Generative AI In Medicine Market Based on Application(Medical Imaging,Drug Discovery,Medical Diagnosis,Patient Data Analysis,Other Applications), Based on Deployment Model(On-premise, Cloud), Based on End-User(Hospitals & Clinics, Clinical Research, Healthcare Organizations, Diagnostic Centers, Other End-Users), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

-

36869

-

April 2024

-

300

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

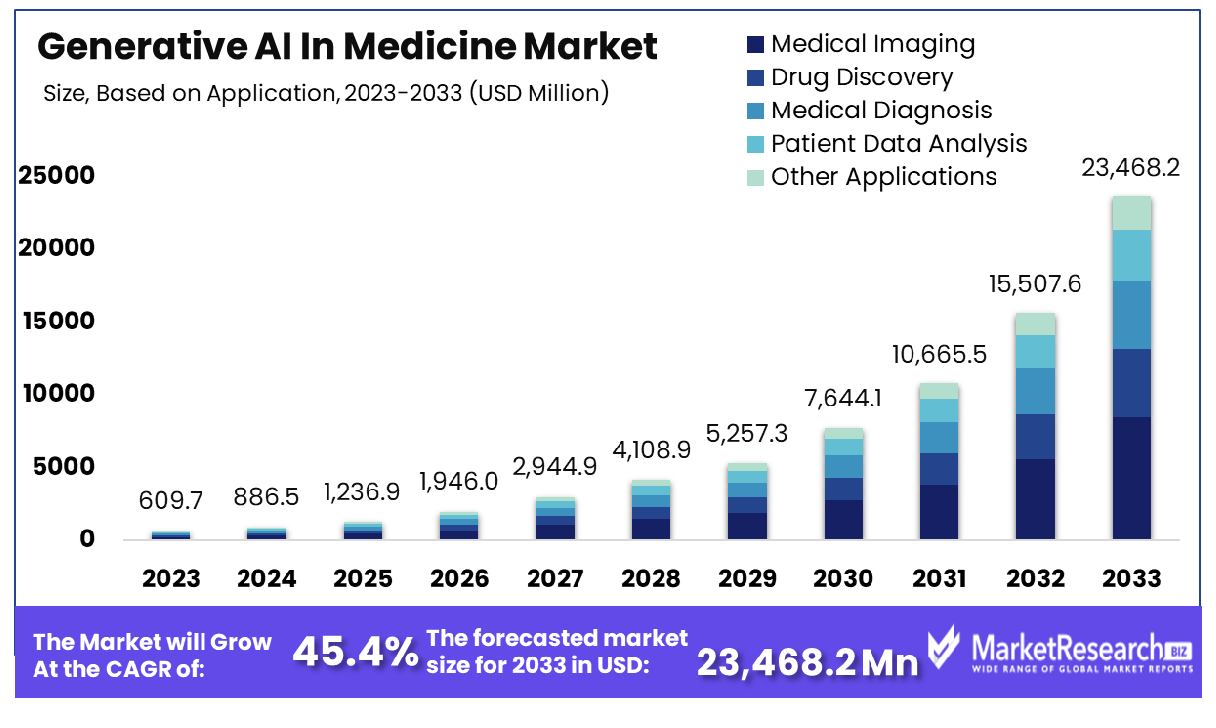

The Generative AI In Medicine Market was valued at USD 609.7 Million in 2023. It is expected to reach USD 23,468.2 Million by 2033, with a CAGR of 45.4% during the forecast period from 2024 to 2033.

The surge in demand for new advanced technologies and the rise in chronic diseases are key driving factors for generative artificial intelligence in the medicine market. Pharmaceuticals and healthcare industries play a vital role in the medicine sectors. Generative AI is changing all aspects of the pharmaceutical and medicines market, restoring the way firms and businesses operate and possibly revealing billions of dollars in value.

