Generative AI In Chip Design Market Report By Type (Generative Adversarial Networks, Variational Autoencoder, Reinforcement Learning, Evolutionary Algorithms, Deep Learning Models, Other Types), By Application (Logic Design, Physical Design, Analog and Mixed-Signal Design, Power Optimization, Design Verification, Other Applications), By Deployment (Offline Deployment, Cloud-Based, On-Premises, Embedded, Hybrid), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

38790

-

April 2024

-

300

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

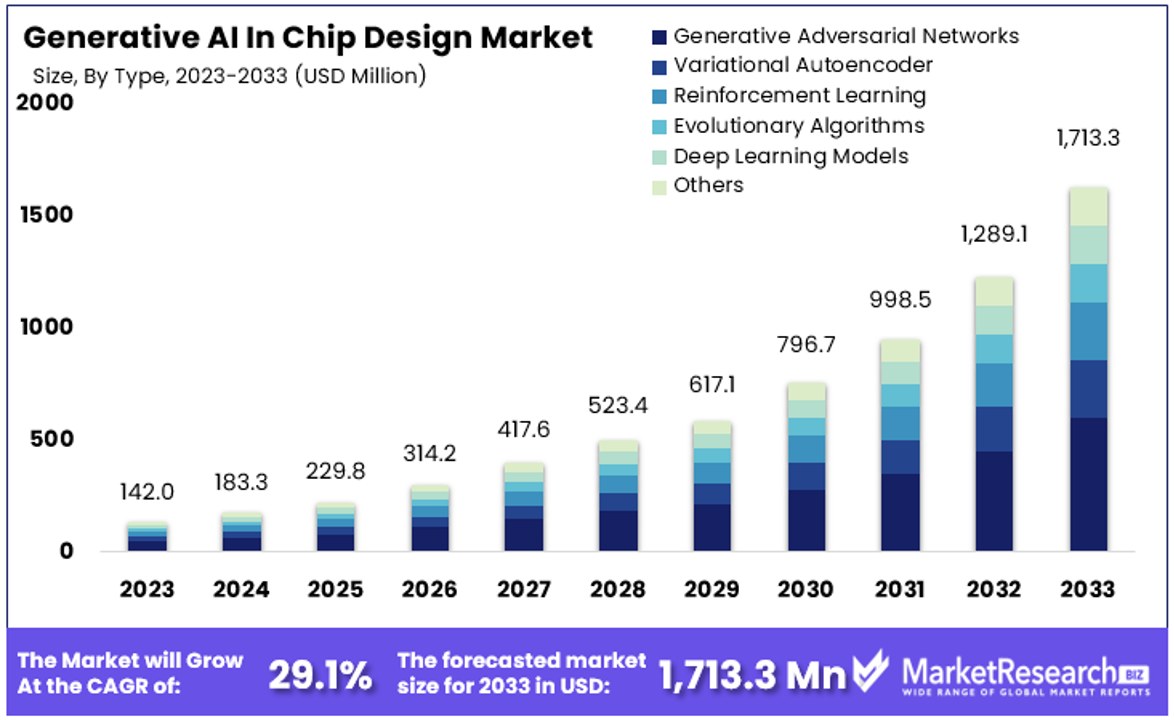

The Global Generative Ai In Chip Design Market size is expected to be worth around USD 1,713.3 Million by 2033, from USD 142 Million in 2023, growing at a CAGR of 29.10% during the forecast period from 2024 to 2033.

The surge in demand for chip design and manufacturing in semiconductors and new advanced technologies are some of the main driving factors for the generative AI in chip design market.

In the semiconductor industry, manufacturers are constantly working hard to enhance chip performance and efficacy to meet the high requirements of the latest technologies. However, old chip design techniques are becoming more difficult and consume more time, obstructing the way for new innovations.

According to InsightsIAS in August 2023, India is considered the global destination for semiconductor firms. It has highly experienced and skilled design engineers, which make up more than 20% of the global workforce.

More than 2,000 integrated circuits (ICs) and chips are designed in India every year. India has some of the main semiconductor companies, namely Intel, Micron, Qualcomm, and many more. There are over 30 semiconductor design startup businesses that have been built in India by following the DLI scheme, with five already having government support.

Generative AI provides a new technique for chip design that is able to explore a number of design spaces and identify fresh solutions that were previously unreachable. By automating monotonous tasks and offering data-driven insights, GenAI can substantially speed up the design process and lead to the development of more new and effective chips.

