Chocolate Market By Product(Milk Chocolate, Dark Chocolate, White Chocolate, Low-Sugar Chocolate), By Sales Category(Everyday Chocolate, Premium Chocolate, Baking Chocolate, Seasonal Chocolate, Health-Conscious Chocolate), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Stores, Other Distribution Channels), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

3438

-

Jan 2024

-

240

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

- Chocolate Market Report Overview

- Chocolate Market Dynamics

- Chocolate Market Segmentation Analysis

- Chocolate Industry Segments

- Chocolate Market Growth Opportunity

- Chocolate Market Regional Analysis

- Chocolate Industry By Region

- Chocolate Market Share Analysis

- Chocolate Industry Key Players

- Chocolate Market Recent Development

- Report Scope

Chocolate Market Report Overview

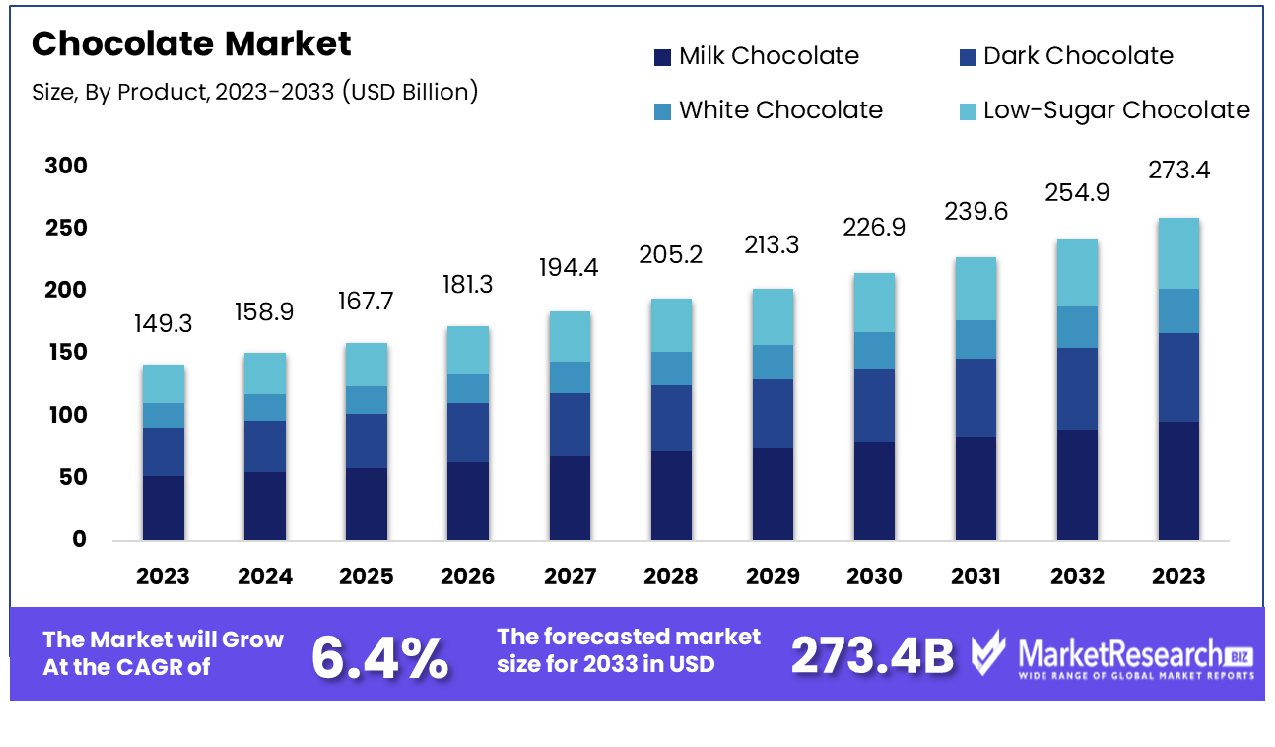

The global chocolate market was valued at USD 149.3 billion in 2023. It is expected to reach USD 273.4 billion by 2033, with a CAGR of 6.4% during the forecast period from 2024 to 2033.

