Granola Bar Market Report By Product Type (Crunchy Granola Bars, Chewy Granola Bars, Protein Granola Bars, Low-Sugar Granola Bars, Gluten-Free Granola Bars, Organic Granola Bars), By Ingredient (Nuts and Seeds, Fruits, Chocolate and Cocoa, Oats and Grains, Honey and Sweeteners, Others), By Flavor (Chocolate Flavored, Nut and Fruit Mix, Peanut Butter, Berry Flavored, Cinnamon, Others), By Distribution Channel, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

6044

-

July 2024

-

324

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

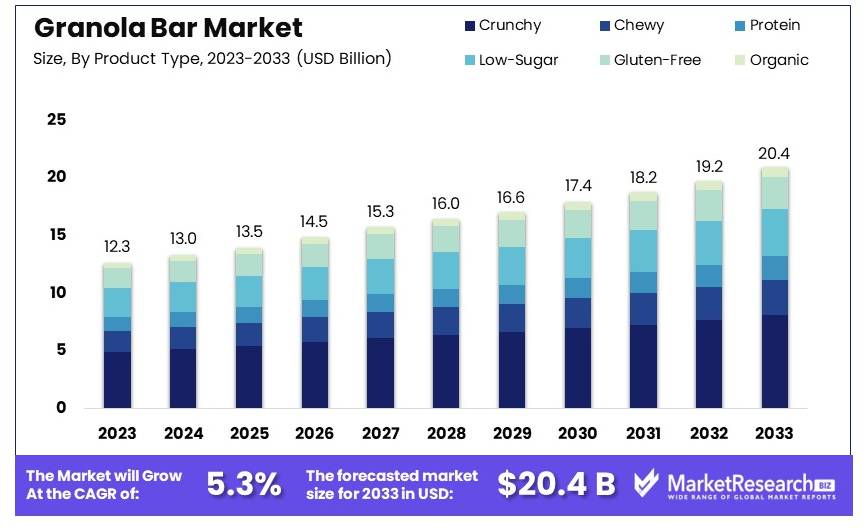

The Global Granola Bar Market size is expected to be worth around USD 20.4 Billion by 2033, from USD 12.3 Billion in 2023, growing at a CAGR of 5.3% during the forecast period from 2024 to 2033.

The Granola Bar Market involves the production and sale of snack bars made from rolled oats, nuts, honey, and other healthy ingredients. Granola bars are popular for their convenience, nutritional value, and variety of flavors. The market is driven by the growing demand for healthy and on-the-go snacks, increasing health consciousness, and the trend towards plant-based diets.

Key segments include organic, gluten-free, and protein-rich granola bars. Companies in this market focus on product innovation, natural and organic certifications, and appealing packaging to attract health-conscious consumers and meet diverse dietary preferences, ensuring sustained market growth.

The granola bar market is poised for substantial growth, driven by changing consumer preferences and strong market fundamentals. According to Glanbia Nutritionals, 33% of bar consumers in the United States prefer granola, oat, or cereal bars, making them the most popular choice. This preference underscores a growing trend towards snacks that combine indulgence with nutritional benefits.

Taste and texture are crucial factors for consumers. A significant 56% of consumers prioritize "great tasting" bars, while 34% emphasize the importance of an "enjoyable texture." Additionally, the high-protein content is a decisive factor for 50% of consumers, reflecting a broader trend towards protein-enhanced snacks associated with better health.

The market dynamics are further bolstered by government initiatives and private investments. The U.S. government supports healthier snack options through various health and nutrition programs. These initiatives aim to promote better eating habits and encourage the consumption of nutritious snacks. Moreover, the health and wellness sector is attracting substantial private investment. The U.S. wellness industry is projected to grow at an annual rate of 6.9%, reaching USD 402 billion by 2026.

Technological advancements in food processing and packaging are also contributing to market growth. Innovations that enhance the taste, texture, and nutritional profile of granola bars are meeting consumer demand for high-quality snacks. These advancements are crucial for maintaining competitiveness in a crowded market.

The granola bar market is set for robust growth. The combination of evolving consumer preferences, supportive government policies, and significant private investments will continue to drive demand. The focus on taste, texture, and nutritional benefits positions granola bars favorably in the health-conscious snack segment.

Key Takeaways

- Market Value: The Granola Bar market was valued at USD 12.3 billion in 2023, and is expected to reach USD 20.4 billion by 2033, with a CAGR of 5.3%.

- By Product Type Analysis: Chewy Granola Bars 40%; Popular for their texture and variety of flavors.

- By Ingredient Analysis: Oats and Grains 50%; Essential for their nutritional benefits and versatility.

- By Flavor Analysis: Nut and Fruit Mix 35%; Favored for the combination of taste and health benefits.

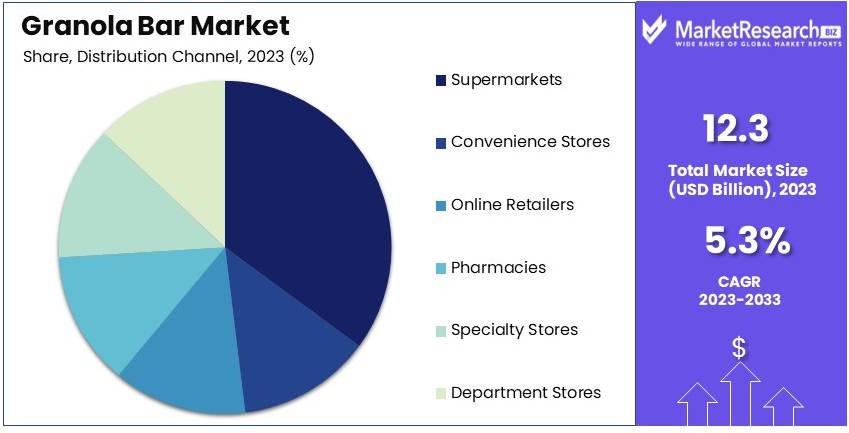

- By Distribution Channel Analysis: Supermarkets/Hypermarkets 45%; Primary sales channel due to convenience and accessibility.

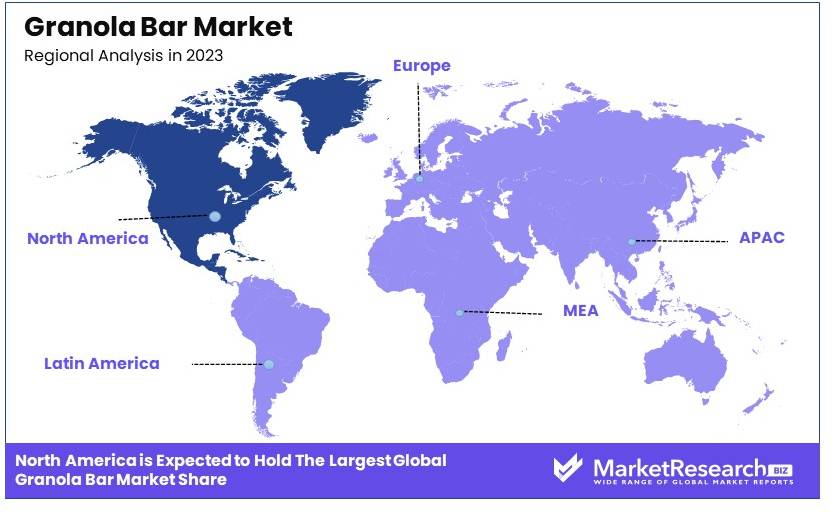

- Dominant Region: North America 38%; High demand driven by health-conscious consumers and snacking trends.

- High Growth Region: Europe; Increasing preference for healthy and on-the-go snacks.

- Analyst Viewpoint: The market shows stable growth with rising health awareness and demand for convenient snacks, though competition remains strong.

- Growth Opportunities: Companies can innovate with new flavors and healthy ingredients, and expand distribution through online retailers to capture a larger market share.

Driving Factors

Increasing Demand for Convenient, Healthy Snacks Drives Market Growth

The growing consumer preference for on-the-go, healthy snack options is a major driver for the granola bar market. Busy lifestyles and rising awareness of health and wellness have led consumers to seek out portable, nutrient-dense foods that can be easily consumed between meals or as meal replacements. For example, KIND Snacks has capitalized on this trend by offering a range of granola bars made with whole nuts, fruits, and grains, positioning them as a wholesome snack option. The company's success, evidenced by its acquisition by Mars for USD 5 billion in 2020, demonstrates the strong market demand for convenient, health-focused snack bars.

This demand for convenience and health in snack foods is driving the development and popularity of granola bars. Consumers looking for quick, nutritious options increasingly turn to granola, fueling market growth. As more people adopt busy lifestyles and prioritize healthy eating, the granola bar market is expected to continue its upward trajectory.

Growing Health and Wellness Consciousness Drives Market Growth

Increasing awareness of the importance of nutrition and the rise of health-conscious consumers are driving growth in the granola bar market. Consumers are seeking out products with natural ingredients, high fiber content, and added nutritional benefits. This trend has led to the development of granola bars fortified with proteins, vitamins, and superfoods. For instance, CLIF Bar has successfully marketed its products as energy bars for active individuals, emphasizing organic ingredients and nutritional content.

The company's continued growth, with annual revenues exceeding USD 900 million, illustrates the strong consumer demand for health-oriented granola bars. The focus on health and wellness is reshaping consumer preferences and driving innovation in the granola bar market. Products that offer additional health benefits or align with dietary trends are particularly popular, reflecting the growing emphasis on nutritious eating habits. This health-conscious trend is expected to sustain and accelerate market growth.

