Automotive Cybersecurity Market By Service (In-Vehicle, External Cloud Services), By Application (Telematics System, Infotainment System, Powertrain System), By Security (Endpoint Security, Application Security, Wireless Network Security), By Vehicle Type (Passenger Car, Commercial Vehicle), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

14106

-

June 2023

-

160

-

-

This report was compiled by Kalyani Khudsange Kalyani Khudsange is a Research Analyst at Prudour Pvt. Ltd. with 2.5 years of experience in market research and a strong technical background in Chemical Engineering and manufacturing. Correspondence Sr. Research Analyst Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

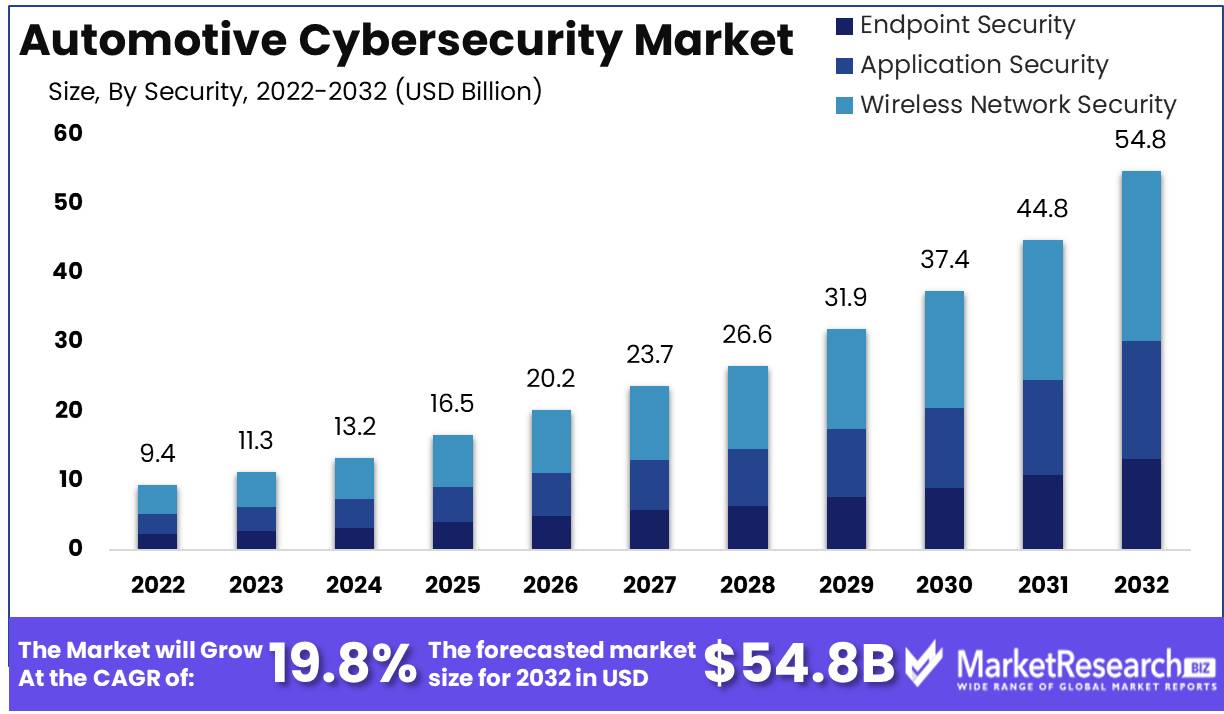

Automotive Cybersecurity Market size is expected to be worth around USD 54.8 Bn by 2032 from USD 9.4 Bn in 2022, growing at a CAGR of 19.8% during the forecast period from 2023 to 2032.

The Automotive Cybersecurity Market has been one of the most rapidly expanding industries. The increasing need to safeguard vehicles from cyber hazards has resulted in the development of numerous cybersecurity solutions tailored to the automotive sector. The increasing adoption of advanced technologies and the expansion of connected vehicle services have fueled the demand for automotive cybersecurity services even further.

