Generative AI In Pharma Market Report By Application (Drug Discovery, Clinical Trial Research, Predictive Analytics, Disease Identification And Diagnosis, Personalized Medicine, Other Applications), By Technology (Machine Learning, Natural Language Processing (NLP), Deep Learning, Other Technologies), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends And Forecast 2024-2033

-

36896

-

March 2024

-

155

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

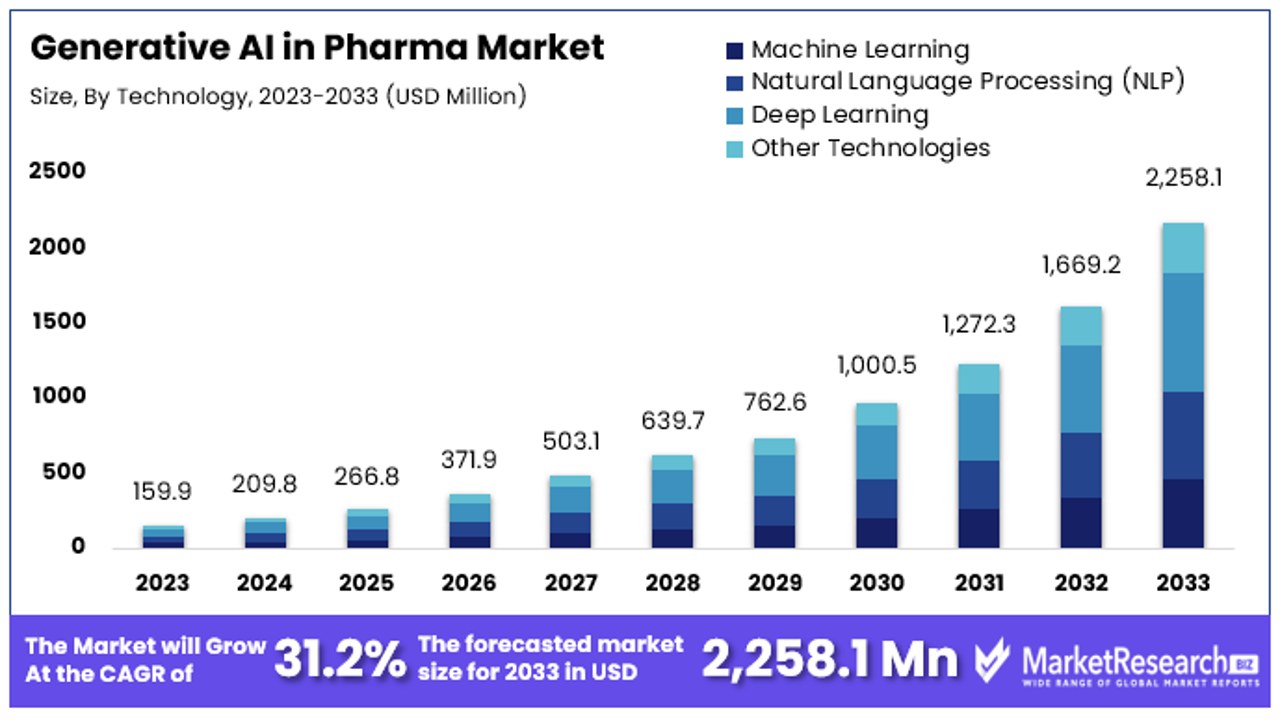

Global Generative AI in Pharma market size is expected to be worth around USD 2258.1 Mn by 2033 from USD 159.9 Mn in 2023, growing at a CAGR of 31.2% during the forecast period from 2024 to 2033.

The surge in demand for the advanced technologies and rise in new medicines and pharmaceutical sectors are some of the main key driving factors for the generative AI in pharma.

Generative AI in the pharma is defined as the new advanced technologies that uses machine learning algorithms to autonomously produce novel solutions and insights customized to pharmaceutical manufacturing and drug developments methods. It uses deep learning methods to analyse huge data sets, forecast molecular structures, enhance drug designs and simulate biological methods.

Generative AI makes the quick discovery of new discovery of new drug designs that facilitates tailored made medicines through accurate drug designs and fastens the enhancement of manufacturing techniques, like bio manufacturing and formulation developments.

