Cloud Infrastructure Service Market By Type (Public Cloud, Private Cloud, Hybrid Cloud), By Organization Size(Large Enterprises, Small and Medium-sized Enterprises (SMEs)), By Service(Software as a Service (SaaS), Platform as a Service (PaaS), Infrastructure as a Service (IaaS)), By Industry(IT and Telecommunications, BFSI, Government, Consumer Goods and Retail, Healthcare, Manufacturing, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

42935

-

Jan 2024

-

179

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Cloud Infrastructure Service Market Size, Share, Trends Analysis

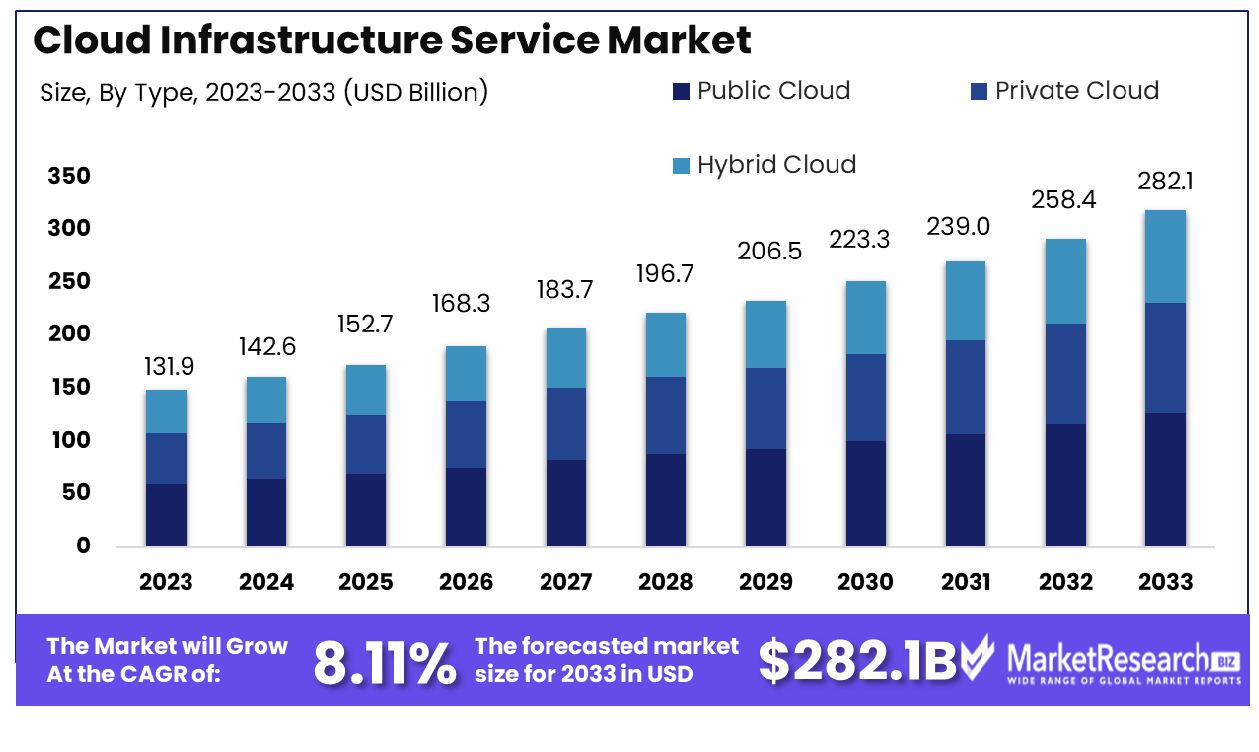

The cloud infrastructure service market was valued at USD 131.9 billion in 2023. It is expected to reach USD 282.1 billion by 2033, with a CAGR of 8.11% during the forecast period from 2024 to 2033.

