Orange Juices Market By Processing Type (Frozen Concentrated Orange Juice (FCOJ), Not-From-Concentrate Juice (NFC), Refrigerated Orange Juice from Concentrate (RECON), Nectar), By Packaging (Cartons, Metal Can, PP Material Bottle, Other Packaging), By Distribution Channel (Food & Beverage Industry, Food Service Provider, Supermarkets & Hypermarkets, Convenience Stores, Specialty Food Stores, Online Retail), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

40543

-

Aug 2024

-

137

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

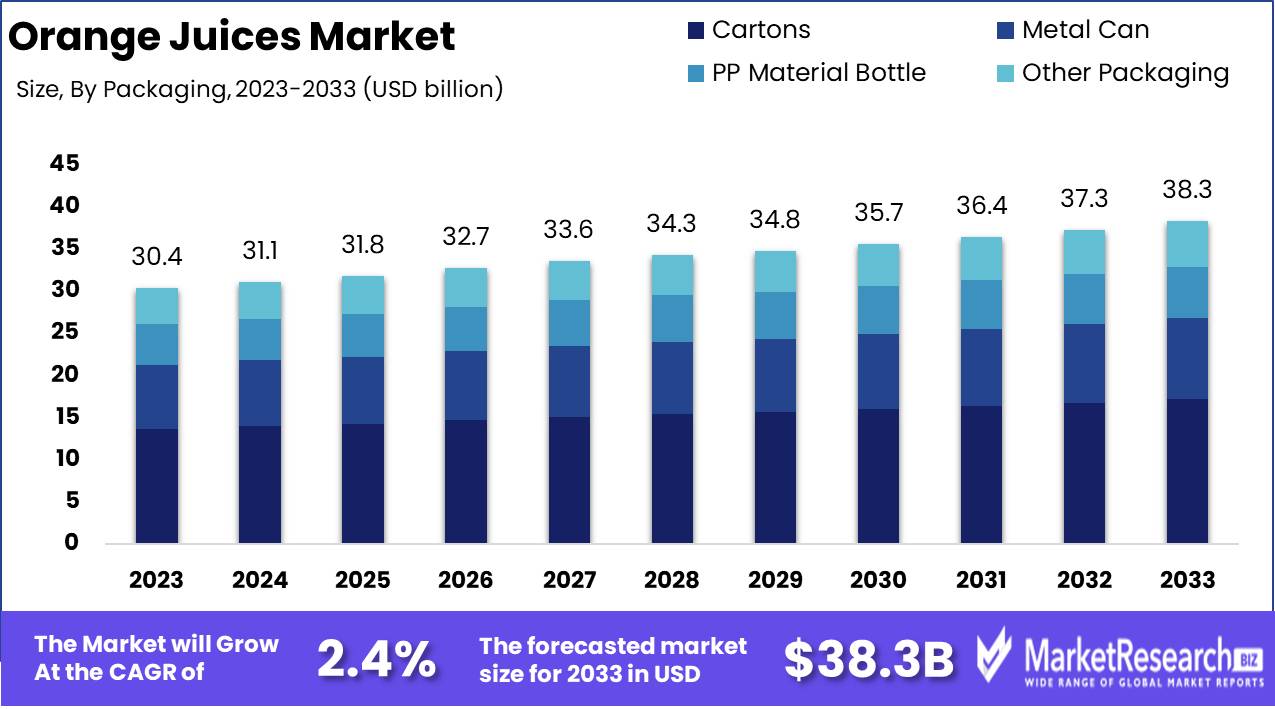

The Global Orange Juices Market was valued at USD 30.4 Bn in 2023. It is expected to reach USD 38.3 Bn by 2033, with a CAGR of 2.4% during the forecast period from 2024 to 2033.

The Orange Juices Market encompasses the production, distribution, and sale of orange juice, including variants like fresh, concentrated, and not-from-concentrate (NFC). This market is driven by consumer preferences for natural and healthy beverages, advancements in production technologies, and growing health consciousness. Key players focus on product differentiation through quality, nutritional value, and taste. The market is influenced by factors such as raw material availability, especially oranges, and the development of sustainable practices to meet consumer demand for eco-friendly products.

The Orange Juices Market is poised for notable growth, driven by evolving consumer preferences and advancements in production technologies. In the 2023/2024 season, U.S. orange juice production is anticipated to rebound to 110,000 tons, attributed to increased orange availability in Florida, the nation's largest producer. This recovery highlights the market's resilience and its dependence on key agricultural regions.

