Protein Snacks Market By Type (Protein Bars & Balls, Protein Drinks, Breakfast Cereals, Bakery Snacks, Processed Meat Snacks, Others), By Source (Animal-Based, Plant-Based, By Distribution Channel (E-Commerce, Supermarkets & Hypermarkets, Specialty Stores, Retail Stores, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

46065

-

April 2024

-

136

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

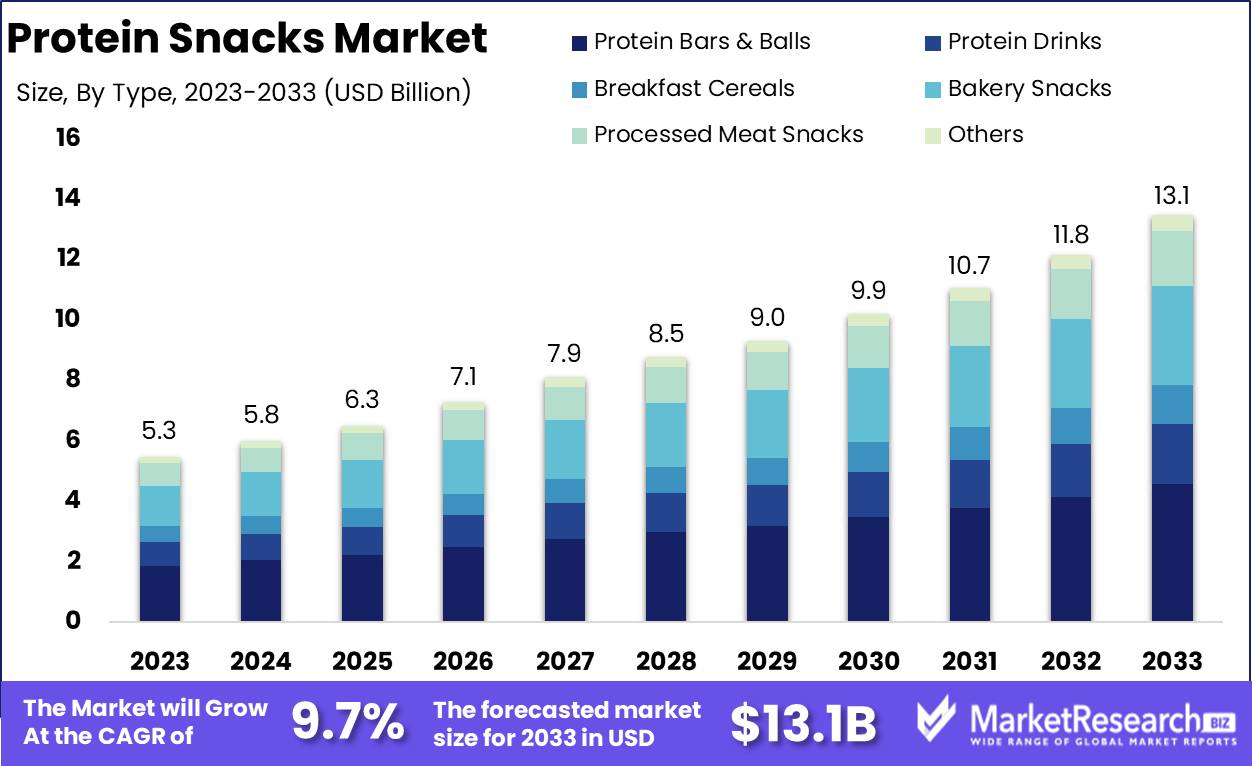

The Global Protein Snacks Market was valued at USD 5.3 Bn in 2023. It is expected to reach USD 13.1 Bn by 2033, with a CAGR of 9.7% during the forecast period from 2024 to 2033.

The Protein Snacks Market refers to the burgeoning sector within the food industry dedicated to offering convenient, protein-rich snack options to consumers. These snacks cater to health-conscious individuals seeking convenient and nutritious alternatives to traditional snacks. With a focus on protein content, these products often include a variety of ingredients such as nuts, seeds, legumes, and meat alternatives. The market encompasses a wide range of products, including protein bars, jerky, protein chips, and ready-to-eat protein snacks. As consumers increasingly prioritize health and wellness, the Protein Snacks Market continues to experience significant growth and innovation, presenting opportunities for brands to meet evolving consumer demands.