The surge in demand for new cloud-based advanced technologies and the rise in data quantities are some of the main driving factors for the cloud infrastructure service market. Cloud infrastructure is an integration of hardware and software resources that create the cloud. The cloud providers maintain worldwide data hubs with multiple IT infrastructure elements, such as servers, physical storage equipment, and networking devices. These form the physical equipment by using all types of OS configurations. They also install different types of software that are needed for an application to run smoothly. The cloud infrastructure in a pay-as-you-go method will help substantially reduce the cost of acquiring and sustaining individuals’ elements.

Cloud infrastructure plays an important role in cloud computing. It supports this by splitting the characteristics and operations of these hardware and software elements. The virtualized resources are then developed by a cloud service provider in the case of a private cloud and made accessible to users all over the internet. Virtual machines and components consisting of servers, memory, storage, firewalls, and network switches are some of the perfect examples of such resources. These resources are constantly making extensive and task-oriented services such as ML and AI.

According to a report published by Google Cloud in January 2022, there has been a rise of 41.4% in the usage of cloud-based services and products. The cloud giants are also planning to transfer legacy enterprise software to cloud-based equipment (33%). Moreover, as per the survey conducted by Google Cloud, there are more than 50% of cloud decision-makers are either hiring new staff or providing re-training to the present staff to augment their cloud spend. There will be more than 50% of the enterprise firms that will use industry cloud platforms to accelerate their business initiatives by 2027.

In IT sectors, cloud infrastructure is predominantly used as it has several advantages, such as enhanced data control, high data security, advances in software updates, increased storage capacity, and flexibility in storage capacity. These are also cost-effective and augment the performance with 99% efficacy and quality. Cloud infrastructure also offers high-end management services and maintains proper functioning and sustainability. The demand for cloud infrastructure will rapidly increase due to its requirements in IT sectors, which will help in market expansion during the forecasted period.

Cloud Infrastructure Service Market Dynamics

Flexibility and Scalability Boosts Cloud Infrastructure Adoption

The increasing prevalence of cloud infrastructure, utilized by over 98% of organizations, is largely driven by its flexibility and scalability. This adaptability allows businesses to swiftly adjust their services in response to fluctuating demands. For instance, retailers can augment server capacity during peak holiday seasons, effectively managing increased traffic.

The rapid growth of top cloud service providers - AWS, Azure, and Google - by 42% year-over-year evidence the escalating reliance on cloud solutions. This trend showcases how the ability to scale resources as needed not only enhances operational efficiency but also supports diverse business requirements, catalyzing the expansion of the cloud infrastructure service market.

Cost-Effectiveness Spurs Market Growth

The market's growth rate is significantly propelled by the cost-effectiveness of cloud infrastructure. Building and maintaining on-premises data centers incurs significant expenses—approximately $1000 per square foot for small data centers and $10 to $12 million per megawatt for commercial centers.

Cloud infrastructure mitigates these costs by obviating the need for costly hardware, turning substantial fixed expenses into variable costs based on usage. Consequently, businesses can economize by paying only for the resources they utilize, making cloud services an increasingly attractive proposition for companies aiming to optimize their operational budgets. The Cloud Infrastructure Service expands to include the Hardware as a Service market segment.

Acceleration of Innovation Through Cloud Computing

Cloud computing's role in facilitating faster innovation is a significant contributor to its market growth, especially among small and medium-sized businesses (SMBs). With 57% of SMB workloads and 56% of SMB data now residing in public clouds, cloud services are crucial for business innovation.

Cloud providers continuously introduce new services and updates, enabling major companies, including startups, to rapidly access advanced technologies like AI. This dynamic ecosystem not only expedites the development of innovative solutions but also provides a competitive edge to businesses leveraging cloud infrastructure for their growth and transformation.