Generative AI signifies the utilization of AI algorithms to produce unique, original, and high-quality solutions based on a shared set of information. It includes training models on huge information sets to understand and learn the patterns and produce fresh results that meet particular criteria. In chip design and manufacturing, generative artificial intelligence helps boost chip architectures, enhance performance, and streamline the design technique.

There are several advantages to implementing GenAI in chip design, such as that it accelerates design iterations, enhances the quality of design and manufacturing efficacy, and also helps overcome design restraints. GenAI in chip design automates layouts and floor design, boosts PPA, and ensures adherence to design protocols. It also streamlines the verification process and decreases human errors. The demand for generative AI in chip design will rapidly grow due to its high demand in semiconductor sectors, which will help in market expansion in the coming years.

Key Takeaways

- Market Value: The Global Generative AI in Chip Design Market is projected to reach approximately USD 1,713.3 Million by 2033, experiencing robust growth from USD 142 Million in 2023, with a substantial CAGR of 29.10% during the forecast period from 2024 to 2033.

- Type Analysis: Generative Adversarial Networks (GANs) lead the market with a 35.6% share, offering realistic chip designs and enhancing semiconductor innovation.

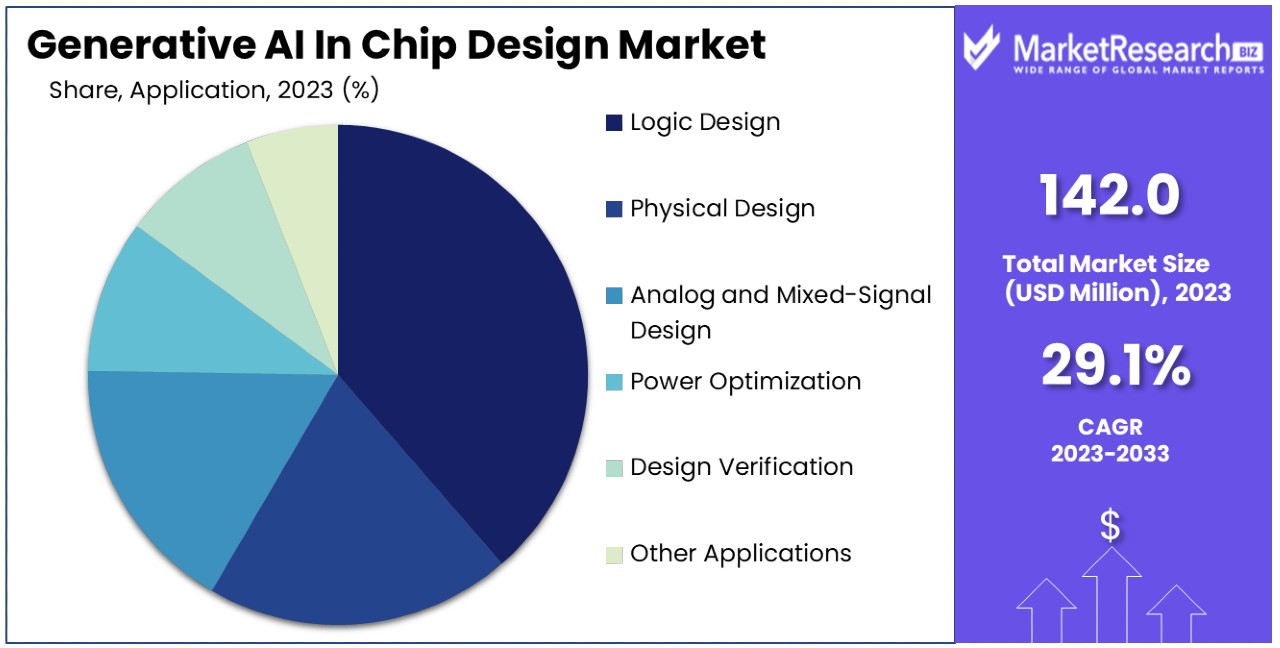

- Logic Design Analysis: Logic Design emerges as the dominant sub-segment, capturing 39% of the market share, by enhancing the creation and optimization of logical circuits and systems, streamlining chip development processes.

- Offline Deployment Analysis: Offline Deployment dominates the deployment category with a 46% market share, catering to the industry's need for high-security environments and uninterrupted processing capabilities, essential for sensitive design tasks.

