Healthy Snacks Market By Product Type (Cereal & granola bars, Nuts & seeds snacks, Meat snacks), By Distribution Channel (Supermarkets, Hypermarkets, Retail Stores, Online Channels), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

5025

-

Oct 2023

-

157

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

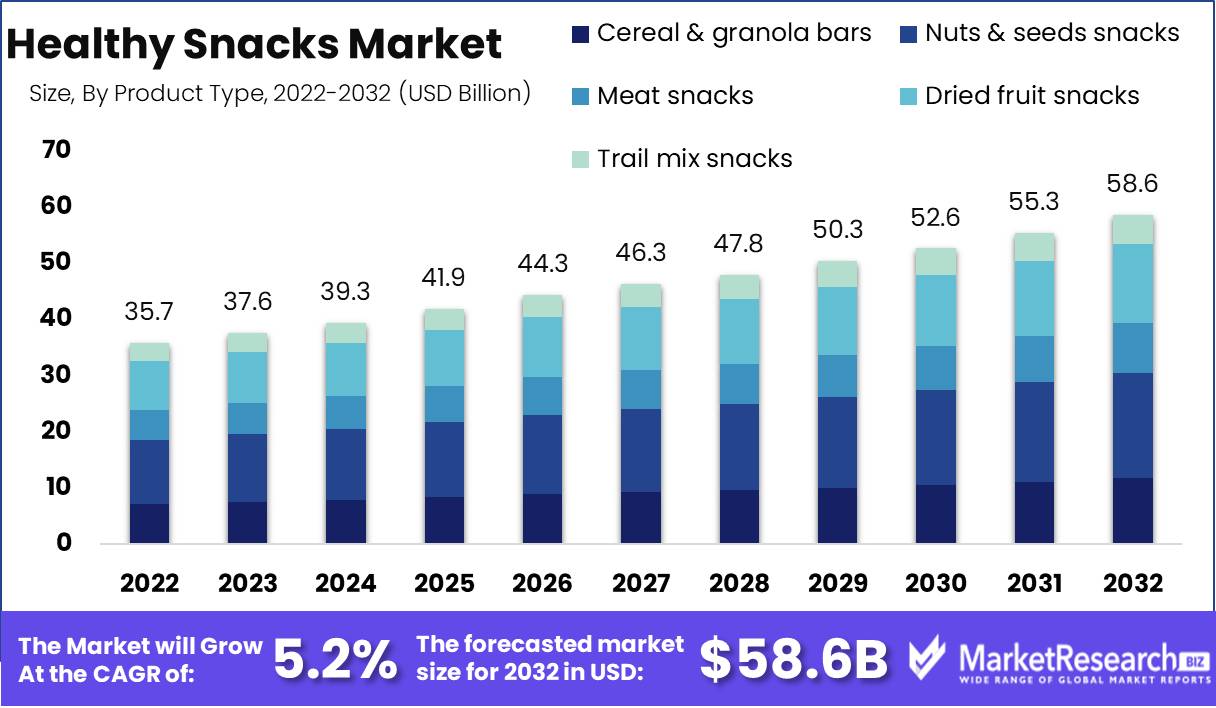

Healthy Snacks Market size is expected to be worth around USD 58.6 Bn by 2032 from USD 35.7 Bn in 2022, growing at a CAGR of 5.2% during the forecast period from 2023 to 2032.

Healthy snacks play an integral role in supporting overall well-being by offering nutrition-packed alternatives to traditional, often less nutritious snack options. They meet increasing consumer demands for mindful eating habits that support their health and dietary goals, and recent trends within the snack industry suggest an increasing commitment to providing healthier snack choices to consumers.

In September 2023, Nestle made an important announcement regarding their investment in healthier products, specifically revamping its confectionery portfolio, to meet rising consumer demands for healthier snack choices. By reinventing confectionery items with health-minded ingredients and formulations, this move shows its dedication to changing consumer tastes while encouraging healthier snacking habits.

In July 2023, 2FIT BRANDS expanded its presence in the healthy snack market by increasing its vegan protein bars and bites line at Common Market Co-Op - part of a nationwide marketing push demonstrating their dedication to providing plant-based proteins as snack options and meeting rising veganism demand with convenient, nutritional snacking solutions.

In January 2023, RXBAR unveiled their Protein-Packed Granola with three delectable flavors - Original, Peanut Butter, and Chocolate - all packed with 10g of protein each, strengthening their commitment to providing nutritious snacks while on the go for health-conscious consumers looking for both taste and nutritional balance.