Compliance Risks Challenge Cloud Infrastructure Service Adoption in Regulated Industries

Compliance risks significantly limit the cloud growth of the cloud infrastructure service market, especially in highly regulated industries like healthcare and finance. These sectors have stringent compliance rules, such as the Health Insurance Portability and Accountability Act (HIPAA) in healthcare, which sets strict standards for how patient data can be stored and managed in the cloud. Ensuring cloud environments comply with these regulations is a complex and ongoing challenge. This complexity can deter regulated industries from fully embracing cloud solutions, as the risk of non-compliance and potential legal and financial repercussions are major concerns.

Market Saturation Intensifies Competition in Cloud Infrastructure Services

Market saturation is a critical factor restraining the growth of the cloud infrastructure service market. As of Q2 2022, the top three cloud service providers - AWS, Azure, and Google - collectively grew by 42%, with Amazon, Google, and Huawei holding a combined market share of 65%. This saturation has led to intensified competition, sparking price wars and squeezing profit margins. In such a crowded market, it becomes increasingly challenging for providers to differentiate their services. This intense competition can hinder the market’s growth as providers struggle to maintain profitability and invest in innovation amidst aggressive pricing strategies.

Cloud Infrastructure Service Market Segmentation Analysis

By Type Analysis

The cloud infrastructure service market is predominantly led by the public cloud segment. Its apex is based on the flexibility, scalability, and cost-efficiency that it can provide. Cloud-based public cloud services provide business users with computing capabilities, such as storage, servers, and networking, that are managed by third-party companies over the Internet. This approach eliminates the need for substantial capital expenditures on infrastructure and is a major draw for businesses seeking to cut IT costs. Clouds that are accessible to the public are well-known due to their easy deployment, their ability to manage changing workloads, and the variety of services and applications they offer.

Private cloud and hybrid cloud are also significant segments. Private clouds are chosen by organizations requiring enhanced control and security for sensitive data. Hybrid cloud computing combines public and private cloud elements, offering a balance between scalability and security, making it suitable for businesses with diverse IT needs. However, the public cloud's benefits of cost savings, agility, and broad service offerings underpin its market dominance.

By Organization Size Analysis

Large Enterprises are the dominant segment in the cloud infrastructure service market. These organizations often have complex IT needs and require robust, scalable, and secure cloud solutions. Large enterprises benefit significantly from cloud services due to their ability to support vast and varied workloads, facilitate global operations, and drive digital transformation initiatives. The cloud's scalability allows these companies to quickly adapt to market changes and business growth, while its global reach helps them maintain operations across different regions.

Small and Medium-sized Enterprises (SMEs) are also important market participants. SMEs increasingly adopt cloud services for their cost-effectiveness and the ability to compete more effectively with larger companies. The market influence of cloud services for large companies is underscored by the extensive resource utilization, global presence, and strategic value they possess.