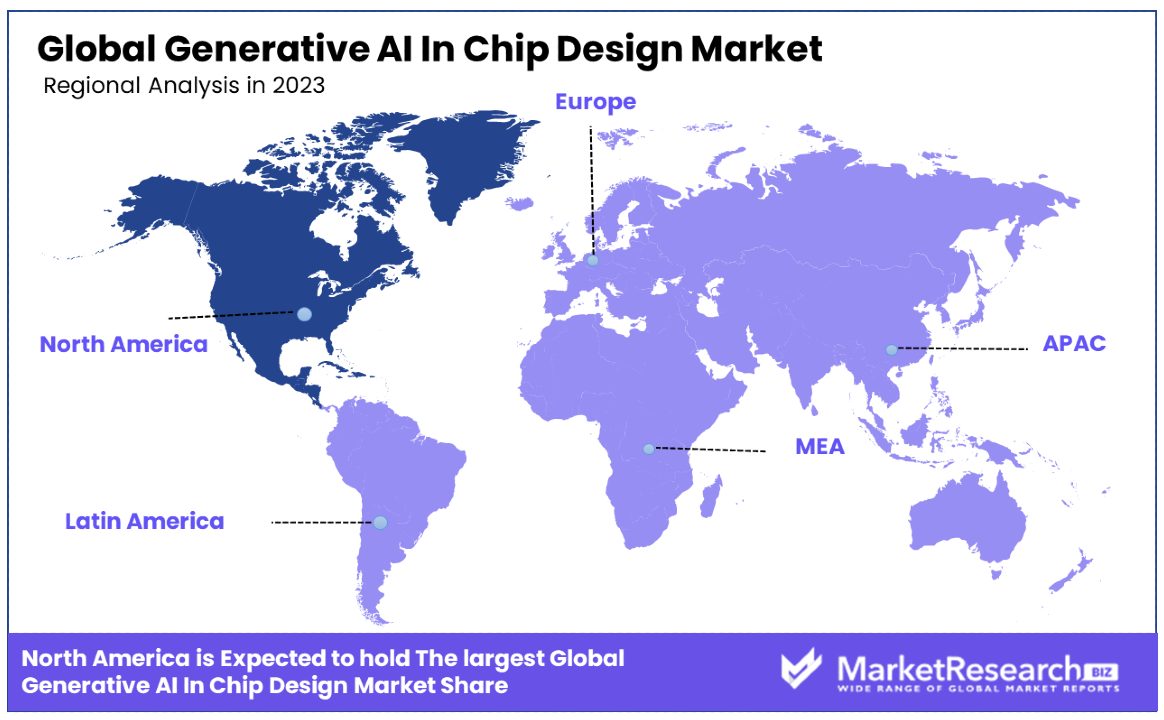

- Regional Analysis: North America dominates the market with a 32% share, fueled by by a competitive yet collaborative environment that encourages technological breakthroughs.

- Growth Opportunity: The market's growth is propelled by increasing demand for AI-driven chip design solutions to meet evolving semiconductor industry needs, such as complexity reduction, performance optimization, and time-to-market acceleration.

Driving Factors

Accelerating Chip Design Cycles Drives Market Growth

The integration of Generative AI into chip design is a pivotal factor accelerating market growth. Deloitte Global projects an investment of US$300 million by top semiconductor companies in AI design tools. This investment underlines the technology's potential to expedite the chip design process, pushing the limits of Moore’s law while offering cost and time efficiencies, and mitigating talent shortages. Generative AI facilitates this acceleration by automating task execution and optimizing design iterations.

It enables the exploration of numerous design candidates, the evaluation of trade-offs, and the identification of optimal configurations, thereby reducing the time-to-market for new designs. Pioneers like Google and Nvidia are at the forefront, utilizing generative AI to hasten their chip design cycles. This automation not only streamlines the development process but also leverages advanced algorithms to surpass traditional design limitations, promising a significant boost in productivity and innovation within the chip design market.

Automating Verification and Testing Enhances Market Efficiency

Generative AI's role in automating verification and testing is transforming the chip design industry, significantly enhancing market efficiency. The verification and testing stages, traditionally known for their time-consuming and resource-intensive nature, are being revolutionized through AI-driven automation. This includes generating test cases, simulating scenarios, and early identification of potential issues, leading to substantial time and cost reductions, alongside improvements in chip quality and reliability.

