5G NTN Market By Component( Hardware, Solution and Service), By Platform (UAS Platform, LEO Satellite, MEO Satellite and GEO Satellite), By Location(Urban, Rural, Remote and Isolated), By End-Use Industry(Maritime, Aerospace & Defense and Other), By Application(eMBB, mMTC and URLLC), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

50951

-

Sept 2024

-

380

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

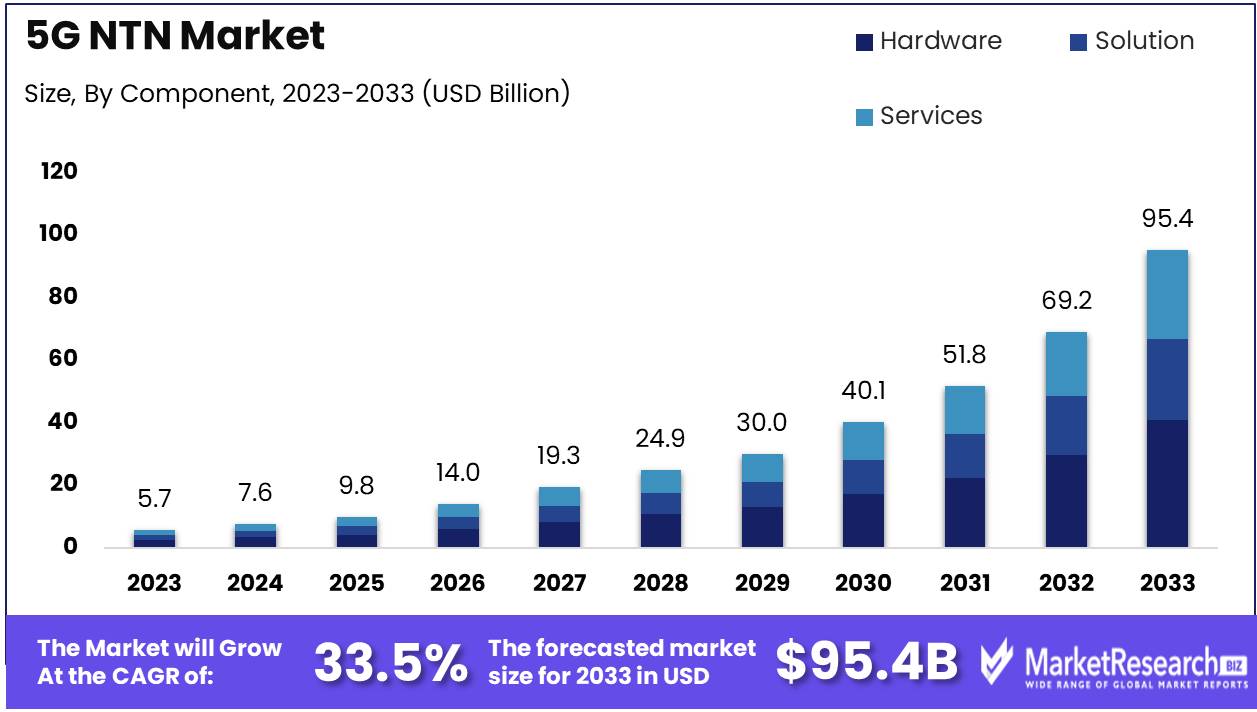

The Global 5G NTN Market was valued at USD 5.7 Billion in 2023. It is expected to reach USD 95.4 Billion by 2033, with a Compound annual growth rate (CAGR) of 33.5% during the forecast period from 2024 to 2033.

The 5G Non-Terrestrial Networks (NTN) market focuses on integrating satellite and aerial communication technologies with 5G infrastructure, enabling seamless connectivity in remote, maritime, and underserved areas. As global demand for ubiquitous, high-speed, and low-latency communications grows, 5G NTN plays a crucial role in expanding coverage beyond terrestrial networks. It supports industries such as logistics, defense, and telecommunications by offering resilient, secure, and wide-ranging connectivity. The convergence of satellite systems and 5G networks enhances operational efficiency, bridging connectivity gaps and accelerating digital transformation across various sectors while driving advancements in IoT, autonomous systems, and global communications.

