Micro Data Center Market By Component (Solution, Services), By Rack Unit (Up to 20 RU, 20-40 RU, Above 40 RU), By Enterprise Size (Large Enterprises Small and Medium-Sized Enterprises (SMEs)), By Industry Vertical (BFSI IT & telecommunication, Colocation, Energy, Healthcare, Industrial, and Others)By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 202-2033

-

50989

-

Sept 2024

-

380

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

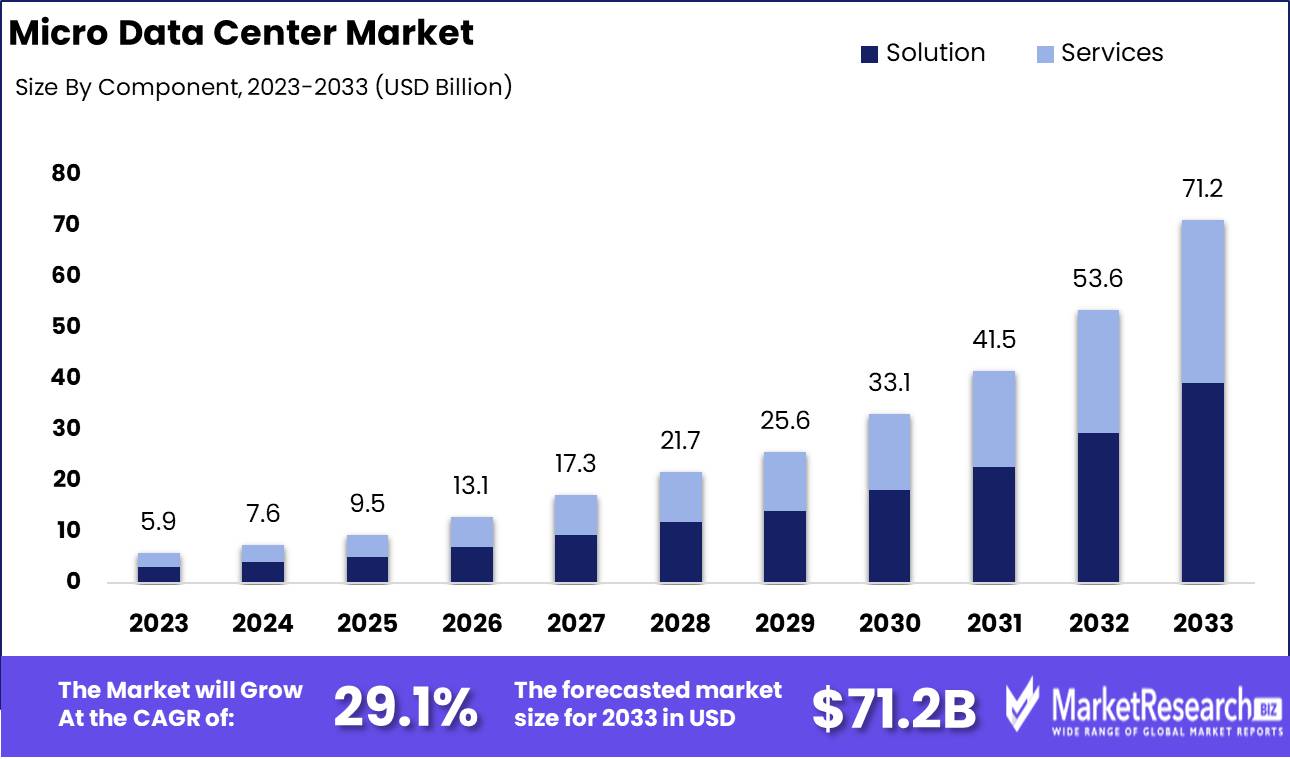

Micro Data Center Market was valued at USD 5.9 Billion in 2023. It is expected to reach USD 71.2 Billion by 2033, with a compound annual growth rate (CAGR) of 29.1% during the forecast period from 2024 to 2033.

The Micro Data Center market refers to a rapidly growing segment in the data infrastructure landscape, driven by the need for compact, scalable, and efficient data storage solutions. Micro data centers are self-contained, modular facilities designed to handle computing, storage, and networking on a smaller scale, often deployed in remote or edge locations to support low-latency applications. These solutions cater to industries with rising demand for real-time data processing, such as telecommunications, healthcare, and manufacturing. Their ability to provide agility, cost-effectiveness, and ease of deployment makes them integral to the broader evolution of edge computing and digital transformation strategies.

The micro data center market is witnessing a transformative shift driven by the increasing demand for edge computing, fueled by advancements in IoT, big data, and machine learning applications. Micro data centers, characterized by their modularity and proximity to end users, offer a scalable, low-latency solution to the limitations of traditional centralized data centers, particularly in environments where real-time data processing is critical. The rise of 5G technology has further accelerated this demand, as telecom operators seek scalable solutions to enhance service quality and improve connectivity. As businesses increasingly require agile and efficient computing solutions, micro data centers are emerging as a key enabler of digital transformation, allowing organizations to deploy data processing capabilities closer to the source of data generation, thereby improving response times and operational efficiency.

In this rapidly evolving landscape, leading players such as Schneider Electric have capitalized on the opportunity with strategic innovations and partnerships. For example, the November 2022 launch of the EcoStruxure Micro Data Center R-Series 42U Medium Density product is designed to streamline deployment for IT professionals, reflecting the growing need for ruggedized, scalable solutions. Furthermore, Schneider’s $3 billion multi-year agreement with Compass Datacenters exemplifies the trend toward prefabricated, modular solutions that address the demands of both edge computing and sustainable infrastructure development.

In parallel, partnerships like the March 2024 MOU between AIIB and BNDES underscore the broader global commitment to advancing micro data center infrastructure, particularly in emerging markets across the Asia Pacific region. As organizations continue to prioritize real-time data processing and sustainable growth, the micro data center market is well-positioned for sustained expansion.

Key Takeaways

- Market Growth: The micro data center market is projected to grow from USD 5.9 billion in 2023 to USD 71.2 billion by 2033, driven by a 29.1% CAGR due to rising demand for edge computing and real-time data processing.

- By Component Analysis: In 2023, the Solutions segment dominated the micro data center market with over 55.1% market share.

- By Rack Unit Analysis: The Above 40 RU segment led the market with a 42.1% share in 2023, driven by high-density computing needs.

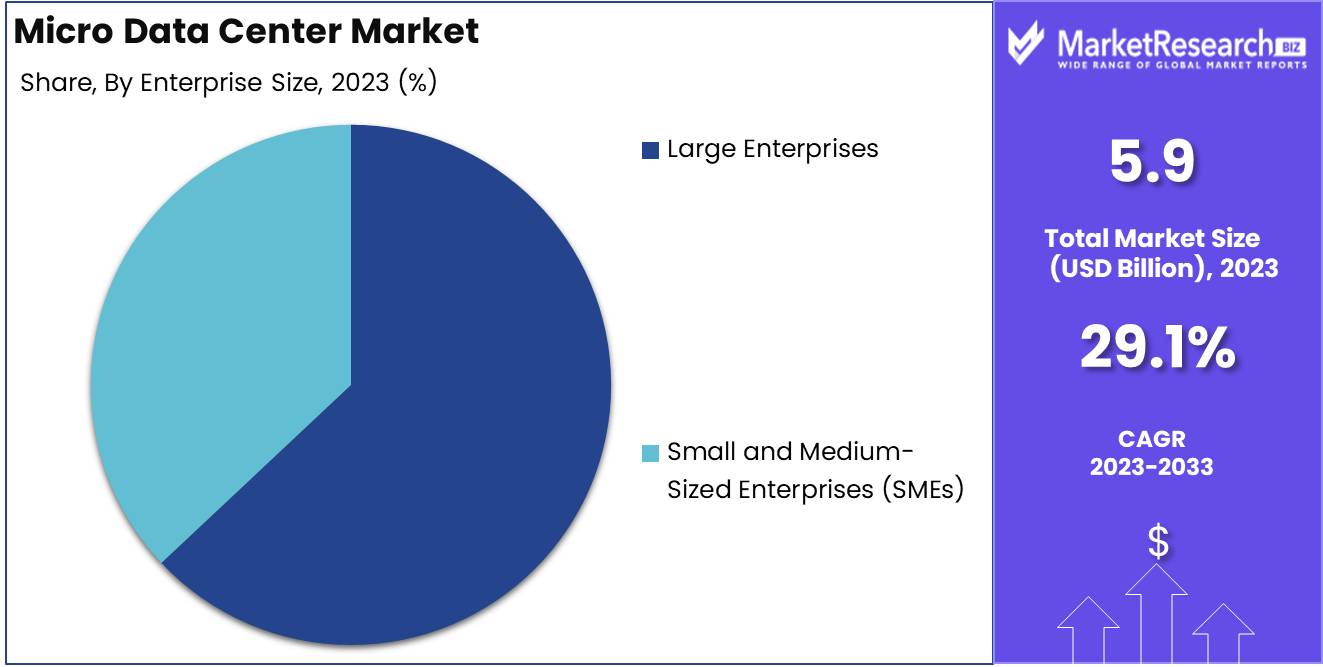

- By Enterprise Size: Large Enterprises accounted for 63.1% of the market share in 2023, reflecting their reliance on scalable IT infrastructure.

- By Industry Vertical: The BFSI sector dominated the industry verticals, capturing 63.1% of the total market share in 2023, driven by real-time transaction processing demands.