As consumers prioritize their well-being, snack markets have evolved to meet this growing need with innovative, nutritious, and delectable choices that make healthy snacking accessible and enjoyable - whether that means updating traditional products, increasing plant-based offerings, or increasing protein content; all areas of this revolution.

Driving factors

Increasing Health Awareness

As health awareness spreads like wildfire, the healthy snacks market embarks on a voyage of transformation. Increasing consumer awareness of the effects of their dietary decisions has led to a surge in demand for natural and organic snacks. As individuals place a greater emphasis on their health, they seek out healthier alternatives to traditional snacks, thereby aligning their consumption patterns with their values. The market responds by providing a variety of natural and organic options with tantalizing flavors and beneficial ingredients to satisfy the discriminating tastes of health-conscious consumers.

The Growth of Vegetable-Based Snacks

The modern, hectic lifestyle has ushered in a new era of on-the-go nibbling. To satisfy the requirements of active individuals, plant-based snacks have become increasingly popular. These snacks offer convenience without sacrificing nutritional value. With their portability and nutritional value, plant-based snacks have become the snack of choice for those on the go. Whether it's plant-based protein bars, vegetable snacks, or fruit pouches, the market offers a wide variety of plant-based treats to meet the ever-changing needs of consumers.

Low-calorie and low-fat foods

In the Healthy Snacks Market, the pursuit of wellness fuels the demand for low-calorie and low-fat snacks. Health-conscious consumers search for snacks that align with their nutritional objectives in order to maintain a balanced diet. Low-calorie and low-fat options not only meet their dietary requirements but also allow them to indulge without remorse. From air-popped popcorn to baked vegetable crackers, the market offers an abundance of scrumptious options that satiate cravings while promoting healthy lifestyle choices.

Gluten-Free and Non-GMO Snacks

Gluten-free and non-GMO snacks are on the rise in the Healthy Snacks Market as a result of the prominence of transparency and conscious consumption. Consumers are becoming more discriminating, scrutinizing ingredient labels and selecting snacks that satisfy their dietary needs. Gluten-free snack options are available for those with gluten sensitivities or celiac disease, whereas non-GMO snacks provide assurance regarding the absence of genetically modified organisms. The market responds to these demands by providing consumers with a vast selection of gluten-free snacks and non-GMO snacks that they can enjoy with confidence. Chia seeds have become a staple in the healthy snacks category, providing a convenient and versatile ingredient for a variety of nutrient-packed snacks.

Accessibility and Growth

The Healthy Snacks Market thrives as a result of its availability through numerous retail channels. From supermarkets to specialty stores to online marketplaces and health food stores, healthy snacks have permeated the entire retail landscape. This extensive availability ensures that consumers can readily locate and enjoy their favorite snacks. The proliferation of retail channels has democratized access to healthy snacking alternatives, making it easier for people from all aspects of life to begin their wellness journey. Healthy Snacks Market, Fruit snacks offers a delicious, nutritious option, blending natural sweetness with essential vitamins for health-conscious consumers.

Restraining Factors

Traditional snacks and Healthy snacks

The high price of healthy snacks in comparison to traditional snacks is one of the largest factors inhibiting the development of the healthy snack market. Healthy snacks are frequently positioned as premium products, resulting in higher prices than traditional snacks. Despite the fact that consumers recognize the value of healthy snacks, they are frequently deterred by the high price, which limits their consumption.

Refreshment Options

A further factor inhibiting the expansion of the healthy refreshment market is the limited availability of healthy snack options in certain regions. Typically, healthy refreshment products are marketed to urban populations, which have a greater awareness of health and wellness. However, the availability of healthy refreshment options is limited in rural and remote areas. This restricts the availability of healthy refreshment brands and, consequently, their growth potential.

Shelf life and High Perishability

Some healthy snack products' brief shelf life and high rate of perishability an additional major factors restraining the market's expansion. Typically, healthy nibble foods are composed of natural ingredients and lack preservatives, making them susceptible to deterioration. This decreases the distribution and marketing potential of healthy snacks by reducing their shelf life.

Brands of Healthy Snacks

A further factor inhibiting the expansion of the healthy snack market is the limited consumer awareness of certain healthy snack brands. On the market, there are numerous brands of healthy snacks, but many of them have limited marketing budgets. As a consequence, many consumers are unaware of the availability of healthy snack brands and their benefits. This hinders their growth and adoption potential.