The 5G Non-Terrestrial Network (NTN) market is poised for significant growth, driven by the convergence of terrestrial and satellite networks. As advancements in satellite technology, such as low Earth orbit (LEO) constellations, continue to reduce latency and improve bandwidth, the feasibility of integrating NTNs with 5G is becoming a reality. This integration is a pivotal component of 3GPP's 5G evolution, particularly with the introduction of Release 17 and further innovations planned in Release 18. NTNs are rapidly emerging as critical enablers of seamless global connectivity, especially in regions where traditional infrastructure is underdeveloped. The ability to merge terrestrial and satellite networks promises to unlock substantial commercial opportunities, with applications ranging from IoT services to enhanced mobile connectivity in remote areas.

Strategic partnerships are accelerating this shift. For instance, Omnispace’s March 2024 collaboration with MTN, Africa's largest mobile network operator, is set to leverage S-band satellite services to expand wireless offerings across 19 countries, directly addressing connectivity gaps for over 290 million customers. Similarly, OneWeb's $50 million multi-year agreement with Galaxy Broadband will extend LEO connectivity across Canada, including its northern territories, a critical step in bridging digital divides. In agriculture, SpaceX’s partnership with John Deere highlights the potential for satellite-based 5G services to transform industries like precision farming. As satellite technologies advance and integration deepens, the 5G NTN market stands at the cusp of becoming a cornerstone for future global connectivity solutions, fostering both technological and economic transformation.

Key Takeaways

- Market Growth: The 5G NTN market is projected to grow at a 33.5% CAGR, reaching USD 95.4 billion by 2033, driven by satellite and terrestrial 5G integration.

- By Component: In 2023, hardware led with 43% market share, crucial for supporting 5G NTN infrastructure like antennas and satellites.

- By Platform : LEO satellites dominated the platform segment with 49% share, offering low-latency and broad coverage, particularly in remote areas.

- By Location: Remote areas held 38.1% of the market in 2023, driven by the need for connectivity in underserved regions.