Automotive Cybersecurity refers to the practice of safeguarding vehicles against cyber threats such as illicit access, larceny, and remote control. The primary objective of automotive cybersecurity is to guarantee the safety and security of vehicles and their occupants. With the increasing number of internet-connected vehicles and the introduction of autonomous vehicles, the danger of cyberattacks is greater than ever. Automotive cybersecurity solutions prevent cyberattacks and protect vehicles from potential damage.

One cannot exaggerate the significance of automotive cybersecurity. It serves a crucial role in assuring the safety of vehicles and their occupants. A effective cyberattack on a vehicle can cause a loss of control, which can result in accidents and fatalities. Increased safety, enhanced dependability, and protection from cyber threats are among the benefits of automotive cybersecurity. Additionally, it aids in sustaining consumer trust and loyalty, which is essential for automakers in a highly competitive market.

In recent years, Automotive Cybersecurity Market has witnessed a number of significant innovations. In-vehicle firewalls that prevent unauthorized access to the vehicle's network represent one of the most significant developments. Biometric authentication systems that use biometrics, facial recognition, and voice recognition to authenticate drivers prior to granting access to the vehicle's systems represent an additional significant innovation. In addition, cybersecurity solutions based on machine learning and artificial intelligence have acquired prominence in this market.

Several industries, including automotive, technology, and cybersecurity, have invested in the Automotive Cybersecurity Market. The automotive industry is investing in this market to guarantee the safety and dependability of vehicles, whereas the technology sector is developing advanced cybersecurity solutions for the automotive industry. Additionally, the cybersecurity industry is investing in this market to capitalize on the expanding demand for automotive cybersecurity services.

Driving factors

Increasing Worries Regarding Vehicle Data Security and Privacy

The Automotive Cybersecurity Market has garnered considerable interest due to a number of factors influencing its landscape. Increasing concerns about the security and privacy of vehicle data are a key factor driving the demand for automotive cybersecurity solutions. As the prevalence of connected and autonomous vehicles increases, so does the likelihood of cyberattacks on automotive systems. This has led to advancements in automotive technology, which in turn has fostered the development of comprehensive cybersecurity measures to combat potential cyber threats.

Government Regulations and Directives that Promote Adoption

Strict government regulations and guidelines regarding vehicle cybersecurity have contributed to the expansion of the market. As consumer awareness of the importance of vehicle cybersecurity has increased, the rate of adoption of these solutions has risen. The market has witnessed the emergence of new and innovative automotive cybersecurity solutions, which has increased demand and made the automotive industry more secure than ever before.

Rapid Expansion of the Automotive Industry in Developing Nations

Market expansion is driven by the swiftly expanding automotive industry in developing economies and the adoption of cloud-based cybersecurity solutions in the automotive sector. Moreover, significant automotive companies are making substantial investments in cybersecurity technologies, which will propel the market's growth prospects even further. Regulatory changes that could affect the Automotive Cybersecurity Market are being considered, with a strong emphasis on assuring the safety and security of automotive systems. Emerging technologies like blockchain and machine learning have the potential to secure communication and data transactions in connected vehicles.

Investing by Major Automotive Manufacturers

Start-ups and specialized vendors offering specialized cybersecurity solutions are potential disruptors that could change the competitive landscape of the Automotive Cybersecurity Market. Moreover, the introduction of cybersecurity insurance policies for connected vehicles has the potential to disrupt the market.

Changes in consumer behavior, specifically a predilection for procuring automotive cybersecurity solutions from certified and reputable sources, may affect market expansion. To remain competitive in the Automotive Cybersecurity Market, Market participants must recognize these emerging trends and adapt their strategies accordingly.

Restraining Factors

Cost Consequences of Innovative Cybersecurity Solutions

Several restraining factors that impede the widespread adoption of advanced practices influence the expansion of the automotive cybersecurity market. The steep cost of implementing sophisticated cybersecurity solutions is one such factor. Some organizations may be unable to implement best practices and cutting-edge technologies because of the necessary financial investment.