The Orange Juices Market is poised for notable growth, driven by evolving consumer preferences and advancements in production technologies. In the 2023/2024 season, U.S. orange juice production is anticipated to rebound to 110,000 tons, attributed to increased orange availability in Florida, the nation's largest producer. This recovery highlights the market's resilience and its dependence on key agricultural regions.One significant trend is the rising demand for not-from-concentrate (NFC) orange juice, promoted as a real juice with no added water or preservatives. This product emphasizes fresh orange nutrition and taste, boasting a shelf life of 28 days. The shift towards NFC juice underscores consumer preference for authenticity and minimal processing, aligning with broader health and wellness trends.

Additionally, the market is witnessing a push towards sustainability, with companies adopting eco-friendly practices in their production and packaging processes. This move is in response to increasing consumer awareness and demand for environmentally responsible products. The emphasis on sustainability is expected to further drive market growth as brands leverage this trend to differentiate themselves.

Advancements in production technologies are enhancing juice quality and extending shelf life without compromising nutritional value. This technological progress is crucial in meeting the growing demand for high-quality orange juice.

Key Takeaways

- Market Value: The Global Orange Juices Market was valued at USD 30.4 Bn in 2023. It is expected to reach USD 38.3 Bn by 2033, with a CAGR of 2.4% during the forecast period from 2024 to 2033.

- By Processing Type: Not-From-Concentrate Juice (NFC) constitutes 40%, favored for its natural flavor and nutritional value.

- By Packaging: Cartons dominate with 45%, preferred for their convenience and preservation qualities.

- By Distribution Channel: Supermarkets & Hypermarkets make up 30%, offering wide accessibility to consumers.

