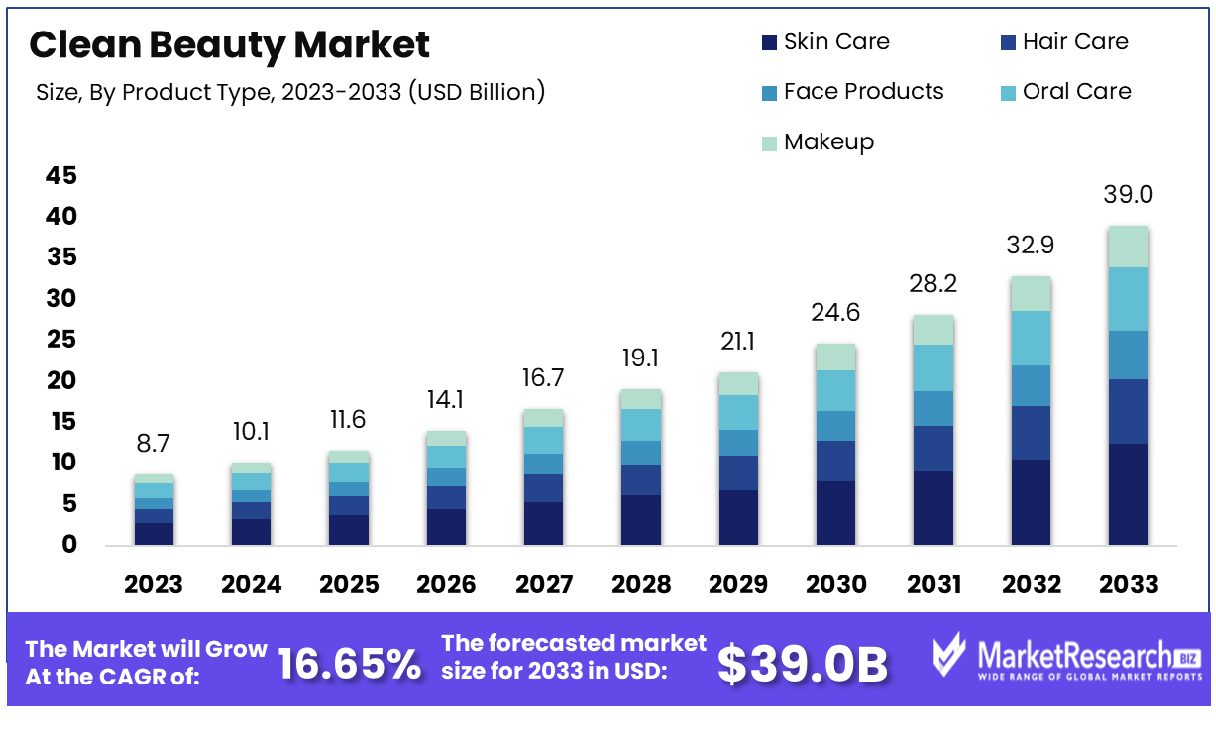

The clean beauty market was valued at USD 8.7 billion in 2023. It is expected to reach USD 39.0 billion by 2033, with a CAGR of 16.65% during the forecast period from 2024 to 2033.

The surge in women population and demand for refined and clean beauty products are some of the main key driving factors for the clean beauty market. Clean beauty refers to cosmetics, skincare, and some of the personal care products that are extracted from clean ingredients and free of harmful elements. These are generally non-toxic, safe, and environmentally friendly components.

The clean beauty transformation is a refusal of conventional beauty brands and their usage, which comprises toxic ingredients like parabens, talc, butylated hydroxyanisole, commonly known as BHA, aluminum elements, artificial colors, phthalates, synthetic fragrances, and many more.

According to an article published by The Conscious Insider, there are more than 50,000 products from 500 firms; 83% of the tested products include titanium dioxide, which is known as a human carcinogen. Most women use 12 types of products in an average day, which comprise 168 different chemicals. For men, it’s an average of six personal care products that contain 85 varied chemicals. Nearly 1 out of 3 beauty products are currently named "clean" in the US. In 2023, Clean Beauty had 5.7 million hashtag views on the social media platform Instagram and 1.3 billion on TikTok. In 2024, it will be 6.3 million on Instagram.

