Cloud Gaming Market By Device(Consoles, Smartphone, Laptop/Tablets, Smart TV, Personal Computer), By Streaming Type(Video Streaming, File Streaming), By End-User(Casual Gamers, Avid Gamers, Hardcore Gamers), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

43659

-

March 2024

-

179

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

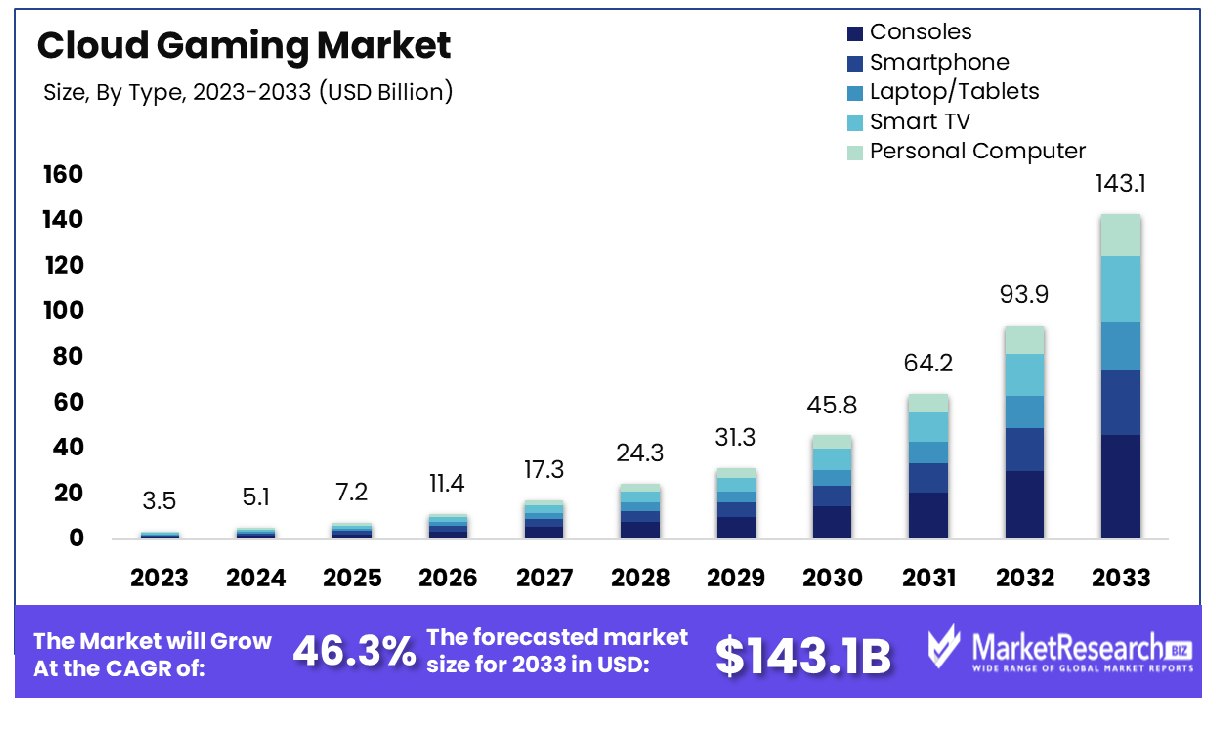

The global Cloud Gaming Market was valued at USD 3.5 billion in 2023, It is expected to reach USD 143.1 billion by 2033, with a CAGR of 46.3% during the forecast period from 2024 to 2033. The surge in demand for new advanced technologies and the emergence of several types of electronic devices are some of the main key driving factors for the cloud gaming market.

Cloud gaming is defined as gaming streaming which has technology that allows the users to play video games without any requirement for powerful local hardware. In cloud gaming, the game is generally run on remote servers in data centers, and the audio and video outputs are streamed to the individual’s electronic device over the internet.

