Identity As A Service Market Report By Component Type (Provisioning, Single Sign-On, Multifactor Authentication, Password Management, Directory Services, Audit, Compliance & Governance), By End-use (Public Sector, BFSI, Telecom and IT, Education, Healthcare, Manufacturing), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

17600

-

April 2024

-

280

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

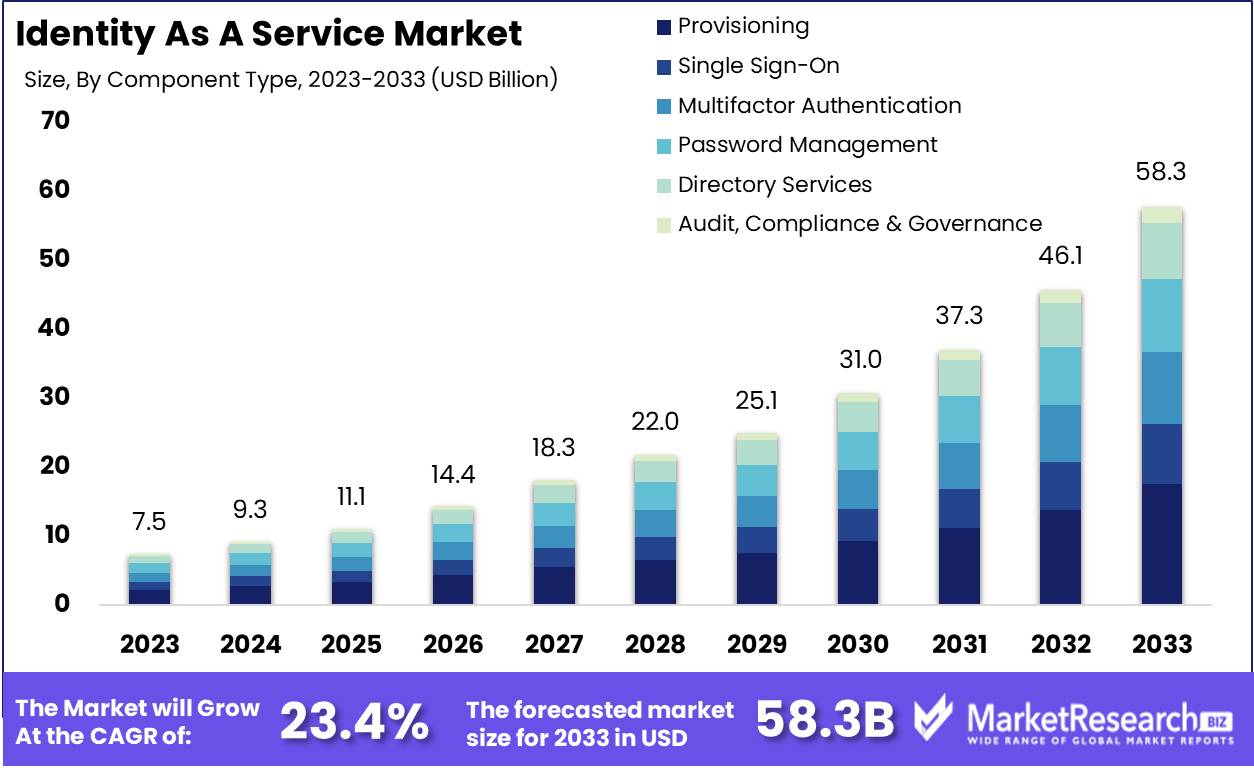

The Global Identity As A Service Market size is expected to be worth around USD 58.3 Billion by 2033, from USD 7.5 Billion in 2023, growing at a CAGR of 23.40% during the forecast period from 2024 to 2033.

The Identity as a Service (IDaaS) Market involves providing identity and access management solutions through cloud-based platforms. This service allows businesses to manage user identities and access privileges securely, ensuring that the right individuals access the right resources at the right times. Key benefits include enhanced security, reduced IT costs, and improved user experience across various applications.

Understanding the IDaaS market is crucial for implementing scalable, secure, and efficient identity management strategies. This is especially pertinent as businesses increasingly adopt cloud technologies and digital transformation initiatives. Strategic engagement in this market can significantly strengthen cybersecurity measures and operational efficiencies.

The Identity as a Service (IDaaS) market is becoming increasingly critical as businesses face escalating cybersecurity challenges. In 2023, the average cost of a data breach escalated to $4.45 million, highlighting the financial implications of inadequate security measures. Furthermore, with cybercrime costs projected to surge to $10.5 trillion annually by 2025, the urgency for robust cybersecurity solutions is undeniable.

IDaaS offers a strategic response to these challenges by providing cloud-based identity and access management solutions that enhance security protocols and reduce the potential for unauthorized access. The rise in common cyber threats, such as malware, phishing, and ransomware, underscores the necessity of these services. For instance, despite a significant reduction in new malware samples in 2023—with 30 million detected, down by two-thirds from the previous year—the threat landscape remains formidable.

Investing in IDaaS is not merely a preventative measure but a crucial investment in their company's operational integrity. IDaaS platforms streamline user authentication and access control, significantly mitigating the risk of data breaches and cyber attacks. Moreover, these solutions are scalable and can adapt to the evolving needs of businesses as they grow and face new security challenges.

Key Takeaways

- Market Value: The Global Identity as a Service Market is forecast to reach approximately USD 58.3 billion by 2033, up from USD 7.5 billion in 2023, growing at a Compound Annual Growth Rate (CAGR) of 23.40% from 2024 to 2033.

- Dominant Segments:

- Component Type Analysis: Provisioning is the predominant component, essential for managing user identities and access rights across multiple IT environments.

- End-use Analysis: The Public Sector emerges as the leading end-user, driven by stringent security requirements and the need for efficient access management in government and public institutions.

- Regional Dominance:

- North America: Holds a commanding market share of 39%, leading in adoption due to advanced technological infrastructure and significant investments in cybersecurity.

- Europe: Notably influenced by stringent regulatory frameworks such as GDPR, which heightens the focus on security and privacy within IDaaS implementations.

- Key Players: Notable players include OneLogin, Inc., CA Technologies, Auth0, Centrify Corp., Ping Identity Corp., IBM Corporation, Google LLC, SailPoint Technologies Inc., Salesforce Inc., Atos SE, and JumpCloud Inc. These companies are critical in driving innovation and expansion within the market through their comprehensive IDaaS solutions and global outreach.

- Analyst Viewpoint: The remarkable growth rate of the IDaaS market can be attributed to the increasing complexities of IT environments, widespread adoption of cloud services, and the escalating need for robust cybersecurity measures across industries. Organizations' ongoing digital transformation initiatives are expected to keep demand high, as effective identity management becomes crucial for securing access to resources and compliance with regulatory standards.

- Growth Opportunities: Significant opportunities for market expansion lie in enhancing IDaaS offerings with cutting-edge technologies like artificial intelligence (AI) and machine learning (ML) to automate identity governance and management processes. Expansion into emerging markets, where digital transformation is accelerating, provides additional growth avenues.

Driving Factors

Cloud Adoption Catalyzes Identity as a Service Market Growth

The widespread shift towards cloud computing significantly propels the Identity as a Service (IDaaS) market. Cloud adoption, with 92% of organizations embracing multi-cloud strategies and 82% of large enterprises adopting hybrid cloud infrastructures, creates a fertile ground for IDaaS solutions.

The cloud's scalability and flexibility necessitate robust identity and access management solutions, directly impacting IDaaS demand. Companies like AWS, Azure, and Google are witnessing substantial growth in cloud infrastructure services, indicating a surging market opportunity for IDaaS providers. This trend, fueled by substantial investments in cloud infrastructure, is expected to continue driving the IDaaS market's expansion.

