Micro Data Center Market By Component (Solution, Services), By Rack Unit (Up to 20 RU, 20-40 RU, Above 40 RU), By Enterprise Size (Large Enterprises Small and Medium-Sized Enterprises (SMEs)), By Industry Vertical (BFSI IT & telecommunication, Colocation, Energy, Healthcare, Industrial, and Others)By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 202-2033

-

50989

-

Sept 2024

-

380

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

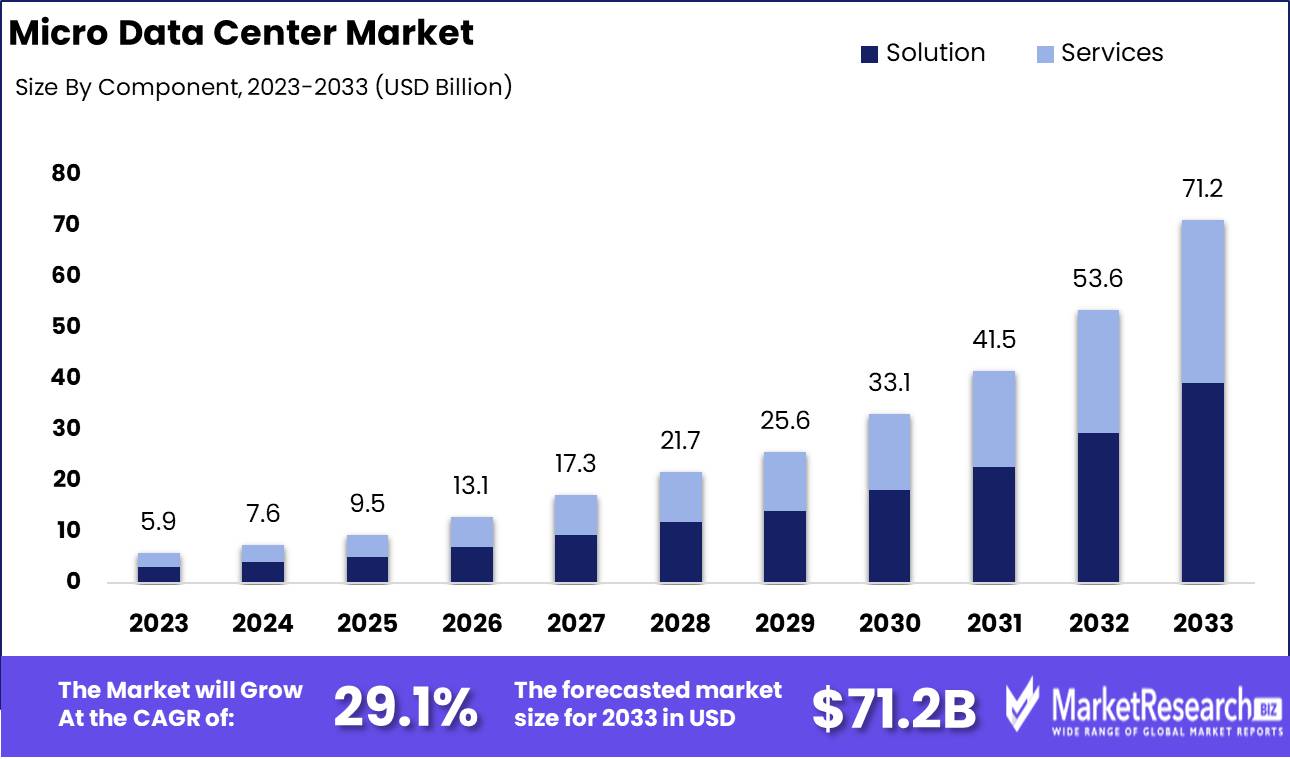

Micro Data Center Market was valued at USD 5.9 Billion in 2023. It is expected to reach USD 71.2 Billion by 2033, with a compound annual growth rate (CAGR) of 29.1% during the forecast period from 2024 to 2033.

The Micro Data Center market refers to a rapidly growing segment in the data infrastructure landscape, driven by the need for compact, scalable, and efficient data storage solutions. Micro data centers are self-contained, modular facilities designed to handle computing, storage, and networking on a smaller scale, often deployed in remote or edge locations to support low-latency applications. These solutions cater to industries with rising demand for real-time data processing, such as telecommunications, healthcare, and manufacturing. Their ability to provide agility, cost-effectiveness, and ease of deployment makes them integral to the broader evolution of edge computing and digital transformation strategies.