Moreover, it supports in drug repurposing by understanding present medications for new therapeutic uses. By integrating computational power with domain expertise, generative AI transforms drug discovery, development and production in the pharma sectors by leading to more efficient methods, decreasing expenses and enhances patient results.

According to Master of code in February 2024, highlights that Adaptyv Bio has introduced a protein engineering foundry by using Gen AI, open source software and synthetic biology to create new medicines, enzymes and sustainable materials. Absci also unveils its uses of zero-shot AI in antibody designs by focusing to decrease the time to clinics for new medicament patients. Pharos iBio developed an AI-driven anticancer medication that addresses the FLT3 gene mutation.

Moreover, Boston consulting group has also identified more than 130 potential use cases for gen AI in biopharma that ranges from patient identification by using health record data to automated medical text generation and digital sales agents. Furthermore, faster drug molecular design is resulting in a 25% reduction in production period.

By using gen AI, it accelerates clinical developments by specifically in automating medical documents by minimizing writing time by 30%. DiffDock attained a 38% success rate in molecular docking predictions, exceptional both traditional methods (23%) and deep learning methods (20%). Recursion used AI to forecast targets for 36 billion compounds, making a scale of research in a week that would have taken 100,000 years with conventional approaches.

Generative AI in pharma provides fast drug discovery through predictive modelling, molecular design and virtual screening, minimizing the time and cost. It improves customized medicines by personaling treatments to individual patients. Furthermore, it enhances the bioprocessing, formulation developments and drug repurposing, nurturing new innovations and enhancing healthcare solutions. The demand for the Generative AI in Pharma will increase due to its requirement in the pharmaceutical industries that will help in market expansion in the coming years.

Key Takeaways

- Market Value: The Global Generative AI in Pharma Market is projected to reach USD 2258.1 Million by 2033, experiencing substantial growth from its 2023 value, with a CAGR of 31.2% during the forecast period from 2024 to 2033.

- Dominant Segments:

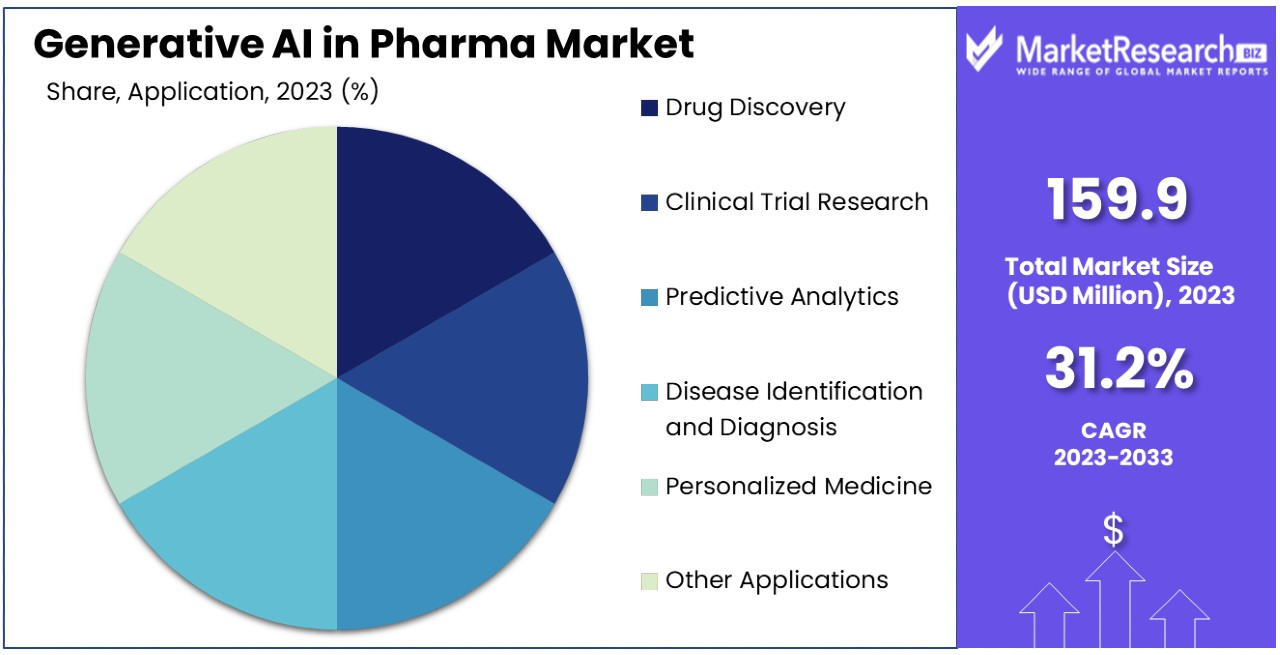

- Application Analysis: Drug Discovery, Emerges as the dominant sub-segment, leveraging Generative AI's ability to accelerate the drug development process by identifying potential candidates quickly and cost-effectively.

- Technology Analysis: Deep Learning, Leads the technology spectrum, offering profound capabilities in interpreting complex patterns within large datasets, particularly beneficial in drug discovery, protein structure prediction, and genomics.

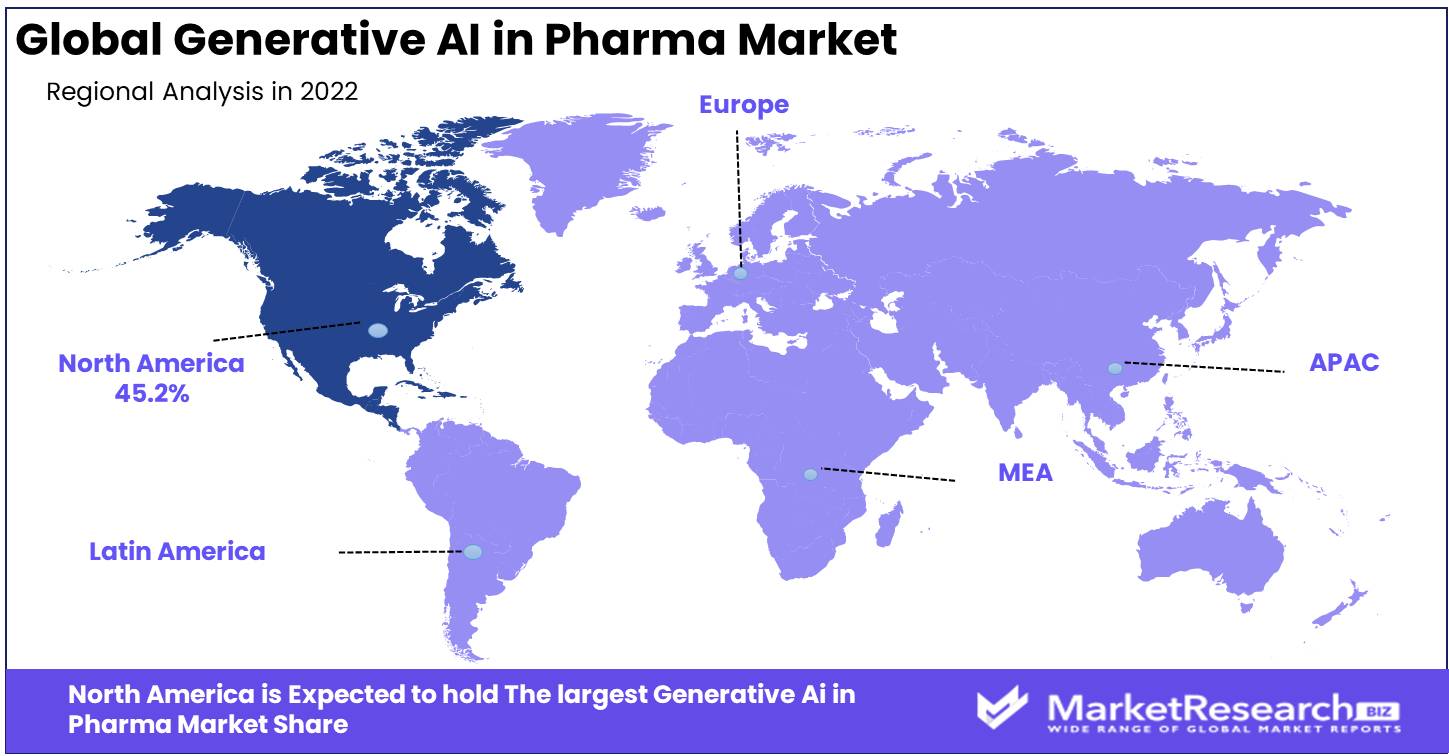

- Regional Analysis:

- North America: Dominates with a 45.2% market share, driven by advanced research infrastructure and significant investments in healthcare AI.