Deficiencies in Standardization and Interoperability

The absence of standardization and interoperability in cybersecurity technologies is also a significant factor holding back development. Integration becomes complex and time-consuming when multiple vendors offer proprietary solutions that are incompatible with one another. Additionally, the absence of a common standard introduces vulnerabilities that can be exploited by cybercriminals, thereby compromising overall security.

Insufficiency of Qualified Cybersecurity Professionals

The lack of qualified cybersecurity professionals poses a problem for the industry. Cybersecurity expertise necessitates specialized knowledge and experience, and the scarcity of competent professionals slows innovation. Recruiting and retaining qualified talent can also be costly, which further hinders the implementation of effective cybersecurity measures.

Existing Systems Complicatedness

The difficulty of incorporating cybersecurity solutions with existing automotive systems is a significant impediment. The automotive industry's diverse systems, communication protocols, and interfaces necessitate case-specific custom solutions. This complexity not only increases implementation expenses, but also necessitates specialized knowledge and skills, which contributes to implementation difficulties.

Limited understanding among Businesses

Small and medium-sized businesses' (SMEs) lack of understanding of the significance of automotive cybersecurity is another factor impeding market growth. Many small and medium-sized enterprises erroneously believe that cybersecurity is only a concern for large corporations, causing them to neglect the need for robust cybersecurity measures. This ignorance leaves them vulnerable to security vulnerabilities and hinders the industry's adoption of cybersecurity best practices.

Security Analysis

Automotive Cybersecurity Market Segment Dominates Wireless Network Security. Cyber threats have increased due to the growing internet connectivity of vehicles and the deployment of advanced driver assistance systems (ADAS). Consequently, the incorporation of cybersecurity measures into automobiles has become essential. Wireless Network security, endpoint security, wireless security, and cloud security are a few of the solution categories that make up the Automotive Cybersecurity Market.

Among these solution categories, Wireless network security is the market leader. Wireless Network security solutions prevent intrusions by preventing unauthorized access to the vehicle's communication networks. This category of solutions consists of firewalls, intrusion detection and prevention systems, virtual private networks, and others. Consumers are becoming increasingly cognizant of the cybersecurity risks posed by the use of connected vehicles. Cybersecurity is a major concern for consumers, particularly when they share their information with automobile manufacturers or third-party vendors. The implementation of Wireless network security solutions provides consumers with assurance that their data is secure, resulting in the widespread adoption of these solutions.

Application Analysis

Market Segment for Telematics System Dominates the Automotive Cybersecurity Market. Telematics System facilitate the transfer of vehicle data to an external system, thereby facilitating the effective administration of vehicle performance. This category of solutions comprises vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communication, among others. Consumers are increasingly adopting connected vehicles, resulting in a high rate of adoption for telematics System.

Due to factors such as a rise in demand for connected cars, the need for efficient fleet management, and rising concerns regarding vehicle safety and cybersecurity, it is anticipated that the Telematics System Segment of the Automotive Cybersecurity Market will experience the quickest growth rate. Implementing telematics System in vehicles provides consumers with the assurance that their data is secure and facilitates the efficient administration of vehicles.

