Natural Gas Engine Market By Engine Power (1000 HP), By Application (Power Generation, Transportation, Other), By End-use Industry (Automotive, Energy & Utilities, Other), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

39521

-

July 2023

-

179

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

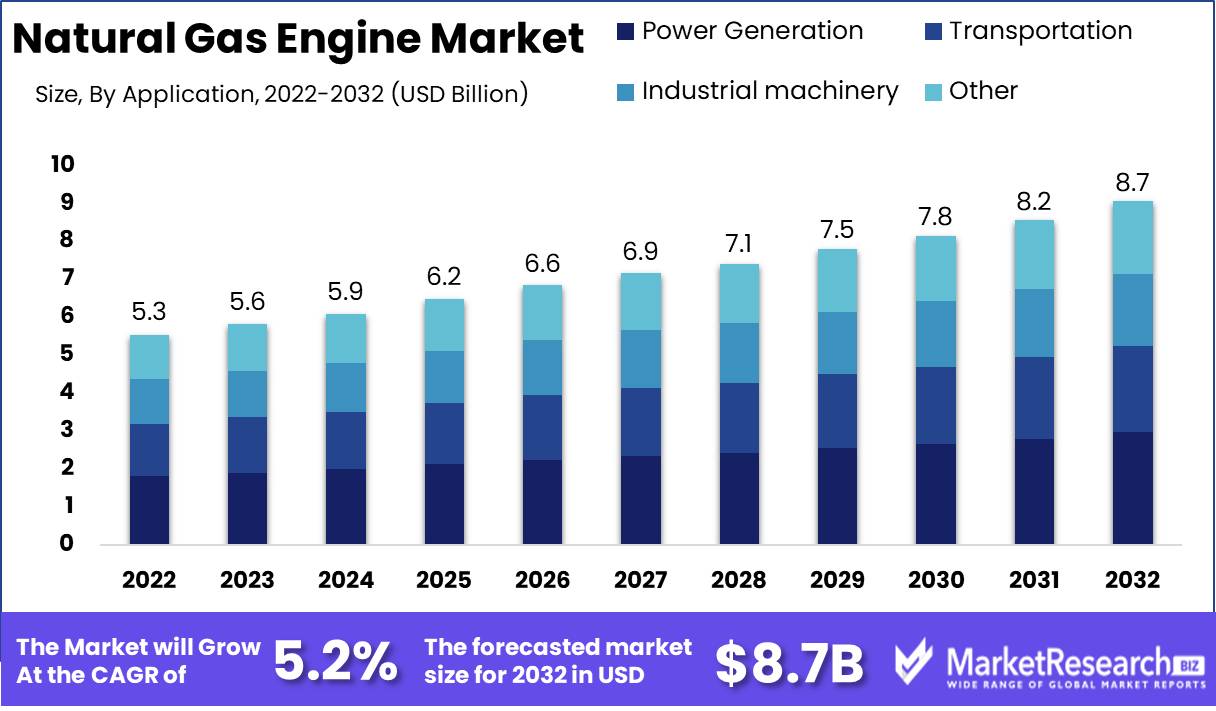

Natural Gas Engine Market size is expected to be worth around USD 8.7 Bn by 2032 from USD 5.3 Bn in 2022, growing at a CAGR of 5.2% during the forecast period from 2023 to 2032.

The natural gas engine market boom. As the benefits of incorporating natural gas engines into operational activities become more widely understood in the corporate and industrial domains, investments in this burgeoning market surge to previously unheard-of levels. This comprehensive report covers the natural gas engine market's definition, objectives, progressive innovations, exponential growth trajectory, diverse applications, principal investors, stimulating drivers, ethical issues, and potential business deployments.

The only way to get a good deal on a car is to drive it. These ingeniously built devices turn natural gas's latent chemical energy into powerful mechanical energy, enabling a variety of utilitarian applications. The natural gas engine market offers an eco-friendly, sustainable alternative to traditional engines that use fossil fuels like gasoline and diesel.