The Protein Snacks Market continues to exhibit robust growth, propelled by evolving consumer preferences towards healthier snacking options and the increasing emphasis on fitness and nutrition. The market has witnessed notable developments, with prominent players strategically positioning themselves to capitalize on emerging trends and consumer demands.

Quest Protein Bars, renowned for their high protein content of 20-21 grams per bar, exemplify the market's focus on protein-rich offerings. This underscores the growing recognition among consumers for convenient, on-the-go protein sources, aligning with lifestyle choices geared towards wellness and fitness.

Moreover, Cottage Cheese emerges as another significant contender within the protein snacks segment, offering approximately 14 grams of protein per 1/2 cup serving. Its versatility and nutritional profile make it an appealing option for health-conscious consumers seeking satiating snacks with substantial protein content.

In a notable development, General Mills' acquisition of Epic Provisions further underscores the market's dynamism. The acquisition, valued at $100 million, reflects a strategic move by General Mills to diversify its product portfolio and cater to the escalating demand for meat-based snacks crafted from premium, natural ingredients. This strategic maneuver not only expands General Mills' market presence but also highlights the increasing convergence of health, sustainability, and indulgence within the protein snacks landscape.

Key Takeaways

- Market Growth: The Global Protein Snacks Market was valued at USD 5.3 Bn in 2023. It is expected to reach USD 13.1 Bn by 2033, with a CAGR of 9.7% during the forecast period from 2024 to 2033.

- By Type: Protein Bars & Balls leading the market, capturing approximately 35% of the market share.