This permits the major players to enjoy a high-quality gaming experience on any type of device with different performance potentialities like smartphones, low-end computers, and tablets. Cloud gaming services provide a series of games that individuals can access without the requirement for more downloads and installations. The success of cloud gaming is highly dependent upon the low latency internet connections to ensure a smooth and responsive gaming experience.

DigitalTv Europe in September 2022, highlights that LG, a renowned consumer electronic leader is widening its market reach through the gaming experience on its latest TVs, by adding new cloud gaming services and a UI update. Moreover, the Blacknut offers over 500 PC and console games, with different types of premium content for families and with up to 5 user profiles. Utomik Cloud technology provides a curated selection of 100 plus games from its 1300+ PC games series offering various genres with indie games among the platform’s highlights. The new cloud gaming apps will be available from September on the LG Apps Store on LG TVs running WebOS 6.0 and WebOS 2022.

Cloud gaming is vital as it changes gaming accessibility, permitting users to play high-quality video games on different electronic devices without any requirement for expensive hardware. It promotes more flexibility, decreases the obstacle to entry makes the gaming experience much smoother, and highlights the emergence of high-demand, platform-agnostic gaming in the digital era. Demand for Cloud gaming will see an upsurge in demand due to an increasing user population and electronic devices which will aid market expansion in coming years.

Key Takeaways

- Market Growth: Cloud Gaming Market was valued at USD 3.5 billion in 2023, It is expected to reach USD 143.1 billion by 2033, with a CAGR of 46.3% during the forecast period from 2024 to 2033.

- By Device: Consoles dominate with a significant 35% market share globally.

- By Streaming Type: Video streaming leads with a commanding 47% market share.

- By End-User: Casual gamers constitute a substantial 45% of the market.