According to an MGI in June 2023, GenAI will have a substantial impact on the pharmaceutical and medical product sector from 2.6% to 4.5% of annual revenue all across the respective industries or USD 60 billion to USD 110 billion annually. Most of the pharma firms spend approx. 20% of revenue on research and development, and the development of a new drug takes an average period of around 10 to 15 years.

Generative AI can help in enhancing the speed and quality of R&D with the level of spending and timeline at a significant value. For example, recognizing the lead is a first step towards the drug discovery process in which the medical researchers recognize a molecule that would best address the target for a capable new drug development that takes place around several months even with old deep learning methodology. GenAI enables medical firms to finish the initial step of drug development within a few weeks. Many pharmaceutical firms have implemented GenAI technology in the drug discovery process to gain high success rates in clinical trials.

There are several advantages of using GenAI in the medicine market such as it helps in reducing the expense and time, helps in drug designing, and customization of medicines, augments clinical trials, modify the structure of the drug elements to improve its pharmaceutical features. This technology also helps in drug repurposing and improves interdisciplinary collaborations in complex problem-solving situations. GenAI models are an important resource for designing new pandemics and making effective preventive measures.

Currently, some of the new and advanced GenAI models are being trained on protein sequences to recognize new antibodies that could address dangerous and infectious diseases, and develop outbreak responses for the coming future. The demand for the GenAI in medicines will increase due to its requirement in various pharmaceutical firms and the emergence of new drug development will help in market expansion during the forecasted period.

Key Takeaways

- Market Growth: The Generative AI In Medicine Market was valued at USD 609.7 Million in 2023. It is expected to reach USD 23,468.2 Million by 2033, with a CAGR of 45.4% during the forecast period from 2024 to 2033.

- Based on Application: Medical imaging dominated 30% of applications.

- Based on the Deployment Model: Cloud deployment accounted for 60%.

- Based on End-User: Hospitals and clinics led end-users at 39%.

- Regional Dominance: In North America, Generative AI in Medicine Market surged by 43%.

- Growth Opportunity: In 2023, the global Generative AI in Medicine market saw significant opportunities in drug discovery and clinical trial optimization, revolutionizing pharmaceutical research and enhancing patient outcomes.

Driving factors

Rising Demand for Personalized Medicine

The generative AI in the medicine market is significantly propelled by the escalating demand for personalized medicine. Personalized medicine aims to tailor medical treatment to the individual characteristics of each patient, which requires extensive data analysis and pattern recognition—capabilities at which AI excels.

Generative AI can analyze vast datasets from genetic information, lifestyle, and clinical histories to identify bespoke treatment paths, enhancing patient outcomes and treatment efficiencies. This alignment with the growing consumer and medical preference for personalized healthcare solutions directly fuels the expansion of generative AI applications in the medical field.

Need for More Efficient and Cost-Effective Solutions in Healthcare

Healthcare systems globally are under increasing pressure to improve efficiency and reduce costs amidst rising healthcare demands and spending. Generative AI addresses these challenges by automating and optimizing processes that traditionally require extensive human labor and time. For example, AI can generate synthetic medical data for research, reducing both the time and cost associated with clinical trials.

Moreover, by improving diagnostic accuracy and speeding up drug discovery processes, generative AI significantly cuts down operational costs and enhances healthcare delivery, making it a cornerstone technology in the quest for more sustainable healthcare systems.

Transformative Potential of Generative AI in Healthcare

Generative AI holds transformative potential in reshaping healthcare landscapes. It extends beyond operational efficiency and cost reduction, fundamentally changing how medical care is conceived and delivered. AI models can generate novel chemical entities, simulate clinical outcomes, and create personalized treatment plans, presenting a paradigm shift in medical research and patient care.

This transformative potential not only contributes to the growth of the generative AI market but also positions it as a critical driver in the future of medicine, integrating seamlessly with the rising demand for personalized medicine and the need for efficiency in healthcare delivery. Together, these factors synergistically enhance the market's growth trajectory, illustrating a compound effect where the sum impact is greater than its contributions.