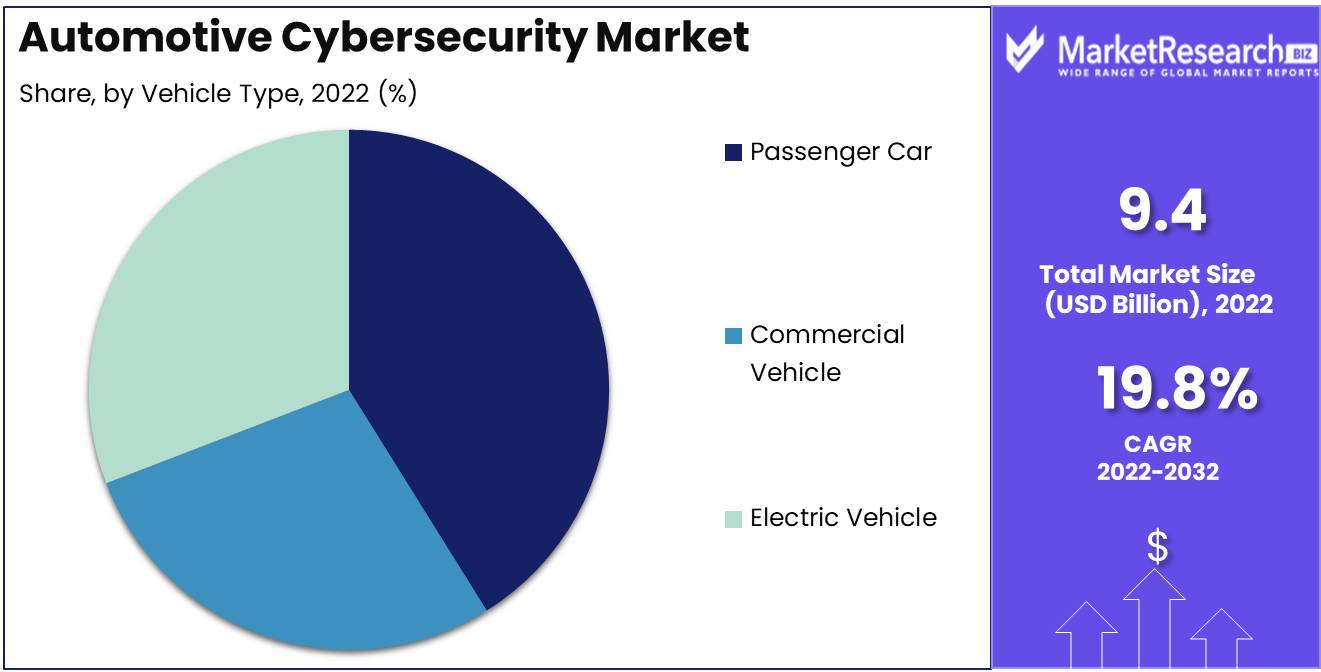

Vehicle Type Analysis

Automotive Cybersecurity Market Segment Dominates Passenger Cars. Due to the high rate of consumer adoption of connected vehicles, the Passenger Cars Segment dominates the Automotive Cybersecurity Market. Increasing demand for fuel-efficient and comfortable vehicles has resulted in numerous technological advancements in passenger automobiles, such as cybersecurity measures. Increasing consumer reliance on technology has resulted in the widespread adoption of connected vehicles. Due to the growing susceptibility of connected vehicles to cyberattacks, the need for cybersecurity measures in passenger vehicles has risen significantly.

Due to factors such as the high adoption rate of connected vehicles, the need for regulatory compliance, and the increase in cyber threats against vehicles, it is anticipated that the Passenger Cars Segment of the Automotive Cybersecurity Market will record the highest growth rate.

Key Market Segments

By Service

- In-Vehicle

- External Cloud Services

By Application

- Telematics System

- Infotainment System

- Powertrain System

- Body Control & Comfort System

- ADAS & Safety System

By Security

- Endpoint Security

- Application Security

- Wireless Network Security

By Vehicle Type

- Passenger Car

- Commercial Vehicle

- Electric Vehicle

Growth Opportunity

Enhanced demand for real-time cybersecurity solutions

To protect automobiles from potential cyberattacks, the automotive industry requires real-time cybersecurity solutions. Real-time cybersecurity solutions employ sophisticated algorithms and continuously monitor the automobile's systems for any suspicious activity. The rising number of cyberthreats in the automotive industry is responsible for the increasing demand for real-time cybersecurity solutions. As a result, there has been a rise in the adoption of real-time cybersecurity solutions, which is anticipated to stimulate the expansion of the automotive cybersecurity market.

