Pressure Vessel Market Report By Material (Steel, Composite, Alloy, Others), By Product (Boiler, Nuclear Reactor, Separator, Storage Vessel, Heat Exchanger, Others), By End-User (Chemicals & Petrochemicals, Oil & Gas, Power Generation, Water Treatment, Pharmaceuticals, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

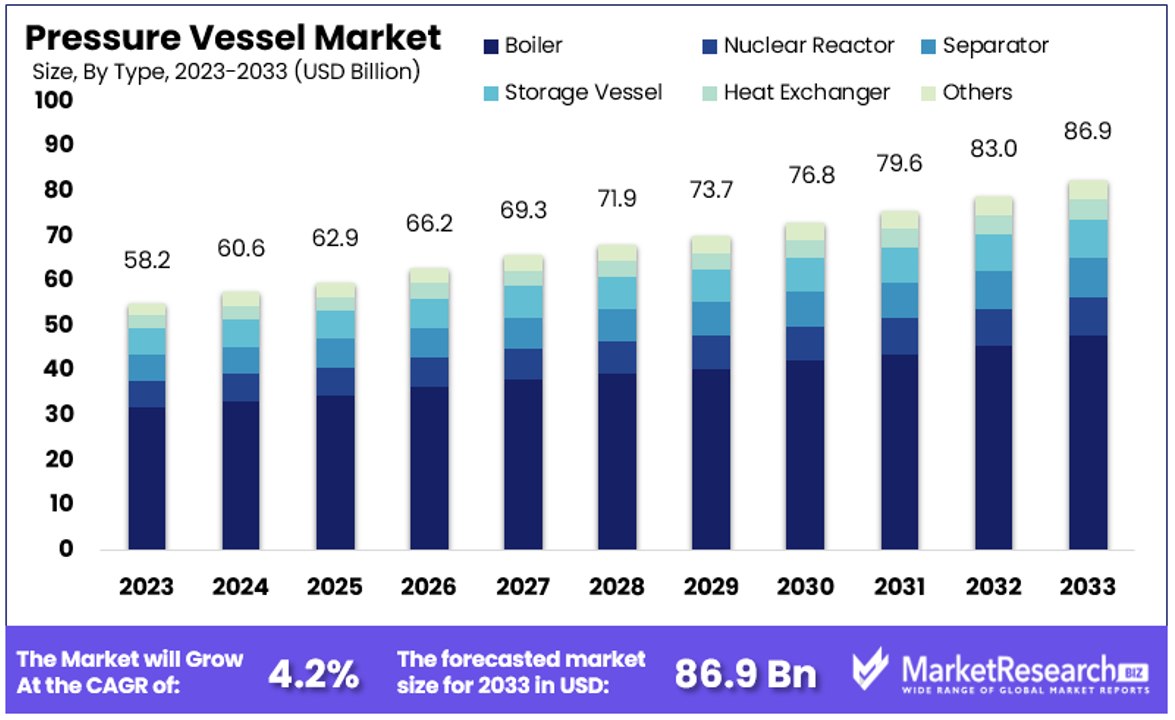

The Global Pressure Vessel Market size is expected to be worth around USD 86.9 Billion by 2033, from USD 58.2 Billion in 2023, growing at a CAGR of 4.20% during the forecast period from 2024 to 2033.

The surge in demand for the chemical and petrochemical sector, rise in advanced pressure vessels and advanced technologies are some of the main key driving factors for the pressure vessel.

A pressure vessel is defined as the container which is designed to grasp fluids or gases at a pressure substantially vary from the ambient pressure. Such vessels are developed to endure the internal pressure exerted by the contents without undergoing deformation and rupture.

Generally, these are made from materials like steel, composite materials and aluminium, pressure vessels undertake arduous design, testing methods and fabrications to make their integrity and safety. They discover applications in several industries that includes petrochemical, aerospace, manufacturing and pharmaceutical, where they are utilized for storing, processing and transporting fluids and gases under pressure.

These pressure vessels come in different shapes and sizes by ranging from small cylinders to large tanks and reactors that depends on their intended purposes. They are subject to restricted regulations and standards to alleviate the risk of accidents and make compliance with safety regulations. The daily inspection and maintenance are important to indorse the reliability and safety vessels during their operational lifespan.