Conventional Refreshment Brands and Products

Traditional food products and brands pose a substantial barrier to the expansion of the healthy refreshment market. Traditional snack products have become the go-to option for fast and convenient nibbling. Consumers are often reluctant to test new products, including healthy snacks, because they are loyal to established brands. This restricts the market penetration of healthy refreshment brands and consequently their expansion.

Type Analysis

The basis of product nuts and seeds snacks segment dominates the healthy snacks market, holding the largest market share. This segment is comprised of various types of nuts and seeds such as almonds, walnuts, cashews, sunflower seeds, pumpkin seeds, and others. Nuts and seeds are considered healthy snack options due to their high nutritional value, as they are a good source of protein, fiber, and healthy fats.

Consumers are increasingly turning to nuts and seeds as a healthier snack option. With the rise of health and wellness industry trends, more people are becoming aware of the nutritional benefits of these types of snacks. Additionally, the convenience of pre-packaged and pre-portioned nut and seed products makes them a popular choice for busy individuals looking for a healthy snack on the go. The nuts and seeds segment in the healthy snacks market is anticipated to register the fastest industry growth rate over the forthcoming years.

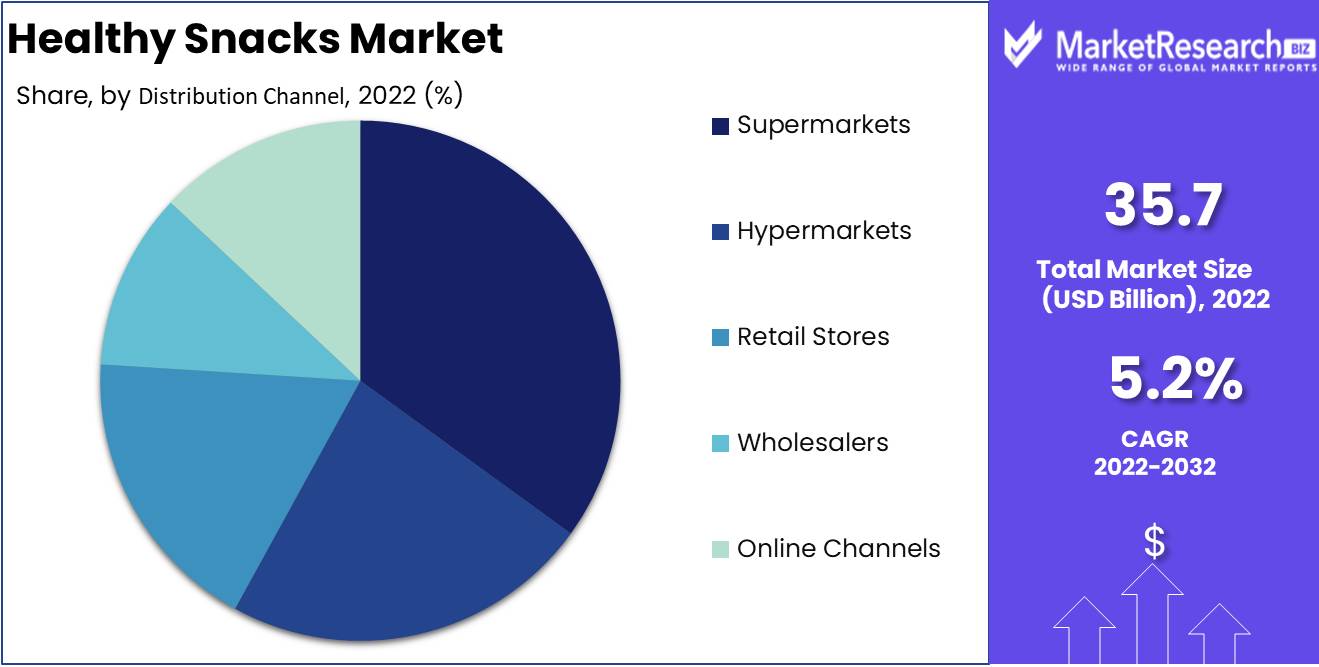

Distribution Channel Analysis

The supermarket segment dominates the healthy snacks market. These types of retail channels offer a wide variety of healthy snacks, including nuts and seeds, in a convenient and accessible way. Additionally, the ability for customers to compare prices and choose from different brands all in one location makes these channels popular among consumers. The healthy snacks market is witnessing industry growth driven by an increase in demand. Supermarkets play a pivotal role in meeting this demand, adjusting their rates and distribution networks to cater to evolving daily schedules and industry trends.