The surge in demand for organic chocolates and the change in consumers' preferences are some of the main driving factors for the global chocolate market. When it comes to sweet or dessert preferences, chocolate is one of the most preferred choices among individuals, from children to adults. Chocolates were originally extracted from the Theobroma cacao tree, which is native to Central America.

According to an article published by Whitakers Chocolate in November 2023, Switzerland is one of the most chocolate-consuming countries per capita. The Swiss are very well-known for their love of chocolate. This national choice for chocolate also showcases the country’s protruding chocolate industry, which is popular for manufacturing some of the finest and most tasty chocolates all over the world.

On average, people in Switzerland consume 8.8 kg of chocolate each year, which is approximately 22lb. Moreover, Germany is the second-largest chocolate consumption country in the world, with 8.4 kg per capita chocolate consumption each year. Toblerone is a reputed Swiss organization known for being the finest chocolate production company in the world.

Most consumers are becoming more health-conscious and are changing their preferences. Organic chocolates do not have any artificial sweeteners and are an ideal preference for consumers. Dark chocolates, white chocolates, and milk chocolates are some of the most common varieties of organic chocolates. Many people choose dark chocolate as it is quite popular in the market and has several health-related advantages.

Milk chocolates are also a preferred choice for those individuals who are looking for a milder chocolate flavor, and white chocolates are the ideal choice for those individuals who want a sweet and creamy taste. Organic chocolates have several positive impacts on health, including protecting skin from harmful UV rays.

Many researchers have shown that antioxidants in organic chocolates can help reduce wrinkles and aging. These contain magnesium, which is good for the heart. Flavonoids are antioxidants that help enhance blood circulation and decrease the risk of heart-related problems. These also defend your body from cardiovascular diseases.

Organic sugar-free chocolates help with excellent brain functioning as they optimize brain memory. It also helps with several neurological problems, such as Alzheimer’s. The demand for the global chocolate market will increase rapidly due to changes in consumers' preferences as well as awareness regarding the health benefits of chocolates, which will help in market expansion in the coming years.

Chocolate Market Dynamics

Health-Conscious Consumer Choices Propel Chocolate Market Expansion

The increasing consumer awareness of health benefits associated with organic, vegan, sugar-free, and gluten-free chocolates significantly drives the chocolate market's growth. In the USA, a notable 20% of consumers are willing to pay a premium for healthier chocolate options, underscoring a shifting preference towards wellness-oriented products.

This trend is paralleled by a rising demand for low-calorie chocolates, showcasing a broader consumer movement towards health-conscious eating. This factor synergizes with the growing global focus on healthier lifestyles and dietary choices, amplifying its impact on the market. The inclination towards healthier chocolate variants is anticipated to persist, potentially leading to more innovative product developments and a sustained expansion of this market segment.

Seasonal Demand Surge Boosts Chocolate Market Dynamics

Seasonal demand significantly influences the chocolate market, with companies launching a variety of products during key occasions like Easter and Christmas. In the US, over 90% of consumers consider gifting chocolate for Christmas, indicating a deep-rooted cultural affinity towards chocolate as a festive gift.

Furthermore, Valentine's Day spending in the US on seasonal chocolate reached $443.7 million in 2022, with an average planned spend per person on candy as a Valentine's gift being $15.9. This seasonal surge in demand underscores the chocolate industry's adaptability and responsiveness to consumer preferences, thereby fuelling the growth rate. The long-term impact of this factor includes sustained seasonal marketing efforts and the potential for new festive-themed innovations, continuously rejuvenating the market.