According to an article published by Enervenue in September 2023, highlights that EnerVenue has introduced the next generation of its energy storage vessels. Enervenue is the first firm to bring metal hydrogen batteries has the potential of more than 30,000 cycles’ to the clean energy revolutions. The latest version of Enervenue’s batteries has the solution’s prolonged, operational flexibility and cost efficiency advantages for stationary storage projects all across myriad use cases.

The nominal power performance augments by 150%. With enhanced material efficacy, the new ESVs increase energy density by 100%. The next-generation ESVs can amenably cycle up to 3 times per day, at 2 to 12-hour discharge rates. Moreover, the next-generation ESVs are sponsored by EnerVenue’s Capacity Assurance™, the sector’s longest, simplest, and most forthright protracted warranty for stationary batteries, proposing an unmatched 20-year/20,000 cycle warranty extension that guarantees at least 88% battery capacity remaining after that period.

The pressure vessels provide advantages like efficient storage and transportation of compressed gases and liquids by expediting safe handling and distribution in different sectors. They make the suppression of substances under high pressure by augmenting industrial methods by decreasing leakage risks and makes the safety of both workers and the surrounding. The demand for the pressure vessels will increase due to its requirement in the various verticals of the industries that will help in market expansion in the coming years.

Key Takeaways

- Market Value: The Global Pressure Vessel Market is projected to reach USD 86.9 Billion by 2033, exhibiting significant growth from its 2023 value, with a CAGR of 4.20% during the forecast period from 2024 to 2033.

- Dominant Segments:

- Material Analysis: Steel dominates the market with a 32.1% share, owing to its durability, resilience, and suitability for high-pressure and high-temperature applications.

- Product Analysis: Boilers hold a dominant position, capturing 60% of the market share, driven by their essential role in power generation, heating, and industrial processes.

- End-User Analysis: The chemicals & petrochemicals industry leads with a 37.6% market share, relying heavily on pressure vessels for production, storage, and processing.

