Generative AI in Lending Market Report By Deployment Mode (Cloud, On-premises), By Application (Credit Scoring, Loan Origination, Risk Assessment, Fraud Detection, Customer Service, Other Applications), By End-User (Banks, Credit Unions, Fintech Companies, Other Financial Institutions)By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

44063

-

March 2024

-

130

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

The Global Generative AI in Lending Market size is expected to be worth around USD xx Billion by 2033, from USD xx Billion in 2023, growing at a CAGR of xx.x% during the forecast period from 2024 to 2033.

The surge in demand for advanced technologies and rise in finance companies are some of the main key driving factors for the generative AI in lending market.

The generative AI in lending is defined as the application of the artificial intelligence methods to enhance different aspects of loan instigation and management process. This technology uses machine learning algorithms to analyze huge quantity of information by comprising borrower data, credit history, risk factors and market trends.

By understanding patterns in borrower behaviors and creditworthiness, generative AI helps in automating loan underwriting, risk assessment processes and decision making. It improves precision in forecasting borrower default challenges by permitting lenders to provide customized loan terms while vindicating potential losses.

Moreover, generative AI can enhance customer experience by expediting loan application methods by providing quick approvals and providing customized product suggestions. It makes the lenders to enhance their loan sample management samples, understanding chances for portfolio diversification and risk mitigation. Generative AI transforms the lending sector by making it more effective, responsive and accessible to the growing requirements of borrowers and lenders alike.

According to an article published frontier enterprise in February 2024, highlights that generative holds the most substantial growth potential in the coming years, with 92% of firms expecting adoption in the next 12 months. Among the companies in Singapore currently by using this technology, 67% plan has boosted their investment in generative AI over the next years.

Moreover, according to Forbes in March 2024, highlights that banks and insurers have built-in hype detectors that has the potentiality to differentiate among fads and genuine value adding innovations. 31% of the financial services organizations have detailed tactics in place to make sure positive workers results and experiences with generative AI.

Generative AI is improving the lending by automating underwriting processes, enhancing the precision in risk assessment and making customized loan offerings. It accelerates loan approvals, offers quick decisions and enhances portfolio management tactics by leading to augmented effectiveness, minimized expenses and enhanced customer satisfactions in the lending sector. The surge in demand for the generative AI in lending will increase due to the monetory sections and loan approvals that will help in market expansion in the coming years

Key Takeaways

- Market Value: The Global Generative AI in Lending Market is expected to witness significant growth, with a projected worth of around USD by 2033, showing a substantial increase from its 2023 value, with a steady CAGR during the forecast period from 2024 to 2033.

- Dominant Segments:

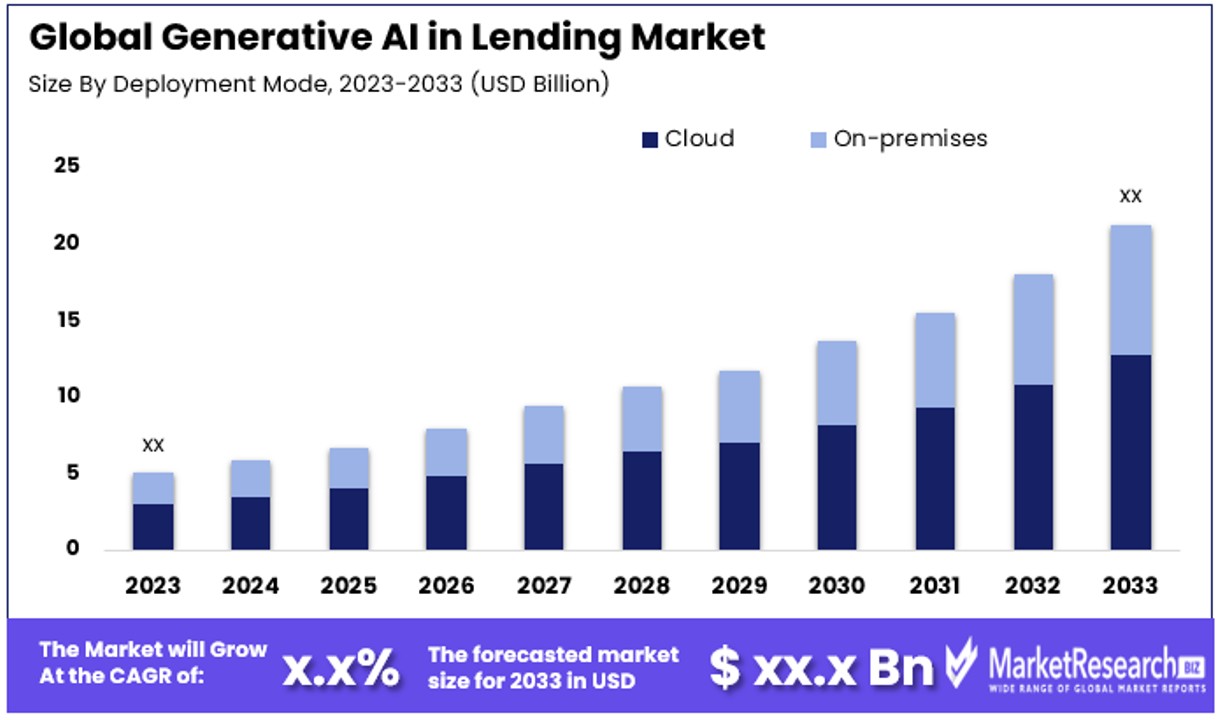

- Deployment Mode Analysis: Cloud deployment mode emerges as dominant due to its flexibility, scalability, and cost-effectiveness, allowing lenders to deploy advanced AI capabilities without significant upfront investments.

- Application Analysis: Credit Scoring stands out as pivotal, driven by Generative AI's ability to enhance accuracy and fairness by analyzing a broader range of data, potentially increasing credit access to underserved populations.

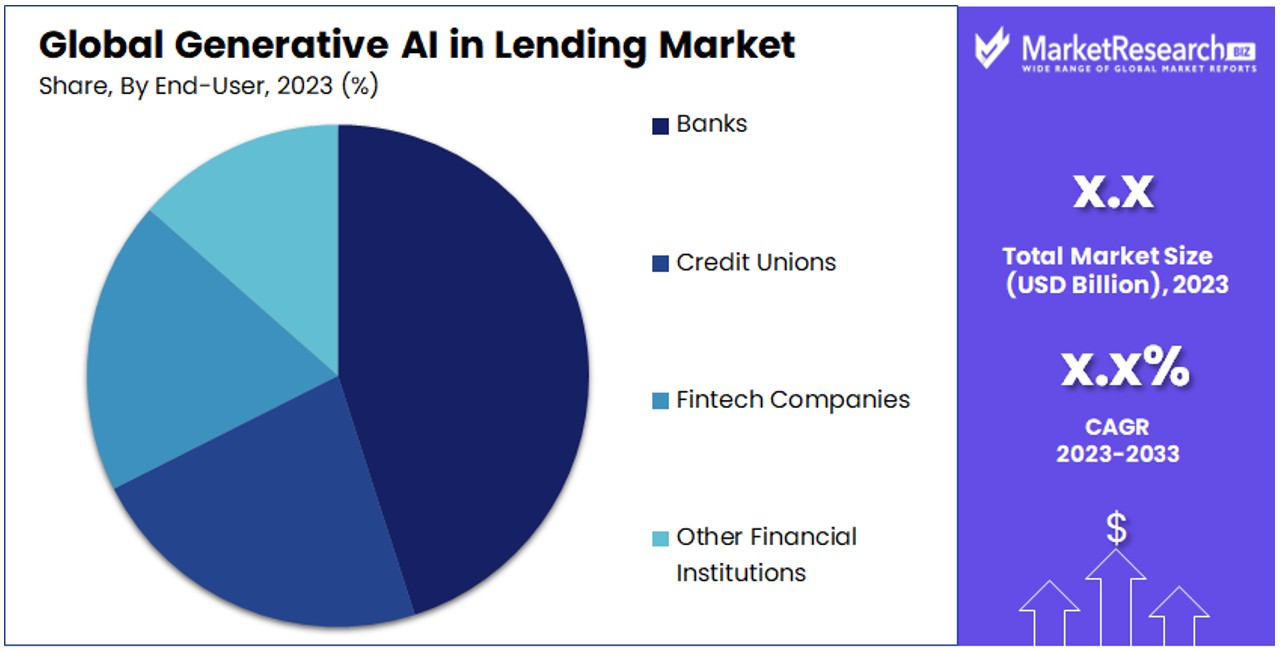

- End-User Analysis:Banks dominate as end-users, leveraging Generative AI to innovate and streamline operations, improve customer service, and manage risk more effectively, setting trends that other segments follow.