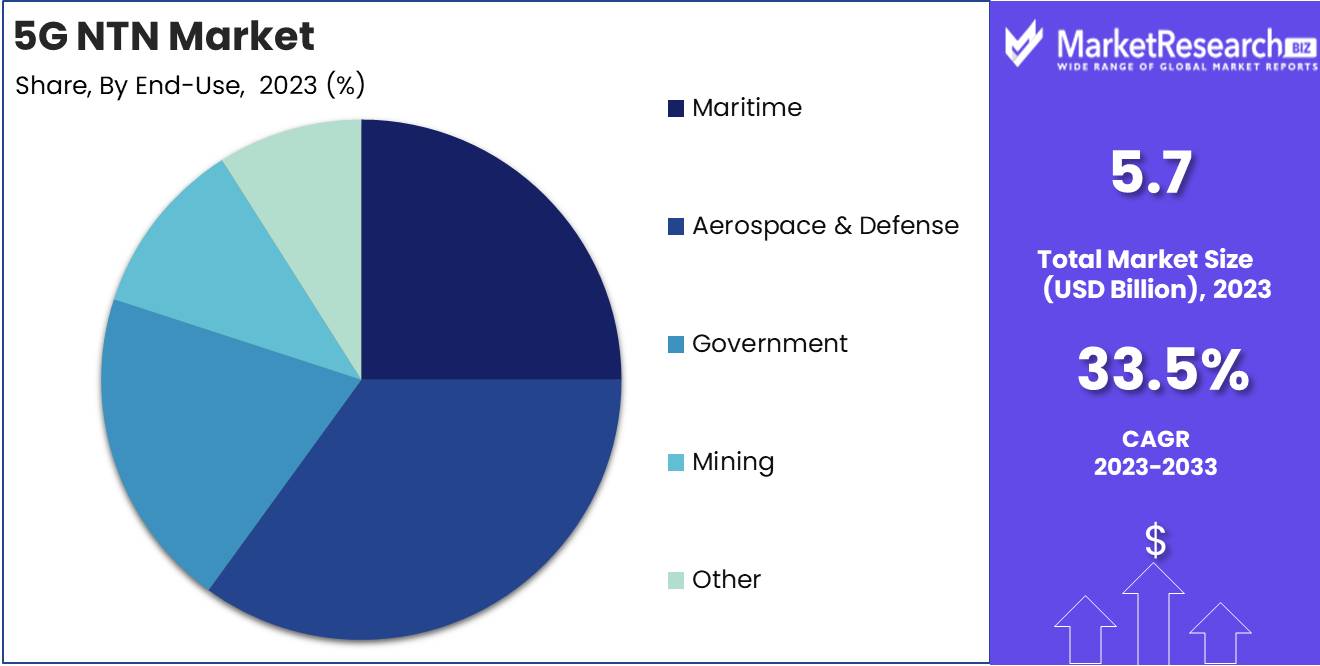

- By End-Use: Aerospace and Defense led with 35.2% market share in 2023, due to the sector's need for secure, global communication networks.

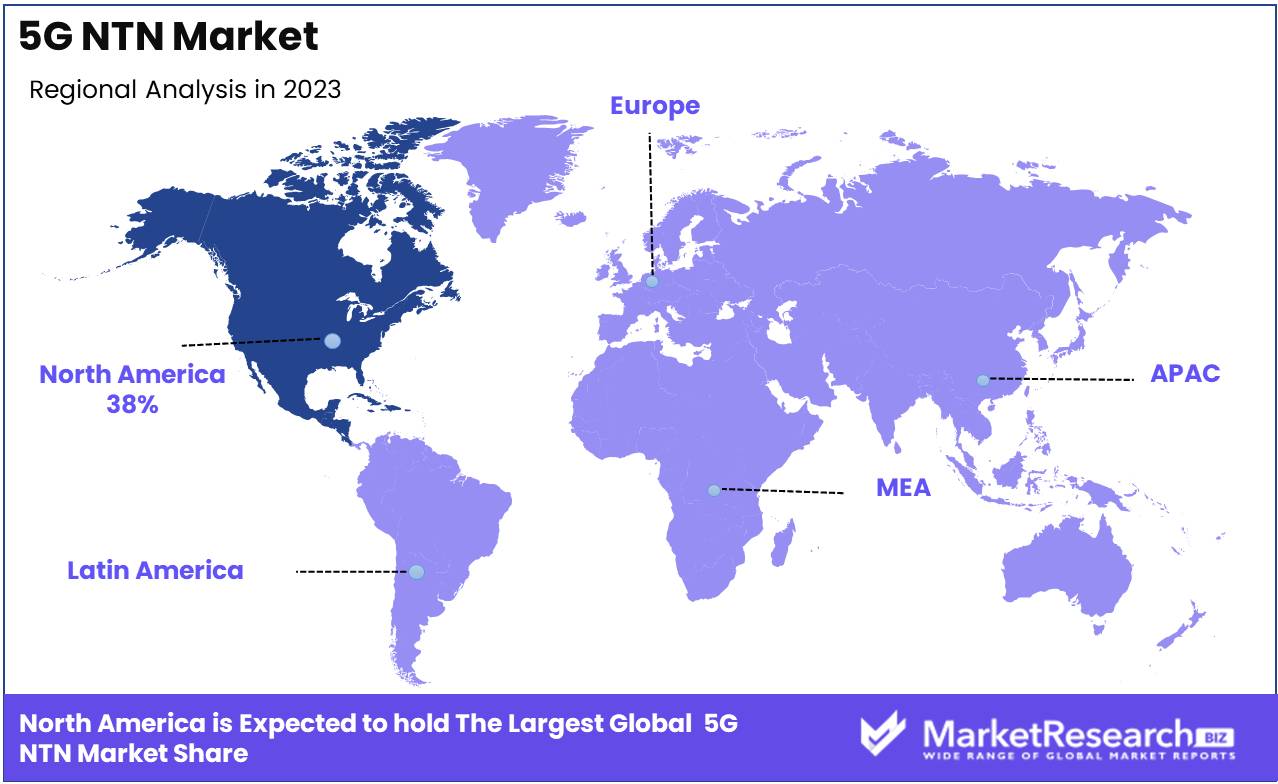

- Regional Dominance: North America held a 38% market share, fueled by investments in rural broadband and satellite infrastructure.