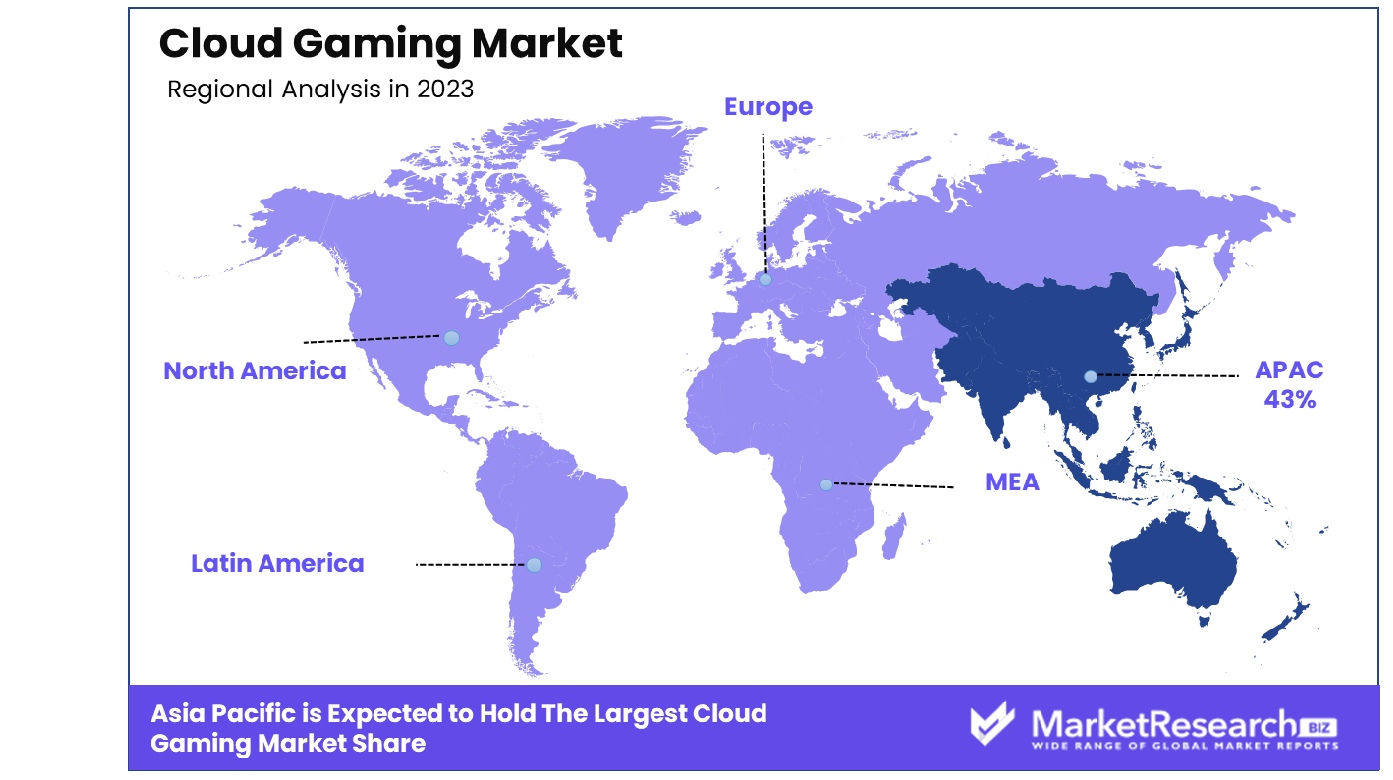

- Regional Dominance: Asia Pacific Dominates with a 43% Market Share in the Cloud Gaming Industry.

- Growth Opportunity: Mobile gaming expansion, driven by cloud gaming, offers growth opportunities, broadening access to high-quality games on smartphones. Developing nations present new markets, as cloud gaming democratizes access to gaming experiences.

Driving factors

Broadband and 5G Expansion Drives Market Growth

The surge in broadband penetration and the rollout of 5G mobile networks are pivotal to the cloud gaming market's expansion. By the end of 2023, the global 5G mobile network connections were expected to hit 1.9 billion, with projections reaching 5.9 billion by 2027. This exponential growth in high-speed internet access underpins the seamless operation of cloud gaming, which demands substantial bandwidth.

The advent of 5G not only enhances game streaming quality but also significantly widens the potential user base, making cloud gaming a more accessible and viable option for a global audience. This technological evolution ensures a smoother, more responsive gaming experience, setting the stage for cloud gaming to capture a larger share of the gaming market.

Game Streaming Technology Innovations Fuel Market Growth

Advancements in game streaming technology have been instrumental in propelling the cloud gaming market forward. With innovations in virtualization, predictive input modeling, and specialized encoding, platforms like Nvidia's GeForce NOW are setting new standards for streaming quality and accessibility.

Such technologies are critical in minimizing latency and enhancing the gaming experience, making cloud streaming gaming more appealing to a broader audience. These advancements not only improve user satisfaction but also broaden the market for cloud gaming by making high-quality gaming experiences accessible without the need for high-end hardware. As these technologies evolve, they will continue to lower barriers to entry, drawing more users to cloud gaming and contributing to market growth.

Smartphone Ownership Expansion Widens Market Reach

A major contributor to the rise of the cloud gaming market is the widespread proliferation of smartphones - 3 billion globally! This proliferation of gaming-capable smartphones expands the addressable market for cloud gaming, opening up new opportunities for service providers like Microsoft's xCloud that target mobile users.

As smartphones become more powerful and capable of delivering high-quality gaming experiences, cloud gaming services are positioned to tap into this vast user base. This trend not only democratizes access to gaming but also catalyzes market expansion by integrating cloud gaming into the daily lives of millions of smartphone users, thereby amplifying its growth potential.

Cloud Gaming's Answer to Hardware Limitations Spurs Market Adoption

The price of gaming consoles and PC upgrades creates a major hurdle to playing the newest games. Cloud gaming emerges as a cost-effective solution, offering access to cutting-edge games without the need for expensive hardware. Platforms like Google Stadia allow users to enjoy AAA games on affordable devices such as Chromecast, eliminating the upfront investment traditionally associated with high-quality gaming experiences.

