CNG Powertrain Market By Drive Type(All-wheel Drive, Rear Wheel Drive, Front Wheel Drive), By Fuel Type(Mono Fuel, Bi-fuel), By Vehicle Type(Passenger Vehicle, Commercial Vehicle), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

42416

-

Feb 2022

-

173

-

-

This report was compiled by Kalyani Khudsange Kalyani Khudsange is a Research Analyst at Prudour Pvt. Ltd. with 2.5 years of experience in market research and a strong technical background in Chemical Engineering and manufacturing. Correspondence Sr. Research Analyst Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

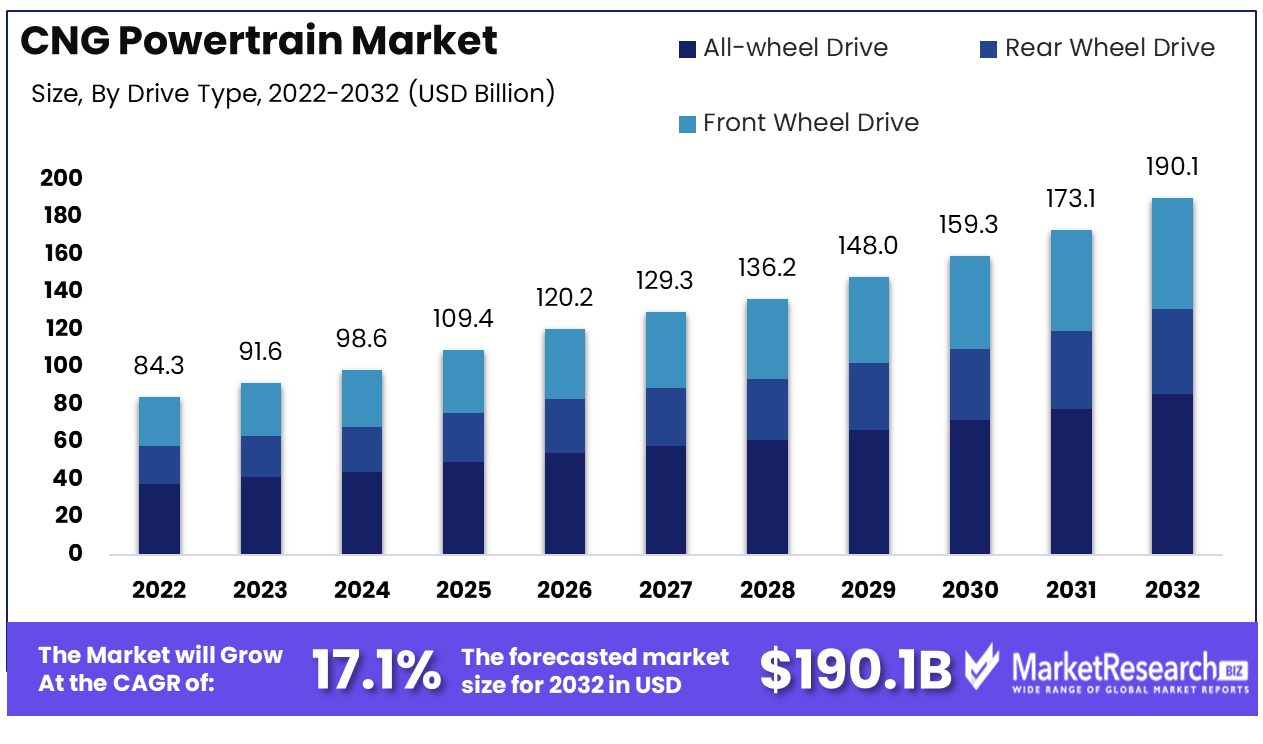

CNG Powertrain Market size is predicted to reach approximately USD 190.1Bn by 2032, from a valuation of USD 84.30 Bn in 2022, growing at a CAGR of 17.1% during the forecast period from 2023 to 2032.

CNG (compressed natural gas) powertrain technology is increasingly being used in vehicles as an alternative to traditional gasoline or diesel engines. It consists of a CNG fuel system that delivers CNG from storage tanks to the engine. CNG engines can either be specifically designed to run on this gaseous fuel source, or modified using a conversion kit to allow combustion of it.