Moreover, presently, the European Union counts 1694 ingredients that are banned from use in cosmetics. Only 11 ingredients are banned from use in cosmetics in the US. Many customers are becoming aware of different skin care problems that are caused by harmful and toxic chemical ingredients in cosmetics. The majority of consumers are opting for pure cosmetics that are safe for their skin and health. There are several advantages to using clean beauty products, such as that they are healthy and safe, as they are formulated to reduce exposure to harmful chemicals and promote a healthy lifestyle.

It is environmentally friendly as it does not use any microplastics or synthetic fragrances. They practice sustainably to eliminate any harmful impact on the environment. Clean beauty products are transparent about the ingredients used in the cosmetic products, as they want customers to use chemical-free products and choose the produce wisely before they buy. The demand for pure beauty products will quickly increase because of the growing awareness of natural and eco-friendly products for the skin, which will assist in expanding the market over the next few years.

Clean Beauty Market Dynamics

Consumer Demand for Natural Ingredients Catalyzes Clean Beauty Market

The clean beauty market is burgeoning, significantly propelled by heightened consumer demand for natural, organic, and sustainably sourced ingredients. This shift is driven by growing awareness of the potential health risks associated with synthetic chemicals in cosmetics. Statistics reveal that, since 2009, 595 cosmetics manufacturers have reported using 88 chemicals linked to health issues in over 73,000 products. This awareness has led to over 65% of consumers seeking clean ingredients, with more than 50% of Gen Z closely scrutinizing product compositions. Brands like Beautycounter have successfully tapped into this market by emphasizing clean products, highlighting a paradigm shift towards safer, more transparent beauty and personal care products.

Social Media and Influencers Amplify Clean Beauty Movement

Social media and influencers play a pivotal role in driving the clean beauty market's growth. Platforms like Instagram and TikTok have become instrumental in raising awareness, with millions of hashtag views dedicated to clean beauty. Brands effectively engage with niche communities, including clean beauty advocates, through campaigns and partnerships with influencers. This digital amplification educates consumers about the benefits of chemical-free products, fostering a more informed and health-conscious audience. The influence of social media in shaping consumer preferences is evident, as it empowers users to make informed decisions and drives the demand for cleaner, safer beauty products.

Regulatory Changes Prompt Clean Beauty Innovation

The increasing regulatory scrutiny of cosmetic ingredients is another significant driver of the clean beauty market. Bans and restrictions on harmful chemicals by entities like the EU and individual states like Washington have compelled brands to reformulate their products. The Toxic-Free Cosmetics Act, enacted in Washington in 2023, which prohibits certain chemicals, exemplifies this trend. This regulatory landscape not only ensures safer products for consumers but also stimulates innovation within the industry. Brands are now incentivized to develop and market products that comply with these stringent standards, leading to an expanded market of clean, non-toxic beauty products.

Higher Price Points Limit Mass Market Adoption of Clean Beauty Products

The higher price points of natural and organic clean beauty products pose a significant barrier to mass market adoption. Smaller indie brands often struggle to achieve economies of scale, leading to higher prices for their products. For example, prices can range significantly, such as $48 for a cleanser or $110 for a moisturizer, with brands like KYPRIS offering products starting at $49.00. This pricing disparity makes it challenging for consumers, especially those with budget constraints, to switch to clean beauty products. The premium pricing of these products limits their accessibility to a broader consumer base, thereby restraining market growth.

Skepticism Over Efficacy and Safety of Natural Ingredients Hinders Clean Beauty Market Growth

Limited clinical testing on the safety and efficacy of some natural ingredients and new botanical extracts in clean beauty products leads to consumer skepticism. This skepticism is compounded by a lack of trust in the industry's sustainability claims. According to a Forbes report, 79% of beauty consumers have doubts about trusting these claims, and less than half believe that beauty brands are transparent about their sustainability practices. This uncertainty about product performance and the authenticity of sustainability claims can deter consumers from choosing clean beauty products, impeding the market's growth. Establishing credibility through rigorous testing and transparent marketing practices is crucial for overcoming these challenges.

Clean Beauty Market Segmentation Analysis

By Product Type Analysis

Skin Care is the dominant segment in the clean beauty market. This prominence is driven by the growing consumer awareness and preference for skincare products made with organic cosmetics, and non-toxic, and sustainable ingredients. The demand for clean skincare products stems from a growing understanding of the impact of synthetic chemicals and preservatives on skin health and the environment. Clean skincare products, which often include cleansers, moisturizers, serums, and treatments, appeal to consumers seeking effective and safe alternatives to the conventional skincare segment. The emphasis on transparency, ethical sourcing, and cruelty-free practices further enhances the appeal of clean skincare products.