The US natural gas engine's impact is undeniable. First, natural gas is a cleaner-burning fuel than gasoline and diesel, reducing greenhouse gas and pollutant emissions. This natural trait of natural gas engines aligns with global initiatives to reduce carbon footprints and prevent climate change and confirms their position as an environmentally friendly alternative.

Nations that use natural gas as a local energy source reduce their dependence on imported oil, fostering self-sufficiency and energy independence. The widespread availability and affordability of the natural gas era make it a tempting alternative for businesses and industries seeking lower operational costs coupled with more efficiency. In addition to the fact that they are the only ones who can do it, they also have a lot of fun.

Recent improvements in the natural gas engine market have been astounding. Engine manufacturers have invested much in R&D, giving us a mix of cutting-edge technologies to improve engine performance, fuel economy, and emissions control. Milestones such as fuel injection technology developments, turbocharging breakthroughs, and combustion optimization victories have increased power output, fuel efficiency, and cleaner emissions, launching the industry into a new era of progress.

Driving factors

Natural Gas Engines Power Sustainability

As humanity becomes more conscious of the harm greenhouse gas emissions cause our world, environmental concerns drive the natural gas engine market. Natural gas engines release less CO2, particulate matter, and other pollutants than gasoline or diesel. The natural gas engine market is appealing to companies and individuals seeking eco-friendly solutions to meet sustainability goals and decrease their carbon impact.

Natural Gas Boom Powers Engine Market

Natural gas demand is another key driver of the natural gas engine market. Many nations are diversifying their energy mix and relying less on fossil fuels. Natural gas is becoming a popular option for power generation, heating, and other uses because of its adaptability and abundance. The growth of the market for natural gas in the United States is a direct result of the increased demand for the product.

Infrastructure Promotes Natural Gas Engines

A robust infrastructure is essential for the broad adoption of natural gas engines. Governments and businesses are putting a lot of money into building natural gas infrastructure because they recognize this requirement. This infrastructure includes pipelines, refueling stations, storage facilities, and other essentials for natural gas engines. The use of natural gas as a fuel source is a common practice, but it is also possible to use it as a source of income.

Natural Gas Engines Rule Transportation and Power

The number of people using the service is growing, and the number of people using the service is increasing. Due to their lower emissions and cost, natural gas engines are becoming popular in transportation. To meet emission regulations and cut expenses, municipalities, businesses, and even individuals are switching to natural gas-powered buses, trucks, and cars.

Government Support Fuels Natural Gas Engine Surge

The world's largest natural gas engine manufacturer, GE, has announced that it would soon be available for purchase. Governments are implementing tax incentives, subsidies, and grants to stimulate the adoption of natural gas engines for businesses and individuals. These incentives lower initial investment costs and make natural gas engines more affordable. Governments are also working to create a favorable regulatory framework that supports the natural gas engine market's growth.

Restraining Factors

Natural Gas Engine Opportunities and Constraints

The natural gas engine market has grown and has potential. Natural gas engines have become a viable alternative to traditional gasoline and diesel engines as more industries and individuals seek cleaner and more sustainable energy sources. When estimating this market's future, various restraining factors must be addressed.

Fuel Prices Affect the Natural Gas Engine Market

The lack of a natural gas engine in the United States has led to a rise in the number of people using it. Supply, demand, geopolitics, and production costs affect natural gas prices. These price swings may dissuade buyers from buying natural gas engines. The cost of a natural gas vehicle is higher than it is for a gasoline vehicle, hence the cost of the vehicle is higher as well.

Partnerships and Efficiency Natural Gas Engine Issues

To overcome these challenges, natural gas engine market stakeholders must form long-term agreements with gas providers to ensure a steady fuel supply at competitive prices. Technological advances targeted at improving the fuel efficiency of natural gas engines can help offset variable prices by reducing fuel usage.