With chip design costs escalating — reaching up to $724 million for 2nm chips — the need for cost-effective solutions is imperative. Generative AI offers a promising avenue, mitigating these financial burdens and streamlining the design process. This shift not only addresses the direct costs associated with chip design but also impacts the broader market by enhancing the speed and quality of semiconductor production, marking a significant leap toward more efficient and economical chip manufacturing methodologies.

Improving Chip Performance and Efficiency Propels Market Innovation

Generative AI's capacity to optimize chip architectures for enhanced performance and efficiency is instrumental in propelling market innovation. This technology leverages AI models to explore design spaces, pinpoint bottlenecks, and recommend modifications, thereby improving key performance metrics like power consumption, speed, and thermal management. Such advancements are crucial for chips used in AI, high-performance computing, and mobile devices, where efficiency and performance are paramount.

The IEEE IRDS predicts a remarkable annual growth rate of 18% for AI accelerator chips, a rate five times higher than that for semiconductors in non-AI applications. This statistic underscores the transformative impact of Generative AI on the semiconductor industry, enabling the creation of chips that are not only faster and more power-efficient but also tailored to meet the evolving demands of technology-driven markets. The synergy between generative AI and chip design not only accelerates market growth but also fosters a culture of innovation, setting new standards for what is possible in semiconductor technology.

Restraining Factors

Data Availability and Quality Challenges Restrains Market Growth

The scarcity and quality of data significantly hinder the expansion of the Generative AI in Chip Design Market. Generative AI models require access to high-quality, diverse datasets for effective training. However, in the semiconductor industry, critical design data is often proprietary, closely guarded, and dispersed across various entities, making it difficult to compile comprehensive datasets for AI training. This lack of accessible, high-quality training data impedes the development and refinement of AI models, directly affecting the reliability and accuracy of generated chip designs.

Moreover, the proprietary nature of chip design data exacerbates this challenge, as sharing and collating such information across organizations could breach confidentiality agreements and compromise competitive advantages. Consequently, these data-related obstacles not only slow the pace of innovation in generative AI applications for chip design but also limit the technology's adoption and effectiveness, particularly in environments where data sharing is restricted or where datasets are incomplete or of poor quality.

Computational Resource Demands Restrains Market Growth

The computational demands associated with training and deploying generative AI models for chip design present significant barriers to market growth. The process is resource-intensive, necessitating advanced computational hardware and considerable processing power. This requirement poses a substantial challenge for smaller chip design firms and organizations with limited technological resources. The need for specialized hardware accelerators and the high costs of computational infrastructure can deter many potential users, particularly small to medium-sized enterprises (SMEs) that might not have the financial capacity to invest in such advanced technology.

As a result, the adoption of generative AI in chip design is skewed towards larger companies with the necessary resources, limiting the overall market expansion. This disparity in access to computational resources stifles innovation among smaller players and constrains the diversity of solutions and advancements within the chip design industry. The financial and logistical barriers to entry for leveraging generative AI technologies thus significantly restrict the growth potential of the market, especially in fostering a competitive and inclusive technological landscape.

Type Analysis

Generative Adversarial Networks: AI's Dual-Model Structure Enhancing Machine Learning Capabilities.

In the Generative AI in Chip Design Market, various technologies play pivotal roles. Among these, Generative Adversarial Networks (GANs) stand out, commanding a significant market share of 35.6%. This dominance is attributed to GANs' unique ability to generate highly realistic and complex chip designs through adversarial training, making them particularly valuable in the semiconductor industry where innovation and precision are paramount. GANs' effectiveness in optimizing chip layouts, reducing design cycles, and their growing application in advanced semiconductor manufacturing processes underscore their leading position.

However, the market is not solely propelled by GANs. Variational Autoencoders (VAEs), Reinforcement Learning (RL), Evolutionary Algorithms (EAs), and Deep Learning Models also contribute substantially to the market's growth. VAEs, for example, play a crucial role in generating and optimizing chip designs by learning the distribution of data, offering an alternative approach to design space exploration.

RL methods are increasingly adopted for their ability to make strategic decisions in the chip design process, optimizing performance metrics through trial and error. EAs, inspired by natural selection, offer robust solutions to optimization problems in chip design, fostering innovation through genetic algorithms and strategies. Deep Learning Models, encompassing a broad spectrum of neural network architectures, are instrumental in automating and improving the accuracy of various design tasks, from circuit design to layout optimization.