Restraining Factors

Impact of Workforce Skills Deficit on Generative AI Adoption in Medicine

The adoption of generative AI in the medical sector is significantly hindered by a lack of skilled professionals who possess the requisite expertise in AI technologies. This specialized knowledge is crucial for developing, managing, and implementing AI systems effectively within clinical and healthcare frameworks.

The scarcity of a skilled workforce delays the integration of AI solutions, potentially leading to slower advancement and adoption rates in medical practices and research institutions. As these technologies require a deep understanding of both AI and medical protocols, the gap in necessary skills can result in prolonged development cycles and increased costs, thereby restraining market growth.

Challenges of Regulatory Compliance in Generative AI for Medicine

Regulatory compliance presents a substantial challenge in the generative AI in medicine market. These technologies are subject to stringent regulatory frameworks designed to ensure patient safety and data security. Navigating these regulations, which vary significantly by region and often lag behind technological advancements, can be a complex and resource-intensive process.

Compliance demands thorough documentation, rigorous testing, and validation of AI models against medical standards, which can extend product development timelines and increase costs. The need for compliance can deter new entrants and limit innovation within the market, directly impacting the pace at which new AI solutions are introduced and adopted in healthcare settings.

Based on Application Analysis

Medical imaging commanded a 30% market share by application.

In 2023, the Generative AI in Medicine Market was segmented into several key application areas: Medical Imaging, Drug Discovery, Medical Diagnosis, Patient Data Analysis, and Other Applications. Among these, Medical Imaging held a dominant market position in the Based on Application segment, capturing more than a 30% share. This prominence can be attributed to the increasing integration of AI technologies in radiology and the growing demand for enhanced diagnostic accuracy and efficiency.

Drug Discovery and Medical Diagnosis also showed substantial market shares, reflecting ongoing investments and the adoption of AI for complex biological data interpretation and predictive analytics. These segments are driven by the need to reduce drug development costs and timeframes, coupled with increasing precision in diagnostic processes.

Patient Data Analysis and Other Applications, although holding smaller shares, are anticipated to grow significantly. The expansion in Patient Data Analysis is propelled by the surge in digital health records and the demand for personalized medicine, which relies heavily on data-driven insights.

Based on Deployment Model Analysis

Cloud deployment held a 60% market share.

In 2023, Cloud held a dominant market position in the Based on Deployment Model segment of the Generative AI in Medicine Market, capturing more than a 60% share. This segment was followed by On-premise solutions, which constituted the remainder of the market.

The prominent position of Cloud deployment is primarily driven by its scalability, flexibility, and cost-efficiency, making it highly suitable for handling the vast data requirements and computational demands of generative AI applications in medicine. Cloud platforms facilitate rapid deployment and integration of AI technologies, allowing healthcare providers and research facilities to leverage advanced analytics and machine learning capabilities without significant upfront investments in physical infrastructure.

Additionally, the Cloud model supports remote data access and real-time data processing, which are crucial for telemedicine and remote patient monitoring systems. This aspect has become increasingly important, enhancing patient care outside traditional clinical settings and during public health emergencies, such as the COVID-19 pandemic.

On-premise deployment, while less prevalent, is favored by organizations that require tight control over their data and systems due to regulatory and security concerns. Hospitals and healthcare institutions that handle sensitive patient data often opt for on-premise solutions to maintain compliance with data protection regulations and ensure high-security standards.