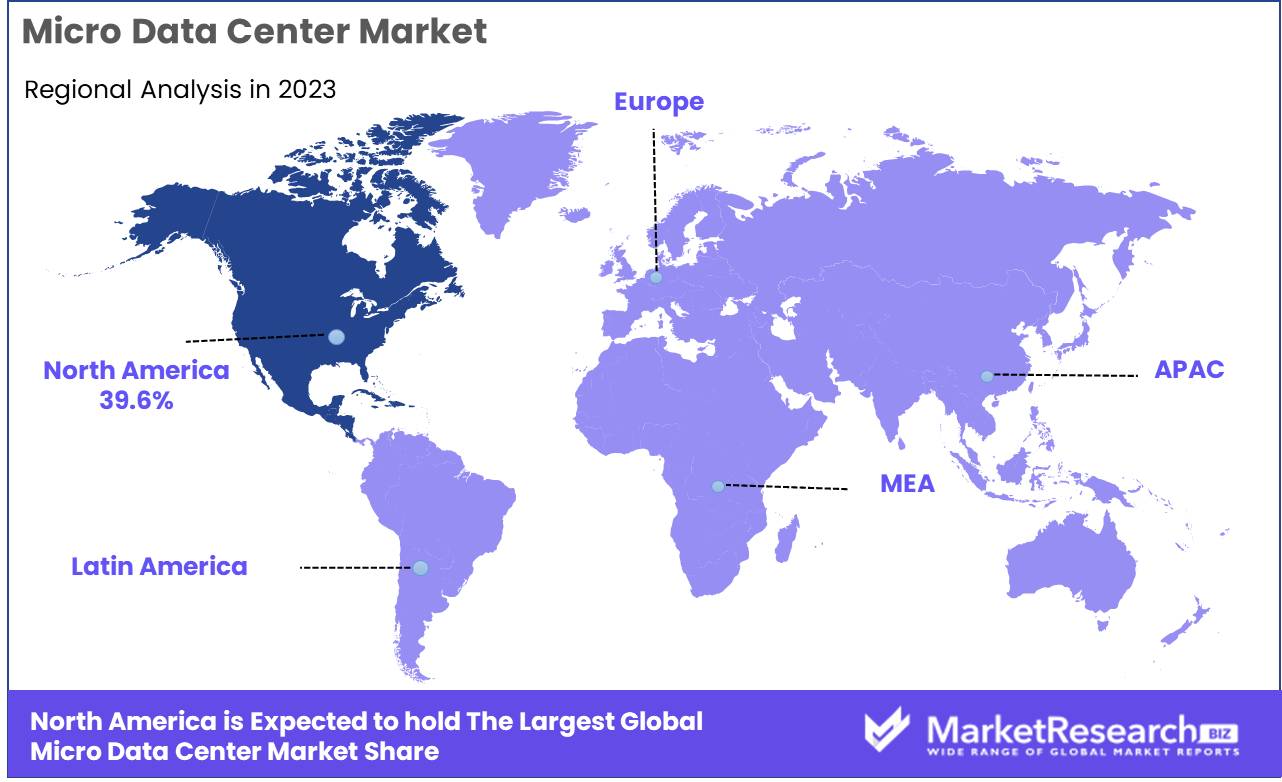

- Regional Dominance: North America led the market with a 39.6% share, driven by the rapid adoption of edge computing and 5G technologies.

- Growth Opportunity: Edge computing is a key growth driver, with IoT device growth expected to exceed 75 billion connected devices by 2025.

- Restraining Factor: The lack of standardization in micro data center solutions hinders scalability and interoperability across deployments.

Driving factors

Emphasis on Security and Threat Detection Integrated Systems

The increasing emphasis on security and integrated threat detection systems is a critical driver for the growth of the Micro Data Center (MDC) market. As digital ecosystems expand, businesses are increasingly vulnerable to cyber threats, with cybercrime projected to cost the global economy $10.5 trillion annually by 2025. This risk landscape has prompted a significant demand for MDCs equipped with robust, real-time security mechanisms to ensure data integrity and prevent breaches.

Micro Data Centers, often located closer to the data source, offer reduced latency but are also more exposed to regional and localized cyber threats. As a result, businesses are integrating advanced threat detection systems within MDCs, leveraging AI-driven security protocols and real-time monitoring capabilities. The seamless integration of cybersecurity tools—such as firewalls, intrusion detection systems, and data encryption—into these compact units enhances their appeal, particularly for industries dealing with sensitive information, such as healthcare, finance, and government sectors.

Increasing Adoption of Edge Computing and IoT

The surge in edge computing and Internet of Things (IoT) adoption is another dominant force propelling the Micro Data Center market forward. drives the need for localized, low-latency data processing solutions that Micro Data Centers uniquely provide. As IoT devices multiply—estimated to exceed 75 billion connected devices globally by 2025—the sheer volume of data generated at the network edge is overwhelming traditional centralized data centers.

Micro Data Centers offer an optimal solution to this challenge by providing decentralized data processing capabilities closer to the source of data generation. This proximity reduces latency, enhances real-time analytics, and supports mission-critical applications, particularly in industries such as manufacturing, telecommunications, and autonomous transportation. For instance, the rise of autonomous vehicles, smart cities, and industrial IoT applications relies heavily on low-latency, high-speed data processing, which MDCs can efficiently provide.

Restraining Factors

Integration Complexity: A Barrier to Adoption, but a Catalyst for Innovation

The complexity involved in integrating micro data centers into existing IT infrastructures is both a challenge and a driving force for innovation in the market. As companies seek to adopt more decentralized and edge-focused computing solutions, many struggle with the technical intricacies of harmonizing these systems with their legacy IT environments. This complexity often slows down adoption rates, leading to extended deployment cycles and higher implementation costs.

Furthermore, as businesses move towards Industry 4.0 and the Internet of Things (IoT) gains traction, seamless integration with IoT devices and cloud infrastructures becomes essential. Therefore, while integration complexity presents a short-term hindrance, it serves as a key motivator for technological advancements that enhance the overall competitiveness and growth of the micro data center market.

Lack of Standardization: Hindering Scalability but Promoting Differentiation

The absence of industry-wide standards for micro data centers presents a significant challenge in terms of scalability and interoperability. Without uniform standards, organizations face difficulty in achieving consistent performance across different regions and vendors. This leads to inefficiencies and increased costs associated with custom-built solutions for each deployment.

However, the lack of standardization also provides an opportunity for vendors to differentiate themselves by developing proprietary technologies and services tailored to specific industry verticals or operational needs. As a result, businesses that can afford to invest in these bespoke systems are often able to leverage more advanced capabilities, including enhanced security, data management, and analytics.

By Component Analysis

Solutions Segment Holds the Largest Market Share, Dominating with Over 55.1% in 2023

In 2023, the solutions segment held a dominant market position in the By Component segmentation of the micro data center market, capturing more than a 55.1% share. This commanding presence highlights the increasing demand for pre-integrated, scalable, and high-performance micro data center solutions, which are designed to meet the growing needs for edge computing, data management, and processing capabilities in diverse industries. The ability of these solutions to provide rapid deployment, enhanced security, and improved energy efficiency has further solidified their adoption across various sectors, including telecommunications, IT, and manufacturing.

Micro data center solutions include pre-engineered, modular systems that integrate computing, storage, and networking components. These comprehensive offerings provide a crucial infrastructure for enterprises looking to expand their edge computing capabilities without the extensive capital investment or space requirements of traditional data centers.

Although the solutions segment leads, the services segment is also gaining traction. These services include installation, consulting, and maintenance, essential for optimizing micro data center operations. The growth in managed services is a key driver here, as enterprises increasingly look for third-party providers to ensure their micro data centers operate efficiently. Services represent an important complementary offering, facilitating the seamless deployment and ongoing support of micro data center infrastructure.

By Rack Unit Analysis

Above 40 RU Segment Dominates the Micro Data Center Market with 42.1% Share in 2023

In 2023, the Above 40 RU segment held a dominant position in the "By Rack Unit" segmentation of the global micro data center market, accounting for more than 42.1% of the total market share. This reflects a growing demand for larger, scalable micro data center solutions driven by enterprises and large organizations seeking to support high-density computing workloads. The segment's robust adoption is influenced by the increasing need for high-capacity data storage and processing, particularly in industries such as telecommunications, IT, and manufacturing.

In contrast, the 20-40 RU segment also demonstrated notable growth, benefiting from the demand for flexible and modular solutions among mid-sized enterprises. As these businesses look to modernize their IT infrastructure, the 20-40 RU segment has emerged as a viable option, offering the scalability to meet growing data requirements while maintaining manageable physical footprints.

At the lower end of the spectrum, the Up to 20 RU segment caters predominantly to small and medium-sized enterprises (SMEs) and edge computing applications. While its market share was relatively smaller in 2023, this segment remains critical for businesses prioritizing cost-efficiency and space-constrained environments. The ongoing expansion of edge computing and IoT applications is expected to drive incremental growth in this segment over the coming years.

By Enterprise Size

Large Enterprises Segment Dominates the Micro Data Center Market with 63.1% Share in 2023

In 2023, the Large Enterprises segment held a dominant market position within the "By Enterprise Size" segmentation of the global micro data center market, capturing more than 63.1% of the total market share. This dominance is primarily driven by the increasing reliance of large corporations on scalable, high-performance data infrastructure to support their complex IT ecosystems, which include vast data storage, cloud computing, and edge applications. Industries such as telecommunications, finance, and healthcare, which require highly secure and robust data solutions, are key contributors to the growth of this segment.

The Small and Medium-Sized Enterprises (SMEs) segment, while representing a smaller market share, is gradually growing due to the rising adoption of digital transformation initiatives and the need for agile and cost-effective IT infrastructure. As SMEs expand their operations and embrace cloud technologies, micro data centers provide a compact and efficient solution that addresses their limited space and budget constraints.

By Industry Vertical

BFSI Segment Dominates the Micro Data Center Market with 27.1% Share in 2023

In 2023, the BFSI (Banking, Financial Services, and Insurance) segment held a dominant market position within the by Industry Vertical segmentation of the global micro data center market, capturing more than 27.1% of the total market share. The BFSI sector's significant reliance on secure, scalable, and efficient data infrastructure has been a key driver of this dominance. With growing regulatory demands, the need for real-time transaction processing, and the shift towards digital banking, micro data centers provide BFSI institutions with the ability to manage high volumes of sensitive data, enhance cybersecurity, and ensure low-latency operations across geographically dispersed locations.