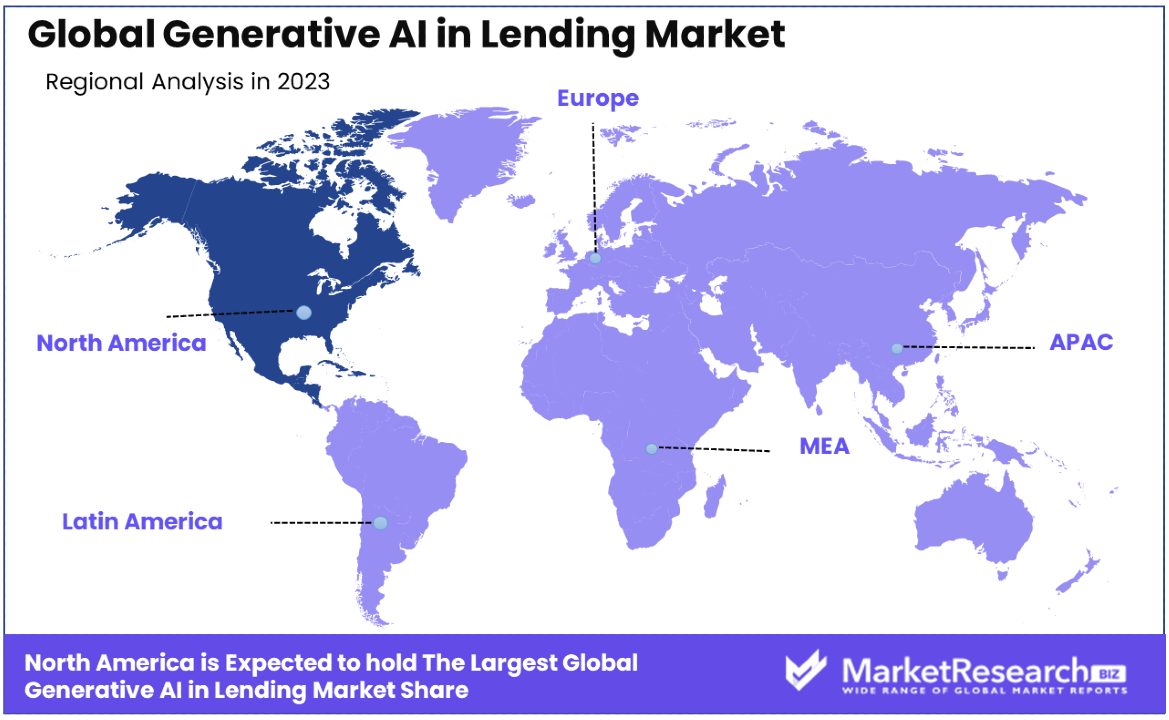

- Regional Analysis: North America leads the market with a dominant 42% share, driven by technological advancement and a dynamic financial landscape. Europe follows with around 28%, benefiting from a strong regulatory framework.

- Key Players: Major players in the market include Informed, C3.ai, Inc, Google LLC, FICO, ZestFinance, DataRobot, Experian plc, Equifax Inc., Adobe Inc., Alphabet Inc. (Google), Microsoft Corporation, Meta Platforms Inc. (formerly Facebook), and Sequoia Capital.

- Analyst Viewpoint: The market's growth is driven by factors such as increased demand for accurate and fair credit assessments, technological advancements, and evolving regulatory environments. Growth opportunities lie in leveraging AI for more personalized lending solutions, improving operational efficiency, and expanding financial services access.