Other segments such as Hair Care, Face Products, Oral Care, and Makeup also significantly contribute to the clean beauty market. Hair care products in the field of healthy beauty are gaining popularity due to their absence of harmful chemicals like parabens and sulfates. Face Products, including foundations and concealers, are evolving with clean formulations that promise safety without compromising on performance.

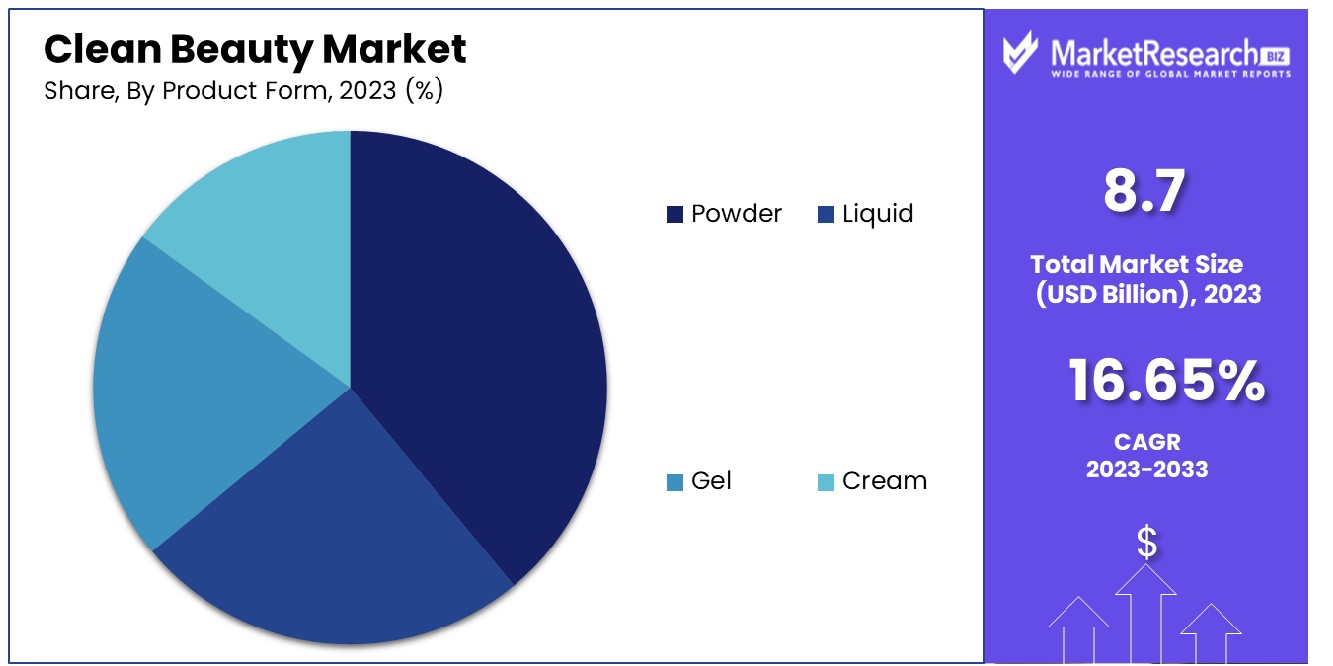

By Product Foam Analysis

Powder is the dominant product form in the clean beauty market. Powder formulations are highly valued for their long shelf life, ease of use, and minimal need for preservatives. This form is particularly popular in products like setting powders, blushes, and eyeshadows, where the absence of liquid reduces the risk of bacterial growth, making them a safer option for consumers looking for clean beauty products. Additionally, powder products often require fewer synthetic additives, aligning well with the clean beauty ethos of using minimal and natural ingredients.

Liquid, Gel, and Cream forms also play significant roles in the clean beauty market. Liquid products, including cleansers and toners, are popular for their ease of application and ability to deliver active ingredients effectively. Gels are favored in skincare for their lightweight texture and hydrating properties, suitable for various skin types. Creams are essential, especially in moisturizers and heavier makeup products, offering rich texture and deep nourishment.

By Age Analysis

Millennials represent the dominant age group in the clean beauty market. This segment's leadership is driven by the millennial generation's heightened awareness and interest in environmental issues, sustainability, and health and wellness. Millennials, typically those born between 1981 and 1996, have shown a strong preference for products that are ethically sourced, environmentally friendly, and free from harmful chemicals. This demographic is more informed and conscious about the ingredients in their beauty products and their impact on health and the environment. They are also willing to invest in higher-quality products that align with these values.