The IT and telecom segment followed, showing strong adoption due to the continuous expansion of 5G networks, cloud computing services, and the need for edge computing solutions. Telecommunications companies are increasingly deploying micro data centers to manage the immense data flow from connected devices and networks while maintaining optimal service performance and minimizing latency.

The Colocation segment also plays a critical role in the market, offering businesses a cost-effective alternative to building their own data centers. As demand for outsourced infrastructure continues to rise, colocation providers are adopting micro data centers to offer flexible, scalable solutions to their clients.

In sectors such as Energy, Healthcare, and Industrial, the adoption of micro data centers is gradually increasing. The Energy sector uses these solutions to manage critical data in remote locations, while the Healthcare industry relies on them for secure and efficient handling of medical records and telemedicine services. The Industrial sector utilizes micro data centers for real-time data processing and IoT applications, enhancing operational efficiency in manufacturing processes.

The Others category, encompassing a wide range of industries, continues to adopt micro data centers for diverse applications, including retail, government, and education, reflecting the broad applicability of these solutions across multiple sectors.

Key Market Segments

By Component

- Solution

- Services

By Rack Unit

- Up to 20 RU

- 20-40 RU

- Above 40 RU

By Enterprise Size

- Large Enterprises

- Small and Medium-Sized Enterprises (SMEs)

By Industry Vertical

- BFSI

- IT and telecom

- Colocation

- Energy

- Healthcare

- Industrial

- Others

Growth Opportunity

Edge Computing and Remote Operations Drive Decentralized Micro Data Center Growth

As the demand for low-latency applications and real-time data processing rises, edge computing has emerged as a critical enabler of modern IT ecosystems. Micro data centers, with their compact size and proximity to data sources, are ideal for supporting edge computing, significantly reducing latency while enhancing network efficiency. These decentralized infrastructures allow businesses to process data closer to where it is generated, crucial for sectors such as IoT, autonomous vehicles, and smart city solutions.

Moreover, the growth of remote operations—fueled by digital transformation, cloud adoption, and distributed workforces— further accelerates the need for localized, reliable data centers The synergy between edge computing and micro data centers creates a robust solution for companies seeking scalable, distributed, and highly efficient computing architectures that cater to the rising demand for real-time, localized services.

This trend interplays with increasing cloud dependency and the growing need for advanced AI-driven applications, both of which require enhanced data processing capabilities at the edge. As a result, micro data centers are crucial in enabling businesses to maintain operational resilience and performance as they transition toward more distributed and digitalized environments.

Resilient IT Infrastructure for Harsh and Challenging Environments Fuels Market Adoption

The need for resilient, highly reliable IT infrastructure in industries operating in challenging environments, such as oil and gas, mining, and military operations, is a key driver for micro data center adoption. These industries often require robust data centers that can withstand extreme temperatures, humidity, and remote locations, which traditional data centers struggle to accommodate. Micro data centers, with their modular design and self-contained units, offer enhanced durability and flexibility, allowing for deployment in non-traditional settings while ensuring uninterrupted operations.

This demand is further compounded by the rapid expansion of the Industrial Internet of Things (IIoT), where continuous data collection, analysis, and response in real-time are non-negotiable. As micro data centers are optimized for such conditions, they offer a highly adaptive solution for industries seeking both resilience and scalability in difficult operational landscapes. Their ability to maintain performance under adverse conditions directly contributes to market expansion, positioning them as indispensable components in the future of industrial operations.

Latest Trends

Edge Computing and IoT Deployment Fueling Growth

The rapid adoption of edge computing and the proliferation of Internet of Things (IoT) devices are significantly shaping the global micro data center market in 2024. As organizations strive to process data closer to the source, micro data centers have become the preferred solution for managing data from edge applications, particularly in industries like manufacturing, healthcare, and smart cities. This trend is being driven by the need for low-latency data processing and real-time decision-making, as IoT devices generate large volumes of data that must be processed quickly and efficiently. The growing demand for edge computing infrastructure is expected to continue driving the adoption of micro data centers, especially in remote or distributed locations.

Focus on High-Performance and Reliable Data Centers

In 2024, there is a clear shift towards developing high-performance and reliable data centers to meet the evolving needs of enterprises. As digital transformation accelerates across industries, the demand for robust, scalable, and resilient data centers is increasing. Micro data centers, known for their compact design, modularity, and scalability, offer enterprises a flexible solution to address their high-density computing requirements. Industries such as BFSI and telecommunications, which rely on 24/7 uptime and minimal downtime, are driving the demand for micro data centers that ensure business continuity and safeguard critical data.

Regional Analysis

North America Leads with Largest Market Share 39.6%

North America dominates the global micro data center market, accounting for approximately 39.6% of the market share. This leadership position is driven by the rapid digital transformation across industries and the increasing demand for localized data storage solutions to support edge computing, particularly in the United States. The US, Canada, and Mexico are key players in this region, with the US leading due to its mature IT infrastructure, high concentration of data centers, and strong presence of cloud service providers. The rise of IoT, 5G deployment, and AI further bolster the demand for MDCs in this region.

Europe is another significant region in the MDC market, with Western Europe being the primary contributor, especially countries like Germany, France, and the UK. These nations are seeing increased investments in digital infrastructure due to stringent data privacy regulations such as GDPR and the growing need for high-performance computing. In Eastern Europe, countries like Russia and Poland are emerging as key markets, driven by industrial digitization and smart city initiatives. Europe’s focus on sustainability and energy efficiency also drives innovation in micro data center deployments, which are often designed with lower energy consumption in mind.

The Asia Pacific region is poised for rapid expansion in the MDC market, with countries like China, India, Japan, and South Korea at the forefront. The region is experiencing a surge in demand due to the increasing digitization of businesses, growing mobile internet users, and the proliferation of 5G networks.

In Latin America, the micro data center market is gradually expanding, with key countries such as Brazil, Mexico, and Argentina leading the charge. Brazil, being the largest economy in the region, is a pivotal market for MDCs, driven by rising IT investments and increasing cloud adoption.

The Middle East & Africa (MEA) region presents a unique opportunity for the MDC market, with increasing adoption of smart city initiatives and growing IT spending in countries like Saudi Arabia, the United Arab Emirates (UAE), and South Africa. The UAE and Saudi Arabia are leading the region’s digital transformation efforts, leveraging MDCs to support advancements in artificial intelligence, IoT, and cloud computing.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The global micro data center market in 2024 is highly competitive, driven by rapid advancements in computing resources, network infrastructure, and power consumption optimization. Major players such as Schneider Electric, Rittal GmbH & Co. KG, and Vertiv Group Corp. are at the forefront of delivering compact, energy-efficient, and scalable micro data center solutions.

Schneider Electric continues to lead with its focus on energy-efficient designs, capitalizing on its established presence in power and automation. Its innovations in edge computing and modular solutions align with increasing demand for scalable and remote data processing capabilities.

Rittal GmbH & Co. KG maintains a strong position by offering robust network infrastructure solutions. Its expertise in industrial enclosures and cooling systems positions it well for the growing need for resilient data center operations, particularly in harsh environments.

Hewlett Packard Enterprise (HPE) emphasizes the integration of high-performance computing resources within its micro data centers. HPE's focus on edge-to-cloud solutions is expected to drive adoption among businesses requiring fast data processing at distributed locations.

IBM Corporation and Vertiv are also significant players, leveraging AI and automation to optimize power consumption and improve operational efficiency. Delta Power Solutions and Eaton bring deep expertise in power management, ensuring reliable energy delivery and further reducing operational costs for end users.

As micro data centers evolve to support IoT, 5G, and edge computing applications, innovation from these key players will be pivotal in addressing challenges in connectivity, power, and environmental sustainability.

Market Key Players

- Schneider Electric

- Rittal GmbH & Co. KG

- Hewlett Packard Enterprise Development LP

- Delta Power Solutions

- Canovate

- Eaton

- Cannon Technologies Ltd.

- IBM Corporation

- Schneider Electric

- Vertiv Group Corp.

- Altron

- Attom Technology

- Other Key Players

Recent Development

- In November 2022, Schneider Electric introduced the EcoStruxure Micro Data Center R-Series 42U Medium Density, further expanding its range of ruggedized micro data centers. This product is designed to simplify the deployment process for IT professionals and solution providers, offering enhanced flexibility and resilience in edge computing environments.

- In March 2024, the Asian Infrastructure Investment Bank (AIIB) and the Banco Nacional de Desenvolvimento Econômico e Social (BNDES) signed a memorandum of understanding (MOU) aimed at advancing sustainable infrastructure development. As part of this broader initiative, micro data center solutions will play a key role in supporting infrastructure growth across the Asia-Pacific region.

- In 2023, Schneider Electric, a leader in the digital transformation of energy management and automation, announced a $3 billion multi-year partnership with Compass Datacenters during its Capital Markets Day. This agreement builds on the companies’ existing collaboration, focusing on the integration of their supply chains to facilitate the production and delivery of prefabricated modular data center solutions.