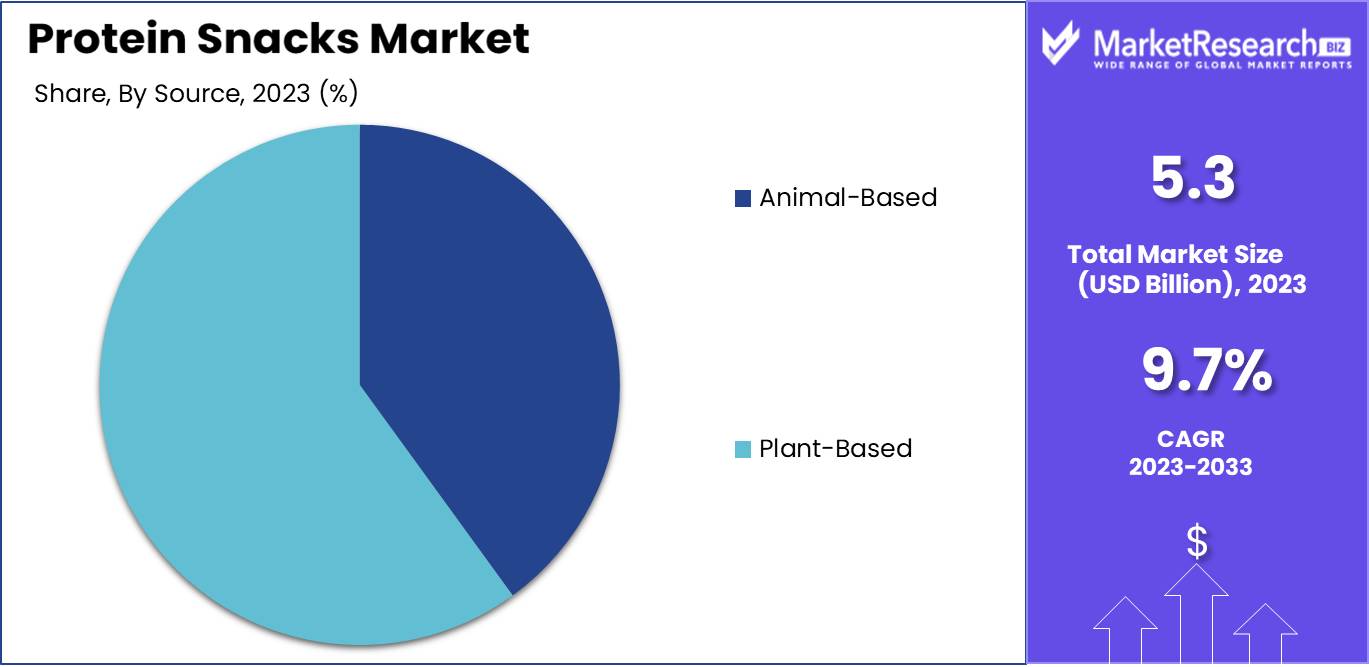

- By Source: Plant-Based protein snacks emerge as the dominant force, constituting approximately 60% of the market share.

- By Distribution Channel: E-Commerce stands out as the dominating factor, accounting for approximately 40% of the market share, providing convenient access to protein snacks for consumers.

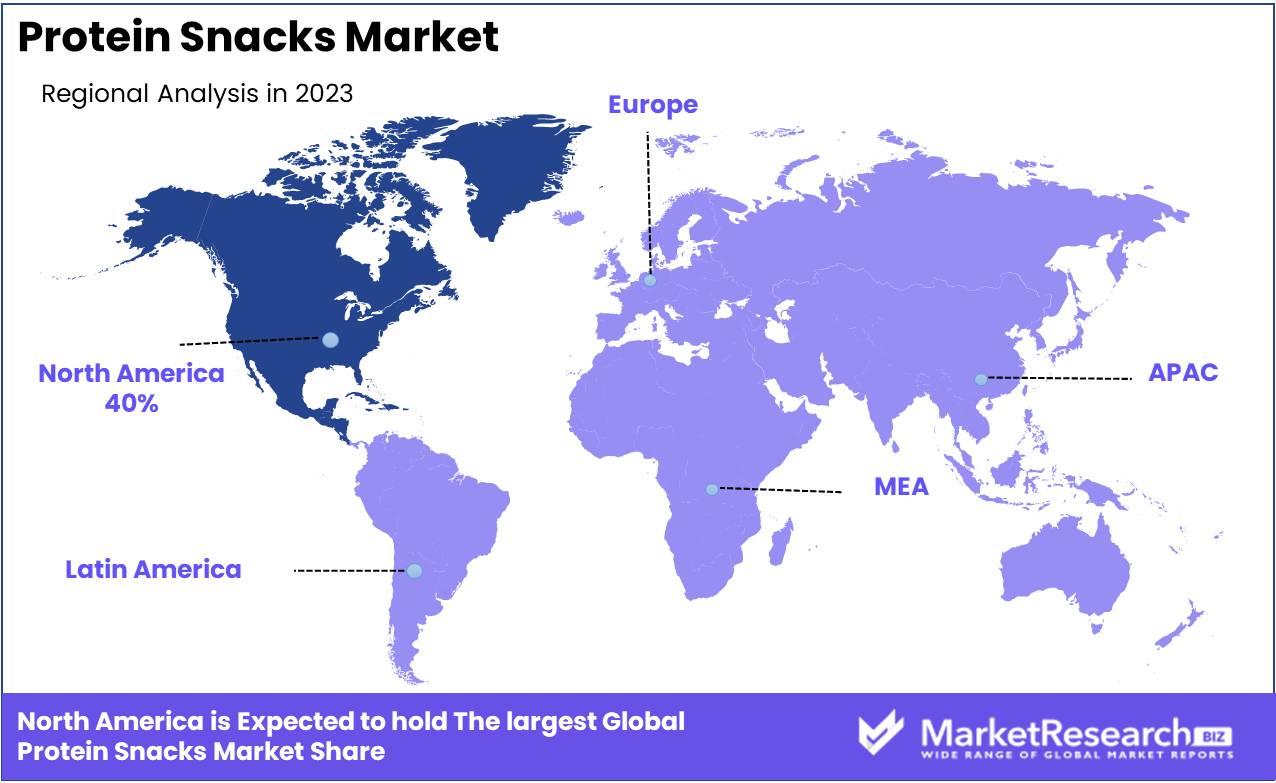

- Regional Dominance: North America asserts dominance, capturing a substantial 40% of the market share, driven by increasing health consciousness and the popularity of protein-rich diets in the region.