Industrial Application in Bakery and Confectionery Catalyzes Market Growth

The increasing use of industrial chocolates in the bakery and confectionery industries is a key element in the development of the market. The industrial chocolate market exhibits robust competitiveness, with leading players like Mars Incorporated, Ferrero International, Mondelez International Inc., Hershey's Chocolate, and Nestle shaping the landscape.

This competition fosters innovation and quality enhancement, leading to broader market appeal and growth. The integration of industrial chocolate into diverse confectionery products not only diversifies the market but also underlines the ingredient's versatility and appeal. This trend's long-term implications include potential market consolidation around key players and continuous innovation, keeping the industry vibrant and expanding.

Cocoa Price Fluctuations Hinder Market Growth

The fluctuation of prices for raw materials, including cocoa, can be a major barrier to the expansion of the chocolate industry, particularly in the sugar-free industry. Regions like West Africa, which are major cocoa producers, often face economic and climatic uncertainties, leading to volatile cocoa prices.

This volatility directly impacts production costs, making it challenging for manufacturers to maintain consistent pricing and profit margins. The sugar-free chocolate market, reliant on high-quality cocoa for its premium products, is particularly affected. This instability can deter new entrants and impede the expansion plans of existing companies, ultimately restraining market growth.

Intensified Competition Leads to Market Constraints

Increasing competition in the chocolate market, involving major players like Mars Incorporated, Ferrero International, Mondelez International Inc., Hershey's Chocolate, and Nestle, is leading to aggressive price wars and reduced profit margins.

This intense rivalry forces companies to engage in continuous price undercutting to retain market share, often at the expense of profitability. Such a competitive environment can limit the market's overall growth potential, as companies might scale back on innovation and expansion efforts to focus on price competition. This scenario can hinder long-term market development, as it prioritizes immediate market capture over sustainable growth strategies.

Chocolate Market Segmentation Analysis

By Product Analysis

In the realm of chocolate, Milk Chocolate stands out as the most widely favored product type globally. Its widespread popularity is attributed to its creamy texture, sweet taste, and universal appeal across various age groups. Milk chocolate is typically made with milk powder, sugar, and a relatively low cocoa content, which contributes to its milder flavor compared to dark chocolate. This type of chocolate is commonly used in candy bars, truffles, and various confectionery items, making it a staple in the global chocolate industry.

Other segments such as Dark Chocolate, White Chocolate along Low-Sugar Chocolate also contribute to the market. Dark Chocolate, known for its high cocoa content and health benefits, appeals to health-conscious consumers and chocolate connoisseurs.

White Chocolate, made without cocoa solids, caters to those who prefer its sweet, creamy profile. Low-sugar chocolate is gaining traction among health-conscious consumers looking to reduce sugar intake without compromising on taste. However, Milk Chocolate remains the most preferred choice due to its widespread acceptance and versatility in various culinary applications.

By Sales Category Analysis

The Everyday Chocolate segment holds the majority share in the chocolate market, accounting for 36% of total sales. This category includes widely consumed chocolate products that are readily available and affordably priced. Everyday Chocolate is popular due to its accessibility and familiarity, making it a regular purchase for many consumers. These products are typically found in grocery stores, supermarkets, and vending machines.

Premium Chocolate, Baking Chocolate, Seasonal Chocolate, and Health-Conscious Chocolate also hold significant market shares. Premium Chocolate caters to consumers seeking high-quality, artisanal products often with unique flavors and higher cocoa content. Baking Chocolate is used primarily in home baking and professional pastry settings.

Seasonal Chocolate peaks during holidays and festive occasions, while Health-Conscious Chocolate, which includes options like sugar-free and high-cocoa content, caters to health-aware consumers.