The micro data center market is witnessing a transformative shift driven by the increasing demand for edge computing, fueled by advancements in IoT, big data, and machine learning applications. Micro data centers, characterized by their modularity and proximity to end users, offer a scalable, low-latency solution to the limitations of traditional centralized data centers, particularly in environments where real-time data processing is critical. The rise of 5G technology has further accelerated this demand, as telecom operators seek scalable solutions to enhance service quality and improve connectivity. As businesses increasingly require agile and efficient computing solutions, micro data centers are emerging as a key enabler of digital transformation, allowing organizations to deploy data processing capabilities closer to the source of data generation, thereby improving response times and operational efficiency.

In this rapidly evolving landscape, leading players such as Schneider Electric have capitalized on the opportunity with strategic innovations and partnerships. For example, the November 2022 launch of the EcoStruxure Micro Data Center R-Series 42U Medium Density product is designed to streamline deployment for IT professionals, reflecting the growing need for ruggedized, scalable solutions. Furthermore, Schneider’s $3 billion multi-year agreement with Compass Datacenters exemplifies the trend toward prefabricated, modular solutions that address the demands of both edge computing and sustainable infrastructure development.

In parallel, partnerships like the March 2024 MOU between AIIB and BNDES underscore the broader global commitment to advancing micro data center infrastructure, particularly in emerging markets across the Asia Pacific region. As organizations continue to prioritize real-time data processing and sustainable growth, the micro data center market is well-positioned for sustained expansion.

Key Takeaways

- Market Growth: The micro data center market is projected to grow from USD 5.9 billion in 2023 to USD 71.2 billion by 2033, driven by a 29.1% CAGR due to rising demand for edge computing and real-time data processing.

- By Component Analysis: In 2023, the Solutions segment dominated the micro data center market with over 55.1% market share.

- By Rack Unit Analysis: The Above 40 RU segment led the market with a 42.1% share in 2023, driven by high-density computing needs.