Consumers are increasingly turning to supermarkets as a source of healthy snacks industry. The convenience of being able to purchase healthy snacks alongside other grocery items makes this a popular choice for busy individuals. Additionally, the variety of options available in these channels allows consumers to find the specific healthy snack they are looking for. The supermarket's key segment in the healthy snacks market is anticipated to register the fastest growth rate over the forthcoming years.

The supermarket holds a leading segment within the healthy snacks market, with a broad segment scope encompassing diverse consumer preferences.

Key Market Segments

By Product Type

- Cereal & granola bars

- Nuts & seeds snacks

- Meat snacks

- Dried fruit snacks

- Trail mix snacks

By Distribution Channel

- Supermarkets

- Hypermarkets

- Retail Stores

- Wholesalers

- Online Channels

Growth Opportunity

Expansion into new markets

Companies are seeking to expand into new markets and regions in order to satisfy the increasing demand for healthy snacks. For instance, the Healthy Snacks Market growth in Asia-Pacific is anticipated to develop at a significant rate over the forecast period due to consumers' increasing awareness of healthy lifestyles and high disposable income. This presents the ideal opportunity for businesses to expand their operations in the region, increase brand recognition, and capture a substantial market share. The market demand for nutritious snacks in the food industry, driven by raw materials, fuels the rapid market growth rate of healthy snacks

Introducing Novel and Inventive Products

Healthy Snacks Market is extremely competitive, and businesses must differentiate themselves by introducing new and innovative products. Research and development must be prioritized in order to remain ahead of the competition. This can be accomplished through the creation of products that appeal to specific consumer requirements, such as low-sugar or vegan snacks. Companies can expand their consumer base and increase brand loyalty with the aid of new products, resulting in increased sales and revenue.

Collaborations and Alliances

Collaborations and partnerships with other brands are a great method for businesses to increase their market share and expand their reach. For instance, a healthy food brand could form a partnership with a gym or fitness center in order to market its products to gym-goers. Both brands can increase their sales and attract new consumers by leveraging each other's customer bases. Partnerships can also result in cross-promotional opportunities and marketing campaigns, which can increase brand recognition and revenue.

Online Sales and Distribution

As e-commerce continues to expand, businesses must maintain a robust online presence in order to remain competitive. Online distribution and sales are essential for reaching a larger audience, particularly in regions without physical storefronts. Companies must invest in their online platforms and create user-friendly websites and mobile applications that streamline the purchasing process. In addition, businesses must optimize their online presence for search engines in order to increase website visibility and traffic.

Functional snacks and individualized nutrition

Consumers are becoming increasingly cognizant of the nutritional value of the snacks they eat. This trend has increased the demand for functional snacks that provide particular health benefits. Due to their high nutrient content, snacks containing superfoods such as chia seeds, goji berries, and quinoa are gaining in popularity. Companies must develop products that address these specific dietary requirements and offer personalized nutrition options. This can be accomplished by providing refreshment packs or meal plans that are tailored to specific dietary needs.

Latest Trends

Durability and Environmental Friendliness

Consumers are becoming more conscientious of the sustainability and eco-friendliness of the products they purchase as concern about the environmental impact of food production and packaging increases. In response, manufacturers of Healthy Snacks are increasingly employing eco-friendly and sustainable packaging materials and implementing sustainable manufacturing practices. In addition to pursuing healthier options, consumers are also seeking those that align with their personal values and beliefs.

Snacks with Additional Health Benefits

Consumers are transitioning away from traditional snacks with little nutritional value in favor of snacks with additional health benefits. The demand for functional snacks, such as those containing added vitamins, minerals, and protein, is increasing as consumers actively seek out snacks that can promote health and wellness. Healthy Snack manufacturers are responding to this expanding demand by introducing new and innovative products.

Innovative and Novel Ingredients

Manufacturers of the Healthy Snacks industry are integrating novel and innovative ingredients to create distinctive and appetizing refreshment products. Some of the most recent refreshment products, for instance, include exotic fruits, ancient cereals, and superfoods, all of which provide distinct nutritional benefits. By developing products with novel and enticing flavor profiles, manufacturers of Healthy Snacks can distinguish themselves from the competition. Savory snacks stand out in the booming healthy snacks market. The snacking industry experiences robust annual growth, with a major share of the market fueled by the rising demand for snacks as an alternative to dinner. In the thriving Healthy Snacks Market, coconut products are also gaining immense popularity, offering a delicious and nutritious alternative to traditional snacks.