While Millennials lead, other age groups like Gen Z, Gen X, and Baby Boomers also contribute to the market. Gen Z, the digitally native and socially conscious demographic, is increasingly influencing clean beauty trends with their demand for transparency and authenticity. Gen X and Baby Boomers are gradually adopting clean beauty products, focusing more on anti-aging products and those with health benefits. However, Millennials' blend of purchasing power, influence, and alignment with the core principles of clean beauty solidifies their position as the most significant consumer group in this market.

By Gender Analysis

Women are the dominant gender segment in the clean beauty market. Traditionally, women have been the primary consumers of beauty products, and this trend continues in the realm of clean beauty. Women are increasingly seeking beauty products that are safe, non-toxic, and ethically produced. The shift towards clean beauty is largely driven by concerns over harmful chemicals in skincare and makeup products and their potential effects on health, particularly reproductive health.

Men and Kids segments are also emerging in the clean beauty market. The men's skincare segment is growing with an increased interest in grooming and self-care products that are free from harmful chemicals. The kids' segment is gradually gaining traction as parents look for safer and gentler products for their children. Despite these growing segments, women's historical and ongoing role as the primary consumers of beauty products, coupled with their growing environmental and health consciousness, makes them the most influential segment in the clean beauty market.

By Distribution Channel Analysis

Specialty Stores are the dominant distribution channel in the clean beauty market. These stores specialize in health and beauty products and often offer a curated selection of clean beauty brands. Specialty stores are preferred by consumers seeking expert advice, a wide range of products, and the ability to physically evaluate products before purchase. They provide a personalized shopping experience with knowledgeable staff who can assist customers in choosing products that align with their specific needs and values.

Online and Retail channels also play crucial roles in the clean beauty market. Online shopping offers convenience, a wide range of options, and often more competitive pricing. However, the lack of physical product interaction is a limiting factor. Retail channels, including supermarkets and drugstores, are expanding their clean beauty offerings to meet growing demand. Despite the growth in online and retail channels, the personalized service, expert advice, and tactile shopping experience offered by specialty stores keep them at the forefront of clean beauty distribution channels.

Clean Beauty Industry Segments

By Product Type

- Skin Care

- Hair Care

- Face Products

- Oral Care

- Makeup

By Product Form

- Powder

- Liquid

- Gel

- Cream

By Age Group

- Millennials

- Gen Z

- Gen X

- Baby Boomers

By Gender

- Women

- Men

- Kids

By Distribution Channel

- Speciality Stores

- Online

- Retail

- Others

Clean Beauty Market Growth Opportunity

Education on Ingredients and Toxins: A Pathway to Growth in the Clean Beauty Market

The opportunity to educate consumers about the usage of harmful ingredients and chemicals in cosmetics is a key factor in the growth of the market for natural beauty products. Many consumers are unaware of the concerns associated with chemicals like parabens, creating a space for brands to inform and guide them. Content marketing and influencer partnerships can be effective tools for this purpose. For instance, Credo Beauty's "Dirty List" educates consumers about banned ingredients, enhancing brand trust and loyalty. This educational approach not only helps in building an informed customer base but also positions brands as leaders in clean beauty, fostering market growth.

Sustainable Packaging: A Crucial Lever for Expansion in Clean Beauty

The move towards sustainable packaging represents a huge potential growth area in the clean beauty industry. Consumers are increasingly concerned about beauty waste and environmental impact, making eco-friendly packaging a crucial factor in their purchasing decisions. Brands that adopt recycled materials, implement refill systems, and reduce excess packaging are more likely to attract environmentally conscious consumers. For example, Love Beauty and Planet's commitment to using 100% recycled materials resonates with the growing consumer preference for sustainability. By embracing eco-friendly packaging, beauty brands can differentiate themselves in a crowded market and cater to the rising demand for sustainable products.