Costs Prevent Natural Gas Engine Adoption

The only way to get a good deal on a new car is to buy a used one. Natural gas engines cost more to manufacture and install than conventional engines. The initial expenditure for natural gas fuelling infrastructure development also raises costs. In price-sensitive economies, increased costs may dissuade firms and individuals from adopting this technology.

Incentives and Collaboration Grow Natural Gas Engines

The use of natural gas as a fuel source is a common practice, but it's also important to note that there are many other factors to consider. To offset the greater costs of buying and installing natural gas engines, governments can offer tax incentives or grants. Research and development can also lower production costs for manufacturers.

Engine Power Analysis

The 300-1000 HP segment leads the natural gas engine market. The best way to get your money's worth is to buy a home with a view to the future. The 300-1000 HP segment dominates due to the growing demand for natural gas engines in numerous applications.

The economic growth of emerging economies is driving the adoption of the 300 - 1000 HP segment of the natural gas engine market. The need for reliable and efficient power solutions is growing as these economies expand. The 300 - 1000 HP engines offer the optimum blend of power and cost, making them suitable for rising economies.

Consumers like 300-1000 HP natural gas engines. The benefits of natural gas engines, such as decreased pollutants, lower fuel costs, and longer engine life, are becoming more widely recognized. These qualities and the 300-1000 HP segment's power output have made it a consumer favorite.

Application Analysis

The power generation segment enjoys a dominant position in the natural gas engine market. This segment supplies power to many industries and sectors. Natural gas engines are the best option for power generation applications due to their reliability and engine efficiency.

Emerging economies' economic growth is driving the adoption of the power generation segment of the natural gas engine market. The following is a list of all the ways in which the United States of America's largest cities can be used to generate electricity. The best way to get your money's worth is to buy a house.

Consumer trends and behavior toward the power generation segment of the natural gas engine market have shown a strong affinity for these engines. Consumers are realizing the benefits of natural gas engines for power generation, such as decreased pollution and fuel prices. The power of the sun is a factor, but the power of the sun is also a factor.