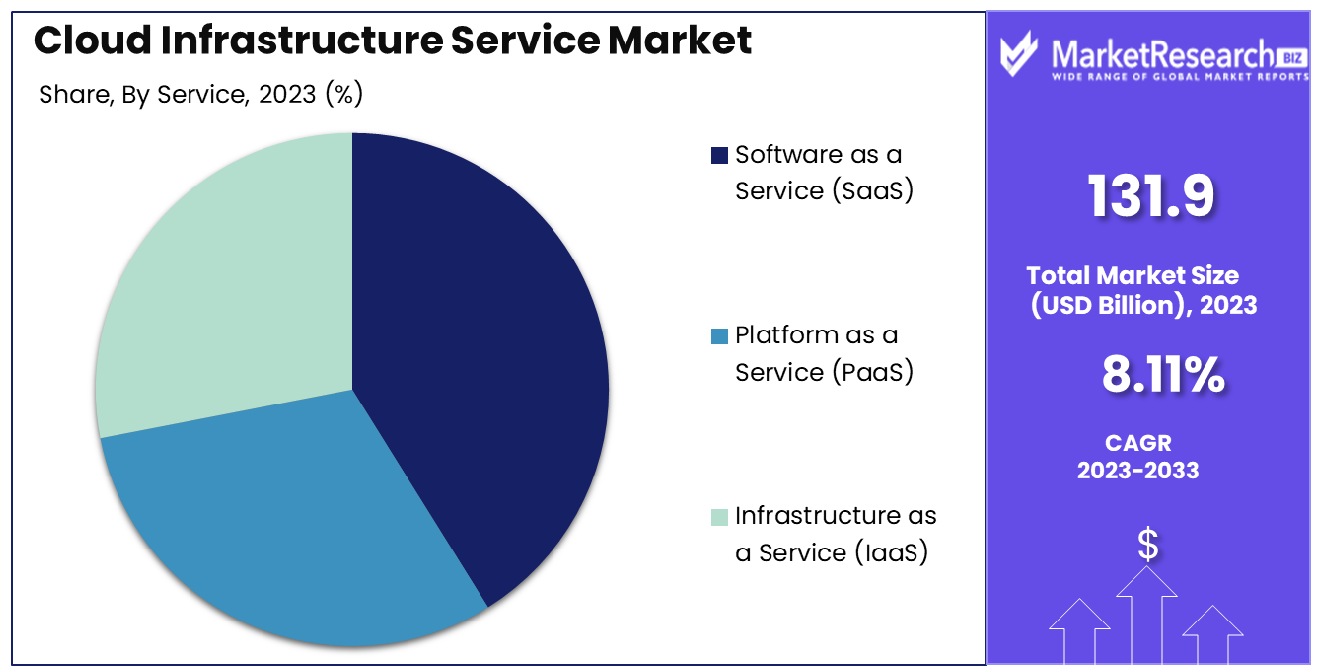

By Service Analysis

Software as a Service (SaaS) is the dominant segment in the cloud infrastructure service market.SaaS offers businesses access to software hosted on cloud-based infrastructures, removing the need to install or maintain applications on personal PCs. This type of model is popular because of its simplicity of use as well as its scalability and subscription-based pricing, which can reduce initial expenses. SaaS applications can be used to cover a broad variety of business functions, such as email, customer relationship management (CRM), cloud ERP (ERP), and collaboration tools.

Infrastructure as a Service (IaaS) and Platform as a Service (PaaS) are also critical segments. IaaS provides virtualized computing resources over the Internet, while PaaS offers hardware and software tools over the Internet, typically for application development. Despite the significance of IaaS and PaaS, SaaS's widespread adoption across industries due to its direct utility for business operations places it at the forefront of the cloud services market.

By Industry Analysis

IT and Telecommunications are the leading industries in the cloud infrastructure services market. This sector heavily depends on cloud-based services for storage, processing, and communication requirements. The cloud's ability to handle substantial data volumes, support extensive communication networks, and provide essential IT service infrastructure aligns perfectly with the requirements of this industry trend.

Other industries, like BFSI, Government, Consumer Goods, Retail, Healthcare, Manufacturing, and Others also heavily utilize cloud services. BFSI uses the cloud for secure data storage and managing customer transactions, Government sectors for improving public services and infrastructure, and Healthcare for patient data management and telemedicine. Yet, due to the pivotal role of cloud service providers within the IT and Telecommunications industries, coupled with rapid growth and advancements, it remains the leading market for cloud infrastructure services.

Cloud Infrastructure Service Industry Segments

By Type

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By Service

- Software as a Service (SaaS)

- Platform as a Service (PaaS)

- Infrastructure as a Service (IaaS)

By Industry

- IT and Telecommunications

- BFSI

- Government

- Consumer Goods and Retail

- Healthcare

- Manufacturing

- Others

Cloud Infrastructure Service Market Growth Opportunity

Hybrid Cloud Adoption Catalyzes Growth in Cloud Infrastructure Services

The significant growth opportunity in the cloud infrastructure services market lies in the increasing adoption of cloud hybrid models among businesses. Hybrid clouds, combining public and private cloud elements, offer organizations the flexibility to maintain some systems on-premises while leveraging the benefits of public cloud services. The key challenge lies in striking the right balance between control and flexibility.