- Growth Opportunity: In the Protein Snacks Market, there lies a significant growth opportunity in diversifying product offerings to include functional and flavored variants, catering to evolving consumer preferences and driving market expansion.

Driving factors

Health & Wellness Trends

The pervasive trend towards health and wellness is a primary driver catapulting the protein snacks market forward. Consumers increasingly prioritize nutrition, seeking products that align with their health goals. Protein snacks, renowned for their muscle-building and satiating properties, perfectly cater to this demand. The emphasis on protein as a macronutrient essential for muscle repair and growth aligns with broader wellness narratives, driving the adoption of protein snacks.

The growing awareness of the role of protein in weight management and overall health amplifies the market's growth trajectory. According to recent statistics, the global protein snacks market is projected to expand significantly in the coming years, fueled in part by this health-conscious consumer mindset.

Fitness and Sports Nutrition

The symbiotic relationship between the protein snacks market and fitness and sports nutrition is undeniable. As individuals engage in physical activities, the need for convenient, protein-rich fuel becomes paramount. Protein snacks offer a convenient solution, delivering essential amino acids to support muscle recovery and growth. Athletes and fitness enthusiasts, in particular, gravitate towards these products to optimize their performance and facilitate post-workout recovery.

This interplay between fitness culture and protein consumption fosters a fertile ground for market expansion. With the fitness industry experiencing steady growth globally, the demand for protein snacks is poised to escalate further, driving market revenues to new heights.

Weight Control

Weight control is a perennial concern for many consumers, and protein snacks emerge as a strategic ally in this endeavor. Protein's role in promoting satiety and supporting lean muscle mass makes protein snacks an attractive option for individuals aiming to manage their weight effectively. By incorporating protein snacks into their diets, consumers can stave off hunger cravings, thereby reducing overall calorie intake.

The metabolic advantages associated with a higher protein diet contribute to enhanced weight management outcomes. As obesity rates continue to rise globally, the demand for weight-friendly snack options like protein snacks is witnessing an upsurge. Market analysts predict sustained growth in the protein snacks segment, driven partly by the burgeoning focus on weight control and healthy eating habits.

Easy Living and Always-On Lifestyles

In today's fast-paced world characterized by perpetual motion and time scarcity, the demand for convenient food solutions is soaring. Protein snacks perfectly align with the needs of consumers leading busy, on-the-go lifestyles. These portable, ready-to-eat options offer a quick and hassle-free source of sustenance, catering to the demands of modern living. Whether it's a midday energy boost or a post-workout refuel, protein snacks provide a convenient solution without compromising on nutrition. The rise of urbanization, coupled with hectic work schedules, further propels the market forward as consumers prioritize convenience without sacrificing health goals. This convergence of convenience and nutrition underscores the pivotal role of protein snacks in catering to the demands of contemporary lifestyles, driving sustained market growth.

Restraining Factors

Health Concerns

Amidst the burgeoning popularity of protein snacks, health concerns emerge as a critical factor influencing market dynamics. While protein snacks are generally perceived as nutritious options, consumer apprehensions regarding additives, preservatives, and excessive processing can dampen demand. Furthermore, allergen sensitivities and intolerances prompt individuals to scrutinize ingredient lists meticulously, favoring products with clean labels and minimal artificial additives.

Addressing these concerns through transparent labeling, clean formulations, and stringent quality control measures becomes imperative for market players to instill consumer confidence and sustain growth. Additionally, educating consumers about the nutritional benefits and safety of protein snacks can mitigate apprehensions, fostering trust and loyalty within the market.

Perishability

The perishable nature of certain protein snack variants poses logistical challenges for manufacturers and retailers alike. Freshly prepared or minimally processed protein snacks, such as refrigerated protein bars or shakes, necessitate stringent cold chain management to maintain product integrity and safety. Failure to adhere to proper storage and distribution protocols can result in spoilage, compromising product quality and consumer satisfaction.