Expansion of Flavor Varieties and Customization Options Drive Market Growth

The diversification of flavors and ingredients in granola bars is driving market growth by appealing to a wider range of consumer preferences. Manufacturers are introducing innovative flavor combinations and allowing for customization to attract different consumer segments. For example, Perfect Bar offers refrigerated granola bars in unique flavors like Peanut Butter Coconut and Almond Butter, catering to consumers looking for fresh, premium options. The company's rapid growth, leading to its acquisition by Mondelez International in 2019, demonstrates the market's appetite for diverse and innovative granola bar offerings.

Offering a variety of flavors and customization options enhances consumer appeal and encourages trial and repeat purchases. As consumers seek new and exciting tastes, the introduction of novel flavors and the ability to personalize granola bars are key factors in driving market growth. This trend towards innovation and variety ensures that the granola bar market remains dynamic and responsive to consumer demands.

Restraining Factors

Perception of High Sugar Content Restrains Market Growth

Despite their reputation as a healthy snack, many granola bars contain high levels of added sugars, deterring health-conscious consumers. As awareness grows about the negative health impacts of excessive sugar consumption, consumers become more cautious about their snack choices.

For example, a 2016 New York Times article highlighted that many popular granola bars contained as much sugar as candy bars, leading to increased scrutiny. This perception has forced some manufacturers to reformulate their products, focusing on reducing sugar content. However, the need for reformulation can slow down market growth as companies invest time and resources to develop new recipes and educate consumers about the changes. As a result, the market growth is restrained by the ongoing concerns over high sugar content in granola bars.

Competition from Alternative Snack Options Restrains Market Growth

The granola bar market faces stiff competition from other healthy snack options, such as fruit and nut bars, protein snacks, and whole food snacks. This wide array of choices can limit market growth as consumers have numerous alternatives in the healthy snack category.

For instance, the rapid growth of RXBar, which offers protein bars made with simple, whole food ingredients, has posed a significant challenge to traditional granola bar brands. RXBar's success, culminating in its USD 600 million acquisition by Kellogg's in 2017, illustrates the intense competition within the healthy snack market. As consumers increasingly opt for these alternative snacks, traditional granola bar sales may stagnate or decline, restraining overall market expansion.

Product Type Analysis

Chewy Granola Bars dominate with 40% due to their soft texture and wide appeal

The granola bar market is segmented by product type into Crunchy Granola Bars, Chewy Granola Bars, Protein Granola Bars, Low-Sugar Granola Bars, Gluten-Free Granola Bars, and Organic Granola Bars. Chewy Granola Bars dominate this segment with a significant 40% market share. This dominance is due to their soft texture and wide appeal among consumers of all ages. Chewy granola bars are popular because they are easy to eat and often come in a variety of flavors and ingredients, catering to diverse tastes.

Chewy granola bars are often chosen for their convenience as a quick snack or meal replacement. They are particularly popular among children and older adults who may prefer a softer texture. The wide range of flavors, from chocolate to fruit and nut mixes, makes chewy granola bars a versatile option that satisfies various palates. Additionally, many chewy granola bars are fortified with vitamins and minerals, enhancing their nutritional value and making them a preferred choice for health-conscious consumers.

Crunchy Granola Bars, while not as dominant, play an important role in the market. They are favored for their crisp texture and the satisfying crunch they provide. Crunchy granola bars are often seen as a more substantial snack and are popular among consumers looking for a more filling option. They are typically made with whole grains and nuts, providing a good source of fiber and protein.

Protein Granola Bars are gaining popularity, especially among fitness enthusiasts and those looking for a high-protein snack. These bars are formulated to provide a significant amount of protein, which is essential for muscle repair and growth. They are often marketed as a convenient post-workout snack or a meal replacement for people on the go.

Low-Sugar and Gluten-Free Granola Bars cater to specific dietary needs and health trends. Low-sugar granola bars appeal to consumers who are conscious about their sugar intake, including diabetics and those on low-sugar diets. Gluten-free granola bars are essential for individuals with celiac disease or gluten intolerance, providing them with a safe and tasty snack option.

Organic Granola Bars are also significant in the market. They are made from organic ingredients, appealing to consumers who prefer natural and sustainably sourced products. The demand for organic granola bars is driven by the growing awareness of the benefits of organic farming and the desire for clean-label products. Each of these sub-segments, while not as dominant as chewy granola bars, contributes to the overall growth and diversification of the granola bar market.

Ingredient Analysis

Oats and Grains dominate with 50% due to their health benefits and versatility

The granola bar market is segmented by ingredient into Nuts and Seeds, Fruits, Chocolate and Cocoa, Oats and Grains, Honey and Sweeteners, and others. Oats and Grains dominate this segment with a commanding 50% market share. This dominance is attributed to their health benefits, versatility, and status as the primary ingredient in most granola bars. Oats and grains are known for their high fiber content, which aids in digestion and provides a steady release of energy, making them a popular choice for health-conscious consumers.

Oats and grains form the base of most granola bars, providing a hearty and nutritious foundation. They are rich in essential nutrients such as vitamins, minerals, and antioxidants. The versatility of oats and grains allows them to be combined with a wide range of other ingredients, such as fruits, nuts, and sweeteners, to create various flavors and textures. This adaptability ensures that granola bars can cater to different dietary preferences and tastes.

Nuts and Seeds are also significant in the market. They add a crunchy texture and are a good source of healthy fats, protein, and fiber. Nuts and seeds, such as almonds, walnuts, chia seeds, and flaxseeds, are often included in granola bars to boost their nutritional profile and provide a satisfying crunch. These ingredients appeal to consumers looking for nutrient-dense snacks that support heart health and provide sustained energy.

Fruits are another important ingredient, adding natural sweetness and additional nutrients to granola bars. Dried fruits such as raisins, cranberries, and apricots are commonly used to enhance flavor and provide vitamins and antioxidants. Fruit-infused granola bars are popular among consumers who prefer naturally sweetened snacks without added sugars.

Chocolate and Cocoa are favored for their rich flavor and indulgence. Granola bars containing chocolate or cocoa are often seen as a treat and are popular among consumers looking for a delicious and satisfying snack. These ingredients appeal to both adults and children, making them a versatile addition to the granola bar market.

Honey and Sweeteners are essential for binding the ingredients together and adding sweetness. Natural sweeteners such as honey, maple syrup, and agave nectar are preferred by consumers seeking healthier alternatives to refined sugar. These ingredients provide a natural source of sweetness and contribute to the overall taste and texture of the granola bars.

Overall, each ingredient type plays a crucial role in defining the taste, texture, and nutritional value of granola bars, but oats and grains' health benefits and versatility make them the dominant ingredient in the market.

Flavor Analysis

Nut and Fruit Mix dominates with 35% due to its balanced taste and nutritional value

The granola bar market is segmented by flavor into Chocolate Flavored, Nut and Fruit Mix, Peanut Butter, Berry Flavored, Cinnamon, and others. Nut and Fruit Mix dominates this segment with a significant 35% market share. This dominance is due to its balanced taste and nutritional value. The combination of nuts and fruits provides a satisfying mix of flavors and textures, appealing to a broad range of consumers.

Nut and fruit mix granola bars are popular because they offer the best of both worlds: the crunchy texture of nuts and the natural sweetness of dried fruits. This combination is not only delicious but also nutritious, providing a good source of protein, healthy fats, fiber, and vitamins. The variety of nuts and fruits used in these bars ensures that they cater to diverse taste preferences and dietary needs.

Chocolate Flavored granola bars are also significant in the market. They are favored for their rich and indulgent taste, making them a popular choice among consumers looking for a treat. Chocolate flavored granola bars often combine the decadence of chocolate with the health benefits of oats and grains, creating a balanced snack that satisfies cravings while providing nutritional value.

Peanut Butter flavored granola bars are popular for their creamy texture and high protein content. Peanut butter adds a rich, nutty flavor that complements the other ingredients in the granola bar. These bars are particularly favored by fitness enthusiasts and those looking for a protein-packed snack.

Berry Flavored granola bars appeal to consumers who enjoy the tart and sweet taste of berries. These bars often contain dried berries like cranberries, blueberries, and strawberries, which add natural sweetness and antioxidants. Berry flavored granola bars are seen as a refreshing and healthy option.

Cinnamon flavored granola bars offer a warm and comforting taste. Cinnamon is known for its potential health benefits, including anti-inflammatory properties and the ability to regulate blood sugar levels. These bars are favored by consumers looking for a spiced and flavorful snack.

Each flavor segment, while not as dominant as nut and fruit mix, plays a crucial role in meeting consumer preferences and contributing to the diversity and growth of the granola bar market.

Distribution Channel Analysis

Supermarkets/Hypermarkets dominate with 45% due to accessibility and wide product range

The granola bar market is segmented by distribution channel into Supermarkets/Hypermarkets, Convenience Stores, Online Retailers, Pharmacies, Specialty Stores, and Department Stores. Supermarkets and hypermarkets dominate this segment with a commanding 45% market share. This dominance is due to their accessibility and wide product range. Supermarkets and hypermarkets are popular shopping destinations where consumers can find a variety of granola bar brands and flavors in one place.

Supermarkets and hypermarkets provide the convenience of one-stop shopping, making it easy for consumers to purchase granola bars along with their other groceries. The wide aisles and organized shelves allow for easy browsing, and the availability of promotional offers and discounts attracts a large number of buyers. The extensive product range ensures that consumers can find granola bars that meet their specific preferences and dietary needs.

Convenience Stores are also significant in the market. These stores offer quick and easy access to granola bars for consumers on the go. Convenience stores are strategically located in high-traffic areas, such as gas stations and urban centers, making them a convenient option for quick purchases. The small pack sizes and ready-to-eat nature of granola bars make them ideal for impulse buys and snacks.