With about 40% of organizations using multi-cloud management tools and engaging with multiple public and private clouds, as reported by Flexer, the demand for solutions that effectively integrate and manage these diverse cloud environments is on the rise. This trend underscores the growing need for hybrid cloud solutions and services, driving market expansion.

Multi-Cloud Strategies Open New Avenues in the Cloud Infrastructure Market

The trend towards multi-cloud strategies, where businesses utilize multiple public clouds like AWS, Azure, and Google Cloud, represents a considerable opportunity for growth in the cloud infrastructure service market. This approach offers redundancy and helps avoid vendor lock-in, but it also introduces complexities in management across different platforms. The lack of unified visibility and operations is a significant pain point.

According to the Nutanix Enterprise Cloud Index report, nearly two-thirds of global IT professionals expect to run a multi-cloud IT model by 2024, with 28% citing lock-in avoidance as a key reason. This rising interest in multi-cloud environments highlights the need for services that can seamlessly manage and integrate various cloud platforms, suggesting robust market growth potential.

Cloud Infrastructure Service Market Regional Analysis

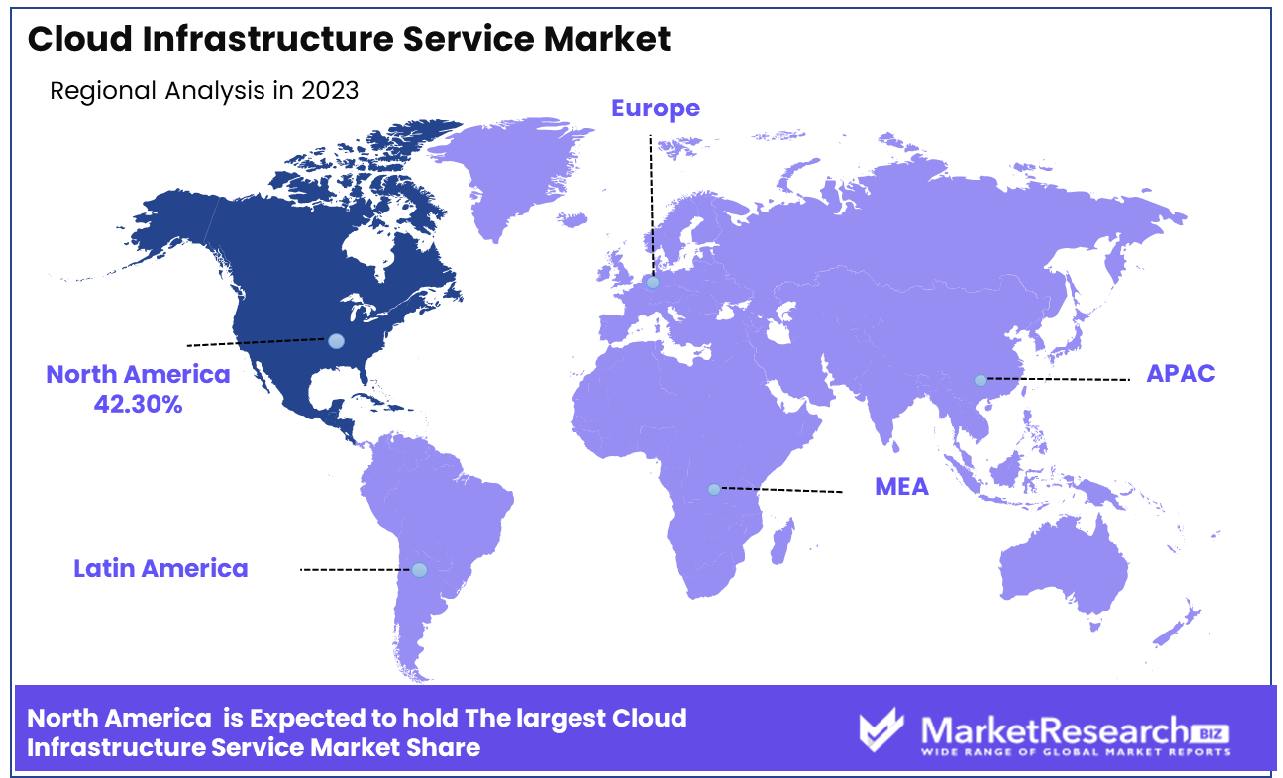

North America Dominates with 42.30% Market Share in the Cloud Infrastructure Service Market

North America's substantial 42.30% market share in the cloud infrastructure service market is underpinned by the presence of major technology firms and a highly developed IT infrastructure. The United States, home to cloud computing giants such as Amazon Web Services (AWS) in Seattle, Microsoft Azure in Redmond, and Google Cloud in Mountain View, California, is a key driver of this market. The region’s market dominance is further supported by Canada, which is witnessing a growing adoption of cloud services in cities like Toronto and Vancouver. The high rate of digital transformation among businesses, a well-established startup ecosystem, and significant investments in cloud technology contribute to the strong market presence.

The cloud infrastructure service market in North America is characterized by rapid technological advancements and a competitive business environment. The increasing adoption of cloud services across various industries, including finance, healthcare, and retail, drives the market. Furthermore, the rising trend of remote work and the demand for flexible and scalable IT solutions have heightened the necessity for cloud-based infrastructure services. The market also benefits from robust cybersecurity measures and regulatory compliance standards, enhancing trust among businesses to adopt cloud services.