Each of these segments, while distinct, contributes to the holistic growth of the Generative AI in Chip Design Market. They address different challenges within chip design, offering diverse tools and methodologies that enrich the market's technological ecosystem. This diversity not only fuels competition and innovation but also broadens the market's applicability across different semiconductor design challenges.

Application Analysis

Logic Design: Fundamental Application in Structuring Efficient, Reliable Digital Systems.

In the Generative AI in Chip Design Market, Logic Design emerges as the dominant sub-segment, capturing a notable 39% of the market share. This prominence is attributed to the critical role that logic design plays in the foundational stages of chip development, where generative AI significantly enhances the creation and optimization of logical circuits and systems.

By automating complex design tasks, AI technologies streamline the development process, enabling more efficient and accurate logic gate configurations. This not only accelerates the design phase but also ensures higher performance and reliability of the final chip products.

Despite Logic Design's dominance, other segments like Physical Design, Analog and Mixed-Signal Design, Power Optimization, and Design Verification also contribute to the market's diversity and growth. Physical Design benefits from AI in automating the layout and routing processes, addressing the increasing complexity of modern chips. Analog and Mixed-Signal Design sees advancements through AI-enabled tools that optimize signal integrity and reduce noise, critical for the growing demand in IoT and automotive applications.

Power Optimization, aided by generative AI, becomes increasingly important as energy efficiency becomes a crucial factor in chip design, especially for mobile and portable devices. Design Verification utilizes AI to automate the testing and validation processes, significantly reducing time and resource expenditure. These applications collectively contribute to the expansive use of generative AI technologies across different stages of chip design, each playing a pivotal role in addressing specific challenges and driving innovation within the semiconductor industry.

Deployment Analysis

Offline Deployment: Ensuring Reliable Performance Without Continuous Internet Connectivity.

In the deployment category of the Generative AI in Chip Design Market, Offline Deployment takes the lead with a commanding 46% market share. This preference underscores the industry's requirement for high-security environments and the need for powerful, uninterrupted processing capabilities that offline systems provide.

Offline deployment allows companies to leverage generative AI tools and applications without the latency and security concerns associated with cloud-based solutions, making it an attractive option for sensitive or proprietary design tasks. The ability to operate without a constant internet connection ensures that the design process remains uninterrupted, enhancing productivity and safeguarding intellectual property.

While Offline Deployment dominates, Cloud-Based, On-Premises, Embedded, and Hybrid deployments also play critical roles in the market's ecosystem. Cloud-Based deployment offers scalability and flexibility, appealing to organizations seeking cost-effective solutions without significant upfront investment in hardware. On-Premises deployment is favored for its control and security, suitable for companies prioritizing data sovereignty and customized integration with existing systems.

Embedded solutions cater to applications requiring AI capabilities directly on chip, integral for edge computing and IoT devices. Hybrid models combine the benefits of cloud and on-premises deployments, offering a balance between flexibility, control, and scalability. Together, these deployment models provide a spectrum of options catering to varied operational needs and strategic preferences within the Generative AI in Chip Design Market, facilitating the adoption of AI technologies across different business contexts and technological requirements.

Key Market Segments

By Type

- Generative Adversarial Networks

- Variational Autoencoder

- Reinforcement Learning

- Evolutionary Algorithms

- Deep Learning Models

- Other Types

By Application

- Logic Design

- Physical Design

- Analog and Mixed-Signal Design

- Power Optimization

- Design Verification

- Other Applications

By Deployment

- Offline Deployment

- Cloud-Based

- On-Premises

- Embedded

- Hybrid

Growth Opportunities

Designing for Specialized AI Hardware Offers Growth Opportunity

The burgeoning demand for AI-specific hardware accelerators presents a substantial growth opportunity within the Generative AI in Chip Design Market. This surge is driven by the increasing need for chips that are custom-built for AI workloads, capable of efficiently handling tasks such as deep learning inference and training, along with specific AI applications like natural language processing and computer vision. Generative AI stands at the forefront of this opportunity, enabling the design of optimized chip architectures through models trained on extensive datasets and performance metrics.