- Europe: Holds approximately 28% market share, supported by strong research infrastructure, public-private partnerships, and increasing healthcare AI investments.

- Analyst Viewpoint: The market's growth is fueled by the urgent need to expedite drug discovery and development processes, enhance R&D efficiency, and deliver personalized healthcare solutions. Opportunities lie in further technological advancements, expanding application areas, and strengthening collaborations across the pharmaceutical ecosystem.

- Market Key Players: Major players include Nvidia, Insilico Medicine Inc., Atomwise Inc., BenevolentAI Ltd., Numerate Inc., XtalPi Inc., Berg Health LLC, Conduent Incorporated, Fujitsu, OKRA.ai, and others.

Driving Factors

Accelerated Drug Discovery Drives Market Growth

Generative AI is revolutionizing the pharmaceutical industry by significantly accelerating the drug discovery process. It achieves this by generating novel molecular structures and predicting drug interactions, thereby enabling the faster development of new medications. A notable collaboration in June 2023 involved the University of Toronto, Foxconn, and Insilico Medicine, focusing on the application of hybrid quantum-classical generative adversarial networks for small-molecule discovery.

This advanced approach is anticipated to produce molecules with superior properties compared to those discovered through traditional methods. Such technological advancements are drawing more companies to invest in Generative AI solutions, underlining its potential to transform drug discovery. The ability to rapidly identify viable new compounds can drastically reduce the time to market for new drugs, making this technology a key driver in the growth of the Generative AI in the pharmaceutical market.

Cost Savings and Efficiency Enhance Pharma Operations

Merck's AI solution highlights the cost-saving potential of Generative AI in the pharmaceutical industry, promising up to 70% savings in time and costs for drug discovery. By automating labor-intensive processes and optimizing drug development, Generative AI brings about significant efficiency gains.

These advancements not only streamline the drug development process but also enhance manufacturing efficiencies. The result is a substantial reduction in expenses and a boost in productivity for pharmaceutical companies. This economic advantage positions Generative AI as a crucial technological adoption for the industry, driving market growth through improved operational efficiency and cost-effectiveness in drug discovery and development.

Personalized Medicine Advances Treatment Effectiveness

Generative AI plays a pivotal role in the development of personalized medicine, enabling the creation of drugs that are tailored to the specific needs of patient groups. This bespoke approach to drug design significantly enhances treatment effectiveness while minimizing side effects, leading to better patient outcomes. Personalized medicine represents a shift towards more patient-centric treatment strategies, a movement that Generative AI is uniquely equipped to support.

As the healthcare industry continues to emphasize individualized care, the demand for Generative AI technologies in drug development is expected to rise. The ability to develop treatments that are precisely aligned with individual patient profiles not only improves clinical outcomes but also drives the adoption of Generative AI solutions in the pharmaceutical sector, contributing to its growth.

Restraining Factors

Lack of Standardization Restrains Market Growth

The absence of universally accepted standards significantly impedes the progress of Generative AI in the pharmaceutical sector. This gap in standardization means that outcomes of Generative AI applications in drug discovery are hard to compare and validate across different research initiatives. Without clear benchmarks or protocols, the industry struggles to develop models that are both accurate and reliable for concocting new chemical entities and testing scientific theories.

This challenge not only affects the efficiency of research and development activities but also undermines the potential for collaborative innovation among scientists, regulatory bodies, and pharmaceutical companies. Ensuring the consistency of results and methodologies is crucial for fostering trust in AI-generated data and facilitating the broader acceptance and implementation of these technologies. Addressing this lack of standardization requires concerted efforts to establish comprehensive guidelines that can harmonize approaches to applying Generative AI in drug development.

