Natural Health Products Market Report By Product Type (Herbal Supplements, Vitamins & Minerals, Probiotics & Prebiotics, Omega-3 Fatty Acids, Homeopathic Remedies, Traditional Chinese Medicine (TCM), Ayurvedic Products, Other Natural Supplements), By Formulation (Capsules, Tablets, Softgels, Powders, Liquids, Teas, Topical Creams/Ointments, Others), By Health Benefit, By Distribution Channel, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

45647

-

May 2024

-

321

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

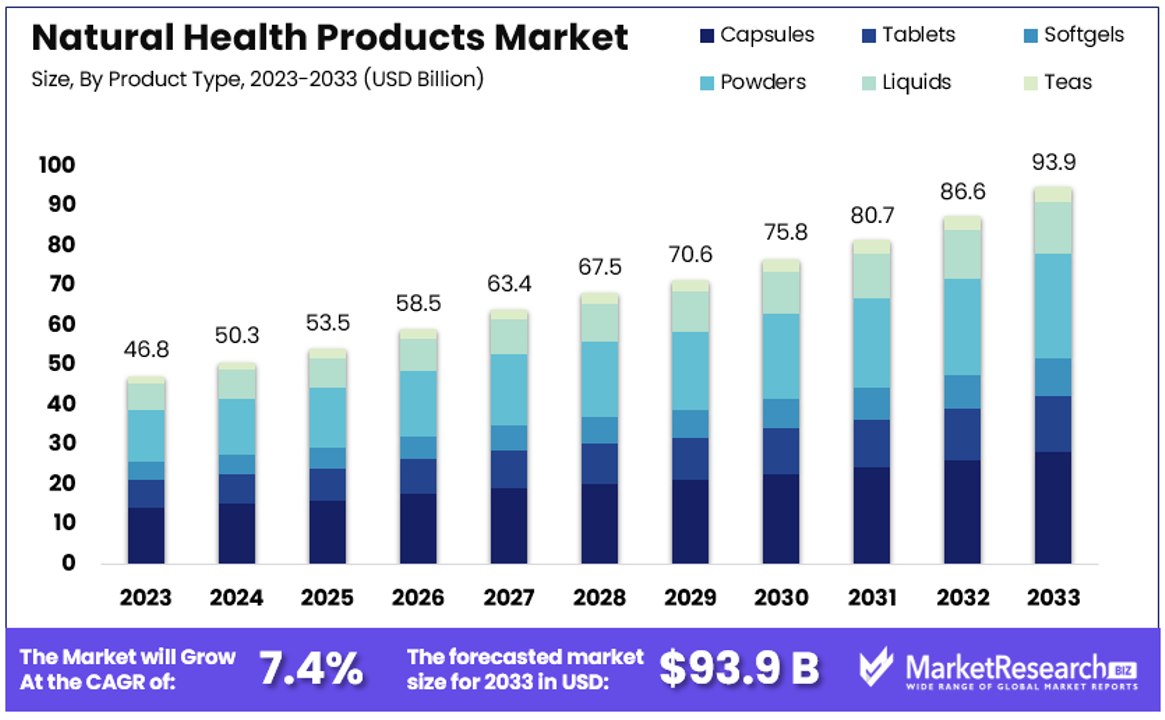

The Global Natural Health Products Market size is expected to be worth around USD 93.9 Billion by 2033, from USD 46.8 Billion in 2023, growing at a CAGR of 7.4% during the forecast period from 2024 to 2033.

The Natural Health Products Market encompasses a range of products derived from natural sources intended to enhance health. This market includes vitamins, minerals, herbal remedies, and other supplements that are increasingly popular for health maintenance and disease prevention. Consumers are driven by a growing preference for natural and organic options, often perceived as safer and more effective than synthetic alternatives.

Key players in this market are focusing on innovation, quality assurance, and compliance with regulatory standards to meet the discerning demands of health-conscious consumers. This sector presents significant growth opportunities for businesses aiming to capitalize on the trend towards healthier lifestyles.

The Natural Health Products Market is experiencing robust growth, driven by a shift in consumer preferences towards wellness and natural ingredients. In the United States, an impressive 43% of Millennials and Gen Z consumers express a preference for natural skincare products. This demographic trend is significant as these age groups often set consumer product trends and influence market dynamics.