Online Retailers are gaining traction due to the growing trend of e-commerce. Online platforms offer the convenience of home delivery and the ability to compare prices and read reviews before making a purchase. This distribution channel is particularly popular among tech-savvy consumers and those who prefer the convenience of online shopping. The wide variety of products available online and the ease of accessing them from home contribute to the growing popularity of this segment.

Pharmacies, Specialty Stores, and Department Stores, while smaller segments, also contribute to the market. Pharmacies stock granola bars as part of their health and wellness offerings, appealing to health-conscious consumers. Specialty stores offer unique and premium granola bar options, catering to niche markets. Department stores provide another convenient shopping destination, often featuring a dedicated section for snacks and health foods.

Each of these distribution channels, while not as dominant as supermarkets and hypermarkets, plays a crucial role in the overall growth and diversification of the granola bar market by addressing different consumer needs and preferences.

Key Market Segments

By Product Type

- Crunchy Granola Bars

- Chewy Granola Bars

- Protein Granola Bars

- Low-Sugar Granola Bars

- Gluten-Free Granola Bars

- Organic Granola Bars

By Ingredient

- Nuts and Seeds

- Fruits

- Chocolate and Cocoa

- Oats and Grains

- Honey and Sweeteners

- Others

By Flavor

- Chocolate Flavored

- Nut and Fruit Mix

- Peanut Butter

- Berry Flavored

- Cinnamon

- Others

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retailers

- Pharmacies

- Specialty Stores

- Department Stores

Growth Opportunities

Functional Granola Bars with Targeted Health Benefits Offer Growth Opportunity

There is significant growth potential in developing granola bars with specific functional benefits, such as improved digestion, enhanced cognitive function, or better sleep. These products can appeal to consumers looking for snacks that offer more than just basic nutrition.

For example, Health Warrior has introduced Superfood Protein Bars containing chia seeds, which are marketed for their omega-3 fatty acids and antioxidant properties. The company's success in this niche, leading to its acquisition by PepsiCo in 2018, demonstrates the market potential for functional granola bars. By focusing on targeted health benefits, manufacturers can attract health-conscious consumers and differentiate their products in a competitive market.

Sustainable and Environmentally Friendly Packaging Offers Growth Opportunity

As consumers become more environmentally conscious, there is an opportunity for granola bar manufacturers to differentiate themselves through sustainable packaging solutions. This could include biodegradable wrappers, recyclable materials, or innovative packaging designs that reduce waste.

For instance, This Saves Lives granola bar brand has partnered with TerraCycle to make their wrappers recyclable, appealing to eco-conscious consumers. Such initiatives can attract environmentally aware customers and potentially open up new market segments. By prioritizing sustainability, companies can enhance their brand image and meet the growing consumer demand for eco-friendly products.

Trending Factors

Incorporation of Adaptogens and Nootropics Are Trending Factors

There is a growing trend towards including adaptogens (stress-reducing herbs) and nootropics (cognitive-enhancing ingredients) in granola bars. These ingredients appeal to consumers looking for functional foods that support mental well-being and cognitive performance.

For instance, IQBAR markets itself as a "brain and body" nutrition bar, incorporating ingredients like Lion's Mane mushroom and MCT oil, which are claimed to support cognitive function. This trend is likely to continue as consumers seek out snacks that offer both physical and mental health benefits. By incorporating these advanced ingredients, manufacturers can cater to the increasing demand for multifunctional health products.

Personalized Nutrition Through Subscription Models Are Trending Factors

The trend towards personalized nutrition is extending to the granola bar market, with some companies offering customized bars through subscription models. This approach allows consumers to tailor their granola bars to their specific nutritional needs and preferences.

For example, MyMuesli, a European company, offers a "mix your own" granola bar option where customers can choose from over 80 ingredients to create their personalized bars. This trend towards customization and subscription-based models is likely to gain traction in the granola bar market. By offering personalized options, companies can enhance customer engagement and loyalty, driving long-term growth in the market.

Regional Analysis

North America Dominates with 38% Market Share in the Granola Bar Market

North America's 38% market share in the granola bar market is primarily driven by the region's growing health consciousness and the increasing popularity of on-the-go eating options. The presence of multiple leading granola bar manufacturers who continuously innovate with flavors and healthy ingredients also plays a vital role in driving the market.

The market dynamics in North America are influenced by lifestyle trends that prioritize convenience and nutritional value. The increasing demand for gluten-free and high-protein snacks among consumers further boosts the granola bar market. Additionally, extensive distribution channels in retail and online platforms enhance product accessibility and consumer reach.

The future market presence of North America in the granola bar sector is expected to remain strong. Trends such as rising awareness of dietary health and the continuous introduction of new products that cater to diverse consumer preferences are likely to drive sustained growth in this region.

Regional Market Shares and Dynamics:

- Europe: Europe holds approximately 30% of the market. The region’s granola bar market benefits from similar health and wellness trends, with a strong emphasis on organic and non-GMO ingredients. The increasing availability of diverse products that cater to health-conscious consumers supports the market's growth.

- Asia Pacific: Asia Pacific accounts for about 20% of the market. The region sees growth driven by increasing urbanization and changes in consumer eating habits. Rising disposable incomes and the expansion of retail infrastructure also contribute to the popularity of granola bars.

- Middle East & Africa: This region captures around 5% of the market. Increasing exposure to Western eating habits and a growing middle class with health-centric eating preferences contribute to the market growth. Urbanization and the expansion of modern retail are likely to enhance market penetration.

- Latin America: Representing around 7% of the market, Latin America’s growth is spurred by rising health awareness and the increasing availability of international brands. Economic improvements and a shift towards healthier snack options are expected to boost demand for granola bars.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The Granola Bar Market is growing due to increasing demand for healthy snacks. Leading companies like General Mills, Inc. and Kellogg Company dominate the market through their popular brands and extensive distribution networks. These market leaders are known for their product innovation and strategic positioning. Quaker Oats Company (PepsiCo, Inc.) and Nature Valley (General Mills, Inc.) focus on health-oriented ingredients to attract health-conscious consumers. KIND LLC and Clif Bar & Company emphasize natural ingredients and sustainable practices, enhancing their market appeal.

Nature's Bakery, LLC and Bob's Red Mill Natural Foods, Inc. leverage their reputation for quality and healthy products to maintain a strong market presence. Kashi Company (Kellogg Company) and Mars, Incorporated offer a wide range of granola bars, catering to various consumer preferences. Nestle S.A. and Atkins Nutritionals, Inc. focus on brand loyalty and marketing to expand their market share.

Premier Nutrition Corporation and RXBAR (Kellogg Company) prioritize protein-rich and clean label products, attracting fitness enthusiasts. Enjoy Life Foods (Mondelez International, Inc.) uses allergen-free ingredients and innovative marketing strategies to reach niche markets. These companies employ strategies such as product diversification, health-focused innovation, and strategic marketing to strengthen their market positions. Leaders like General Mills and Kellogg Company shape market trends through their popular brands and strong market strategies, driving growth and setting industry standards in the granola bar market.

Market Key Players

- General Mills, Inc.

- Kellogg Company

- Quaker Oats Company (PepsiCo, Inc.)

- Nature Valley (General Mills, Inc.)

- KIND LLC

- Clif Bar & Company

- Nature's Bakery, LLC

- Bob's Red Mill Natural Foods, Inc.

- Kashi Company (Kellogg Company)

- Mars, Incorporated

- Nestle S.A.

- Atkins Nutritionals, Inc.

- Premier Nutrition Corporation

- RXBAR (Kellogg Company)

- Enjoy Life Foods (Mondelez International, Inc.)

Recent Developments

- July 2024: MadeGood, known for its organic and non-GMO snacks, has introduced a new Chocolate Chip Granola Bar. This bar is certified vegan, nut-free, and contains added vegetable extracts like spinach and broccoli, providing a unique nutritional profile. The company aims to target health-conscious consumers looking for convenient and nutritious snack options. The new product is expected to boost MadeGood's sales in the healthy snacks market, contributing to a projected revenue growth of 10% this year.

- May 2024: KIND Snacks has seen substantial growth with its Protein Breakfast Bars, particularly the Blueberry Almond flavor. Each bar contains 8 grams of protein and 5 grams of fiber, making them a balanced option for breakfast or an on-the-go snack. KIND's focus on using whole ingredients and reducing added sugars resonates with health-conscious consumers, driving a 12% increase in year-over-year sales. The company's dedication to transparency and quality continues to strengthen its market position.