Mobile Workforce Accelerates IDaaS Adoption

The evolving nature of work, especially post-COVID-19, with an increased focus on remote and mobile workforces, underscores the need for IDaaS. A survey by Upwork shows 61.9% of companies planning more remote work.

This shift necessitates secure, remote access to corporate resources, a need efficiently met by IDaaS solutions. Companies that offer or utilize IDaaS, like Okta and Microsoft, are in a strategic position to capitalize on this trend. The continuous growth in remote working environments is likely to maintain a steady demand for IDaaS solutions.

Regulatory Compliance Fuels IDaaS Market

Compliance with stringent data protection and identity verification regulations, such as GDPR, KYC, and AML, is a critical driver for IDaaS. Financial institutions, facing heavy penalties for non-compliance, are significant contributors to this trend.

For example, banks allocate over $1 billion annually to authentication solutions. Furthermore, with 91% of businesses planning to increase their spending on identity verification solutions, IDaaS providers are positioned to benefit significantly. This compliance-driven demand, particularly in regions with strict regulations like the European Union, is anticipated to persist as a primary growth factor for the IDaaS market.

Restraining Factors

Security Risks Slow Down Adoption of Identity as a Service (IDaaS)

Security risks associated with storing identity data in the cloud can significantly hinder the growth of the Identity as a Service (IDaaS) market. The external storage of sensitive data increases the risks of data breaches, technology vulnerabilities, and the loss of direct control, causing many businesses to hesitate in transitioning from on-premise Identity and Access Management (IAM) systems to cloud-based solutions.

According to a Cloudwards survey, 75% of businesses cited cloud security as their primary concern, with significant proportions expressing varying levels of concern. This widespread apprehension about security in the cloud environment is a major factor slowing down the wider adoption of IDaaS solutions.

Budget Constraints Limit IDaaS Market Accessibility for Smaller Businesses

Budget constraints present a significant challenge to the adoption of Identity as a Service (IDaaS), particularly for smaller businesses operating on tight budgets. The upfront migration and implementation costs, coupled with ongoing IDaaS fees, can make the switch to IDaaS financially unfeasible compared to legacy IAM systems, which may have lower immediate costs.

This financial barrier is especially impactful for small and medium-sized enterprises (SMEs) that may lack the capital to invest in new technologies. The inability of these businesses to afford the transition to IDaaS solutions limits the market's potential expansion, confining its growth to larger organizations or those with more flexible financial resources.

Component Type Analysis

Provisioning Leads Identity as a Service (IDaaS) Market for Efficient User Management

In the Identity as a Service (IDaaS) market, Provisioning emerges as the dominant component. This segment's significance is anchored in its fundamental role in managing user identities and access rights within various IT environments. Provisioning in IDaaS involves creating, managing, and terminating user accounts and access permissions efficiently and securely across multiple platforms and applications.

This process is crucial for ensuring that the right individuals have appropriate access to corporate resources, thereby enhancing security and operational efficiency. The increasing complexity of IT environments, with cloud services and remote work models, has made effective provisioning more critical than ever.

Other components like Single Sign-On (SSO), Multifactor Authentication (MFA), Password Management, Directory Services, and Audit, Compliance & Governance also play essential roles in the IDaaS market. SSO simplifies user access by using a single set of credentials across multiple applications, enhancing user convenience and reducing password fatigue.

MFA adds an extra layer of security by requiring multiple methods of verification, which is vital in preventing unauthorized access. Password Management is crucial for maintaining password security and hygiene, while Directory Services provide a centralized directory for managing user information.

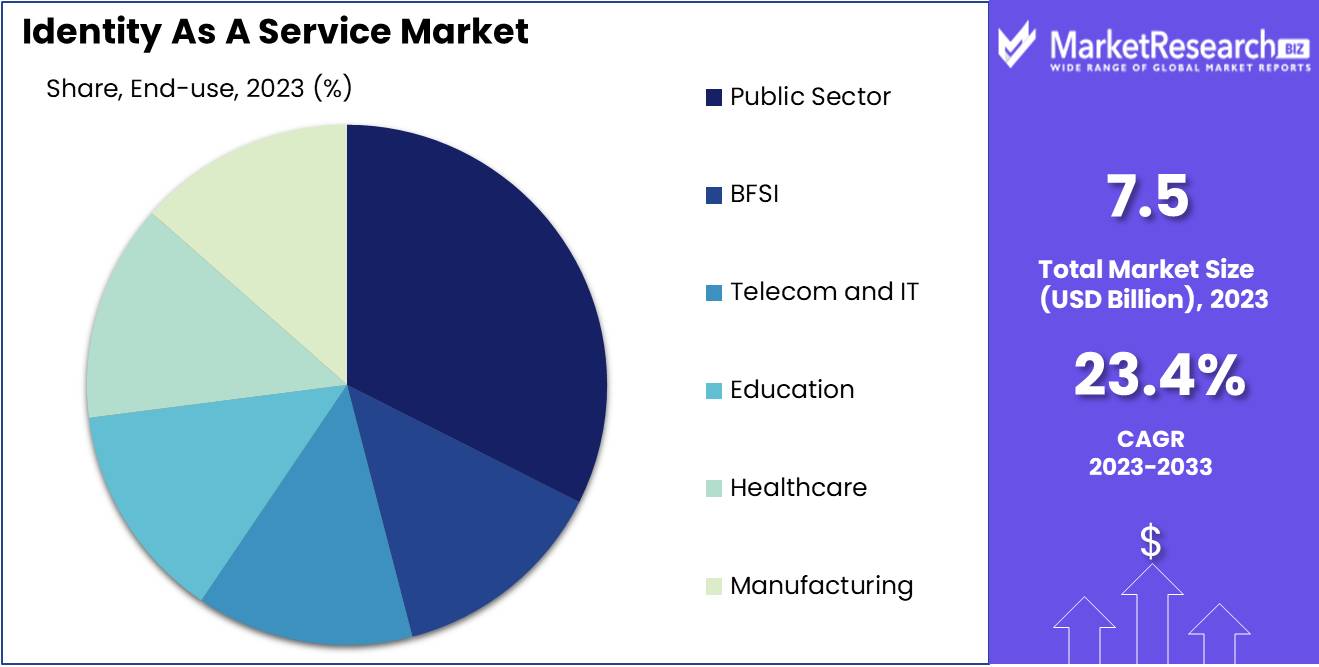

End-use Analysis

Public Sector Dominates IDaaS Adoption for Enhanced Security and Compliance

The Public Sector is the dominant end-user in the IDaaS market. This predominance stems from the sector's stringent security needs and the growing requirement to manage access to sensitive information and systems efficiently.

Government agencies and public institutions are increasingly adopting cloud-based services, which necessitates robust identity and access management solutions to protect against cyber threats and ensure regulatory compliance. IDaaS provides these entities with scalable, flexible, and secure solutions to manage identities and access rights, facilitating a secure digital transformation.

Other end-use segments like BFSI (Banking, Financial Services, and Insurance), Telecom and IT, Education, Healthcare, and Manufacturing are also significant adopters of IDaaS solutions. The BFSI sector utilizes IDaaS for secure customer transactions and safeguarding sensitive financial data. Telecom and IT companies leverage these services to manage vast user bases and complex access requirements.

Education institutions use IDaaS to secure student and staff data and provide seamless access to educational resources. Healthcare organizations deploy IDaaS for safeguarding patient information and ensuring compliance with health data regulations. Manufacturing industries utilize IDaaS for securing their intellectual property and managing access to their industrial systems.