Emergence of blockchain-based security technologies

A growing number of industries, including the automotive industry, are adopting blockchain technology. Blockchain technology offers a secure and decentralized method of preserving data, making it difficult for intruders to access information. Utilizing blockchain-based cybersecurity solutions can prevent unauthorized access to automobiles' systems and improve the security of automobiles. Consequently, the emergence of blockchain-based cybersecurity solutions presents a substantial growth opportunity for the automotive cybersecurity market.

Artificial intelligence and Machine learning

Artificial intelligence (AI) and machine learning (ML) are gaining popularity in the automotive industry, especially in terms of cybersecurity. AI and ML algorithms can detect suspicious activity in a vehicle's system and take preventative measures against potential cyberattacks. The increasing use of AI and ML in cybersecurity technologies is anticipated to fuel the growth of the automotive cybersecurity market.

Increased demand for cloud-based security solutions

Cars can be protected from potential cyberattacks in a cost-efficient and scalable manner with cloud-based cybersecurity solutions. The demand for cloud-based security solutions is anticipated to increase as the number of connected vehicles rises. These solutions can prevent unauthorized access to a vehicle's systems, detect potential cyberattacks, and safeguard the vehicles from damage. Consequently, the increasing demand for cloud-based cybersecurity solutions represents a substantial growth opportunity for the automotive cybersecurity market.

Increasing collaboration and partnerships

Major automotive manufacturers are progressively collaborating with cybersecurity solution providers to enhance the security of their vehicles' systems. For example, BMW partnered with Tencent Keen Security Lab in 2020 to conduct joint research and development in the field of automotive cybersecurity. Such partnerships can assist automakers in staying clear of potential cyber threats and bolstering the security of their vehicles. The growth of the automotive cybersecurity market is anticipated to be fueled by the increasing collaboration and partnerships between major automotive stakeholders and cybersecurity solution providers.

Latest Trends

Vehicle Design and Development Processes

Transformational trends in the incorporation of cybersecurity solutions are reshaping the landscape of vehicle design and development in the automotive industry. Integration of cybersecurity solutions throughout the entire vehicle lifecycle, from design to decommissioning, is a significant trend. With the proliferation of connected vehicle features, such as navigation and driver assistance systems, it is essential to incorporate cybersecurity from the outset. Manufacturers are collaborating with cybersecurity specialists to develop comprehensive security solutions, including firewalls, intrusion detection systems, encryption, and access control mechanisms.

Biometric Authentication Technologies

Another prominent trend in automotive cybersecurity is the increasing adoption of biometric authentication technologies. Using fingerprints, facial recognition, and voice recognition, biometric authentication helps control vehicle access and prevent unauthorized use. This is particularly important for autonomous vehicles, which rely on complex sensors and control systems. Biometric authentication technologies enhance vehicle security by preventing unauthorized access to vital vehicle systems, thereby mitigating the risk of cyber attacks.

Increasing Demand for Over-the-Air Updates

OTA updates are becoming increasingly prevalent and are revolutionizing automotive cybersecurity. OTA updates enable remote software updates, eliminating the need for dealership or service center visits. This technology enables manufacturers to rapidly respond to emergent cyber threats by distributing patches and updates in a timely manner. OTA updates ensure that vehicles remain secure and up-to-date, while also making it easy to add new features and functionality without disrupting vehicle owners.

Advanced Cybersecurity Certification and Testing

The creation of advanced cybersecurity testing and certification programs is another significant trend that is propelling Automotive Cybersecurity Market. As vehicles become more connected and reliant on complex software and hardware architectures, the likelihood of cyber attacks continues to rise. Regulatory agencies and industry organizations are developing stringent cybersecurity standards and testing programs to ensure that vehicles meet stringent security requirements. These programs ensure that vehicles can withstand a variety of cyber hazards, including hacking, data theft, and malicious software.

Bug Bounty Programs to Identify Vulnerabilities

Also on the rise are bug bounty programs, which play a crucial role in identifying vulnerabilities in automotive cybersecurity. These programs incentivize security researchers to identify and disclose potential software and hardware architecture vulnerabilities. By proactively identifying vulnerabilities, manufacturers can respond promptly to potential cybersecurity threats, reducing the risk of exploitation by malicious actors.

