Modular Nuclear Reactors Market By Coolant(Heavy liquid metal, Gases), By Application(Power Generation, Desalination), By End-Use Industry(Transmission & Distribution, Utilities), By Connectivity(Grid–Connected, Off–Grid), By Location(Land, Marine), By Deployment(Single–Module Power Plant, Multi–Module Power Plant), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

42480

-

Dec 2023

-

179

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

- Modular Nuclear Reactors Market Size, Share, Trends Analysis

- Modular Nuclear Reactors Market Dynamics

- Modular Nuclear Reactors Market Segmentation Analysis

- Modular Nuclear Reactors Industry Segments

- Modular Nuclear Reactors Market Regional Analysis

- Modular Nuclear Reactors Industry By Region

- Modular Nuclear Reactors Market Share Analysis

- Modular Nuclear Reactors Industry Key Players

- Modular Nuclear Reactors Market Recent Development

- Report Scope

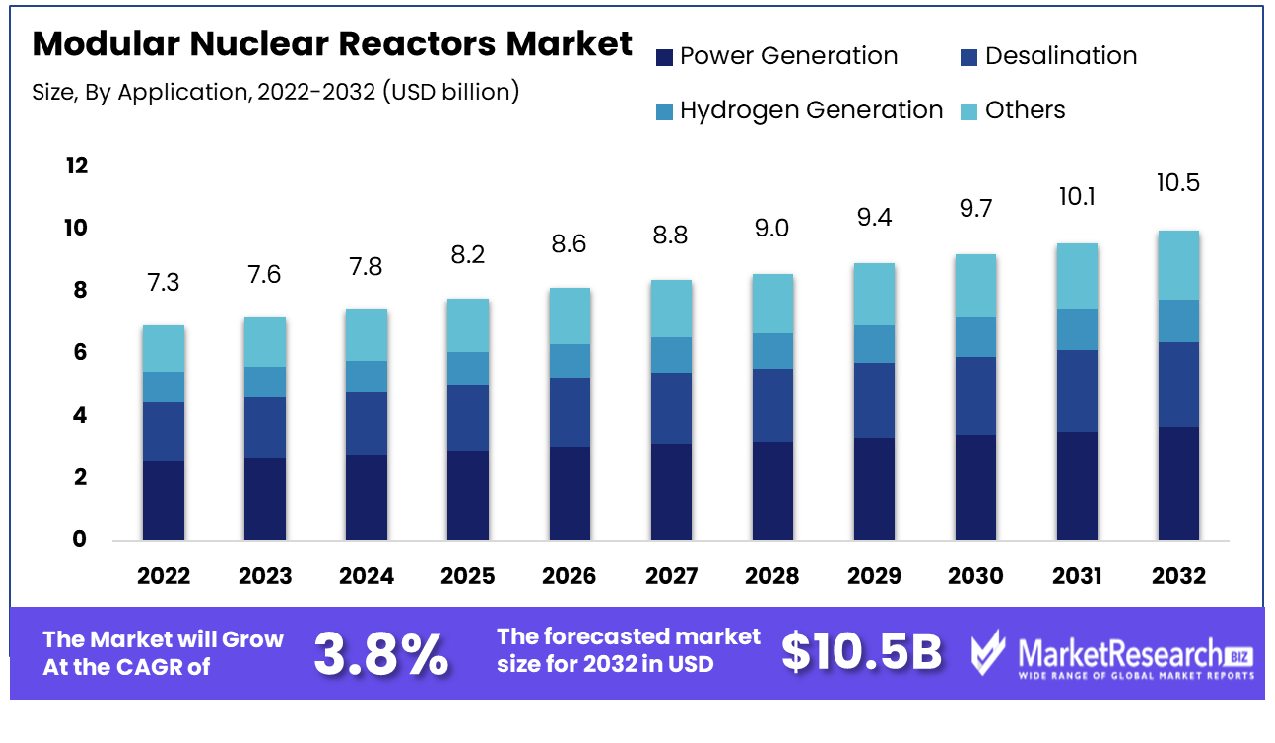

Modular Nuclear Reactor Market size is estimated to reach USD 10.5 Bn by 2032, an increase from its USD 7.3 Bn estimate by 2022. Growth projections estimate an annual compound compound annual growth rate of (CAGR) 3.8% during 2023-2032.

