Net Zero Solutions Market By Energy Type(Solar, Wind, Hydro, Geothermal, Others), By Location (Upstream, Downstream), By Application(Industry, Buildings, Transport, Electricity and Heating, Other), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

42487

-

Dec 2023

-

179

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Net Zero Solutions Market Size, Share, Trends Analysis

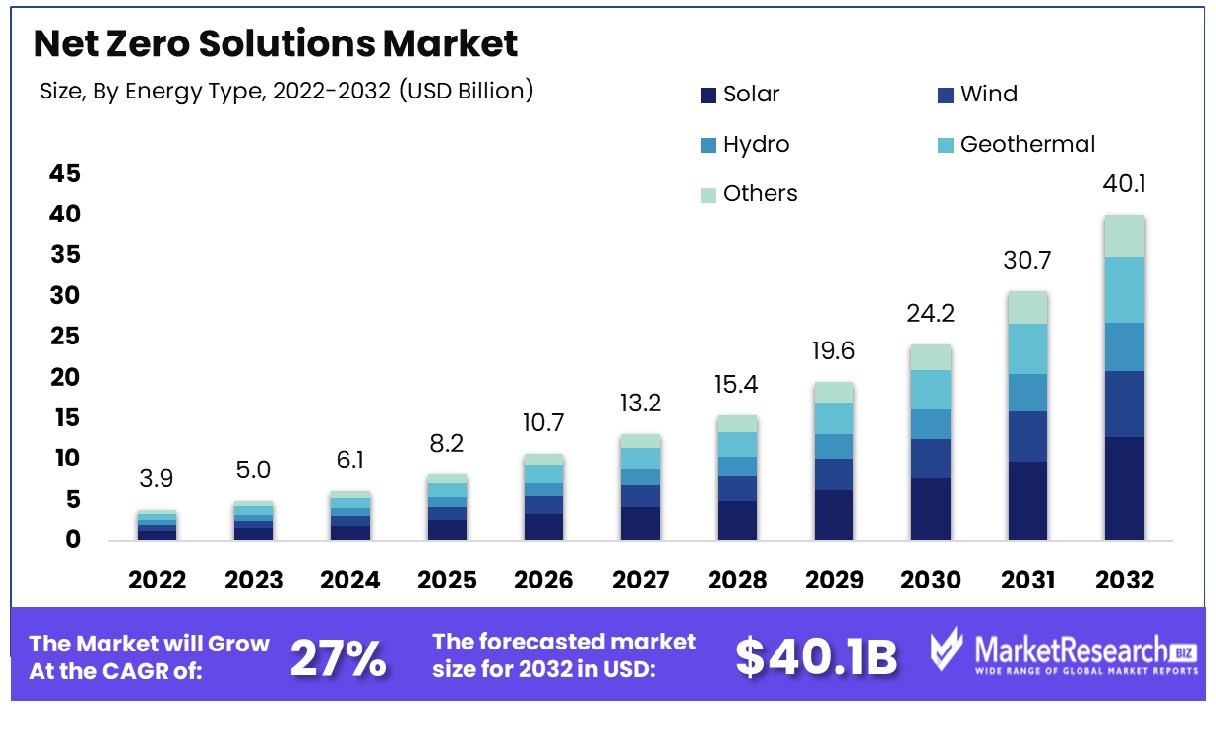

Net Zero Solutions Market size is estimated to reach USD 40.1 Bn by 2032, an increase from its USD 3.9 Bn estimate by 2022. Growth projections estimate an annual compound compound annual growth rate of (CAGR) 27% during 2023-2032.

Net Zero Solutions are strategies and technologies designed to balance out greenhouse gas emissions with greenhouse gas removal from the atmosphere, to combat climate change. This strategy includes renewable energy sources, energy efficiency improvements, carbon capture storage technology, and sustainable agriculture practices to achieve a 'net zero' carbon footprint and thus decrease global warming while creating an eco-friendly future.

The main goal is achieving a "net zero" carbon footprint which ultimately reduces global warming while creating a healthier and sustainable environment. The urgent need to reduce emissions by 45% by 2030 and achieve net zero by 2050, as highlighted by global climate goals, creates a substantial market for Net Zero Solutions.

The commitment of 32% of publicly listed companies to net-zero targets in 2023 signals a growing demand for solutions that can effectively reduce carbon footprints. This shift provides a significant opportunity for companies offering innovative solutions in renewable energy, carbon capture, and sustainable practices, aligning with the global momentum towards mitigating climate change.