Transparent Ingredient Sourcing and Labeling

Consumers are paying greater attention to the constituents in their food and beverages demanding transparency regarding the sourcing and manufacturing of food products. In response, manufacturers of Healthy Snacks are implementing more transparent labeling practices that identify all ingredients used in their products in a plain manner. By supplying this information, manufacturers can establish credibility with consumers who wish to make informed decisions about the foods they eat.

Snacking as a Meal Substitute

As consumers embrace a more flexible approach to dining, the practice of substituting snacks for meals is gaining popularity. Convenient and healthy refreshment options that can replace traditional meals on the go are in high demand from consumers. Manufacturers of healthy snacks are responding to this expanding demand by introducing nutritionally dense products such as meal replacement bars and protein drinks.

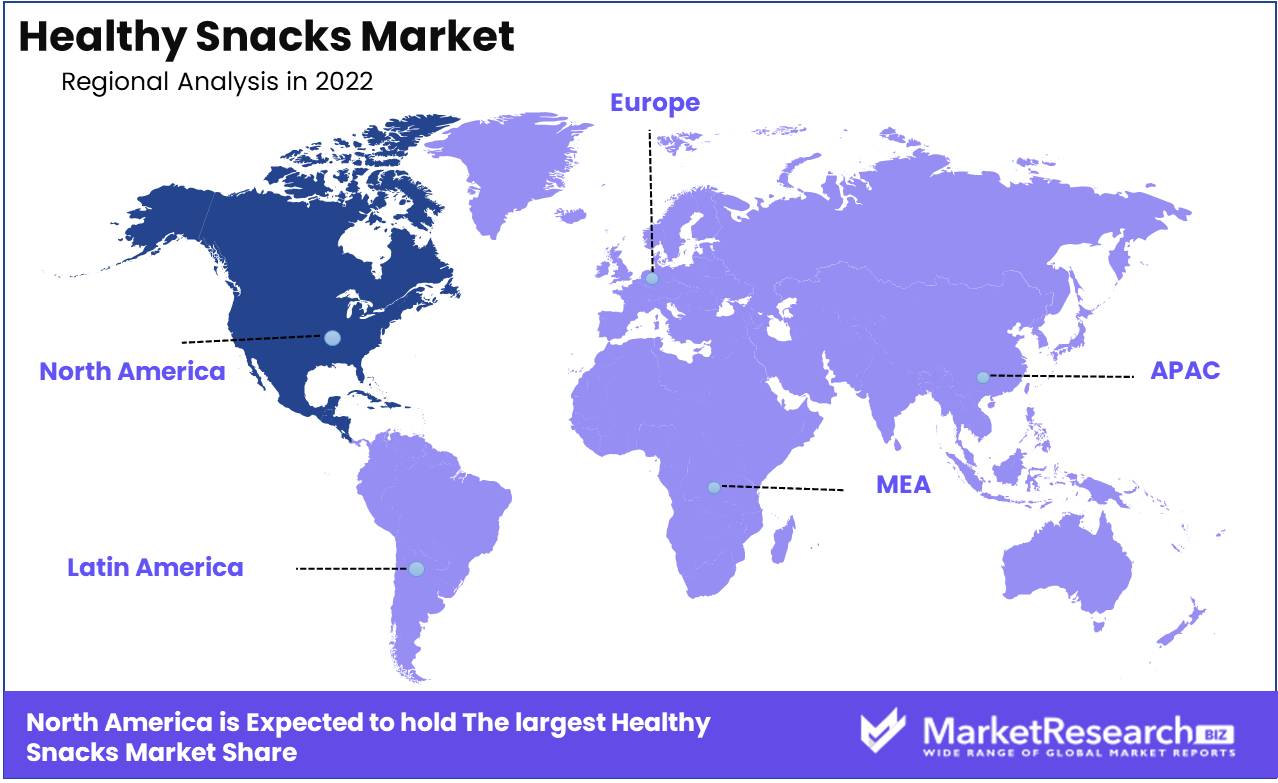

Regional Analysis

In North America, the Healthy Snacks Market has experienced a meteoric rise due to an increase in health awareness and a shift in dietary preferences. The increasing demand for nutritious and tasty snacks has resulted in the availability of a vast array of products that appeal to all dietary restrictions and preferences. This report provides a comprehensive overview of the Healthy Snacks Market in North America, analyzing the reasons for its growth and the various key factors that contribute to its success. North America region is anticipated to become the fastest-growing market in the global industry over the forecast period.