CNG powertrains are growing increasingly popular as they produce far fewer emissions compared to gasoline or diesel. Fleets with central refueling infrastructure, like buses, refuse trucks, and delivery vehicles, are finding the most use from CNG technology as they are refueling from a central location regularly. Using CNG allows these high-mileage fleets to reduce emissions and take advantage of a lower-cost fuel.

The CNG Powertrain Market is expected to experience significant growth in the coming years driven by several key factors. One major driver is the push towards lower emissions and more environmentally friendly vehicles.

Compressed natural gas (CNG) vehicles offer lower greenhouse gas emissions compared to conventional gasoline or diesel vehicles. This helps to meet government regulations in Europe and Asia that mandate lower emissions with higher fuel economy. This has driven the adoption of CNG vehicles and growth for the CNG Powertrain Market.

Maruti Suzuki has launched the S-CNG powertrain option for the Fronx in India. The company has focused on CNG powertrains, moving away from diesel engines. The CNG variant comes equipped with a five-speed manual gearbox. Maruti Suzuki's launch marks part of its plan to provide CNG vehicles to Indian consumers.

Cummins Inc. has introduced a new heavy-duty powertrain for natural gas customers, featuring the ISX12N+Endurant HD N powertrain from its Integrated power portfolio. This integrated natural gas powertrain, combining the ISX12N near-zero natural gas engine with the Endurant HD N 12-speed automated transmission, is aimed at heavy-duty regional haul fleets seeking to reduce emissions and enhance sustainability.

Another major factor is the abundant supply and lower cost of natural gas, especially in regions like North America. Natural gas is domestically produced in many countries and provides an affordable alternative fuel.

Fleets and consumers are incentivized to switch to CNG vehicles due to the cost savings over gasoline and diesel. As more refueling infrastructure is built to support CNG vehicles, adoption rates should increase, benefiting the CNG Powertrain Market.

Overall, environmental regulations, abundant natural gas supplies, infrastructure development, and cost savings are providing growth momentum for the CNG Powertrain Market globally. If these trends continue as expected, the CNG Powertrain Market is poised for solid expansion over the coming decade.

Driving Factors

Cost Efficiency Boosts CNG Powertrain Adoption

CNG powertrains are increasingly popular due to their lower running costs compared to traditional fuel options. For consumers and businesses alike, the economic benefits of using CNG, such as lower fuel prices and reduced maintenance costs, make it an attractive alternative. This cost efficiency is driving the adoption of CNG vehicles, particularly in sectors where cost savings are a priority.

The trend towards CNG powertrains is reinforced by the growing awareness of their economic advantages, suggesting a market shift towards more cost-effective fuel solutions. As fuel prices continue to fluctuate, the appeal of CNG as a more stable and affordable option is likely to drive further growth in the CNG powertrain market.

Abundant Natural Gas Resources Propel Market Growth

The availability of abundant natural gas resources significantly contributes to the growth of the CNG powertrain market. This abundant supply ensures a consistent and cost-effective fuel source, making CNG a viable long-term solution for transportation needs.

The reliability of natural gas as a fuel source not only provides stability to the market but also encourages investment and development in CNG infrastructure and technology. As natural gas continues to be an accessible resource, its role in powering CNG vehicles will likely remain a key driver for the expansion of the CNG powertrain market, offering an environmentally and economically viable alternative to traditional fuels.

Advancements in CNG Technology Enhance Market Appeal

Ongoing advancements in CNG powertrain technology are improving the efficiency and performance of CNG vehicles, making them more appealing to both consumers and businesses. These technological improvements include enhanced fuel storage systems, optimized engine performance, and increased range.

As CNG vehicles become more efficient and comparable in performance to their gasoline counterparts, consumer hesitation towards adopting CNG technology is diminishing. This evolution in technology is not only addressing previous limitations of CNG vehicles but is also setting the stage for a more competitive market. The continuous enhancement of CNG powertrain technology suggests a future where CNG vehicles are a mainstream option, driven by their improved efficiency, performance, and environmental benefits.