Moreover, commitments like CalPERS' $100 billion investment towards net-zero solutions by 2030 demonstrate the increasing financial support for sustainable initiatives. The focus on reducing carbon emissions intensity by 50% by 2030 among investment portfolios signals a shift in capital flow towards companies that offer effective net-zero solutions. This trend not only facilitates the development of cutting-edge technologies and approaches for mitigating emissions but also presents companies operating within this space with significant market opportunities.

Further, the Net-Zero Government Initiative with participation from countries such as the U.S., Australia, Canada, Germany, and Singapore emphasizes the significance of government action for driving the net-zero transition. This initiative creates a demand for solutions that can help governments achieve their emission reduction targets.

The transition to net zero necessitates widespread deployment of new technologies across industries, presenting a fertile ground for innovation and technological advancement. According to the International Energy Agency (IEA), the energy sector's transition to net-zero CO2 emissions by 2070 necessitates the use of radical technological advancements, including energy efficiency, renewables, nuclear power, carbon capture, utilization and storage (CCUS), hydrogen and hydrogen-related fuels, and bioenergy with carbon capture and direct air capture.

The market for such technologies is set to expand significantly as industries and governments seek effective tools to meet their net-zero commitments.

Net Zero Solutions Market Dynamics

Demand for Clean Energy Catalyzes Net Zero Market

As awareness of the environmental effects of fossil fuels grows, the world is witnessing an increasing shift towards renewable energy sources such as wind, solar, or hydroelectric power. This shift is not solely driven by environmental concerns but is increasingly economically advantageous as renewable energies become cost-efficient alternatives.

The demand for clean energy is driving innovation and investment in net zero solutions, which aim to balance the greenhouse gases emitted with the amount removed from the atmosphere. This trend indicates sustained growth in the market, as clean energy becomes increasingly integral to global energy strategies.

Government Support Accelerates Net Zero Initiatives

Government support for net zero solutions and decarbonization strategies significantly contributes to market growth. Policies, incentives, and funding from governments around the world are instrumental in driving the adoption of net zero technologies and practices. This support often takes the form of subsidies for renewable energy, carbon pricing mechanisms, and targets for reducing emissions.

As governments commit to climate change agreements and set ambitious carbon neutrality goals, the demand for technologies and services that can deliver these outcomes is growing. The continued focus on decarbonization at the policy level suggests a robust future for the net zero solutions market, fueled by governmental commitments to environmental sustainability.

Environmental Concerns Drive Sustainable Energy Grid Development

Environmental concerns and the need for sustainable energy grids are key factors propelling the net zero solutions market. Climate Change awareness has created a shift in global energy systems. Energy grids must not only be reliable and cost-effective but must also be sustainable and eco-friendly.

This has created an unprecedented desire for zero-carbon solutions that incorporate renewable energy sources into the grid, increasing energy efficiency while decreasing carbon footprints. The focus on sustainable energy grids should further fuel net zero solutions as part of an overall initiative to combat climate change and foster environmental stewardship.

Stringent Regulations and Compliance Requirements Restrain Net Zero Solutions Market Growth

The net-zero solutions market faces significant challenges due to stringent regulations and compliance requirements. As governments worldwide implement more rigorous environmental policies, companies striving for net zero emissions must navigate a complex landscape of rules and standards. Complying with ever-evolving regulations often necessitates making significant investments in cutting-edge technologies and processes, which can be both expensive and time-consuming.

Many companies, especially smaller ones, may struggle to cover operational and financial expenses that limit their ability to invest or implement net-zero strategies. This regulatory complexity can slow down market growth by deterring potential adopters who are concerned about the cost and complexity of compliance.

Complexity of Implementing Net Zero Strategies Limits Market Expansion

Achieving net zero emissions typically involves a comprehensive overhaul of existing practices, encompassing energy efficiency, renewable energy adoption, supply chain adjustments, and sometimes carbon offsetting.

This multifaceted approach can be daunting, especially for industries that are heavily reliant on fossil fuels or those with complex operational structures. The challenge of accurately measuring and reducing emissions across different sectors of a business adds further complexity. This intricate process can discourage organizations from pursuing net zero strategies, thus limiting the market's expansion as companies grapple with the complexities of transitioning to a net zero future.

Net Zero Solutions Market Segmentation Analysis

By Energy Type Analysis

Solar energy dominates the industry of net zero solutions with a 61.7% market share due to its wide application and rapid decline in costs. This success can be attributed to advances in photovoltaic (PV) cell technology which have improved efficiency while expanding use across both residential and commercial settings.