- Growth Opportunity: Significant growth lies in expanding connectivity to underserved areas, particularly through IoT solutions like the SpaceX-John Deere partnership.

- Restraint Factor : Spectrum management is a challenge, requiring coordination to avoid interference between satellite and terrestrial networks.

Driving factors

Rising Demand for High-Speed Connectivity Drives Expansion of 5G NTN

The increasing need for high-speed, low-latency networks is a primary growth driver for the 5G Non-Terrestrial Network (NTN) market. As data-intensive applications like high-definition video streaming, virtual reality (VR), and gaming become more prevalent, especially in underserved regions, the demand for robust connectivity solutions intensifies. 5G NTN offers the capacity to address these gaps, ensuring reliable service where traditional networks fall short, propelling market expansion.

IoT and M2M Communication Fuels Adoption of 5G NTN

The growing reliance on IoT devices and machine-to-machine (M2M) communication is significantly accelerating the demand for 5G NTN. Industries such as manufacturing, agriculture, and transportation, which require real-time data processing and communication, benefit from the high-speed, reliable networks that 5G NTN delivers. This trend further underscores the market’s expansion as sectors increasingly depend on connected devices for operational efficiency.

Restraining Factors

Effective Spectrum Management: The Backbone of 5G NTN Market Growth

Spectrum management plays a pivotal role in enabling the growth of the 5G non-terrestrial networks (NTN) market, as efficient coordination between terrestrial and satellite-based networks is critical to avoid performance degradation. The rising demand for high-speed, low-latency communication across industries means that interference between these networks can severely impact service quality, particularly in densely populated areas where spectrum congestion is prevalent.

Regulatory bodies and industry stakeholders are actively working to harmonize spectrum allocation to support seamless operation across different network types. For instance, leveraging dynamic spectrum sharing (DSS) technologies and advanced frequency coordination techniques will allow for more flexible spectrum utilization, mitigating interference risks. This not only preserves service integrity but also drives the adoption of 5G NTN by ensuring that performance standards are met across diverse applications, from remote connectivity to advanced IoT services.

Coverage and Capacity Limitations: The Dual-Edged Sword of 5G NTN Deployment

The 5G NTN market's growth is driven in part by its promise of extending connectivity to underserved and remote regions, areas where terrestrial networks often falter due to geographic or infrastructural challenges. However, limitations in coverage and capacity compared to terrestrial 5G networks present a significant challenge to widespread adoption.

While 5G NTN can fill coverage gaps in remote and rural areas, the overall capacity remains lower than that of ground-based 5G networks, particularly in urban environments where demand for high bandwidth is intense. The limited spectrum available to satellite networks exacerbates this issue, restricting the ability to deliver comparable data speeds and throughput in high-density areas. Moreover, high latency—especially in geostationary satellite communications—can hinder certain real-time applications, such as augmented reality (AR) and autonomous driving.

By Component Analysis

In 2023, hardware held a dominant market position in the By Component segment of the 5G Non-Terrestrial Network (NTN) market, capturing more than a 43% share. This dominance is largely attributed to the critical role that hardware components such as antennas, satellites, and gateways play in the infrastructure and deployment of 5G NTN systems. As the backbone of 5G NTN architecture, hardware ensures the robust transmission and reception of data over non-terrestrial platforms, making it indispensable in the ongoing global expansion of 5G networks.