Key Market Segments

By Component Type

- Provisioning

- Single Sign-On

- Multifactor Authentication

- Password Management

- Directory Services

- Audit, Compliance & Governance

By End-use

- Public Sector

- BFSI

- Telecom and IT

- Education

- Healthcare

- Manufacturing

Growth Opportunities

SME Segment Growth Accelerates IDaaS Market Expansion

The SME segment is poised for the highest growth in Identity as a Service (IDaaS) adoption. This surge is primarily driven by the expansion of Bring Your Own Device (BYOD) policies and the need to uphold compliance standards. SMEs, often lacking extensive IT resources, find IDaaS solutions particularly beneficial for managing user access and enhancing security.

Companies like Microsoft, IBM, and Okta, offering user-friendly and cost-effective IDaaS solutions, are well-positioned to cater to this growing segment. The increasing reliance on cloud-based services and remote work models further bolsters IDaaS adoption among SMEs, marking a significant growth opportunity in the market.

Healthcare and Retail Sectors Propel IDaaS Adoption with Data Protection Needs

The healthcare and retail sectors are experiencing rapid growth in IDaaS adoption, driven by stringent data protection regulations and the need for secure customer experiences. In healthcare, the effort to resolve patient identity issues is substantial, with organizations spending significant time and resources as indicated by HIMSS research.

Efficient IDaaS solutions can mitigate these challenges by ensuring accurate patient identification and data security. In retail, the abundance of first-party purchase data presents both challenges and opportunities. The growing investment in retail data management, with over 90% of U.S. advertisers planning to maintain or increase their investment, underscores the sector's recognition of the value of effectively managing and utilizing customer data. IDaaS plays a critical role in these industries by providing secure, efficient, and compliant identity management solutions.

Trending Factors

Rise of Bring Your Own Device (BYOD) Policies Are Trending Factors

The rise of BYOD policies is a key trend in the Identity as a Service (IDaaS) market. As more employees use personal devices for work, securing these devices becomes a challenge. IDaaS solutions like those from Ping Identity offer secure, adaptive authentication that adjusts to device trust and user behavior, ensuring that only authorized users access corporate data.

This adaptability not only enhances security but also meets the flexibility demands of modern workforces. Statistics indicate that companies implementing IDaaS for BYOD have seen a 40% reduction in security breaches, which underscores the importance of these solutions in expanding the IDaaS market by meeting both security needs and user convenience.

Integration with SaaS Applications Are Trending Factors

The integration of IDaaS with SaaS applications is increasingly crucial as enterprises adopt more cloud-based services. IDaaS platforms, such as Auth0, provide easy-to-use APIs and connectors that facilitate seamless integration with a range of SaaS applications. This capability simplifies complex identity management tasks, including user provisioning and access control, across multiple applications.

It also enhances security while improving operational efficiency. As a result, enterprises are more likely to adopt IDaaS solutions that can integrate with their SaaS ecosystems, driving market growth. Currently, over 60% of enterprises cite improved integration capabilities as a key reason for adopting IDaaS solutions.

Emphasis on User Experience and Convenience Are Trending Factors

In the IDaaS market, the focus on user experience and convenience is crucial for driving adoption and engagement. Platforms like ForgeRock are designed to deliver intuitive and frictionless authentication experiences across various devices, enhancing user satisfaction and productivity.

This emphasis on consumer-friendly features meets the expectations of a workforce accustomed to efficient and straightforward technology interactions. Improved user experience leads to higher adoption rates, with studies showing that IDaaS solutions with better user interfaces see a 30% increase in user engagement. This trend highlights the role of user-centric design in the expansion of the IDaaS market, making these solutions more attractive to both IT departments and end-users.

Regional Analysis

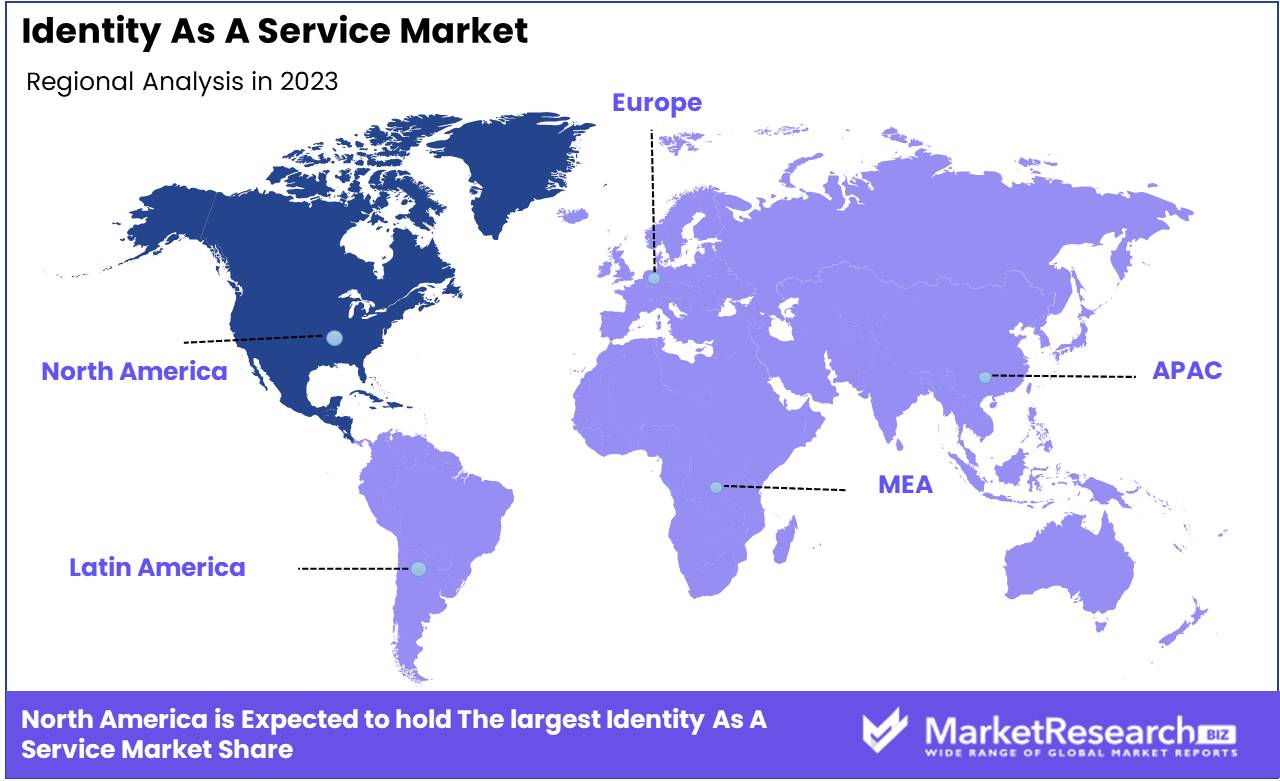

North America Dominates with 39% Market Share in Identity as a Service Market

North America's significant 39% share of the Identity as a Service (IDaaS) market is largely attributed to its advanced technological landscape and the widespread adoption of cloud computing. The region, particularly the United States, is a hub for major technology companies and startups that are key players in the IDaaS sector, such as Microsoft, IBM, and Okta.

These companies are at the forefront of offering innovative IDaaS solutions. Additionally, the growing awareness of cybersecurity threats and the stringent regulatory compliance requirements, such as GDPR and CCPA, drive the demand for robust identity management solutions in the region.