To mitigate these challenges, investments in robust supply chain infrastructure, including temperature-controlled storage facilities and efficient distribution networks, are imperative. Additionally, technological advancements enabling extended shelf-life and innovative packaging solutions can mitigate perishability concerns, enhancing market viability and scalability.

Regulatory Obstacles

Navigating the complex regulatory landscape represents a formidable obstacle for players in the protein snacks market. Stringent regulations governing food safety, labeling, and ingredient standards vary across regions, necessitating meticulous compliance efforts to ensure market access and product legality. Additionally, evolving regulatory frameworks and heightened scrutiny from health authorities necessitate continuous monitoring and adaptation to remain compliant.

Market players must invest in regulatory expertise and engage in proactive dialogue with regulatory agencies to anticipate and address emerging compliance challenges effectively. Failure to navigate regulatory obstacles can impede market entry, hinder innovation, and erode consumer trust, underscoring the paramount importance of regulatory diligence in sustaining market growth.

By Type Analysis

In 2023, Protein Bars & Balls held a dominant market position in the "By Type" segment of the Protein Snacks Market, capturing more than a 35% share. Protein Bars & Balls have emerged as a popular choice among consumers seeking convenient and nutritious snacking options. These products are favored for their portability, longer shelf life, and high protein content, catering to the demands of health-conscious individuals with busy lifestyles.

Protein Bars & Balls are available in a variety of flavors and formulations, ranging from vegan and gluten-free options to those enriched with additional vitamins and minerals. The versatility of these products appeals to a broad spectrum of consumers, including athletes, fitness enthusiasts, and those simply looking to incorporate more protein into their diets.

Furthermore, the growing trend of on-the-go consumption patterns and the increasing preference for snacks that provide sustained energy have propelled the demand for Protein Bars & Balls. Manufacturers have responded by introducing innovative formulations that not only deliver on nutritional value but also on taste and texture, thereby enhancing the overall consumer experience.

By Source Analysis

In 2023, Plant-Based held a dominant market position in the "By Source" segment of the Protein Snacks Market, capturing more than a 60% share. The rise of Plant-Based protein snacks reflects a growing consumer shift towards sustainable, cruelty-free, and health-conscious dietary choices. As concerns over environmental impact and animal welfare continue to influence consumer behavior, the demand for Plant-Based protein snacks has surged, driving significant growth in this segment.

Plant-Based protein snacks encompass a wide range of products derived from sources such as soy, pea, rice, hemp, and other plant sources. These snacks not only provide a sustainable alternative to animal-based protein but also offer various health benefits, including lower levels of saturated fat and cholesterol, as well as higher fiber content.

The popularity of Plant-Based protein snacks is further fueled by increasing awareness of the health benefits associated with plant-centric diets, including weight management, improved cardiovascular health, and reduced risk of certain chronic diseases. Additionally, the versatility of plant-based ingredients allows for the creation of diverse and flavorful snack options that cater to different dietary preferences and restrictions, including vegan, vegetarian, and gluten-free diets.

Manufacturers in the Protein Snacks Market have responded to this trend by introducing a plethora of innovative Plant-Based protein snacks, including bars, balls, chips, and jerky, among others. These products not only deliver on taste and texture but also on nutritional quality, offering consumers a guilt-free snacking option that aligns with their ethical and dietary values.

By Distribution Channel Analysis

In 2023, E-Commerce held a dominant market position in the By Distribution Channel segment of the Protein Snacks Market, capturing more than a 40% share. The rapid expansion of E-Commerce channels has reshaped the landscape of protein snack distribution, offering consumers unparalleled convenience, choice, and accessibility.

The rise of E-Commerce as a preferred distribution channel for protein snacks can be attributed to several factors, including the increasing penetration of smartphones and internet connectivity, changing consumer shopping behaviors, and the convenience of doorstep delivery. E-Commerce platforms provide consumers with a seamless shopping experience, allowing them to browse a wide assortment of protein snacks, compare prices, read reviews, and make purchases from the comfort of their homes or on-the-go.