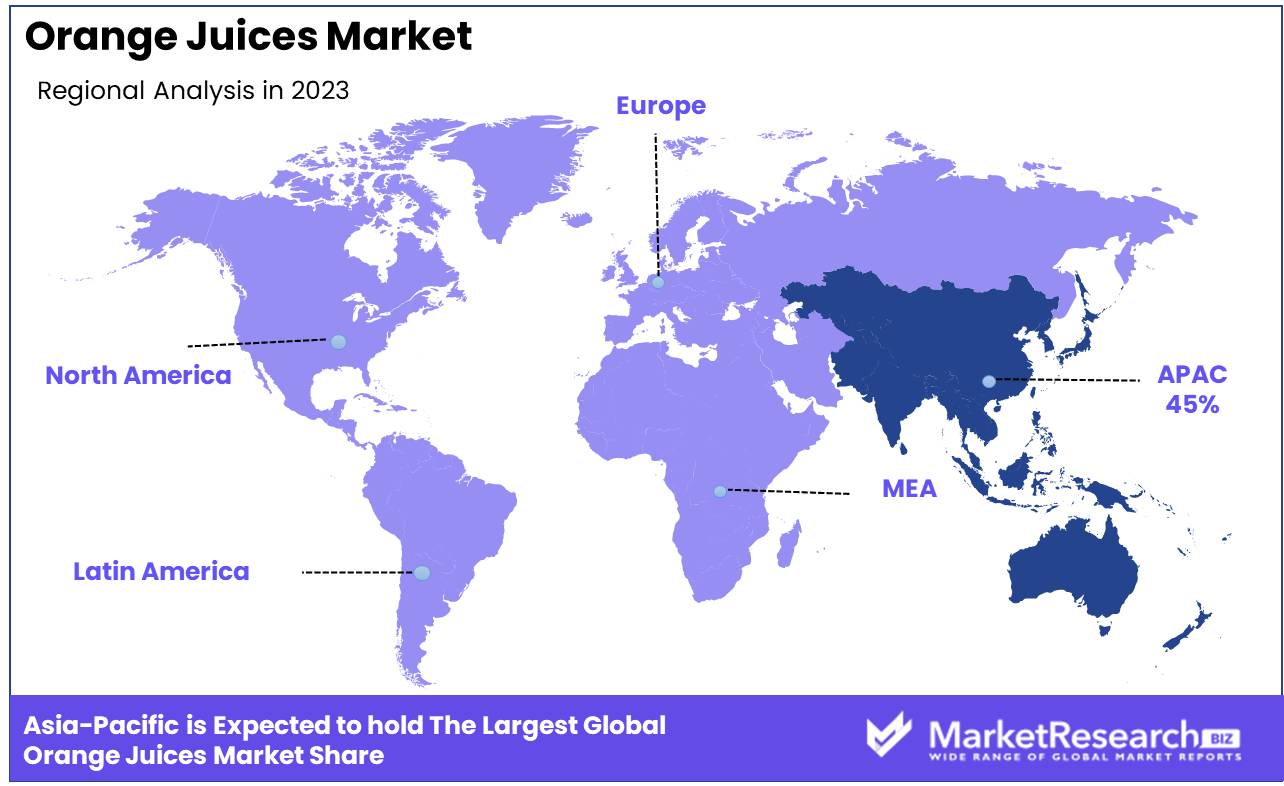

- Regional Dominance: Asia-Pacific holds a 45% market share, driven by rising health awareness and demand for fresh beverages.

- Growth Opportunity: Introducing fortified orange juices with added vitamins and minerals can appeal to health-conscious consumers and boost market growth.

Driving factors

Growing Consumer Demand for Healthy and Natural Beverages

The global Orange Juices Market is significantly driven by the growing consumer demand for healthy and natural beverages. As consumers become increasingly health-conscious, they are shifting away from sugary sodas and artificially flavored energy drinks towards more nutritious options. Orange juice, with its natural sweetness and absence of artificial additives, fits perfectly into this trend.

The rising preference for beverages that offer health benefits is propelling the market for orange juices. This trend is supported by the increasing availability of organic and preservative-free orange juice products, catering to the demand for clean label and natural health products.

Increasing Awareness of the Nutritional Benefits of Orange Juice

The increasing awareness of the nutritional benefits of orange juice is another pivotal factor contributing to the market’s growth. Orange juice is rich in essential nutrients such as vitamin C, potassium, and antioxidants, which are known to boost immune function, improve skin health, and support overall well-being.

This awareness has been bolstered by public health campaigns and educational initiatives emphasizing the importance of a balanced diet and the role of fruits and fruit juices in maintaining health. As consumers become more informed about the health benefits of orange juice, its consumption is expected to rise, driving market growth.

Expansion in Ready-to-Drink Beverage Options

The expansion in ready-to-drink (RTD) beverage options is a significant driver of the Orange Juices Market. The modern, fast-paced lifestyle has led to an increased demand for convenient food and beverage options. Ready-to-drink orange juice products offer a quick and easy way for consumers to enjoy the benefits of orange juice without the need for preparation.

This convenience, combined with innovations in packaging and product variety, has made RTD orange juices highly appealing. The market is seeing a surge in single-serve and portable packaging formats, catering to on-the-go consumers and enhancing the product's accessibility.

Restraining Factors

High Cost of Production and Fluctuating Orange Prices

One of the primary restraining factors for the Orange Juices Market is the high cost of production and the fluctuating prices of oranges. The cultivation of oranges involves significant investment in terms of land, labor, water, and agricultural inputs. Additionally, the process of extracting and packaging orange juice is capital-intensive. These high production costs can be a barrier to market entry and expansion for many producers.

The price of oranges is subject to volatility due to factors such as weather conditions, diseases affecting orange crops, and changes in agricultural policies. For instance, adverse weather events like droughts or hurricanes can drastically reduce orange yields, leading to higher prices for raw materials. This volatility in orange prices can squeeze profit margins for juice producers and make it challenging to maintain consistent pricing for consumers. The uncertainty surrounding production costs and orange prices can deter investment and growth in the market.

Competition from Other Fruit Juices and Beverages

The Orange Juices Market also faces significant competition from other fruit juices and beverages. Consumers have a wide array of choices when it comes to beverages, including apple juice, grape juice, berry blends, and various non-juice options like flavored water, energy drinks, and plant-based beverages. This competition is intensified by the continuous innovation and marketing efforts by producers of alternative beverages, which often highlight unique health benefits, exotic flavors, or lower sugar content compared to orange juice.

This competitive landscape can limit the growth prospects for orange juice as it vies for shelf space and consumer attention. Brands must continuously innovate and differentiate their products to maintain market share, which can be both costly and challenging. The presence of numerous alternatives means that even slight shifts in consumer preferences or trends can impact the demand for orange juice.