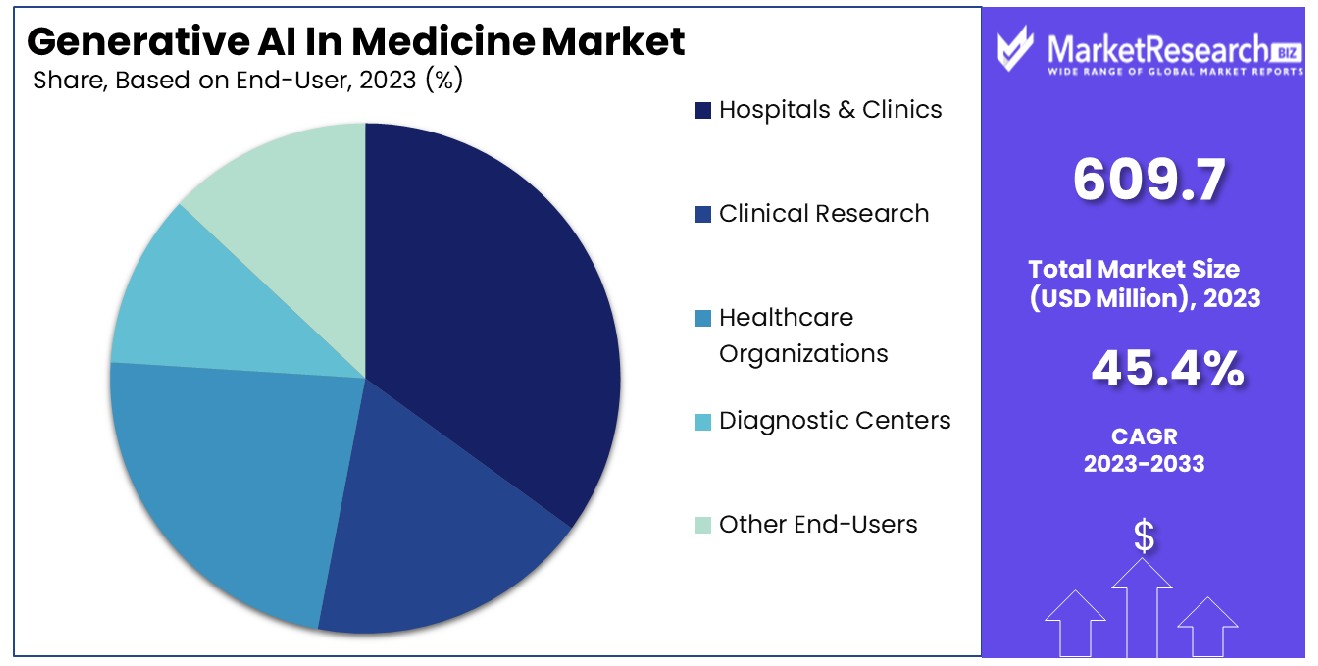

Based on End-User Analysis

Hospitals and clinics led end-users with 39%.

In 2023, Hospitals & Clinics held a dominant market position in the Based on End-User segment of the Generative AI in Medicine Market, capturing more than 39% of the market share. This segment was followed by Clinical Research, Healthcare Organizations, Diagnostic Centers, and Other End-Users, each contributing variably to the market dynamics.

The substantial share held by Hospitals & Clinics can be attributed to the increasing integration of advanced AI technologies, including generative AI, to enhance diagnostic accuracy, personalize treatment plans, and improve patient outcomes. The deployment of generative AI in these settings facilitates the synthesis of large datasets, enabling the development of more precise and efficient medical solutions.

Clinical Research entities also significantly leveraged generative AI to streamline drug development and clinical trials. By utilizing predictive models and simulations, these organizations have been able to reduce time-to-market for new therapeutics and increase the efficiency of research processes.

Healthcare Organizations have adopted generative AI to optimize operational efficiencies and patient care delivery. This technology aids in the management of healthcare data, prediction of patient admissions, and resource allocation, thereby enhancing overall service delivery.

Diagnostic Centers have utilized generative AI to improve the accuracy and speed of diagnostic processes. AI algorithms assist in the analysis of medical imaging, pathology, and other diagnostic data, leading to quicker and more accurate diagnoses.