Modular nuclear reactors, also known as Small Modular Reactors (SMRs), are smaller, less scalable reactors used to produce nuclear energy. Unlike traditional large nuclear reactors, SMRs are designed for reduced onsite construction, increased containment efficiency, and enhanced safety features.

Typically, they generate up to 300 megawatts of electricity per unit, which allows for a more flexible and incremental deployment compared to larger nuclear technology plants. SMRs are seen as a promising solution to meet diverse energy needs, offering potential benefits in terms of cost, scalability, and reduced greenhouse gas emissions.

The ongoing development of existing, new, and next-generation reactor designs, including SMR technologies, is central to the market's expansion. Continuous innovation in reactor design enhances efficiency, safety, and adaptability to various environments and needs. This evolution of technology attracts investment and interest from various sectors, broadening the potential applications of SMRs.

As these technologies advance, they open new market opportunities, particularly in regions seeking sustainable and reliable energy sources to meet growing demands and environmental commitments.

Small Modular Reactors (SMRs) are increasingly recognized as pivotal in global decarbonization strategies and the shift to cleaner energy sources. With over 80 SMR projects in development across 18 countries, as reported by the International Atomic Energy Agency, their global significance is unmistakable.

For Instance, In December 2023, China successfully initiated commercial deployment operations at the Shidao Bay nuclear power output plant, featuring next-generation gas-cooled nuclear reactors, showcasing the nation's commitment to reducing carbon emissions and securing a sustainable energy future. This widespread development reflects a growing consensus on the role of nuclear energy in achieving carbon neutrality, positioning SMRs as a key player in the future energy landscape.

Power Purchase Agreements (PPAs), such as NuScale's commitment from Utah power sector major companies, provide a stable market for SMR-produced power. The need for substantial clean nuclear power, as indicated by the US Department of Energy's suggestion of 770 gigawatts by 2050, opens vast opportunities for Modular Nuclear reactor deployment. NuScale's exploration of international markets, including proposed projects in Romania, exemplifies the expanding global interest in Modular Nuclear reactor type technology, offering significant potential for growth strategies in both domestic and international markets.

Government initiatives, like the Advanced Reactor Demonstration Program of the Department of Energy - which provided significant financial backing to X-energy - have also played an instrumental role in speeding up SMR development and deployment. Not only did these initiatives provide the necessary financial backing, but also demonstrated their potential. The agreement between X-energy and Energy Northwest for building modular reactors in Central Washington is a testament to the growing interest in the nuclear power sector as a viable solution to global warming. Such governmental backing is a key driver in expanding the market for SMRs, encouraging further investment and development in this sector.

Modular Nuclear Reactors Market Dynamics

Clean Energy Goals Propel Modular Nuclear Reactor Market

Clean energy already supplies 15.2% of U.S. electricity generation and avoids 438 million tons of CO2 emissions every year. Moreover, an NREL study suggests multiple paths toward reaching 100% clean electricity by 2035, each offering substantial advantages over additional power output versatile nature system costs. As corporations and nations throughout the world commit to reducing their carbon footprints, nucleus power has increasingly become part of a sustainable energy mix.

Modular nuclear reactors, with their smaller dimensions and lower emissions compared to generation using fossil fuels, align perfectly with this objective. The global focus on achieving clean energy targets suggests a sustained demand for modular nuclear reactors, positioning them as key solutions in the fight against climate change.

Small Size and Modular Construction Enhance Market Appeal

These features allow for reactors to be built in a factory setting and transported to the site, significantly reducing manufacturing, construction time, and costs. Modular construction also enables scalability, where additional modules can be added as required, making it a flexible option for varying energy needs.