Furthermore, a survey indicates that 61% of consumers expect natural product companies to adhere to higher standards in terms of quality, corporate mission, and sustainability practices. This reflects a broader consumer sentiment that companies in this sector are held to a more stringent accountability framework.

Additionally, the labeling of food products as "natural" strongly impacts consumer perception, with 51% of U.S. adults associating such labels with whole ingredients. This perception underscores the importance of clear and transparent labeling in driving product choice and loyalty. Companies operating in the Natural Health Products Market must navigate these expectations by integrating ethical sourcing and sustainable practices into their business models to maintain credibility and appeal to an increasingly discerning customer base.

The convergence of these factors creates a compelling growth narrative for the Natural Health Products Market. Companies that are proactive in leveraging these trends through strategic marketing, rigorous quality control, and sustainable practices are likely to secure competitive advantages. As the market continues to expand, the potential for innovation and differentiation will be key drivers for new entrants and existing players aiming to capture and retain market share in this dynamic industry segment.

Key Takeaways

- Market Value: The Global Natural Health Products Market is forecasted to reach USD 93.9 billion by 2033, reflecting growth from USD 46.8 billion in 2023, with a notable CAGR of 7.40% during the forecast period from 2024 to 2033.

- Product Type Analysis: Herbal Supplements lead with 35% market share, driven by widespread consumer trust and recognition of their health benefits, followed by vitamins and minerals, probiotics, prebiotics, omega-3 fatty acids, homeopathic remedies, and other natural supplements.

- Formulation Analysis: Capsules dominate with 30% market share due to ease of use and effective delivery of ingredients, followed by tablets, softgels, powders, liquids, teas, topical creams, and ointments.

- Health Benefit Analysis: Immune Support products dominate with 40% market share, spurred by increasing health awareness and pandemic effects, followed by Digestive Health, Bone & Joint Health, Heart Health, Weight Management, Skin & Hair Health, etc

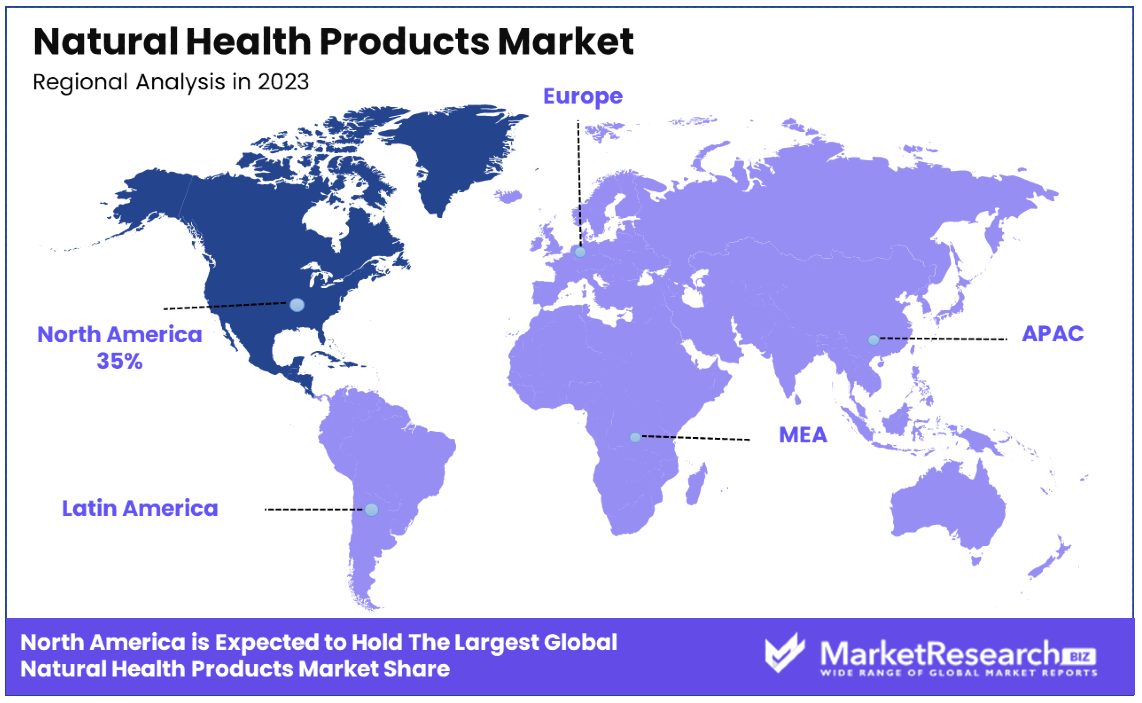

- North America: Leads the market with a 35% market share, driven by high consumer health consciousness and the widespread availability of natural health products.