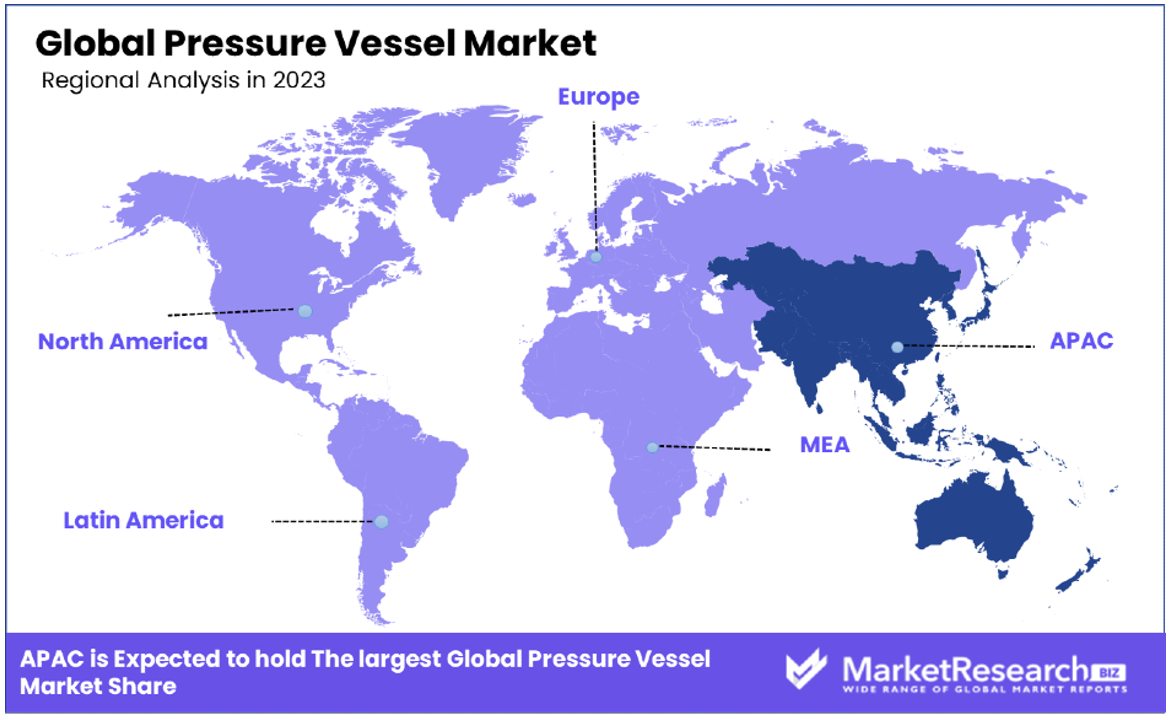

- Regional Analysis: Asia Pacific dominates the market with a 38.5% market share, driven by industrialization, infrastructure development, and increasing energy demand. North America holds a significant share of approximately 24%.

- Analyst Viewpoint: The pressure vessel market's growth is propelled by increasing industrialization, infrastructure development, and energy demand globally. Technological advancements in materials and manufacturing processes, along with the expansion of end-user industries, present significant growth opportunities for market players.

- Market Key Players: Major players in the global pressure vessel market include IHI Corporation, Bharat Heavy Electricals Limited, Larsen & Toubro Limited, Mitsubishi Hitachi Power Systems, Babcock & Wilcox, and Doosan Heavy Industries & Construction, among others.

Driving Factors

Growing Energy Needs Worldwide Drives Market Growth

The surging global demand for energy is a pivotal force propelling the pressure vessel market. With the International Energy Agency (IEA) forecasting a 21% increase in total energy demand by 2040, alongside a 28% rise in natural gas demand and a 17% uplift in oil demand by 2050, the need for pressure vessels is intensifying. These vessels are integral to the oil and gas, power generation, and manufacturing sectors for storage, processing, and transportation of fluids and gases.

The expansion of nuclear power plants and the push towards renewable energy sources further amplify the demand for pressure vessels. This uptrend is not only driven by the escalating energy consumption but also by the shift towards more sustainable and diversified energy sources. The pressure vessel market thrives as it adapts to these evolving energy landscapes, offering solutions that cater to both traditional and emerging energy sectors.

Technological Advancements and Efficiency Boost Market Growth

Technological innovation is at the heart of the pressure vessel market's expansion. Advancements in design and materials have led to the development of more efficient, durable, and safer pressure vessels. These improvements include features like corrosion resistance, enhanced strength, and better formability, which meet the rigorous standards of various industries.

The adoption of composite materials, for example, has significantly reduced maintenance costs and extended the lifespan of pressure vessels. This progress not only enhances the performance and reliability of pressure vessels but also addresses the growing environmental and safety concerns. Manufacturers are heavily investing in research and development to innovate and improve their offerings, ensuring they meet the increasing demands of industries such as chemicals, petrochemicals, and energy. The market growth is fueled by the continuous pursuit of technological excellence, making pressure vessels more adaptable and efficient for a wide range of applications.

Industrial Expansion and Infrastructure Projects Propel Market Growth

The global surge in industrial activities and infrastructure projects is a major driver for the pressure vessel market. As urbanization accelerates and the need for infrastructure such as roads, bridges, and high-rise buildings increases, so does the demand for pressure vessels. The Asian Development Bank (ADB) estimates that around US$1.7 trillion is needed annually in infrastructure investment across Asia through 2030. This expansion extends to the manufacturing and construction sectors, where pressure vessels play a critical role in the storage and processing of materials.

The development of new refineries, chemical plants, and power generation facilities further boosts the demand for pressure vessels. Governments and private entities investing in infrastructure and industrial growth support the market's upward trajectory. This dynamic reflects how the pressure vessel market is integral to the broader industrial ecosystem, providing essential components for the development and operation of a wide range of projects and facilities.

Restraining Factors

Volatility in Raw Material Prices Restrains Market Growth

The fluctuating costs of raw materials, particularly metals such as steel and stainless steel crucial for making pressure vessels, significantly hinder market growth. These fluctuations can lead to unpredictable production expenses, squeezing profit margins and complicating pricing strategies for manufacturers. Economic instability, trade tensions, and disruptions in supply chains contribute to this unpredictability, adversely affecting the market's profitability.