This approach allows for the exploration and generation of designs that are not only tailored to specific AI tasks but also push the boundaries of what's possible in AI hardware performance. Leading companies like Google and Nvidia are pioneering in this space, leveraging generative AI to craft their next-generation AI accelerators. This trend not only highlights the crucial role of generative AI in meeting the specialized needs of AI hardware development but also underscores the technology's potential to catalyze innovation and efficiency in chip design, heralding a new era of AI-accelerated computing.

Enabling Domain-Specific Chip Design Offers Growth Opportunity

The capability of Generative AI to facilitate the design of chips for specific domains or applications marks a significant growth opportunity in the market. This trend is particularly relevant in industries such as automotive, healthcare, and telecommunications, where the demand for chips that meet unique performance characteristics, regulatory standards, and domain-specific requirements is escalating.

By integrating domain-specific knowledge and constraints into the generative models, chip designers can unlock new possibilities in architecture optimization, tailored to the distinct needs of each sector. This approach aligns with the growing interest in application-specific integrated circuits (ASICs) and domain-specific accelerators, which are critical for enhancing performance, efficiency, and functionality in targeted applications. The ability of generative AI to drive the development of these specialized chips not only meets the evolving demands of various industries but also opens up new avenues for innovation, customization, and technological advancement in the semiconductor sector.

Latest Trends

Hybrid AI Approaches

The movement towards utilizing hybrid AI approaches in the Generative AI in Chip Design Market is a key trending factor, showcasing the integration of generative AI with other artificial intelligence techniques like reinforcement learning, evolutionary algorithms, and constraint-based optimization. This trend capitalizes on the unique strengths of diverse AI methods, facilitating a more comprehensive exploration of design spaces, effective constraint management, and the fine-tuning of chip architectures to meet specific performance goals.

The adoption of hybrid AI approaches allows for the bridging of gaps left by singular AI methods, offering a multifaceted strategy to chip design that enhances efficiency and innovation. This convergence of AI techniques is not just a testament to the versatility and adaptability of AI in addressing complex design challenges but also highlights the market's shift towards more sophisticated, nuanced solutions that can navigate the intricacies of modern semiconductor design with greater precision and effectiveness. The trend towards hybrid AI methods is driven by the pursuit of optimizing chip designs beyond what traditional or single AI approaches can achieve, signaling a maturing market that leverages the full spectrum of AI capabilities to push the boundaries of chip technology.

Collaborative AI and Human-in-the-Loop Design

The trend towards collaborative AI and human-in-the-loop design underscores a pivotal shift in the Generative AI in Chip Design Market, recognizing the indispensable role of human expertise in tandem with AI automation. This approach highlights a harmonious interplay between generative AI models and human designers, where AI is leveraged to automate and refine the chip design process, while human input is crucial for injecting domain-specific knowledge, setting constraints, and steering the design towards practical, innovative solutions.

The acknowledgment of the value of human insight in the AI-driven design cycle represents an evolution in market practices, emphasizing that while AI can dramatically enhance efficiency and possibilities, the nuanced judgment and experience of human designers are irreplaceable for ensuring designs meet real-world requirements and standards. This trend not only facilitates a more integrated, effective design process but also fosters a culture of innovation where AI's computational power and human creativity converge, leading to superior chip designs.

Regional Analysis

North America holds a 32% share in the generative AI-driven chip design market segment.

In the burgeoning field of generative AI in chip design, regional market dynamics exhibit significant variances influenced by technological adoption rates, investment climates, and industrial activities. Dominating the sector, North America accounts for 32% of the global market share, bolstered by robust tech infrastructures and concentrated investments from leading tech giants and startups alike, predominantly in the U.S. and Canada. The region benefits from advanced R&D capabilities and strong governmental support for AI and semiconductor advancements.

Europe follows, with a strong emphasis on innovation and sustainable development within the chip industry, supported by substantial EU funding for technology projects. Europe's market is driven by a focus on integrating AI into automotive and industrial applications, reflecting its mature automotive sector and stringent regulatory framework favoring advanced technologies.

The Asia Pacific region is rapidly ascending in this space, anticipated to outpace others in growth, thanks to aggressive technological adoption and manufacturing expansions. Countries like South Korea, Taiwan, China, and Japan are pivotal, with their substantial semiconductor manufacturing bases and hefty investments in AI and related technologies.

