Laptop Market By End-user (Personal, Business, Gaming), By Type(Traditional laptop, 2-in-1 laptop), By Design(Notebook, Ultrabook, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

8198

-

Feb 2024

-

189

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

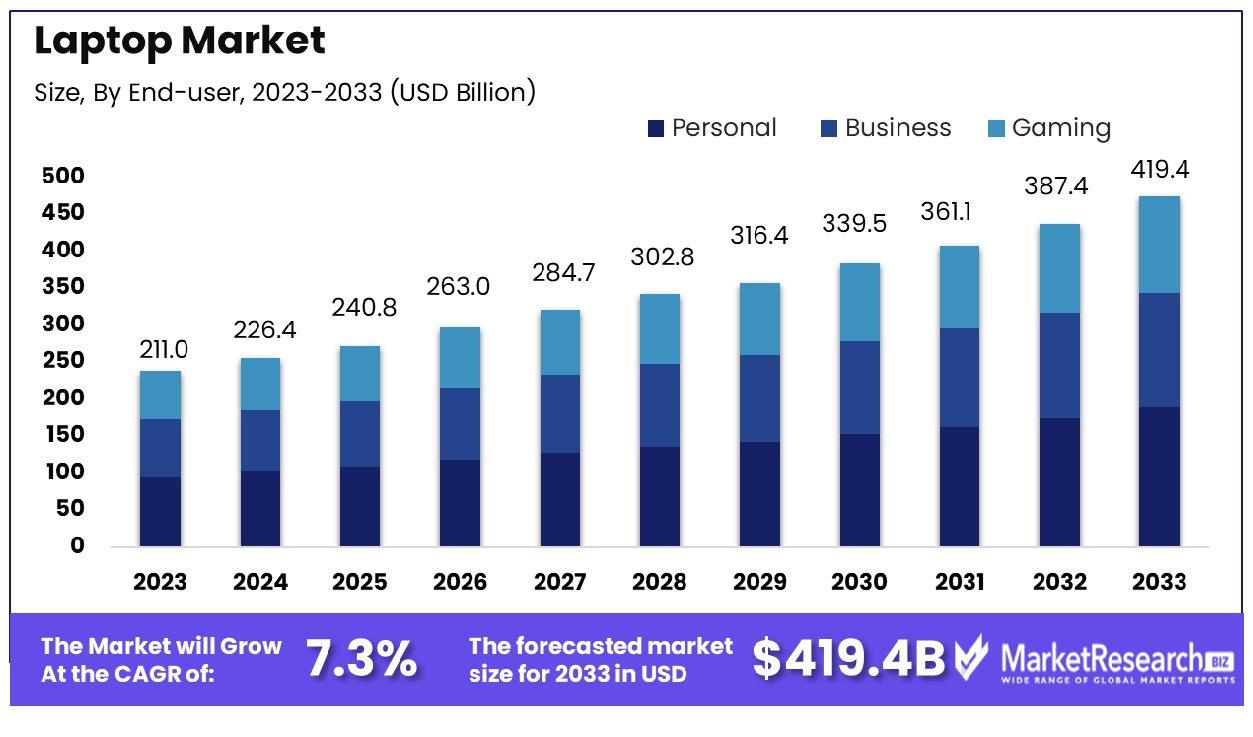

The global laptop market was valued at USD 211.0 billion in 2023. It is expected to reach USD 419.4 billion by 2033, with a CAGR of 7.3% during the forecast period from 2024 to 2033.

The surge in demand for advanced technologies and the sudden rise in education sectors are some of the main key driving factors for the laptop market. A laptop also known as a notebook computer by manufacturers is a battery-powered personal computer that is smaller than a briefcase. It can be easily transported and can be used in momentary spaces like airplanes, temporary offices, meetings, and libraries.