The solution segment is another key contributor to the 5G NTN market, encompassing a range of software and platform-based offerings designed to enhance system efficiency, manage connectivity, and optimize the integration between terrestrial and non-terrestrial networks. As demand for seamless connectivity and higher data throughput grows, the solution segment is expected to experience notable growth in the coming years, particularly as industries look to leverage advanced analytics, network management tools, and customized solutions to optimize network performance.

The service segment, while smaller in comparison, plays an essential supporting role within the 5G NTN ecosystem. This category includes installation, integration, maintenance, and managed services, all of which are critical for ensuring the successful deployment and operational continuity of 5G NTN systems. As organizations increasingly adopt 5G NTN for various applications, including remote communications, IoT, and autonomous systems, the demand for professional services is expected to rise steadily.

By Platform Analysis

In 2023, the Low Earth Orbit (LEO) Satellite held a dominant market position in the By Platform segment of the global 5G Non-Terrestrial Network (NTN) market, capturing more than 49% of the total market share. The LEO Satellite segment's robust growth is driven by its advantages in low-latency communication, cost-effective deployment, and ability to deliver high-speed connectivity to underserved regions. LEO satellites' closer proximity to Earth, compared to Medium Earth Orbit (MEO) and Geostationary Earth Orbit (GEO) satellites, enables faster data transmission rates, positioning it as a key enabler for 5G NTN expansion, particularly in remote and rural areas.

The UAS (Unmanned Aerial System) Platform segment also shows potential for growth, leveraging flexible deployment capabilities for 5G coverage in areas with limited infrastructure. However, its market share remained smaller compared to the LEO Satellite in 2023.

MEO (Medium Earth Orbit) Satellite and GEO (Geostationary Earth Orbit) Satellite segments account for a relatively lower market share. While MEO satellites offer a balance between coverage and latency, and GEO satellites are valuable for wide-area broadcast services, their higher latency and more costly deployment hinder their competitiveness against LEO satellites in the evolving 5G NTN landscape.

By Location Analysis

In 2023, remote held a dominant market position in the "By Location" segment of the 5G Non-Terrestrial Networks (NTN) market, capturing more than a 38.1% share. This dominance is largely attributed to the increasing demand for enhanced connectivity in remote and underserved regions, where traditional terrestrial networks struggle to provide sufficient coverage. The following breakdown of the "By Location" segment offers key insights

The remote segment accounted for the largest share of the market, driven by the critical need to bridge the digital divide in sparsely populated areas. Remote locations often face significant challenges with conventional network infrastructure, making 5G NTN solutions an essential alternative for ensuring reliable communication services. The ability to provide high-speed, low-latency connectivity through satellites and other non-terrestrial systems has made 5G NTN a game-changer in these regions, enabling new opportunities in areas like telemedicine, remote education, and emergency services.

Urban areas, though traditionally well-served by existing network infrastructure, continue to see steady growth in 5G NTN deployments. Urban centers contributed a substantial share to the 5G NTN market due to the increasing demand for ultra-reliable low-latency communication (URLLC) for applications such as autonomous vehicles, smart cities, and industrial automation. However, their market share was overshadowed by the remote segment, reflecting the saturation of terrestrial networks in urban locations.

The rural segment also saw significant adoption of 5G NTN solutions, particularly in regions where extending terrestrial networks is cost-prohibitive. With agricultural sectors increasingly adopting IoT-driven technologies, 5G NTN has become a key enabler of smart farming practices and real-time data exchange. While the rural segment accounted for a notable portion of the market, it lagged behind the remote segment in terms of market penetration.

Isolated areas, including geographically challenging regions such as mountainous areas and islands, represented a niche yet crucial part of the 5G NTN market. Although the market share of isolated locations was smaller compared to other segments, there is growing interest in leveraging 5G NTN technology to provide critical communication infrastructure in these otherwise unreachable locations. This segment is expected to witness steady growth as the technology matures and becomes more accessible.