This flexibility is particularly appealing in remote or smaller regions where large-scale traditional nuclear facilities are not feasible. The off-site construction process and reduced material waste make modular construction a cost-effective option. It can save 30-50% of the overall construction time, leading to cost savings in manufacturing. The modular nuclear reactors Market is increasingly influenced by modular salt reactors and hybrid energy systems, offering the largest share in neutron reactor energy associations.

Safety Advantages Boost Nuclear Energy Adoption

Modern modular reactors are designed with advanced safety features that minimize the risk of accidents and radiation exposure. These safety enhancements, including passive safety systems and inherent safe designs, have increased public and regulatory acceptance of nuclear energy.

As safety concerns have historically been a significant barrier to nuclear energy adoption, these advancements are crucial in gaining trust and expanding the market. The ongoing improvements in reactor-type safety are likely to further bolster the market growth, making modular nuclear reactors a more widely accepted and sought-after option for safe, clean energy generation.

Socioeconomic Challenges Including Public Opposition and Waste Disposal Limit Modular Nuclear Reactors Market Growth

The growth of the modular nuclear market is significantly impeded by socioeconomic challenges, notably public opposition and the issue of nuclear waste disposal. Public concern about nuclear safety, often fueled by past nuclear incidents, leads to resistance against new reactor sector installations. This opposition can result in regulatory and permitting delays, increasing project timelines and costs.

Additionally, the unresolved challenge of long-term nuclear waste management continues to be a major deterrent. These socioeconomic factors create an environment of uncertainty around nuclear energy, making it difficult for modular reactor projects to gain the necessary public and political support for development and implementation.

Competition from Renewable Energy Sources Challenges Modular Nuclear Reactors Market

Competition from other renewable energy sources also restrains the growth of the modular nuclear market. Renewable energy sources like wind, solar, and hydroelectric power are becoming more efficient and economical, offering appealing alternatives to nuclear power. Investors, governments, and the general public alike increasingly favor eco-friendly renewable sources like wind, solar, and hydroelectric power as viable solutions.

Renewable energy technology has grown increasingly advanced over the past several years, leading to cost reduction and favorable regulatory frameworks that make them formidable alternatives to modular nuclear generators. This competitive landscape challenges the market's expansion, as potential investors and policymakers may opt for alternative renewable energy solutions over nuclear power.

Modular Nuclear Reactors Market Segmentation Analysis

By Coolant Analysis

Heavy liquid metal coolants, particularly lead or lead-bismuth eutectic, dominate the Modular Nuclear market with a 45% share. The basis of reactor type the high boiling points and efficient heat transfer capabilities make them ideal for high-temperature generator operations, enhancing safety and efficiency. These coolants also have a low neutron absorption cross-section, beneficial for sustaining nuclear reactions. Their use is particularly advantageous in fast neutron generators, where they aid in achieving a compact and simpler reactor design, a key aspect of modular nuclear reactors.

Gas coolants, like helium, are used for their chemical inertness and efficiency. Molten salt coolants offer high-temperature operation capability and inherent safety features. Water remains a traditional coolant due to its availability and effective heat transfer properties. Other coolants are being explored for specific reactor designs and applications. In the modular nuclear sector, the development of both boiling water reactors and heavy-water reactor segments is pivotal for advancing nuclear energy technology.

By Application Analysis

Power generation is the primary application for Modular Nuclear Reactors, holding a 34% market share. The segment's dominance is driven by the global demand for reliable and clean energy sources. Modular reactors offer a scalable and flexible approach to the nuclear power generation segment, catering to diverse power needs and enabling easier integration into existing power grids. Their smaller size and enhanced safety features make them particularly suitable for regions with limited grid infrastructure.

Desalination and hydrogen generation are emerging applications, utilizing the high-temperature steam and electricity produced by modular reactors. Other applications include district process heating and industrial process heat supply.

