Citric Acid Market Report By Form (Anhydrous Citric Acid, Hydrous Citric Acid), By Application (Food and Beverages [Beverages, Confectionery, Dairy, Bakery, Others], Pharmaceuticals, Cosmetics, Cleaning Agents, Others), By Function (Acidulant, Flavor Enhancer, Preservative, Antioxidant, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

48893

-

July 2024

-

291

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

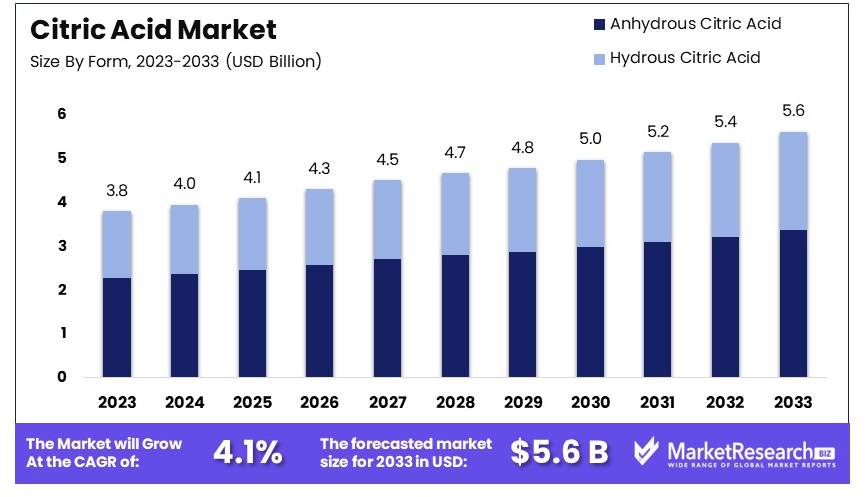

The Global Citric Acid Market size is expected to be worth around USD 5.6 Billion by 2033, from USD 3.8 Billion in 2023, growing at a CAGR of 4.1% during the forecast period from 2024 to 2033.

The Citric Acid Market refers to the global industry involved in the production, distribution, and sale of citric acid. Citric acid is a weak organic acid found in citrus fruits like lemons and oranges. It is widely used as a preservative, flavoring agent, and cleaning agent.

In the food and beverage industry, citric acid is used to enhance flavor and maintain freshness. It is also essential in the pharmaceutical industry for stabilizing medicines and as an active ingredient in dietary supplements. Additionally, the cosmetic and personal care industry utilizes citric acid for its antioxidant properties and pH adjustment capabilities.

The Citric Acid Market demonstrates robust growth, driven by its widespread applications across various industries. Global production of citric acid exceeds 2 million tons annually, underscoring its significant market presence. The production process primarily involves the fermentation of sugars using the fungus Aspergillus niger, which accounts for approximately 99% of the world's citric acid production. Leading producers such as China and the United States play a pivotal role, exporting large quantities to meet the global demand.

In the food and beverage industry, citric acid is indispensable for enhancing flavors and preserving products, aligning with the growing consumer preference for convenience foods and beverages. The pharmaceutical industry also relies heavily on citric acid for stabilizing medications and as an active ingredient in dietary supplements. The cosmetic and personal care sector benefits from its antioxidant properties and ability to adjust pH levels, further propelling market growth.

Key market drivers include the increasing demand for natural and organic products and the expanding applications of citric acid in various industries. However, challenges such as fluctuating raw material prices and regulatory constraints require strategic navigation. Despite these challenges, the market outlook remains positive, with continuous innovation and technological advancements enhancing production efficiency and expanding application scopes.

The citric acid market presents significant growth opportunities. Market participants must stay attuned to industry trends and regulatory developments while leveraging technological advancements to maintain a competitive edge. The ongoing shift towards natural and organic products is expected to further fuel demand, ensuring sustained market growth in the foreseeable future.

Key Takeaways

- Market Value: The Citric Acid Market was valued at USD 3.8 billion in 2023 and is expected to reach USD 5.6 billion by 2033, with a CAGR of 4.1%.

- By Form Analysis: Anhydrous Citric Acid dominates with 60%; it is crucial due to its high demand in various industrial applications.