It can be changed into a desktop computer with a docking station which is a hardware frame that distributes connections for all input or output devices like a monitor, printer, and keyboard. A laptop computer comprises a battery that permits it to run anywhere with or without nearby power outlets. The built-in networking and 5G cellular connectivity permit a laptop to link and surf the internet without any wires.

Several laptop manufacturers are developing affordable Android laptops to target customers in countries with low buying power capacity, which is anticipated to attract a huge number of customers from specific regions. According to a report published by Live Mint in January 2024, Taiwan-based firm, Wistron’s new laptop manufacturing plant is projected to develop 3,000 employment chances. There are over 50% of the laptops that are manufactured will be supplied and these plants will also generate IoT elements and EVs- related to manufacturing plants. Moreover, Dell introduced 4 new laptops in India that are comprised of Alienware gaming devices.

Laptops are used in every corner of the respective fields. These are commonly used in the education and IT sectors. The foremost benefit of having or purchasing a laptop is that it can be easily carried used without any difficulties anytime and anywhere. These are augmenting connectivity, predictability, maintaining speed and accuracy, and collaborating opportunities and information security. The demand for the laptop will increase due to its high-end requirements in several sectors that will help in market expansion in the coming years.

Key Takeaways

- Market Growth: The laptop market was valued at USD 211.0 billion in 2023. It is expected to reach USD 419.4 billion by 2033, with a CAGR of 7.3% during the forecast period from 2024 to 2033.

- By End-user: Personal laptops dominate, catering to individual needs and preferences effectively.

- By Type: Traditional laptops remain prevalent, favored for their reliability and familiarity.

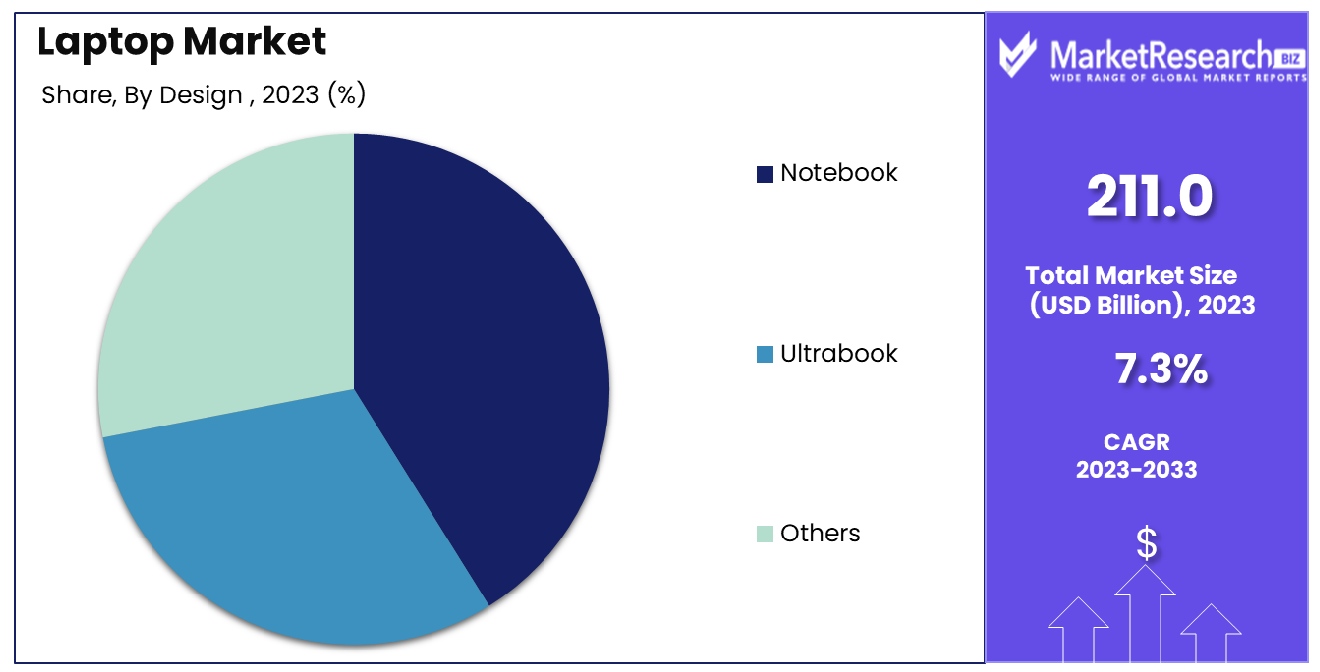

- By Design: Notebook design leads, combining portability with functionality for widespread appeal.