Restraining Factors

Market Consolidation Restrains CNG Powertrain Market Growth

The consolidation of the Compressed Natural Gas (CNG) powertrain market, dominated by a few key players, creates challenges in standardization and widespread implementation. This market concentration can lead to a lack of diversity in product offerings and innovation, as a few companies control the market trends and technological advancements.

The dominance of these major players may also hinder the entry of new competitors, potentially stifling innovation and market expansion. Additionally, the standardization of CNG powertrain technology across different regions becomes challenging when controlled by a limited number of companies, impacting the global adoption and integration of CNG technologies in the automotive sector.

Shift Towards Electric Vehicles Challenges CNG Powertrain Market Growth

The growing trend and shift towards electric vehicles (EVs) present a significant challenge to the CNG powertrain market. As the automotive industry increasingly focuses on electric mobility, driven by environmental concerns and governmental policies promoting sustainable transportation, EVs are gaining prominence. In the CNG Powertrain Market, Net Zero Solutions pioneers eco-friendly innovations, significantly reducing carbon footprints and enhancing efficiency.

This shift diverts both consumer interest and investment away from CNG vehicles to electric alternatives. The burgeoning EV market, with its advancements in battery technology and charging infrastructure, is becoming more appealing to consumers and manufacturers alike. This transition poses a competitive threat to the CNG powertrain market, potentially limiting its growth as the industry gravitates towards electrification.

CNG Powertrain Market Segmentation Analysis

Drive Type

All-wheel drive (AWD) systems dominate the CNG powertrain market. This preference stems from their enhanced stability, traction, and performance, especially under varied and challenging driving conditions. AWD systems distribute power to all four wheels, providing better handling and safety, which is particularly advantageous for vehicles operating in regions with adverse weather conditions. The growing consumer demand for vehicles equipped with AWD for improved driving dynamics, combined with the environmental benefits of CNG, significantly contributes to this segment's growth.

Rear-wheel drive (RWD) and front-wheel drive (FWD) systems are also prevalent in the CNG powertrain market, each offering specific advantages like cost-effectiveness (FWD) and better power distribution for heavy loads (RWD). However, they don’t match the all-terrain versatility of AWD systems.