Solar energy adoption can also be driven by favorable policies of governments and incentives offered to individuals as part of an overall effort to reduce carbon emissions. With its ability to scale from small rooftop installations up to huge solar farms, solar power offers a reliable net-zero energy solution with which many problems may be overcome.

Wind energy stands out due to its ability to produce large volumes of electricity with minimal carbon emissions, while hydroelectricity offers reliable renewable power in areas with abundant water sources. Geothermal power also offers continuous energy supply while other forms of renewable energy such as biomass, tidal power, and geothermal offer reliable backup options that contribute towards net zero consumption options on the market.

By Location Analysis

The upstream segment, which encompasses the creation and purchase of Net Zero Solutions, holds a 71.6% market share. This encompasses the production of renewable energy equipment such as solar panels and wind turbines as well as developing projects related to these renewable energies.

The surge in this market can be attributed to an increase in investments in renewable energy infrastructure as well as the advancement of technologies that make use of renewable energy more efficiently.

Downstream operations involve administering, transmitting, and using energy from renewable sources. While renewable energy represents only a small proportion of total system usage today, its integration is essential to making sure its potential is maximized.

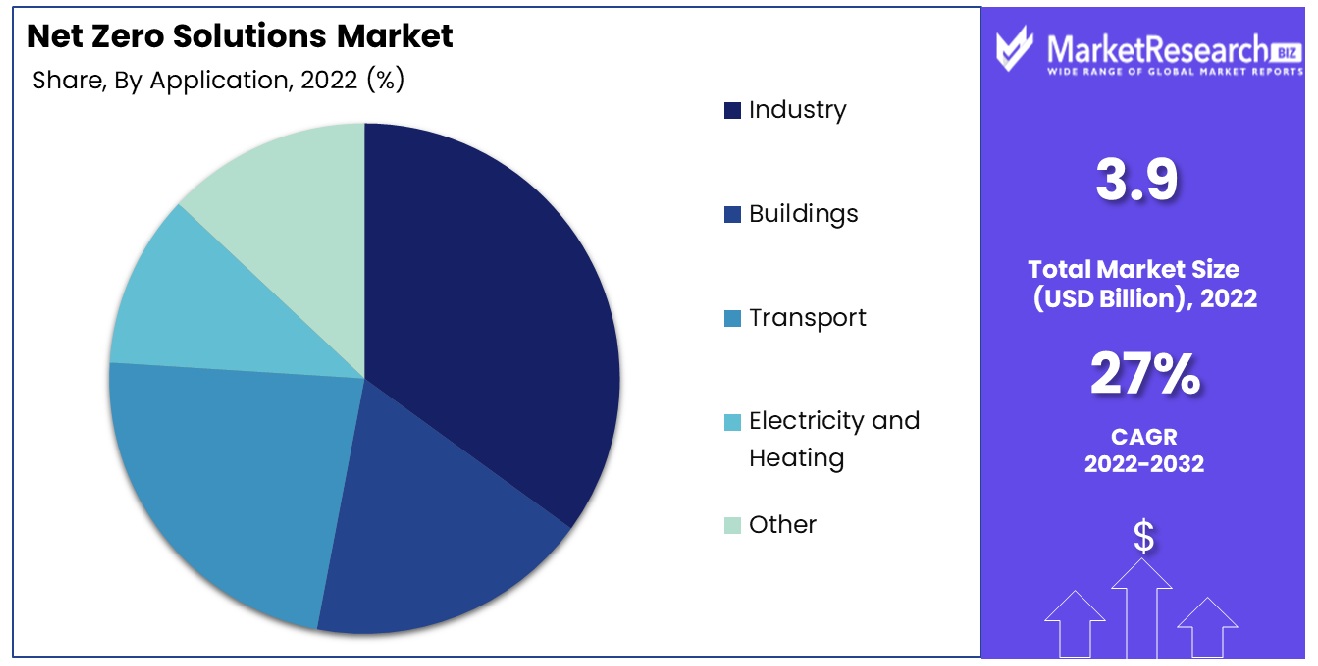

By Application Analysis

Industrial industries represent 45.8% of net zero solutions sold worldwide, accounting for 458 percent. Industries have increasingly adopted sustainable energy sources and energy-saving techniques to lower their carbon footprint and comply with environmental laws, with their growth being fuelled by needs related to manufacturing processes, waste reduction strategies, circular economy principles, and supporting manufacturing processes.