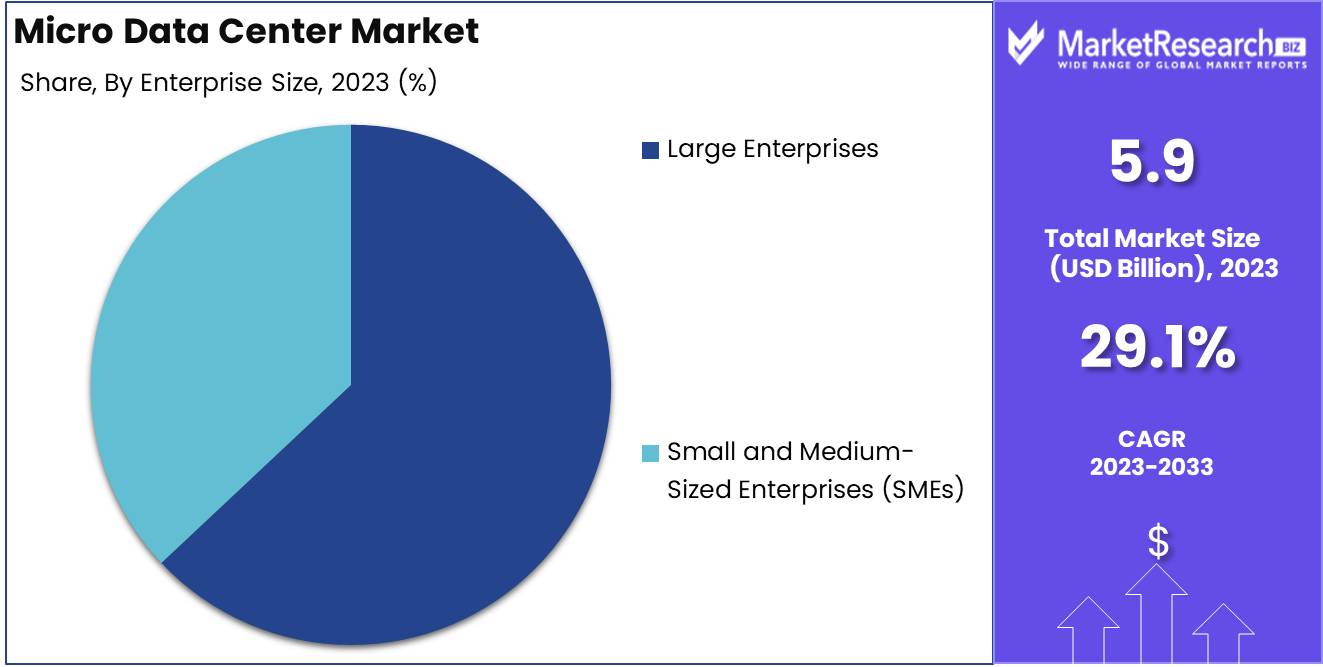

- By Enterprise Size: Large Enterprises accounted for 63.1% of the market share in 2023, reflecting their reliance on scalable IT infrastructure.

- By Industry Vertical: The BFSI sector dominated the industry verticals, capturing 63.1% of the total market share in 2023, driven by real-time transaction processing demands.

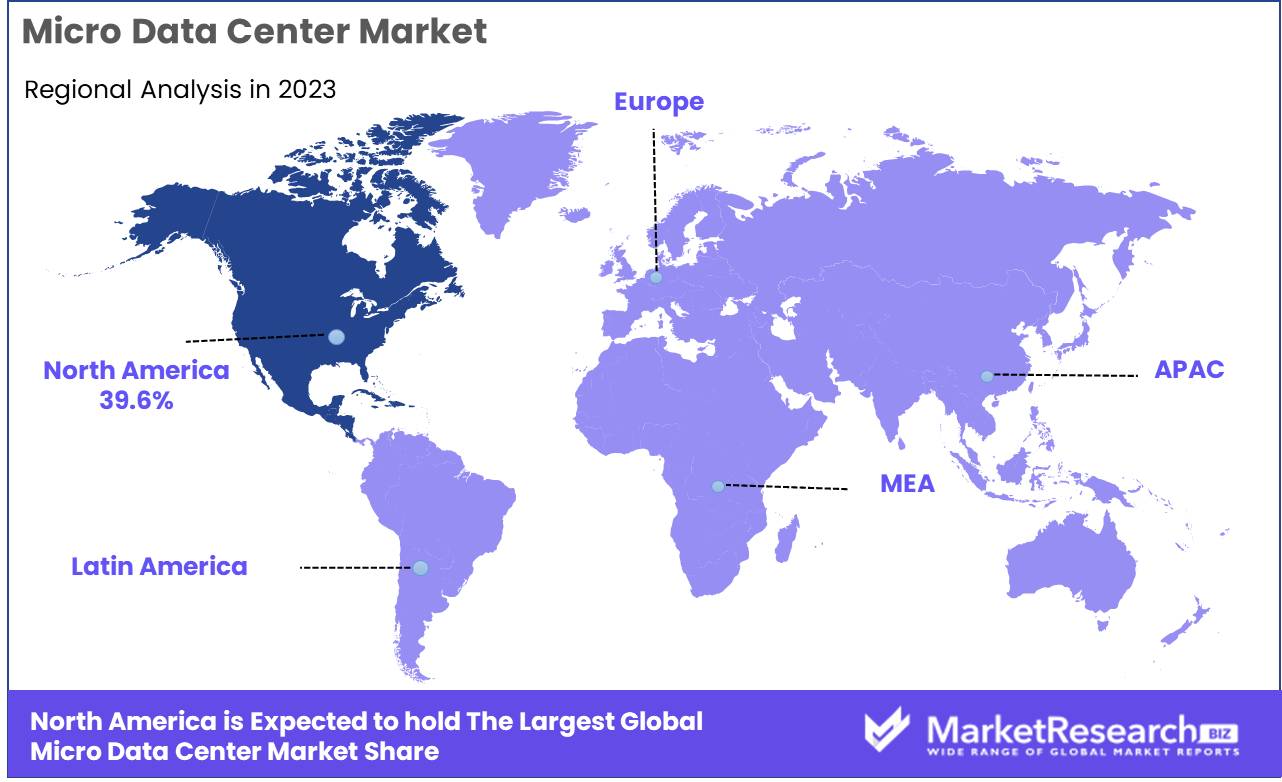

- Regional Dominance: North America led the market with a 39.6% share, driven by the rapid adoption of edge computing and 5G technologies.

- Growth Opportunity: Edge computing is a key growth driver, with IoT device growth expected to exceed 75 billion connected devices by 2025.