This accessibility broadens the appeal of cloud gaming, attracting a wider audience that was previously hindered by hardware cost constraints. As cloud gaming continues to offer an affordable gateway to premium gaming experiences, it is expected to attract an increasingly larger user base, further driving market growth.

Restraining Factors

Internet Latency Issues Restrains Market Growth

Internet latency is a significant bottleneck for cloud gaming, where even minimal delays can disrupt gameplay, leading to a subpar experience. In regions with underdeveloped internet infrastructure, high latency is common. For instance, India's average mobile latency stands at about 40ms, which is unfavorable for cloud gaming.

This issue limits the market's potential, confining it to areas with advanced internet capabilities. Therefore, the market for cloud gaming is being severely hindered by inequities in global internet connectivity, dissuading many potential players from joining cloud gaming services.

Resistance from Traditional Gamers Restrains Market Growth

Traditional gamers, accustomed to high-end hardware, often exhibit resistance to cloud gaming. This demographic values the superior graphics and gameplay that consoles and gaming PCs offer and may view cloud gaming's occasional latency and compression artifacts as unacceptable compromises. Such resistance impedes cloud gaming's acceptance, particularly among hardcore gamers who demand the highest quality experiences.

This skepticism among a key gaming demographic challenges cloud gaming services' efforts to broaden their user base, slowing market growth. Overcoming this resistance requires not only technological advancements in cloud gaming but also a cultural shift in perceptions of gaming quality and experience.

By Device Analysis

Consoles dominate with a 35% market share, attracting gamers with their high-performance hardware and exclusive titles.

Consoles hold a substantial share of the cloud gaming market, accounting for 35% of usage. This dominance can be attributed to the seamless implementation of cloud gaming services and consoles, giving gamers access to an extensive collection of games, without the need to invest in high-end hardware. Consoles such as PlayStation and Xbox have established ecosystems that facilitate cloud gaming, enhancing user experience through optimized performance and accessibility. Moreover, console manufacturers have been actively investing in cloud gaming technologies, further bolstering this segment's growth.

Other segments like smartphones, laptops/tablets, smart TVs, and personal computers also contribute to the market's expansion. Smartphones, in particular, represent a rapidly growing segment due to the increasing penetration of high-speed internet and the proliferation of gaming-capable smartphones. Laptop/Tablets offer versatility, appealing to users seeking portable gaming experiences without compromising on game quality. Smart TVs are emerging as a convenient platform for casual gaming directly on the television, while personal computers remain a staple for gamers preferring traditional gaming setups with the added benefit of cloud gaming's versatility.