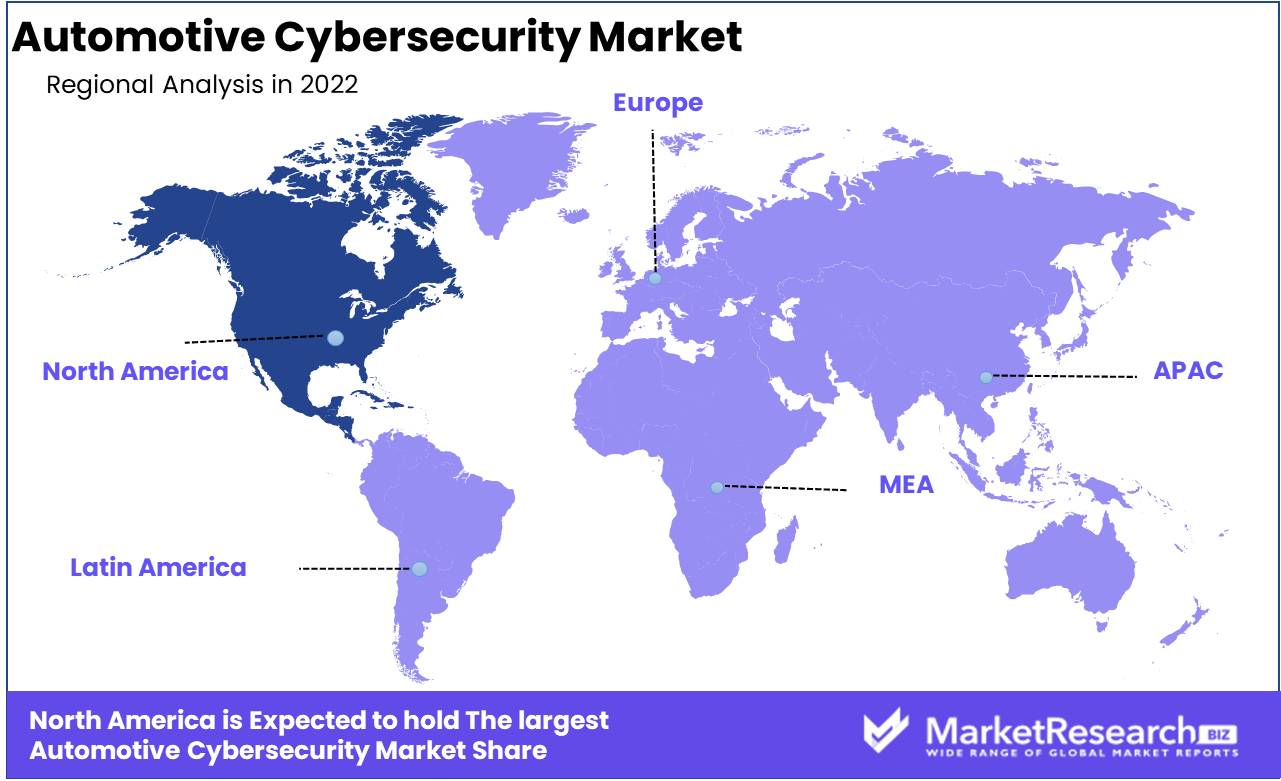

Regional Analysis

North America is A Center for Innovative Automotive Cybersecurity Solutions. As technology continues to advance quickly, the automotive industry is facing unprecedented cybersecurity challenges. The growing number of connected vehicles and reliance on digital systems have exposed the automotive industry to new vulnerabilities, making cybersecurity a top priority for manufacturers worldwide.

In the automotive industry, North America has emerged as a center for advanced cybersecurity solutions. The region's world-famous technology companies, government support, and robust research and development capabilities have established an ecosystem that fosters innovation and propels progress in this crucial area.