Regulatory and Compliance Challenges Restrains Market Growth

Navigating the complex regulatory landscape of the pharmaceutical industry poses a formidable barrier to incorporating Generative AI technologies. Pharma companies must meticulously ensure that their use of AI in drug discovery and development complies with an array of stringent regulations. This involves adapting research methodologies and operational processes to meet industry standards, a task that demands significant time, resources, and expertise.

The regulatory rigor is intended to safeguard public health and ensure the efficacy and safety of new drugs. However, it also slows the pace of innovation by imposing constraints on the exploration and implementation of advanced AI tools. The necessity to align AI applications with regulatory requirements not only prolongs the time to market for new treatments but also escalates costs. Overcoming these regulatory and compliance hurdles is essential for realizing the full potential of Generative AI in accelerating drug discovery and bringing revolutionary treatments to patients more efficiently.

Application Analysis

In the rapidly evolving Generative AI in Pharma Market, the application segment reveals insightful trends, particularly spotlighting Drug Discovery as the dominant sub-segment. This prominence is attributed to Generative AI's ability to significantly accelerate the drug development process, from initial discovery through to preclinical testing.

AI's capacity to analyze vast datasets enables the identification of potential drug candidates at a speed and scale unattainable through traditional methods. This not only reduces the time frame for discovery but also potentially lowers costs, making it a pivotal area of investment for pharmaceutical companies aiming to enhance their R&D efficiency and productivity.

Other segments, while not as dominant, play critical roles in the market's expansion. Clinical Trial Research benefits from Generative AI by optimizing trial designs and patient selection, thus enhancing the efficiency and success rates of clinical trials. Predictive Analytics utilizes AI to forecast disease trends and drug responses, which is crucial for both epidemic preparedness and personalized treatment plans. Disease Identification and Diagnosis, and Personalized Medicine are sectors where AI's ability to process and interpret complex biological data can lead to more accurate diagnoses and tailored treatment strategies, significantly impacting patient outcomes.

Despite the clear dominance of Drug Discovery, the contribution of segments like Clinical Trial Research, Predictive Analytics, Disease Identification and Diagnosis, and Personalized Medicine cannot be understated. Each plays a unique role in supporting the overarching goal of faster, more efficient, and patient-centric drug development and healthcare solutions.

Technology Analysis

Within the technology spectrum of Generative AI in Pharma, Deep Learning stands out as the dominant sub-segment, primarily due to its profound capabilities in interpreting complex patterns within large datasets, a common challenge in pharmaceutical research.

Deep Learning algorithms excel in identifying potential drug compounds, predicting their effectiveness, and highlighting possible side effects, thereby becoming an indispensable tool in the Drug Discovery process. Its application extends beyond mere discovery, facilitating advancements in areas like protein structure prediction and genomics, which are critical for understanding disease mechanisms and developing targeted therapies.

Other technologies, including Machine Learning and Natural Language Processing (NLP), while not the frontrunners, are instrumental in broadening the application scope of Generative AI in Pharma. Machine Learning underpins many of the analytical tasks in drug discovery and development, offering predictive insights that guide decision-making. NLP, on the other hand, excels in extracting valuable information from unstructured data, such as scientific papers and clinical reports, thereby enhancing knowledge discovery and facilitating a deeper understanding of diseases and treatment outcomes.

Deep Learning's preeminence does not diminish the significance of Machine Learning and NLP; rather, it underscores the complementary nature of these technologies. Machine Learning's predictive models and NLP's ability to decipher complex language and extract meaningful data are vital in streamlining research processes, enhancing data quality, and ultimately, speeding up the time-to-market for new drugs. Together, these technologies form a robust foundation for the Generative AI ecosystem in Pharma, each contributing uniquely to the sector's growth by improving accuracy, efficiency, and innovation in drug development and beyond.

