Hydrogen as a Fuel Market By Technology (Proton Exchange Membrane Fuel cells, Phosphoric Acid Fuel Cells, Solid Oxide Fuel Cells, Others), By Application (Stationary, Transportation, Portable), By End-Use (Commercial & Industrial, Data Centers, Transportation, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

42259

-

Dec 2023

-

130

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

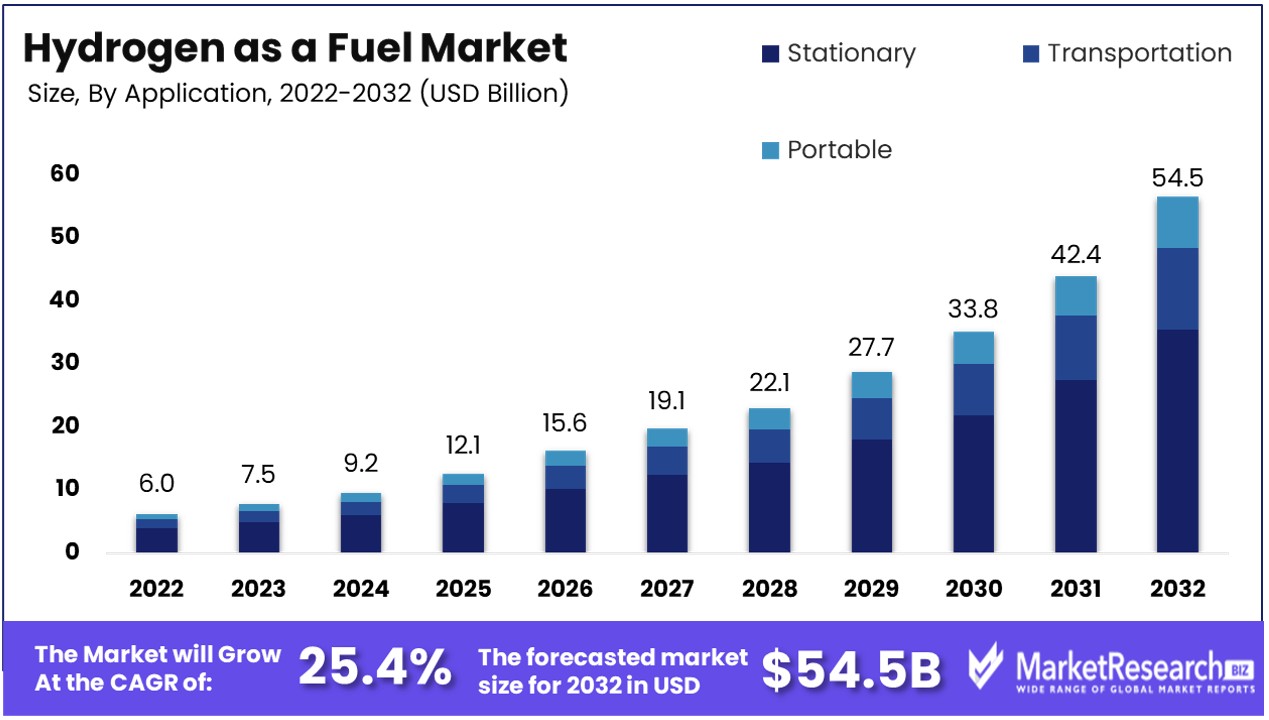

Hydrogen as a Fuel Market size is predicted to reach approximately USD 54.5 Bn by 2032, from a valuation of USD 6.0 Bn in 2022, growing at a CAGR of 25.4% during the forecast period from 2023 to 2032.

Hydrogen is considered a potential sustainable fuel for the future. When used in a fuel cell, hydrogen reacts with oxygen to produce electrical energy, with water as the only byproduct. Compared to fossil fuels, hydrogen does not emit greenhouse gases or air pollutants when used, making it a clean fuel. Transitioning to a hydrogen economy could significantly reduce human impact on climate change.

International Renewable Energy Agency (IRENA) emphasizes the increasing global commitment to achieving net-zero emissions, with 131 countries covering 88% of global greenhouse gas emissions having announced net-zero targets by April 2022.

The Hydrogen as a Fuel Market is expected to experience significant growth in the coming years driven by several key factors. One major driver is the push towards decarbonization and reducing greenhouse gas emissions from the transportation and energy sectors. Hydrogen is seen as a clean fuel alternative that can help countries meet emissions reduction targets when produced from renewable energy sources.