For instance, a sharp rise in steel prices can force manufacturers to adjust their budgets and pricing models abruptly, making it challenging to maintain competitiveness and profitability. This volatility not only impacts the financial planning of companies but also the affordability of pressure vessels for end-users, potentially delaying or reducing investments in sectors that rely on these essential components.

Competition and Market Saturation Limit Market Expansion

Intense competition and saturation within the pressure vessel market pose substantial challenges. The dominance of a few major players creates high barriers for new entrants, while established manufacturers face stiff competition to maintain or grow their market share. In regions or segments where the market is saturated, companies may engage in price competitions, which can erode profit margins and diminish overall market profitability.

For businesses to succeed in such a competitive landscape, differentiating themselves through innovation, superior quality, and exceptional service is essential. The presence of industry giants like Mitsubishi Hitachi Power Systems and IHI Corporation exemplifies the intense competition that stifles the growth opportunities for newer companies. This environment demands continuous innovation and strategic positioning to capture and retain market segments, making market saturation and competition critical restraints on the expansion of the pressure vessel industry.

Material Analysis

In the Pressure Vessel Market, materials play a pivotal role in defining the segments within the industry. Among these, steel stands out as the dominant material, accounting for 32.1% of the market. The predominance of steel in pressure vessel manufacturing is due to its durability, resilience, and ability to withstand high pressures and temperatures, making it an indispensable choice for industries such as oil and gas, chemicals, and power generation. Steel's versatility and cost-effectiveness further solidify its position as a market leader, despite the challenges posed by fluctuations in raw material prices.

Composite materials are emerging as a significant segment in the pressure vessel market. This segment benefits from advancements in material science that offer enhanced strength, corrosion resistance, and reduced weight compared to traditional steel vessels. Composites are increasingly preferred in applications where weight reduction is crucial, such as in aerospace and renewable energy sectors, driving their market share upward.

Alloys, including stainless steel alloys, are another key material segment. These materials are prized for their corrosion resistance and are often used in harsh chemical environments or high-temperature applications. Alloys offer a balance between performance and cost, making them suitable for a wide range of industrial applications.

The "others" category encompasses a variety of materials, including but not limited to, aluminum and titanium. These materials are selected for specific applications where their unique properties, such as superior corrosion resistance or lightweight, are advantageous. Although they occupy a smaller portion of the market, these alternative materials are critical for specialized applications, contributing to the diversity and adaptability of the pressure vessel market.

Product Analysis

In the diverse landscape of the Pressure Vessel Market, the product segment is crucial for understanding market dynamics. Among the various products, boilers emerge as the dominant sub-segment, capturing 60% of the market share. Boilers are essential in numerous industries for generating steam or hot water, which is then used for power generation, heating, or as a utility in processes.

This widespread application across industries such as power generation, manufacturing, and chemicals drives the high demand for boilers. Their central role in energy production and process industries underscores their dominance in the pressure vessel market.

Nuclear reactors, separators, storage vessels, and heat exchangers constitute other significant segments within the market. Nuclear reactors are critical in the power generation sector, particularly in countries investing in nuclear energy for sustainable and low-carbon power sources. Separators and storage vessels are indispensable in the oil and gas industry, facilitating the processing and storage of extracted products. Heat exchangers play a vital role across various industries, including chemicals and petrochemicals, by allowing heat transfer between two or more fluids, optimizing processes, and saving energy.

The "others" category includes specialized pressure vessels tailored for specific applications, such as reactors in the pharmaceutical industry or cryogenic containers for LNG transport. These specialized vessels cater to niche markets, contributing to the overall growth and diversification of the pressure vessel market.