E-Commerce offers a level of convenience and accessibility that traditional brick-and-mortar retail channels cannot match. With 24/7 availability and global reach, E-Commerce platforms enable consumers to access a diverse range of protein snacks from both local and international brands, regardless of geographical limitations. This accessibility has been particularly advantageous for consumers in rural or underserved areas where access to specialty stores or supermarkets may be limited.

Key Market Segments

By Type

- Protein Bars & Balls

- Protein Drinks

- Breakfast Cereals

- Bakery Snacks

- Processed Meat Snacks

- Others

By Source

- Animal-Based

- Plant-Based

By Distribution Channel

- E-Commerce

- Supermarkets & Hypermarkets

- Specialty Stores

- Retail Stores

- Others

Growth Opportunity

Increasing Demand

The global protein snacks market is poised for substantial growth in 2024, primarily driven by an increasing demand for healthier snacking options. As consumers become more health-conscious, there is a growing preference for snacks that offer both convenience and nutritional benefits.

Protein snacks, with their promise of sustaining energy levels and supporting muscle growth and repair, have gained significant traction among fitness enthusiasts and health-conscious individuals alike. This rising demand is not limited to any particular demographic but is seen across various age groups and lifestyles, indicating a broad market potential for protein snacks.

Product Innovation

Innovation stands as a key driver for the growth of the protein snacks market in 2024. With consumers constantly seeking novel and exciting snack options, manufacturers are responding with innovative product offerings. From plant-based protein snacks to novel flavors and formats, the market is witnessing a wave of creativity aimed at capturing consumer interest.

Technological advancements in food processing and packaging are enabling the development of protein snacks that not only deliver on taste and nutrition but also offer convenience and longer shelf life. This emphasis on innovation not only helps companies differentiate themselves in a crowded market but also opens up new avenues for growth and expansion.

Latest Trends

Plant-Based Protein

One of the prominent trends shaping the global protein snacks market in 2024 is the surge in demand for plant-based protein options. With an increasing number of consumers adopting vegetarian, vegan, or flexitarian diets, there is a growing preference for snacks that align with these dietary choices. Plant-based protein snacks, derived from sources such as peas, soy, lentils, and chickpeas, are gaining popularity due to their perceived health benefits and sustainability credentials.

Advancements in food technology have enabled manufacturers to create plant-based snacks that not only mimic the taste and texture of animal-based products but also offer comparable protein content. As a result, plant-based protein snacks are witnessing robust growth, attracting both health-conscious consumers and those concerned about environmental impact.

Online Segment Growth

Another significant trend driving the global protein snacks market in 2024 is the exponential growth of the online segment. The proliferation of e-commerce platforms and the increasing penetration of smartphones and internet connectivity have transformed the way consumers shop for groceries and snacks. Online retail channels offer unparalleled convenience, allowing consumers to browse a wide range of products, compare prices, and make purchases from the comfort of their homes.

This convenience factor is particularly appealing to busy professionals, urban dwellers, and millennials who prioritize convenience and time-saving solutions. As a result, the online segment of the protein snacks market is experiencing rapid growth, presenting opportunities for both established brands and emerging players to expand their reach and capitalize on changing consumer behavior.

Regional Analysis

North America emerged as a dominant force in the global protein snacks market, commanding a substantial share of 40%.

The North American protein snacks market showcases robust growth, capturing a significant share of 40% in 2023, with a market value exceeding USD 3 billion. This dominance is attributed to the region's growing health-conscious population, increasing demand for convenient and nutritious snacking options, and a well-established distribution network. The United States stands as a key contributor to this market, accounting for the majority of the regional revenue. Market players are focusing on product innovation and marketing strategies to cater to evolving consumer preferences for protein-rich snacks.

Europe's protein snacks market demonstrates steady growth, fueled by rising health awareness and a growing inclination towards protein-rich diets among consumers. Countries such as Germany, the UK, and France are witnessing increasing demand for protein snacks, driven by busy lifestyles and a preference for on-the-go nutritional solutions.

The Asia Pacific emerges as a lucrative market for protein snacks, characterized by rapid urbanization, changing dietary habits, and a growing fitness culture. Countries like China, Japan, and India lead the market, driven by increasing disposable incomes and a rising awareness of health and wellness.