Driving Factors

Streamlining Loan Application Processes Drives Market Growth

The integration of Generative AI into the lending market significantly streamlines the loan application process, marking a transformative shift in how lenders operate and interact with customers. By automating the generation of personalized documents, forms, and tailored communication, Generative AI not only speeds up processing times but also substantially enhances the customer experience. This efficiency is crucial in a competitive market where quick loan approval can be a key differentiator. Faster processing times mean that lenders can handle a higher volume of applications with the same resources, increasing their market reach and profitability.

Moreover, the automation of routine tasks reduces the likelihood of human error, further improving the reliability and consistency of the lending process. The result is a more agile, responsive lending industry capable of adapting to changing market demands and customer expectations. Thus cutting-edge AI technologies are revolutionizing financial services, enhancing efficiency and accuracy in areas like risk assessment and fraud detection.

Enhancing Risk Assessment and Credit Scoring Drives Market Growth

Generative AI's capability to analyze vast amounts of data, including non-traditional or alternative data sources, revolutionizes the risk assessment and credit scoring aspects of lending. This innovation allows for the generation of more accurate and nuanced credit risk assessments and scoring models, leading to better-informed lending decisions.

The use of Generative AI for risk assessment enables lenders to identify potential red flags and opportunities that traditional models might overlook, offering a more comprehensive view of a borrower's creditworthiness. This enhanced accuracy reduces the risk of default, securing higher profitability for lenders and opening up new lending opportunities within underserved or traditionally high-risk segments. Additionally, the ability to incorporate a broader range of data into credit assessments democratizes access to credit, as potential borrowers who might have been excluded by conventional metrics can now be evaluated more fairly.

Intelligent Chatbots and Virtual Assistants Drive Market Growth

Generative AI-powered intelligent chatbots and virtual assistants are redefining customer service in the lending market. By providing 24/7 support, answering queries, and guiding borrowers through the lending process, these AI tools significantly improve the borrower experience. The immediate, round-the-clock assistance ensures that potential borrowers can access information and resolve issues without delay, increasing customer satisfaction and engagement.

Moreover, intelligent chatbots and virtual assistants can handle a vast volume of queries simultaneously, reducing the workload on human customer service teams and allowing them to focus on more complex customer needs. This efficiency not only reduces operational costs but also scales the lender's customer service capabilities without proportionately increasing resources. As these AI systems learn from interactions, they become increasingly sophisticated in understanding and responding to customer needs, further enhancing the quality of service.

Restraining Factors

Regulatory and Compliance Concerns Restrain Market Growth

The deployment of Generative AI in lending is significantly hampered by regulatory and compliance concerns. The lending sector, known for its stringent regulations, is cautious about adopting AI models that could potentially compromise fairness, transparency, and adherence to legal standards. The crux of the issue lies in the 'black box' nature of AI, where decision-making processes are not always transparent, leading to fears of unintentional biases and discriminatory practices.

This apprehension is compounded by the potential for AI-driven decisions to violate existing fair lending laws and consumer protection statutes, creating a significant barrier to widespread adoption. Regulators and financial institutions remain wary, prioritizing the need to ensure that AI applications in lending do not result in unfair treatment of borrowers or contravene regulatory mandates. This cautious stance, while necessary for protecting consumer rights, limits the pace and extent of Generative AI's integration into the lending industry.

Data Privacy and Security Risks Restrain Market Growth

Generative AI's requirement for extensive access to personal and financial data introduces data privacy and security risks that act as a deterrent to its broader adoption in the lending market. The sensitivity of the data handled by the lending industry cannot be overstated, with the integration of AI models raising the stakes in terms of potential data breaches or misuse.

These concerns are not unfounded, as the proliferation of AI technologies increases the attack surface for cyber threats, thereby elevating the risk of unauthorized access to confidential information. The possibility of such breaches undermines consumer trust and could have severe reputational and financial consequences for lending institutions. Ensuring robust data security measures and maintaining privacy are paramount, but the challenges in achieving these in the context of AI deployment create a significant hurdle.

Deployment Mode Analysis

The cloud deployment mode emerges as the dominant sub-segment in the Generative AI in lending market, propelled by its flexibility, scalability, and cost-effectiveness. Cloud-based solutions offer lenders the ability to deploy advanced AI capabilities without the need for significant upfront investment in hardware and infrastructure.