Report Scope

Report Features Description Market Value (2023) USD 5.9 Bn Forecast Revenue (2033) USD 71.2 Bn CAGR (2024-2032) 29.1 Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Solution, Services), By Rack Unit (Up to 20 RU, 20-40 RU, Above 40 RU), By Enterprise Size (Large Enterprises Small and Medium-Sized Enterprises (SMEs)), By Industry Vertical (BFSI IT & telecommunication, Colocation, Energy, Healthcare, Industrial, and Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Schneider Electric, Rittal GmbH & Co. KG, Hewlett Packard Enterprise Development LP, Delta Power Solutions, Canovate, Eaton, Cannon Technologies Ltd., IBM Corporation, Schneider Electric, Vertiv Group Corp., Altron, Attom Technology, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

- 1. Executive Summary

- 1.1. Definition

- 1.2. Taxonomy

- 1.3. Research Scope

- 1.4. Key Analysis

- 1.5. Key Findings by Major Segments

- 1.6. Top strategies by Major Players

- 2. Global Micro Data Center Market Overview

- 2.1. Micro Data Center Market Dynamics

- 2.1.1. Drivers

- 2.1.2. Opportunities

- 2.1.3. Restraints

- 2.1.4. Challenges

- 2.2. Macro-economic Factors

- 2.3. Regulatory Framework

- 2.4. Market Investment Feasibility Index

- 2.5. PEST Analysis

- 2.6. PORTER’S Five Force Analysis

- 2.7. Drivers & Restraints Impact Analysis

- 2.8. Industry Chain Analysis

- 2.9. Cost Structure Analysis

- 2.10. Marketing Strategy

- 2.11. Russia-Ukraine War Impact Analysis

- 2.12. Opportunity Map Analysis

- 2.13. Market Competition Scenario Analysis

- 2.14. Product Life Cycle Analysis

- 2.15. Opportunity Orbits

- 2.16. Manufacturer Intensity Map

- 2.17. Major Companies sales by Value & Volume

- 2.1. Micro Data Center Market Dynamics

- 3. Global Micro Data Center Market Analysis, Opportunity and Forecast, 2016-2032

- 3.1. Global Micro Data Center Market Analysis, 2016-2021

- 3.2. Global Micro Data Center Market Opportunity and Forecast, 2023-2032

- 3.3. Global Micro Data Center Market Analysis, Opportunity and Forecast, By By Component, 2016-2032

- 3.3.1. Global Micro Data Center Market Analysis by By Component: Introduction

- 3.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Component, 2016-2032

- 3.3.3. Solution

- 3.3.4. Services

- 3.4. Global Micro Data Center Market Analysis, Opportunity and Forecast, By By Rack (US$ Mn & Units), 2016-2032

- 3.4.1. Global Micro Data Center Market Analysis by By Rack (US$ Mn & Units): Introduction

- 3.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Rack (US$ Mn & Units), 2016-2032

- 3.4.3. Up to 20 RU

- 3.4.4. 20-40 RU

- 3.4.5. Above 40 RU

- 3.5. Global Micro Data Center Market Analysis, Opportunity and Forecast, By By Enterprise Size, 2016-2032

- 3.5.1. Global Micro Data Center Market Analysis by By Enterprise Size: Introduction

- 3.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Enterprise Size, 2016-2032

- 3.5.3. Large Enterprises

- 3.5.4. Small and Medium-Sized Enterprises (SMEs)

- 3.6. Global Micro Data Center Market Analysis, Opportunity and Forecast, By By Industry Vertical, 2016-2032

- 3.6.1. Global Micro Data Center Market Analysis by By Industry Vertical: Introduction

- 3.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Industry Vertical, 2016-2032

- 3.6.3. BFSI

- 3.6.4. IT and telecom

- 3.6.5. Colocation

- 3.6.6. Energy

- 3.6.7. Healthcare

- 3.6.8. Industrial

- 3.6.9. Others

- 4. North America Micro Data Center Market Analysis, Opportunity and Forecast, 2016-2032

- 4.1. North America Micro Data Center Market Analysis, 2016-2021

- 4.2. North America Micro Data Center Market Opportunity and Forecast, 2023-2032

- 4.3. North America Micro Data Center Market Analysis, Opportunity and Forecast, By By Component, 2016-2032

- 4.3.1. North America Micro Data Center Market Analysis by By Component: Introduction

- 4.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Component, 2016-2032

- 4.3.3. Solution

- 4.3.4. Services

- 4.4. North America Micro Data Center Market Analysis, Opportunity and Forecast, By By Rack (US$ Mn & Units), 2016-2032

- 4.4.1. North America Micro Data Center Market Analysis by By Rack (US$ Mn & Units): Introduction

- 4.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Rack (US$ Mn & Units), 2016-2032

- 4.4.3. Up to 20 RU

- 4.4.4. 20-40 RU

- 4.4.5. Above 40 RU

- 4.5. North America Micro Data Center Market Analysis, Opportunity and Forecast, By By Enterprise Size, 2016-2032

- 4.5.1. North America Micro Data Center Market Analysis by By Enterprise Size: Introduction

- 4.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Enterprise Size, 2016-2032

- 4.5.3. Large Enterprises

- 4.5.4. Small and Medium-Sized Enterprises (SMEs)

- 4.6. North America Micro Data Center Market Analysis, Opportunity and Forecast, By By Industry Vertical, 2016-2032

- 4.6.1. North America Micro Data Center Market Analysis by By Industry Vertical: Introduction

- 4.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Industry Vertical, 2016-2032

- 4.6.3. BFSI

- 4.6.4. IT and telecom

- 4.6.5. Colocation

- 4.6.6. Energy

- 4.6.7. Healthcare

- 4.6.8. Industrial

- 4.6.9. Others

- 4.7. North America Micro Data Center Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 4.7.1. North America Micro Data Center Market Analysis by Country : Introduction

- 4.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 4.7.2.1. The US

- 4.7.2.2. Canada

- 4.7.2.3. Mexico

- 5. Western Europe Micro Data Center Market Analysis, Opportunity and Forecast, 2016-2032

- 5.1. Western Europe Micro Data Center Market Analysis, 2016-2021

- 5.2. Western Europe Micro Data Center Market Opportunity and Forecast, 2023-2032

- 5.3. Western Europe Micro Data Center Market Analysis, Opportunity and Forecast, By By Component, 2016-2032

- 5.3.1. Western Europe Micro Data Center Market Analysis by By Component: Introduction

- 5.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Component, 2016-2032

- 5.3.3. Solution

- 5.3.4. Services

- 5.4. Western Europe Micro Data Center Market Analysis, Opportunity and Forecast, By By Rack (US$ Mn & Units), 2016-2032

- 5.4.1. Western Europe Micro Data Center Market Analysis by By Rack (US$ Mn & Units): Introduction

- 5.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Rack (US$ Mn & Units), 2016-2032

- 5.4.3. Up to 20 RU

- 5.4.4. 20-40 RU

- 5.4.5. Above 40 RU

- 5.5. Western Europe Micro Data Center Market Analysis, Opportunity and Forecast, By By Enterprise Size, 2016-2032

- 5.5.1. Western Europe Micro Data Center Market Analysis by By Enterprise Size: Introduction

- 5.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Enterprise Size, 2016-2032

- 5.5.3. Large Enterprises

- 5.5.4. Small and Medium-Sized Enterprises (SMEs)

- 5.6. Western Europe Micro Data Center Market Analysis, Opportunity and Forecast, By By Industry Vertical, 2016-2032

- 5.6.1. Western Europe Micro Data Center Market Analysis by By Industry Vertical: Introduction

- 5.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Industry Vertical, 2016-2032

- 5.6.3. BFSI

- 5.6.4. IT and telecom

- 5.6.5. Colocation

- 5.6.6. Energy

- 5.6.7. Healthcare

- 5.6.8. Industrial

- 5.6.9. Others

- 5.7. Western Europe Micro Data Center Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 5.7.1. Western Europe Micro Data Center Market Analysis by Country : Introduction

- 5.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 5.7.2.1. Germany

- 5.7.2.2. France

- 5.7.2.3. The UK

- 5.7.2.4. Spain

- 5.7.2.5. Italy

- 5.7.2.6. Portugal

- 5.7.2.7. Ireland

- 5.7.2.8. Austria

- 5.7.2.9. Switzerland

- 5.7.2.10. Benelux

- 5.7.2.11. Nordic

- 5.7.2.12. Rest of Western Europe

- 6. Eastern Europe Micro Data Center Market Analysis, Opportunity and Forecast, 2016-2032

- 6.1. Eastern Europe Micro Data Center Market Analysis, 2016-2021

- 6.2. Eastern Europe Micro Data Center Market Opportunity and Forecast, 2023-2032

- 6.3. Eastern Europe Micro Data Center Market Analysis, Opportunity and Forecast, By By Component, 2016-2032

- 6.3.1. Eastern Europe Micro Data Center Market Analysis by By Component: Introduction

- 6.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Component, 2016-2032

- 6.3.3. Solution

- 6.3.4. Services

- 6.4. Eastern Europe Micro Data Center Market Analysis, Opportunity and Forecast, By By Rack (US$ Mn & Units), 2016-2032

- 6.4.1. Eastern Europe Micro Data Center Market Analysis by By Rack (US$ Mn & Units): Introduction

- 6.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Rack (US$ Mn & Units), 2016-2032

- 6.4.3. Up to 20 RU

- 6.4.4. 20-40 RU

- 6.4.5. Above 40 RU

- 6.5. Eastern Europe Micro Data Center Market Analysis, Opportunity and Forecast, By By Enterprise Size, 2016-2032

- 6.5.1. Eastern Europe Micro Data Center Market Analysis by By Enterprise Size: Introduction

- 6.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Enterprise Size, 2016-2032

- 6.5.3. Large Enterprises

- 6.5.4. Small and Medium-Sized Enterprises (SMEs)

- 6.6. Eastern Europe Micro Data Center Market Analysis, Opportunity and Forecast, By By Industry Vertical, 2016-2032

- 6.6.1. Eastern Europe Micro Data Center Market Analysis by By Industry Vertical: Introduction

- 6.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Industry Vertical, 2016-2032

- 6.6.3. BFSI

- 6.6.4. IT and telecom

- 6.6.5. Colocation

- 6.6.6. Energy

- 6.6.7. Healthcare

- 6.6.8. Industrial

- 6.6.9. Others

- 6.7. Eastern Europe Micro Data Center Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 6.7.1. Eastern Europe Micro Data Center Market Analysis by Country : Introduction