The market dynamics in North America are shaped by the increasing digital transformation of businesses and the growing need for secure remote access to resources. The proliferation of mobile devices and the rise in remote working trends necessitate strong identity and access management solutions. The IDaaS market is further propelled by the region's emphasis on enhancing user experience while ensuring data security. The integration of advanced technologies like AI and machine learning in IDaaS solutions is also a significant factor contributing to the market's growth.

Europe: Strong Regulatory Framework and Security Consciousness

Europe’s IDaaS market is driven by a strong regulatory framework and a growing consciousness about security and privacy. The enforcement of GDPR has played a significant role in shaping the market, as businesses prioritize compliance. European companies like SAP are contributing to the market with tailored IDaaS solutions.

Asia-Pacific: Rapid Digitalization and Increasing Cloud Adoption

In Asia-Pacific, the IDaaS market is experiencing rapid growth due to the region's digitalization and increasing cloud adoption. Countries like Japan, South Korea, and Australia are seeing a surge in the demand for IDaaS solutions, with companies like Alibaba and Zoho playing a key role. The market is driven by the growing SME sector and the need for scalable and cost-effective identity management solutions.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the Identity as a Service (IDaaS) Market, an increasingly crucial domain for digital identity security and management, the companies listed are instrumental in shaping the future of access control and authentication. OneLogin, Inc. and Auth0 stand out as prominent players, providing comprehensive IDaaS solutions that cater to the growing need for secure and user-friendly identity verification. Their strategic positioning emphasizes ease of integration, user experience, and scalability, significantly influencing how businesses protect and manage digital identities.

CA Technologies, a veteran in the IT landscape, leverages its extensive experience to offer robust IDaaS solutions, reflecting the industry's shift towards more integrated and comprehensive security frameworks. Centrify Corp. focuses on unifying identity management across various platforms, showcasing the market's potential for streamlined access control in increasingly hybrid IT environments.

Ping Identity Corp., renowned for its flexibility and innovation in identity security, plays a crucial role in advancing the capabilities of IDaaS solutions, particularly in complex enterprise scenarios requiring multi-factor authentication and single sign-on solutions.

Market Key Players

- OneLogin, Inc.

- CA Technologies

- Auth0

- Centrify Corp.

- Ping Identity Corp.

- IBM Corporation

- Google LLC

- Ping Identity Corporation

- SailPoint Technologies Inc.

- Salesforce Inc.

- Atos SE

- JumpCloud Inc.

Recent Developments

- In December 2023, ProfilePrint Pte. Ltd.'s recent developments and Series B funding underscore the growing importance of AI-driven identity solutions in the agrifood industry. The implications for the Identity as a Service market include increased demand for advanced, collaborative, and efficient identity solutions integrated with artificial intelligence. Organizations within the IDaaS market should closely monitor these trends to align their offerings with the evolving needs of the agrifood sector.

- In September 2023, Eviden, a leading security market leader within Atos Group and partner of HID Global, announced their collaboration. Companies using HID technology for physical and logical access control will utilize Eviden's Identity and Access Management suite for online asset access management.

- In May 2023, Ping Identity began offering its service with PingOne Protect - an innovative product for protecting against fraud and risk. Through an integration of Identity and Access Management (IAM) with multiple security measures to detect fraudulent behavior throughout customer experiences, this unique protection strategy offers unique protection from threats.

Report Scope

Report Features Description Market Value (2023) USD 7.5 Billion Forecast Revenue (2033) USD 58.3 Billion CAGR (2024-2033) 23.40% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component Type (Provisioning, Single Sign-On, Multifactor Authentication, Password Management, Directory Services, Audit, Compliance & Governance), By End-use (Public Sector, BFSI, Telecom and IT, Education, Healthcare, Manufacturing) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape OneLogin, Inc., CA Technologies, Auth0, Centrify Corp., Ping Identity Corp. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

- 1. Executive Summary

- 1.1. Definition

- 1.2. Taxonomy

- 1.3. Research Scope

- 1.4. Key Analysis

- 1.5. Key Findings by Major Segments

- 1.6. Top strategies by Major Players

- 2. Global Identity As A Service Market Overview

- 2.1. Identity As A Service Market Dynamics

- 2.1.1. Drivers

- 2.1.2. Opportunities

- 2.1.3. Restraints

- 2.1.4. Challenges

- 2.2. Macro-economic Factors

- 2.3. Regulatory Framework

- 2.4. Market Investment Feasibility Index

- 2.5. PEST Analysis

- 2.6. PORTER’S Five Force Analysis

- 2.7. Drivers & Restraints Impact Analysis

- 2.8. Industry Chain Analysis

- 2.9. Cost Structure Analysis

- 2.10. Marketing Strategy

- 2.11. Russia-Ukraine War Impact Analysis

- 2.12. Opportunity Map Analysis

- 2.13. Market Competition Scenario Analysis

- 2.14. Product Life Cycle Analysis

- 2.15. Opportunity Orbits

- 2.16. Manufacturer Intensity Map

- 2.17. Major Companies sales by Value & Volume

- 2.1. Identity As A Service Market Dynamics

- 3. Global Identity As A Service Market Analysis, Opportunity and Forecast, 2016-2032

- 3.1. Global Identity As A Service Market Analysis, 2016-2021

- 3.2. Global Identity As A Service Market Opportunity and Forecast, 2023-2032

- 3.3. Global Identity As A Service Market Analysis, Opportunity and Forecast, By Component Type , 2016-2032

- 3.3.1. Global Identity As A Service Market Analysis by Component Type : Introduction

- 3.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Component Type , 2016-2032

- 3.3.3. Provisioning

- 3.3.4. Single Sign-On

- 3.3.5. Multifactor Authentication

- 3.3.6. Password Management

- 3.3.7. Directory Services

- 3.3.8. Audit, Compliance & Governance

- 3.4. Global Identity As A Service Market Analysis, Opportunity and Forecast, By End-use, 2016-2032

- 3.4.1. Global Identity As A Service Market Analysis by End-use: Introduction

- 3.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By End-use, 2016-2032

- 3.4.3. Public Sector

- 3.4.4. BFSI

- 3.4.5. Telecom and IT

- 3.4.6. Education

- 3.4.7. Healthcare

- 3.4.8. Manufacturing

- 4. North America Identity As A Service Market Analysis, Opportunity and Forecast, 2016-2032

- 4.1. North America Identity As A Service Market Analysis, 2016-2021

- 4.2. North America Identity As A Service Market Opportunity and Forecast, 2023-2032

- 4.3. North America Identity As A Service Market Analysis, Opportunity and Forecast, By Component Type , 2016-2032

- 4.3.1. North America Identity As A Service Market Analysis by Component Type : Introduction

- 4.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Component Type , 2016-2032

- 4.3.3. Provisioning

- 4.3.4. Single Sign-On

- 4.3.5. Multifactor Authentication

- 4.3.6. Password Management

- 4.3.7. Directory Services

- 4.3.8. Audit, Compliance & Governance

- 4.4. North America Identity As A Service Market Analysis, Opportunity and Forecast, By End-use, 2016-2032

- 4.4.1. North America Identity As A Service Market Analysis by End-use: Introduction

- 4.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By End-use, 2016-2032

- 4.4.3. Public Sector

- 4.4.4. BFSI

- 4.4.5. Telecom and IT

- 4.4.6. Education

- 4.4.7. Healthcare

- 4.4.8. Manufacturing

- 4.5. North America Identity As A Service Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 4.5.1. North America Identity As A Service Market Analysis by Country : Introduction

- 4.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 4.5.2.1. The US

- 4.5.2.2. Canada

- 4.5.2.3. Mexico

- 5. Western Europe Identity As A Service Market Analysis, Opportunity and Forecast, 2016-2032