Europe: Strong Data Privacy Regulations and Diverse Market

Europe’s cloud infrastructure service market is driven by strong data privacy regulations like GDPR and a diverse market with significant growth in countries like Germany, the UK, and France. Companies like Deutsche Telekom and OVHcloud provide competitive services. The primary market features include the increasing emphasis on data sovereignty and the growing utilization of cloud-based services in the public sector.

Asia-Pacific: Rapid Expansion and Emerging Markets

In Asia-Pacific, the cloud infrastructure service market is rapidly expanding, led by countries like China and Japan. Companies such as Alibaba Cloud in China and NTT Communications in Japan are major contributors. The market is driven by the region’s growing digital economy, increasing internet penetration, and the rising demand for cost-effective IT solutions. Emerging markets like India and Southeast Asia present significant growth opportunities due to their large, digitally-savvy populations and growing startup ecosystems.

Cloud Infrastructure Service Industry By Region

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of Middle East & Africa

Cloud Infrastructure Service Market Share Analysis

In the Cloud Infrastructure Service Market, a highly competitive and rapidly evolving sector, the companies listed are pivotal in driving innovation and providing cloud solutions across various industries. Amazon Web Services Inc. and Microsoft Corporation are industry vertical titans, leading the market with extensive cloud offerings like AWS and Azure. Their strategic positioning emphasizes scalability, reliability, and a broad range of services, significantly influencing how businesses and organizations migrate to and operate in the cloud.

Google LLC and IBM Corporation, with their respective services like Google Cloud and IBM Cloud, are key players known for their robust infrastructure and pioneering technologies in areas like artificial intelligence and machine learning. These companies reflect the industry's shift towards more integrated and advanced cloud services.

Oracle Corporation and SAP SE offer cloud services that are highly integrated with their software solutions, appealing particularly to businesses looking for seamless integration with existing systems. Their focus on enterprise resource planning and database management in the cloud showcases the market's adaptability to diverse business needs.

Cloud Infrastructure Service Industry Key Players

- Amazon Web Services Inc.

- Oracle Corporation

- IBM Corporation

- Alibaba Group Holding Limited

- Microsoft Corporation

- VMware, Inc.

- Google LLC

- Rackspace Technology, Inc.

- SAP SE

- Salesforce, Inc.