The Other End-Users category, which includes private practices and small medical facilities, has increasingly adopted generative AI solutions to remain competitive and address specific healthcare challenges effectively.

Key Market Segments

Based on Application

- Medical Imaging

- Drug Discovery

- Medical Diagnosis

- Patient Data Analysis

- Other Applications

Based on Deployment Model

- On-premise

- Cloud

Based on End-User

- Hospitals & Clinics

- Clinical Research

- Healthcare Organizations

- Diagnostic Centers

- Other End-Users

Growth Opportunity

Opportunities in Drug Discovery and Development

In 2023, the global Generative AI in Medicine market witnessed a surge in opportunities, particularly in the realm of drug discovery and development. AI-driven generative models have revolutionized the traditional drug development process by accelerating the identification of novel compounds and optimizing their properties.

These models analyze vast datasets to predict molecular structures with desired therapeutic effects, significantly reducing the time and cost involved in drug discovery. Pharmaceutical companies are increasingly integrating generative AI into their research pipelines to expedite the identification of promising drug candidates and enhance their competitiveness in the market.

Advancements in Clinical Trial Design and Implementation

The utilization of Generative AI in Medicine has also opened up new opportunities in the design and implementation of clinical trials. By analyzing patient data and medical literature, AI algorithms can optimize trial protocols, identify suitable patient populations, and predict potential outcomes more accurately.

This enables pharmaceutical companies to design more efficient and cost-effective clinical trials, leading to faster approvals and market entry for new therapies. Additionally, AI-powered predictive modeling enhances patient recruitment and retention strategies, ultimately improving the quality and reliability of clinical trial results.

Latest Trends

Clinical Decision Support

In 2023, the integration of Generative AI into clinical decision support systems emerged as a pivotal trend in the healthcare sector. By harnessing vast amounts of patient data, Generative AI empowered healthcare professionals with visualizations and insights crucial for informed decision-making.

Whether diagnosing complex diseases or recommending treatment plans, Generative AI offered unparalleled support, enhancing the efficiency and accuracy of medical interventions. This trend marked a significant stride towards personalized medicine, where treatments are tailored to individual patient needs, ultimately improving patient outcomes and healthcare quality.

Target Identification and Validation

Another noteworthy trend in 2023 was the utilization of Generative AI for target identification and validation in drug discovery. With the exponential growth of biological datasets, pharmaceutical companies faced the challenge of efficiently analyzing vast amounts of complex data to identify potential drug targets. Generative AI proved instrumental in this process, rapidly analyzing datasets to pinpoint promising targets and accelerating the early stages of drug discovery.

By streamlining target identification and validation, Generative AI not only expedited the drug development process but also contributed to the discovery of novel therapies for a myriad of diseases, addressing unmet medical needs and fostering innovation in the pharmaceutical industry.