For Instance, Aircraft are responsible for 2.5% of global CO2 emissions, and the industry aims to achieve net-zero emissions by 2050. Both Airbus and startups like ZeroAvia and Universal Hydrogen are exploring hydrogen technology.

Additionally, falling costs for hydrogen production via electrolysis as well as commitments by major automakers to expand their hydrogen vehicle offerings are providing momentum.

Government policies and incentives aimed at supporting the adoption of hydrogen technology are also catalyzing the Hydrogen as a Fuel Market’s expansion. Regions with comprehensive hydrogen development strategies such as the EU, China, Japan and South Korea are likely to see substantial Hydrogen as a Fuel Market growth.

The Inflation Reduction Act of 2022, also known as the US Climate Change Bill, is a landmark climate legislation focusing on energy measures. It promotes low-carbon energy, offers tax credits for eco-friendly technologies, and encourages electric vehicle purchases. Within a year, it spurred $110 billion in clean energy investments, created 170,000 jobs, and aims to reduce U.S. greenhouse gas emissions by 40%, fostering cleaner air and improved public health.

Furthermore, interest from the energy industry in blending hydrogen with natural gas to reduce the carbon intensity is driving early investment. If renewable hydrogen reaches cost parity with fossil fuel-based hydrogen sooner than predicted, it could greatly accelerate the Hydrogen as a Fuel Market’s growth globally.

The hydrogen fuel market shows immense potential for growth and innovation. As countries aim to decarbonize economies, hydrogen is poised to play a pivotal role as a clean fuel and energy carrier. Companies have robust opportunities to develop more efficient and cost-competitive production, storage and distribution solutions for hydrogen through sustained R&D. Emerging use cases in sectors like transportation, electricity generation and industry open new revenue streams.

By continuing research into novel hydrogen production methods, storage materials and fuel cells, companies can enable wider adoption. Realizing hydrogen's versatility would necessitate strategic partnerships between private and public players to co-create technologies and infrastructure. Unlocking long-term, sustainable value propositions would further accelerate innovation in this high-growth market.

Hydrogen as a Fuel Market Dynamics

Decarbonizing Industrial and Transport Sectors Fuels Hydrogen Market

Hydrogen's role in decarbonizing key industrial, heat, and transport sectors that are difficult or expensive to electrify significantly contributes to Hydrogen as a Fuel Market growth. Many industrial processes and heavy-duty transport systems cannot be easily electrified due to technical constraints or high costs. Hydrogen offers a viable alternative, enabling these sectors to reduce their carbon footprint without compromising efficiency.

Its versatility as a fuel and energy carrier makes it particularly suited for high-energy-demand applications. The trend towards decarbonization, driven by global climate change initiatives, positions hydrogen as a key player in achieving emission reduction goals. The long-term market growth for hydrogen as a fuel is likely to be sustained by its increasing adoption in these hard-to-electrify sectors, driven by the global push for cleaner energy solutions.

Zero Emissions from Hydrogen Fuel Cells Boost Market Appeal

The fact that hydrogen fuel cells produce no greenhouse gases or other pollutants bolsters their attractiveness in reducing emissions, thus driving the hydrogen fuel market. This environmental benefit positions hydrogen fuel cells as a leading solution in the shift towards sustainable energy, especially in sectors where emissions reduction is a critical goal.

The absence of pollutants in hydrogen fuel cell operations aligns with increasing environmental regulations and public demand for cleaner energy sources. As the world intensifies its efforts to combat climate change, the demand for zero-emission energy solutions like hydrogen fuel cells is expected to grow. This trend indicates a robust future for the Hydrogen as a Fuel Market, where its environmental credentials play a key role in its expansion.

Government and Industry Support Propel Hydrogen Transportation Market

The hydrogen market for transportation is bolstered by government and industry efforts toward clean, economical, and safe hydrogen production and distribution, especially for use in fuel cell electric vehicles (FCEVs). These efforts include investments in infrastructure development, research into cost-effective production methods, and policies supporting hydrogen adoption.

The collaboration between government entities and industry players is crucial in overcoming barriers to hydrogen use, such as high costs and lack of refueling infrastructure. This combined support is not only accelerating the development of the hydrogen transportation market but also shaping a future where FCEVs are a common sight. The ongoing commitment to establishing a hydrogen economy, particularly in transportation, foresees a market driven by the dual goals of environmental sustainability and energy security.