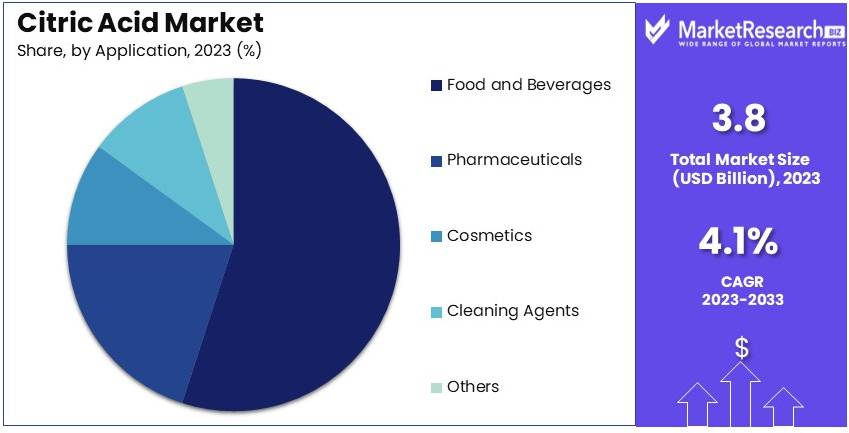

- By Application Analysis: Food and Beverages segment leads with 55%; its dominance is attributed to citric acid's extensive use as a preservative and flavor enhancer.

- By Function Analysis: Acidulant segment dominates with 70%; it is significant for its essential role in acidity regulation in foods and beverages.

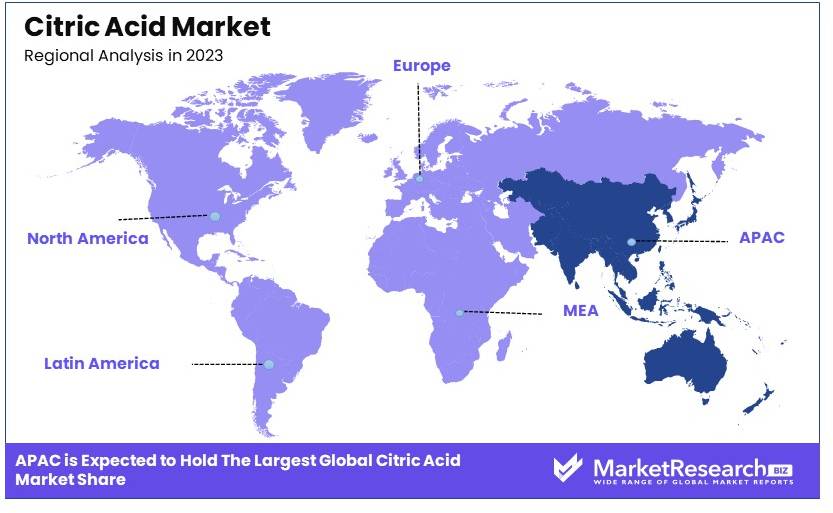

- Dominant Region: Asia Pacific leads with approximately 37%; this is due to the region's extensive food and beverage industry.

- High Growth Region: Europe is expected to show substantial growth, driven by increasing demand for natural food additives.

- Analyst Viewpoint: The citric acid market is experiencing moderate growth with significant competition. Future predictions indicate steady demand, driven by the food and beverage industry.

- Growth Opportunities: Key players can leverage the growing trend for natural preservatives and expand their market presence through strategic collaborations and product innovations.

Driving Factors

Rising Demand from the Food and Beverage Industry Drives Market Growth

The food and beverage sector significantly influences the demand for citric acid, using it widely as a food preservative, flavor enhancer, and acidity regulator. This demand is driven by changing consumer lifestyles that favor processed foods and ready-to-eat meals, a trend accelerated by urbanization and busier schedules.

Citric acid is key in the production of popular items like carbonated drinks, fruit juices, and jams, enhancing flavor and extending shelf life. The increasing consumption of these products directly boosts the use of citric acid, making it indispensable in food manufacturing and reinforcing its continuous market growth.