-

- 1. Executive Summary

- 1.1. Definition

- 1.2. Taxonomy

- 1.3. Research Scope

- 1.4. Key Analysis

- 1.5. Key Findings by Major Segments

- 1.6. Top strategies by Major Players

- 2. Global Granola Bar Market Overview

- 2.1. Granola Bar Market Dynamics

- 2.1.1. Drivers

- 2.1.2. Opportunities

- 2.1.3. Restraints

- 2.1.4. Challenges

- 2.2. Macro-economic Factors

- 2.3. Regulatory Framework

- 2.4. Market Investment Feasibility Index

- 2.5. PEST Analysis

- 2.6. PORTER’S Five Force Analysis

- 2.7. Drivers & Restraints Impact Analysis

- 2.8. Industry Chain Analysis

- 2.9. Cost Structure Analysis

- 2.10. Marketing Strategy

- 2.11. Russia-Ukraine War Impact Analysis

- 2.12. Opportunity Map Analysis

- 2.13. Market Competition Scenario Analysis

- 2.14. Product Life Cycle Analysis

- 2.15. Opportunity Orbits

- 2.16. Manufacturer Intensity Map

- 2.17. Major Companies sales by Value & Volume

- 2.1. Granola Bar Market Dynamics

- 3. Global Granola Bar Market Analysis, Opportunity and Forecast, 2016-2032

- 3.1. Global Granola Bar Market Analysis, 2016-2021

- 3.2. Global Granola Bar Market Opportunity and Forecast, 2023-2032

- 3.3. Global Granola Bar Market Analysis, Opportunity and Forecast, By Product Type, 2016-2032

- 3.3.1. Global Granola Bar Market Analysis by Product Type: Introduction

- 3.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Product Type, 2016-2032

- 3.3.3. Crunchy Granola Bars

- 3.3.4. Chewy Granola Bars

- 3.3.5. Protein Granola Bars

- 3.3.6. Low-Sugar Granola Bars

- 3.3.7. Gluten-Free Granola Bars

- 3.3.8. Organic Granola Bars

- 3.4. Global Granola Bar Market Analysis, Opportunity and Forecast, By Ingredient, 2016-2032

- 3.4.1. Global Granola Bar Market Analysis by Ingredient: Introduction

- 3.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Ingredient, 2016-2032

- 3.4.3. Nuts and Seeds

- 3.4.4. Fruits

- 3.4.5. Chocolate and Cocoa

- 3.4.6. Oats and Grains

- 3.4.7. Honey and Sweeteners

- 3.4.8. Others

- 3.5. Global Granola Bar Market Analysis, Opportunity and Forecast, By Flavor, 2016-2032

- 3.5.1. Global Granola Bar Market Analysis by Flavor: Introduction

- 3.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Flavor, 2016-2032

- 3.5.3. Chocolate Flavored

- 3.5.4. Nut and Fruit Mix

- 3.5.5. Peanut Butter

- 3.5.6. Berry Flavored

- 3.5.7. Cinnamon

- 3.5.8. Others

- 3.6. Global Granola Bar Market Analysis, Opportunity and Forecast, By Distribution Channel, 2016-2032

- 3.6.1. Global Granola Bar Market Analysis by Distribution Channel: Introduction

- 3.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Distribution Channel, 2016-2032

- 3.6.3. Supermarkets/Hypermarkets

- 3.6.4. Convenience Stores

- 3.6.5. Online Retailers

- 3.6.6. Pharmacies

- 3.6.7. Specialty Stores

- 3.6.8. Department Stores

- 4. North America Granola Bar Market Analysis, Opportunity and Forecast, 2016-2032

- 4.1. North America Granola Bar Market Analysis, 2016-2021

- 4.2. North America Granola Bar Market Opportunity and Forecast, 2023-2032

- 4.3. North America Granola Bar Market Analysis, Opportunity and Forecast, By Product Type, 2016-2032

- 4.3.1. North America Granola Bar Market Analysis by Product Type: Introduction

- 4.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Product Type, 2016-2032

- 4.3.3. Crunchy Granola Bars

- 4.3.4. Chewy Granola Bars

- 4.3.5. Protein Granola Bars

- 4.3.6. Low-Sugar Granola Bars

- 4.3.7. Gluten-Free Granola Bars

- 4.3.8. Organic Granola Bars

- 4.4. North America Granola Bar Market Analysis, Opportunity and Forecast, By Ingredient, 2016-2032

- 4.4.1. North America Granola Bar Market Analysis by Ingredient: Introduction

- 4.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Ingredient, 2016-2032

- 4.4.3. Nuts and Seeds

- 4.4.4. Fruits

- 4.4.5. Chocolate and Cocoa

- 4.4.6. Oats and Grains

- 4.4.7. Honey and Sweeteners

- 4.4.8. Others

- 4.5. North America Granola Bar Market Analysis, Opportunity and Forecast, By Flavor, 2016-2032

- 4.5.1. North America Granola Bar Market Analysis by Flavor: Introduction

- 4.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Flavor, 2016-2032

- 4.5.3. Chocolate Flavored

- 4.5.4. Nut and Fruit Mix

- 4.5.5. Peanut Butter

- 4.5.6. Berry Flavored

- 4.5.7. Cinnamon

- 4.5.8. Others

- 4.6. North America Granola Bar Market Analysis, Opportunity and Forecast, By Distribution Channel, 2016-2032

- 4.6.1. North America Granola Bar Market Analysis by Distribution Channel: Introduction

- 4.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Distribution Channel, 2016-2032

- 4.6.3. Supermarkets/Hypermarkets

- 4.6.4. Convenience Stores

- 4.6.5. Online Retailers

- 4.6.6. Pharmacies

- 4.6.7. Specialty Stores

- 4.6.8. Department Stores

- 4.7. North America Granola Bar Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 4.7.1. North America Granola Bar Market Analysis by Country : Introduction

- 4.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 4.7.2.1. The US

- 4.7.2.2. Canada

- 4.7.2.3. Mexico

- 5. Western Europe Granola Bar Market Analysis, Opportunity and Forecast, 2016-2032

- 5.1. Western Europe Granola Bar Market Analysis, 2016-2021

- 5.2. Western Europe Granola Bar Market Opportunity and Forecast, 2023-2032

- 5.3. Western Europe Granola Bar Market Analysis, Opportunity and Forecast, By Product Type, 2016-2032

- 5.3.1. Western Europe Granola Bar Market Analysis by Product Type: Introduction

- 5.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Product Type, 2016-2032

- 5.3.3. Crunchy Granola Bars

- 5.3.4. Chewy Granola Bars

- 5.3.5. Protein Granola Bars

- 5.3.6. Low-Sugar Granola Bars

- 5.3.7. Gluten-Free Granola Bars

- 5.3.8. Organic Granola Bars

- 5.4. Western Europe Granola Bar Market Analysis, Opportunity and Forecast, By Ingredient, 2016-2032

- 5.4.1. Western Europe Granola Bar Market Analysis by Ingredient: Introduction

- 5.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Ingredient, 2016-2032

- 5.4.3. Nuts and Seeds

- 5.4.4. Fruits

- 5.4.5. Chocolate and Cocoa

- 5.4.6. Oats and Grains

- 5.4.7. Honey and Sweeteners

- 5.4.8. Others

- 5.5. Western Europe Granola Bar Market Analysis, Opportunity and Forecast, By Flavor, 2016-2032

- 5.5.1. Western Europe Granola Bar Market Analysis by Flavor: Introduction

- 5.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Flavor, 2016-2032

- 5.5.3. Chocolate Flavored

- 5.5.4. Nut and Fruit Mix

- 5.5.5. Peanut Butter

- 5.5.6. Berry Flavored

- 5.5.7. Cinnamon

- 5.5.8. Others

- 5.6. Western Europe Granola Bar Market Analysis, Opportunity and Forecast, By Distribution Channel, 2016-2032

- 5.6.1. Western Europe Granola Bar Market Analysis by Distribution Channel: Introduction

- 5.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Distribution Channel, 2016-2032

- 5.6.3. Supermarkets/Hypermarkets

- 5.6.4. Convenience Stores

- 5.6.5. Online Retailers

- 5.6.6. Pharmacies

- 5.6.7. Specialty Stores

- 5.6.8. Department Stores

- 5.7. Western Europe Granola Bar Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 5.7.1. Western Europe Granola Bar Market Analysis by Country : Introduction

- 5.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 5.7.2.1. Germany

- 5.7.2.2. France

- 5.7.2.3. The UK

- 5.7.2.4. Spain

- 5.7.2.5. Italy

- 5.7.2.6. Portugal

- 5.7.2.7. Ireland

- 5.7.2.8. Austria

- 5.7.2.9. Switzerland

- 5.7.2.10. Benelux

- 5.7.2.11. Nordic

- 5.7.2.12. Rest of Western Europe

- 6. Eastern Europe Granola Bar Market Analysis, Opportunity and Forecast, 2016-2032

- 6.1. Eastern Europe Granola Bar Market Analysis, 2016-2021

- 6.2. Eastern Europe Granola Bar Market Opportunity and Forecast, 2023-2032

- 6.3. Eastern Europe Granola Bar Market Analysis, Opportunity and Forecast, By Product Type, 2016-2032

- 6.3.1. Eastern Europe Granola Bar Market Analysis by Product Type: Introduction

- 6.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Product Type, 2016-2032

- 6.3.3. Crunchy Granola Bars

- 6.3.4. Chewy Granola Bars

- 6.3.5. Protein Granola Bars

- 6.3.6. Low-Sugar Granola Bars

- 6.3.7. Gluten-Free Granola Bars

- 6.3.8. Organic Granola Bars

- 6.4. Eastern Europe Granola Bar Market Analysis, Opportunity and Forecast, By Ingredient, 2016-2032

- 6.4.1. Eastern Europe Granola Bar Market Analysis by Ingredient: Introduction

- 6.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Ingredient, 2016-2032

- 6.4.3. Nuts and Seeds

- 6.4.4. Fruits

- 6.4.5. Chocolate and Cocoa

- 6.4.6. Oats and Grains

- 6.4.7. Honey and Sweeteners

- 6.4.8. Others

- 6.5. Eastern Europe Granola Bar Market Analysis, Opportunity and Forecast, By Flavor, 2016-2032

- 6.5.1. Eastern Europe Granola Bar Market Analysis by Flavor: Introduction

- 6.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Flavor, 2016-2032

- 6.5.3. Chocolate Flavored

- 6.5.4. Nut and Fruit Mix

- 6.5.5. Peanut Butter

- 6.5.6. Berry Flavored

- 6.5.7. Cinnamon

- 6.5.8. Others

- 6.6. Eastern Europe Granola Bar Market Analysis, Opportunity and Forecast, By Distribution Channel, 2016-2032