- Europe: Holds a 30% share of the market, benefiting from advanced healthcare systems and increasing consumer adoption of natural health products.

- Analyst Viewpoint: Analysts anticipate steady growth in the Natural Health Products Market, driven by rising consumer interest in natural and holistic wellness solutions, increased health awareness, and expanding distribution channels.

- Growth Opportunities: Growth opportunities lie in the development of innovative product formulations, expansion into emerging markets, strategic partnerships with healthcare professionals, and leveraging digital platforms for marketing and distribution.

Driving Factors

Rising Health Consciousness Drives Market Growth

The surge in health consciousness among consumers is a pivotal driver for the Natural Health Products Market. As awareness of the adverse side effects associated with synthetic medications grows, more individuals are turning towards natural remedies that offer perceived safety and effectiveness. For instance, the popularity of herbal supplements like turmeric and ginger, known for their anti-inflammatory properties, highlights this trend.

This shift is not just about avoiding synthetics but also about embracing products that support long-term health and wellness. The demand for natural alternatives spans across various demographics, particularly among those who are proactive about their health. This broad and growing interest directly contributes to the market expansion, as consumers not only seek but also trust natural products to maintain their health.

Increasing Prevalence of Chronic Diseases Fuels Market Expansion

The rising global incidence of chronic conditions such as diabetes, obesity, and heart disease is critically shaping the Natural Health Products Market. Many individuals perceive natural products as safer and potentially more effective than traditional pharmaceuticals, especially for long-term management and prevention.

Natural supplements like green tea and garcinia cambogia, which are favored for their weight management benefits, have become increasingly popular. This trend reflects a wider consumer shift towards natural health solutions that align with a holistic approach to healthcare. By integrating these natural options into their health regimes, consumers are actively addressing chronic health issues, thereby driving continuous growth in the market.

Shift Towards Preventive Healthcare Propels Market Growth

A significant shift towards preventive healthcare has become a major growth factor in the Natural Health Products Market. Today's consumers are more proactive than ever in adopting lifestyles that emphasize disease prevention and overall well-being. This preventive approach is markedly boosting the demand for products like probiotics, antioxidants, and natural immune boosters.

The popularity of these products is supported by a growing body of research that underscores their health benefits, leading to increased consumer trust and market demand. The focus on prevention rather than cure reflects a fundamental change in healthcare perspectives, catalyzing the expansion of the natural health products sector. This trend not only increases the current market size but also sets a stable foundation for future growth as more consumers adopt preventive healthcare practices.

Restraining Factors

Lack of Standardization and Quality Control Restrains Market Growth

The absence of standardized regulations and robust quality control in the Natural Health Products Market significantly hampers its growth. Despite ongoing regulatory efforts, inconsistencies remain prevalent in product quality, potency, and efficacy across different regions and brands. These inconsistencies can lead to products that do not meet consumer expectations or, worse, may be unsafe.

For instance, certain herbal supplements have been found to contain undisclosed ingredients or exhibit variable potency due to poor manufacturing controls. Such issues erode consumer trust and discourage adoption, as buyers are left unsure about the reliability and effectiveness of these products. Overcoming this challenge is crucial for the market to maintain its credibility and ensure sustained consumer engagement.

Limited Scientific Evidence and Research Restrains Market Growth

A major limitation facing the Natural Health Products Market is the lack of comprehensive scientific research and clinical trials to support many of the claims made by these products. While traditional and anecdotal evidence may be compelling, the modern healthcare environment demands rigorous scientific validation to support the safety and efficacy of health products.

The absence of such evidence can lead to skepticism among healthcare professionals and consumers alike. For example, many traditional remedies or plant-based extracts lack thorough, scientifically robust studies that verify their health benefits. This skepticism can limit the market's growth by restraining the widespread acceptance and integration of natural health products into mainstream healthcare and consumer health regimens.