Increasing Use in Pharmaceutical and Personal Care Products Drives Market Growth

Citric acid is essential in both the pharmaceutical and personal care industries due to its versatility. In pharmaceuticals, it’s used in effervescent tablets and syrups, improving taste and stability of medicines. In the personal care market, citric acid functions as a pH regulator and chelator in products such as cosmetics, skin care, and hair care items.

The growing consumer interest in personal health and beauty products, particularly in emerging economies, has led to an increased demand for citric acid, reflecting its expanding role across diverse industry applications.

Growing Demand from the Detergent and Cleaning Industry Drives Market Growth

In the laundry detergent and cleaning industry, citric acid is prized for its effectiveness as a chelating agent and water softener. It is particularly favored in eco-friendly and biodegradable cleaning products, aligning with rising consumer awareness and demand for sustainable practices.

Citric acid enhances the cleaning performance of products like laundry detergents and helps prevent mineral buildup, making it a critical component in the formulation of environmentally friendly cleaning solutions. This increasing shift towards sustainable cleaning options is a strong driver for the continued use and market growth of citric acid.

Restraining Factors

Fluctuations in Raw Material Prices Restrain Market Growth

The production of citric acid depends heavily on raw materials like molasses, corn starch, and other carbohydrate sources. Prices of these materials can vary greatly due to weather conditions, crop yields, and market dynamics.

For example, a poor sugarcane harvest can lead to a surge in molasses prices, significantly increasing production costs for citric acid manufacturers. This volatility in raw material prices impacts overall production costs and profitability. Manufacturers struggle to maintain stable pricing, which can deter potential buyers and limit market growth.

Competition from Alternative Acids Restrains Market Growth

Citric acid competes with alternative acids such as acetic acid, lactic acid, and phosphoric acid. These alternatives can substitute citric acid in various applications, affecting its demand and market share. For instance, food and beverage manufacturers might choose lactic acid or acetic acid as cheaper alternatives to citric acid.

The availability and competitive pricing of these substitutes pose a challenge for the citric acid market. As more manufacturers opt for alternative acids, the demand for citric acid decreases, hindering its market expansion.

Form Analysis

Anhydrous Citric Acid dominates with 60% due to its versatility and stability.

Anhydrous Citric Acid commands a significant majority in the citric acid market with a 60% share, primarily due to its superior stability and versatility in numerous applications. This form of citric acid, which lacks water molecules, is highly prized in industries where moisture can compromise product integrity, such as in dietary supplements and effervescent powders. Its concentrated nature allows for more controlled and effective dosage in formulations, making it indispensable in both food technology and pharmaceuticals.

Conversely, Hydrous Citric Acid, which contains water, is essential in applications that benefit from its easier solubility, such as in syrups and liquid preparations. It's particularly preferred in beverages and other liquid products where a rapid dissolution of citric acid is necessary. Despite its smaller share, Hydrous Citric Acid enhances the range of applications for citric acid by fitting into niches where anhydrous form cannot perform effectively. Together, both forms of citric acid ensure comprehensive coverage across diverse industries, allowing for tailored functionalities that cater to specific product needs.

Application Analysis

Food and Beverages dominate with 55% due to its role in taste and preservation.

The Food and Beverages segment utilizes citric acid predominantly, making up 55% of its market application. Citric acid is integral in this sector, where it serves multiple roles including food flavor, preservation, and microbial growth inhibition. Its utility is most pronounced in the beverage industry, where it helps maintain the appealing tart flavor in soft drinks and fruit juices while also stabilizing the pH to inhibit unwanted microbial activity.

The sub-segments within Food and Beverages, such as confectionery, dairy, and bakery products, leverage citric acid to improve taste and extend shelf life. In confectionery, it prevents sugar crystallization and adds a sour note to candies. In dairy, citric acid is used to set certain types of cheeses and in bakery products, it can act as a leavening agent when combined with baking soda. These applications underline the flexibility of citric acid in adapting to different food processing requirements, making it a staple ingredient that supports the overarching growth in the food industry.

Function Analysis

Acidulant dominates with 70% due to its essential role in pH control and flavor.