By End-Use Analysis

In 2023, Aerospace and Defense held a dominant market position in the "By End-Use" segment of the 5G Non-Terrestrial Networks (NTN) market, capturing more than a 35.2% share. The sector’s reliance on advanced, secure, and highly reliable communication networks for mission-critical operations made 5G NTN a crucial technology, driving strong adoption. Below is a detailed analysis of the By End-Use segment

The Aerospace and Defense sector led the market, largely due to the heightened need for real-time data transmission, global coverage, and secure communication channels in military and aviation applications. 5G NTN technology, which includes satellite-based communication and low-earth orbit (LEO) systems, offers enhanced situational awareness, rapid data transfer, and robust connectivity in remote or conflict-prone regions. As governments and defense agencies increasingly adopt sophisticated unmanned systems, autonomous drones, and real-time surveillance technologies, 5G NTN has become a strategic enabler for mission-critical operations, significantly contributing to the sector’s market share dominance.

The maritime sector followed closely behind in its adoption of 5G NTN technologies. With shipping routes, offshore oil platforms, and other maritime operations often located far from terrestrial networks, the sector faces unique connectivity challenges. 5G NTN solutions provide high-speed, continuous connectivity for vessel tracking, real-time navigation systems, and crew welfare applications. While the maritime sector holds a notable share of the market, it remains slightly behind Aerospace and Defense due to the latter’s more immediate and strategic use cases.

Government agencies also represent a substantial portion of the 5G NTN market. From disaster response coordination to border security and infrastructure management, 5G NTN enables seamless communication in areas underserved by terrestrial networks. Governments are increasingly investing in this technology to support public safety and emergency services, ensuring robust communication systems are in place during critical situations. Despite this significant interest, the segment remains third in market share compared to the Aerospace and Defense and Maritime sectors.

The mining sector has seen growing adoption of 5G NTN, particularly in remote locations where mining operations often occur. The use of NTN technology supports the implementation of autonomous vehicles, remote machinery operation, and real-time data analytics, improving both safety and operational efficiency. However, while there is notable growth potential in this sector, the mining segment still holds a smaller market share relative to the larger Aerospace and Defense and Maritime sectors.

The Other segment, encompassing industries such as agriculture, transportation, and energy, accounts for a diverse range of applications. These sectors leverage 5G NTN for tasks like smart farming, utility management, and connected logistics in remote or underserved regions. Although collectively significant, this segment remains the smallest in terms of market share, reflecting the more niche or specialized use cases relative to other end-use categories.

By Application Analysis

In 2023, massive Machine-Type Communications (mMTC) held a dominant market position in the "By Application" segment of the 5G Non-Terrestrial Networks (NTN) Market, capturing more than 46.4% of the overall market share. This leadership reflects the increasing demand for highly scalable connectivity solutions required for Internet of Things (IoT) devices, industrial automation, and smart city applications. mMTC is crucial for supporting a vast number of low-power, low-data-rate devices that communicate over wide geographic areas, making it a cornerstone of the evolving 5G NTN infrastructure. The adoption of mMTC is being driven by industries such as agriculture, logistics, and smart infrastructure, which require extensive connectivity with minimal human intervention.

In contrast, enhanced Mobile Broadband (eMBB) accounted for a substantial portion of the 5G NTN market, driven by the need for high-speed, high-capacity data transmission in both consumer and enterprise applications. eMBB is particularly critical in providing seamless, high-quality connectivity in remote or underserved regions, enabling services such as video streaming, augmented reality (AR), and immersive experiences. Although it did not capture the dominant share, its growing integration in satellite-based 5G solutions indicates a key role in expanding broadband access globally.

Ultra-Reliable Low-Latency Communications (URLLC), while representing a smaller segment of the market, is expected to experience significant growth in the coming years due to its application in mission-critical communications. This includes sectors like autonomous transportation, healthcare, and industrial robotics, where near-instantaneous data transmission with minimal latency is critical. Although URLLC’s market share is currently smaller compared to mMTC and eMBB, its importance in enabling real-time applications in highly dynamic and sensitive environments positions it as a high-growth area within the 5G NTN landscape.