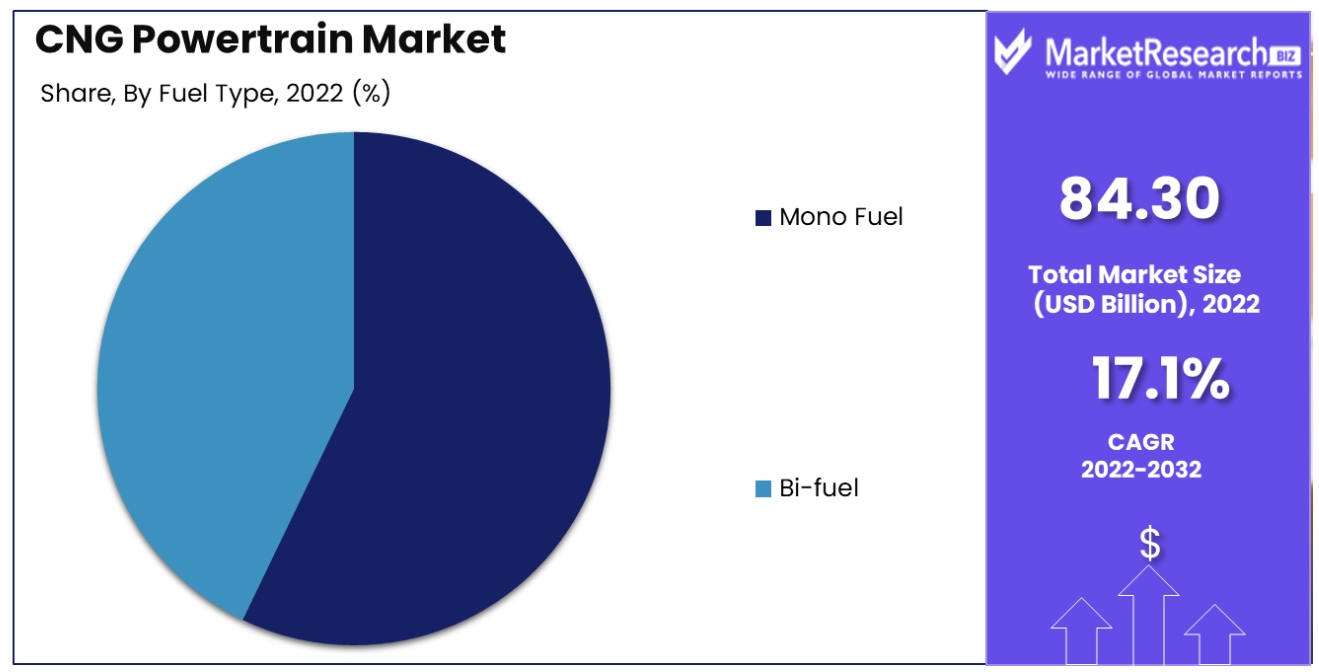

Fuel Type

Mono-fuel CNG powertrains, using exclusively CNG as a fuel source, lead this segment. Their dominance is attributed to the increasing shift towards cleaner fuel alternatives due to environmental concerns and stringent emission regulations. Mono-fuel CNG vehicles offer reduced emissions compared to traditional gasoline or diesel engines, making them a preferred choice for eco-conscious consumers and in regions with strict environmental policies.

Bi-fuel CNG powertrains, which can alternate between CNG and another fuel type, provide flexibility and are beneficial in areas where CNG refueling infrastructure is limited. However, they are secondary to mono-fuel systems in market share. As advancements in bi-fuel technology continue, addressing concerns related to infrastructure and range, their market presence is expected to grow, especially in regions transitioning to a diverse and multi-fuel transportation landscape.

Vehicle Type

Passenger vehicles represent the largest segment in the CNG powertrain market. This dominance is fueled by the increasing demand for personal vehicles with lower emissions and operational costs. The rising consumer awareness of environmental issues and the economic benefits of CNG vehicles, coupled with improving CNG distribution infrastructure, are key drivers for this segment’s growth.

Commercial vehicles, including buses and trucks, also significantly contribute to the CNG powertrain market, particularly in public transportation and logistics. However, their market share is smaller compared to passenger vehicles. The adoption of CNG powertrains in commercial fleets is gaining traction, driven by cost savings, government incentives, and the positive environmental impact associated with reduced emissions in high-mileage applications.

CNG Powertrain Industry Key Segments

By Drive Type

- All-wheel Drive

- Rear Wheel Drive

- Front Wheel Drive

By Fuel Type

- Mono Fuel

- Bi-fuel

By Vehicle Type

- Passenger Vehicle

- Commercial Vehicle

CNG Powertrain Market Growth Opportunities

Growing Demand for Transitional Fuels Positions CNG as Principal Energy Source in Net-Zero Drive

The escalating demand for alternative transitional fuels, in pursuit of achieving net-zero carbon emissions, positions Compressed Natural Gas (CNG) as a principal energy source in the powertrain market. CNG, being cleaner and more environmentally friendly compared to traditional fossil fuels, aligns with global initiatives for reducing carbon footprints.

This growing environmental awareness and regulatory push for greener fuels are significantly driving the adoption of CNG vehicles. Recent trends indicate an increasing preference for CNG as a transitional fuel, suggesting a substantial market expansion potential as nations and industries work towards their carbon neutrality goals.

Engine Efficiency Enhancements in CNG Vehicles Fuel Market Expansion

Manufacturers' focus on increasing engine efficiency, particularly through advancements like superior CNG (s-CNG) technology in passenger vehicles, is a key factor driving market growth. These technological enhancements aim to improve fuel economy and overall vehicle performance.

The development of more efficient CNG engines, offering better mileage and reduced emissions, caters to the growing consumer demand for performance-oriented yet eco-friendly vehicles. The ongoing innovations in CNG technology, enhancing engine efficiency, are not only elevating the appeal of CNG vehicles but also significantly contributing to the expansion of the CNG powertrain market.