Key Market Segments

By Application

- Drug Discovery

- Clinical Trial Research

- Predictive Analytics

- Disease Identification and Diagnosis

- Personalized Medicine

- Other Applications

By Technology

- Machine Learning

- Natural Language Processing (NLP)

- Deep Learning

- Other Technologies

Growth Opportunities

Supply Chain Optimization Offers Growth Opportunity

The integration of Generative AI into the pharmaceutical supply chain and manufacturing processes marks a significant leap towards operational excellence. By leveraging AI to analyze vast arrays of data, including historical sales, market dynamics, and environmental factors, pharmaceutical companies can now predict demand with unprecedented accuracy.

This not only ensures the uninterrupted supply of medicines but also significantly reduces waste, marrying efficiency with cost savings. Sanofi's adoption of AI for streamlining its manufacturing and supply chain operations serves as a prime example, showcasing how AI can drive substantial improvements in efficiency, resource management, and operational agility. The ability of AI to fine-tune the supply chain responds directly to the industry's need for more dynamic and responsive production systems, presenting a substantial opportunity for market growth.

Collaborative Innovation Offers Growth Opportunity

The burgeoning trend of collaboration among AI startups, pharmaceutical companies, and academic institutions is propelling the Generative AI market forward. These partnerships foster a rich environment for innovation, pooling together diverse expertise to tackle complex challenges in drug discovery and development.

Collaborations, such as the one between Pharos Therapeutics and the University of Sydney, are pivotal in demonstrating the efficacy of AI-generated compounds, enhancing the drug development pipeline from discovery through to clinical trials. This ecosystem of collaborative innovation not only accelerates the pace of research and development but also opens up new avenues for market expansion, underscoring the critical role of partnerships in leveraging Generative AI to its fullest potential in the pharmaceutical industry.

Trending Factors

Cost-Effective Drug Development Are Trending Factors

The drive towards more cost-effective drug development methodologies is shaping the adoption of Generative AI in the pharmaceutical industry. By automating and optimizing various stages of drug development, AI technologies offer significant reductions in the time and labor traditionally required, presenting opportunities for substantial cost savings and enhanced productivity.

The key challenge lies in balancing the initial expenses of AI implementation against the efficiency and cost-reduction benefits it brings. As pharmaceutical companies refine their strategies to capitalize on these advantages, the trend towards leveraging AI for cost-effectiveness is becoming increasingly prominent, aligning with the industry's broader objectives of reducing drug development costs while meeting the demands of consumers and regulatory bodies.

Regulatory Compliance and Standardization Are Trending Factors

The push for improved regulatory compliance and standardization in the application of Generative AI within drug development is a critical trend driving the pharmaceutical market's growth and sustainability. The current lack of uniform standards complicates the comparison of research outcomes and the assurance of consistent results.

Efforts to collaborate with researchers, regulatory bodies, and pharmaceutical partners aim to establish clear guidelines and elevate standards, tackling prevalent issues such as data privacy, security, and regulatory adherence. These initiatives are crucial for fostering trust in AI technologies, ensuring their ethical application, and facilitating their successful integration into the pharmaceutical industry. As the sector moves towards addressing these regulatory and standardization challenges, their resolution stands as a pivotal trend influencing the market's trajectory.

Regional Analysis

North America Dominates with 45.2% Market Share

North America's leading position in the Generative AI in Pharma Market, holding a 45.2% share, is a reflection of several pivotal factors contributing to its dominance. This region's robust market share can be attributed to a strong ecosystem of pharmaceutical companies and tech giants, significant investments in AI and healthcare research, and a favorable regulatory environment that supports innovation. The presence of leading universities and research institutions further fuels the advancement of AI technologies, making North America a hub for innovation in Generative AI applications in pharmaceuticals.

The dynamic nature of North America's pharmaceutical sector, characterized by high R&D spending, collaboration between academia and industry, and a swift adoption of technological advancements, underpins the region's supremacy. The regulatory bodies in this region, such as the FDA, are also progressive in adopting guidelines that facilitate the integration of AI in drug development, enhancing the region's attractiveness for AI-driven pharmaceutical innovations.

Regional Market Shares

- Europe: Europe holds a significant market share, accounting for approximately 28%, driven by its strong research infrastructure, public-private partnerships, and increasing investment in healthcare AI.

- Asia Pacific: The Asia Pacific region, with a market share of 18%, is rapidly growing due to rising healthcare expenditures, digital transformation in the pharmaceutical sector, and supportive government policies towards AI and healthcare innovation.