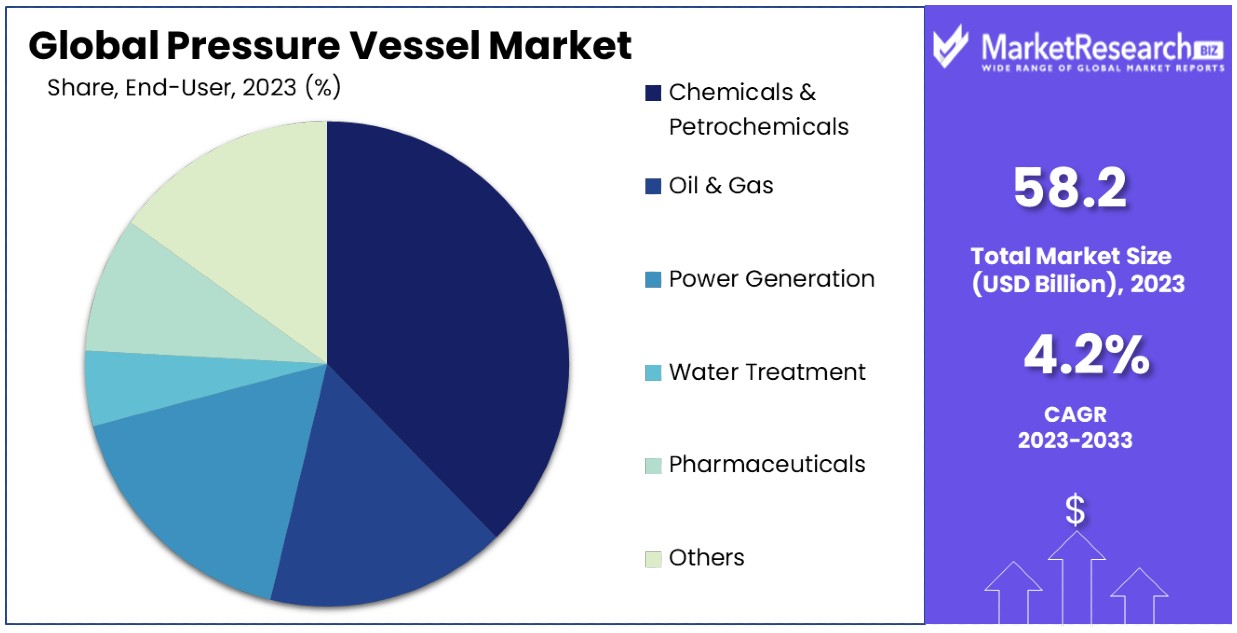

End-User Analysis

The end-user segment analysis of the Pressure Vessel Market reveals the chemicals & petrochemicals industry as the leading consumer, accounting for 37.6% of the market. This dominance is driven by the critical need for pressure vessels in the production, storage, and processing of chemicals and petrochemical products.

These industries rely heavily on pressure vessels for various applications, including reactors, separators, and storage tanks, to ensure safe and efficient processing of volatile and hazardous substances. The high demand from the chemicals and petrochemicals sector is indicative of the vital role pressure vessels play in supporting industrial processes and product development.

Other key end-users include the oil & gas, power generation, water treatment, and pharmaceuticals sectors. The oil & gas industry utilizes pressure vessels in exploration, production, and refining processes, highlighting their importance in energy supply chains. Power generation is another major consumer, where pressure vessels are used in boilers, nuclear reactors, and storage solutions to generate and store energy. Water treatment facilities employ pressure vessels for filtration and purification processes, essential for providing clean water. The pharmaceutical industry relies on pressure vessels for the sterile processing and manufacture of medical products, underscoring their role in healthcare and safety.

The "others" category encompasses a wide range of industries, such as food and beverage, aerospace, and automotive, where pressure vessels are used in specific applications. These sectors contribute to the market's diversity and growth potential, reflecting the universal need for pressure vessels across different industrial and commercial activities.

Key Market Segments

By Material

- Steel

- Composite

- Alloy

- Others

By Product

- Boiler

- Nuclear Reactor

- Separator

- Storage Vessel

- Heat Exchanger

- Others

By End-User

- Chemicals & Petrochemicals

- Oil & Gas

- Power Generation

- Water Treatment

- Pharmaceuticals

- Others

Growth Opportunities

Rising Demand for Alternative Fuels and Energy Sources Offers Growth Opportunity

The shift towards sustainability and alternative fuels presents significant growth opportunities within the Pressure Vessel Market. With a global push for cleaner energy solutions, pressure vessels have become crucial in handling and storing alternative fuels such as hydrogen, biodiesel, and natural gas. This trend is propelled by increasing investments in renewable energy sources and the need for infrastructure to support the production and distribution of these fuels.