Product Type Analysis

Herbal Supplements dominate with 35% due to widespread consumer trust and recognition of their health benefits.

The Product Type segment of the Natural Health Products Market is significantly led by Herbal Supplements, which currently hold approximately 35% of the market share. This dominance is largely attributed to the deep-rooted consumer perception of herbal products as safe and effective natural remedies. Herbal supplements, including popular choices like turmeric, ginseng, and echinacea, have been traditionally used for centuries, which lends them a credibility that newer or less familiar supplements may lack. The trust in these products is further bolstered by a growing body of scientific research that supports their health benefits, making them a go-to option for consumers looking for natural health solutions.

Vitamins and minerals form another critical sub-segment, supported by their well-established roles in maintaining essential body functions and preventing nutrient deficiencies. Probiotics and prebiotics are rapidly gaining market share due to increasing awareness of gut health's impact on overall well-being. Omega-3 fatty acids are recognized for their benefits to heart and brain health, making them popular among various consumer demographics. Homeopathic remedies, Traditional Chinese Medicine (TCM), and Ayurvedic products each cater to niche markets that value specific cultural and holistic treatment approaches. Other natural supplements, including novel plant extracts and blends, contribute to the diversity and depth of the market, fulfilling the demand for personalized health care solutions.

Formulation Analysis

Capsules lead with 30% due to ease of use and effective delivery of ingredients.

In the Formulation segment of the Natural Health Products Market, capsules emerge as the dominant sub-segment, holding about 30% of the market. Their popularity stems from the convenience they offer—capsules are easy to consume, carry, and store, making them a preferred choice for both consumers and manufacturers. Additionally, capsules effectively mask the taste and odor of their contents, which enhances consumer acceptance, especially for supplements like fish oil, which may have an unpleasant natural taste.

Tablets are another prevalent form, favored for their cost-effectiveness and long shelf life, which appeals to price-sensitive consumers. Softgels share similar advantages to capsules, including the ability to contain liquid ingredients, which can enhance the bioavailability of certain supplements like vitamin E and omega-3 fatty acids. Powders and liquids offer flexible dosing options and are particularly popular in the sports nutrition and weight management categories. Teas have a traditional appeal and are increasingly being infused with various herbs and supplements to enhance health benefits. Topical creams and ointments provide targeted relief and are essential in segments like natural pain relief and skin care. The diversity of formulations allows manufacturers to meet specific consumer needs, ensuring the sustained growth of each sub-segment within the broader market.

Health Benefit Analysis

Immune Support dominates with 40% due to increasing health awareness and pandemic effects.

In the Health Benefit segment of the Natural Health Products Market, Immune Support products are distinctly leading, holding approximately 40% of this market segment. This dominance has been significantly bolstered by the heightened consumer focus on health maintenance and disease prevention, especially in light of recent global health crises. Products that support immune health, including supplements rich in vitamins C and D, zinc, and elderberry, have seen a surge in demand as consumers seek to bolster their immune systems against potential infections.

Digestive Health is another key area, with products like probiotics and prebiotics gaining traction due to growing awareness of gut health's critical role in overall wellness. Bone & Joint Health remains a staple in the market, driven by an aging population and increasing incidences of arthritis and osteoporosis. Heart Health and Weight Management products also see steady demand, reflecting ongoing concerns over cardiovascular diseases and obesity, respectively.

The market for Skin & Hair Health products is expanding, fueled by consumer interest in natural beauty and personal care products that offer cosmetic benefits along with health improvements. Mental Wellness, Energy & Vitality, and Detoxification products cater to niche but growing segments, focusing on holistic health and the integration of mental and physical well-being. Each of these sub-segments contributes to the overall diversity and growth of the natural health products market, addressing a wide array of consumer health concerns.