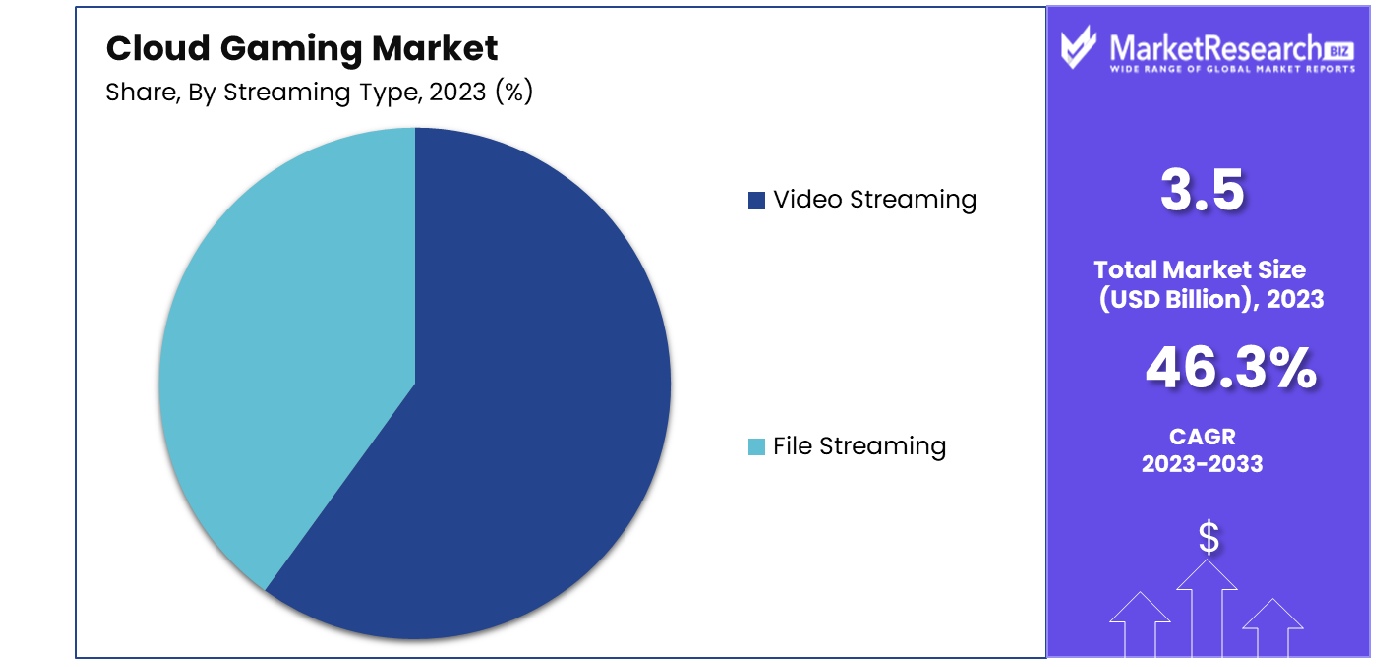

By Streaming Type Analysis

Video streaming holds a significant 47% market share, offering convenience and a vast library of content.

The video streaming segment is the most prevalent form of cloud gaming, capturing 47% of the market. This method streams gameplay video directly to the user's device, requiring only a stable internet connection without the need for high-end local hardware. Video streaming's dominance is underpinned by its accessibility and convenience, allowing users to play games across various devices seamlessly.

File streaming, although less common, plays a crucial role in the ecosystem by offering an alternative that streams game files to the user's device, allowing for local execution. This method can provide lower latency experiences under certain conditions and is an essential part of the market's diversity, catering to users with specific preferences or technical requirements.

By End-User Analysis

Casual gamers represent 45% of the market, enjoying accessible games on various platforms and devices.

Casual gamers constitute the biggest segment of users of the market for cloud gaming with about 45% of the base. The dominant position of this segment is driven by the attraction of cloud gaming's ease of use accessibility, accessibility, and variety of games that are suitable for play on the go. Casual gamers, who may not own high-end gaming hardware, find cloud gaming an attractive option due to its low entry barriers and the ability to play across multiple devices.

Avid and hardcore gamers, while not the dominant segments are crucial to the market's depth and diversity. Avid gamers, who play more frequently but may not invest as much in gaming as hardcore gamers, represent a significant portion of the market looking for flexibility and variety in gaming. Hardcore gamers, demanding the highest quality and performance, challenge cloud gaming services to continuously improve and innovate, driving technological advancements and enhancing the service quality for all user segments.

Key Market Segments

By Device

- Consoles

- Smartphone

- Laptop/Tablets

- Smart TV

- Personal Computer

By Streaming Type

- Video Streaming

- File Streaming

By End-User

- Casual Gamers

- Avid Gamers

- Hardcore Gamers

Growth Opportunity

Mobile Gaming Expansion Offers Growth Opportunity

The growth of mobile gaming cloud gaming, with users predicted to grow between 32 and around 87 million by the year 2025. This is a huge growth potential for the market for cloud gaming. With no hardware restrictions cloud gaming market growth permits the creation of console and PC-quality games for mobile devices, expanding the possibilities of gaming on mobile devices. Niantic's development of a cloud-streamed AR mobile cloud gaming exemplifies this trend. This shift not only enhances the quality and complexity of mobile games but also significantly expands the user base, as gamers seek more immersive experiences on their smartphones.