By Processing Type Analysis

Not-From-Concentrate Juice (NFC) held a dominant market position in the By Processing Type segment of the Orange Juices Market, capturing more than a 40% share.

In 2023, Not-From-Concentrate Juice (NFC) held a dominant market position in the By Processing Type segment of the Orange Juices Market, capturing more than a 40% share. NFC juice is preferred by consumers for its perceived freshness and higher quality compared to other processing types. It is minimally processed and often marketed as a premium product, which appeals to health-conscious consumers seeking natural and less processed beverages.

Frozen Concentrated Orange Juice (FCOJ), although historically significant, has seen a decline in preference as consumers shift towards more convenient and fresh-tasting options. FCOJ is still popular in regions with limited access to fresh juice and is valued for its longer shelf life and cost-effectiveness.

Refrigerated Orange Juice from Concentrate (RECON) offers a balance between freshness and shelf stability, catering to consumers looking for a mid-range option. Nectar is less common but caters to specific market segments that prefer a thicker and sweeter beverage.

By Packaging Analysis

Cartons held a dominant market position in the By Packaging segment of the Orange Juices Market, capturing more than a 45% share.

In 2023, Cartons held a dominant market position in the By Packaging segment of the Orange Juices Market, capturing more than a 45% share. Cartons are favored for their convenience, cost-effectiveness, and environmental benefits. They provide excellent protection for the juice, preserving its freshness and flavor while being lightweight and easy to transport. The recyclability of cartons also appeals to environmentally conscious consumers and companies aiming to reduce their carbon footprint.

Metal Cans are less popular due to their heavier weight and potential for flavor alteration over time. However, they offer durability and a long shelf life, making them suitable for specific markets and distribution needs.

PP Material Bottles (Polypropylene) are appreciated for their transparency, allowing consumers to see the product. They are also lightweight and shatter-resistant, making them a practical choice for both manufacturers and consumers.

Other Packaging includes glass bottles and innovative packaging solutions aimed at niche markets or specific consumer preferences.