Manufacturers that develop and offer pressure vessels designed specifically for alternative energy applications are well-positioned to capture a growing market segment. As the world moves away from fossil fuels, the demand for these specialized pressure vessels is expected to rise, providing a clear pathway for market expansion. This transition not only aligns with global sustainability goals but also opens new avenues for innovation in pressure vessel manufacturing, catering to the unique requirements of alternative fuel storage and processing.

Integration of Advanced Materials and Composites Offers Growth Opportunity

The incorporation of advanced materials and composites into pressure vessel manufacturing marks a transformative phase for the market, offering extended growth prospects. Advanced materials, including titanium, steel alloys, nickel alloys, and composites, are redefining the standards of durability, strength, and corrosion resistance for pressure vessels. This evolution meets the stringent demands of various industries, such as chemicals, petrochemicals, and oil & gas, where operational conditions can be extreme.

By leveraging these innovative materials, manufacturers not only enhance the performance and lifespan of pressure vessels but also address the environmental and safety concerns associated with traditional materials. The move towards advanced materials and composites reflects a broader industry trend towards more efficient, reliable, and sustainable solutions, presenting manufacturers with opportunities to differentiate their products and capture new markets. As industries continue to face rigorous operational and environmental standards, the demand for these high-performance pressure vessels is set to increase, driving market growth and innovation.

Trending Factors

Energy Efficiency and Sustainability Are Trending Factors

The trend toward energy efficiency and sustainability significantly contributes to the expansion of the pressure vessel market. This movement is fueled by the increasing demand for vessels that offer reduced energy consumption, lower emissions, and the use of environmentally friendly materials. The push for sustainability is not just a market trend but aligns with global regulatory mandates and sustainability goals, propelling the adoption of innovative and energy-efficient pressure vessels.

Manufacturers who prioritize and innovate in eco-friendly solutions are positioned at the forefront, capturing the attention of both environmentally conscious consumers and businesses aiming to meet stringent environmental standards. This trend is further supported by statistics indicating a rising preference among industries for sustainable manufacturing practices and products, showcasing a direct correlation between sustainability efforts and market growth in the pressure vessel sector.

Asia Pacific Region's Global Market Dominance Is a Trending Factor

The Asia Pacific region's dominance in the pressure vessel market is a pivotal trend, driving global market dynamics and fostering innovation. Home to leading companies such as Bharat Heavy Electricals Limited (India) and IHI Corporation (Japan), the region is at the forefront of technological advancement and industrial growth.

Asia Pacific's focus on infrastructure development and energy efficiency not only caters to its domestic needs but also sets a global benchmark in pressure vessel technology and manufacturing practices. This dominance is underscored by data highlighting the region's substantial contribution to the market's expansion, through both the demand for cutting-edge pressure vessel solutions and the supply of innovative products. The region's strategic emphasis on sustainable and efficient energy solutions further bolsters its position as a market leader, influencing trends and market dynamics worldwide.

Regional Analysis

Asia Pacific Dominates with 38.5% Market Share

Asia Pacific's commanding 38.5% share of the pressure vessel market is attributed to its robust industrial growth, significant investments in infrastructure, and a strong emphasis on energy efficiency. This region benefits from the presence of major industry players and a favorable manufacturing environment, contributing to its dominance. The adoption of advanced technologies and a focus on sustainable practices further support Asia Pacific's leading position.

The dynamics of the Asia Pacific region, including rapid industrialization, extensive R&D activities, and government support for energy projects, significantly influence the pressure vessel market. These elements, combined with the region's expansive manufacturing capabilities, create a conducive environment for market growth.

Given its current trajectory, Asia Pacific is expected to maintain and potentially increase its market share. Continued emphasis on infrastructure development and renewable energy projects is likely to fuel further growth. This trend suggests a bright future for the region's influence on the global pressure vessel market.

Regional Market Shares and Dynamics:

- North America: North America holds a significant market share of approximately 24%. The region's commitment to adopting renewable energy sources and updating its energy infrastructure drives its market growth. North America's advanced technological landscape and stringent safety regulations for pressure vessels contribute to its substantial market presence.