Meanwhile, the Middle East & Africa and Latin America are emerging players in this domain. The Middle East, with its recent initiatives towards diversifying economies through technology, is witnessing nascent growth in AI applications, including chip design. Latin America, though smaller in market size, is gradually embracing digital transformations, which include the adoption of advanced AI in various sectors, thereby slowly expanding its stake in this market.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the field of Generative AI in Chip Design, giants like NVIDIA, Intel, and Alphabet (Google) lead the charge, reshaping how advanced chips are conceptualized and developed. These companies, along with others such as Apple and IBM, have leveraged language models and machine learning to enhance Electronic Design Automation (EDA), propelling the design quality and power efficiency of graphics processing units and other critical components to new heights.

The strategic positioning of these firms within the market is pivotal, as they harness generative AI to address the escalating market demand for more sophisticated, energy-efficient edge devices. This technology allows engineering teams to automate and optimize product design, outpacing traditional methods that cannot handle the massive amounts of data or complex calculations required for today's advanced chip development.

Qualcomm, Amazon, and emerging players like SambaNova Systems and Cerebras Systems have made significant strides in integrating generative AI to streamline rapid prototyping and improve design quality. Their efforts mirror the broader industry's shift towards utilizing AI not just in product design but also in areas like drug discovery, where the principles of AI-driven design can lead to breakthroughs in efficiency and innovation.

Moreover, companies like Groq have underscored the importance of machine learning in achieving unprecedented levels of power efficiency, a crucial factor as the industry moves towards more sustainable product design. This shift towards generative AI in chip design marks a departure from traditional methods, allowing for the creation of highly advanced chips that meet the rigorous demands of modern applications.

As these key players continue to pioneer the use of generative AI in chip design, they are setting new standards for the entire industry. Their market influence extends beyond chip design, impacting how technology companies approach the development of new products and solutions. By pushing the boundaries of what is possible with electronic design automation, they are not only meeting the current market demand but also paving the way for future innovations that will further revolutionize the field.

Market Key Players

- NVIDIA

- Synopsys, Inc.

- Intel

- Alphabet (Google)

- Apple

- IBM

- Qualcomm

- Amazon Web Services

- SambaNova Systems

- Cerebras Systems

- Groq

Recent Developments

- In November 2023, The introduction of Synopsys.ai Copilot, signifies a significant advancement in the field of generative AI for chip design. It is described as the world's first GenAI capability for chip design, offers engineers almost-instant answers to questions related to electronic design automation (EDA) tools.

- In July 2023, Efabless Corporation, a prominent player in the chip design market, announced the launch of its second AI-Generated Open-Source Silicon Design Challenge. This initiative is part of a series aiming to leverage generative AI in chip design and foster collaboration within a global community.

- In November 2023, The announcement made by AMD at the Ignite developers conference with Microsoft showcases significant advancements in generative AI capabilities. The introduction of the AMD Instinct MI300X accelerator, AMD EPYC CPUs, and AMD Ryzen CPUs with AI engines is poised to have a transformative impact on various sectors.

- In Novermber 2023, Microsoft unveiled two custom-designed chips – the Microsoft Azure Maia AI Accelerator and the Microsoft Azure Cobalt CPU – along with a comprehensive systems approach to Azure hardware, Microsoft aims to tailor everything "from silicon to service" to meet the growing demand for AI.

- In October 2023, Nvidia introduced ChipNeMo, a custom large language model (LLM) developed by NVIDIA engineers for internal use in semiconductor design. This model, trained on NVIDIA's internal data, showcases the potential of using generative AI tailored to the highly specialized field of chip design. The long-term vision is to apply generative AI to every stage of chip design, aiming for significant gains in overall productivity.

Report Scope

Report Features Description Market Value (2023) USD 142 Million Forecast Revenue (2033) USD 1,713.3 Million CAGR (2024-2033) 29.10% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Generative Adversarial Networks, Variational Autoencoder, Reinforcement Learning, Evolutionary Algorithms, Deep Learning Models, Other Types), By Application (Logic Design, Physical Design, Analog and Mixed-Signal Design, Power Optimization, Design Verification, Other Applications), By Deployment (Offline Deployment, Cloud-Based, On-Premises, Embedded, Hybrid) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape NVIDIA, Intel, Alphabet (Google), Apple, IBM, Qualcomm, Amazon, SambaNova Systems, Cerebras Systems, Groq Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- NVIDIA

- Synopsys, Inc.

- Intel

- Alphabet (Google)

- Apple

- IBM

- Qualcomm

- Amazon Web Services

- SambaNova Systems

- Cerebras Systems

- Groq