- 6.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 6.7.2.1. Russia

- 6.7.2.2. Poland

- 6.7.2.3. The Czech Republic

- 6.7.2.4. Greece

- 6.7.2.5. Rest of Eastern Europe

- 7. APAC Micro Data Center Market Analysis, Opportunity and Forecast, 2016-2032

- 7.1. APAC Micro Data Center Market Analysis, 2016-2021

- 7.2. APAC Micro Data Center Market Opportunity and Forecast, 2023-2032

- 7.3. APAC Micro Data Center Market Analysis, Opportunity and Forecast, By By Component, 2016-2032

- 7.3.1. APAC Micro Data Center Market Analysis by By Component: Introduction

- 7.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Component, 2016-2032

- 7.3.3. Solution

- 7.3.4. Services

- 7.4. APAC Micro Data Center Market Analysis, Opportunity and Forecast, By By Rack (US$ Mn & Units), 2016-2032

- 7.4.1. APAC Micro Data Center Market Analysis by By Rack (US$ Mn & Units): Introduction

- 7.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Rack (US$ Mn & Units), 2016-2032

- 7.4.3. Up to 20 RU

- 7.4.4. 20-40 RU

- 7.4.5. Above 40 RU

- 7.5. APAC Micro Data Center Market Analysis, Opportunity and Forecast, By By Enterprise Size, 2016-2032

- 7.5.1. APAC Micro Data Center Market Analysis by By Enterprise Size: Introduction

- 7.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Enterprise Size, 2016-2032

- 7.5.3. Large Enterprises

- 7.5.4. Small and Medium-Sized Enterprises (SMEs)

- 7.6. APAC Micro Data Center Market Analysis, Opportunity and Forecast, By By Industry Vertical, 2016-2032

- 7.6.1. APAC Micro Data Center Market Analysis by By Industry Vertical: Introduction

- 7.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Industry Vertical, 2016-2032

- 7.6.3. BFSI

- 7.6.4. IT and telecom

- 7.6.5. Colocation

- 7.6.6. Energy

- 7.6.7. Healthcare

- 7.6.8. Industrial

- 7.6.9. Others

- 7.7. APAC Micro Data Center Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 7.7.1. APAC Micro Data Center Market Analysis by Country : Introduction

- 7.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 7.7.2.1. China

- 7.7.2.2. Japan

- 7.7.2.3. South Korea

- 7.7.2.4. India

- 7.7.2.5. Australia & New Zeland

- 7.7.2.6. Indonesia

- 7.7.2.7. Malaysia

- 7.7.2.8. Philippines

- 7.7.2.9. Singapore

- 7.7.2.10. Thailand

- 7.7.2.11. Vietnam

- 7.7.2.12. Rest of APAC

- 8. Latin America Micro Data Center Market Analysis, Opportunity and Forecast, 2016-2032

- 8.1. Latin America Micro Data Center Market Analysis, 2016-2021

- 8.2. Latin America Micro Data Center Market Opportunity and Forecast, 2023-2032

- 8.3. Latin America Micro Data Center Market Analysis, Opportunity and Forecast, By By Component, 2016-2032

- 8.3.1. Latin America Micro Data Center Market Analysis by By Component: Introduction

- 8.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Component, 2016-2032

- 8.3.3. Solution

- 8.3.4. Services

- 8.4. Latin America Micro Data Center Market Analysis, Opportunity and Forecast, By By Rack (US$ Mn & Units), 2016-2032

- 8.4.1. Latin America Micro Data Center Market Analysis by By Rack (US$ Mn & Units): Introduction

- 8.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Rack (US$ Mn & Units), 2016-2032

- 8.4.3. Up to 20 RU

- 8.4.4. 20-40 RU

- 8.4.5. Above 40 RU

- 8.5. Latin America Micro Data Center Market Analysis, Opportunity and Forecast, By By Enterprise Size, 2016-2032

- 8.5.1. Latin America Micro Data Center Market Analysis by By Enterprise Size: Introduction

- 8.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Enterprise Size, 2016-2032

- 8.5.3. Large Enterprises

- 8.5.4. Small and Medium-Sized Enterprises (SMEs)

- 8.6. Latin America Micro Data Center Market Analysis, Opportunity and Forecast, By By Industry Vertical, 2016-2032

- 8.6.1. Latin America Micro Data Center Market Analysis by By Industry Vertical: Introduction

- 8.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Industry Vertical, 2016-2032

- 8.6.3. BFSI

- 8.6.4. IT and telecom

- 8.6.5. Colocation

- 8.6.6. Energy

- 8.6.7. Healthcare

- 8.6.8. Industrial

- 8.6.9. Others

- 8.7. Latin America Micro Data Center Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 8.7.1. Latin America Micro Data Center Market Analysis by Country : Introduction

- 8.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 8.7.2.1. Brazil

- 8.7.2.2. Colombia

- 8.7.2.3. Chile

- 8.7.2.4. Argentina

- 8.7.2.5. Costa Rica

- 8.7.2.6. Rest of Latin America

- 9. Middle East & Africa Micro Data Center Market Analysis, Opportunity and Forecast, 2016-2032

- 9.1. Middle East & Africa Micro Data Center Market Analysis, 2016-2021

- 9.2. Middle East & Africa Micro Data Center Market Opportunity and Forecast, 2023-2032

- 9.3. Middle East & Africa Micro Data Center Market Analysis, Opportunity and Forecast, By By Component, 2016-2032

- 9.3.1. Middle East & Africa Micro Data Center Market Analysis by By Component: Introduction

- 9.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Component, 2016-2032

- 9.3.3. Solution

- 9.3.4. Services

- 9.4. Middle East & Africa Micro Data Center Market Analysis, Opportunity and Forecast, By By Rack (US$ Mn & Units), 2016-2032

- 9.4.1. Middle East & Africa Micro Data Center Market Analysis by By Rack (US$ Mn & Units): Introduction

- 9.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Rack (US$ Mn & Units), 2016-2032

- 9.4.3. Up to 20 RU

- 9.4.4. 20-40 RU

- 9.4.5. Above 40 RU

- 9.5. Middle East & Africa Micro Data Center Market Analysis, Opportunity and Forecast, By By Enterprise Size, 2016-2032

- 9.5.1. Middle East & Africa Micro Data Center Market Analysis by By Enterprise Size: Introduction

- 9.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Enterprise Size, 2016-2032

- 9.5.3. Large Enterprises

- 9.5.4. Small and Medium-Sized Enterprises (SMEs)

- 9.6. Middle East & Africa Micro Data Center Market Analysis, Opportunity and Forecast, By By Industry Vertical, 2016-2032

- 9.6.1. Middle East & Africa Micro Data Center Market Analysis by By Industry Vertical: Introduction

- 9.6.2. Market Size Absolute $ Opportunity Analysis and Forecast, By By Industry Vertical, 2016-2032

- 9.6.3. BFSI

- 9.6.4. IT and telecom

- 9.6.5. Colocation

- 9.6.6. Energy

- 9.6.7. Healthcare

- 9.6.8. Industrial

- 9.6.9. Others

- 9.7. Middle East & Africa Micro Data Center Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 9.7.1. Middle East & Africa Micro Data Center Market Analysis by Country : Introduction

- 9.7.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 9.7.2.1. Algeria

- 9.7.2.2. Egypt

- 9.7.2.3. Israel

- 9.7.2.4. Kuwait

- 9.7.2.5. Nigeria

- 9.7.2.6. Saudi Arabia

- 9.7.2.7. South Africa

- 9.7.2.8. Turkey

- 9.7.2.9. The UAE

- 9.7.2.10. Rest of MEA

- 10. Global Micro Data Center Market Analysis, Opportunity and Forecast, By Region , 2016-2032

- 10.1. Global Micro Data Center Market Analysis by Region : Introduction

- 10.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Region , 2016-2032

- 10.2.1. North America

- 10.2.2. Western Europe

- 10.2.3. Eastern Europe

- 10.2.4. APAC

- 10.2.5. Latin America

- 10.2.6. Middle East & Africa

- 11. Global Micro Data Center Market Competitive Landscape, Market Share Analysis, and Company Profiles

- 11.1. Market Share Analysis

- 11.2. Company Profiles

- 11.3. Schneider Electric

- 11.3.1. Company Overview

- 11.3.2. Financial Highlights

- 11.3.3. Product Portfolio

- 11.3.4. SWOT Analysis

- 11.3.5. Key Strategies and Developments

- 11.4. Rittal GmbH & Co. KG

- 11.4.1. Company Overview

- 11.4.2. Financial Highlights

- 11.4.3. Product Portfolio

- 11.4.4. SWOT Analysis

- 11.4.5. Key Strategies and Developments

- 11.5. Hewlett Packard Enterprise Development LP

- 11.5.1. Company Overview

- 11.5.2. Financial Highlights

- 11.5.3. Product Portfolio

- 11.5.4. SWOT Analysis

- 11.5.5. Key Strategies and Developments

- 11.6. Delta Power Solutions

- 11.6.1. Company Overview

- 11.6.2. Financial Highlights

- 11.6.3. Product Portfolio

- 11.6.4. SWOT Analysis

- 11.6.5. Key Strategies and Developments

- 11.7. Canovate

- 11.7.1. Company Overview

- 11.7.2. Financial Highlights

- 11.7.3. Product Portfolio

- 11.7.4. SWOT Analysis

- 11.7.5. Key Strategies and Developments

- 11.8. Eaton

- 11.8.1. Company Overview

- 11.8.2. Financial Highlights

- 11.8.3. Product Portfolio

- 11.8.4. SWOT Analysis

- 11.8.5. Key Strategies and Developments

- 11.9. Cannon Technologies Ltd.