- Rackspace Hosting, Inc

- Dell, Technologies Inc

- Hewlett Packard Enterprise Development Lp

- International Business Machines Corporation

- Cisco Systems, Inc

- Isagenix International LLC

- RyohinKeikaku Co. Ltd.

- Adobe Inc.

Cloud Infrastructure Service Market Recent Development

- In January 2024, Accenture announced its acquisition of Navisite, a digital transformation and managed services provider, to enhance its application and infrastructure managed services capabilities. The move aims to assist North American clients in modernizing IT for the AI era, leveraging Navisite's expertise in cloud and digital technologies.

- In January 2024, Huawei organized the "Egypt Internet Innovation Forum," emphasizing its commitment to supporting Egypt's digital transformation through Huawei Cloud services. The forum showcased cloud solutions for fintech, e-commerce, and media, highlighting Huawei's dedication to driving innovation and growth across sectors in Egypt.

- In January 2024, Google Cloud eliminated network data transfer fees, aiming to support an open ecosystem and differentiate itself from competitors like AWS with "restrictive licensing practices." This move allows customers to transfer data out of Google Cloud to other providers or on-premises environments without additional charges. The decision aligns with Google's commitment to customer choice and competition in the cloud market.

- In January 2024, Vantage Data Centers secures $6.4bn funding for expanding hyperscale facilities globally. Investment from DigitalBridge Group and Silver Lake will drive the construction of additional data centers to meet the rising demand for cloud and AI services.

- In January 2024, Yotta Data Services launches the 'Yotta G1' data center in GIFT City, Gujarat, with an investment exceeding Rs 500 crore. The facility offers high-density racks, 2 MW power, and comprehensive digital services, supporting global businesses and local enterprises.

- In January 2024, Microsoft upgrades its cloud services to enable customers to store all personal data within the EU, addressing concerns about data privacy laws. The move aligns with the growing trend of localizing data storage amid EU regulations.

- In December 2023, AWS launched its second infrastructure region in Canada, AWS Canada West (Calgary), becoming the first major cloud provider in Western Canada. The move aims to enhance resilience, availability, and lower latency for customers, with an estimated $17.9 billion investment through 2037, supporting over 9,300 jobs annually. The new region supports advanced technologies like AI and ML, fostering innovation in the country.

Report Scope

Report Features Description Market Value (2023) USD 131.9 Billion Forecast Revenue (2033) USD 761.5 Billion CAGR (2024-2032) 8.11% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Public Cloud, Private Cloud, Hybrid Cloud), By Organization Size(Large Enterprises, Small and Medium-sized Enterprises (SMEs)), By Service(Software as a Service (SaaS), Platform as a Service (PaaS), Infrastructure as a Service (IaaS)), By Industry(IT and Telecommunications, BFSI, Government, Consumer Goods and Retail, Healthcare, Manufacturing, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Amazon Web Services Inc., Oracle Corporation, IBM Corporation, Alibaba Group Holding Limited, Microsoft Corporation, VMware, Inc., Google LLC, Rackspace Technology, Inc., SAP SE, Salesforce, Inc., Rackspace Hosting, Inc., Dell, Technologies Inc., Hewlett Packard Enterprise Development Lp, International Business Machines Corporation, Cisco Systems, Inc, Isagenix International LLC, RyohinKeikaku Co. Ltd., Adobe Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Amazon Web Services Inc.

- Oracle Corporation

- IBM Corporation

- Alibaba Group Holding Limited

- Microsoft Corporation

- VMware, Inc.

- Google LLC

- Rackspace Technology, Inc.

- SAP SE

- Salesforce, Inc.

- Rackspace Hosting, Inc

- Dell, Technologies Inc

- Hewlett Packard Enterprise Development Lp

- International Business Machines Corporation

- Cisco Systems, Inc

- Isagenix International LLC

- RyohinKeikaku Co. Ltd.

- Adobe Inc.