- 5.1. Western Europe Identity As A Service Market Analysis, 2016-2021

- 5.2. Western Europe Identity As A Service Market Opportunity and Forecast, 2023-2032

- 5.3. Western Europe Identity As A Service Market Analysis, Opportunity and Forecast, By Component Type , 2016-2032

- 5.3.1. Western Europe Identity As A Service Market Analysis by Component Type : Introduction

- 5.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Component Type , 2016-2032

- 5.3.3. Provisioning

- 5.3.4. Single Sign-On

- 5.3.5. Multifactor Authentication

- 5.3.6. Password Management

- 5.3.7. Directory Services

- 5.3.8. Audit, Compliance & Governance

- 5.4. Western Europe Identity As A Service Market Analysis, Opportunity and Forecast, By End-use, 2016-2032

- 5.4.1. Western Europe Identity As A Service Market Analysis by End-use: Introduction

- 5.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By End-use, 2016-2032

- 5.4.3. Public Sector

- 5.4.4. BFSI

- 5.4.5. Telecom and IT

- 5.4.6. Education

- 5.4.7. Healthcare

- 5.4.8. Manufacturing

- 5.5. Western Europe Identity As A Service Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 5.5.1. Western Europe Identity As A Service Market Analysis by Country : Introduction

- 5.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 5.5.2.1. Germany

- 5.5.2.2. France

- 5.5.2.3. The UK

- 5.5.2.4. Spain

- 5.5.2.5. Italy

- 5.5.2.6. Portugal

- 5.5.2.7. Ireland

- 5.5.2.8. Austria

- 5.5.2.9. Switzerland

- 5.5.2.10. Benelux

- 5.5.2.11. Nordic

- 5.5.2.12. Rest of Western Europe

- 6. Eastern Europe Identity As A Service Market Analysis, Opportunity and Forecast, 2016-2032

- 6.1. Eastern Europe Identity As A Service Market Analysis, 2016-2021

- 6.2. Eastern Europe Identity As A Service Market Opportunity and Forecast, 2023-2032

- 6.3. Eastern Europe Identity As A Service Market Analysis, Opportunity and Forecast, By Component Type , 2016-2032

- 6.3.1. Eastern Europe Identity As A Service Market Analysis by Component Type : Introduction

- 6.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Component Type , 2016-2032

- 6.3.3. Provisioning

- 6.3.4. Single Sign-On

- 6.3.5. Multifactor Authentication

- 6.3.6. Password Management

- 6.3.7. Directory Services

- 6.3.8. Audit, Compliance & Governance

- 6.4. Eastern Europe Identity As A Service Market Analysis, Opportunity and Forecast, By End-use, 2016-2032

- 6.4.1. Eastern Europe Identity As A Service Market Analysis by End-use: Introduction

- 6.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By End-use, 2016-2032

- 6.4.3. Public Sector

- 6.4.4. BFSI

- 6.4.5. Telecom and IT

- 6.4.6. Education

- 6.4.7. Healthcare

- 6.4.8. Manufacturing

- 6.5. Eastern Europe Identity As A Service Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 6.5.1. Eastern Europe Identity As A Service Market Analysis by Country : Introduction

- 6.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 6.5.2.1. Russia

- 6.5.2.2. Poland

- 6.5.2.3. The Czech Republic

- 6.5.2.4. Greece

- 6.5.2.5. Rest of Eastern Europe

- 7. APAC Identity As A Service Market Analysis, Opportunity and Forecast, 2016-2032

- 7.1. APAC Identity As A Service Market Analysis, 2016-2021

- 7.2. APAC Identity As A Service Market Opportunity and Forecast, 2023-2032

- 7.3. APAC Identity As A Service Market Analysis, Opportunity and Forecast, By Component Type , 2016-2032

- 7.3.1. APAC Identity As A Service Market Analysis by Component Type : Introduction

- 7.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Component Type , 2016-2032

- 7.3.3. Provisioning

- 7.3.4. Single Sign-On

- 7.3.5. Multifactor Authentication

- 7.3.6. Password Management

- 7.3.7. Directory Services

- 7.3.8. Audit, Compliance & Governance

- 7.4. APAC Identity As A Service Market Analysis, Opportunity and Forecast, By End-use, 2016-2032

- 7.4.1. APAC Identity As A Service Market Analysis by End-use: Introduction

- 7.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By End-use, 2016-2032

- 7.4.3. Public Sector

- 7.4.4. BFSI

- 7.4.5. Telecom and IT

- 7.4.6. Education

- 7.4.7. Healthcare

- 7.4.8. Manufacturing

- 7.5. APAC Identity As A Service Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 7.5.1. APAC Identity As A Service Market Analysis by Country : Introduction

- 7.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 7.5.2.1. China

- 7.5.2.2. Japan

- 7.5.2.3. South Korea

- 7.5.2.4. India

- 7.5.2.5. Australia & New Zeland

- 7.5.2.6. Indonesia

- 7.5.2.7. Malaysia

- 7.5.2.8. Philippines

- 7.5.2.9. Singapore

- 7.5.2.10. Thailand

- 7.5.2.11. Vietnam

- 7.5.2.12. Rest of APAC

- 8. Latin America Identity As A Service Market Analysis, Opportunity and Forecast, 2016-2032

- 8.1. Latin America Identity As A Service Market Analysis, 2016-2021

- 8.2. Latin America Identity As A Service Market Opportunity and Forecast, 2023-2032

- 8.3. Latin America Identity As A Service Market Analysis, Opportunity and Forecast, By Component Type , 2016-2032

- 8.3.1. Latin America Identity As A Service Market Analysis by Component Type : Introduction

- 8.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Component Type , 2016-2032

- 8.3.3. Provisioning

- 8.3.4. Single Sign-On

- 8.3.5. Multifactor Authentication

- 8.3.6. Password Management

- 8.3.7. Directory Services

- 8.3.8. Audit, Compliance & Governance

- 8.4. Latin America Identity As A Service Market Analysis, Opportunity and Forecast, By End-use, 2016-2032

- 8.4.1. Latin America Identity As A Service Market Analysis by End-use: Introduction

- 8.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By End-use, 2016-2032

- 8.4.3. Public Sector

- 8.4.4. BFSI

- 8.4.5. Telecom and IT

- 8.4.6. Education

- 8.4.7. Healthcare

- 8.4.8. Manufacturing

- 8.5. Latin America Identity As A Service Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 8.5.1. Latin America Identity As A Service Market Analysis by Country : Introduction

- 8.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 8.5.2.1. Brazil

- 8.5.2.2. Colombia

- 8.5.2.3. Chile

- 8.5.2.4. Argentina

- 8.5.2.5. Costa Rica

- 8.5.2.6. Rest of Latin America

- 9. Middle East & Africa Identity As A Service Market Analysis, Opportunity and Forecast, 2016-2032

- 9.1. Middle East & Africa Identity As A Service Market Analysis, 2016-2021

- 9.2. Middle East & Africa Identity As A Service Market Opportunity and Forecast, 2023-2032

- 9.3. Middle East & Africa Identity As A Service Market Analysis, Opportunity and Forecast, By Component Type , 2016-2032

- 9.3.1. Middle East & Africa Identity As A Service Market Analysis by Component Type : Introduction

- 9.3.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Component Type , 2016-2032

- 9.3.3. Provisioning

- 9.3.4. Single Sign-On

- 9.3.5. Multifactor Authentication

- 9.3.6. Password Management

- 9.3.7. Directory Services

- 9.3.8. Audit, Compliance & Governance

- 9.4. Middle East & Africa Identity As A Service Market Analysis, Opportunity and Forecast, By End-use, 2016-2032