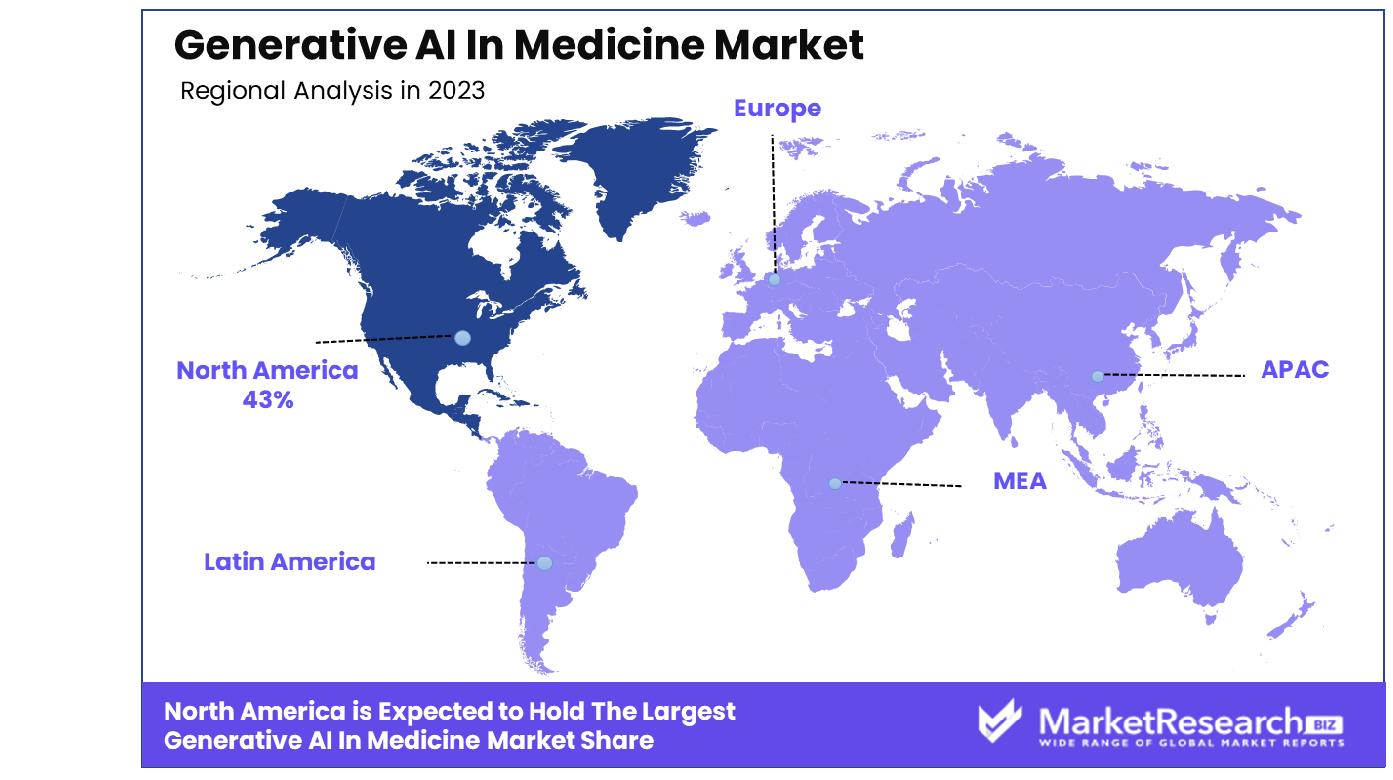

Regional Analysis

In North America, Generative AI in Medicine market holds a dominant share of 43%, reflecting strong growth.

North America emerged as the dominating region, capturing a substantial market share of 43%. This dominance can be attributed to the region's robust healthcare infrastructure, extensive adoption of advanced technologies, and significant investments in research and development initiatives. Furthermore, the presence of key market players and strategic collaborations between healthcare organizations and technology firms have further fueled market growth in North America.

In Europe, the Generative AI in Medicine Market exhibited steady growth, driven by increasing government initiatives to promote the adoption of AI in healthcare, the rising prevalence of chronic diseases, and the growing demand for personalized medicine. Countries like the UK, Germany, and France are at the forefront of market growth in the region, leveraging Generative AI to enhance patient care and optimize healthcare delivery.

The Asia Pacific region showcased remarkable potential for market expansion, owing to rapid advancements in healthcare infrastructure, burgeoning healthcare expenditure, and increasing awareness regarding the benefits of AI in medicine. Countries such as China, Japan, and India are witnessing significant investments in healthcare technology, driving the adoption of Generative AI solutions to address healthcare challenges and improve patient outcomes.

In the Middle East & Africa and Latin America regions, the Generative AI in Medicine Market experienced gradual growth, propelled by increasing government initiatives to modernize healthcare systems, rising prevalence of chronic diseases, and growing healthcare investments. While these regions are still in the nascent stage of adoption compared to mature markets, they present lucrative opportunities for market players to expand their presence and tap into untapped market potential.