Approximately 39% of the global market share for healthy snacks is held by North America. The region's dominance can be attributed to the population's high health awareness, with more individuals adopting healthier lifestyles and diets. A variety of healthful refreshment options have been introduced to the market in response to consumer demand. Gluten-free products, and vegan, and keto-friendly snacks are available to accommodate all dietary restrictions.

Healthy Snacks Market in North America is extremely competitive, with many established companies and new entrants contending for market share. The brands at the forefront of this trend are focused on innovation, manufacturing distinctive products with functional benefits while still catering to consumer preferences.

As the Healthy Snacks Market in North America continues to expand, there are a number of emerging trends to keep an eye on. Alternative refreshment options, such as insect-based and plant-based snacks, are on the rise. As a sustainable and environmentally favorable alternative to traditional snack options, these products are acquiring popularity.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Healthy Snacks Market is a rapidly expanding industry, propelled primarily by the rising demand for healthy and convenient food options. Several major player participants vie for market share in a highly competitive market. These key companies have been at the forefront of innovation, investing significantly in R&D to create innovative products that meet the requirements of health-conscious consumers.

Nestle is a major participant in the healthy snacks industry. The company's Nestle Health Science division offers a variety of healthy snack options, including health bars, drink mixtures, and nutritional supplements. PepsiCo, Kellogg, and Mondelez International are three additional market leaders with a significant presence in the refreshment segment.

The transition toward plant-based snacks is one of the market's most influential trends. Several major companies have introduced plant-based snacks to meet the rising demand for vegan and natural food alternatives. PepsiCo has introduced a selection of plant-based snacks, and Mondelez International offers plant-based options under the Enjoy Life Foods brand.

Increasing emphasis on eco-friendly packaging is another significant market development. Several major key players have introduced biodegradable or recyclable packaging for their products in response to the rising demand for eco-friendly alternatives. Kellogg has introduced a variety of snack bars with compostable packaging, and Nestle has pledged to make all of its packaging recyclable or reusable by 2025. There are some major key market players are as follows:

Top Key Players in Healthy Snacks Market

- General Mills, Inc.

- Mondelez International, Inc.

- PepsiCo Foods

- Hormel Foods Corporation

- Kind LLC

- Tyson Foods Inc

- Select Harvests Ltd

- Nestlé S.A.

- B&G Foods Inc.

- Hain Celestial Group, Inc.

- Danone S.A.

- Kraft Heinz Company

- Kellogg Company

Recent Development

- In September 2023, Nestlé announced a significant investment in healthier product ranges, with a focus on enhancing its confectionery portfolio to align with producing better-for-you options across its entire product lineup. This move reflects a long-term commitment to meeting consumer demand for healthier snacking choices.

- In July 2023, 2FIT BRANDS expanded its product line of vegan protein bars and Vegan Protein Bites into Common Market Co-Op, a specialty grocery store known for offering conscientious and affordable products catering to various diets and lifestyles. This strategic move marks the beginning of a major marketing push by 2FIT to increase brand awareness and expand its presence in retail stores across the country.

- In January 2023, RXBAR introduced a brand-new Granola line with three yummy flavors: Original, Peanut Butter, and Chocolate. These granolas are made with good, real ingredients and each serving has a strong 10g of protein. This shows RXBAR's strong dedication to simple and genuine snacks.

Report Scope

Report Features Description Market Value (2022) USD 35.7 Bn Forecast Revenue (2032) USD 58.6 Bn CAGR (2023-2032) 5.2% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Cereal & granola bars, Nuts & seeds snacks, Meat snacks, Dried fruit snacks, Trail mix snacks)

By Distribution Channel (Supermarkets, Hypermarkets, Retail Stores, Wholesalers, Online Channels)Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape General Mills, Inc., Mondelez International, Inc., PepsiCo Foods, Hormel Foods Corporation, Kind LLC, Tyson Foods Inc., Select Harvests Ltd, Nestlé S.A., B&G Foods Inc., Hain Celestial Group, Inc., Kraft Heinz Company, Kellogg Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- General Mills, Inc.

- Mondelez International, Inc.

- PepsiCo Foods

- Hormel Foods Corporation

- Kind LLC

- Tyson Foods Inc

- Select Harvests Ltd

- Nestlé S.A.

- B&G Foods Inc.

- Hain Celestial Group, Inc.

- Danone S.A.

- Kraft Heinz Company

- Kellogg Company