This model supports rapid scaling to accommodate growing data volumes and computational needs, a critical advantage given the expanding scope of generative AI applications. Furthermore, cloud services facilitate easier updates and improvements to AI models, ensuring that lending institutions can quickly adapt to market changes and regulatory updates.

The on-premises deployment mode, while offering higher control over data and systems, typically requires more substantial initial investments and ongoing maintenance. This mode remains relevant for institutions prioritizing data control and security, especially in regions with stringent data residency regulations.

The dominance of cloud deployment is underlined by the increasing preference for as-a-service platforms, which allow lenders to leverage cutting-edge AI technologies with lower entry barriers. As cloud computing infrastructure continues to evolve, its role in enabling the widespread adoption of generative AI in lending is expected to grow, offering lenders of all sizes access to powerful tools for credit scoring, risk assessment, and customer service.

Application Analysis

In the application segment of the Generative AI in lending market, Credit Scoring stands out as a pivotal area, driving innovation and efficiency in lending decisions. Generative AI significantly enhances the accuracy and fairness of credit scoring by analyzing a broader range of data, including non-traditional data points, to assess borrower risk. This capability allows for more nuanced and personalized credit assessments, potentially opening up credit access to underserved populations.

Other applications such as Loan Origination, Risk Assessment, Fraud Detection, and Customer Service also greatly benefit from Generative AI, each contributing to the overall growth of the market. For instance, in Loan Origination, AI streamlines the application and approval process, while in Risk Assessment, it provides deeper insights into potential risks associated with lending. Fraud Detection applications benefit from AI’s ability to identify and flag anomalies that may indicate fraudulent activity, and Customer Service applications use AI to enhance borrower engagement and support.

However, the transformational impact of Generative AI on Credit Scoring cannot be overstated. By making credit assessments more accurate and inclusive, Generative AI not only improves the operational efficiency of lending institutions but also plays a crucial role in democratizing access to financial services. As regulatory environments evolve to accommodate these innovations, the application of Generative AI in credit scoring is expected to continue its trajectory of growth, further cementing its status as a key driver of market expansion.

End-User Analysis

Banks stand out as the dominant end-user in the Generative AI in lending market, leveraging this technology to innovate and streamline operations across multiple fronts. The adoption of Generative AI by banks is driven by the need to enhance customer service, improve risk management, and ensure competitive advantage in a rapidly evolving financial landscape. These institutions are integrating AI to automate and personalize loan origination processes, refine credit scoring models with more comprehensive data analysis, and implement advanced fraud detection systems.

The role of banks in the adoption of Generative AI is pivotal, given their significant market share and influence in the financial services industry. They have the resources and infrastructure to invest in cutting-edge technologies, setting trends that other market segments often follow. The incorporation of Generative AI allows banks to offer more tailored financial products, respond more effectively to customer needs, and manage risk more efficiently, leading to better financial outcomes and customer satisfaction.

Other financial institutions, including credit unions, fintech, and various non-banking financial companies (NBFCs), also contribute to the growth of Generative AI in lending. Credit unions are leveraging AI to offer more personalized services to their members, while fintech companies are at the forefront of innovating with AI for more agile and user-friendly lending solutions. These segments play crucial roles in pushing the boundaries of what's possible with Generative AI, often focusing on niche markets or specific customer needs that larger banks may overlook.

Key Market Segments

By Deployment Mode

- Cloud

- On-premises

By Application

- Credit Scoring

- Loan Origination

- Risk Assessment

- Fraud Detection

- Customer Service

- Other Applications

By End-User

- Banks

- Credit Unions

- Fintech Companies

- Other Financial Institutions

Growth Opportunities

Streamlining Loan Application Processes Offers Growth Opportunity

The integration of Generative AI into the loan application process presents a substantial growth opportunity for the lending market. By automating the creation of personalized documents, forms, and communications, lenders can significantly reduce the time and labor traditionally required for these tasks. This streamlining effect not only cuts operational costs but also enhances the customer experience through faster processing times.