- 9.4.1. Middle East & Africa Identity As A Service Market Analysis by End-use: Introduction

- 9.4.2. Market Size Absolute $ Opportunity Analysis and Forecast, By End-use, 2016-2032

- 9.4.3. Public Sector

- 9.4.4. BFSI

- 9.4.5. Telecom and IT

- 9.4.6. Education

- 9.4.7. Healthcare

- 9.4.8. Manufacturing

- 9.5. Middle East & Africa Identity As A Service Market Analysis, Opportunity and Forecast, By Country , 2016-2032

- 9.5.1. Middle East & Africa Identity As A Service Market Analysis by Country : Introduction

- 9.5.2. Market Size Absolute $ Opportunity Analysis and Forecast, Country , 2016-2032

- 9.5.2.1. Algeria

- 9.5.2.2. Egypt

- 9.5.2.3. Israel

- 9.5.2.4. Kuwait

- 9.5.2.5. Nigeria

- 9.5.2.6. Saudi Arabia

- 9.5.2.7. South Africa

- 9.5.2.8. Turkey

- 9.5.2.9. The UAE

- 9.5.2.10. Rest of MEA

- 10. Global Identity As A Service Market Analysis, Opportunity and Forecast, By Region , 2016-2032

- 10.1. Global Identity As A Service Market Analysis by Region : Introduction

- 10.2. Market Size Absolute $ Opportunity Analysis and Forecast, By Region , 2016-2032

- 10.2.1. North America

- 10.2.2. Western Europe

- 10.2.3. Eastern Europe

- 10.2.4. APAC

- 10.2.5. Latin America

- 10.2.6. Middle East & Africa

- 11. Global Identity As A Service Market Competitive Landscape, Market Share Analysis, and Company Profiles

- 11.1. Market Share Analysis

- 11.2. Company Profiles

- 11.3. OneLogin, Inc.

- 11.3.1. Company Overview

- 11.3.2. Financial Highlights

- 11.3.3. Product Portfolio

- 11.3.4. SWOT Analysis

- 11.3.5. Key Strategies and Developments

- 11.4. CA Technologies

- 11.4.1. Company Overview

- 11.4.2. Financial Highlights

- 11.4.3. Product Portfolio

- 11.4.4. SWOT Analysis

- 11.4.5. Key Strategies and Developments

- 11.5. Auth0

- 11.5.1. Company Overview

- 11.5.2. Financial Highlights

- 11.5.3. Product Portfolio

- 11.5.4. SWOT Analysis

- 11.5.5. Key Strategies and Developments

- 11.6. Centrify Corp.

- 11.6.1. Company Overview

- 11.6.2. Financial Highlights

- 11.6.3. Product Portfolio

- 11.6.4. SWOT Analysis

- 11.6.5. Key Strategies and Developments

- 11.7. Ping Identity Corp.

- 11.7.1. Company Overview

- 11.7.2. Financial Highlights

- 11.7.3. Product Portfolio

- 11.7.4. SWOT Analysis

- 11.7.5. Key Strategies and Developments

- 11.13.1. Company Overview

- 11.13.2. Financial Highlights

- 11.13.3. Product Portfolio

- 11.13.4. SWOT Analysis

- 11.13.5. Key Strategies and Developments

- 12. Assumptions and Acronyms

- 13. Research Methodology

- 14. Contact

- List of Figures

- Figure 1: Global Identity As A Service Market Revenue (US$ Mn) Market Share by Component Type in 2022

- Figure 2: Global Identity As A Service Market Attractiveness Analysis by Component Type , 2016-2032

- Figure 3: Global Identity As A Service Market Revenue (US$ Mn) Market Share by End-usein 2022

- Figure 4: Global Identity As A Service Market Attractiveness Analysis by End-use, 2016-2032

- Figure 5: Global Identity As A Service Market Revenue (US$ Mn) Market Share by Region in 2022

- Figure 6: Global Identity As A Service Market Attractiveness Analysis by Region, 2016-2032

- Figure 7: Global Identity As A Service Market Revenue (US$ Mn) (2016-2032)

- Figure 8: Global Identity As A Service Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Figure 9: Global Identity As A Service Market Revenue (US$ Mn) Comparison by Component Type (2016-2032)

- Figure 10: Global Identity As A Service Market Revenue (US$ Mn) Comparison by End-use (2016-2032)

- Figure 11: Global Identity As A Service Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Figure 12: Global Identity As A Service Market Y-o-Y Growth Rate Comparison by Component Type (2016-2032)

- Figure 13: Global Identity As A Service Market Y-o-Y Growth Rate Comparison by End-use (2016-2032)

- Figure 14: Global Identity As A Service Market Share Comparison by Region (2016-2032)

- Figure 15: Global Identity As A Service Market Share Comparison by Component Type (2016-2032)

- Figure 16: Global Identity As A Service Market Share Comparison by End-use (2016-2032)

- Figure 17: North America Identity As A Service Market Revenue (US$ Mn) Market Share by Component Type in 2022

- Figure 18: North America Identity As A Service Market Attractiveness Analysis by Component Type , 2016-2032

- Figure 19: North America Identity As A Service Market Revenue (US$ Mn) Market Share by End-usein 2022

- Figure 20: North America Identity As A Service Market Attractiveness Analysis by End-use, 2016-2032

- Figure 21: North America Identity As A Service Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 22: North America Identity As A Service Market Attractiveness Analysis by Country, 2016-2032

- Figure 23: North America Identity As A Service Market Revenue (US$ Mn) (2016-2032)

- Figure 24: North America Identity As A Service Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 25: North America Identity As A Service Market Revenue (US$ Mn) Comparison by Component Type (2016-2032)

- Figure 26: North America Identity As A Service Market Revenue (US$ Mn) Comparison by End-use (2016-2032)

- Figure 27: North America Identity As A Service Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 28: North America Identity As A Service Market Y-o-Y Growth Rate Comparison by Component Type (2016-2032)

- Figure 29: North America Identity As A Service Market Y-o-Y Growth Rate Comparison by End-use (2016-2032)

- Figure 30: North America Identity As A Service Market Share Comparison by Country (2016-2032)

- Figure 31: North America Identity As A Service Market Share Comparison by Component Type (2016-2032)

- Figure 32: North America Identity As A Service Market Share Comparison by End-use (2016-2032)

- Figure 33: Western Europe Identity As A Service Market Revenue (US$ Mn) Market Share by Component Type in 2022

- Figure 34: Western Europe Identity As A Service Market Attractiveness Analysis by Component Type , 2016-2032

- Figure 35: Western Europe Identity As A Service Market Revenue (US$ Mn) Market Share by End-usein 2022

- Figure 36: Western Europe Identity As A Service Market Attractiveness Analysis by End-use, 2016-2032

- Figure 37: Western Europe Identity As A Service Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 38: Western Europe Identity As A Service Market Attractiveness Analysis by Country, 2016-2032

- Figure 39: Western Europe Identity As A Service Market Revenue (US$ Mn) (2016-2032)

- Figure 40: Western Europe Identity As A Service Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 41: Western Europe Identity As A Service Market Revenue (US$ Mn) Comparison by Component Type (2016-2032)

- Figure 42: Western Europe Identity As A Service Market Revenue (US$ Mn) Comparison by End-use (2016-2032)

- Figure 43: Western Europe Identity As A Service Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 44: Western Europe Identity As A Service Market Y-o-Y Growth Rate Comparison by Component Type (2016-2032)

- Figure 45: Western Europe Identity As A Service Market Y-o-Y Growth Rate Comparison by End-use (2016-2032)

- Figure 46: Western Europe Identity As A Service Market Share Comparison by Country (2016-2032)