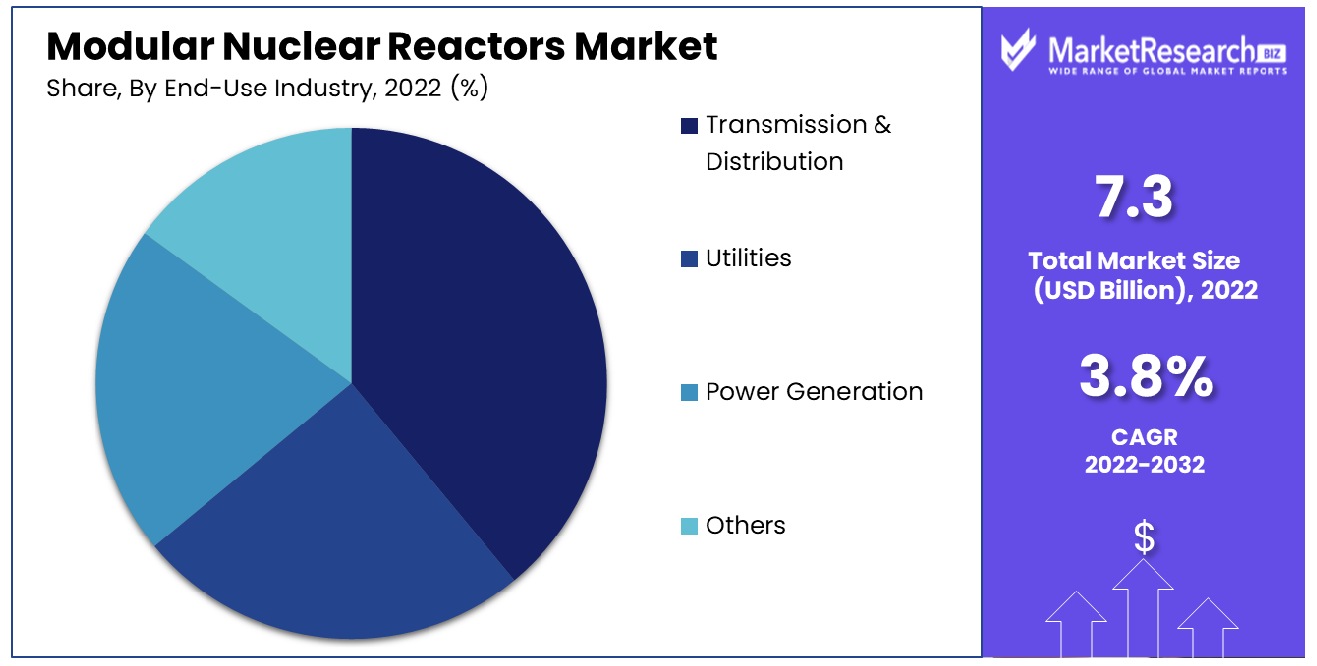

By End-Use Industry Analysis

The transmission and distribution sector, constituting 34% of the market, leads in the end-use industry segment. The modular reactor type is increasingly being considered for integration into the existing power grid to provide stable and efficient energy distribution. They offer a solution to meet the increasing power rating demands and to replace aging fossil fuel-based power plants.

The power generation segment sector benefits from the deployment of these reactors in meeting base-load electricity demand. Other sectors include research and military applications. The Nuclear Power Institute of China (NPIC) has designed a multi-purpose small modular reactor, the ACP100 or Linglong One, which has passive safety features, notably decay heat removal, and will be installed underground.

By Connectivity Analysis

Grid-connected modular nuclear reactors, with a 65% market share, are the dominant connectivity type. Rapid expansion in this sector is due to integrating nuclear reactors into national grids as an energy production diversifier and grid stabilizer, helping transition towards lower carbon energy systems in heavily populated or industrial areas with high power needs that demand constant and reliable electricity supplies. Grid-connected reactors play a pivotal role in meeting such energy storage requirements.