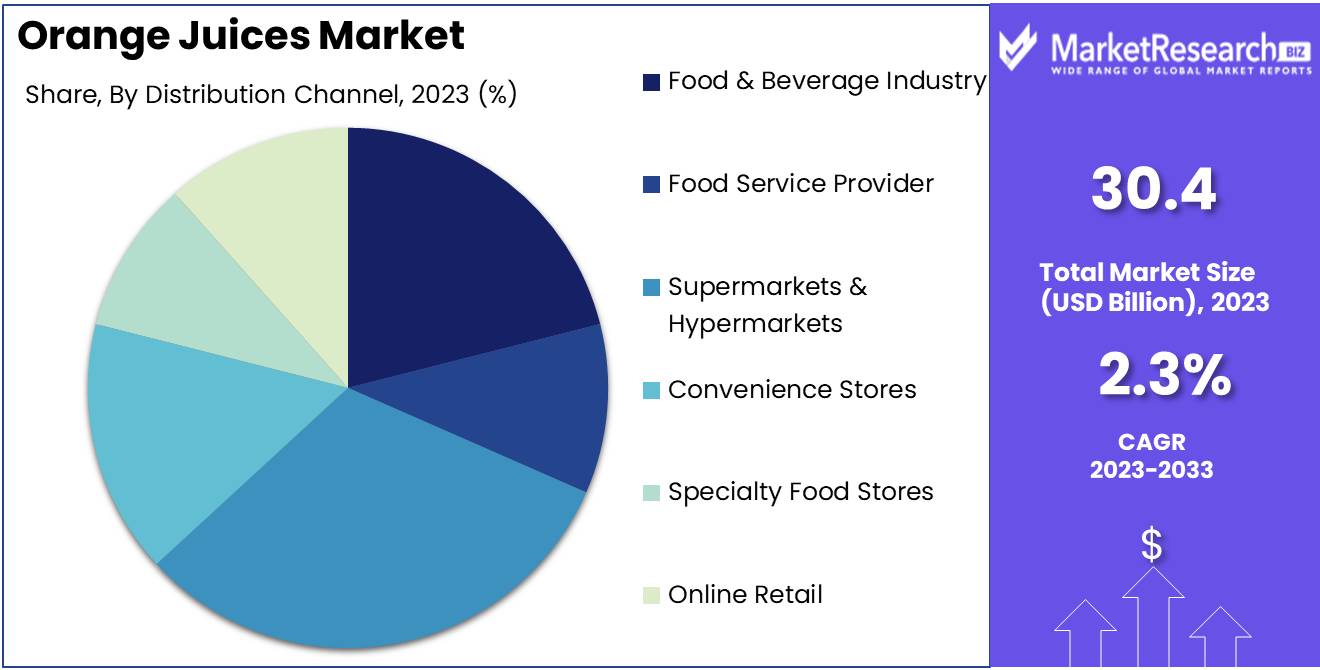

By Distribution Channel Analysis

Supermarkets & Hypermarkets held a dominant market position in the By Distribution Channel segment of the Orange Juices Market, capturing more than a 30% share.

In 2023, Supermarkets & Hypermarkets held a dominant market position in the By Distribution Channel segment of the Orange Juices Market, capturing more than a 30% share. These large retail outlets offer a wide variety of products, making them a preferred shopping destination for consumers. Their ability to offer competitive prices and frequent promotions also drives higher sales volumes for orange juices. The extensive reach and convenience of supermarkets and hypermarkets make them a key distribution channel.

Food & Beverage Industry purchases orange juice in bulk for use in product formulations, catering, and food service operations, contributing significantly to the overall market.

Food Service Providers, including restaurants, cafes, and hotels, are crucial channels for orange juice distribution, especially for freshly prepared and NFC juices.

Convenience Stores cater to on-the-go consumers seeking quick and easy access to beverages. Their smaller footprint and extended hours make them a convenient choice for purchasing orange juice.

Specialty Food Stores focus on high-quality and unique products, attracting health-conscious and discerning consumers.

Online Retail is rapidly growing as a distribution channel, driven by the increasing adoption of e-commerce and consumer preference for home delivery. Online platforms offer a broad range of products and brands, making them an attractive option for busy consumers.

Key Market Segments

By Processing Type

- Frozen Concentrated Orange Juice (FCOJ)

- Not-From-Concentrate Juice (NFC)

- Refrigerated Orange Juice from Concentrate (RECON)

- Nectar

By Packaging

- Cartons

- Metal Can

- PP Material Bottle

- Other Packaging

By Distribution Channel

- Food & Beverage Industry

- Food Service Provider

- Supermarkets & Hypermarkets

- Convenience Stores

- Specialty Food Stores

- Online Retail

Growth Opportunity

Growth Potential in Organic and Fortified Orange Juice Products

In 2024, the global Orange Juices Market is poised to capitalize on the development of organic and fortified orange juice products. With a rising consumer preference for organic foods and beverages, orange juice producers have a significant opportunity to expand their product lines to include organic variants. Organic orange juice appeals to health-conscious consumers who prioritize products free from pesticides and synthetic additives.

The market for fortified orange juice—enriched with vitamins, minerals, and other nutrients—offers further growth potential. These fortified products cater to consumers seeking added health benefits, such as enhanced immunity and better overall nutrition, making them attractive in the competitive beverage market.

Expansion in Emerging Markets Driving Market Growth

The expansion in emerging markets presents a lucrative opportunity for the Orange Juices Market in 2024. Regions such as Asia-Pacific, Latin America, and Africa are experiencing economic growth, urbanization, and increasing disposable incomes, which drive the demand for convenient and nutritious beverages.

As lifestyles become more fast-paced and health awareness rises in these regions, the consumption of orange juice is expected to increase. Companies that invest in distribution networks and localized marketing strategies in these emerging markets can tap into a growing consumer base, thus driving market expansion. The rising middle class and younger demographics in these regions also provide a fertile ground for introducing new and innovative orange juice products.

Latest Trends

Adoption of Sustainable and Eco-Friendly Packaging

In 2024, the global Orange Juices Market is expected to witness a significant trend towards the use of sustainable and eco-friendly packaging. As environmental concerns become increasingly prominent, consumers are demanding more sustainable solutions from their favorite brands. Orange juice producers are responding by adopting packaging materials that are recyclable, biodegradable, or made from renewable resources.

This shift not only helps reduce the environmental footprint but also aligns with the values of eco-conscious consumers. Brands that prioritize sustainable packaging are likely to enhance their market appeal and gain a competitive edge. The use of eco-friendly packaging is also beneficial in meeting regulatory requirements and corporate sustainability goals, further driving its adoption in the industry.