- Restraining Factor: The lack of standardization in micro data center solutions hinders scalability and interoperability across deployments.

Driving factors

Emphasis on Security and Threat Detection Integrated Systems

The increasing emphasis on security and integrated threat detection systems is a critical driver for the growth of the Micro Data Center (MDC) market. As digital ecosystems expand, businesses are increasingly vulnerable to cyber threats, with cybercrime projected to cost the global economy $10.5 trillion annually by 2025. This risk landscape has prompted a significant demand for MDCs equipped with robust, real-time security mechanisms to ensure data integrity and prevent breaches.

Micro Data Centers, often located closer to the data source, offer reduced latency but are also more exposed to regional and localized cyber threats. As a result, businesses are integrating advanced threat detection systems within MDCs, leveraging AI-driven security protocols and real-time monitoring capabilities. The seamless integration of cybersecurity tools—such as firewalls, intrusion detection systems, and data encryption—into these compact units enhances their appeal, particularly for industries dealing with sensitive information, such as healthcare, finance, and government sectors.

Increasing Adoption of Edge Computing and IoT

The surge in edge computing and Internet of Things (IoT) adoption is another dominant force propelling the Micro Data Center market forward. drives the need for localized, low-latency data processing solutions that Micro Data Centers uniquely provide. As IoT devices multiply—estimated to exceed 75 billion connected devices globally by 2025—the sheer volume of data generated at the network edge is overwhelming traditional centralized data centers.

Micro Data Centers offer an optimal solution to this challenge by providing decentralized data processing capabilities closer to the source of data generation. This proximity reduces latency, enhances real-time analytics, and supports mission-critical applications, particularly in industries such as manufacturing, telecommunications, and autonomous transportation. For instance, the rise of autonomous vehicles, smart cities, and industrial IoT applications relies heavily on low-latency, high-speed data processing, which MDCs can efficiently provide.

Restraining Factors

Integration Complexity: A Barrier to Adoption, but a Catalyst for Innovation

The complexity involved in integrating micro data centers into existing IT infrastructures is both a challenge and a driving force for innovation in the market. As companies seek to adopt more decentralized and edge-focused computing solutions, many struggle with the technical intricacies of harmonizing these systems with their legacy IT environments. This complexity often slows down adoption rates, leading to extended deployment cycles and higher implementation costs.

Furthermore, as businesses move towards Industry 4.0 and the Internet of Things (IoT) gains traction, seamless integration with IoT devices and cloud infrastructures becomes essential. Therefore, while integration complexity presents a short-term hindrance, it serves as a key motivator for technological advancements that enhance the overall competitiveness and growth of the micro data center market.

Lack of Standardization: Hindering Scalability but Promoting Differentiation

The absence of industry-wide standards for micro data centers presents a significant challenge in terms of scalability and interoperability. Without uniform standards, organizations face difficulty in achieving consistent performance across different regions and vendors. This leads to inefficiencies and increased costs associated with custom-built solutions for each deployment.

However, the lack of standardization also provides an opportunity for vendors to differentiate themselves by developing proprietary technologies and services tailored to specific industry verticals or operational needs. As a result, businesses that can afford to invest in these bespoke systems are often able to leverage more advanced capabilities, including enhanced security, data management, and analytics.

By Component Analysis

Solutions Segment Holds the Largest Market Share, Dominating with Over 55.1% in 2023

In 2023, the solutions segment held a dominant market position in the By Component segmentation of the micro data center market, capturing more than a 55.1% share. This commanding presence highlights the increasing demand for pre-integrated, scalable, and high-performance micro data center solutions, which are designed to meet the growing needs for edge computing, data management, and processing capabilities in diverse industries. The ability of these solutions to provide rapid deployment, enhanced security, and improved energy efficiency has further solidified their adoption across various sectors, including telecommunications, IT, and manufacturing.

Micro data center solutions include pre-engineered, modular systems that integrate computing, storage, and networking components. These comprehensive offerings provide a crucial infrastructure for enterprises looking to expand their edge computing capabilities without the extensive capital investment or space requirements of traditional data centers.

Although the solutions segment leads, the services segment is also gaining traction. These services include installation, consulting, and maintenance, essential for optimizing micro data center operations. The growth in managed services is a key driver here, as enterprises increasingly look for third-party providers to ensure their micro data centers operate efficiently. Services represent an important complementary offering, facilitating the seamless deployment and ongoing support of micro data center infrastructure.