Clean Beauty Market Regional Analysis

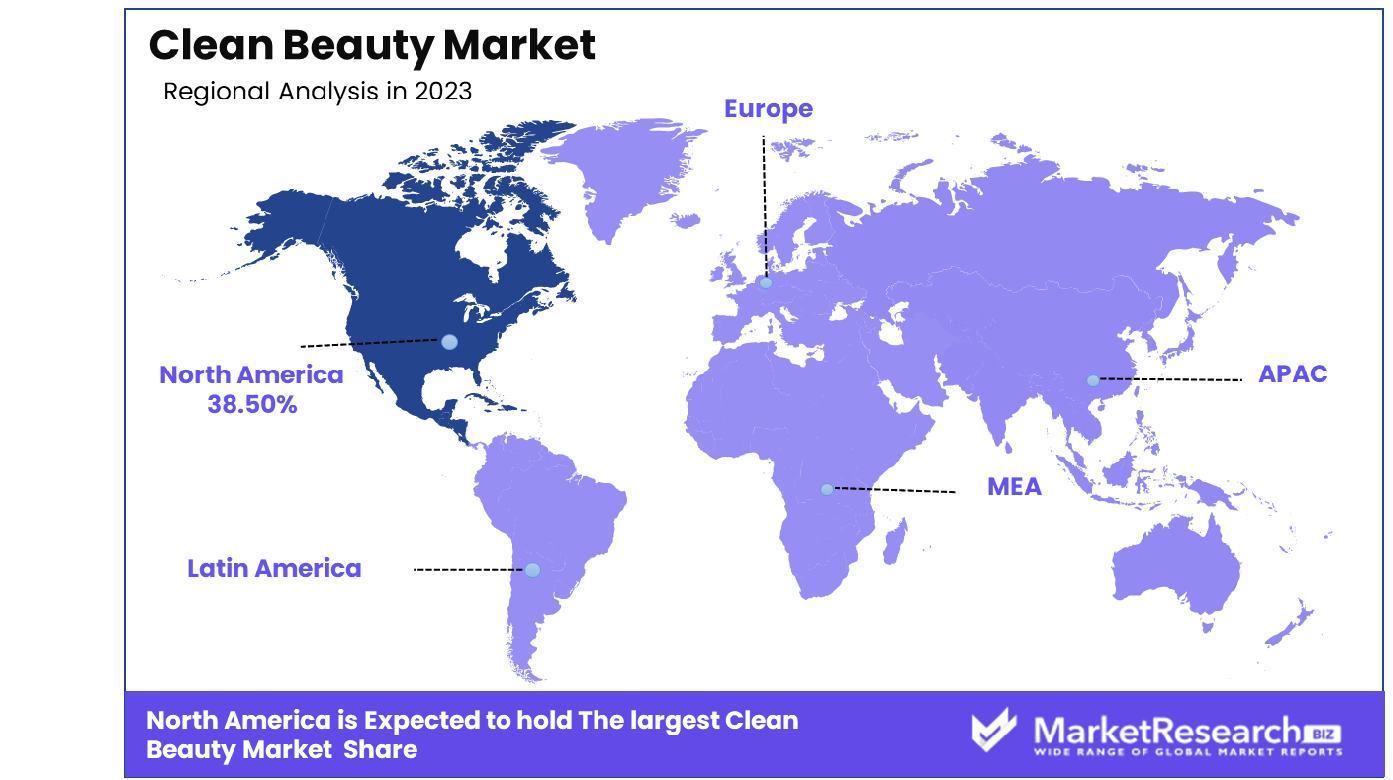

North America Dominates with 38.50% Market Share in the Clean Beauty Market

North America's significant 38.50% market share in the clean beauty industry is driven by heightened consumer awareness and a growing preference for natural and organic personal care products. The region, particularly the United States and Canada, has seen a surge in demand for beauty products that are free from harmful chemicals and are environmentally sustainable. This trend is fueled by a well-informed consumer base that is increasingly concerned about health, wellness, and the environmental impact of their consumption choices. The presence of a large number of innovative clean beauty brands, many of which are pioneering the movement towards green cosmetics, also contributes to the market's growth.

The clean beauty market in North America is characterized by the evolving consumer perception of beauty and wellness. There is a growing emphasis on transparent labeling, ethical sourcing, and cruelty-free practices in the beauty industry. The market is further bolstered by robust digital marketing strategies and a strong online retail presence, making clean beauty products more accessible to a wider audience. Additionally, the influence of celebrities and beauty influencers advocating for clean beauty has significantly impacted consumer choices, further propelling the market.

Europe: Progressive Regulations and Sustainable Practices

Europe’s clean beauty market is driven by progressive regulations and a focus on sustainable practices. Stringent EU regulations on cosmetic ingredients and a high consumer preference for ethically produced, environmentally friendly products fuel market growth. Brands in Europe are increasingly focusing on sustainability, from product formulation to packaging.