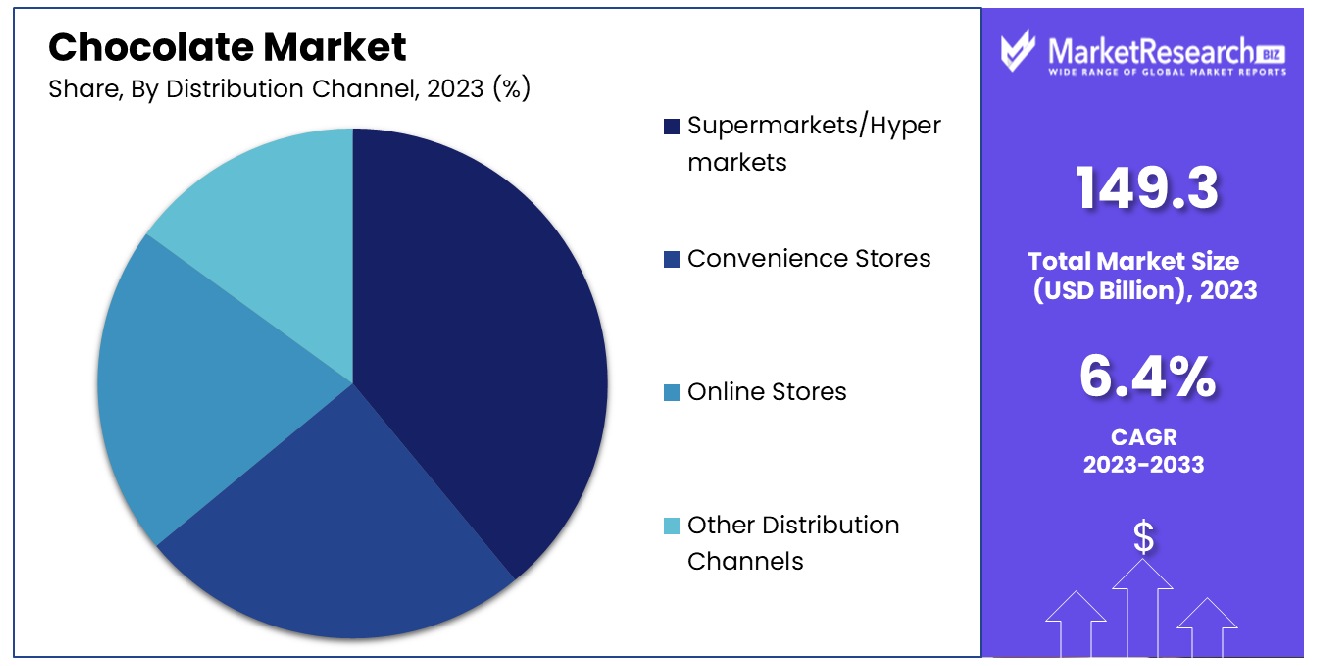

By Distribution Channel Analysis

Supermarkets/Hypermarkets are the dominating distribution channel in the chocolate market, with a 43% share. This dominance is due to the wide variety of chocolate products these stores offer under one roof, along with their extensive reach and convenience. Supermarkets and hypermarkets provide consumers with the opportunity to explore a wide range of chocolate brands and products, including international and local varieties, making them a preferred shopping destination.

While Supermarkets/Hypermarkets lead, Convenience Stores and Online Stores are also key channels. Convenience Stores offer quick and easy access to a range of chocolate products, ideal for impulse purchases. Online Stores, though currently holding a smaller market share with a 4.5% CAGR, are the fastest-growing segment.

The rise of e-commerce platforms has made it easier for consumers to purchase chocolates from the comfort of their homes. The swift growth of online chocolate sales can be ascribed to factors like the convenience of doorstep delivery, a varied selection of chocolate choices, and the ability to evaluate both the price and quality of chocolate.