By Rack Unit Analysis

Above 40 RU Segment Dominates the Micro Data Center Market with 42.1% Share in 2023

In 2023, the Above 40 RU segment held a dominant position in the "By Rack Unit" segmentation of the global micro data center market, accounting for more than 42.1% of the total market share. This reflects a growing demand for larger, scalable micro data center solutions driven by enterprises and large organizations seeking to support high-density computing workloads. The segment's robust adoption is influenced by the increasing need for high-capacity data storage and processing, particularly in industries such as telecommunications, IT, and manufacturing.

In contrast, the 20-40 RU segment also demonstrated notable growth, benefiting from the demand for flexible and modular solutions among mid-sized enterprises. As these businesses look to modernize their IT infrastructure, the 20-40 RU segment has emerged as a viable option, offering the scalability to meet growing data requirements while maintaining manageable physical footprints.

At the lower end of the spectrum, the Up to 20 RU segment caters predominantly to small and medium-sized enterprises (SMEs) and edge computing applications. While its market share was relatively smaller in 2023, this segment remains critical for businesses prioritizing cost-efficiency and space-constrained environments. The ongoing expansion of edge computing and IoT applications is expected to drive incremental growth in this segment over the coming years.

By Enterprise Size

Large Enterprises Segment Dominates the Micro Data Center Market with 63.1% Share in 2023

In 2023, the Large Enterprises segment held a dominant market position within the "By Enterprise Size" segmentation of the global micro data center market, capturing more than 63.1% of the total market share. This dominance is primarily driven by the increasing reliance of large corporations on scalable, high-performance data infrastructure to support their complex IT ecosystems, which include vast data storage, cloud computing, and edge applications. Industries such as telecommunications, finance, and healthcare, which require highly secure and robust data solutions, are key contributors to the growth of this segment.

The Small and Medium-Sized Enterprises (SMEs) segment, while representing a smaller market share, is gradually growing due to the rising adoption of digital transformation initiatives and the need for agile and cost-effective IT infrastructure. As SMEs expand their operations and embrace cloud technologies, micro data centers provide a compact and efficient solution that addresses their limited space and budget constraints.

By Industry Vertical

BFSI Segment Dominates the Micro Data Center Market with 27.1% Share in 2023

In 2023, the BFSI (Banking, Financial Services, and Insurance) segment held a dominant market position within the by Industry Vertical segmentation of the global micro data center market, capturing more than 27.1% of the total market share. The BFSI sector's significant reliance on secure, scalable, and efficient data infrastructure has been a key driver of this dominance. With growing regulatory demands, the need for real-time transaction processing, and the shift towards digital banking, micro data centers provide BFSI institutions with the ability to manage high volumes of sensitive data, enhance cybersecurity, and ensure low-latency operations across geographically dispersed locations.

The IT and telecom segment followed, showing strong adoption due to the continuous expansion of 5G networks, cloud computing services, and the need for edge computing solutions. Telecommunications companies are increasingly deploying micro data centers to manage the immense data flow from connected devices and networks while maintaining optimal service performance and minimizing latency.

The Colocation segment also plays a critical role in the market, offering businesses a cost-effective alternative to building their own data centers. As demand for outsourced infrastructure continues to rise, colocation providers are adopting micro data centers to offer flexible, scalable solutions to their clients.

In sectors such as Energy, Healthcare, and Industrial, the adoption of micro data centers is gradually increasing. The Energy sector uses these solutions to manage critical data in remote locations, while the Healthcare industry relies on them for secure and efficient handling of medical records and telemedicine services. The Industrial sector utilizes micro data centers for real-time data processing and IoT applications, enhancing operational efficiency in manufacturing processes.

The Others category, encompassing a wide range of industries, continues to adopt micro data centers for diverse applications, including retail, government, and education, reflecting the broad applicability of these solutions across multiple sectors.