Distribution Channel Analysis

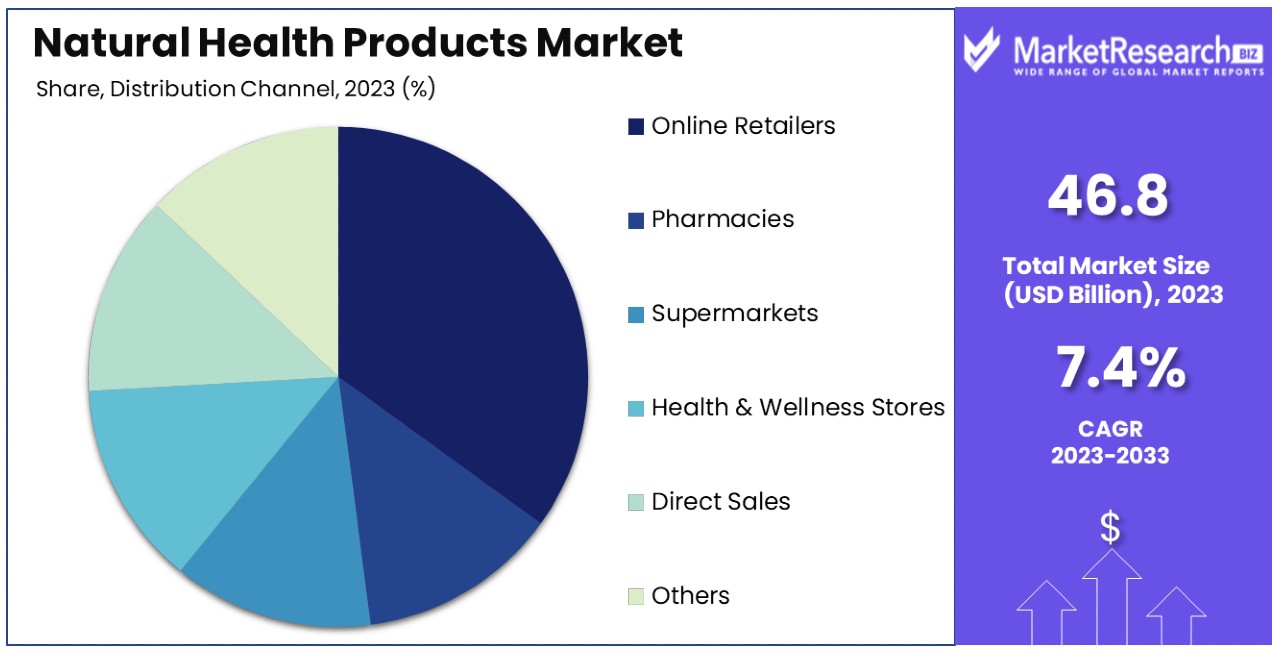

Online Retailers lead with 45% due to convenience and the rise of e-commerce.

In the Distribution Channel segment, Online Retailers currently dominate the Natural Health Products Market, capturing about 45% of the market share. This dominance is largely driven by the convenience and widespread availability of online shopping platforms, coupled with the increasing consumer preference for buying products from the comfort of their homes. The growth of e-commerce has been further accelerated by technological advancements and the expansion of digital marketing strategies, making it easier for consumers to access a wide range of natural health products globally.

Health & Wellness Stores continue to play a crucial role in the market, serving as trusted sources for consumers looking for personalized service and expert advice. Pharmacies and Drugstores are essential for distributing products that consumers perceive as more medical-oriented, such as vitamins and supplements for specific health conditions. Supermarkets and Hypermarkets have increased their health product ranges to capture the growing consumer interest in health and wellness, making natural health products more accessible alongside everyday grocery shopping.

Direct Sales, including MLM companies, exploit personal selling and network marketing strategies to reach and educate consumers about the benefits of their products, often focusing on specific supplements like weight management shakes or nutritional systems. Other distribution channels, including specialty stores and fitness centers, complement the overall market by targeting specific consumer segments and creating additional avenues for product sales. Each channel's role and strategy contribute to the sector's dynamics, influencing how products are marketed, accessed, and consumed within different consumer demographics.