Off-grid solutions are invaluable for remote locations and industrial applications that do not have access to grid electricity, where grid connectivity may not be feasible or economical. These applications are also vital in providing energy security independence and security, especially in isolated communities or regions with limited infrastructure, making them an attractive option for sustainable development.

By Location Analysis

Land-based installations lead the market with a 62% share. The dominance of this segment is due to the ease of site selection, established regulatory frameworks, and the larger number of potential sites on land deployment compared to marine harsh environments. Land-based reactors also benefit from easier access for construction and maintenance, and a well-established supply chain, contributing to their market lead.

Marine-based modular reactors are being explored for their unique applications in remote coastal areas and for maritime propulsion. These reactors offer the advantage of proximity to large bodies of water for cooling purposes and can be pivotal in supporting isolated coastal communities or industries with limited access to other forms of energy sector.

By Deployment Analysis

Single-module power plants hold a 54% share in the deployment segment. Their popularity is due to the ease of deployment, lower initial investment, and scalability. These plants are ideal for regions with lower power demand or as pilot projects for larger deployments. Furthermore, single-module reactors can be deployed more rapidly than multi-module systems, offering flexibility and speed in response to urgent or evolving energy needs.

Multi-module plants are considered for larger power generation segment needs, offering economies of scale and operational flexibility. These plants are particularly suited for areas with high energy demands or as part of a strategy to phase out older, less efficient power plants, thereby contributing significantly to energy modernization and decarbonization efforts.