- Europe: Europe accounts for about 22% of the market share, driven by its focus on renewable energy, nuclear power, and stringent environmental regulations. The region's advanced manufacturing capabilities and emphasis on sustainable practices support its strong market position.

- Middle East & Africa: This region holds around 9% of the market share. Investments in infrastructure projects, especially in the energy sector, and the increasing demand for desalination plants are key drivers behind its market share.

- Latin America: Latin America has a market share of approximately 7%. The region's growth is primarily fueled by the expansion of the energy sector, including oil and gas and renewable energy projects, contributing to the demand for pressure vessels.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the Pressure Vessel Market, major companies like IHI Corporation, Larsen & Toubro Limited, and Mitsubishi Heavy Industries play pivotal roles in shaping industry dynamics and market trends. Key factors contributing to market growth include the rapid annual growth rate in the forecast period, reflecting the industry's resilience and potential for sustained expansion.

Their impact is profound, especially within sectors such as chemical industries and the petrochemical industry, where demand for chemicals necessitates reliable pressure vessel solutions. These major players hold significant pressure vessel market share, catering to the diverse needs of the chemical sector and ensuring safety and efficiency in industrial processes.

The largest market for pressure vessels is within the chemical sector, driving market growth and expansion. As demand for chemicals continues to rise, pressure vessel manufacturers witness rapid expansion opportunities, further bolstering market growth.

Strategic positioning involves product launches and customization options to meet specific industry requirements. Carbon steel pressure vessels remain popular due to their durability and cost-effectiveness, catering to the industrial sector's needs.

Market Key Players

- IHI Corporation

- Bharat Heavy Electricals Limited

- Larsen & Toubro

- Mitsubishi Hitachi Power Systems

- Babcock & Wilcox

- Doosan Heavy Industries & Construction

- Mitsubishi Heavy Industries

- Babcock & Wilcox Enterprises, Inc.

- Alfa Laval AB

- Andritz AG

- Kelvion Holding GmbH

- GEA Group Aktiengesellschaft

- Abbott & Co

- Halvorsen Company

- Samuel Pressure Vessel Group

- Westinghouse Electric Company

- Dongfang Turbine Co. Ltd.

- GEA Group AG

Recent Developments

- On February 2024, the reactor pressure vessel for Unit 4 at the Kudankulam Nuclear Power Plant (KKNPP) was successfully installed in its design position. This significant milestone was achieved through the use of the Open Top technology, a method that allows for the installation of reactor vessels through an open dome, thereby expediting the installation process.

- On March 2024, Pixargus, in collaboration with the Fraunhofer Institute for Production Technology (IPT) and industrial partner Taniq, introduced a new measuring head to monitor the quality of laser-assisted tape winding in FRP pressure vessel manufacturing.

- On October 2023, AZL Aachen GmbH commenced a new project titled "Trends and Design Factors for Hydrogen Pressure Vessels" in collaboration with industry partners.

Report Scope

Report Features Description Market Value (2023) USD 58.2 Billion Forecast Revenue (2033) USD 86.9 Billion CAGR (2024-2033) 4.20% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Steel, Composite, Alloy, Others), By Product (Boiler, Nuclear Reactor, Separator, Storage Vessel, Heat Exchanger, Others), By End-User (Chemicals & Petrochemicals, Oil & Gas, Power Generation, Water Treatment, Pharmaceuticals, Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape IHI Corporation, Bharat Heavy Electricals Limited, Larsen & Toubro Limited, Mitsubishi Hitachi Power Systems, Babcock & Wilcox, Doosan Heavy Industries & Construction, Mitsubishi Heavy Industries, Babcock & Wilcox Enterprises, Inc., Alfa Laval AB, Andritz AG, Kelvion Holding GmbH, GEA Group Aktiengesellschaft, Abbott & Co, Halvorsen Company, Westinghouse Electric Company, Dongfang Turbine Co. Ltd., GEA Group AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Abbott

- Bharat Heavy Electricals

- Larsen & Toubro

- Samuel Pressure Vessel

- Barton Firtop

- Babcock & Wilcox

- HERITAGE BV

- Doosan

- General Electric

- Mitsubishi