- 6.6.1. Eastern Europe Granola Bar Market Analysis by Distribution Channel: Introduction

- 6.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Distribution Channel, 2016-2032

- 6.6.3. Supermarkets/Hypermarkets

- 6.6.4. Convenience Stores

- 6.6.5. Online Retailers

- 6.6.6. Pharmacies

- 6.6.7. Specialty Stores

- 6.6.8. Department Stores

- 6.7. Eastern Europe Granola Bar Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 6.7.1. Eastern Europe Granola Bar Market Analysis by Country : Introduction

- 6.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 6.7.2.1. Russia

- 6.7.2.2. Poland

- 6.7.2.3. The Czech Republic

- 6.7.2.4. Greece

- 6.7.2.5. Rest of Eastern Europe

- 7. APAC Granola Bar Market Analysis, Opportunity and Forecast, 2016-2032

- 7.1. APAC Granola Bar Market Analysis, 2016-2021

- 7.2. APAC Granola Bar Market Opportunity and Forecast, 2023-2032

- 7.3. APAC Granola Bar Market Analysis, Opportunity and Forecast, By Product Type, 2016-2032

- 7.3.1. APAC Granola Bar Market Analysis by Product Type: Introduction

- 7.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Product Type, 2016-2032

- 7.3.3. Crunchy Granola Bars

- 7.3.4. Chewy Granola Bars

- 7.3.5. Protein Granola Bars

- 7.3.6. Low-Sugar Granola Bars

- 7.3.7. Gluten-Free Granola Bars

- 7.3.8. Organic Granola Bars

- 7.4. APAC Granola Bar Market Analysis, Opportunity and Forecast, By Ingredient, 2016-2032

- 7.4.1. APAC Granola Bar Market Analysis by Ingredient: Introduction

- 7.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Ingredient, 2016-2032

- 7.4.3. Nuts and Seeds

- 7.4.4. Fruits

- 7.4.5. Chocolate and Cocoa

- 7.4.6. Oats and Grains

- 7.4.7. Honey and Sweeteners

- 7.4.8. Others

- 7.5. APAC Granola Bar Market Analysis, Opportunity and Forecast, By Flavor, 2016-2032

- 7.5.1. APAC Granola Bar Market Analysis by Flavor: Introduction

- 7.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Flavor, 2016-2032

- 7.5.3. Chocolate Flavored

- 7.5.4. Nut and Fruit Mix

- 7.5.5. Peanut Butter

- 7.5.6. Berry Flavored

- 7.5.7. Cinnamon

- 7.5.8. Others

- 7.6. APAC Granola Bar Market Analysis, Opportunity and Forecast, By Distribution Channel, 2016-2032

- 7.6.1. APAC Granola Bar Market Analysis by Distribution Channel: Introduction

- 7.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Distribution Channel, 2016-2032

- 7.6.3. Supermarkets/Hypermarkets

- 7.6.4. Convenience Stores

- 7.6.5. Online Retailers

- 7.6.6. Pharmacies

- 7.6.7. Specialty Stores

- 7.6.8. Department Stores

- 7.7. APAC Granola Bar Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 7.7.1. APAC Granola Bar Market Analysis by Country : Introduction

- 7.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 7.7.2.1. China

- 7.7.2.2. Japan

- 7.7.2.3. South Korea

- 7.7.2.4. India

- 7.7.2.5. Australia & New Zeland

- 7.7.2.6. Indonesia

- 7.7.2.7. Malaysia

- 7.7.2.8. Philippines

- 7.7.2.9. Singapore

- 7.7.2.10. Thailand

- 7.7.2.11. Vietnam

- 7.7.2.12. Rest of APAC

- 8. Latin America Granola Bar Market Analysis, Opportunity and Forecast, 2016-2032

- 8.1. Latin America Granola Bar Market Analysis, 2016-2021

- 8.2. Latin America Granola Bar Market Opportunity and Forecast, 2023-2032

- 8.3. Latin America Granola Bar Market Analysis, Opportunity and Forecast, By Product Type, 2016-2032

- 8.3.1. Latin America Granola Bar Market Analysis by Product Type: Introduction

- 8.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Product Type, 2016-2032

- 8.3.3. Crunchy Granola Bars

- 8.3.4. Chewy Granola Bars

- 8.3.5. Protein Granola Bars

- 8.3.6. Low-Sugar Granola Bars

- 8.3.7. Gluten-Free Granola Bars

- 8.3.8. Organic Granola Bars

- 8.4. Latin America Granola Bar Market Analysis, Opportunity and Forecast, By Ingredient, 2016-2032

- 8.4.1. Latin America Granola Bar Market Analysis by Ingredient: Introduction

- 8.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Ingredient, 2016-2032

- 8.4.3. Nuts and Seeds

- 8.4.4. Fruits

- 8.4.5. Chocolate and Cocoa

- 8.4.6. Oats and Grains

- 8.4.7. Honey and Sweeteners

- 8.4.8. Others

- 8.5. Latin America Granola Bar Market Analysis, Opportunity and Forecast, By Flavor, 2016-2032

- 8.5.1. Latin America Granola Bar Market Analysis by Flavor: Introduction

- 8.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Flavor, 2016-2032

- 8.5.3. Chocolate Flavored

- 8.5.4. Nut and Fruit Mix

- 8.5.5. Peanut Butter

- 8.5.6. Berry Flavored

- 8.5.7. Cinnamon

- 8.5.8. Others

- 8.6. Latin America Granola Bar Market Analysis, Opportunity and Forecast, By Distribution Channel, 2016-2032

- 8.6.1. Latin America Granola Bar Market Analysis by Distribution Channel: Introduction

- 8.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Distribution Channel, 2016-2032

- 8.6.3. Supermarkets/Hypermarkets

- 8.6.4. Convenience Stores

- 8.6.5. Online Retailers

- 8.6.6. Pharmacies

- 8.6.7. Specialty Stores

- 8.6.8. Department Stores

- 8.7. Latin America Granola Bar Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 8.7.1. Latin America Granola Bar Market Analysis by Country : Introduction

- 8.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 8.7.2.1. Brazil

- 8.7.2.2. Colombia

- 8.7.2.3. Chile

- 8.7.2.4. Argentina

- 8.7.2.5. Costa Rica

- 8.7.2.6. Rest of Latin America

- 9. Middle East & Africa Granola Bar Market Analysis, Opportunity and Forecast, 2016-2032

- 9.1. Middle East & Africa Granola Bar Market Analysis, 2016-2021

- 9.2. Middle East & Africa Granola Bar Market Opportunity and Forecast, 2023-2032

- 9.3. Middle East & Africa Granola Bar Market Analysis, Opportunity and Forecast, By Product Type, 2016-2032

- 9.3.1. Middle East & Africa Granola Bar Market Analysis by Product Type: Introduction

- 9.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Product Type, 2016-2032

- 9.3.3. Crunchy Granola Bars

- 9.3.4. Chewy Granola Bars

- 9.3.5. Protein Granola Bars

- 9.3.6. Low-Sugar Granola Bars

- 9.3.7. Gluten-Free Granola Bars

- 9.3.8. Organic Granola Bars

- 9.4. Middle East & Africa Granola Bar Market Analysis, Opportunity and Forecast, By Ingredient, 2016-2032

- 9.4.1. Middle East & Africa Granola Bar Market Analysis by Ingredient: Introduction

- 9.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Ingredient, 2016-2032

- 9.4.3. Nuts and Seeds

- 9.4.4. Fruits

- 9.4.5. Chocolate and Cocoa

- 9.4.6. Oats and Grains

- 9.4.7. Honey and Sweeteners

- 9.4.8. Others

- 9.5. Middle East & Africa Granola Bar Market Analysis, Opportunity and Forecast, By Flavor, 2016-2032

- 9.5.1. Middle East & Africa Granola Bar Market Analysis by Flavor: Introduction

- 9.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Flavor, 2016-2032

- 9.5.3. Chocolate Flavored

- 9.5.4. Nut and Fruit Mix

- 9.5.5. Peanut Butter

- 9.5.6. Berry Flavored

- 9.5.7. Cinnamon

- 9.5.8. Others

- 9.6. Middle East & Africa Granola Bar Market Analysis, Opportunity and Forecast, By Distribution Channel, 2016-2032

- 9.6.1. Middle East & Africa Granola Bar Market Analysis by Distribution Channel: Introduction

- 9.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Distribution Channel, 2016-2032

- 9.6.3. Supermarkets/Hypermarkets

- 9.6.4. Convenience Stores

- 9.6.5. Online Retailers

- 9.6.6. Pharmacies

- 9.6.7. Specialty Stores

- 9.6.8. Department Stores

- 9.7. Middle East & Africa Granola Bar Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 9.7.1. Middle East & Africa Granola Bar Market Analysis by Country : Introduction

- 9.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 9.7.2.1. Algeria

- 9.7.2.2. Egypt

- 9.7.2.3. Israel

- 9.7.2.4. Kuwait

- 9.7.2.5. Nigeria

- 9.7.2.6. Saudi Arabia

- 9.7.2.7. South Africa

- 9.7.2.8. Turkey

- 9.7.2.9. The UAE

- 9.7.2.10. Rest of MEA

- 10. Global Granola Bar Market Analysis, Opportunity and Forecast, By Region , 2016-2032

- 10.1. Global Granola Bar Market Analysis by Region : Introduction

- 10.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Region , 2016-2032

- 10.2.1. North America

- 10.2.2. Western Europe

- 10.2.3. Eastern Europe

- 10.2.4. APAC

- 10.2.5. Latin America

- 10.2.6. Middle East & Africa

- 11. Global Granola Bar Market Competitive Landscape, Market Share Analysis, and Company Profiles

- 11.1. Market Share Analysis

- 11.2. Company Profiles

- 11.3. General Mills, Inc.