A strong network of tech companies is one of the propelling elements behind North America's leadership in automotive cybersecurity. Silicon Valley in California is home to some of the most innovative technology corporations in the world, such as Apple, Google, and Intel. These companies have made substantial investments in the creation of sophisticated cybersecurity products and have been at the vanguard of cybersecurity research.

North America is home to a vast network of entrepreneurs and smaller companies whose sole focus is automotive cybersecurity, in addition to the tech titans. Many of these companies offer cutting-edge products and services that are assisting to improve the safety and security of vehicles on the road, spurring innovation in the industry.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Connected automobiles, autonomous driving, and advanced driver assistance systems (ADAS) are becoming the norm in the automotive industry, which is undergoing a vast digital transformation. As a result of this growth in automotive connectivity, cybersecurity has become a significant concern for manufacturers, governments, and consumers. Consequently, the demand for automotive cybersecurity solutions is growing significantly, spawning a new market for high-tech cybersecurity providers.

The Automotive Cybersecurity Market is dominated by global technology giants specializing in network security, cloud security, and internet of things (IoT) security, such as Intel Corporation, Cisco Systems, and Symantec. These tech titans have the expertise and resources to provide the automotive industry with comprehensive cybersecurity solutions.

In addition, there are automotive-specific cybersecurity specialists such as Argus Cyber Security, Karamba Security, and Upstream Security. These businesses have developed solutions tailored to the distinct and complex challenges of securing connected vehicles.

BMW, Ford, and General Motors, among others, have established internal cybersecurity teams and partnered with third-party service providers to assure the security of their vehicles.

Top Key Players in Automotive Cybersecurity Market

- Argus Cyber Security Ltd.

- Arilou Technologies

- Vector Informatik GmbH

- NXP Semiconductors N.V.

- HARMAN International

- Continental AG

- ESCRYPT

- Karamba Security

- Robert Bosch GmbH

- Symantec Corporation

- Denso Corporation

- Honeywell International, Inc.

- Guardknox Cyber Technologies Ltd.

Recent Development

In August 2021, GM launched their cybersecurity bug bounty program. Independent security experts are paid to find and disclose GM car software cybersecurity problems. This program emphasizes the company's commitment to consumer cyber security.

In May 2021, BMW revealed its new integrated cybersecurity platform. This technology detects and responds to cyber attacks in real time, improving vehicle security.

In January 2021, Volkswagen purchased Trillium safe, a respected cybersecurity business specialized in safe data management and complete cybersecurity services. Volkswagen may improve its cybersecurity and car cyberdefense with this acquisition.

In December 2020, Ford's Cyber Defense Center opened. This center monitors and responds to cyberattacks on the company's car software and other vital systems. The center identifies cyber hazards and creates mitigation plans.

In November 2020, Tesla launched their cybersecurity team. Tesla's car software is constantly monitored and supported by the team to prevent cyberattacks.

Report Scope:

Report Features Description Market Value (2022) USD 9.4 Bn Forecast Revenue (2032) USD 54.8 Bn CAGR (2023-2032) 19.8% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Service (In-Vehicle, External Cloud Services)

By Application (Telematics System, Infotainment System, Powertrain System, Body Control & Comfort System, ADAS & Safety System)

By Security (Endpoint Security, Application Security, Wireless Network Security)

By Vehicle Type (Passenger Car, Commercial Vehicle, Electric VehicleRegional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Argus Cyber Security Ltd., Arilou Technologies, Vector Informatik GmbH, NXP Semiconductors N.V., HARMAN International, Continental AG, ESCRYPT, Karamba Security, Robert Bosch GmbH, Symantec Corporation, Denso Corporation, Honeywell International, Inc., Guardknox Cyber Technologies Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Argus Cyber Security Ltd.

- Arilou Technologies

- Vector Informatik GmbH

- NXP Semiconductors N.V.

- HARMAN International

- Continental AG

- ESCRYPT

- Karamba Security

- Robert Bosch GmbH

- Symantec Corporation

- Denso Corporation

- Honeywell International, Inc.

- Guardknox Cyber Technologies Ltd.