High Production Costs Limit Widespread Adoption of Hydrogen Fuel

Electrolysis-based methods for producing hydrogen fuel remain a costly way of producing the energy source, which limits its widespread adoption. Production of hydrogen fuel currently exceeds that of fossil fuels due to energy requirements and cost associated with electrolysis.

This cost disparity makes hydrogen less competitive as an energy source in markets where cost-efficiency is paramount. The economic challenge is further compounded in regions with limited renewable energy sources, as the environmental benefits of hydrogen are best realized when produced from clean energy sources. This cost factor restricts the market's ability to compete with more established, cheaper fossil fuels.

Competition from Batteries in Transportation Limits Hydrogen's Market

Batteries present a serious competition to hydrogen fuel solutions in the transportation sector. As battery technology improves to offer greater range, faster charging times, and reduced costs, electric vehicles (EVs) have become an attractive alternative to traditional internal combustion engine vehicles.

This transition toward battery-powered transportation decreases the addressable market for hydrogen fuel cell vehicles, which are still developing both infrastructure-wise and financially. The competition from batteries, especially in the automotive industry, limits the potential market growth for hydrogen as a fuel source, as consumers and manufacturers may prefer the more established and rapidly evolving battery technology.

Hydrogen as a Fuel Market Segmentation Analysis

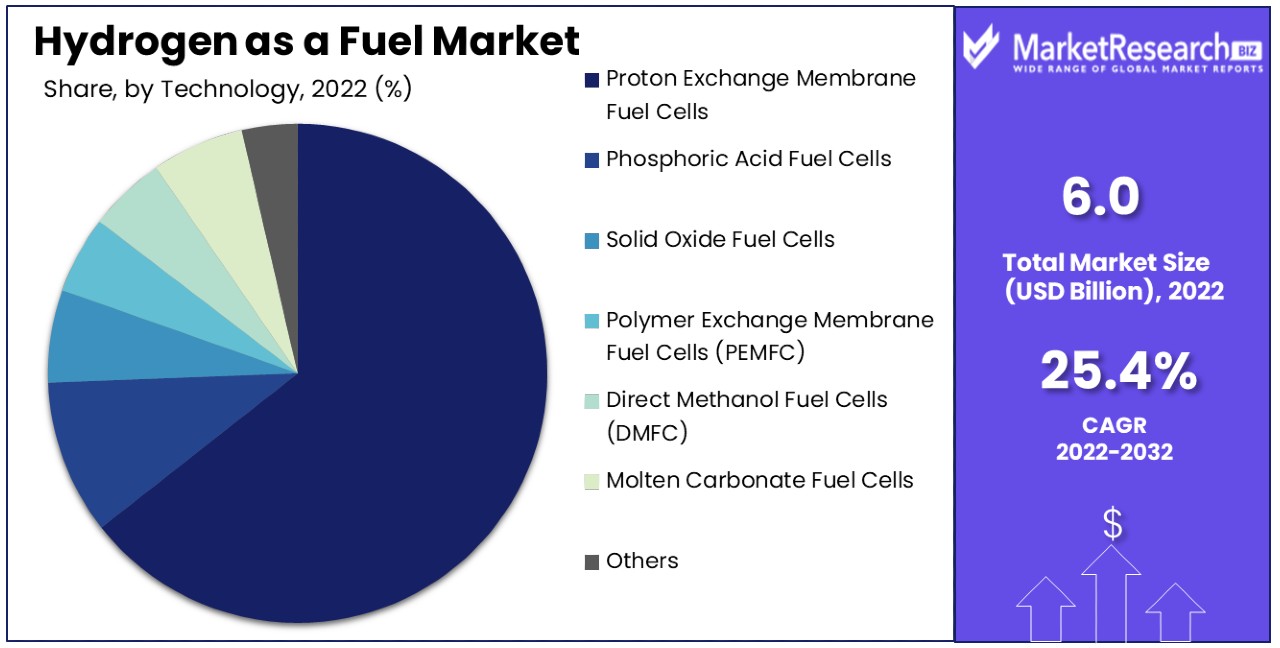

By Technology Analysis

Proton Exchange Membrane (PEM) fuel cells, leading with 64.6% market share, are pivotal in the Hydrogen as a Fuel Market. Their dominance is attributed to their energy efficiency, low operating temperatures, and suitability for a wide range of applications, from automotive to stationary power generation. PEM fuel cells offer rapid start-up and scalability, making them ideal for vehicles and smaller-scale energy solutions. Their growth is driven by advancements in membrane technology, reducing costs and improving durability.