The result is a more efficient, responsive lending process that can accommodate a higher volume of applications with greater accuracy and less manual intervention. Such improvements are crucial for staying competitive in a financial landscape that increasingly values speed and personalization. As Generative AI technology evolves, its potential to further refine and accelerate loan processing will continue to unlock new efficiencies, making it a pivotal factor in the expansion of the lending market.

Enhancing Risk Assessment and Credit Scoring Offers Growth Opportunity

The application of Generative AI in risk assessment and credit scoring is revolutionizing the way lenders evaluate loan applications, offering a significant growth opportunity for the lending industry. By harnessing the power of Generative AI to analyze a broader array of data—including non-traditional sources such as social media activity and spending patterns—lenders can gain a more nuanced understanding of a borrower's creditworthiness.

This approach enables the identification of creditworthy individuals who might be overlooked by traditional scoring models, thereby expanding the potential customer base. Companies like Zest AI exemplify how such technology can provide deeper, more accurate risk assessments, allowing for more informed lending decisions and reducing the risk of default. This capability not only enhances the precision of lending decisions but also opens the door to markets previously deemed too risky, marking a significant leap forward in how lenders manage and mitigate risk.

Trending Factors

Fraud Detection and Prevention Are Trending Factors

Fraud detection and prevention using Generative AI is rapidly becoming a trend in the lending market, driven by the technology's ability to analyze complex datasets and identify irregular patterns indicative of fraudulent activities. With financial fraud becoming increasingly sophisticated, the adoption of Generative AI models allows lenders to stay a step ahead, significantly reducing financial risks.

Companies like Feedzai and Sift Science are at the forefront, leveraging Generative AI to enhance their fraud detection capabilities. This trend is not only about safeguarding assets but also about building trust with customers, crucial in today's digital finance landscape. As these AI models become more advanced, their role in fraud prevention is expected to become even more critical, marking a significant trend in the industry's move towards more secure and intelligent lending practices.

Regulatory Compliance and Documentation Are Trending Factors

Generative AI's role in ensuring regulatory compliance and documentation is emerging as a key trend in the lending industry. The capacity of Generative AI to parse through vast amounts of regulatory text and generate accurate, compliant documents is revolutionizing how lenders approach compliance. This technology streamlines the production of necessary reports and disclosures, significantly reducing the manual effort required and minimizing the risk of errors.

By automating these processes, lenders can ensure adherence to the latest regulatory requirements with greater efficiency, thereby reducing the risk of penalties. This trend highlights the growing importance of AI in navigating the complex regulatory landscape of the lending sector, offering a clear pathway to enhanced compliance and operational efficiency.

Regional Analysis

North America Dominates with 42% Market Share

North America, with a commanding 42% share of the Generative AI in lending market, stands as a pivotal region driving the industry's growth. This dominance is attributed to several key factors, including the region's robust financial ecosystem, significant investments in AI and technology innovation, and a strong regulatory framework that fosters safe yet progressive adoption of new technologies. The presence of a large number of tech companies and startups, alongside substantial financial institutions, fuels the development and integration of Generative AI solutions in lending practices.

The market dynamics in North America are shaped by its advanced digital infrastructure, high digital literacy rates, and a culture that is quick to adopt technological innovations. These characteristics ensure a receptive environment for Generative AI applications, from fraud detection to personalized lending experiences. Moreover, the regulatory bodies in North America have been proactive in creating guidelines that balance innovation with consumer protection, encouraging the responsible use of AI in financial services.

For other regions, the market share and growth rates are as follows:

- Europe: Holding a significant 28% share, Europe's lending market benefits from robust regulatory standards and a commitment to consumer data protection, fostering the development of trustworthy AI solutions that comply with stringent regulations. This environment encourages the creation of transparent and secure lending platforms, providing consumers with confidence in utilizing AI-driven financial services across the continent.

- Asia Pacific: Accounting for approximately 20% of the market, the Asia Pacific region experiences rapid digitalization and a flourishing fintech ecosystem, particularly prominent in countries like China and India. This growth is fueled by widespread adoption of AI technologies in lending, supported by the region's increasing connectivity and a tech-savvy population eager to embrace innovative financial solutions.