The Middle East & Africa region demonstrates a growing interest in protein snacks, driven by a rising health-conscious population and increasing disposable incomes. While the market is still in its nascent stage, countries like the UAE, Saudi Arabia, and South Africa show promising growth prospects.

Latin America presents significant opportunities for the protein snacks market, fueled by a growing awareness of health and wellness among consumers. Countries like Brazil, Mexico, and Argentina lead the market, driven by increasing urbanization and a preference for convenient and nutritious snacking options.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In 2024, the global protein snacks market is witnessing robust growth, driven by evolving consumer preferences towards healthier snacking options and increased awareness about the importance of protein in daily diets. Among the key players shaping this landscape, General Mills Inc. stands out as a significant contributor. Leveraging its extensive distribution network and strong brand recognition, General Mills has been able to penetrate diverse markets with its protein snack offerings. The company's focus on innovation and product diversification has helped it stay ahead of evolving consumer trends, catering to a wide range of dietary preferences and needs.

Buff Bake, Good Full Stop Ltd., and Clif Bar & Company are also notable players in this market, known for their commitment to quality and ingredient transparency. With a focus on natural ingredients and appealing flavor profiles, these companies have successfully tapped into the growing demand for clean label snacks. Hormel Foods Corporation and Vitaco Health are similarly positioned to capitalize on the increasing consumer inclination towards protein-rich snacks, offering a diverse portfolio of products catering to various dietary requirements and lifestyles.

Additionally, emerging players like Bounce Foods Ltd. and Powerful Men LLC are gaining traction with their innovative product offerings and targeted marketing strategies. These companies are capitalizing on the rising demand for convenient, on-the-go protein snacks, particularly among health-conscious consumers. Overall, the global protein snacks market in 2024 is characterized by intense competition and dynamic consumer preferences, with key players continuously striving to innovate and differentiate their offerings to stay ahead in the evolving landscape.

Market Key Players

- General Mills Inc

- Buff Bake

- Good Full Stop Ltd.

- Clif Bar & Company

- Hormel Foods Corporation

- Vitaco Health

- Bounce Foods Ltd

- Powerful Men LLC

- Premier Nutrition Corporation

- The WhiteWave Foods Company

- Sponser Sports Foods Ltd.

- Quest Nutrition LLC

- Pure Protein

- Protein Package

- Naturell India Pvt. Ltd.

- Kellogg Co.

Recent Development

- In April 2024, WIC Capital invests in West African agribusiness, backing ACASEN for cashew processing expansion. Eyes plant-based meat alternatives and natural cosmetics, with investments in beverage and skincare companies.

- In March 2024, SemCap Food and Nutrition invests $68m in US-based Aloha, a B-Corp-certified, employee-owned producer of organic plant-based snacks and drinks. Retains management and climate-neutral status, aims for independent operation.

Report Scope

Report Features Description Market Value (2023) USD 5.3 Bn Forecast Revenue (2033) USD 13.1 Bn CAGR (2024-2033) 9.7% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Protein Bars & Balls, Protein Drinks, Breakfast Cereals, Bakery Snacks, Processed Meat Snacks, Others), By Source (Animal-Based, Plant-Based, By Distribution Channel (E-Commerce, Supermarkets & Hypermarkets, Specialty Stores, Retail Stores, Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape General Mills Inc, Buff Bake, Good Full Stop Ltd., Clif Bar & Company, Hormel Foods Corporation, Vitaco Health, Bounce Foods Ltd, Powerful Men LLC, Premier Nutrition Corporation, The WhiteWave Foods Company, Sponser Sports Foods Ltd., Quest Nutrition LLC, Pure Protein, Protein Package, Naturell India Pvt. Ltd., Kellogg Co. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- General Mills Inc

- Buff Bake

- Good Full Stop Ltd.

- Clif Bar & Company

- Hormel Foods Corporation

- Vitaco Health

- Bounce Foods Ltd

- Powerful Men LLC

- Premier Nutrition Corporation

- The WhiteWave Foods Company

- Sponser Sports Foods Ltd.

- Quest Nutrition LLC

- Pure Protein

- Protein Package

- Naturell India Pvt. Ltd.

- Kellogg Co.