New Markets in Developing Nations Offer Growth Opportunity

Cloud gaming's affordability and accessibility present major growth opportunities in developing nations, where the penetration of traditional gaming hardware is limited. Microsoft's pilot of xCloud in Brazil highlights the potential to tap into new user demographics in Latin America and beyond. By bypassing the need for expensive consoles and PCs, cloud gaming can democratize access to high-quality gaming experiences, fostering market expansion in regions with growing digital infrastructure but previously underserved by the gaming industry.

Latest Trends

Integration with Streaming Media Devices

The partnership between cloud gaming services and makers of smart TVs and streaming devices like Chromecast and Nvidia Shield TV underscores a significant opportunity for market growth. These collaborations make cloud gaming more accessible to a wider audience, seamlessly integrating gaming into the living room entertainment ecosystem. Such integration not only enhances the visibility of cloud gaming services but also positions them as a standard component of home entertainment, potentially capturing users who may not have engaged with gaming previously.

Blockchain Integration Is on the Rise

The integration of blockchain technology in cloud gaming, as demonstrated by platforms like Ultra, opens new avenues for securing digital rights and assets, thereby enhancing trust and value within the gaming ecosystem. Blockchain's potential to support game streaming through transparent and secure transactions can foster innovation, create new revenue models, and attract users and developers interested in the benefits of decentralized technology. This integration represents a forward-looking approach to addressing digital ownership and rights management in gaming, offering a growth pathway by merging cutting-edge technology with new gaming experiences.

Regional Analysis

Asia Pacific Dominates with a 43% Market Share

The Asia Pacific region's dominance in the cloud gaming market, holding a 43% share, can be attributed to several key factors. High-speed internet penetration, especially in countries like South Korea and Japan, alongside significant advancements in 5G technology, provides a robust infrastructure for cloud gaming. Furthermore, the region's large and growing population of tech-savvy consumers, particularly in China and India, contributes to a vast potential user base. The cultural acceptance and popularity of gaming, combined with strong local ecosystems of game developers and publishers, further fuel the growth.

Regional dynamics, including economic growth, technological innovation, and digital infrastructure development, play crucial roles in shaping the cloud gaming industry in Asia Pacific. The region's commitment to digitalization, coupled with competitive telecommunications markets, ensures widespread availability of high-speed, reliable internet services, essential for cloud gaming. In addition, the presence of large gaming key companies in the region promotes the development of cloud gaming platforms as well as content which makes it a center for both consumption and development.

The Asia Pacific's market presence is expected to continue its growth trajectory, further solidifying its dominance in the cloud gaming sector. As infrastructure continues to improve and smartphone penetration increases, cloud gaming is likely to become more accessible, attracting even more users. The region's influence on global gaming trends and technologies will likely increase, driving innovation and possibly setting standards for cloud gaming worldwide. With the ongoing investment in digital infrastructure as well as gambling ecosystems, Asia Pacific is poised to be at the forefront of the gaming industry's growth.

North America: A Key Player in Cloud Gaming

North America, with its advanced digital infrastructure and high disposable income levels, represents a significant market for cloud gaming. The region benefits from widespread high-speed internet access and a strong culture of technological adoption, making it an ideal environment for cloud gaming platforms. Furthermore, the presence of large gaming and technology firms facilitates the continuous development and investments in the field.

Europe: Strategic Growth in Cloud Gaming

Europe's cloud gaming market is characterized by its strong digital infrastructure, regulatory support for digital services, and a diverse gaming audience. The region's emphasis on data privacy and consumer rights aligns with cloud gaming platforms' need to ensure secure and fair services. With ongoing investments in 5G and broadband expansion, Europe is strategically positioned for growth in cloud gaming, catering to its tech-savvy population's demands.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In the rapidly evolving Cloud Gaming Market, key players such as NVIDIA Corporation, Microsoft Corporation, Google LLC (Google Stadia), Sony Interactive Entertainment LLC (PlayStation Now), and Tencent Holdings Limited are leading the charge in transforming gaming experiences.