Modular Nuclear Reactors Industry Segments

By Coolant

- Heavy liquid metal

- Gases

- Molten salt

- Water

- Others

By Application

- Power Generation

- Desalination

- Hydrogen Generation

- Others

By End-Use Industry

- Transmission & Distribution

- Utilities

- Power Generation

- Others

By Connectivity

- Grid–Connected

- Off–Grid

By Location

- Land

- Marine

By Deployment

- Single–Module Power Plant

- Multi–Module Power Plant

Modular Nuclear Reactors Market Regional Analysis

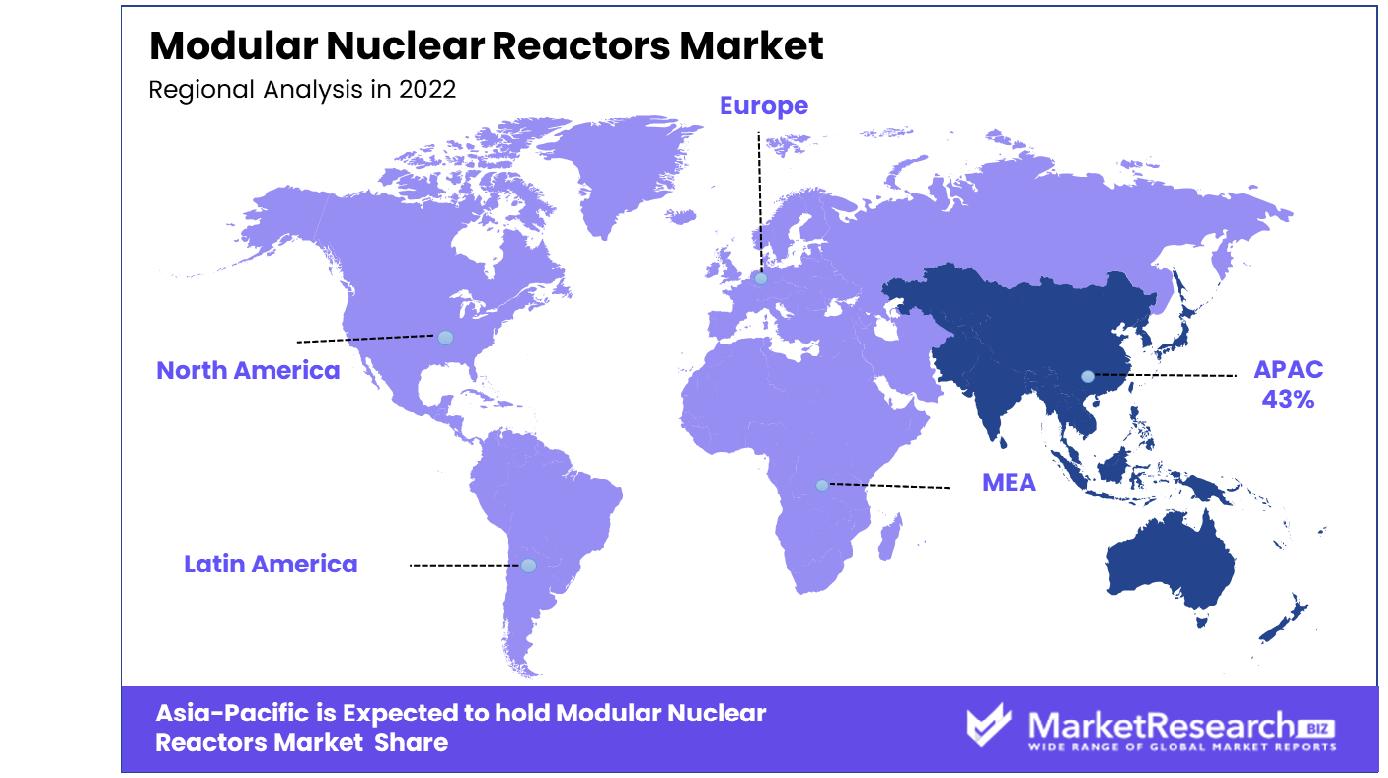

Asia Pacific Dominates with a 43% Market Share

Asia Pacific's dominant 43% share in the Modular Nuclear Reactors Market can be attributed to the region's escalating energy demand and strategic shift towards clean energy sources. China, South Korea, and Japan have made substantial investments in nuclear energy to diversify their energy sources and meet carbon emission reduction goals. Their focus on technological innovation - for instance developing more reliable nuclear reactors - ensures they remain market leaders.

Asia Pacific markets are heavily influenced by their rapidly developing economies and urbanization processes, which create demand for reliable yet sustainable energy sources. Modular light water reactors offer a promising solution due to their smaller size, reduced risk, and scalability, making them suitable for the region's varied geographical and economic landscapes.

Europe's Focus on Clean Energy Transition

Europe’s modular nuclear reactors market is driven by the region's focus on the clean energy transition and reducing greenhouse gas emissions. European countries are exploring nuclear energy as a means to achieve their ambitious climate goals, with a growing interest in modular reactors for their potential to provide stable, low-carbon energy. The region's stringent safety standards and commitment to sustainable energy practices support the development of modular nature nuclear technology.

North America's Innovation and Energy Diversification

North America's energy industry plays a critical role in supporting economies across Canada, the U.S., Mexico, and beyond. Energy innovation remains at the core of U.S. business opportunities; fuelled by public investments for research and development and private capital for commercialization. Public investments were estimated at USD 44 billion globally for energy R&D alone with approximately 80% dedicated towards green power R&D; further efforts by regions to modernize nuclear infrastructure as well as growing demand for small but sophisticated reactor fuel for off-grid areas are helping expand the market.

Modular Nuclear Reactors Industry By Region

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of Middle East & Africa

In the burgeoning Modular Nuclear Reactors Market, the companies listed are key players propelling this sector forward, reshaping the landscape of nuclear energy with compact, efficient designs. Bechtel Corporation, with its extensive experience in engineering and construction, leads in the development and deployment of modular reactors, emphasizing the market's focus on safety and scalability.

China National Nuclear Corporation and Nuclear Power Corporation of India Limited (NPCIL) are pivotal in driving the adoption of modular reactors in Asia, reflecting the growing global interest in nuclear energy as a reliable and clean power source. BWX Technologies Inc. and GE, with their technological expertise in nuclear energy, play crucial roles in advancing modular reactor designs, showcasing the industry's innovation in enhancing efficiency and reducing construction time.