Key Market Segments

By Product Type

- Herbal Supplements

- Vitamins & Minerals

- Probiotics & Prebiotics

- Omega-3 Fatty Acids

- Homeopathic Remedies

- Traditional Chinese Medicine (TCM)

- Ayurvedic Products

- Other Natural Supplements

By Formulation

- Capsules

- Tablets

- Softgels

- Powders

- Liquids

- Teas

- Topical Creams/Ointments

- Others

By Health Benefit

- Immune Support

- Digestive Health

- Bone & Joint Health

- Heart Health

- Weight Management

- Skin & Hair Health

- Mental Wellness

- Energy & Vitality

- Detoxification

- Others

By Distribution Channel

- Health & Wellness Stores

- Pharmacies/Drugstores

- Supermarkets/Hypermarkets

- Online Retailers

- Direct Sales (MLM Companies)

- Others

Growth Opportunities

E-commerce and Direct-to-Consumer (D2C) Channels Offer Growth Opportunity

The ascent of e-commerce and Direct-to-Consumer (D2C) channels marks a significant growth opportunity for the Natural Health Products Market. This shift allows companies to engage directly with consumers, bypassing traditional retail constraints and fostering a more personalized shopping experience. With the convenience of online shopping, consumers have easy access to a broader range of products, including those that are niche or region-specific.

Data analytics employed by these platforms enable companies to tailor their marketing strategies and product recommendations based on individual consumer behavior and preferences. Subscription models, which ensure regular product delivery, have become particularly popular, reinforcing customer loyalty and consistent revenue streams. This direct engagement not only increases visibility but also enhances consumer trust through personalized interactions and improved service quality.

Strategic Partnerships and Collaborations Offer Growth Opportunity

Strategic partnerships and collaborations present considerable growth opportunities within the Natural Health Products Market. By aligning with research institutions and healthcare professionals, companies can drive innovation and substantiate the health claims of their products through clinical research. Such collaborations often result in the development of scientifically backed products that can meet the stringent requirements of informed consumers and healthcare providers.

For instance, partnering with universities to conduct research can provide the necessary clinical evidence to support the efficacy and safety of natural health products, significantly boosting their market credibility. Moreover, these partnerships can facilitate entry into new markets and expand the consumer base by leveraging the established trust and authority of the academic and medical communities. These strategic alliances not only enhance product offerings but also fortify brand reputations and consumer confidence, setting the stage for sustained growth.

Trending Factors

Clean Label and Transparency Are Trending Factors

Clean label and transparency are becoming increasingly influential trends in the Natural Health Products Market. Consumers are more health-conscious than ever and demand clarity about what they consume. This trend towards transparency requires products to have straightforward, easily understandable labels that list all ingredients without any hidden or synthetic additives.

Companies that commit to clean label practices are rewarded with greater consumer trust and loyalty. For example, brands that use recognizable, non-artificial ingredients and provide comprehensive details about their sourcing are finding favor with consumers who prioritize product purity and ethical production methods. This push for transparency is not just a preference but a demand from consumers who are more informed and vigilant about their health and the environment.

Personalization and Customization Are Trending Factors

Personalization and customization are shaping up as key trends in the Natural Health Products Market. Today's consumers are not satisfied with one-size-fits-all solutions and seek products tailored to their specific health needs and lifestyle choices. The rising trend of personalized health care allows companies to offer products that are specifically designed to cater to individual dietary requirements, health conditions, and even genetic profiles.

For instance, the popularity of services like personalized vitamin subscriptions, which use algorithms to tailor supplement packs based on individual health data, highlights the growing demand for customized health products. This trend is driving innovation in the market, encouraging companies to develop new technologies and formulations that can meet the unique preferences and needs of each consumer, thus expanding the market's reach and penetration.

Regional Analysis

North America Dominates with 35% Market Share

North America holds a dominant position in the Natural Health Products Market, commanding a 35% market share. This leadership is primarily driven by high consumer awareness and acceptance of natural and alternative health solutions, especially in the U.S. and Canada. The region boasts a robust infrastructure for health and wellness, including extensive retail networks and a strong online presence, which facilitates wide product availability and accessibility. Additionally, North America has stringent regulatory standards ensuring product quality and safety, increasing consumer trust.

The market dynamics in North America are shaped by a proactive approach towards health and wellness, with consumers increasingly opting for preventive health care measures. There is also a significant trend towards clean labels and organic products, driven by consumer demand for transparency and quality. The presence of major global players in this region who invest heavily in research and development contributes to continuous innovation and product diversification, further strengthening the market's growth.

Regional Market Shares:

- Europe: Holds a 30% share of the market, driven by increasing consumer preference for natural and organic products and strong regulatory frameworks.