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Netherlands

- Russia

- Italy

- Rest of Europe

Asia-Pacific

- China

- Japan

- Singapore

- Thailand

- South Korea

- Vietnam

- India

- New Zealand

- Rest of Asia Pacific

Latin America

- Mexico

- Brazil

- Rest of Latin America

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Rest of the Middle East & Africa

Key Players Analysis

In 2023, the global Generative AI in Medicine market witnessed a dynamic landscape characterized by intense competition and innovation. Among the key players, several companies stood out for their significant contributions and strategic positioning within this burgeoning market.

IBM Watson Health continued to be a frontrunner in the domain, leveraging its advanced AI capabilities to transform healthcare delivery and decision-making. With its vast trove of data and deep learning algorithms, IBM Watson Health offers robust solutions for personalized medicine, clinical decision support, and drug discovery.

Microsoft Corporation emerged as a formidable competitor, capitalizing on its Azure cloud platform and AI technologies to empower healthcare organizations with predictive analytics and genomics research tools.

Aidoc, with its focus on medical imaging analysis, played a pivotal role in enhancing diagnostic accuracy and efficiency through AI-powered solutions for radiology.

Insilico Medicine pioneered the application of generative AI in drug discovery and biomarker development, driving innovation in precision medicine and accelerating the drug development process.

PathAI made significant strides in pathology diagnostics, harnessing AI to improve accuracy and speed in disease diagnosis, prognosis, and treatment selection.

Butterfly Network disrupted the medical imaging landscape with its handheld ultrasound devices powered by AI, enabling point-of-care diagnostics in diverse clinical settings.

Deep Genomics emerged as a leader in genomic medicine, employing AI to decipher the genetic basis of disease and develop targeted therapies.

Google LLC, Tencent Holdings Ltd., Neuralink Corporation, and Johnson & Johnson also played key roles in advancing generative AI applications across various facets of medicine, including diagnostics, therapeutics, and healthcare management.

Market Key Players

- IBM Watson Health

- Microsoft Corporation

- Aidoc

- Insilico Medicine

- PathAI

- Butterfly Network

- Deep Genomics

- Google LLC

- Tencent Holdings Ltd.

- Neuralink Corporation

- Johnson & Johnson

- Other Key Players

Recent Development

- In March 2024, Insilico Medicine utilizes generative AI for drug discovery, achieving milestones like FDA clearance for small-molecule treatments, identifying dual-purpose targets, and developing a dual inhibitor for cancer.

- In March 2024, Microsoft advances generative AI adoption in healthcare, showcasing collaborations with Stanford Medicine, WellSpan Health, and Providence. Commitment to Responsible AI principles and partnerships drive innovation.

- In March 2024, Anima Anandkumar, NVIDIA's senior director of AI research, foresees AI revolutionizing drug discovery, accelerating treatments for diseases, aided by gen-AI models' potential.

Report Scope

Report Features Description Market Value (2023) USD 609.7 Million Forecast Revenue (2033) USD 23,468.2 Million CAGR (2024-2032) 45.4% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered Based on Application(Medical Imaging,Drug Discovery,Medical Diagnosis,Patient Data Analysis,Other Applications), Based on Deployment Model(On-premise, Cloud), Based on End-User(Hospitals & Clinics, Clinical Research, Healthcare Organizations, Diagnostic Centers, Other End-Users) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape IBM Watson Health, Microsoft Corporation, Aidoc, Insilico Medicine, PathAI, Butterfly Network, Deep Genomics, Google LLC, Tencent Holdings Ltd., Neuralink Corporation, Johnson & Johnson, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- IBM Watson Health

- Microsoft Corporation

- Aidoc

- Insilico Medicine

- PathAI

- Butterfly Network

- Deep Genomics

- Google LLC

- Tencent Holdings Ltd.

- Neuralink Corporation

- Johnson & Johnson

- Other Key Players