Key Market Segments

By Component

- Hardware

- Solution

- Service

By Platform

- UAS Platform

- LEO Satellite

- MEO Satellite

- GEO Satellite

By Location

- Urban

- Rural

- Remote

- Isolated

By End-Use

- Aerospace & Defense

- Government

- Mining

- Other

By Application

- eMBB

- mMTC

- URLLC

Growth Opportunity

Expansion of Universal Connectivity Needs

As the world increasingly relies on data-driven applications, the need for seamless and universal connectivity is paramount. In 2024, the 5G Non-Terrestrial Network (NTN) market is positioned for significant growth, driven by its ability to provide coverage in regions where terrestrial networks are either limited or non-existent. Key sectors such as agriculture, remote healthcare, and disaster management are among the industries that stand to benefit from 5G NTN solutions, which can extend connectivity to rural and underserved areas. This trend aligns with the broader evolution toward global connectivity, allowing for enhanced communication, IoT integration, and improved service delivery across a wider geographical span.

NTN in Evolution Toward 5G and 6G

The rapid development of 5G NTN technology also reflects its foundational role in the transition toward 6G networks. By 2024, companies investing in this sector will have an early-mover advantage as they lay the groundwork for future 6G standards, which will further accelerate network capabilities, enabling faster data transmission and supporting advanced applications like autonomous transportation and smart cities. Satellite providers, in particular, are expected to play a crucial role in bridging the connectivity gap, underscoring the importance of NTN systems in meeting both current and future demands for high-speed, reliable communication.

Latest Trends

Integration with Terrestrial Networks

One of the most significant trends in 2024 is the seamless integration of NTN with terrestrial 5G networks. Companies are focused on bridging the gap between satellite and ground-based systems to provide uninterrupted connectivity. This hybrid approach enhances coverage in regions where terrestrial networks alone are insufficient, such as rural or maritime areas. Integration enables network operators to expand their service offerings and address gaps in coverage, thereby unlocking new revenue streams.

Focus on Software-Centric Approaches

Another emerging trend is the growing emphasis on software-centric solutions. Traditional network infrastructure is giving way to virtualized, cloud-based models that offer flexibility, scalability, and cost efficiency. By leveraging software-defined networking (SDN) and network function virtualization (NFV), operators can streamline their operations and respond more dynamically to customer demands. This shift reduces reliance on costly hardware investments and accelerates time-to-market for 5G NTN services.

Regional Analysis

North America Dominates with 38% Largest Market Share

North America, which dominates the market with a 38% share, is at the forefront of 5G NTN adoption. This region benefits from robust investments in satellite technology and telecommunications infrastructure, particularly in the United States, where demand for rural connectivity, defense, and space-related applications is accelerating market growth. The U.S. government’s initiatives to expand broadband coverage and support for private-sector innovation in satellite networks are key growth drivers.

Europe follows closely, driven by increased focus on digital transformation, connectivity expansion in remote areas, and strong public-private partnerships. The European Space Agency (ESA) and national governments are heavily investing in NTN technologies, particularly in sectors like agriculture and transportation. Countries like the UK and France are spearheading efforts to integrate terrestrial and non-terrestrial networks, creating substantial market opportunities.

Asia Pacific is seeing rapid growth, fueled by rising demand for enhanced connectivity across emerging markets such as India and China. Investments in satellite technology, driven by the need to support 5G expansion in rural and mountainous regions, are propelling the market. China, in particular, has ambitious plans to deploy large-scale satellite constellations to complement its terrestrial networks, positioning it as a future market leader.

Middle East & Africa is in the nascent stages of 5G NTN adoption, with efforts focused primarily on improving communication infrastructure in underserved regions. Governments in the UAE and Saudi Arabia are making significant investments in space and satellite technology, aiming to boost economic diversification and support smart city initiatives.

Latin America is witnessing moderate growth, with regional telecom providers exploring NTN solutions to address connectivity challenges in remote and rural areas. Countries like Brazil and Mexico are key players, seeking to leverage NTN technology to support agriculture and disaster recovery operations.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

The global 5G Non-Terrestrial Networks (NTN) market in 2024 is marked by the presence of a diverse group of key players, each contributing to the ecosystem with distinct strengths and innovations. Qualcomm Technologies and MediaTek Inc., as semiconductor giants, continue to dominate the chipset space, providing critical components for enabling 5G NTN integration across various devices. Their role is essential in supporting the advancement of seamless satellite-to-ground communication.