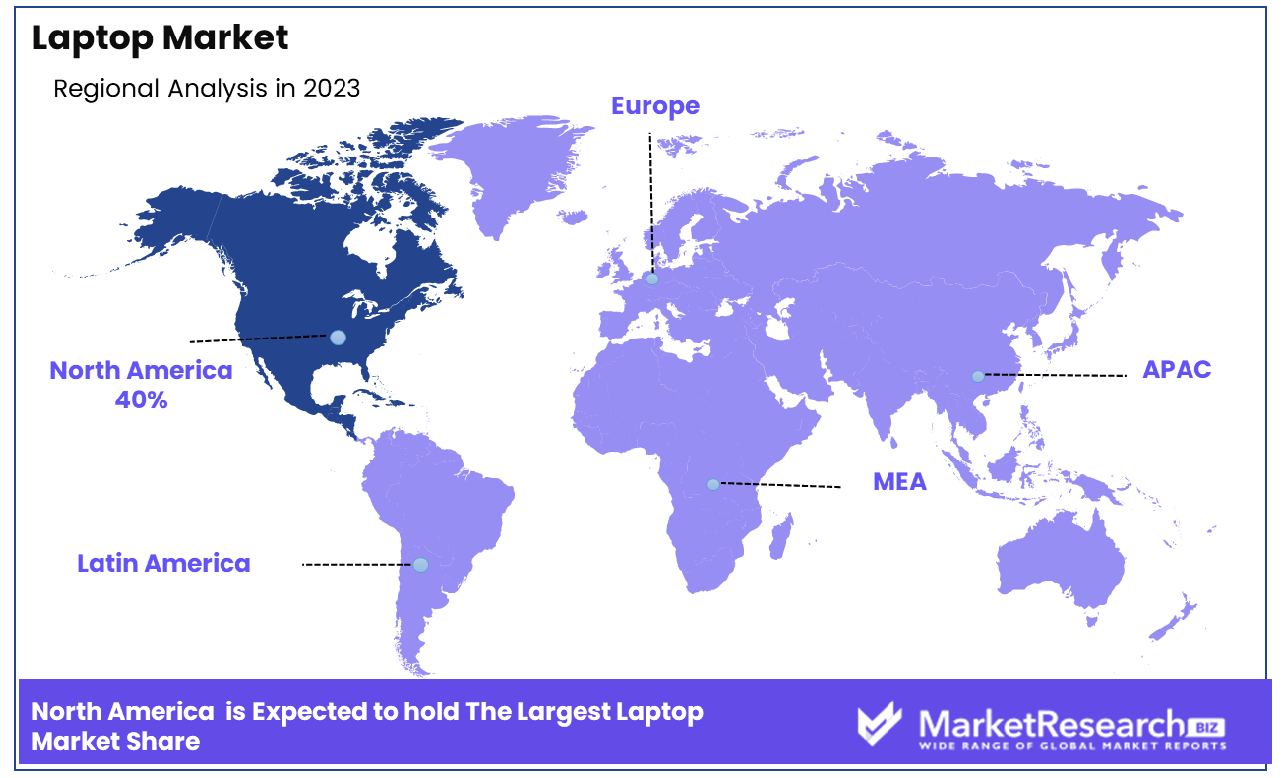

- Regional Dominance: North America Dominates with 40% Market Share in Laptop Industry

- Growth Opportunity: The education sector's embrace of affordable Chromebooks drives laptop demand while emerging markets present the untapped potential for expansion.