Key Market Segments

By Component

- Solution

- Services

By Rack Unit

- Up to 20 RU

- 20-40 RU

- Above 40 RU

By Enterprise Size

- Large Enterprises

- Small and Medium-Sized Enterprises (SMEs)

By Industry Vertical

- BFSI

- IT and telecom

- Colocation

- Energy

- Healthcare

- Industrial

- Others

Growth Opportunity

Edge Computing and Remote Operations Drive Decentralized Micro Data Center Growth

As the demand for low-latency applications and real-time data processing rises, edge computing has emerged as a critical enabler of modern IT ecosystems. Micro data centers, with their compact size and proximity to data sources, are ideal for supporting edge computing, significantly reducing latency while enhancing network efficiency. These decentralized infrastructures allow businesses to process data closer to where it is generated, crucial for sectors such as IoT, autonomous vehicles, and smart city solutions.

Moreover, the growth of remote operations—fueled by digital transformation, cloud adoption, and distributed workforces— further accelerates the need for localized, reliable data centers The synergy between edge computing and micro data centers creates a robust solution for companies seeking scalable, distributed, and highly efficient computing architectures that cater to the rising demand for real-time, localized services.

This trend interplays with increasing cloud dependency and the growing need for advanced AI-driven applications, both of which require enhanced data processing capabilities at the edge. As a result, micro data centers are crucial in enabling businesses to maintain operational resilience and performance as they transition toward more distributed and digitalized environments.

Resilient IT Infrastructure for Harsh and Challenging Environments Fuels Market Adoption

The need for resilient, highly reliable IT infrastructure in industries operating in challenging environments, such as oil and gas, mining, and military operations, is a key driver for micro data center adoption. These industries often require robust data centers that can withstand extreme temperatures, humidity, and remote locations, which traditional data centers struggle to accommodate. Micro data centers, with their modular design and self-contained units, offer enhanced durability and flexibility, allowing for deployment in non-traditional settings while ensuring uninterrupted operations.

This demand is further compounded by the rapid expansion of the Industrial Internet of Things (IIoT), where continuous data collection, analysis, and response in real-time are non-negotiable. As micro data centers are optimized for such conditions, they offer a highly adaptive solution for industries seeking both resilience and scalability in difficult operational landscapes. Their ability to maintain performance under adverse conditions directly contributes to market expansion, positioning them as indispensable components in the future of industrial operations.

Latest Trends

Edge Computing and IoT Deployment Fueling Growth

The rapid adoption of edge computing and the proliferation of Internet of Things (IoT) devices are significantly shaping the global micro data center market in 2024. As organizations strive to process data closer to the source, micro data centers have become the preferred solution for managing data from edge applications, particularly in industries like manufacturing, healthcare, and smart cities. This trend is being driven by the need for low-latency data processing and real-time decision-making, as IoT devices generate large volumes of data that must be processed quickly and efficiently. The growing demand for edge computing infrastructure is expected to continue driving the adoption of micro data centers, especially in remote or distributed locations.

Focus on High-Performance and Reliable Data Centers

In 2024, there is a clear shift towards developing high-performance and reliable data centers to meet the evolving needs of enterprises. As digital transformation accelerates across industries, the demand for robust, scalable, and resilient data centers is increasing. Micro data centers, known for their compact design, modularity, and scalability, offer enterprises a flexible solution to address their high-density computing requirements. Industries such as BFSI and telecommunications, which rely on 24/7 uptime and minimal downtime, are driving the demand for micro data centers that ensure business continuity and safeguard critical data.

Regional Analysis

North America Leads with Largest Market Share 39.6%

North America dominates the global micro data center market, accounting for approximately 39.6% of the market share. This leadership position is driven by the rapid digital transformation across industries and the increasing demand for localized data storage solutions to support edge computing, particularly in the United States. The US, Canada, and Mexico are key players in this region, with the US leading due to its mature IT infrastructure, high concentration of data centers, and strong presence of cloud service providers. The rise of IoT, 5G deployment, and AI further bolster the demand for MDCs in this region.

Europe is another significant region in the MDC market, with Western Europe being the primary contributor, especially countries like Germany, France, and the UK. These nations are seeing increased investments in digital infrastructure due to stringent data privacy regulations such as GDPR and the growing need for high-performance computing. In Eastern Europe, countries like Russia and Poland are emerging as key markets, driven by industrial digitization and smart city initiatives. Europe’s focus on sustainability and energy efficiency also drives innovation in micro data center deployments, which are often designed with lower energy consumption in mind.

The Asia Pacific region is poised for rapid expansion in the MDC market, with countries like China, India, Japan, and South Korea at the forefront. The region is experiencing a surge in demand due to the increasing digitization of businesses, growing mobile internet users, and the proliferation of 5G networks.