- Asia Pacific: Accounts for 25% of the market, with growth fueled by expanding middle-class populations and increasing awareness of health and wellness.

- Latin America: Represents 5% of the market, with potential growth due to rising health consciousness and improving healthcare infrastructure.

- Middle East & Africa: Contributes 5% to the market, where gradual awareness and the availability of natural health products are starting to gain traction.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the natural health products market, various companies play crucial roles, each with distinct impacts and strategic positioning contributing to market influence.

GFR Pharma, USANA Health Sciences, Inc., and Herbalife Nutrition are among the major players shaping the market landscape. Their diverse product portfolios and widespread distribution networks enable them to reach a broad consumer base, exerting significant market influence.

Nestlé Health Science, Blackmores, and Nature's Bounty also hold substantial market shares. Leveraging their strong brand presence and commitment to quality, these companies cater to evolving consumer preferences, driving market growth.

NOW Foods and GNC (General Nutrition Centers) play pivotal roles in the market, offering a wide range of natural health products and supplements. Their strategic partnerships and retail presence contribute to market expansion and consumer accessibility.

Gaia Herbs, Swisse Wellness, and The Himalaya Drug Company are notable players known for their focus on herbal remedies and natural ingredients. Their emphasis on sustainability and wellness resonates with consumers, enhancing their strategic positioning in the market.

Young Living, with its emphasis on essential oils and holistic wellness, occupies a significant market share. Its direct sales model and commitment to purity and authenticity position it as a key player driving market trends and consumer preferences.

Overall, the natural health products market is characterized by dynamic competition and continuous innovation. The strategic positioning and market influence of these key players contribute to the overall growth and evolution of the industry, catering to the increasing demand for natural and wellness-focused products.

Market Key Players

- GFR Pharma

- USANA Health Sciences, Inc.

- Herbalife Nutrition

- Nestlé Health Science

- Blackmores

- Nature's Bounty

- NOW Foods

- GNC (General Nutrition Centers)

- Gaia Herbs

- Swisse Wellness

- The Himalaya Drug Company

- Young Living

Recent Developments

- On April 2024, researchers at Dalhousie University in Canada, in collaboration with the pet nutraceutical company Adored Beast Apothecary, are developing a manufacturing process for natural health products to help manage cancers in dogs.

- On April 2024, the International Union for Conservation of Nature (IUCN) and its partners launched the One Health Central Asia project, which aims to mitigate the risk of zoonotic diseases in Central Asia.

- On March 2024, BranchOut Food Inc., a food technology company, announced that it will debut a brand refresh and launch two new product lines, including Salad Toppers and Kids' Snack Packs, at the Natural Products Expo West in Anaheim, California.

Report Scope

Report Features Description Market Value (2023) USD 46.8 Billion Forecast Revenue (2033) USD 93.9 Billion CAGR (2024-2033) 7.40% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Herbal Supplements, Vitamins & Minerals, Probiotics & Prebiotics, Omega-3 Fatty Acids, Homeopathic Remedies, Traditional Chinese Medicine (TCM), Ayurvedic Products, Other Natural Supplements), By Formulation (Capsules, Tablets, Softgels, Powders, Liquids, Teas, Topical Creams/Ointments, Others), By Health Benefit (Immune Support, Digestive Health, Bone & Joint Health, Heart Health, Weight Management, Skin & Hair Health, Mental Wellness, Energy & Vitality, Detoxification, Others), By Distribution Channel (Health & Wellness Stores, Pharmacies/Drugstores, Supermarkets/Hypermarkets, Online Retailers, Direct Sales (MLM Companies), Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape GFR Pharma, USANA Health Sciences, Inc., Herbalife Nutrition, Nestlé Health Science, Blackmores, Nature's Bounty, NOW Foods, GNC (General Nutrition Centers), Gaia Herbs, Swisse Wellness, The Himalaya Drug Company, Young Living Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- GFR Pharma

- USANA Health Sciences, Inc.

- Herbalife Nutrition

- Nestlé Health Science

- Blackmores

- Nature's Bounty

- NOW Foods

- GNC (General Nutrition Centers)

- Gaia Herbs

- Swisse Wellness

- The Himalaya Drug Company

- Young Living