- 11.9.1. Company Overview

- 11.9.2. Financial Highlights

- 11.9.3. Product Portfolio

- 11.9.4. SWOT Analysis

- 11.9.5. Key Strategies and Developments

- 11.10. IBM Corporation

- 11.10.1. Company Overview

- 11.10.2. Financial Highlights

- 11.10.3. Product Portfolio

- 11.10.4. SWOT Analysis

- 11.10.5. Key Strategies and Developments

- 11.11. Schneider Electric

- 11.11.1. Company Overview

- 11.11.2. Financial Highlights

- 11.11.3. Product Portfolio

- 11.11.4. SWOT Analysis

- 11.11.5. Key Strategies and Developments

- 11.12. Vertiv Group Corp.

- 11.12.1. Company Overview

- 11.12.2. Financial Highlights

- 11.12.3. Product Portfolio

- 11.12.4. SWOT Analysis

- 11.12.5. Key Strategies and Developments

- 11.13. Altron

- 11.13.1. Company Overview

- 11.13.2. Financial Highlights

- 11.13.3. Product Portfolio

- 11.13.4. SWOT Analysis

- 11.13.5. Key Strategies and Developments

- 11.14. Attom Technology

- 11.14.1. Company Overview

- 11.14.2. Financial Highlights

- 11.14.3. Product Portfolio

- 11.14.4. SWOT Analysis

- 11.14.5. Key Strategies and Developments

- 11.15. Other Key Players

- 11.15.1. Company Overview

- 11.15.2. Financial Highlights

- 11.15.3. Product Portfolio

- 11.15.4. SWOT Analysis

- 11.15.5. Key Strategies and Developments

- 12. Assumptions and Acronyms

- 13. Research Methodology

- 14. Contact

List of Figures

-

- Figure 1: Global Micro Data Center Market Revenue (US$ Mn) Market Share by By Component in 2022

- Figure 2: Global Micro Data Center Market Market Attractiveness Analysis by By Component, 2016-2032

- Figure 3: Global Micro Data Center Market Revenue (US$ Mn) Market Share by By Rack (US$ Mn & Units)in 2022

- Figure 4: Global Micro Data Center Market Market Attractiveness Analysis by By Rack (US$ Mn & Units), 2016-2032

- Figure 5: Global Micro Data Center Market Revenue (US$ Mn) Market Share by By Enterprise Sizein 2022

- Figure 6: Global Micro Data Center Market Market Attractiveness Analysis by By Enterprise Size, 2016-2032

- Figure 7: Global Micro Data Center Market Revenue (US$ Mn) Market Share by By Industry Verticalin 2022

- Figure 8: Global Micro Data Center Market Market Attractiveness Analysis by By Industry Vertical, 2016-2032

- Figure 9: Global Micro Data Center Market Revenue (US$ Mn) Market Share by Region in 2022

- Figure 10: Global Micro Data Center Market Market Attractiveness Analysis by Region, 2016-2032

- Figure 11: Global Micro Data Center Market Market Revenue (US$ Mn) (2016-2032)

- Figure 12: Global Micro Data Center Market Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Figure 13: Global Micro Data Center Market Market Revenue (US$ Mn) Comparison by By Component (2016-2032)

- Figure 14: Global Micro Data Center Market Market Revenue (US$ Mn) Comparison by By Rack (US$ Mn & Units) (2016-2032)

- Figure 15: Global Micro Data Center Market Market Revenue (US$ Mn) Comparison by By Enterprise Size (2016-2032)

- Figure 16: Global Micro Data Center Market Market Revenue (US$ Mn) Comparison by By Industry Vertical (2016-2032)

- Figure 17: Global Micro Data Center Market Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Figure 18: Global Micro Data Center Market Market Y-o-Y Growth Rate Comparison by By Component (2016-2032)

- Figure 19: Global Micro Data Center Market Market Y-o-Y Growth Rate Comparison by By Rack (US$ Mn & Units) (2016-2032)

- Figure 20: Global Micro Data Center Market Market Y-o-Y Growth Rate Comparison by By Enterprise Size (2016-2032)

- Figure 21: Global Micro Data Center Market Market Y-o-Y Growth Rate Comparison by By Industry Vertical (2016-2032)

- Figure 22: Global Micro Data Center Market Market Share Comparison by Region (2016-2032)

- Figure 23: Global Micro Data Center Market Market Share Comparison by By Component (2016-2032)

- Figure 24: Global Micro Data Center Market Market Share Comparison by By Rack (US$ Mn & Units) (2016-2032)

- Figure 25: Global Micro Data Center Market Market Share Comparison by By Enterprise Size (2016-2032)

- Figure 26: Global Micro Data Center Market Market Share Comparison by By Industry Vertical (2016-2032)

- Figure 27: North America Micro Data Center Market Revenue (US$ Mn) Market Share by By Componentin 2022

- Figure 28: North America Micro Data Center Market Market Attractiveness Analysis by By Component, 2016-2032

- Figure 29: North America Micro Data Center Market Revenue (US$ Mn) Market Share by By Rack (US$ Mn & Units)in 2022

- Figure 30: North America Micro Data Center Market Market Attractiveness Analysis by By Rack (US$ Mn & Units), 2016-2032

- Figure 31: North America Micro Data Center Market Revenue (US$ Mn) Market Share by By Enterprise Sizein 2022

- Figure 32: North America Micro Data Center Market Market Attractiveness Analysis by By Enterprise Size, 2016-2032

- Figure 33: North America Micro Data Center Market Revenue (US$ Mn) Market Share by By Industry Verticalin 2022

- Figure 34: North America Micro Data Center Market Market Attractiveness Analysis by By Industry Vertical, 2016-2032

- Figure 35: North America Micro Data Center Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 36: North America Micro Data Center Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 37: North America Micro Data Center Market Market Revenue (US$ Mn) (2016-2032)

- Figure 38: North America Micro Data Center Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 39: North America Micro Data Center Market Market Revenue (US$ Mn) Comparison by By Component (2016-2032)

- Figure 40: North America Micro Data Center Market Market Revenue (US$ Mn) Comparison by By Rack (US$ Mn & Units) (2016-2032)

- Figure 41: North America Micro Data Center Market Market Revenue (US$ Mn) Comparison by By Enterprise Size (2016-2032)

- Figure 42: North America Micro Data Center Market Market Revenue (US$ Mn) Comparison by By Industry Vertical (2016-2032)

- Figure 43: North America Micro Data Center Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 44: North America Micro Data Center Market Market Y-o-Y Growth Rate Comparison by By Component (2016-2032)

- Figure 45: North America Micro Data Center Market Market Y-o-Y Growth Rate Comparison by By Rack (US$ Mn & Units) (2016-2032)

- Figure 46: North America Micro Data Center Market Market Y-o-Y Growth Rate Comparison by By Enterprise Size (2016-2032)

- Figure 47: North America Micro Data Center Market Market Y-o-Y Growth Rate Comparison by By Industry Vertical (2016-2032)

- Figure 48: North America Micro Data Center Market Market Share Comparison by Country (2016-2032)

- Figure 49: North America Micro Data Center Market Market Share Comparison by By Component (2016-2032)

- Figure 50: North America Micro Data Center Market Market Share Comparison by By Rack (US$ Mn & Units) (2016-2032)

- Figure 51: North America Micro Data Center Market Market Share Comparison by By Enterprise Size (2016-2032)

- Figure 52: North America Micro Data Center Market Market Share Comparison by By Industry Vertical (2016-2032)

- Figure 53: Western Europe Micro Data Center Market Revenue (US$ Mn) Market Share by By Componentin 2022

- Figure 54: Western Europe Micro Data Center Market Market Attractiveness Analysis by By Component, 2016-2032

- Figure 55: Western Europe Micro Data Center Market Revenue (US$ Mn) Market Share by By Rack (US$ Mn & Units)in 2022

- Figure 56: Western Europe Micro Data Center Market Market Attractiveness Analysis by By Rack (US$ Mn & Units), 2016-2032

- Figure 57: Western Europe Micro Data Center Market Revenue (US$ Mn) Market Share by By Enterprise Sizein 2022

- Figure 58: Western Europe Micro Data Center Market Market Attractiveness Analysis by By Enterprise Size, 2016-2032

- Figure 59: Western Europe Micro Data Center Market Revenue (US$ Mn) Market Share by By Industry Verticalin 2022

- Figure 60: Western Europe Micro Data Center Market Market Attractiveness Analysis by By Industry Vertical, 2016-2032

- Figure 61: Western Europe Micro Data Center Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 62: Western Europe Micro Data Center Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 63: Western Europe Micro Data Center Market Market Revenue (US$ Mn) (2016-2032)

- Figure 64: Western Europe Micro Data Center Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 65: Western Europe Micro Data Center Market Market Revenue (US$ Mn) Comparison by By Component (2016-2032)

- Figure 66: Western Europe Micro Data Center Market Market Revenue (US$ Mn) Comparison by By Rack (US$ Mn & Units) (2016-2032)

- Figure 67: Western Europe Micro Data Center Market Market Revenue (US$ Mn) Comparison by By Enterprise Size (2016-2032)

- Figure 68: Western Europe Micro Data Center Market Market Revenue (US$ Mn) Comparison by By Industry Vertical (2016-2032)

- Figure 69: Western Europe Micro Data Center Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 70: Western Europe Micro Data Center Market Market Y-o-Y Growth Rate Comparison by By Component (2016-2032)

- Figure 71: Western Europe Micro Data Center Market Market Y-o-Y Growth Rate Comparison by By Rack (US$ Mn & Units) (2016-2032)

- Figure 72: Western Europe Micro Data Center Market Market Y-o-Y Growth Rate Comparison by By Enterprise Size (2016-2032)

- Figure 73: Western Europe Micro Data Center Market Market Y-o-Y Growth Rate Comparison by By Industry Vertical (2016-2032)

- Figure 74: Western Europe Micro Data Center Market Market Share Comparison by Country (2016-2032)