- 11.3.1. Company Overview

- 11.3.2. Financial Highlights

- 11.3.3. Product Portfolio

- 11.3.4. SWOT Analysis

- 11.3.5. Key Strategies and Developments

- 11.4. Kellogg Company

- 11.4.1. Company Overview

- 11.4.2. Financial Highlights

- 11.4.3. Product Portfolio

- 11.4.4. SWOT Analysis

- 11.4.5. Key Strategies and Developments

- 11.5. Quaker Oats Company (PepsiCo, Inc.)

- 11.5.1. Company Overview

- 11.5.2. Financial Highlights

- 11.5.3. Product Portfolio

- 11.5.4. SWOT Analysis

- 11.5.5. Key Strategies and Developments

- 11.6. Nature Valley (General Mills, Inc.)

- 11.6.1. Company Overview

- 11.6.2. Financial Highlights

- 11.6.3. Product Portfolio

- 11.6.4. SWOT Analysis

- 11.6.5. Key Strategies and Developments

- 11.7. KIND LLC

- 11.7.1. Company Overview

- 11.7.2. Financial Highlights

- 11.7.3. Product Portfolio

- 11.7.4. SWOT Analysis

- 11.7.5. Key Strategies and Developments

- 11.8. Clif Bar & Company

- 11.8.1. Company Overview

- 11.8.2. Financial Highlights

- 11.8.3. Product Portfolio

- 11.8.4. SWOT Analysis

- 11.8.5. Key Strategies and Developments

- 11.9. Nature's Bakery, LLC

- 11.9.1. Company Overview

- 11.9.2. Financial Highlights

- 11.9.3. Product Portfolio

- 11.9.4. SWOT Analysis

- 11.9.5. Key Strategies and Developments

- 11.10. Bob's Red Mill Natural Foods, Inc.

- 11.10.1. Company Overview

- 11.10.2. Financial Highlights

- 11.10.3. Product Portfolio

- 11.10.4. SWOT Analysis

- 11.10.5. Key Strategies and Developments

- 11.11. Kashi Company (Kellogg Company)

- 11.11.1. Company Overview

- 11.11.2. Financial Highlights

- 11.11.3. Product Portfolio

- 11.11.4. SWOT Analysis

- 11.11.5. Key Strategies and Developments

- 11.12. Mars, Incorporated

- 11.12.1. Company Overview

- 11.12.2. Financial Highlights

- 11.12.3. Product Portfolio

- 11.12.4. SWOT Analysis

- 11.12.5. Key Strategies and Developments

- 11.13.1. Company Overview

- 11.13.2. Financial Highlights

- 11.13.3. Product Portfolio

- 11.13.4. SWOT Analysis

- 11.13.5. Key Strategies and Developments

- 11.14. Nestle S.A.

- 11.14.1. Company Overview

- 11.14.2. Financial Highlights

- 11.14.3. Product Portfolio

- 11.14.4. SWOT Analysis

- 11.14.5. Key Strategies and Developments

- 11.15. Premier Nutrition Corporation

- 11.15.1. Company Overview

- 11.15.2. Financial Highlights

- 11.15.3. Product Portfolio

- 11.15.4. SWOT Analysis

- 11.15.5. Key Strategies and Developments

- 11.16. RXBAR (Kellogg Company)

- 11.16.1. Company Overview

- 11.16.2. Financial Highlights

- 11.16.3. Product Portfolio

- 11.16.4. SWOT Analysis

- 11.16.5. Key Strategies and Developments

- 11.17. Enjoy Life Foods (Mondelez International, Inc.)

- 11.17.1. Company Overview

- 11.17.2. Financial Highlights

- 11.17.3. Product Portfolio

- 11.17.4. SWOT Analysis

- 11.17.5. Key Strategies and Developments

- 12. Assumptions and Acronyms

- 13. Research Methodology

- 14. Contact

"

- List of Figures

- "

- Figure 1: Global Granola Bar Market Revenue (US$ Mn) Market Share by Product Type in 2022

- Figure 2: Global Granola Bar Market Attractiveness Analysis by Product Type, 2016-2032

- Figure 3: Global Granola Bar Market Revenue (US$ Mn) Market Share by Ingredientin 2022

- Figure 4: Global Granola Bar Market Attractiveness Analysis by Ingredient, 2016-2032

- Figure 5: Global Granola Bar Market Revenue (US$ Mn) Market Share by Flavorin 2022

- Figure 6: Global Granola Bar Market Attractiveness Analysis by Flavor, 2016-2032

- Figure 7: Global Granola Bar Market Revenue (US$ Mn) Market Share by Distribution Channelin 2022

- Figure 8: Global Granola Bar Market Attractiveness Analysis by Distribution Channel, 2016-2032

- Figure 9: Global Granola Bar Market Revenue (US$ Mn) Market Share by Region in 2022

- Figure 10: Global Granola Bar Market Attractiveness Analysis by Region, 2016-2032

- Figure 11: Global Granola Bar Market Revenue (US$ Mn) (2016-2032)

- Figure 12: Global Granola Bar Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Figure 13: Global Granola Bar Market Revenue (US$ Mn) Comparison by Product Type (2016-2032)

- Figure 14: Global Granola Bar Market Revenue (US$ Mn) Comparison by Ingredient (2016-2032)

- Figure 15: Global Granola Bar Market Revenue (US$ Mn) Comparison by Flavor (2016-2032)

- Figure 16: Global Granola Bar Market Revenue (US$ Mn) Comparison by Distribution Channel (2016-2032)

- Figure 17: Global Granola Bar Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Figure 18: Global Granola Bar Market Y-o-Y Growth Rate Comparison by Product Type (2016-2032)

- Figure 19: Global Granola Bar Market Y-o-Y Growth Rate Comparison by Ingredient (2016-2032)

- Figure 20: Global Granola Bar Market Y-o-Y Growth Rate Comparison by Flavor (2016-2032)

- Figure 21: Global Granola Bar Market Y-o-Y Growth Rate Comparison by Distribution Channel (2016-2032)

- Figure 22: Global Granola Bar Market Share Comparison by Region (2016-2032)

- Figure 23: Global Granola Bar Market Share Comparison by Product Type (2016-2032)

- Figure 24: Global Granola Bar Market Share Comparison by Ingredient (2016-2032)

- Figure 25: Global Granola Bar Market Share Comparison by Flavor (2016-2032)

- Figure 26: Global Granola Bar Market Share Comparison by Distribution Channel (2016-2032)

- Figure 27: North America Granola Bar Market Revenue (US$ Mn) Market Share by Product Typein 2022

- Figure 28: North America Granola Bar Market Attractiveness Analysis by Product Type, 2016-2032

- Figure 29: North America Granola Bar Market Revenue (US$ Mn) Market Share by Ingredientin 2022

- Figure 30: North America Granola Bar Market Attractiveness Analysis by Ingredient, 2016-2032

- Figure 31: North America Granola Bar Market Revenue (US$ Mn) Market Share by Flavorin 2022

- Figure 32: North America Granola Bar Market Attractiveness Analysis by Flavor, 2016-2032

- Figure 33: North America Granola Bar Market Revenue (US$ Mn) Market Share by Distribution Channelin 2022

- Figure 34: North America Granola Bar Market Attractiveness Analysis by Distribution Channel, 2016-2032

- Figure 35: North America Granola Bar Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 36: North America Granola Bar Market Attractiveness Analysis by Country, 2016-2032

- Figure 37: North America Granola Bar Market Revenue (US$ Mn) (2016-2032)

- Figure 38: North America Granola Bar Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 39: North America Granola Bar Market Revenue (US$ Mn) Comparison by Product Type (2016-2032)

- Figure 40: North America Granola Bar Market Revenue (US$ Mn) Comparison by Ingredient (2016-2032)

- Figure 41: North America Granola Bar Market Revenue (US$ Mn) Comparison by Flavor (2016-2032)

- Figure 42: North America Granola Bar Market Revenue (US$ Mn) Comparison by Distribution Channel (2016-2032)

- Figure 43: North America Granola Bar Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 44: North America Granola Bar Market Y-o-Y Growth Rate Comparison by Product Type (2016-2032)

- Figure 45: North America Granola Bar Market Y-o-Y Growth Rate Comparison by Ingredient (2016-2032)

- Figure 46: North America Granola Bar Market Y-o-Y Growth Rate Comparison by Flavor (2016-2032)

- Figure 47: North America Granola Bar Market Y-o-Y Growth Rate Comparison by Distribution Channel (2016-2032)

- Figure 48: North America Granola Bar Market Share Comparison by Country (2016-2032)

- Figure 49: North America Granola Bar Market Share Comparison by Product Type (2016-2032)

- Figure 50: North America Granola Bar Market Share Comparison by Ingredient (2016-2032)

- Figure 51: North America Granola Bar Market Share Comparison by Flavor (2016-2032)

- Figure 52: North America Granola Bar Market Share Comparison by Distribution Channel (2016-2032)

- Figure 53: Western Europe Granola Bar Market Revenue (US$ Mn) Market Share by Product Typein 2022

- Figure 54: Western Europe Granola Bar Market Attractiveness Analysis by Product Type, 2016-2032

- Figure 55: Western Europe Granola Bar Market Revenue (US$ Mn) Market Share by Ingredientin 2022

- Figure 56: Western Europe Granola Bar Market Attractiveness Analysis by Ingredient, 2016-2032