Driving factors

Portability Enhances Laptop Market Dynamics

The laptop market is experiencing significant growth driven by the demand for portable computing devices. Modern laptops, like Apple's MacBook Air, epitomize portability with their lightweight, sleek designs. Ultrabooks and Chromebooks, typically weighing between 2 to 3 pounds, cater to the needs of professionals and students who require computing mobility.

The trend towards slim, compact laptops, typically around 13 to 14 inches and weighing about 3 pounds or less, reflects consumers' preference for devices that support an on-the-go lifestyle, thus fueling market expansion.

Performance Advances Propel Laptop Demand

Technological advancements in processing power, graphics, and memory are key growth drivers for the laptop market. In 2023, the Apple M3 8 Core's top PassMark performance score exemplifies the capabilities of modern laptops to handle intensive tasks like the gaming industry, video editing, and data analysis.

This surge in performance parameters broadens the applicability of laptops, catering to a diverse range of user needs, from casual browsing to professional-grade applications, thereby stimulating market steady growth.

Remote Work Spurs Laptop Sales

The shift towards remote work, accelerated by the pandemic, significantly impacts the laptop market. With 12.7% of full-time employees working remotely and 28.2% in a hybrid model, as reported by Forbes in 2023, there's a heightened demand for laptops that support video conferencing, cloud collaboration, and seamless online access.

This trend is further reinforced by a Gallup survey indicating the productivity benefits perceived by a majority of the workforce, including Gen Z, Gen X, and millennials, in remote and hybrid work setups. This shift in work culture underpins the sustained demand and growth in the laptop market.

Restraining Factors

Market Saturation Curbs Laptop Industry Growth in North America

The laptop market in mature regions like North America is grappling with saturation challenges. Many companies in this area are focusing on enhancing their current operations and investing in research and development. Despite these efforts, a decline in revenue is expected during the forecast period. The saturation in these mature markets is largely due to the majority of product categories reaching their peak demand, with little room for significant growth. This situation presents a notable restraint for the laptop industry in North America, as the potential for expanding the customer base and increasing sales is considerably limited.

Component Shortages Disrupt Laptop Market Supply Chain

The laptop market has been adversely impacted by supply chain disruptions, particularly due to COVID-19-related issues. This has led to significant shortages in essential components like semiconductor chips, hindering the production capabilities of laptop manufacturers. Consequently, the reduced supply of laptops in the market has triggered an increase in prices. These component shortages not only affect the availability of laptops but also challenge the industry's ability to meet consumer demand efficiently. This constraint poses a significant barrier to the growth of the laptop market, as companies struggle to maintain consistent production levels and competitive pricing.

By End-user Analysis

Personal laptops are favored by individual users for their tailored features and personalized experiences.

Personal Use stands as the predominant segment in the laptop market. This segment's dominance is attributed to the wide-ranging utility of laptops for individual users, encompassing a variety of tasks from basic computing and internet browsing to more demanding applications like multimedia editing and programming. The increasing affordability and versatility of laptops have made them essential tools for personal use, further accelerated by the global shift towards remote work and online education. The growing demand for lightweight and portable computing solutions for personal use underscores the segment's market dominance.

Business and Gaming segments, while significant, follow the personal segment. Gaming laptops designed for business purposes emphasize features like enhanced security, robust build quality, and enterprise-grade software support, catering to professional work environments. The gaming segment, driven by advancements in graphics and processing power, caters to the rising demand for high-performance laptops capable of running sophisticated gaming applications. Nevertheless, the broad appeal and adaptability of laptops for personal use solidify their leading position in the market.

By Type Analysis

Traditional laptops remain popular due to their reliability and familiar form factor among consumers.