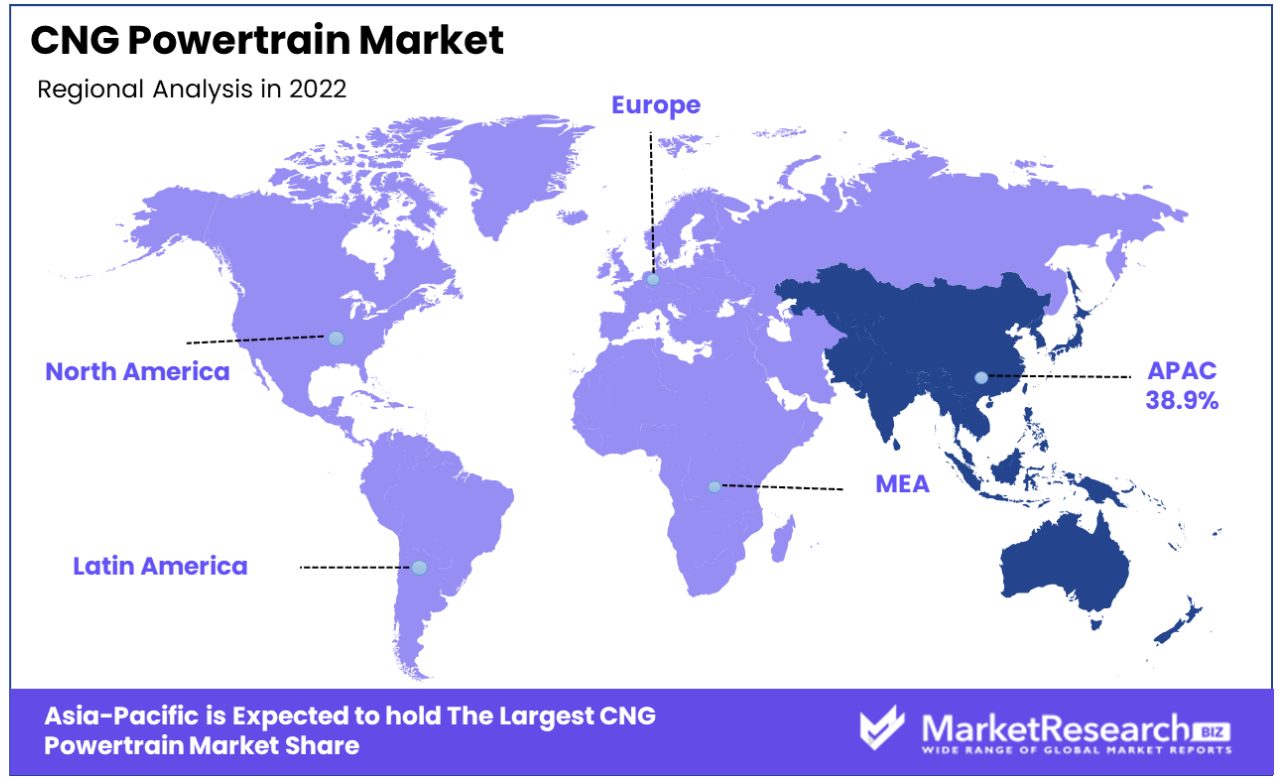

CNG Powertrain Market Regional Analysis

Asia-Pacific Dominates with 38.90% Market Share

Asia-Pacific's significant 38.90% share in the global CNG Powertrain Market is driven by the region's increasing focus on reducing carbon emissions and improving air quality. Countries like China and India, facing severe air pollution challenges, are actively promoting the use of cleaner fuels like Compressed Natural Gas (CNG).

The region's large automotive market, coupled with governmental incentives and stringent emission regulations, significantly contributes to the adoption of CNG powertrains. Additionally, the abundant availability of natural gas in several Asia-Pacific countries provides a cost-effective and sustainable fuel alternative, bolstering the market growth.