Net Zero energy buildings are constructed to use as little energy as possible while still producing enough to meet or even surpass energy requirements, typically through sustainable sources. Transport has moved towards electric and hydrogen vehicles while heating/electric power applications use renewable sources while improving grid efficiencies; additionally, there may be agriculture or waste management applications which all play an essential part in reaching net zero targets.

Net Zero Solutions Industry Segments

By Energy Type

- Solar

- Wind

- Hydro

- Geothermal

- Others

By Location

- Upstream

- Downstream

By Application

- Industry

- Buildings

- Transport

- Electricity and Heating

- Other

Net Zero Solutions Market Regional Analysis

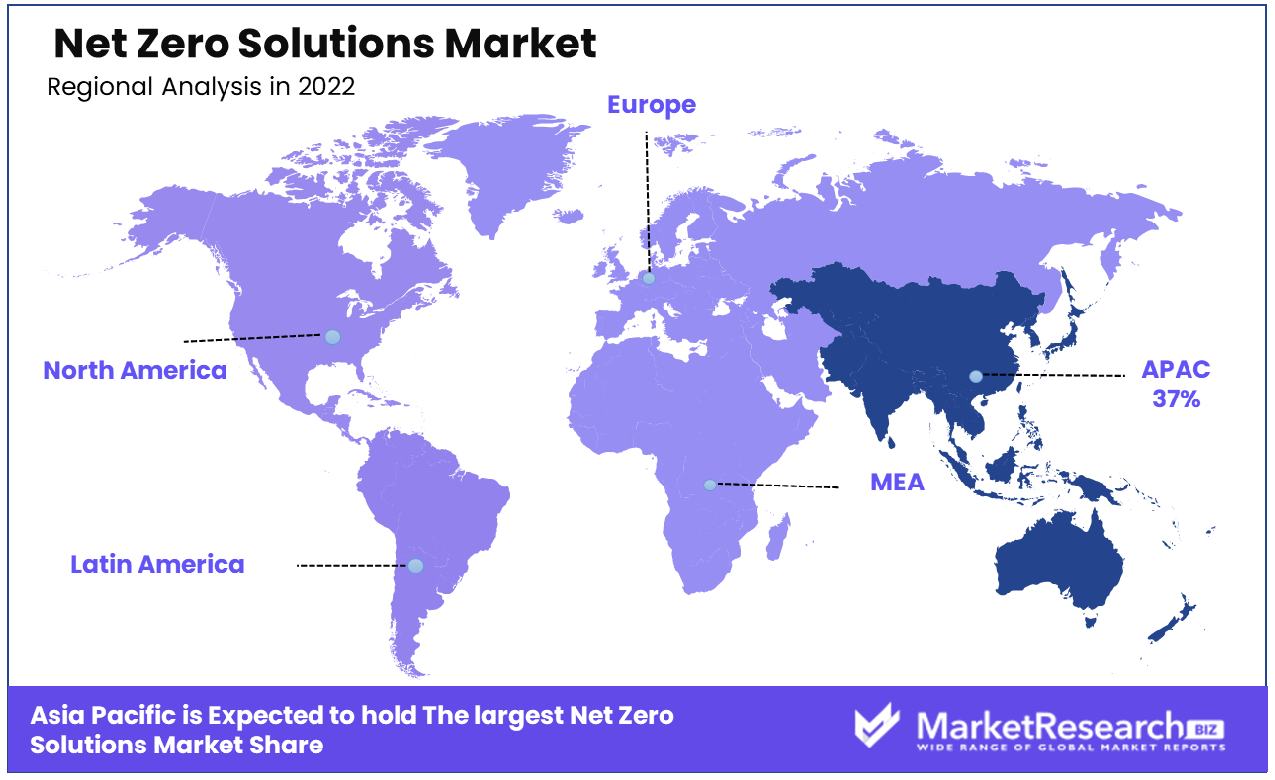

Asia Pacific Dominates with 37% Market Share in Net Zero Solutions

Asia Pacific holds 37% of the net zero solutions market valued at USD 1.6 billion, thanks to their increasing efforts in combatting climate change and sustainable development. Countries like China, Japan, and India are at the forefront of fighting climate change as they implement aggressive targets to mitigate its effects. These countries also invest heavily in renewable energy sources and carbon-neutral technology - all driving demand further driving this market segment. Rapid economic development coupled with urbanization also require sustainable solutions which has further stimulated its market.