These gaming companies leverage their technological prowess and extensive gaming libraries to provide seamless, high-quality streaming services. NVIDIA's GeForce NOW, Microsoft's integration with Xbox Game Pass, and Google Stadia's cloud platform exemplify the strategic positioning aimed at capturing diverse segments of gamers, from casual to hardcore. Sony's PlayStation Now capitalizes on its vast PlayStation game library, appealing to loyal console gamers.

Emerging players like Amazon.com, Inc. (Amazon Luna), Ubisoft Entertainment SA, Electronic Arts Inc. (EA Play), and Valve Corporation enrich the ecosystem with unique offerings and partnerships, enhancing the content available for streaming. Amazon Luna and Apple Inc. (Apple Arcade) leverage their existing consumer base and cloud infrastructure to provide curated gaming experiences, targeting casual gamers and Apple device users, respectively.

Smaller entities like Parsec Cloud Inc., Blade (Shadow), Blacknut, and Vortex focus on niche aspects of cloud gaming, such as high-performance PC gaming access and family-friendly content, underscoring the market's diversity. These major companies contribute to the competitive dynamics by pushing technological boundaries and expanding the market's reach to include underserved regions and demographics.Market Key Players

- NVIDIA Corporation

- Microsoft Corporation

- Google LLC (Google Stadia)

- Sony Interactive Entertainment LLC (PlayStation Now)

- Tencent Holdings Limited

- Amazon.com, Inc. (Amazon Luna)

- Ubisoft Entertainment SA

- Electronic Arts Inc. (EA Play)

- Valve Corporation

- Apple Inc. (Apple Arcade)

- Parsec Cloud Inc.

- Blade (Shadow)

- NVIDIA GeForce NOW

- Blacknut

- Vortex

Recent Development

- In February 2024, Nokia unveiled Multi-Access Edge Slicing, showcased with e& UAE at Mobile World Congress 2024. It enables premium slicing services across 4G/5G, FWA, and FA, supporting diverse applications simultaneously, and enhancing network efficiency and user experience.

- In February 2024, Utomik and Cloudbase unite, revolutionizing cloud gaming. With over 1,700 games available, including 300 cloud-based titles, gamers enjoy a seamless, expansive experience across PC, Android, and Smart TV platforms.

- In February 2024, Aethir and Well-Link Tech collaborated to revolutionize cloud gaming and AI potential. Aethir's decentralized GPU network enhances Well-Link Tech's real-time cloud rendering, targeting 200 million users for immersive experiences.

Report Scope

Report Features Description Market Value (2023) USD 3.5 Billion Forecast Revenue (2033) USD 143.1 Billion CAGR (2024-2032) 46.3% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Device(Consoles, Smartphone, Laptop/Tablets, Smart TV, Personal Computer), By Streaming Type(Video Streaming, File Streaming), By End-User(Casual Gamers, Avid Gamers, Hardcore Gamers) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape NVIDIA Corporation, Microsoft Corporation, Google LLC (Google Stadia), Sony Interactive Entertainment LLC (PlayStation Now), Tencent Holdings Limited, Amazon.com, Inc. (Amazon Luna), Ubisoft Entertainment SA, Electronic Arts Inc. (EA Play), Valve Corporation, Apple Inc. (Apple Arcade), Parsec Cloud Inc., Blade (Shadow), NVIDIA GeForce NOW, Blacknut, Vortex Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- NVIDIA Corporation

- Microsoft Corporation

- Google LLC (Google Stadia)

- Sony Interactive Entertainment LLC (PlayStation Now)

- Tencent Holdings Limited

- Amazon.com, Inc. (Amazon Luna)

- Ubisoft Entertainment SA

- Electronic Arts Inc. (EA Play)

- Valve Corporation

- Apple Inc. (Apple Arcade)

- Parsec Cloud Inc.

- Blade (Shadow)

- NVIDIA GeForce NOW

- Blacknut

- Vortex