In the laptop market, Traditional Laptops command a substantial market share, maintaining their status as the dominant segment. Their widespread popularity is largely due to their proven reliability, range of options catering to different price points, and their suitability for a diverse range of applications. Traditional laptops offer the right balance of performance, durability, and cost-effectiveness, making them suitable for both personal and professional use. They continue to be the go-to choice for users seeking a straightforward, dependable computing device.

2-in-1 laptops, which can double as tablets, present an emerging trend offering versatility and portability. These devices are particularly popular among users who value the flexibility of a touchscreen interface and the convenience of a convertible design. Despite this, the conventional laptop segment, with its comprehensive range and established user base, remains the market leader.

By Design Analysis

Notebook designs continue to dominate the market, offering a balance of portability and functionality.

Notebooks hold a leading position in the laptop market by design. Noted for their compactness, lighter weight, and practical features, notebooks meet the needs of a wide user base, including students, professionals, and casual users. Their portability and affordability are key factors that contribute to their widespread popularity. Notebooks are designed to offer an optimal balance between functionality and mobility, making them a preferred choice for users who require a versatile computing solution.

Key Market Segments

By End-user

- Personal

- Business

- Gaming

By Type

- Traditional laptop

- 2-in-1 laptop

By Design

- Notebook

- Ultrabook

- Others

Growth Opportunity

Education Sector Drives Demand for Affordable Computing Solutions

The education sector's shift towards digital classrooms and e-learning represents a substantial growth opportunity for the laptop market. The increasing adoption of laptops in schools and universities, especially affordable Chromebooks, is a key driver. Retailers like Tech to School, Best Buy, and Google for Education are capitalizing on this trend by offering a range of Chromebooks, priced between $200 to $500, designed to meet diverse educational needs.

This trend is not just about the number of devices sold but also about the potential for creating long-term customer relationships and brand loyalty among young users, setting the stage for future market expansion as these students enter the workforce.

Emerging Markets Present New Frontiers for Laptop Expansion

Developing nations with burgeoning middle classes, such as India and Indonesia, offer significant untapped potential for the laptop market. In 2022, India alone imported laptops and tablets worth $6.9 billion. This demand is propelled by the country's large youth population, increasing internet penetration, and government digitalization initiatives.

Targeting these emerging markets with consumer laptops tailored to local needs and price sensitivities can unlock vast new customer segments. As these economies grow and digital literacy improves, the demand for personal computing devices is expected to surge, providing a lucrative avenue for growth and diversification for laptop manufacturers and retailers.

Latest Trends

Rise of Ultra-Portable Laptops

Ultra-portable laptops, boasting sleek designs and lightweight builds, are gaining momentum in the market. With consumers prioritizing mobility, manufacturers are focusing on enhancing battery life and performance, catering to the needs of professionals and students seeking convenience without compromising productivity.

Surge in Demand for Hybrid 2-in-1 Laptops

The laptop market is witnessing a surge in demand for hybrid 2-in-1 devices, offering versatility as both laptops and tablets. This trend is fueled by consumers seeking multifunctional gadgets for work and entertainment, prompting manufacturers to innovate with flexible designs and screen size capabilities.

Regional Analysis

North America Dominates with 40% Market Share in Laptop Industry

North America's commanding 40% share of the global laptop market is underpinned by several key factors. Firstly, the presence of tech giants like Apple, HP, and Dell, headquartered in this region, plays a pivotal role. These companies not only lead in innovation but also have a significant impact on market trends. Additionally, the high consumer purchasing power and the rapid adoption of new technology in this region contribute to sustained market growth.

The laptop market in North America is characterized by a high demand for innovative features, such as lightweight models, longer battery life, and advanced processors. The region also shows a strong preference for premium, high-performance laptops, particularly for business and gaming purposes. Moreover, the integration of laptops with educational systems and corporate sectors, further fueled by the remote work culture, significantly drives market growth.