- Figure 75: Western Europe Micro Data Center Market Market Share Comparison by By Component (2016-2032)

- Figure 76: Western Europe Micro Data Center Market Market Share Comparison by By Rack (US$ Mn & Units) (2016-2032)

- Figure 77: Western Europe Micro Data Center Market Market Share Comparison by By Enterprise Size (2016-2032)

- Figure 78: Western Europe Micro Data Center Market Market Share Comparison by By Industry Vertical (2016-2032)

- Figure 79: Eastern Europe Micro Data Center Market Revenue (US$ Mn) Market Share by By Componentin 2022

- Figure 80: Eastern Europe Micro Data Center Market Market Attractiveness Analysis by By Component, 2016-2032

- Figure 81: Eastern Europe Micro Data Center Market Revenue (US$ Mn) Market Share by By Rack (US$ Mn & Units)in 2022

- Figure 82: Eastern Europe Micro Data Center Market Market Attractiveness Analysis by By Rack (US$ Mn & Units), 2016-2032

- Figure 83: Eastern Europe Micro Data Center Market Revenue (US$ Mn) Market Share by By Enterprise Sizein 2022

- Figure 84: Eastern Europe Micro Data Center Market Market Attractiveness Analysis by By Enterprise Size, 2016-2032

- Figure 85: Eastern Europe Micro Data Center Market Revenue (US$ Mn) Market Share by By Industry Verticalin 2022

- Figure 86: Eastern Europe Micro Data Center Market Market Attractiveness Analysis by By Industry Vertical, 2016-2032

- Figure 87: Eastern Europe Micro Data Center Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 88: Eastern Europe Micro Data Center Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 89: Eastern Europe Micro Data Center Market Market Revenue (US$ Mn) (2016-2032)

- Figure 90: Eastern Europe Micro Data Center Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 91: Eastern Europe Micro Data Center Market Market Revenue (US$ Mn) Comparison by By Component (2016-2032)

- Figure 92: Eastern Europe Micro Data Center Market Market Revenue (US$ Mn) Comparison by By Rack (US$ Mn & Units) (2016-2032)

- Figure 93: Eastern Europe Micro Data Center Market Market Revenue (US$ Mn) Comparison by By Enterprise Size (2016-2032)

- Figure 94: Eastern Europe Micro Data Center Market Market Revenue (US$ Mn) Comparison by By Industry Vertical (2016-2032)

- Figure 95: Eastern Europe Micro Data Center Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 96: Eastern Europe Micro Data Center Market Market Y-o-Y Growth Rate Comparison by By Component (2016-2032)

- Figure 97: Eastern Europe Micro Data Center Market Market Y-o-Y Growth Rate Comparison by By Rack (US$ Mn & Units) (2016-2032)

- Figure 98: Eastern Europe Micro Data Center Market Market Y-o-Y Growth Rate Comparison by By Enterprise Size (2016-2032)

- Figure 99: Eastern Europe Micro Data Center Market Market Y-o-Y Growth Rate Comparison by By Industry Vertical (2016-2032)

- Figure 100: Eastern Europe Micro Data Center Market Market Share Comparison by Country (2016-2032)

- Figure 101: Eastern Europe Micro Data Center Market Market Share Comparison by By Component (2016-2032)

- Figure 102: Eastern Europe Micro Data Center Market Market Share Comparison by By Rack (US$ Mn & Units) (2016-2032)

- Figure 103: Eastern Europe Micro Data Center Market Market Share Comparison by By Enterprise Size (2016-2032)

- Figure 104: Eastern Europe Micro Data Center Market Market Share Comparison by By Industry Vertical (2016-2032)

- Figure 105: APAC Micro Data Center Market Revenue (US$ Mn) Market Share by By Componentin 2022

- Figure 106: APAC Micro Data Center Market Market Attractiveness Analysis by By Component, 2016-2032

- Figure 107: APAC Micro Data Center Market Revenue (US$ Mn) Market Share by By Rack (US$ Mn & Units)in 2022

- Figure 108: APAC Micro Data Center Market Market Attractiveness Analysis by By Rack (US$ Mn & Units), 2016-2032

- Figure 109: APAC Micro Data Center Market Revenue (US$ Mn) Market Share by By Enterprise Sizein 2022

- Figure 110: APAC Micro Data Center Market Market Attractiveness Analysis by By Enterprise Size, 2016-2032

- Figure 111: APAC Micro Data Center Market Revenue (US$ Mn) Market Share by By Industry Verticalin 2022

- Figure 112: APAC Micro Data Center Market Market Attractiveness Analysis by By Industry Vertical, 2016-2032

- Figure 113: APAC Micro Data Center Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 114: APAC Micro Data Center Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 115: APAC Micro Data Center Market Market Revenue (US$ Mn) (2016-2032)

- Figure 116: APAC Micro Data Center Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 117: APAC Micro Data Center Market Market Revenue (US$ Mn) Comparison by By Component (2016-2032)

- Figure 118: APAC Micro Data Center Market Market Revenue (US$ Mn) Comparison by By Rack (US$ Mn & Units) (2016-2032)

- Figure 119: APAC Micro Data Center Market Market Revenue (US$ Mn) Comparison by By Enterprise Size (2016-2032)

- Figure 120: APAC Micro Data Center Market Market Revenue (US$ Mn) Comparison by By Industry Vertical (2016-2032)

- Figure 121: APAC Micro Data Center Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 122: APAC Micro Data Center Market Market Y-o-Y Growth Rate Comparison by By Component (2016-2032)

- Figure 123: APAC Micro Data Center Market Market Y-o-Y Growth Rate Comparison by By Rack (US$ Mn & Units) (2016-2032)

- Figure 124: APAC Micro Data Center Market Market Y-o-Y Growth Rate Comparison by By Enterprise Size (2016-2032)

- Figure 125: APAC Micro Data Center Market Market Y-o-Y Growth Rate Comparison by By Industry Vertical (2016-2032)

- Figure 126: APAC Micro Data Center Market Market Share Comparison by Country (2016-2032)

- Figure 127: APAC Micro Data Center Market Market Share Comparison by By Component (2016-2032)

- Figure 128: APAC Micro Data Center Market Market Share Comparison by By Rack (US$ Mn & Units) (2016-2032)

- Figure 129: APAC Micro Data Center Market Market Share Comparison by By Enterprise Size (2016-2032)

- Figure 130: APAC Micro Data Center Market Market Share Comparison by By Industry Vertical (2016-2032)

- Figure 131: Latin America Micro Data Center Market Revenue (US$ Mn) Market Share by By Componentin 2022

- Figure 132: Latin America Micro Data Center Market Market Attractiveness Analysis by By Component, 2016-2032

- Figure 133: Latin America Micro Data Center Market Revenue (US$ Mn) Market Share by By Rack (US$ Mn & Units)in 2022

- Figure 134: Latin America Micro Data Center Market Market Attractiveness Analysis by By Rack (US$ Mn & Units), 2016-2032

- Figure 135: Latin America Micro Data Center Market Revenue (US$ Mn) Market Share by By Enterprise Sizein 2022

- Figure 136: Latin America Micro Data Center Market Market Attractiveness Analysis by By Enterprise Size, 2016-2032

- Figure 137: Latin America Micro Data Center Market Revenue (US$ Mn) Market Share by By Industry Verticalin 2022

- Figure 138: Latin America Micro Data Center Market Market Attractiveness Analysis by By Industry Vertical, 2016-2032

- Figure 139: Latin America Micro Data Center Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 140: Latin America Micro Data Center Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 141: Latin America Micro Data Center Market Market Revenue (US$ Mn) (2016-2032)

- Figure 142: Latin America Micro Data Center Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 143: Latin America Micro Data Center Market Market Revenue (US$ Mn) Comparison by By Component (2016-2032)

- Figure 144: Latin America Micro Data Center Market Market Revenue (US$ Mn) Comparison by By Rack (US$ Mn & Units) (2016-2032)

- Figure 145: Latin America Micro Data Center Market Market Revenue (US$ Mn) Comparison by By Enterprise Size (2016-2032)

- Figure 146: Latin America Micro Data Center Market Market Revenue (US$ Mn) Comparison by By Industry Vertical (2016-2032)

- Figure 147: Latin America Micro Data Center Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 148: Latin America Micro Data Center Market Market Y-o-Y Growth Rate Comparison by By Component (2016-2032)

- Figure 149: Latin America Micro Data Center Market Market Y-o-Y Growth Rate Comparison by By Rack (US$ Mn & Units) (2016-2032)

- Figure 150: Latin America Micro Data Center Market Market Y-o-Y Growth Rate Comparison by By Enterprise Size (2016-2032)

- Figure 151: Latin America Micro Data Center Market Market Y-o-Y Growth Rate Comparison by By Industry Vertical (2016-2032)

- Figure 152: Latin America Micro Data Center Market Market Share Comparison by Country (2016-2032)

- Figure 153: Latin America Micro Data Center Market Market Share Comparison by By Component (2016-2032)

- Figure 154: Latin America Micro Data Center Market Market Share Comparison by By Rack (US$ Mn & Units) (2016-2032)

- Figure 155: Latin America Micro Data Center Market Market Share Comparison by By Enterprise Size (2016-2032)

- Figure 156: Latin America Micro Data Center Market Market Share Comparison by By Industry Vertical (2016-2032)

- Figure 157: Middle East & Africa Micro Data Center Market Revenue (US$ Mn) Market Share by By Componentin 2022

- Figure 158: Middle East & Africa Micro Data Center Market Market Attractiveness Analysis by By Component, 2016-2032

- Figure 159: Middle East & Africa Micro Data Center Market Revenue (US$ Mn) Market Share by By Rack (US$ Mn & Units)in 2022

- Figure 160: Middle East & Africa Micro Data Center Market Market Attractiveness Analysis by By Rack (US$ Mn & Units), 2016-2032