Introduction of New Flavors and Blends

Another notable trend in the Orange Juices Market for 2024 is the introduction of new flavors and blends. As consumers seek variety and unique taste experiences, orange juice producers are innovating with creative combinations and flavor infusions. Blends that incorporate other fruits such as mango, pineapple, or berries, as well as botanical ingredients like ginger or turmeric, are gaining popularity.

These innovative products cater to diverse consumer preferences and create opportunities for premium pricing. Additionally, the introduction of exotic and seasonal flavors helps in attracting adventurous consumers and maintaining their interest in the category.

Regional Analysis

Asia-Pacific led the Orange Juices Market in 2023, capturing a 45% share.

In 2023, the Asia-Pacific region led the Orange Juices Market, capturing a 45% share. The high demand for orange juice in countries like China, India, and Japan drives market growth. Increasing health consciousness, rising disposable incomes, and the growing popularity of fruit juices as a healthy beverage choice contribute to the market's dominance in this region. Additionally, the expansion of distribution networks and the availability of a wide variety of orange juice products further support market growth.

North America is a significant market, with the U.S. being one of the largest consumers of orange juice. The region benefits from a strong focus on health and wellness, along with a well-established beverage industry that promotes the consumption of fruit juices.

Europe follows closely, with countries like Germany, the UK, and France leading in orange juice consumption. The region's high health awareness and preference for natural and organic beverages drive the demand for orange juice.

In the Middle East & Africa, the orange juice market is emerging, with increasing consumer awareness of the health benefits of fruit juices. The UAE and South Africa are notable markets, driven by rising disposable incomes and growing demand for healthy beverages.

Latin America is witnessing steady growth, with Brazil and Mexico being key markets. Brazil, as one of the largest producers of oranges, contributes significantly to the supply side, while rising health consciousness among consumers supports market growth.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In 2024, the global orange juice market is shaped by consumer preferences for natural and healthy beverages, driving demand for high-quality products. Astral Foods and Campofrio Food Group are significant players, known for their extensive distribution networks and commitment to sourcing high-quality oranges. Their focus on sustainability and natural ingredients resonates with health-conscious consumers.

Cargill Incorporated plays a crucial role in the supply chain, providing ingredients and food processing solutions that enhance the quality and shelf-life of orange juice products. Their expertise in agricultural supply chains ensures consistent quality and supply, supporting the market's growth. Bar-S Foods and Carolina Packers Inc. also contribute to the market with their focus on innovative packaging and value-added products, appealing to a broad consumer base.

The orange juice market in 2024 is driven by trends towards organic and minimally processed beverages. Companies are increasingly investing in sustainable sourcing and production practices to meet consumer demand for ethical and environmentally friendly products. The market's growth is further supported by the introduction of new flavors and fortified products, catering to diverse consumer preferences.

Key players continue to innovate in product development and marketing strategies, emphasizing health benefits and quality. The orange juice market remains competitive, with companies striving to differentiate themselves through superior product quality, sustainable practices, and effective supply chain management, ensuring steady growth and consumer loyalty.

Market Key Players

- Astral Foods

- Bar-S Foods

- Campofrio Food Group

- Cargill

- Incorporated

- Carolina Packers Inc

Recent Development

- In May 2024, Astral Foods invested $15 million in upgrading their juice production facilities to enhance efficiency and meet growing demand. This investment aims to improve production capacity by 25%.

- In January 2024, Cargill, Incorporated launched a new line of organic orange juices. This launch aims to cater to health-conscious consumers and increase market share by 10%.

Report Scope

Report Features Description Market Value (2023) USD 30.4 Bn Forecast Revenue (2033) USD 38.3 Bn CAGR (2024-2033) 2.4% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Processing Type (Frozen Concentrated Orange Juice (FCOJ), Not-From-Concentrate Juice (NFC), Refrigerated Orange Juice from Concentrate (RECON), Nectar), By Packaging (Cartons, Metal Can, PP Material Bottle, Other Packaging), By Distribution Channel (Food & Beverage Industry, Food Service Provider, Supermarkets & Hypermarkets, Convenience Stores, Specialty Food Stores, Online Retail) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Astral Foods, Bar-S Foods, Campofrio Food Group, Cargill, Incorporated, Carolina Packers Inc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Astral Foods

- Bar-S Foods

- Campofrio Food Group

- Cargill

- Incorporated

- Carolina Packers Inc