- Figure 57: Western Europe Granola Bar Market Revenue (US$ Mn) Market Share by Flavorin 2022

- Figure 58: Western Europe Granola Bar Market Attractiveness Analysis by Flavor, 2016-2032

- Figure 59: Western Europe Granola Bar Market Revenue (US$ Mn) Market Share by Distribution Channelin 2022

- Figure 60: Western Europe Granola Bar Market Attractiveness Analysis by Distribution Channel, 2016-2032

- Figure 61: Western Europe Granola Bar Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 62: Western Europe Granola Bar Market Attractiveness Analysis by Country, 2016-2032

- Figure 63: Western Europe Granola Bar Market Revenue (US$ Mn) (2016-2032)

- Figure 64: Western Europe Granola Bar Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 65: Western Europe Granola Bar Market Revenue (US$ Mn) Comparison by Product Type (2016-2032)

- Figure 66: Western Europe Granola Bar Market Revenue (US$ Mn) Comparison by Ingredient (2016-2032)

- Figure 67: Western Europe Granola Bar Market Revenue (US$ Mn) Comparison by Flavor (2016-2032)

- Figure 68: Western Europe Granola Bar Market Revenue (US$ Mn) Comparison by Distribution Channel (2016-2032)

- Figure 69: Western Europe Granola Bar Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 70: Western Europe Granola Bar Market Y-o-Y Growth Rate Comparison by Product Type (2016-2032)

- Figure 71: Western Europe Granola Bar Market Y-o-Y Growth Rate Comparison by Ingredient (2016-2032)

- Figure 72: Western Europe Granola Bar Market Y-o-Y Growth Rate Comparison by Flavor (2016-2032)

- Figure 73: Western Europe Granola Bar Market Y-o-Y Growth Rate Comparison by Distribution Channel (2016-2032)

- Figure 74: Western Europe Granola Bar Market Share Comparison by Country (2016-2032)

- Figure 75: Western Europe Granola Bar Market Share Comparison by Product Type (2016-2032)

- Figure 76: Western Europe Granola Bar Market Share Comparison by Ingredient (2016-2032)

- Figure 77: Western Europe Granola Bar Market Share Comparison by Flavor (2016-2032)

- Figure 78: Western Europe Granola Bar Market Share Comparison by Distribution Channel (2016-2032)

- Figure 79: Eastern Europe Granola Bar Market Revenue (US$ Mn) Market Share by Product Typein 2022

- Figure 80: Eastern Europe Granola Bar Market Attractiveness Analysis by Product Type, 2016-2032

- Figure 81: Eastern Europe Granola Bar Market Revenue (US$ Mn) Market Share by Ingredientin 2022

- Figure 82: Eastern Europe Granola Bar Market Attractiveness Analysis by Ingredient, 2016-2032

- Figure 83: Eastern Europe Granola Bar Market Revenue (US$ Mn) Market Share by Flavorin 2022

- Figure 84: Eastern Europe Granola Bar Market Attractiveness Analysis by Flavor, 2016-2032

- Figure 85: Eastern Europe Granola Bar Market Revenue (US$ Mn) Market Share by Distribution Channelin 2022

- Figure 86: Eastern Europe Granola Bar Market Attractiveness Analysis by Distribution Channel, 2016-2032

- Figure 87: Eastern Europe Granola Bar Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 88: Eastern Europe Granola Bar Market Attractiveness Analysis by Country, 2016-2032

- Figure 89: Eastern Europe Granola Bar Market Revenue (US$ Mn) (2016-2032)

- Figure 90: Eastern Europe Granola Bar Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 91: Eastern Europe Granola Bar Market Revenue (US$ Mn) Comparison by Product Type (2016-2032)

- Figure 92: Eastern Europe Granola Bar Market Revenue (US$ Mn) Comparison by Ingredient (2016-2032)

- Figure 93: Eastern Europe Granola Bar Market Revenue (US$ Mn) Comparison by Flavor (2016-2032)

- Figure 94: Eastern Europe Granola Bar Market Revenue (US$ Mn) Comparison by Distribution Channel (2016-2032)

- Figure 95: Eastern Europe Granola Bar Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 96: Eastern Europe Granola Bar Market Y-o-Y Growth Rate Comparison by Product Type (2016-2032)

- Figure 97: Eastern Europe Granola Bar Market Y-o-Y Growth Rate Comparison by Ingredient (2016-2032)

- Figure 98: Eastern Europe Granola Bar Market Y-o-Y Growth Rate Comparison by Flavor (2016-2032)

- Figure 99: Eastern Europe Granola Bar Market Y-o-Y Growth Rate Comparison by Distribution Channel (2016-2032)

- Figure 100: Eastern Europe Granola Bar Market Share Comparison by Country (2016-2032)

- Figure 101: Eastern Europe Granola Bar Market Share Comparison by Product Type (2016-2032)

- Figure 102: Eastern Europe Granola Bar Market Share Comparison by Ingredient (2016-2032)

- Figure 103: Eastern Europe Granola Bar Market Share Comparison by Flavor (2016-2032)

- Figure 104: Eastern Europe Granola Bar Market Share Comparison by Distribution Channel (2016-2032)

- Figure 105: APAC Granola Bar Market Revenue (US$ Mn) Market Share by Product Typein 2022

- Figure 106: APAC Granola Bar Market Attractiveness Analysis by Product Type, 2016-2032

- Figure 107: APAC Granola Bar Market Revenue (US$ Mn) Market Share by Ingredientin 2022

- Figure 108: APAC Granola Bar Market Attractiveness Analysis by Ingredient, 2016-2032

- Figure 109: APAC Granola Bar Market Revenue (US$ Mn) Market Share by Flavorin 2022

- Figure 110: APAC Granola Bar Market Attractiveness Analysis by Flavor, 2016-2032

- Figure 111: APAC Granola Bar Market Revenue (US$ Mn) Market Share by Distribution Channelin 2022

- Figure 112: APAC Granola Bar Market Attractiveness Analysis by Distribution Channel, 2016-2032

- Figure 113: APAC Granola Bar Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 114: APAC Granola Bar Market Attractiveness Analysis by Country, 2016-2032

- Figure 115: APAC Granola Bar Market Revenue (US$ Mn) (2016-2032)

- Figure 116: APAC Granola Bar Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 117: APAC Granola Bar Market Revenue (US$ Mn) Comparison by Product Type (2016-2032)

- Figure 118: APAC Granola Bar Market Revenue (US$ Mn) Comparison by Ingredient (2016-2032)

- Figure 119: APAC Granola Bar Market Revenue (US$ Mn) Comparison by Flavor (2016-2032)

- Figure 120: APAC Granola Bar Market Revenue (US$ Mn) Comparison by Distribution Channel (2016-2032)

- Figure 121: APAC Granola Bar Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 122: APAC Granola Bar Market Y-o-Y Growth Rate Comparison by Product Type (2016-2032)

- Figure 123: APAC Granola Bar Market Y-o-Y Growth Rate Comparison by Ingredient (2016-2032)

- Figure 124: APAC Granola Bar Market Y-o-Y Growth Rate Comparison by Flavor (2016-2032)

- Figure 125: APAC Granola Bar Market Y-o-Y Growth Rate Comparison by Distribution Channel (2016-2032)

- Figure 126: APAC Granola Bar Market Share Comparison by Country (2016-2032)

- Figure 127: APAC Granola Bar Market Share Comparison by Product Type (2016-2032)

- Figure 128: APAC Granola Bar Market Share Comparison by Ingredient (2016-2032)

- Figure 129: APAC Granola Bar Market Share Comparison by Flavor (2016-2032)

- Figure 130: APAC Granola Bar Market Share Comparison by Distribution Channel (2016-2032)

- Figure 131: Latin America Granola Bar Market Revenue (US$ Mn) Market Share by Product Typein 2022

- Figure 132: Latin America Granola Bar Market Attractiveness Analysis by Product Type, 2016-2032

- Figure 133: Latin America Granola Bar Market Revenue (US$ Mn) Market Share by Ingredientin 2022

- Figure 134: Latin America Granola Bar Market Attractiveness Analysis by Ingredient, 2016-2032

- Figure 135: Latin America Granola Bar Market Revenue (US$ Mn) Market Share by Flavorin 2022

- Figure 136: Latin America Granola Bar Market Attractiveness Analysis by Flavor, 2016-2032

- Figure 137: Latin America Granola Bar Market Revenue (US$ Mn) Market Share by Distribution Channelin 2022

- Figure 138: Latin America Granola Bar Market Attractiveness Analysis by Distribution Channel, 2016-2032

- Figure 139: Latin America Granola Bar Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 140: Latin America Granola Bar Market Attractiveness Analysis by Country, 2016-2032

- Figure 141: Latin America Granola Bar Market Revenue (US$ Mn) (2016-2032)

- Figure 142: Latin America Granola Bar Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 143: Latin America Granola Bar Market Revenue (US$ Mn) Comparison by Product Type (2016-2032)

- Figure 144: Latin America Granola Bar Market Revenue (US$ Mn) Comparison by Ingredient (2016-2032)

- Figure 145: Latin America Granola Bar Market Revenue (US$ Mn) Comparison by Flavor (2016-2032)

- Figure 146: Latin America Granola Bar Market Revenue (US$ Mn) Comparison by Distribution Channel (2016-2032)

- Figure 147: Latin America Granola Bar Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 148: Latin America Granola Bar Market Y-o-Y Growth Rate Comparison by Product Type (2016-2032)

- Figure 149: Latin America Granola Bar Market Y-o-Y Growth Rate Comparison by Ingredient (2016-2032)

- Figure 150: Latin America Granola Bar Market Y-o-Y Growth Rate Comparison by Flavor (2016-2032)