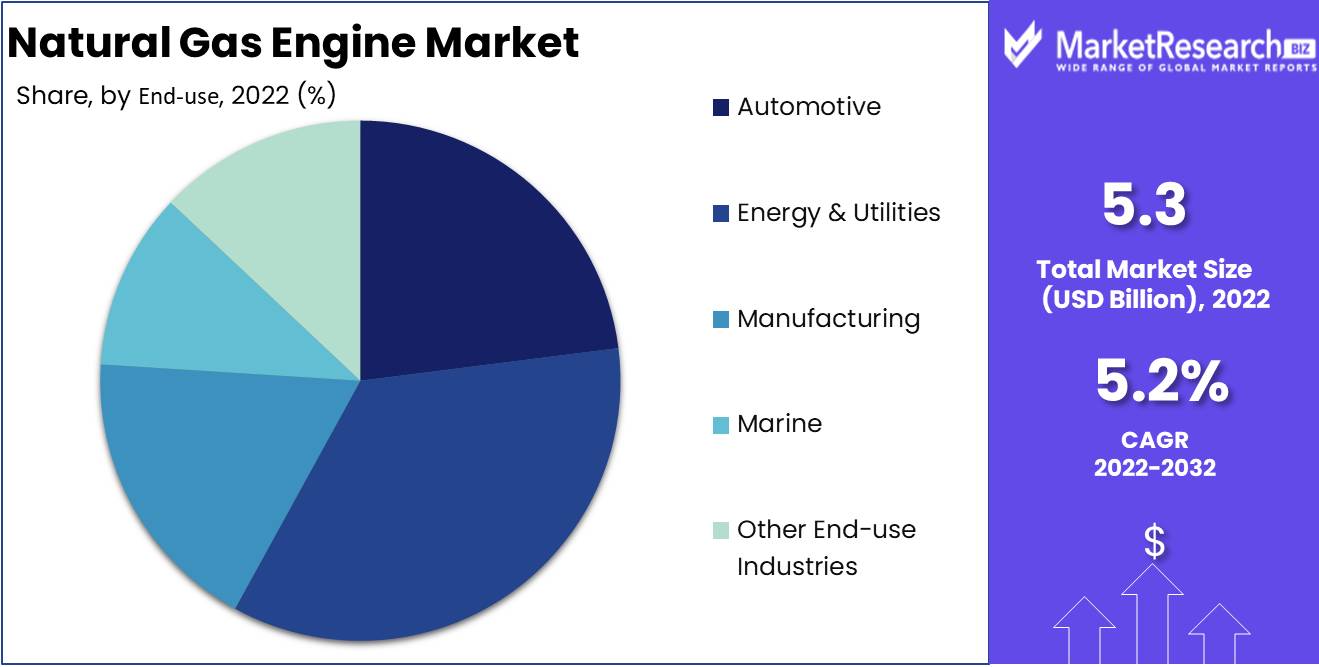

End-use Industry Analysis

Energy & utilities dominate natural gas engine sales. This segment provides power solutions to energy and utility sectors, including electricity generation, oil and gas operations, and other energy-intensive industries. The best way to get a good deal on a car is to drive it.

The growth of the economy has led to the creation of a number of new technologies, including the use of smartphones and tablets. As these economies grow, energy and utilities seek reliable and efficient power solutions. The Energy & Utilities segment offers the ideal blend of power output and cost-effectiveness, making it particularly appealing for rising economies.

Consumer behavior in the energy & utilities segment of the natural gas engine market shows a high preference for these engines. The benefits of using a natural gas generator to power your home are well-known, but so are the risks associated with using it. The term "energy" refers to a type of energy that is used to describe a product or service.

Key Market Segments

By Engine Power

- <300 HP

- 300-1000 HP

- >1000 HP

By Application

- Power Generation

- Transportation

- Industrial machinery

- Other Applications

By End-use Industry

- Automotive

- Energy & Utilities

- Manufacturing

- Marine

- Other End-use Industries

Growth Opportunity

Renewable Energy and Natural Gas Engines

Renewable natural gas (RNG) is gaining popularity as a sustainable alternative to fossil fuels. Renewable sources, including organic waste from landfills, wastewater treatment facilities, and agriculture, are used to produce RNG. This abundant, greener energy source can be employed in natural gas engines, offering growth. The growing global focus on decreasing greenhouse gas emissions and the availability of RNG are likely to boost demand for natural gas engines and market growth.

Tech-Driven Change AI, IoT Improve Natural Gas Engines

The natural gas engine market is being transformed by AI and the Internet of Things. AI and IoT solutions offer real-time monitoring, predictive maintenance, engine performance, fuel efficiency, and emissions optimization. The use of a natural gas engine to generate electricity is a common practice, but it is also possible to use a natural gas generator. The market for natural gas engines will grow as the sector adopts AI and IoT solutions.

High Demand for Natural Gas Engines

While marine and off-road applications have been identified as natural gas engine market growth drivers, the transportation industry offers another attractive possibility. Natural gas engines are cheaper, quieter, and cleaner than diesel engines. The demand for natural gas engines in buses, trucks, and other transportation vehicles is expected to rise as cities and countries move toward decarbonization and stricter emission laws.

Powerful Partnerships Boosting Natural Gas Engines

Collaborations drive growth and innovation in any industry, including the natural gas engine market. Strategic relationships between engine manufacturers, technology providers, and renewable energy organizations can speed the development and adoption of sophisticated natural gas engine solutions. Collaborations enable research, development, and market penetration. The natural gas engine market can unleash new growth opportunities by leveraging stakeholders' skills and resources.