Europe's Strong Position in the Global Laptop Market

Europe's market share in the laptop industry is bolstered by robust demand for both consumer and business laptops. The region benefits from a diverse consumer base and a strong inclination towards technologically advanced, energy-efficient laptops. Additionally, European countries' focus on digital education initiatives contributes to the consistent demand for laptops.

Asia Pacific's Growing Influence on the Laptop Market

The Asia Pacific region, while holding a smaller share compared to North America, is rapidly growing due to its burgeoning consumer base and increasing internet penetration. The region is a significant hub for laptop manufacturing, with countries like China and Taiwan playing key roles in the supply chain. The increasing affordability of laptops and growing IT infrastructure in emerging economies further boost the market's growth potential in this region.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In the highly competitive laptop market, each company listed plays a pivotal role, characterized by unique strategic positioning and market influence. Acer Inc. is known for offering a wide range of laptops catering to various segments, balancing performance and affordability. Their focus on budget-friendly options makes them a go-to choice for cost-conscious consumers.

Apple Inc., with its MacBook line, stands out for its premium design, high-performance capabilities, and seamless integration within the Apple ecosystem. This positions Apple as a leader in the high-end market segment, appealing to consumers seeking a combination of aesthetics, performance, and brand value.

ASUSTeK Computer Inc. and Micro-Star International Co. Ltd. (MSI) are recognized for their strong presence in the gaming laptop segment. Their focus on high-performance hardware and dedicated gaming features appeals to a niche but rapidly growing segment of the market.

Market Key Players

- Acer Inc.

- Apple Inc.

- ASUSTeK Computer Inc.

- Dell Technologies Inc.

- Hewlett-Packard Development Company L.P.

- Lenovo Group Limited

- Microsoft Corporation

- Micro-Star International Co. Ltd.

- Razer Inc.

- Samsung Electronics Co. Ltd.

- Sony Group Corporation

- Sony

- Panasonic

- LG Electronics

- Philips

- Toshiba Corp.

- Alphabet Inc.

Recent Development

- In January 2024, Asus launched the new ZenBook 14 OLED lineup in India, featuring Intel AI chips, 3K OLED displays with 120Hz refresh rates, and Intel Core Ultra processors with up to 32GB RAM and 1TB storage

- In January 2024, Lenovo launches the Legion 9i gaming laptop in India, featuring an Intel Core i9-13980HX processor, NVIDIA GeForce RTX 4090 GPU, AI-tuned cooling, and a 3.2K Mini-LED display with a 165Hz variable refresh rate.

- In December 2023, Lenovo announced the redesigned Legion Y7000P gaming laptop for 2024, featuring a modern aesthetic with a new rear vent configuration and upgraded hardware, including an i7-14650HX processor and RTX 4060 graphics card.

Report Scope

Report Features Description Market Value (2023) USD 211.0 Billion Forecast Revenue (2033) USD 419.4 Billion CAGR (2024-2032) 7.3% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By End-user (Personal, Business, Gaming), By Type(Traditional laptop, 2-in-1 laptop), By Design(Notebook, Ultrabook, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Acer Inc., Apple Inc., ASUSTeK Computer Inc., Dell Technologies Inc., Hewlett-Packard Development Company L.P., Lenovo Group Limited, Microsoft Corporation, Micro-Star International Co. Ltd., Razer Inc., Samsung Electronics Co. Ltd., Sony Group Corporation, Sony, Panasonic, LG Electronics, Philips, Toshiba Corp., Alphabet Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Acer Inc.

- Apple Inc.

- ASUSTeK Computer Inc.

- Dell Technologies Inc.

- Hewlett-Packard Development Company L.P.

- Lenovo Group Limited

- Microsoft Corporation

- Micro-Star International Co. Ltd.

- Razer Inc.

- Samsung Electronics Co. Ltd.

- Sony Group Corporation

- Sony

- Panasonic

- LG Electronics

- Philips

- Toshiba Corp.

- Alphabet Inc.