Chocolate Industry Segments

By Product

- Milk Chocolate

- Dark Chocolate

- White Chocolate

- Low-Sugar Chocolate

By Sales Category

- Everyday Chocolate

- Premium Chocolate

- Baking Chocolate

- Seasonal Chocolate

- Health-Conscious Chocolate

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Stores

- Other Distribution Channels

Chocolate Market Growth Opportunity

Rising Consumer Demand for Dark Chocolate Boosts Market Growth

The increasing consumer demand for dark chocolate, driven by its perceived health benefits and unique flavor profile, presents a significant growth opportunity in the chocolate market. Dark chocolate, known for its higher cocoa content and lower sugar levels, is increasingly favored for its potential health advantages, such as heart health and antioxidant properties.

This shift in consumer preference is guiding chocolate companies to expand their dark chocolate offerings, catering to a health-conscious audience. The trend aligns with the broader movement towards healthier eating, positioning dark chocolate as a preferred choice for consumers seeking indulgence coupled with health benefits, thereby driving market growth.

Sustainable and Ethical Sourcing in Cocoa Boosts Chocolate Market Appeal

The chocolate industry's focus on sustainable sourcing of cocoa beans, fair trade practices, and reducing the carbon footprint is opening new avenues for market growth. Commitments by major companies like Nestlé, which aims to source 100% of its cocoa through the Nestlé Cocoa Plan by 2025, and Olam Food Ingredients' achievement of 100% traceability in its global cocoa supply chain, are setting new standards in the industry.

These efforts resonate with increasingly environmentally and socially conscious consumers, who are more likely to support brands that align with their values. This shift towards sustainability and ethical sourcing not only addresses critical global issues but also enhances brand reputation and customer loyalty, contributing to market expansion.