- Middle East & Africa: Despite holding a smaller share of about 6%, the Middle East & Africa region demonstrates potential for expansion fueled by ongoing digitalization efforts and investments in fintech innovation. As these markets embrace AI-driven lending solutions, there's an opportunity for growth driven by increased accessibility to financial services and improved efficiency in lending processes.

- Latin America: With a modest share of approximately 4%, Latin America's lending market is on a gradual upswing, propelled by the rise of fintech startups and expanding internet penetration across the region. The emergence of AI-driven lending platforms in Latin America offers new avenues for financial inclusion and innovation, catering to the diverse needs of a rapidly evolving consumer base.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the evolving landscape of the Generative AI in Lending Market, key players are redefining the integration of artificial intelligence within the financial sector. Companies such as Informed, C3.ai, Inc., and Google LLC are at the forefront, leveraging AI to enhance decision-making processes in the finance industry. Their strategic positioning underscores a commitment to innovating risk assessment methodologies, optimizing risk profiles, and personalizing risk tolerance evaluations for clients.

FICO and ZestFinance have been instrumental in transforming historical market data into actionable insights, enabling more informed decisions in the banking sectors. DataRobot, Experian plc, and Equifax Inc. contribute significantly to the market by improving credit assessments with advanced analytics, thus influencing market conditions favorably.

Adobe Inc., alongside Alphabet Inc. (Google) and Microsoft Corporation, further accelerates this transformation by embedding AI-driven solutions into various banking industry processes. Their efforts, combined with those of Meta Platforms Inc., Sequoia Capital, and Andreessen Horowitz, highlight a collective push towards utilizing artificial intelligence to meet the dynamic needs of the finance sector.

Emerging players like Soma Capital, Khosla Ventures, Ceridian, and Zycus also play crucial roles, demonstrating the widespread acknowledgment of AI's potential across Financial markets. Their innovative approaches to lending and credit evaluation signify a robust movement towards a more efficient, transparent, and user-centric finance industry, paving the way for a future where AI-driven solutions become integral to the financial sector's evolution.

Market Key Players

- Informed

- C3.ai, Inc

- Google LLC

- FICO

- ZestFinance

- DataRobot

- Experian plc

- Equifax Inc.

- Adobe Inc.

- Alphabet Inc. (Google)

- Microsoft Corporation

- Meta Platforms Inc. (formerly Facebook)

- Sequoia Capital

- Andreessen Horowitz

- Soma Capital

- Khosla Ventures

- Ceridian

- Zycus

- Other Key Players

Recent Developments

- On February 2024, Zest AI introduced LuLu, its new lending intelligence companion, designed to revolutionize the lending industry by providing strategic insights and performance optimization tools for lenders.

- On January 2024, Scienaptic AI announced a strategic integration partnership with DigiFi, a leader in automated digital lending solutions, to revolutionize credit lending with AI integration.

- On October 2023, Galytix, a GenAI data technology company, announced the extension of its GX data platform to automate corporate credit lending for global banks, providing early warning signals and streamlining the lending process for financial institutions.

Report Scope

Report Features Description Market Value (2023) USD xx Billion Forecast Revenue (2033) USD xx Billion CAGR (2024-2033) xx.x% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Deployment Mode (Cloud, On-premises), By Application (Credit Scoring, Loan Origination, Risk Assessment, Fraud Detection, Customer Service, Other Applications), By End-User (Banks, Credit Unions, Fintech Companies, Other Financial Institutions) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Informed, C3.ai, Inc, Google LLC, FICO, ZestFinance, DataRobot, Experian plc, Equifax Inc., Adobe Inc., Alphabet Inc. (Google), Microsoft Corporation, Meta Platforms Inc. (formerly Facebook), Sequoia Capital, Andreessen Horowitz, Soma Capital, Khosla Ventures, Ceridian, Zycus, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Informed

- C3.ai, Inc

- Google LLC

- FICO

- ZestFinance

- DataRobot

- Experian plc

- Equifax Inc.

- Adobe Inc.

- Alphabet Inc. (Google)

- Microsoft Corporation

- Meta Platforms Inc. (formerly Facebook)

- Sequoia Capital

- Andreessen Horowitz

- Soma Capital

- Khosla Ventures

- Ceridian

- Zycus

- Other Key Players