Latest Trends

Dual-Fuel Power Generation

In today's fast-paced world, the natural gas engine market seeks novel ways to improve efficiency and reduce environmental effects. Dual-fuel engines have been popular recently. These engines use natural gas and diesel to replace fossil fuels, transforming power generation.

Eco-Friendly Dual-Fuel Engines

Global emission reduction initiatives have increased due to environmental contamination concerns. Dual-fuel engines reduce harmful pollutants and are crucial to this effort. Industries can reduce greenhouse gas emissions, sulfur oxides, and particulate matter significantly by adopting this technology. This meets strict environmental requirements and makes power generation more sustainable.

Eco-Power System Retrofitting

Dual-fuel power system retrofitting is a major market development in the natural gas engine sector. The usage of a diesel engine to power a home is a common practice, but it's not always practical. Businesses in various energy markets can save money and increase fuel flexibility by using natural gas alongside diesel.

Digital Monitoring Improves Dual-Fuel Engines

The natural gas engine market has improved performance and efficiency with enhanced digital monitoring systems. These high-tech technologies allow real-time engine parameter monitoring for preemptive maintenance and improved operational management. Data analytics helps industries reduce downtime, boost production, and boost power generation system efficiency. Digital monitoring unlocks the full potential of dual-fuel engines, accelerating their use throughout industries.

Dual-Fuel Engine Performance

Dual-fuel engines have better performance and are more environmentally friendly than conventional engines. These engines have increased power output and reduced operating expenses due to natural gas combustion efficiency. The natural gas engine market reduces carbon deposits and engine longevity. Dual-fuel engines are appealing to industries seeking operational excellence due to their performance and maintenance advantages.