Chocolate Market Regional Analysis

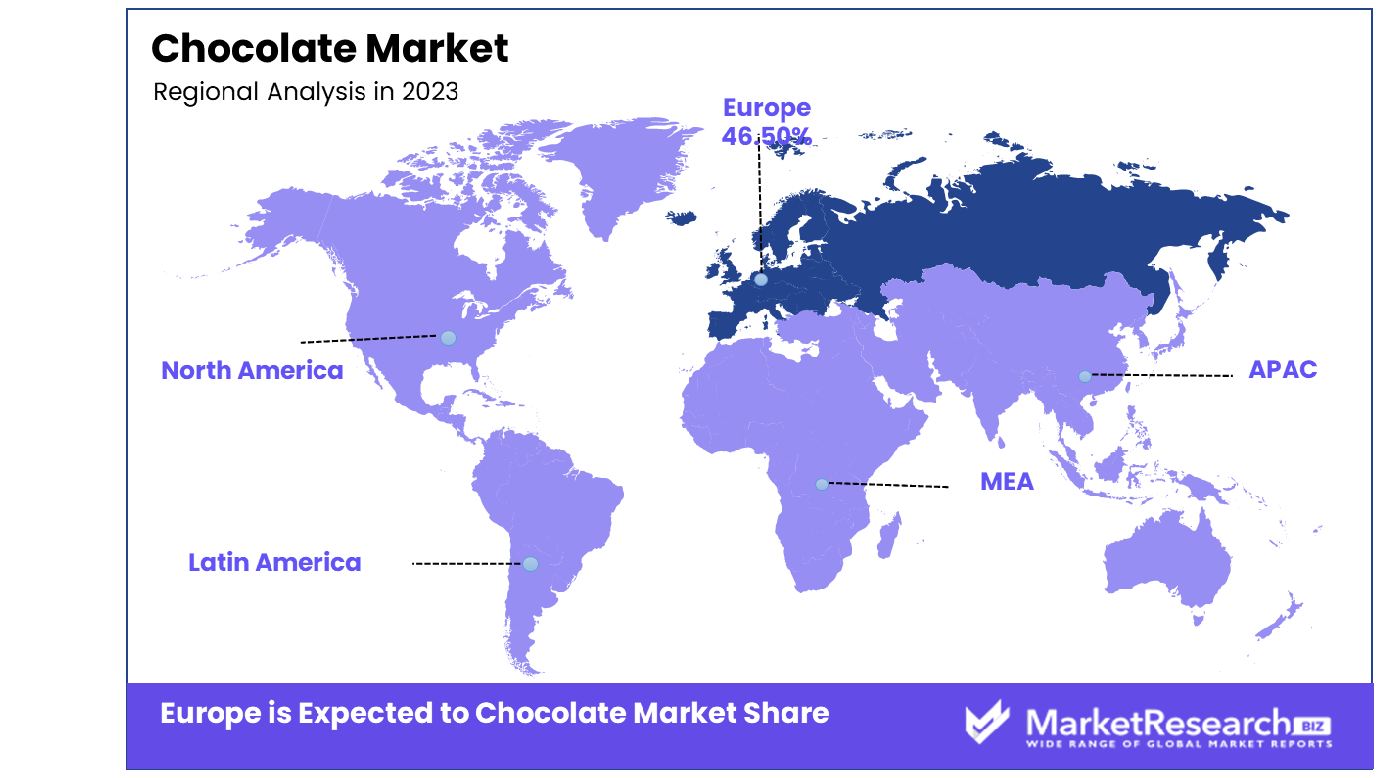

Europe Dominates with 46.50% Market Share in the Chocolate Market

Europe's dominance of 46.50% worldwide chocolate market is grounded in the enduring tradition of chocolate production and consumption. culture of producing and consuming chocolate. The region, particularly Western Europe, is renowned for its premium quality and artisanal chocolate products. Countries like France, Germany, and the UK lead in seasonal chocolate sales, with Western Europe alone achieving nearly USD 7 billion in retail sales in 2022, according to Euromonitor International. The strong presence of globally recognized chocolate brands, high consumer spending power, and a deeply ingrained culture of chocolate as a key element of culinary indulgence significantly contribute to Europe's market dominance.

This European chocolatier market in Europe is defined by a strong desire for premium and hand-crafted chocolates. The consumers in this region have sophisticated palates, often preferring high-quality, dark chocolates with higher cacao content. There is also a growing trend towards ethical consumption, with an increasing demand for fair trade and organic chocolates. Additionally, innovative flavor combinations and product diversification, including sugar-free and vegan options, are expanding the market’s appeal. The well-established distribution channels and strong export markets further bolster the European chocolate industry.

North America: High Consumption and Diverse Preferences

In North America, chocolate accounts for 59% of all candy sales, with a notable preference for milk chocolate. The US chocolate market is characterized by diverse consumer preferences, with approximately 34% of Americans favoring dark chocolate. The region's market is driven by large-scale production, extensive distribution networks, and aggressive marketing strategies by major chocolate manufacturers.

Asia-Pacific: Growing Market and Changing Consumer Tastes

The Asia-Pacific chocolate market is growing rapidly, driven by changing consumer tastes and increasing disposable incomes. Countries like China and India are experiencing a surge in chocolate consumption, with consumers gradually shifting from traditional sweets to chocolate. The market is marked by rising demand for premium, as well as the growing awareness of the positive health benefits that come with dark chocolate. The expanding retail infrastructure and rising urbanization in the region are also key factors contributing to market growth.

Chocolate Industry By Region

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of Middle East & Africa

In the competitive Chocolate Market, characterized by diverse consumer tastes, the mentioned businesses are at the forefront of influencing global chocolate trends and consumer preferences. Mars Wrigley Confectionery, The Hershey Company, and Ferrero Group (with brands like Ferrero Rocher and Ferrero Ardennes SA) are industry giants, known for their extensive product ranges and global presence. Their strategic positioning emphasizes brand strength, product innovation, and wide distribution networks, significantly influencing consumer choices and market dynamics.

Lindt & Sprüngli and Ghirardelli are renowned for their premium chocolate offerings, catering to a segment that prioritizes quality and luxury. Their focus on craftsmanship and tradition reflects the industry's segment catering to more discerning chocolate connoisseurs.