Mitsubishi Heavy Industries, Ltd. and Korea Electric Power Corporation, known for their heavy industry and energy solutions, contribute significantly to the market with their focus on developing robust and efficient modular nuclear reactors. Holtec International and General Atomics, focusing on advanced nuclear technologies, underscore the market's shift towards smaller, more flexible systems. Major players in the modular nuclear industry are focusing on flexible power generation and key growth strategies to enhance market modular reactor market size and modular reactor market share.

Modular Nuclear Reactors Industry Key Players

- Bechtel Corporation

- China National Nuclear Corporation

- BWX Technologies Inc.

- GE

- Mitsubishi Heavy Industries, Ltd.

- Holtec International

- General Atomics

- Rolls Royce

- Nuclear Power Corporation of India Limited (NPCIL)

- NuScale Power, LLC.

- Korea Electric Power Corporation

- China National Nuclear Corporation

- TERRESTRIAL ENERGY INC.

- Westinghouse Electric Company LLC

- Hitachi Nuclear Energy

- Tokamak Energy Ltd.

- Toshiba Energy Systems & Solutions Corporation

- Moltex Energy

Modular Nuclear Reactors Market Recent Development

- In October 2023, Czech Prime Minister Petr Fiala expressed the readiness of Czechia to deepen collaboration with the United Kingdom in nuclear energy, specifically focusing on the development of small modular reactors. This statement comes after a meeting between Czech Prime Minister Petr Fiala and his British counterpart Rishi Sunak in Granada.

- In March 2023, Last Energy, a U.S.-based micromodular nuclear technology firm, secured PPAs for 34 PWR-20 small modular reactor (SMR) units with four industrial partners in the UK and Poland. These deals represent a combined $18.9 billion in power sales and mark "the largest pipeline of new nuclear power plants under development in the world.

- In August 2023, Illinois Governor J.B. Pritzker vetoed SB76, a legislation that aimed to repeal the state's moratorium on new nuclear power plants.

- In July 2023, Jacobs, a prominent engineering company, was chosen by Ultra Safe Nuclear Corporation UK (USNC) to provide support for the design and development of a new Micro Modular Power Reactor (MMR).

Report Scope

Report Features Description Market Value (2022) USD 7.3 Billion Forecast Revenue (2032) USD 10.5 Billion CAGR (2023-2032) 3.8% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Coolant(Heavy liquid metal, Gases, Molten salt, Water, Others), By Application(Power Generation, Desalination, Hydrogen Generation, Others), By End-Use Industry(Transmission & Distribution, Utilities, Power Generation, Others), By Connectivity(Grid–Connected, Off–Grid), By Location(Land, Marine), By Deployment(Single–Module Power Plant, Multi–Module Power Plant) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Bechtel Corporation, China National Nuclear Corporation, BWX Technologies Inc., GE, Mitsubishi Heavy Industries, Ltd., Holtec International, General Atomics, Rolls Royce, Nuclear Power Corporation of India Limited (NPCIL), NuScale Power, LLC., Korea Electric Power Corporation, China National Nuclear Corporation, TERRESTRIAL ENERGY INC., Westinghouse Electric Company LLC, Hitachi Nuclear Energy, Tokamak Energy Ltd., Toshiba Energy Systems & Solutions Corporation, Moltex Energy Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Bechtel Corporation

- China National Nuclear Corporation

- BWX Technologies Inc.

- GE

- Mitsubishi Heavy Industries, Ltd.

- Holtec International

- General Atomics

- Rolls Royce

- Nuclear Power Corporation of India Limited (NPCIL)

- NuScale Power, LLC.

- Korea Electric Power Corporation

- China National Nuclear Corporation

- TERRESTRIAL ENERGY INC.

- Westinghouse Electric Company LLC

- Hitachi Nuclear Energy

- Tokamak Energy Ltd.

- Toshiba Energy Systems & Solutions Corporation

- Moltex Energy