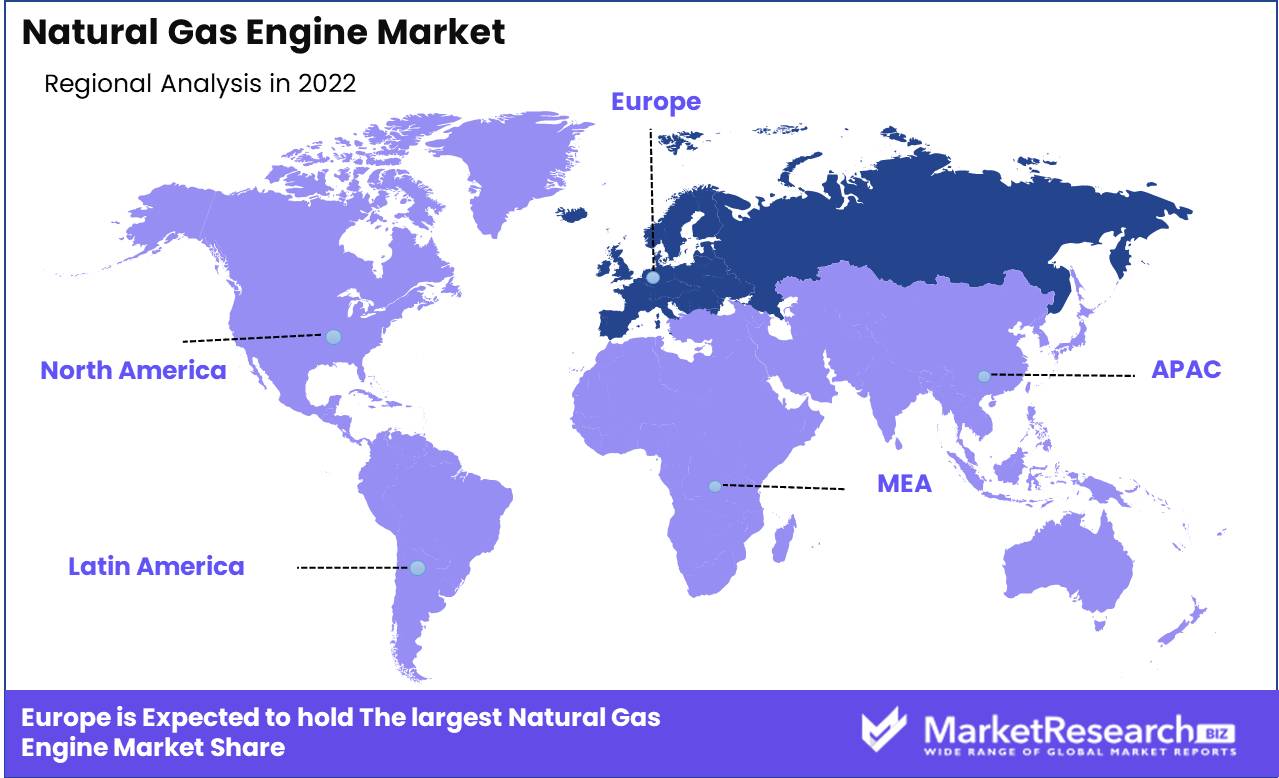

Regional Analysis

Europe dominates the natural gas engine market. Natural gas dominates today's energy landscape. The use of natural gas as a source of energy has been a growing trend in recent years, and it is no surprise that the market for natural gas has increased. The majority of the time, the United States has been a leader in the development of new technologies.

Europe is a leader in the natural gas engine market thanks to its commitment to sustainability and carbon reduction. Europe has used natural gas engines to power many applications thanks to its advanced technology and infrastructure. Natural gas engines have become the go-to choice for a variety of energy needs across the region, from domestic and commercial usage to large-scale industrial activities.

European renewables have also helped natural gas engines grow. The use of a natural gas generator to generate electricity is a common practice. The region's energy transition plans and energy security depend on these engines' flexibility and reliability.

Europe's resolve to diversify its energy mix has played a key part in natural gas engines' success. The region has invested in natural gas infrastructure and distribution networks to reduce fossil fuel use. This proactive approach has strengthened Europe's energy security and enabled the widespread use of natural gas engines.

The use of natural gas as a fuel source has been a growing trend in recent years, and this is no exception. These engines have changed the way enterprises work in transportation, shipping, power generation, and construction. The transportation industry, which requires efficient and environmentally friendly solutions, has quickly adopted natural gas engines due to their lower emissions and cost-effectiveness.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Due to the demand for cleaner and more sustainable power solutions, the natural gas engine market is booming. Caterpillar, Wärtsilä, Rolls-Royce plc, Volkswagen, Siemens, and INNIO lead this market. Each company's experience, technological advances, and commitment to sustainability help the natural gas engine industry develop.

US-based multinational Caterpillar dominates the natural gas engine market. Caterpillar manufactures natural gas engines for power generation, oil and gas, marine, and rail applications with a focus on sustainability. Their engines enhance fuel efficiency and reduce pollutants, benefiting clients economically and environmentally.

Another natural gas engine market leader is Finnish Wärtsilä. The company provides superior marine and energy technologies and lifecycle solutions. Wärtsilä's natural gas engines are known for their efficiency, reliability, and sustainability. For power generation, distributed energy solutions, and marine propulsion, they provide a wide range of engines.

British multinational engineering business Rolls-Royce plc has contributed significantly to the natural gas engine market. It designs and builds high-performance power systems, including natural gas engines. Rolls-Royce plc supplies natural gas engines for power production, marine propulsion, and oil and gas applications.

Volkswagen, a German automaker, entered the natural gas engine market. Volkswagen's natural gas engines use automotive technical experience. These engines enhance performance, fuel efficiency, and pollution. Volkswagen hopes to reduce transportation sector carbon dioxide emissions by adding natural gas engines.

Siemens, a German multinational business, has also made its mark in the natural gas engine market. Power generation, electrification, and automation are just a few of the fields in which the organization has experience. Siemens' high-efficiency natural gas engines are reliable. Industrial, power, and cogeneration applications use their engines.