The market dynamics in Asia-Pacific are characterized by the increasing development and production of CNG vehicles by local and international automakers. The region’s growing infrastructure for CNG refueling stations and the rising demand for cost-effective and efficient transportation solutions further enhance market prospects. Furthermore, the shift in consumer preference towards eco-friendly vehicles, supported by governmental policies and subsidies, plays a crucial role in driving the CNG powertrain market in the region.

Europe's Strong Commitment to Emission Reduction

Europe’s CNG powertrain market is driven by the region's strong commitment to reducing greenhouse gas emissions and promoting sustainable mobility solutions. The European Union’s stringent emission standards and supportive policies for alternative fuels like CNG encourage the adoption of CNG vehicles. The growing network of CNG refueling stations and the focus on energy diversification contribute to the market's growth in Europe.

North America's Growing Environmental Awareness and Market Potential

In North America, the CNG powertrain market is expanding, driven by growing environmental awareness and the need for emission reduction in the transportation sector. The United States and Canada have significant natural gas reserves, providing a solid foundation for the CNG market. The region’s developing infrastructure for CNG refueling and the increasing interest in alternative fuel vehicles present significant growth potential for the CNG powertrain market.

CNG Powertrain Industry By Region

North America

- The US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of the Middle East & Africa

CNG Powertrain Market Key Player Analysis

In the CNG Powertrain Market, a sector increasingly important for sustainable transportation solutions, the companies listed are pivotal players shaping its future. Cummins Inc. and AB Volvo, with their extensive experience in heavy-duty powertrain systems, lead in the development and supply of CNG engines and components, emphasizing the market's shift towards cleaner, alternative fuel technologies for commercial vehicles.

Robert Bosch GmbH and FPT Industrial S.P.A., renowned for their engineering expertise and technological innovations, play crucial roles in advancing CNG powertrain efficiency and performance, catering to both commercial and passenger vehicles. Ford Motor Company and General Motors, as major automotive manufacturers, contribute to the market by integrating CNG systems into their vehicle lineups, demonstrating the growing acceptance of CNG as a viable alternative to traditional fuels in the consumer market.

Maruti Suzuki and Hyundai, with significant market shares in regions with high CNG vehicle adoption, underscore the importance of catering to local market needs and regulatory environments. Their strategies reflect the industry's adaptability to different geographic demands and fuel infrastructure.

Honda, known for its commitment to environmentally friendly technologies, has been instrumental in developing CNG-compatible passenger vehicles, catering to a growing segment of eco-conscious consumers. Iveco and Volvo, focusing on commercial vehicles, highlight the market's emphasis on heavy-duty applications where CNG powertrains offer a significant advantage in terms of emissions and fuel efficiency.

Collectively, these companies not only drive innovation in the CNG Powertrain Market but also represent a spectrum of strategies, from advancing engine technology to adapting vehicle designs, crucial for the adoption and expansion of CNG as a sustainable fuel alternative in the automotive industry.

Key Players

- Google LLC

- IBM Corp

- Microsoft Corporation

- Hyundai Motor Company

- Intel Corporation

- Siemens AG

- General Electric Company

- Cisco Systems, Inc.

- Oracle Corporation

- NVIDIA Corporation

- Accenture plc

- Honda Motor Company

Recent Development

May 2023 - Shell Plc would utilize the AI-based technology of big-data analytics company SparkCognition in its deep sea exploration and production to boost offshore oil output. According to this partnership, SparkCognition's artificial intelligence (AI) algorithms would process and evaluate a significant amount of seismic data for Shell's search for new oil reservoirs.

May 2023 - UNIST, a national university of South Korea, has announced a strategic partnership with ADNOC, the largest oil company in the UAE, to take the lead in the global digital carbon-neutral market. This partnership intends to lead the development of a decarbonization optimization system for large-scale oil refining and petrochemical processes by utilizing the power of artificial intelligence.

-

-

- Google LLC

- IBM Corp

- Microsoft Corporation

- Hyundai Motor Company

- Intel Corporation

- Siemens AG

- General Electric Company

- Cisco Systems, Inc.

- Oracle Corporation

- NVIDIA Corporation

- Accenture plc

- Honda Motor Company