Phosphoric Acid, Solid Oxide, Direct Methanol, and Molten Carbonate Fuel Cells each cater to specific needs. Solid Oxide Fuel Cells are preferred for high-temperature applications, while Direct Methanol Fuel Cells are valued for their ease of fuel handling. Phosphoric Acid and Molten Carbonate Fuel Cells are suitable for larger, stationary applications. The diversity of these technologies contributes to the market's overall growth.

By Application Analysis

Stationary applications, constituting 68.5% of the market, are primarily in commercial and industrial sectors. This dominance is due to the increasing demand for reliable, low-emission power sources. Stationary fuel cells are used for on-site power generation, backup power, and as a part of decentralized energy systems. Their growth is supported by the shift towards sustainable energy solutions and the need for energy security.

The transportation sector is rapidly adopting hydrogen fuel cells, especially in public transport and commercial vehicles. Portable applications are emerging, with fuel cells being used in smaller devices and emergency power systems, offering mobility and convenience.

By End-Use Analysis

The commercial and industrial sector, with a 48.2% share, is the largest end-use market for hydrogen fuel cells. These sectors utilize hydrogen fuel cells for continuous power supply and peak-load energy management. The growth in this segment is driven by the need for energy-efficient, environmentally-friendly power solutions in industries and businesses.

Data centers require reliable, uninterrupted power, making fuel cells a preferred choice. In transportation, hydrogen fuel cells are key to powering electric vehicles. Military and defense applications include portable power and unmanned vehicles. Residential use is growing, with fuel cells providing an alternative to traditional power sources. Utilities use fuel cells for grid support and distributed generation. Each of these end-use sectors contributes to the diverse applications of hydrogen fuel cells, supporting the market's expansion.

Hydrogen as a Fuel Industry Key Segments

By Technology

- Proton Exchange Membrane Fuel cells

- Phosphoric Acid Fuel Cells

- Solid Oxide Fuel Cells

- Polymer Exchange Membrane Fuel Cells (PEMFC)

- Direct Methanol Fuel Cells (DMFC)

- Molten Carbonate Fuel Cells

- Others

By Application

- Stationary

- Transportation

- Portable

By End-Use

- Commercial & Industrial

- Data Centers

- Transportation

- Military & Defense

- Residential

- Utilities

- Others

Hydrogen as a Fuel Market Growth Opportunities

Hydrogen-Powered Heavy Transport Supports Net-Zero Emission Targets

The adoption of hydrogen fuel cell technology in heavy transport sectors such as trucks, trains, ships, and planes offers a significant growth opportunity for the Hydrogen as a Fuel Market. This shift from high-polluting diesel fuels to hydrogen aligns with global net-zero emission targets.

Hydrogen fuel cells provide a viable solution for reducing emissions in heavy transportation, a sector traditionally challenging to decarbonize. The increasing focus on sustainability and the implementation of strict environmental regulations are driving the demand for cleaner fuel alternatives, positioning hydrogen as a key player in the transition towards sustainable, low-emission transport systems.

Abundant Renewable Energy Resources Drive Global Hydrogen Supply Chains

Countries possessing abundant and cheap renewable energy resources have the potential to produce low-cost green hydrogen, opening up significant opportunities in the global hydrogen fuel market. By exporting green hydrogen to major energy importers like Europe or Asia, these countries can establish global hydrogen supply chains.

This development is critical in creating a sustainable and economically viable market for hydrogen fuel, catering to the growing international demand for hydrogen. The trend towards leveraging renewable resources for hydrogen production underscores a strategic market expansion, fostering global collaborations and investments in hydrogen infrastructure and technology.