Asia-Pacific: Growing Awareness and Changing Consumer Preferences

In Asia-Pacific, the market for natural beauty is growing rapidly, fueled by increased awareness among consumers and shifting preferences towards more natural and safe products for beauty. Countries like South Korea and Japan are leading the way with innovative, clean beauty formulations. The increasing middle-class population and rising disposable incomes in the region are also contributing to the market's growth. The market is expected to benefit from the growing trend of natural and organic ingredients and a rising focus on personal well-being.

Clean Beauty Industry By Region

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of Middle East & Africa

Clean Beauty Market Share Analysis

There is the Clean Beauty Market, a quickly growing industry driven by increasing demand from consumers seeking non-toxic and natural products. The companies included have a major role to play in the development of trends and consumer preferences. Burt's Bees and bareMinerals are prominent players, recognized for their commitment to using natural ingredients and sustainable practices. Their strategic positioning emphasizes purity, ethical sourcing, and eco-friendly packaging, significantly influencing consumer perceptions of clean beauty.

Ere Perez Natural Cosmetics and Juice Beauty, Inc. specialize in organic and plant-based formulations, catering to consumers seeking high-performance beauty products that are also environmentally responsible. Their focus on combining nature with science reflects the industry's shift towards innovative and effective clean beauty solutions.

Honest Beauty LLC, founded by Jessica Alba, has gained notable attention for its transparent approach to ingredient sourcing and product formulation, showcasing the market's potential for brand trust and consumer loyalty. Kjaer Weis and RMS Beauty, with their luxury positioning and high-quality organic ingredients, play crucial roles in elevating the clean beauty market to a premium level.

Clean Beauty Industry Key Players

- Burt's Bees

- bareMinerals

- Ere Perez Natural Cosmetics

- Avon

- Juice Beauty, Inc.

- Honest Beauty LLC

- Kjaer Weis

- Inika

- rms beauty

- Vapour Beauty

- Mineral Fusion Natural Brands

- BITE Beauty

Clean Beauty Market Recent Development

- In January 2024, Glossier introduces the highly anticipated Full Orbit Eye Cream, featuring hydrating ingredients like polyglutamic and hyaluronic acid, niacinamide, arctic microalgae, white hawthorn, and jasmine flower extract. Available online, in stores, and at select Sephora locations, it addresses eye area concerns with 24-hour hydration, depuffing, and dark circle reduction. The launch aligns with industry trends emphasizing hydration, clean beauty, and targeted skincare.

- In January 2024, Amika launches "Stylist Collective," enlisting influencers like Eric Vaughn and Sal Salcedo to shape education initiatives for salons. Following Amika's acquisition, the expected 100% revenue growth signals a commitment to professional hair care, constituting 40% of overall revenue. The brand aims to foster loyalty and industry investment with this program.

- In December 2023, Lumson, a leader in skincare and makeup packaging, expanded into hair care with three comprehensive collections: Slim, Verona, and Round. These turnkey solutions cater to various hair care products, aligning with the holistic trend and addressing the fusion of hair care and skincare.

- In December 2023, Northern California-based clean beauty brand Iris&Romeo expands its retail presence into Sephora with a Series A partnership backed by True Beauty Ventures. The brand emphasizes minimalist, multi-functional products, and plans to enhance retail readiness and expand its team with the new investment.

Report Scope

Report Features Description Market Value (2023) USD 8.7 Billion Forecast Revenue (2033) USD 39.0 Billion CAGR (2024-2032) 16.65% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type(Skin Care, Hair Care, Face Products, Oral Care, Makeup), By Product Form(Powder, Liquid, Gel, Cream), By Age Group(Millennials, Gen Z, Gen X , Baby Boomers), By Gender(Women, Men, Kids), By Distribution Channel(Speciality Stores, Online, Retail, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Burt's Bees, bareMinerals, Ere Perez Natural Cosmetics, Avon, Juice Beauty, Inc., Honest Beauty LLC, Kjaer Weis, Inika, rms beauty, Vapour Beauty, Mineral Fusion Natural Brands, BITE Beauty Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Burt's Bees

- bareMinerals

- Ere Perez Natural Cosmetics

- Avon

- Juice Beauty, Inc.

- Honest Beauty LLC

- Kjaer Weis

- Inika

- rms beauty

- Vapour Beauty

- Mineral Fusion Natural Brands

- BITE Beauty