- Figure 47: Western Europe Identity As A Service Market Share Comparison by Component Type (2016-2032)

- Figure 48: Western Europe Identity As A Service Market Share Comparison by End-use (2016-2032)

- Figure 49: Eastern Europe Identity As A Service Market Revenue (US$ Mn) Market Share by Component Type in 2022

- Figure 50: Eastern Europe Identity As A Service Market Attractiveness Analysis by Component Type , 2016-2032

- Figure 51: Eastern Europe Identity As A Service Market Revenue (US$ Mn) Market Share by End-usein 2022

- Figure 52: Eastern Europe Identity As A Service Market Attractiveness Analysis by End-use, 2016-2032

- Figure 53: Eastern Europe Identity As A Service Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 54: Eastern Europe Identity As A Service Market Attractiveness Analysis by Country, 2016-2032

- Figure 55: Eastern Europe Identity As A Service Market Revenue (US$ Mn) (2016-2032)

- Figure 56: Eastern Europe Identity As A Service Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 57: Eastern Europe Identity As A Service Market Revenue (US$ Mn) Comparison by Component Type (2016-2032)

- Figure 58: Eastern Europe Identity As A Service Market Revenue (US$ Mn) Comparison by End-use (2016-2032)

- Figure 59: Eastern Europe Identity As A Service Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 60: Eastern Europe Identity As A Service Market Y-o-Y Growth Rate Comparison by Component Type (2016-2032)

- Figure 61: Eastern Europe Identity As A Service Market Y-o-Y Growth Rate Comparison by End-use (2016-2032)

- Figure 62: Eastern Europe Identity As A Service Market Share Comparison by Country (2016-2032)

- Figure 63: Eastern Europe Identity As A Service Market Share Comparison by Component Type (2016-2032)

- Figure 64: Eastern Europe Identity As A Service Market Share Comparison by End-use (2016-2032)

- Figure 65: APAC Identity As A Service Market Revenue (US$ Mn) Market Share by Component Type in 2022

- Figure 66: APAC Identity As A Service Market Attractiveness Analysis by Component Type , 2016-2032

- Figure 67: APAC Identity As A Service Market Revenue (US$ Mn) Market Share by End-usein 2022

- Figure 68: APAC Identity As A Service Market Attractiveness Analysis by End-use, 2016-2032

- Figure 69: APAC Identity As A Service Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 70: APAC Identity As A Service Market Attractiveness Analysis by Country, 2016-2032

- Figure 71: APAC Identity As A Service Market Revenue (US$ Mn) (2016-2032)

- Figure 72: APAC Identity As A Service Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 73: APAC Identity As A Service Market Revenue (US$ Mn) Comparison by Component Type (2016-2032)

- Figure 74: APAC Identity As A Service Market Revenue (US$ Mn) Comparison by End-use (2016-2032)

- Figure 75: APAC Identity As A Service Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 76: APAC Identity As A Service Market Y-o-Y Growth Rate Comparison by Component Type (2016-2032)

- Figure 77: APAC Identity As A Service Market Y-o-Y Growth Rate Comparison by End-use (2016-2032)

- Figure 78: APAC Identity As A Service Market Share Comparison by Country (2016-2032)

- Figure 79: APAC Identity As A Service Market Share Comparison by Component Type (2016-2032)

- Figure 80: APAC Identity As A Service Market Share Comparison by End-use (2016-2032)

- Figure 81: Latin America Identity As A Service Market Revenue (US$ Mn) Market Share by Component Type in 2022

- Figure 82: Latin America Identity As A Service Market Attractiveness Analysis by Component Type , 2016-2032

- Figure 83: Latin America Identity As A Service Market Revenue (US$ Mn) Market Share by End-usein 2022

- Figure 84: Latin America Identity As A Service Market Attractiveness Analysis by End-use, 2016-2032

- Figure 85: Latin America Identity As A Service Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 86: Latin America Identity As A Service Market Attractiveness Analysis by Country, 2016-2032

- Figure 87: Latin America Identity As A Service Market Revenue (US$ Mn) (2016-2032)

- Figure 88: Latin America Identity As A Service Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 89: Latin America Identity As A Service Market Revenue (US$ Mn) Comparison by Component Type (2016-2032)

- Figure 90: Latin America Identity As A Service Market Revenue (US$ Mn) Comparison by End-use (2016-2032)

- Figure 91: Latin America Identity As A Service Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 92: Latin America Identity As A Service Market Y-o-Y Growth Rate Comparison by Component Type (2016-2032)

- Figure 93: Latin America Identity As A Service Market Y-o-Y Growth Rate Comparison by End-use (2016-2032)

- Figure 94: Latin America Identity As A Service Market Share Comparison by Country (2016-2032)

- Figure 95: Latin America Identity As A Service Market Share Comparison by Component Type (2016-2032)

- Figure 96: Latin America Identity As A Service Market Share Comparison by End-use (2016-2032)

- Figure 97: Middle East & Africa Identity As A Service Market Revenue (US$ Mn) Market Share by Component Type in 2022

- Figure 98: Middle East & Africa Identity As A Service Market Attractiveness Analysis by Component Type , 2016-2032

- Figure 99: Middle East & Africa Identity As A Service Market Revenue (US$ Mn) Market Share by End-usein 2022

- Figure 100: Middle East & Africa Identity As A Service Market Attractiveness Analysis by End-use, 2016-2032

- Figure 101: Middle East & Africa Identity As A Service Market Revenue (US$ Mn) Market Share by Country in 2022

- Figure 102: Middle East & Africa Identity As A Service Market Attractiveness Analysis by Country, 2016-2032

- Figure 103: Middle East & Africa Identity As A Service Market Revenue (US$ Mn) (2016-2032)

- Figure 104: Middle East & Africa Identity As A Service Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Figure 105: Middle East & Africa Identity As A Service Market Revenue (US$ Mn) Comparison by Component Type (2016-2032)

- Figure 106: Middle East & Africa Identity As A Service Market Revenue (US$ Mn) Comparison by End-use (2016-2032)

- Figure 107: Middle East & Africa Identity As A Service Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Figure 108: Middle East & Africa Identity As A Service Market Y-o-Y Growth Rate Comparison by Component Type (2016-2032)

- Figure 109: Middle East & Africa Identity As A Service Market Y-o-Y Growth Rate Comparison by End-use (2016-2032)

- Figure 110: Middle East & Africa Identity As A Service Market Share Comparison by Country (2016-2032)

- Figure 111: Middle East & Africa Identity As A Service Market Share Comparison by Component Type (2016-2032)

- Figure 112: Middle East & Africa Identity As A Service Market Share Comparison by End-use (2016-2032)

- List of Tables

- Table 1: Global Identity As A Service Market Comparison by Component Type (2016-2032)

- Table 2: Global Identity As A Service Market Comparison by End-use (2016-2032)

- Table 3: Global Identity As A Service Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 4: Global Identity As A Service Market Revenue (US$ Mn) (2016-2032)

- Table 5: Global Identity As A Service Market Revenue (US$ Mn) Comparison by Region (2016-2032)

- Table 6: Global Identity As A Service Market Revenue (US$ Mn) Comparison by Component Type (2016-2032)

- Table 7: Global Identity As A Service Market Revenue (US$ Mn) Comparison by End-use (2016-2032)

- Table 8: Global Identity As A Service Market Y-o-Y Growth Rate Comparison by Region (2016-2032)

- Table 9: Global Identity As A Service Market Y-o-Y Growth Rate Comparison by Component Type (2016-2032)

- Table 10: Global Identity As A Service Market Y-o-Y Growth Rate Comparison by End-use (2016-2032)