Hydrogen as a Fuel Market Regional Analysis

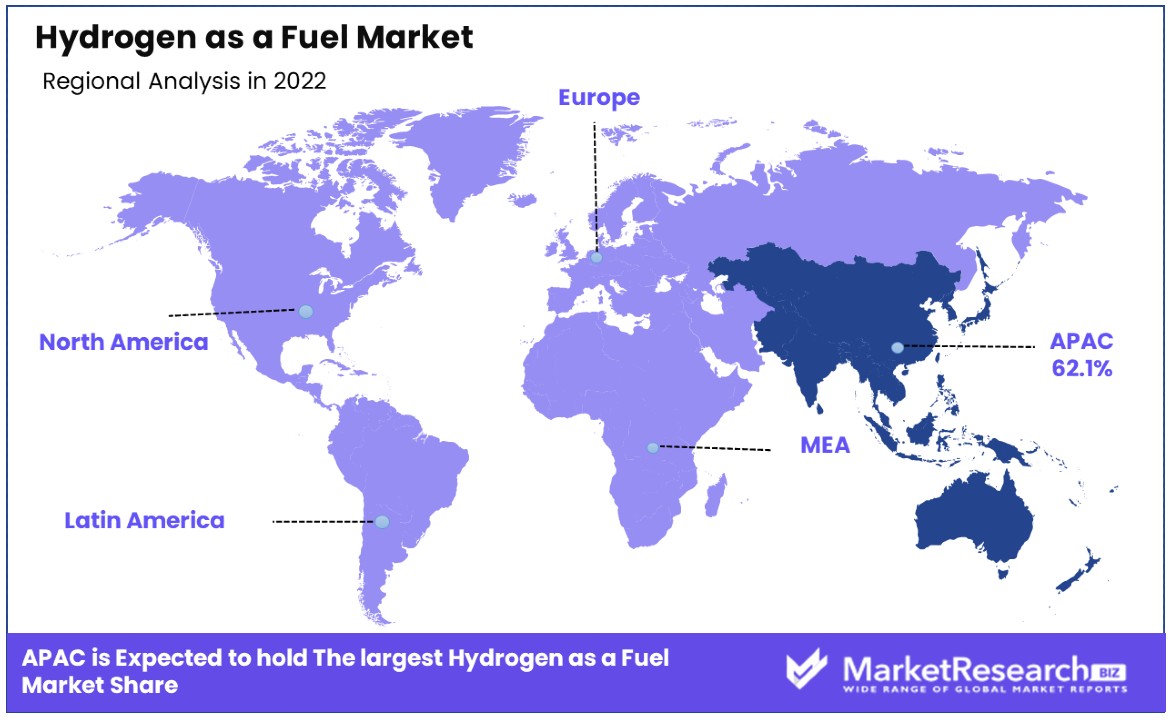

Asia Pacific Dominates with 62.1% Market Share

Asia Pacific's substantial 62.1% share in the global Hydrogen as a Fuel Market is primarily driven by the region's strong commitment to reducing carbon emissions and transitioning to cleaner energy sources. Countries like Japan, South Korea, and China are leading this shift, heavily investing in hydrogen technology as part of their national energy strategies.

The region's focus on sustainable transportation, including the development of hydrogen fuel cell vehicles, significantly contributes to market growth. Additionally, Asia Pacific's large manufacturing base provides an ideal environment for the development and scaling of hydrogen technologies.

The market dynamics in Asia Pacific are influenced by governmental initiatives and public-private partnerships aimed at developing hydrogen infrastructure, such as hydrogen fueling stations and production facilities. The increasing demand for clean energy in industrial applications and public transportation systems in the region further drives the adoption of hydrogen fuel.

Europe Is Leading in Innovation and Policy Support

Europe's hydrogen fuel market is driven by strong policy support and innovation in green hydrogen technologies. The European Union's ambitious climate targets and the emphasis on energy transition contribute to the region's focus on hydrogen as a key component of its renewable energy strategy. European countries are also pioneering in the integration of hydrogen in various sectors, including transportation and industrial processes, backed by significant research and development efforts.

North America's Growing Interest in Clean Energy Solutions

In North America, particularly in the United States and Canada, the Hydrogen as a Fuel Market is expanding due to growing interest in clean energy solutions and reducing dependency on fossil fuels. The region is seeing increased investments in hydrogen infrastructure and technology development. North America's vast natural resources and technological capabilities position it well for the adoption and production of hydrogen fuel, particularly for industrial and transportation applications.

Hydrogen as a Fuel Industry By Region

North America

- The US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of the Middle East & Africa

Hydrogen as a Fuel Market Key Player Analysis

In the Hydrogen as a Fuel Market, an area pivotal for the transition to sustainable energy, the listed companies play significant roles in shaping its trajectory. Air Liquide, Linde plc, and Air Products and Chemicals, Inc., as leaders in industrial gases, are pivotal in the production and supply chain of hydrogen, demonstrating the market's focus on infrastructure and accessibility.