- Middle East & Africa: This region accounts for a smaller share of 5%, but it is gradually expanding with investments in healthcare infrastructure and a growing interest in adopting AI technologies.

- Latin America: Latin America, holding a 3.8% market share, shows potential for growth with increasing awareness and adoption of AI in healthcare, despite facing challenges such as limited access to technology and funding.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the Generative AI in Pharmaing Market, major players like Nvidia, Insilico Medicine Inc., and Atomwise Inc. play a crucial role in leveraging artificial intelligence (AI) to provide data-driven insights for informed decision-making in pharmaceutical research and development. These companies utilize cutting-edge technology and digital tools to analyze vast datasets and generate actionable insights, thereby addressing market volatility and enhancing strategic positioning.

Insilico Medicine Inc., Atomwise Inc., and BenevolentAI Ltd. are at the forefront of AI-driven drug discovery, offering innovative solutions that expedite the identification of novel drug candidates and optimize molecular designs. By harnessing AI algorithms, these companies enable pharmaceutical companies to make informed decisions and accelerate the drug development process, ultimately improving patient outcomes.

Nvidia, with its expertise in GPU-accelerated computing, provides the computational power necessary for training complex AI models in pharmaceutical research. Its technology plays a crucial role in enabling the widespread adoption of generative AI in pharmaing, facilitating the analysis of diverse datasets and the generation of AI-driven insights.

Additionally, companies like Numerate Inc., XtalPi Inc., and Berg Health LLC contribute to the advancement of AI in pharmaceutical research, offering specialized solutions that leverage machine learning algorithms to uncover hidden patterns and relationships in biological data. By providing actionable insights, these companies empower pharmaceutical researchers to make informed decisions and drive innovation in drug discovery and development.

Fujitsu, Conduent Incorporated, and OKRA.ai also play significant roles in the Generative AI in Pharmaing Market, offering comprehensive AI solutions that address various challenges faced by the pharmaceutical industry. Their strategic positioning and commitment to advancing AI technologies underscore their influence in shaping the future of pharmaceutical research and development.

Market Key Players

- Nvidia

- Insilico Medicine Inc.

- Atomwise Inc.

- BenevolentAI Ltd.

- Numerate Inc.

- XtalPi Inc.

- Berg Health LLC

- Conduent Incorporated

- Fujitsu

- OKRA.ai

- Other Key Players

Recent Developments

- On June 2023, Eli Lilly & Company and XtalPi Inc. launched an AI drug development alliance that could cost around $250 million in milestone and upfront payments. The partnership will use the robotics platform of XtalPi and its built-in AI to develop and distribute drug candidates from scratch to the unnamed goal.

- On March 2023, Mitsui & Co Ltd. a Japanese company, announced a collaboration in 2023 with NVIDIA at Tokyo 1 to support the pharmaceutical industry in Japan with technology that uses the ability to generate AI models for the development of drugs.

- On June 2023 University of Toronto, Foxconn, as well as Insilico Medicine, collaborated on a research project that seeks to study the application for hybrid quantum-classical, generative adversarial networks to aid in small-molecule discovery. The small molecules that are created using this technique are likely to have better properties than those produced by classical GANs.

Report Scope

Report Features Description Market Value (2023) USD 159.9 Mn Forecast Revenue (2033) USD 2258.1 Mn CAGR (2023-2033) 31.2% Base Year for Estimation 2023 Historic Period 2017-2023 Forecast Period 2023-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Application (Drug Discovery, Clinical Trial Research, Predictive Analytics, Disease Identification and Diagnosis, Personalized Medicine, Other Applications), By Technology (Machine Learning, Natural Language Processing (NLP), Deep Learning, Other Technologies) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Nvidia, Insilico Medicine Inc., Atomwise Inc., BenevolentAI Ltd., Numerate Inc., XtalPi Inc., Berg Health LLC, Conduent Incorporated, Fujitsu, OKRA.ai, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Insilico Medicine Inc.

- Atomwise Inc.

- BenevolentAI Ltd.

- Numerate Inc.

- XtalPi Inc.

- Berg Health LLC.

- Other Key Players