- Figure 151: Latin America Granola Bar Market Y-o-Y Growth Rate Comparison by Distribution Channel (2016-2032)

- Figure 152: Latin America Granola Bar Market Share Comparison by Country (2016-2032)

- Figure 153: Latin America Granola Bar Market Share Comparison by Product Type (2016-2032)

- Figure 154: Latin America Granola Bar Market Share Comparison by Ingredient (2016-2032)

- Figure 155: Latin America Granola Bar Market Share Comparison by Flavor (2016-2032)

- Figure 156: Latin America Granola Bar Market Share Comparison by Distribution Channel (2016-2032)

- Figure 157: Middle East & Africa Granola Bar Market Revenue (US$ Mn) Market Share by Product Typein 2022

- Figure 158: Middle East & Africa Granola Bar Market Attractiveness Analysis by Product Type, 2016-2032

- Figure 159: Middle East & Africa Granola Bar Market Revenue (US$ Mn) Market Share by Ingredientin 2022

- Figure 160: Middle East & Africa Granola Bar Market Attractiveness Analysis by Ingredient, 2016-2032

- Figure 161: Middle East & Africa Granola Bar Market Revenue (US$ Mn) Market Share by Flavorin 2022

- Figure 162: Middle East & Africa Granola Bar Market Attractiveness Analysis by Flavor, 2016-2032

- Figure 163: Middle East & Africa Granola Bar Market Revenue (US$ Mn) Market Share by Distribution Channelin 2022

- Figure 164: Middle East & Africa Granola Bar Market Attractiveness Analysis by Distribution Channel, 2016-2032

- Figure 165: Middle East & Africa Granola Bar Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 166: Middle East & Africa Granola Bar Market Attractiveness Analysis by Country, 2016-2032

- Figure 167: Middle East & Africa Granola Bar Market Revenue (US$ Mn) (2016-2032)

- Figure 168: Middle East & Africa Granola Bar Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 169: Middle East & Africa Granola Bar Market Revenue (US$ Mn) Comparison by Product Type (2016-2032)

- Figure 170: Middle East & Africa Granola Bar Market Revenue (US$ Mn) Comparison by Ingredient (2016-2032)

- Figure 171: Middle East & Africa Granola Bar Market Revenue (US$ Mn) Comparison by Flavor (2016-2032)

- Figure 172: Middle East & Africa Granola Bar Market Revenue (US$ Mn) Comparison by Distribution Channel (2016-2032)

- Figure 173: Middle East & Africa Granola Bar Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 174: Middle East & Africa Granola Bar Market Y-o-Y Growth Rate Comparison by Product Type (2016-2032)

- Figure 175: Middle East & Africa Granola Bar Market Y-o-Y Growth Rate Comparison by Ingredient (2016-2032)

- Figure 176: Middle East & Africa Granola Bar Market Y-o-Y Growth Rate Comparison by Flavor (2016-2032)

- Figure 177: Middle East & Africa Granola Bar Market Y-o-Y Growth Rate Comparison by Distribution Channel (2016-2032)

- Figure 178: Middle East & Africa Granola Bar Market Share Comparison by Country (2016-2032)

- Figure 179: Middle East & Africa Granola Bar Market Share Comparison by Product Type (2016-2032)

- Figure 180: Middle East & Africa Granola Bar Market Share Comparison by Ingredient (2016-2032)

- Figure 181: Middle East & Africa Granola Bar Market Share Comparison by Flavor (2016-2032)

- Figure 182: Middle East & Africa Granola Bar Market Share Comparison by Distribution Channel (2016-2032)

"

- List of Tables

- "

- Table 1: Global Granola Bar Market Comparison by Product Type (2016-2032)

- Table 2: Global Granola Bar Market Comparison by Ingredient (2016-2032)

- Table 3: Global Granola Bar Market Comparison by Flavor (2016-2032)

- Table 4: Global Granola Bar Market Comparison by Distribution Channel (2016-2032)

- Table 5: Global Granola Bar Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 6: Global Granola Bar Market Revenue (US$ Mn) (2016-2032)

- Table 7: Global Granola Bar Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 8: Global Granola Bar Market Revenue (US$ Mn) Comparison by Product Type (2016-2032)

- Table 9: Global Granola Bar Market Revenue (US$ Mn) Comparison by Ingredient (2016-2032)

- Table 10: Global Granola Bar Market Revenue (US$ Mn) Comparison by Flavor (2016-2032)

- Table 11: Global Granola Bar Market Revenue (US$ Mn) Comparison by Distribution Channel (2016-2032)

- Table 12: Global Granola Bar Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Table 13: Global Granola Bar Market Y-o-Y Growth Rate Comparison by Product Type (2016-2032)

- Table 14: Global Granola Bar Market Y-o-Y Growth Rate Comparison by Ingredient (2016-2032)

- Table 15: Global Granola Bar Market Y-o-Y Growth Rate Comparison by Flavor (2016-2032)

- Table 16: Global Granola Bar Market Y-o-Y Growth Rate Comparison by Distribution Channel (2016-2032)

- Table 17: Global Granola Bar Market Share Comparison by Region (2016-2032)

- Table 18: Global Granola Bar Market Share Comparison by Product Type (2016-2032)

- Table 19: Global Granola Bar Market Share Comparison by Ingredient (2016-2032)

- Table 20: Global Granola Bar Market Share Comparison by Flavor (2016-2032)

- Table 21: Global Granola Bar Market Share Comparison by Distribution Channel (2016-2032)

- Table 22: North America Granola Bar Market Comparison by Ingredient (2016-2032)

- Table 23: North America Granola Bar Market Comparison by Flavor (2016-2032)

- Table 24: North America Granola Bar Market Comparison by Distribution Channel (2016-2032)

- Table 25: North America Granola Bar Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 26: North America Granola Bar Market Revenue (US$ Mn) (2016-2032)

- Table 27: North America Granola Bar Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 28: North America Granola Bar Market Revenue (US$ Mn) Comparison by Product Type (2016-2032)

- Table 29: North America Granola Bar Market Revenue (US$ Mn) Comparison by Ingredient (2016-2032)

- Table 30: North America Granola Bar Market Revenue (US$ Mn) Comparison by Flavor (2016-2032)

- Table 31: North America Granola Bar Market Revenue (US$ Mn) Comparison by Distribution Channel (2016-2032)

- Table 32: North America Granola Bar Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 33: North America Granola Bar Market Y-o-Y Growth Rate Comparison by Product Type (2016-2032)

- Table 34: North America Granola Bar Market Y-o-Y Growth Rate Comparison by Ingredient (2016-2032)

- Table 35: North America Granola Bar Market Y-o-Y Growth Rate Comparison by Flavor (2016-2032)

- Table 36: North America Granola Bar Market Y-o-Y Growth Rate Comparison by Distribution Channel (2016-2032)

- Table 37: North America Granola Bar Market Share Comparison by Country (2016-2032)

- Table 38: North America Granola Bar Market Share Comparison by Product Type (2016-2032)

- Table 39: North America Granola Bar Market Share Comparison by Ingredient (2016-2032)

- Table 40: North America Granola Bar Market Share Comparison by Flavor (2016-2032)

- Table 41: North America Granola Bar Market Share Comparison by Distribution Channel (2016-2032)

- Table 42: Western Europe Granola Bar Market Comparison by Product Type (2016-2032)

- Table 43: Western Europe Granola Bar Market Comparison by Ingredient (2016-2032)

- Table 44: Western Europe Granola Bar Market Comparison by Flavor (2016-2032)

- Table 45: Western Europe Granola Bar Market Comparison by Distribution Channel (2016-2032)

- Table 46: Western Europe Granola Bar Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 47: Western Europe Granola Bar Market Revenue (US$ Mn) (2016-2032)

- Table 48: Western Europe Granola Bar Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 49: Western Europe Granola Bar Market Revenue (US$ Mn) Comparison by Product Type (2016-2032)

- Table 50: Western Europe Granola Bar Market Revenue (US$ Mn) Comparison by Ingredient (2016-2032)

- Table 51: Western Europe Granola Bar Market Revenue (US$ Mn) Comparison by Flavor (2016-2032)

- Table 52: Western Europe Granola Bar Market Revenue (US$ Mn) Comparison by Distribution Channel (2016-2032)

- Table 53: Western Europe Granola Bar Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 54: Western Europe Granola Bar Market Y-o-Y Growth Rate Comparison by Product Type (2016-2032)

- Table 55: Western Europe Granola Bar Market Y-o-Y Growth Rate Comparison by Ingredient (2016-2032)

- Table 56: Western Europe Granola Bar Market Y-o-Y Growth Rate Comparison by Flavor (2016-2032)

- Table 57: Western Europe Granola Bar Market Y-o-Y Growth Rate Comparison by Distribution Channel (2016-2032)

- Table 58: Western Europe Granola Bar Market Share Comparison by Country (2016-2032)

- Table 59: Western Europe Granola Bar Market Share Comparison by Product Type (2016-2032)

- Table 60: Western Europe Granola Bar Market Share Comparison by Ingredient (2016-2032)

- Table 61: Western Europe Granola Bar Market Share Comparison by Flavor (2016-2032)

- Table 62: Western Europe Granola Bar Market Share Comparison by Distribution Channel (2016-2032)

- Table 63: Eastern Europe Granola Bar Market Comparison by Product Type (2016-2032)

- Table 64: Eastern Europe Granola Bar Market Comparison by Ingredient (2016-2032)

- Table 65: Eastern Europe Granola Bar Market Comparison by Flavor (2016-2032)

- Table 66: Eastern Europe Granola Bar Market Comparison by Distribution Channel (2016-2032)