As an acidulant, citric acid dominates the market functions, accounting for 70% of its usage. This primary role is crucial in numerous manufacturing processes where controlling acidity is essential not only for flavor but also for maintaining the safety and stability of the products. In food preservation, the proper acidity level can significantly inhibit the growth of harmful bacteria, thereby extending the product's shelf life and ensuring safety for consumption.

Beyond its role as an acidulant, citric acid's versatility extends to being a flavor enhancer, where it adds a pleasant acidic taste without overshadowing the primary flavors of the food. As a preservative and antioxidant, citric acid also helps prevent spoilage and maintain the color and texture of food products during storage. These secondary functions are vital in industries such as pharmaceuticals, where citric acid solutions are used to stabilize active ingredients and improve the palatability of oral medications.

Key Market Segments

By Form

- Anhydrous Citric Acid

- Hydrous Citric Acid

By Application

- Food and Beverages

- Beverages

- Confectionery

- Dairy

- Bakery

- Others

- Pharmaceuticals

- Cosmetics

- Cleaning Agents

- Others

By Function

- Acidulant

- Flavor Enhancer

- Preservative

- Antioxidant

- Others

Growth Opportunities

Increasing Demand for Biodegradable and Eco-friendly Products Offers Growth Opportunity

The shift towards sustainability has heightened the appeal of biodegradable and eco-friendly products, which significantly benefits the citric acid market. As a naturally derived product, citric acid is an excellent alternative to synthetic chemicals, especially in industries like cleaning and personal care. Its biodegradability and low toxicity make it a preferred ingredient for companies looking to meet consumer demand for green products.

This trend is facilitating new product developments and innovations, such as citric acid-based detergents and cleaners, which are marketed as safer for both the environment and human health. As awareness and regulations around environmental impact continue to tighten, the demand for citric acid in eco-friendly formulations is expected to drive considerable market growth.

Advancements in Biotechnology and Fermentation Processes Offer Growth Opportunity

Research in biotechnology and enhancements in fermentation processes are key drivers for improving the production and efficiency of citric acid. The introduction of new microbial strains and the optimization of fermentation conditions are pivotal in increasing yield and reducing costs. For example, the use of genetically engineered fungi and bacteria has shown potential to enhance citric acid output from renewable resources, making production more sustainable and cost-effective.

These advancements not only help in meeting the growing demand more efficiently but also bolster the citric acid market's competitiveness by reducing dependency on traditional, more expensive production methods. This ongoing progress in biotechnological research promises to expand the citric acid market by improving its appeal through sustainability and efficiency.

Trending Factors

Increasing Demand for Natural and Clean-label Products Are Trending Factors

Consumer preference for transparency and natural ingredients in their products has led to a surge in demand for natural and clean-label goods. Citric acid's natural origin makes it highly desirable in the food and beverage industry, where it is used as a preservative and flavor enhancer.

The emphasis on clean labeling has encouraged manufacturers to prominently display citric acid on ingredient lists, highlighting its natural properties to attract health-conscious consumers. This trend is not only a response to consumer preferences but also aligns with global movements towards healthier diets and more responsible consumption, driving sustained interest and growth in the citric acid market.

Focus on Sustainability and Circular Economy Are Trending Factors

The citric acid industry's commitment to sustainability and the circular economy is becoming increasingly important. Manufacturers are adopting practices that minimize environmental impact and optimize resource use, such as utilizing agricultural waste and by-products as feedstocks for citric acid production. This approach not only reduces the environmental footprint but also enhances the sustainability of the supply chain.

Driven by consumer demand, regulatory frameworks, and the industry's own sustainability goals, these practices are setting new standards in the market. As more companies integrate these principles into their operations, the citric acid market is poised for further growth, bolstered by its role in promoting environmental sustainability and resource efficiency.

Regional Analysis

Asia Pacific Dominates with 37% Market Share in the Citric Acid Market

Asia Pacific's commanding 37% market share in the citric acid industry is largely due to its expansive agricultural base and cost-effective manufacturing capabilities. The region's abundant supply of raw materials such as corn and sugarcane, essential for citric acid production, lowers production costs and boosts output. Additionally, strong governmental support for biochemical sector advancements has further strengthened its market position.