Austrian energy solutions supplier INNIO rounds out the top natural gas engine market players. INNIO provides reliable and sustainable energy solutions worldwide. INNIO offers natural gas engines for power production, marine propulsion, and oil and gas applications. Their engines meet strict environmental rules and are efficient.

Top Key Players in the Natural Gas Engine Market

- Caterpillar (U.S.)

- Wärtsilä (Finland)

- Rolls-Royce plc (UK)

- Volkswagen (Germany)

- Siemens (Germany)

- INNIO (Austria)

- Cummins Inc., (U.S.)

- Mitsubishi Heavy Industries, Ltd. (Japan)

- Kawasaki Heavy Industries, Ltd. (Japan)

- Ningbo C.S.I Power & Machinery Group Co., Ltd. (China)

- IHI Power Systems Co., Ltd. (Japan)

- JFE Engineering Corporation (Japan)

- Liebherr (Germany)

- Hyundai Heavy Industries Co., Ltd. (South Korea)

- ENF Ltd., (China)

- R Schmitt Enertec GMBH (Germany)

- China National Petroleum Corporation (China)

- Fairbanks Morse Defense (U.S.)

- Baudouin (France)

Recent Development

- In 2023, Cummins announced the highly anticipated launch of its QSB9-G natural gas engine Leading the way.

- In 2022, With the introduction of the GX8 natural gas engine, designed specifically for light-duty vehicles, Westport Fuel Systems made waves.

- In 2021, CNH Industrial introduced its Natural Power F-Max truck, which is propelled by a natural gas engine, in an industry-defining move.

- In 2020, Continuing the trend, Caterpillar made waves with the launch of its C13 natural gas engine, designed specifically for use in construction equipment.

- In 2019, With the launch of its medium-duty truck-specific NGT engine Navistar International left an indelible mark on the natural gas engine market.

Report Scope

Report Features Description Market Value (2022) USD 5.3 Bn Forecast Revenue (2032) USD 8.7 Bn CAGR (2023-2032) 5.2% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Engine Power (<300 HP, 300-1000 HP, >1000 HP), By Application (Power Generation, Transportation, Industrial Machinery, Other Applications), By End-use Industry (Automotive, Energy & Utilities, Manufacturing, Marine, Other End-use Industries) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Caterpillar (U.S.), Wärtsilä (Finland), Rolls-Royce plc (UK), Volkswagen (Germany), Siemens (Germany), INNIO (Austria), Cummins Inc., (U.S.), Mitsubishi Heavy Industries, Ltd. (Japan), Kawasaki Heavy Industries, Ltd. (Japan), Ningbo C.S.I Power & Machinery Group Co., Ltd. (China), IHI Power Systems Co., Ltd. (Japan), JFE Engineering Corporation (Japan), Liebherr (Germany), Hyundai Heavy Industries Co., Ltd. (South Korea), ENF Ltd., (China), R Schmitt Enertec GMBH (Germany), China National Petroleum Corporation (China), Fairbanks Morse Defense (U.S.), Baudouin (France) Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Caterpillar (U.S.)

- Wärtsilä (Finland)

- Rolls-Royce plc (UK)

- Volkswagen (Germany)

- Siemens (Germany)

- INNIO (Austria)

- Cummins Inc., (U.S.)

- Mitsubishi Heavy Industries, Ltd. (Japan)

- Kawasaki Heavy Industries, Ltd. (Japan)

- Ningbo C.S.I Power & Machinery Group Co., Ltd. (China)

- IHI Power Systems Co., Ltd. (Japan)

- JFE Engineering Corporation (Japan)

- Liebherr (Germany)

- Hyundai Heavy Industries Co., Ltd. (South Korea)

- ENF Ltd., (China)

- R Schmitt Enertec GMBH (Germany)

- China National Petroleum Corporation (China)

- Fairbanks Morse Defense (U.S.)

- Baudouin (France)