Companies like OneWeb and Intelsat focus on satellite communications, pushing the boundaries of global connectivity, particularly in remote and underserved areas. Their satellite constellations play a pivotal role in expanding 5G NTN services, complementing terrestrial networks.

Traditional telecom leaders such as Ericsson, Nokia, and ZTE Corporation are spearheading efforts to integrate 5G infrastructure with NTN capabilities, driving advancements in network equipment and connectivity solutions. These firms are also key players in expanding 5G NTN’s commercial and industrial applications, enabling industries such as aviation, maritime, and defense to benefit from enhanced communication technologies.

Thales Group, with its expertise in aerospace and defense, is positioned to bridge the gap between civilian and military applications of 5G NTN, particularly in critical communication systems. Meanwhile, testing and measurement companies like Keysight Technologies, Rohde & Schwarz, and Spirent Communications provide essential validation and optimization tools to ensure the robustness and reliability of 5G NTN networks.

Emerging players like Omnispace LLC and Skylo Technologies bring innovation to the market, focusing on IoT and hybrid satellite-cellular solutions, addressing niche demands across agriculture, logistics, and emergency services.

Market Key Players

- Qualcomm Technologies

- MediaTek Inc.

- OneWeb

- Thales Group

- Ericsson

- ZTE Corporation

- Keysight Technologies

- Intelsat

- Omnispace LLC

- SoftBank Group Corporation

- Spirent Communications

- Rohde & Schwarz

- Echostar Corporation

- Skylo Technologies

- Nokia

- Other Key players

Recent Development

- In March 12, 2024, Omnispace announced a strategic partnership with MTN, Africa's largest mobile network operator. MTN, which serves over 290 million customers across 19 countries, offers voice, data, fintech, digital, enterprise, wholesale, and API services. This collaboration will explore the use of S-band satellite services to enhance MTN’s wireless service offerings and improve connectivity across its markets.

- In February 1, 2023, OneWeb and Galaxy Broadband Communications Inc., an Ontario-based satellite service provider, finalized a $50 million USD multi-year agreement. The partnership aims to deliver OneWeb’s low Earth orbit (LEO) satellite connectivity solutions across Canada, including the northern territory of Nunavut. This deal forms part of a larger initiative to bolster 5G connectivity in underserved regions.

- In March 2024, SpaceX and John Deere entered into a partnership to provide advanced satellite communications (SATCOM) services to farmers using the Starlink network. This collaboration seeks to overcome rural connectivity challenges, enabling farmers to fully utilize precision agriculture technologies.

Report Scope

Report Features Description Market Value (2023) USD 5.7 Bn Forecast Revenue (2033) USD 95.4 Bn CAGR (2024-2032) 33.5% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component( Hardware, Solution and Service), By Platform (UAS Platform, LEO Satellite, MEO Satellite and GEO Satellite), By Location(Urban, Rural, Remote and Isolated), By End-Use Industry(Maritime, Aerospace & Defense, Government, Mining and Other), By Application(eMBB, mMTC and URLLC) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Qualcomm Technologies, MediaTek Inc., OneWeb, Thales Group, Ericsson, ZTE Corporation, Keysight Technologies, Intelsat, Omnispace LLC, SoftBank Group Corporation, Spirent Communications, Rohde & Schwarz, Echostar Corporation, Skylo Technologies, Nokia, Other Key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Qualcomm Technologies

- MediaTek Inc.

- OneWeb

- Thales Group

- Ericsson

- ZTE Corporation

- Keysight Technologies

- Intelsat

- Omnispace LLC

- SoftBank Group Corporation

- Spirent Communications

- Rohde & Schwarz

- Echostar Corporation

- Skylo Technologies

- Nokia

- Other Key players