- Table 11: Global Identity As A Service Market Share Comparison by Region (2016-2032)

- Table 12: Global Identity As A Service Market Share Comparison by Component Type (2016-2032)

- Table 13: Global Identity As A Service Market Share Comparison by End-use (2016-2032)

- Table 14: North America Identity As A Service Market Comparison by End-use (2016-2032)

- Table 15: North America Identity As A Service Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 16: North America Identity As A Service Market Revenue (US$ Mn) (2016-2032)

- Table 17: North America Identity As A Service Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 18: North America Identity As A Service Market Revenue (US$ Mn) Comparison by Component Type (2016-2032)

- Table 19: North America Identity As A Service Market Revenue (US$ Mn) Comparison by End-use (2016-2032)

- Table 20: North America Identity As A Service Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 21: North America Identity As A Service Market Y-o-Y Growth Rate Comparison by Component Type (2016-2032)

- Table 22: North America Identity As A Service Market Y-o-Y Growth Rate Comparison by End-use (2016-2032)

- Table 23: North America Identity As A Service Market Share Comparison by Country (2016-2032)

- Table 24: North America Identity As A Service Market Share Comparison by Component Type (2016-2032)

- Table 25: North America Identity As A Service Market Share Comparison by End-use (2016-2032)

- Table 26: Western Europe Identity As A Service Market Comparison by Component Type (2016-2032)

- Table 27: Western Europe Identity As A Service Market Comparison by End-use (2016-2032)

- Table 28: Western Europe Identity As A Service Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 29: Western Europe Identity As A Service Market Revenue (US$ Mn) (2016-2032)

- Table 30: Western Europe Identity As A Service Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 31: Western Europe Identity As A Service Market Revenue (US$ Mn) Comparison by Component Type (2016-2032)

- Table 32: Western Europe Identity As A Service Market Revenue (US$ Mn) Comparison by End-use (2016-2032)

- Table 33: Western Europe Identity As A Service Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 34: Western Europe Identity As A Service Market Y-o-Y Growth Rate Comparison by Component Type (2016-2032)

- Table 35: Western Europe Identity As A Service Market Y-o-Y Growth Rate Comparison by End-use (2016-2032)

- Table 36: Western Europe Identity As A Service Market Share Comparison by Country (2016-2032)

- Table 37: Western Europe Identity As A Service Market Share Comparison by Component Type (2016-2032)

- Table 38: Western Europe Identity As A Service Market Share Comparison by End-use (2016-2032)

- Table 39: Eastern Europe Identity As A Service Market Comparison by Component Type (2016-2032)

- Table 40: Eastern Europe Identity As A Service Market Comparison by End-use (2016-2032)

- Table 41: Eastern Europe Identity As A Service Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 42: Eastern Europe Identity As A Service Market Revenue (US$ Mn) (2016-2032)

- Table 43: Eastern Europe Identity As A Service Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 44: Eastern Europe Identity As A Service Market Revenue (US$ Mn) Comparison by Component Type (2016-2032)

- Table 45: Eastern Europe Identity As A Service Market Revenue (US$ Mn) Comparison by End-use (2016-2032)

- Table 46: Eastern Europe Identity As A Service Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 47: Eastern Europe Identity As A Service Market Y-o-Y Growth Rate Comparison by Component Type (2016-2032)

- Table 48: Eastern Europe Identity As A Service Market Y-o-Y Growth Rate Comparison by End-use (2016-2032)

- Table 49: Eastern Europe Identity As A Service Market Share Comparison by Country (2016-2032)

- Table 50: Eastern Europe Identity As A Service Market Share Comparison by Component Type (2016-2032)

- Table 51: Eastern Europe Identity As A Service Market Share Comparison by End-use (2016-2032)

- Table 52: APAC Identity As A Service Market Comparison by Component Type (2016-2032)

- Table 53: APAC Identity As A Service Market Comparison by End-use (2016-2032)

- Table 54: APAC Identity As A Service Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 55: APAC Identity As A Service Market Revenue (US$ Mn) (2016-2032)

- Table 56: APAC Identity As A Service Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 57: APAC Identity As A Service Market Revenue (US$ Mn) Comparison by Component Type (2016-2032)

- Table 58: APAC Identity As A Service Market Revenue (US$ Mn) Comparison by End-use (2016-2032)

- Table 59: APAC Identity As A Service Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 60: APAC Identity As A Service Market Y-o-Y Growth Rate Comparison by Component Type (2016-2032)

- Table 61: APAC Identity As A Service Market Y-o-Y Growth Rate Comparison by End-use (2016-2032)

- Table 62: APAC Identity As A Service Market Share Comparison by Country (2016-2032)

- Table 63: APAC Identity As A Service Market Share Comparison by Component Type (2016-2032)

- Table 64: APAC Identity As A Service Market Share Comparison by End-use (2016-2032)

- Table 65: Latin America Identity As A Service Market Comparison by Component Type (2016-2032)

- Table 66: Latin America Identity As A Service Market Comparison by End-use (2016-2032)

- Table 67: Latin America Identity As A Service Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 68: Latin America Identity As A Service Market Revenue (US$ Mn) (2016-2032)

- Table 69: Latin America Identity As A Service Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 70: Latin America Identity As A Service Market Revenue (US$ Mn) Comparison by Component Type (2016-2032)

- Table 71: Latin America Identity As A Service Market Revenue (US$ Mn) Comparison by End-use (2016-2032)

- Table 72: Latin America Identity As A Service Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 73: Latin America Identity As A Service Market Y-o-Y Growth Rate Comparison by Component Type (2016-2032)

- Table 74: Latin America Identity As A Service Market Y-o-Y Growth Rate Comparison by End-use (2016-2032)

- Table 75: Latin America Identity As A Service Market Share Comparison by Country (2016-2032)

- Table 76: Latin America Identity As A Service Market Share Comparison by Component Type (2016-2032)

- Table 77: Latin America Identity As A Service Market Share Comparison by End-use (2016-2032)

- Table 78: Middle East & Africa Identity As A Service Market Comparison by Component Type (2016-2032)

- Table 79: Middle East & Africa Identity As A Service Market Comparison by End-use (2016-2032)

- Table 80: Middle East & Africa Identity As A Service Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 81: Middle East & Africa Identity As A Service Market Revenue (US$ Mn) (2016-2032)

- Table 82: Middle East & Africa Identity As A Service Market Revenue (US$ Mn) Comparison by Country (2016-2032)

- Table 83: Middle East & Africa Identity As A Service Market Revenue (US$ Mn) Comparison by Component Type (2016-2032)

- Table 84: Middle East & Africa Identity As A Service Market Revenue (US$ Mn) Comparison by End-use (2016-2032)

- Table 85: Middle East & Africa Identity As A Service Market Y-o-Y Growth Rate Comparison by Country (2016-2032)

- Table 86: Middle East & Africa Identity As A Service Market Y-o-Y Growth Rate Comparison by Component Type (2016-2032)

- Table 87: Middle East & Africa Identity As A Service Market Y-o-Y Growth Rate Comparison by End-use (2016-2032)

- Table 88: Middle East & Africa Identity As A Service Market Share Comparison by Country (2016-2032)

- Table 89: Middle East & Africa Identity As A Service Market Share Comparison by Component Type (2016-2032)

- Table 90: Middle East & Africa Identity As A Service Market Share Comparison by End-use (2016-2032)

- 1. Executive Summary

-

- Symantec Corporation (LifeLock Inc.)

- Experian plc

- Equifax Inc

- TransUnion

- Fair Isaac Corporation (FICO)

- Affinion Group Holdings Inc

- RELX PLC (LexisNexis)

- Intersections Inc

- AllClear ID Inc.