Asia Pacific markets today are marked by an increasing emphasis on cutting greenhouse gas emissions and improving energy efficiency across various areas. Solar, wind, and other renewable sources are being harnessed with great success while government policies and incentives designed to encourage green initiatives as well as investments into sustainable technology play a crucial role. Technological advancement in areas like smart grids, energy storage, and carbon capture further fuels the growth of markets in this region.

Europe's Pioneering Sustainable Initiatives and Policies

Europe's net zero solutions market is driven by the region's pioneering role in sustainable initiatives and stringent environmental policies. The European Union's Green Deal and other climate-centric agendas set a framework for substantial investment in carbon-neutral technologies. The region's focus on innovation in renewable energy, energy efficiency, and sustainable urban development supports the market's growth.

North America Has Progressive Adaptation and Technological Advancements

In North America, particularly in the United States and Canada, the net zero solutions market is expanding due to progressive adaptation to climate change and technological advancements. The region's increasing investment in renewable energy sources, green buildings, and sustainable transportation, along with governmental support and private sector initiatives, contributes to market growth. North America's robust technological ecosystem and focus on research and development in sustainable technologies further enhance its market position.

Net Zero Solutions Industry By Region

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of Middle East & Africa

Net Zero Solutions Market Share Analysis

In the Net Zero Solutions Market, a rapidly evolving sector focused on achieving carbon neutrality, the companies listed are instrumental in driving forward sustainable solutions. DGB Group and GranBio are key innovators, providing cutting-edge technologies and bioenergy solutions, which demonstrate the market's focus on renewable and sustainable energy sources as essential components of achieving net zero goals.

Mercuria and McDermott, with their expertise in energy and infrastructure, play crucial roles in large-scale projects that integrate sustainable practices, reflecting the industry's shift towards holistic, system-wide approaches to carbon neutrality. Royal HaskoningDHV, appearing twice in the list, stands out for its consulting and engineering solutions that facilitate sustainable development, emphasizing the importance of strategic planning and environmental management in net zero initiatives.

Overall, the Net Zero Solutions Market sees a dynamic interplay between new and existing players. New entrants bring innovative technologies and fresh perspectives, often focusing on specific niches or novel solutions. In contrast, established players leverage their broad experience and resources to implement large-scale and integrated solutions. This diversity fosters a competitive yet collaborative environment, crucial for driving effective and wide-reaching solutions in the journey towards net zero emissions.

Net Zero Solutions Industry Key Players

- DGB Group

- Mercuria

- McDermott

- Royal HaskoningDHV

- Institutional Shareholder Services Inc.

- Net – Zero Think

- Royal HaskoningDHV

- Net Zero Climate

- GranBio

- JRP Solutions

Net Zero Solutions Market Recent Development

- In September 2023, British Gas released the second iteration of the Net Zero Homes Index, which tracks public attitudes towards achieving Net Zero. The index indicated that more than three-quarters (78%) of respondents were willing to make changes in their homes to achieve Net Zero.

- In 2023, The Kingswinford Training Academy has evolved into a net zero solutions hub, expanding its training offerings to cover various green energy technologies.

- In July 2023, Nike introduced ReactX foam in the new InfinityRN 4 road running trainers. This innovative foam reduces the carbon footprint of the shoe's midsole by 43%, supporting Nike's goal of achieving a 70% reduction in greenhouse gas emissions.

- In 2022, Swiss Re is working with the Partnership for Carbon Accounting Financials (PCAF) in the context of the NZIA to develop a methodology to calculate carbon emissions associated with insurance portfolios. This aims to steer their underwriting business towards less carbon-intensive activities.

Report Scope

Report Features Description Market Value (2022) USD 3.9 Billion Forecast Revenue (2032) USD 40.1 Billion CAGR (2023-2032) 27% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Energy Type(Solar, Wind, Hydro, Geothermal, Others), By Location (Upstream, Downstream), By Application(Industry, Buildings, Transport, Electricity and Heating, Other) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape DGB Group, Mercuria, McDermott, Royal HaskoningDHV, Institutional Shareholder Services Inc., Net – Zero Think, Royal HaskoningDHV, Net Zero Climate, GranBio, JRP Solutions Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- DGB Group

- Mercuria

- McDermott

- Royal HaskoningDHV

- Institutional Shareholder Services Inc.

- Net – Zero Think

- Royal HaskoningDHV

- Net Zero Climate

- GranBio

- JRP Solutions