Shell plc and Saudi Arabian Oil Co., traditionally oil and gas giants, are transitioning towards sustainable energy, investing heavily in hydrogen fuel technologies, reflecting the broader industry shift towards clean energy. Toyota Motor Corporation and Hyundai Motor Company, leading in the development and commercialization of hydrogen fuel cell vehicles (FCVs), underscore the automotive industry's role in driving hydrogen fuel adoption.

General Motors, Honda Motor Co., Ltd., and BMW AG, with their commitments to FCVs, highlight the growing interest in hydrogen as a viable alternative to traditional fossil fuels in the transportation sector. Daimler AG, Audi AG, and Nikola Corporation focusing on hydrogen-powered trucks and commercial vehicles, showcase the potential of hydrogen in heavy-duty transportation.

Cummins Inc., known for its engines and power solutions, and Ballard Power Systems Inc., specializing in fuel cell technology, play crucial roles in developing and providing hydrogen-based power systems for various applications, from vehicles to stationary power.

Collectively, these companies not only drive the growth of Hydrogen as a Fuel Market but also represent a spectrum of strategies, from production and infrastructure development to vehicle manufacturing and technological innovation, crucial for the adoption and advancement of hydrogen as a clean and sustainable energy source.

Major Market Players in Hydrogen as a Fuel Market

- Air Liquide

- Linde plc

- Air Products and Chemicals, Inc.

- Shell plc

- Saudi Arabian Oil Co.

- Toyota Motor Corporation

- Hyundai Motor Company

- General Motors

- Honda Motor Co., Ltd.

- BMW AG

- Daimler AG

- Audi AG

- Nikola Corporation

- Cummins Inc.

- Ballard Power Systems Inc.

Recent Developments

- In November 2023, GAC Motor, a Chinese automaker, revealed its ERA model concept hydrogen car at the Guangzhou Auto Show. The vehicle's distinctive design incorporates recycled ocean plastic, seaweed, and other biomaterials, reflecting the country's commitment to decarbonization.

- In September 2023, FuelCell Energy and Toyota completed the world's first "Tri-gen" production system at Toyota's Port of Long Beach operations, owned and operated by FuelCell Energy. This innovative system produces renewable electricity, renewable hydrogen, and usable water from directed biogas.

- In August 2023, Nikola Corporation announced that the demand for their hydrogen fuel cell electric vehicles (FCEVs) has surpassed 200 sales orders. A majority of the sales orders to the California Air Resources Board's Hybrid and Zero-Emission Truck and Bus Voucher Incentive Project (HVIP) program, which provides incentives to customers.

- In August 2023, Hyzon Motors, in collaboration with Performance Food Group (PFG) and Chart Industries, completed its first customer demonstration of a liquid hydrogen fuel cell electric truck. This milestone affirms the viability of onboard liquid hydrogen for long-distance, zero-emission transportation in commercial trucking applications.

Report Scope

Report Features Description Market Value (2022) US$ 6.0 Bn Forecast Revenue (2032) US$ 54.5 Bn CAGR (2023-2032) 25.4% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Technology (Proton Exchange Membrane Fuel cells, Phosphoric Acid Fuel Cells, Solid Oxide Fuel Cells, Polymer Exchange Membrane Fuel Cells (PEMFC), Direct Methanol Fuel Cells (DMFC), Molten Carbonate Fuel Cells, Others), By Application (Stationary, Transportation, Portable), By End-Use (Commercial & Industrial, Data Centers, Transportation, Military & Defense, Residential, Utilities, Others) Regional Analysis North America - The US, Canada, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Air Liquide, Linde plc, Air Products and Chemicals, Inc., Shell plc, Saudi Arabian Oil Co., Toyota Motor Corporation, Hyundai Motor Company, General Motors, Honda Motor Co., Ltd., BMW AG, Daimler AG, Audi AG, Nikola Corporation, Cummins Inc., Ballard Power Systems Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Air Liquide

- Linde plc

- Air Products and Chemicals, Inc.

- Shell plc

- Saudi Arabian Oil Co.

- Toyota Motor Corporation

- Hyundai Motor Company

- General Motors

- Honda Motor Co., Ltd.

- BMW AG

- Daimler AG

- Audi AG

- Nikola Corporation

- Cummins Inc.

- Ballard Power Systems Inc.