- Figure 161: Middle East & Africa Micro Data Center Market Revenue (US$ Mn) Market Share by By Enterprise Sizein 2022

- Figure 162: Middle East & Africa Micro Data Center Market Market Attractiveness Analysis by By Enterprise Size, 2016-2032

- Figure 163: Middle East & Africa Micro Data Center Market Revenue (US$ Mn) Market Share by By Industry Verticalin 2022

- Figure 164: Middle East & Africa Micro Data Center Market Market Attractiveness Analysis by By Industry Vertical, 2016-2032

- Figure 165: Middle East & Africa Micro Data Center Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 166: Middle East & Africa Micro Data Center Market Market Attractiveness Analysis by Country, 2016-2032

- Figure 167: Middle East & Africa Micro Data Center Market Market Revenue (US$ Mn) (2016-2032)

- Figure 168: Middle East & Africa Micro Data Center Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 169: Middle East & Africa Micro Data Center Market Market Revenue (US$ Mn) Comparison by By Component (2016-2032)

- Figure 170: Middle East & Africa Micro Data Center Market Market Revenue (US$ Mn) Comparison by By Rack (US$ Mn & Units) (2016-2032)

- Figure 171: Middle East & Africa Micro Data Center Market Market Revenue (US$ Mn) Comparison by By Enterprise Size (2016-2032)

- Figure 172: Middle East & Africa Micro Data Center Market Market Revenue (US$ Mn) Comparison by By Industry Vertical (2016-2032)

- Figure 173: Middle East & Africa Micro Data Center Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 174: Middle East & Africa Micro Data Center Market Market Y-o-Y Growth Rate Comparison by By Component (2016-2032)

- Figure 175: Middle East & Africa Micro Data Center Market Market Y-o-Y Growth Rate Comparison by By Rack (US$ Mn & Units) (2016-2032)

- Figure 176: Middle East & Africa Micro Data Center Market Market Y-o-Y Growth Rate Comparison by By Enterprise Size (2016-2032)

- Figure 177: Middle East & Africa Micro Data Center Market Market Y-o-Y Growth Rate Comparison by By Industry Vertical (2016-2032)

- Figure 178: Middle East & Africa Micro Data Center Market Market Share Comparison by Country (2016-2032)

- Figure 179: Middle East & Africa Micro Data Center Market Market Share Comparison by By Component (2016-2032)

- Figure 180: Middle East & Africa Micro Data Center Market Market Share Comparison by By Rack (US$ Mn & Units) (2016-2032)

- Figure 181: Middle East & Africa Micro Data Center Market Market Share Comparison by By Enterprise Size (2016-2032)

- Figure 182: Middle East & Africa Micro Data Center Market Market Share Comparison by By Industry Vertical (2016-2032)

List of Tables

- Table 1: Global Micro Data Center Market Market Comparison by By Component (2016-2032)

- Table 2: Global Micro Data Center Market Market Comparison by By Rack (US$ Mn & Units) (2016-2032)

- Table 3: Global Micro Data Center Market Market Comparison by By Enterprise Size (2016-2032)

- Table 4: Global Micro Data Center Market Market Comparison by By Industry Vertical (2016-2032)

- Table 5: Global Micro Data Center Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 6: Global Micro Data Center Market Market Revenue (US$ Mn) (2016-2032)

- Table 7: Global Micro Data Center Market Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 8: Global Micro Data Center Market Market Revenue (US$ Mn) Comparison by By Component (2016-2032)

- Table 9: Global Micro Data Center Market Market Revenue (US$ Mn) Comparison by By Rack (US$ Mn & Units) (2016-2032)

- Table 10: Global Micro Data Center Market Market Revenue (US$ Mn) Comparison by By Enterprise Size (2016-2032)

- Table 11: Global Micro Data Center Market Market Revenue (US$ Mn) Comparison by By Industry Vertical (2016-2032)

- Table 12: Global Micro Data Center Market Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Table 13: Global Micro Data Center Market Market Y-o-Y Growth Rate Comparison by By Component (2016-2032)

- Table 14: Global Micro Data Center Market Market Y-o-Y Growth Rate Comparison by By Rack (US$ Mn & Units) (2016-2032)

- Table 15: Global Micro Data Center Market Market Y-o-Y Growth Rate Comparison by By Enterprise Size (2016-2032)

- Table 16: Global Micro Data Center Market Market Y-o-Y Growth Rate Comparison by By Industry Vertical (2016-2032)

- Table 17: Global Micro Data Center Market Market Share Comparison by Region (2016-2032)

- Table 18: Global Micro Data Center Market Market Share Comparison by By Component (2016-2032)

- Table 19: Global Micro Data Center Market Market Share Comparison by By Rack (US$ Mn & Units) (2016-2032)

- Table 20: Global Micro Data Center Market Market Share Comparison by By Enterprise Size (2016-2032)

- Table 21: Global Micro Data Center Market Market Share Comparison by By Industry Vertical (2016-2032)

- Table 22: North America Micro Data Center Market Market Comparison by By Rack (US$ Mn & Units) (2016-2032)

- Table 23: North America Micro Data Center Market Market Comparison by By Enterprise Size (2016-2032)

- Table 24: North America Micro Data Center Market Market Comparison by By Industry Vertical (2016-2032)

- Table 25: North America Micro Data Center Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 26: North America Micro Data Center Market Market Revenue (US$ Mn) (2016-2032)

- Table 27: North America Micro Data Center Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 28: North America Micro Data Center Market Market Revenue (US$ Mn) Comparison by By Component (2016-2032)

- Table 29: North America Micro Data Center Market Market Revenue (US$ Mn) Comparison by By Rack (US$ Mn & Units) (2016-2032)

- Table 30: North America Micro Data Center Market Market Revenue (US$ Mn) Comparison by By Enterprise Size (2016-2032)

- Table 31: North America Micro Data Center Market Market Revenue (US$ Mn) Comparison by By Industry Vertical (2016-2032)

- Table 32: North America Micro Data Center Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 33: North America Micro Data Center Market Market Y-o-Y Growth Rate Comparison by By Component (2016-2032)

- Table 34: North America Micro Data Center Market Market Y-o-Y Growth Rate Comparison by By Rack (US$ Mn & Units) (2016-2032)

- Table 35: North America Micro Data Center Market Market Y-o-Y Growth Rate Comparison by By Enterprise Size (2016-2032)

- Table 36: North America Micro Data Center Market Market Y-o-Y Growth Rate Comparison by By Industry Vertical (2016-2032)

- Table 37: North America Micro Data Center Market Market Share Comparison by Country (2016-2032)

- Table 38: North America Micro Data Center Market Market Share Comparison by By Component (2016-2032)

- Table 39: North America Micro Data Center Market Market Share Comparison by By Rack (US$ Mn & Units) (2016-2032)

- Table 40: North America Micro Data Center Market Market Share Comparison by By Enterprise Size (2016-2032)

- Table 41: North America Micro Data Center Market Market Share Comparison by By Industry Vertical (2016-2032)

- Table 42: Western Europe Micro Data Center Market Market Comparison by By Component (2016-2032)

- Table 43: Western Europe Micro Data Center Market Market Comparison by By Rack (US$ Mn & Units) (2016-2032)

- Table 44: Western Europe Micro Data Center Market Market Comparison by By Enterprise Size (2016-2032)

- Table 45: Western Europe Micro Data Center Market Market Comparison by By Industry Vertical (2016-2032)

- Table 46: Western Europe Micro Data Center Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 47: Western Europe Micro Data Center Market Market Revenue (US$ Mn) (2016-2032)

- Table 48: Western Europe Micro Data Center Market Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 49: Western Europe Micro Data Center Market Market Revenue (US$ Mn) Comparison by By Component (2016-2032)

- Table 50: Western Europe Micro Data Center Market Market Revenue (US$ Mn) Comparison by By Rack (US$ Mn & Units) (2016-2032)

- Table 51: Western Europe Micro Data Center Market Market Revenue (US$ Mn) Comparison by By Enterprise Size (2016-2032)

- Table 52: Western Europe Micro Data Center Market Market Revenue (US$ Mn) Comparison by By Industry Vertical (2016-2032)

- Table 53: Western Europe Micro Data Center Market Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 54: Western Europe Micro Data Center Market Market Y-o-Y Growth Rate Comparison by By Component (2016-2032)

- Table 55: Western Europe Micro Data Center Market Market Y-o-Y Growth Rate Comparison by By Rack (US$ Mn & Units) (2016-2032)

- Table 56: Western Europe Micro Data Center Market Market Y-o-Y Growth Rate Comparison by By Enterprise Size (2016-2032)

- Table 57: Western Europe Micro Data Center Market Market Y-o-Y Growth Rate Comparison by By Industry Vertical (2016-2032)

- Table 58: Western Europe Micro Data Center Market Market Share Comparison by Country (2016-2032)

- Table 59: Western Europe Micro Data Center Market Market Share Comparison by By Component (2016-2032)

- Table 60: Western Europe Micro Data Center Market Market Share Comparison by By Rack (US$ Mn & Units) (2016-2032)

- Table 61: Western Europe Micro Data Center Market Market Share Comparison by By Enterprise Size (2016-2032)

- Table 62: Western Europe Micro Data Center Market Market Share Comparison by By Industry Vertical (2016-2032)

- Table 63: Eastern Europe Micro Data Center Market Market Comparison by By Component (2016-2032)

- Table 64: Eastern Europe Micro Data Center Market Market Comparison by By Rack (US$ Mn & Units) (2016-2032)

- Table 65: Eastern Europe Micro Data Center Market Market Comparison by By Enterprise Size (2016-2032)

- Table 66: Eastern Europe Micro Data Center Market Market Comparison by By Industry Vertical (2016-2032)

- Table 67: Eastern Europe Micro Data Center Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 68: Eastern Europe Micro Data Center Market Market Revenue (US$ Mn) (2016-2032)