Barry Callebaut Group, a leading supplier of high-quality cocoa and demand for chocolate products, plays a crucial role in the B2B sector, supplying various confectionery brands. Their commitment to sustainability and quality standards is pivotal in shaping industry practices. Cadbury (owned by Mondelez International) and Milka, with their mass appeal and extensive product lines, demonstrate the market's potential for widespread brand loyalty and consumer reach.

Chocolate Industry Key Players

- Toblerone

- Ghirardelli

- Barry Callebaut Group

- Ferrero Ardennes SA

- Guylian

- Ferrero Rocher

- Mars Wrigley Confectionery

- Natra

- Patchi

- Hershey's

- Valrhona

- Milka

- Cadbury

- Lotus Chocolate Company

- Lindt & Sprüngli

- Meiji Holding Co., Ltd.

- Cargill, Inc.

- Mars Inc.

- Nestle S.A.

- Mondelez International, Inc.

Chocolate Market Recent Development

- In January 2024, Sugar Bowl Bakery introduces a delectable addition to its portfolio, the Cranberry Orange White Chocolate Duet Bites®. Launched by Kevin Ly, Director of Innovation and R&D, this innovative flavor combines zesty cranberries, fresh orange essence, and sweet white chocolate, enhancing the bakery's commitment to quality ingredients and unique flavors. The product caters to diverse consumption occasions, available at select Costco retailers nationwide from November 2023, priced at $9.99 per box. This introduction reflects Sugar Bowl Bakery's strategic move to captivate consumers and boost its presence in the competitive chocolate market.

- In January 2024, Starbucks unveils its Winter Menu 2024, featuring enticing beverages and delectable treats. New offerings include the Almond Biscotti Oat Latte, Iced Almond Biscotti Oat Latte, and Golden Caramel White Hot Chocolate. Accompanying these are fresh food additions like Egg White Bites and Caramel White Chocolate Blondie. Starbucks continues to adapt to consumer preferences, providing a diverse and appealing selection in the competitive chocolate market.

- In December 2023, Mars China advances its commitment to sustainable packaging with the launch of the SNICKERS® bar featuring dark chocolate cereal. The innovative product showcases low-sugar, low-GI content, and individual packaging made from easily recyclable mono-polypropylene material. This aligns with Mars China's "Designed For Recycling" concept, contributing to a healthier planet.

- In November 2023, Milma, Kerala's dairy cooperative, expanded with premium dark chocolate (Deliza brand), milk chocolate, and innovative biscuits. Aligned with 'Repositioning Milma 2023,' the move targets health-conscious consumers, marking a strategic milestone in the dairy market.

Report Scope

Report Features Description Market Value (2023) USD 149.3 billion Forecast Revenue (2033) USD 273.3 billion CAGR (2024-2032) 6.4% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product(Milk Chocolate, Dark Chocolate, White Chocolate, Low-Sugar Chocolate), By Sales Category(Everyday Chocolate, Premium Chocolate, Baking Chocolate, Seasonal Chocolate, Health-Conscious Chocolate), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Stores, Other Distribution Channels) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Toblerone, Ghirardelli, Barry Callebaut Group, Ferrero Ardennes SA, Guylian, Ferrero Rocher, Mars Wrigley Confectionery, Natra, Patchi, Hershey's, Valrhona, Milka, Cadbury, Lotus Chocolate Company, Lindt & Sprüngli, Meiji Holding Co., Ltd., Cargill, Inc., Mars Inc., Nestle S.A., Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Toblerone

- Ghirardelli

- Barry Callebaut Group

- Ferrero Ardennes SA

- Guylian

- Ferrero Rocher

- Mars Wrigley Confectionery

- Natra

- Patchi

- Hershey's

- Valrhona

- Milka

- Cadbury

- Lotus Chocolate Company

- Lindt & Sprüngli

- Meiji Holding Co., Ltd.

- Cargill, Inc.

- Mars Inc.

- Nestle S.A.

- Mondelez International, Inc.