In Latin America, the micro data center market is gradually expanding, with key countries such as Brazil, Mexico, and Argentina leading the charge. Brazil, being the largest economy in the region, is a pivotal market for MDCs, driven by rising IT investments and increasing cloud adoption.

The Middle East & Africa (MEA) region presents a unique opportunity for the MDC market, with increasing adoption of smart city initiatives and growing IT spending in countries like Saudi Arabia, the United Arab Emirates (UAE), and South Africa. The UAE and Saudi Arabia are leading the region’s digital transformation efforts, leveraging MDCs to support advancements in artificial intelligence, IoT, and cloud computing.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The global micro data center market in 2024 is highly competitive, driven by rapid advancements in computing resources, network infrastructure, and power consumption optimization. Major players such as Schneider Electric, Rittal GmbH & Co. KG, and Vertiv Group Corp. are at the forefront of delivering compact, energy-efficient, and scalable micro data center solutions.

Schneider Electric continues to lead with its focus on energy-efficient designs, capitalizing on its established presence in power and automation. Its innovations in edge computing and modular solutions align with increasing demand for scalable and remote data processing capabilities.

Rittal GmbH & Co. KG maintains a strong position by offering robust network infrastructure solutions. Its expertise in industrial enclosures and cooling systems positions it well for the growing need for resilient data center operations, particularly in harsh environments.

Hewlett Packard Enterprise (HPE) emphasizes the integration of high-performance computing resources within its micro data centers. HPE's focus on edge-to-cloud solutions is expected to drive adoption among businesses requiring fast data processing at distributed locations.

IBM Corporation and Vertiv are also significant players, leveraging AI and automation to optimize power consumption and improve operational efficiency. Delta Power Solutions and Eaton bring deep expertise in power management, ensuring reliable energy delivery and further reducing operational costs for end users.

As micro data centers evolve to support IoT, 5G, and edge computing applications, innovation from these key players will be pivotal in addressing challenges in connectivity, power, and environmental sustainability.

Market Key Players

- Schneider Electric

- Rittal GmbH & Co. KG

- Hewlett Packard Enterprise Development LP

- Delta Power Solutions

- Canovate

- Eaton

- Cannon Technologies Ltd.

- IBM Corporation

- Schneider Electric

- Vertiv Group Corp.

- Altron

- Attom Technology

- Other Key Players

Recent Development

- In November 2022, Schneider Electric introduced the EcoStruxure Micro Data Center R-Series 42U Medium Density, further expanding its range of ruggedized micro data centers. This product is designed to simplify the deployment process for IT professionals and solution providers, offering enhanced flexibility and resilience in edge computing environments.

- In March 2024, the Asian Infrastructure Investment Bank (AIIB) and the Banco Nacional de Desenvolvimento Econômico e Social (BNDES) signed a memorandum of understanding (MOU) aimed at advancing sustainable infrastructure development. As part of this broader initiative, micro data center solutions will play a key role in supporting infrastructure growth across the Asia-Pacific region.

- In 2023, Schneider Electric, a leader in the digital transformation of energy management and automation, announced a $3 billion multi-year partnership with Compass Datacenters during its Capital Markets Day. This agreement builds on the companies’ existing collaboration, focusing on the integration of their supply chains to facilitate the production and delivery of prefabricated modular data center solutions.

Report Scope

Report Features Description Market Value (2023) USD 5.9 Bn Forecast Revenue (2033) USD 71.2 Bn CAGR (2024-2032) 29.1 Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Solution, Services), By Rack Unit (Up to 20 RU, 20-40 RU, Above 40 RU), By Enterprise Size (Large Enterprises Small and Medium-Sized Enterprises (SMEs)), By Industry Vertical (BFSI IT & telecommunication, Colocation, Energy, Healthcare, Industrial, and Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Schneider Electric, Rittal GmbH & Co. KG, Hewlett Packard Enterprise Development LP, Delta Power Solutions, Canovate, Eaton, Cannon Technologies Ltd., IBM Corporation, Schneider Electric, Vertiv Group Corp., Altron, Attom Technology, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Schneider Electric

- Rittal GmbH & Co. KG

- Hewlett Packard Enterprise Development LP

- Delta Power Solutions

- Canovate

- Eaton

- Cannon Technologies Ltd.

- IBM Corporation

- Schneider Electric

- Vertiv Group Corp.

- Altron

- Attom Technology

- Other Key Players