The Asia Pacific region benefits from a rapidly growing food and beverage industry, where citric acid is extensively used as a preservative and flavor enhancer. Moreover, the increasing consumer preference for clean-label and natural ingredients propels the demand for citric acid in food products. The widespread industrial base also accelerates demand in non-food sectors like cosmetics and pharmaceuticals, enhancing overall market dynamics.

The future market influence of Asia Pacific in the citric acid sector is expected to grow. Continued industrialization, coupled with advancements in biotechnology and an increasing emphasis on sustainable manufacturing practices, are likely to drive further expansion. The region's strategic focus on exporting citric acid to meet global demands also predicts a stable increase in its market share.

Regional Market Share Analysis:

- North America: Holds approximately 20% of the market share. The demand in North America is driven by the widespread use of citric acid in food preservation, pharmaceuticals, and environmentally friendly cleaning products.

- Europe: Accounts for around 25% of the market. Europe's strict environmental regulations favor citric acid over synthetic chemicals, boosting its use in food, beverages, and eco-friendly products.

- Middle East & Africa: With a 7% market share, the growth is attributed to increased industrial activities and growing awareness about health and wellness, which spur demand for citric acid in food and healthcare products.

- Latin America: Represents about 11% of the market. The rise is fueled by the expanding food processing industry and the growing popularity of convenience foods that require food additives like citric acid.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The citric acid market is influenced by major agricultural and biochemical firms. Archer Daniels Midland Company and Cargill, Incorporated are dominant due to their extensive agricultural operations. Tate & Lyle PLC and Jungbunzlauer Suisse AG are key for their focus on specialty ingredients. COFCO Biochemical (AnHui) Co., Ltd. and Weifang Ensign Industry Co., Ltd. are significant players from China, emphasizing large-scale production.

RZBC Group Co., Ltd. and Gadot Biochemical Industries Ltd. specialize in high-purity citric acid for various industries. Huangshi Xinghua Biochemical Co., Ltd. and S.A. Citrique Belge N.V. are known for their consistent quality and supply reliability. Shandong Juxian Hongde Citric Acid Co., Ltd. and Shandong TTCA Co., Ltd. contribute with their competitive pricing strategies. Citrique Belge stands out for its innovation in production processes.

These companies impact the market through technological advancements and efficient production methods. Strategic collaborations and expansions into emerging markets drive growth. The focus remains on catering to food and beverage, pharmaceuticals, and cleaning agents industries with high-quality citric acid.

Market Key Players

- Archer Daniels Midland Company

- Cargill, Incorporated

- Tate & Lyle PLC

- Jungbunzlauer Suisse AG

- COFCO Biochemical (AnHui) Co., Ltd.

- Weifang Ensign Industry Co., Ltd.

- RZBC Group Co., Ltd.

- Gadot Biochemical Industries Ltd.

- Huangshi Xinghua Biochemical Co., Ltd.

- S.A. Citrique Belge N.V.

- Shandong Juxian Hongde Citric Acid Co., Ltd.

- Shandong TTCA Co., Ltd.

- Citrique Belge

Recent Developments

- May 2024: Global citric acid prices experienced a significant surge due to supply chain disruptions caused by the collapse of the Francis Scott Key Bridge in Baltimore. This event forced the Port of Baltimore to close, leading to logistical challenges and increased costs for citric acid and other commodities.

- June 2022: Jungbunzlauer, a leading citric acid manufacturer, introduced Monomagnesium citrate. This product is used in functional foods, beverages, and supplements due to its sour taste and high solubility. Additionally, Jungbunzlauer expanded its Port Colborne facility in Canada in April 2021 to meet the growing demand for citric acid and citrate-based products.

Report Scope

Report Features Description Market Value (2023) USD 3.8 Billion Forecast Revenue (2033) USD 5.6 Billion CAGR (2024-2033) 4.1% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Anhydrous Citric Acid, Hydrous Citric Acid), By Application (Food and Beverages [Beverages, Confectionery, Dairy, Bakery, Others], Pharmaceuticals, Cosmetics, Cleaning Agents, Others), By Function (Acidulant, Flavor Enhancer, Preservative, Antioxidant, Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Archer Daniels Midland Company, Cargill, Incorporated, Tate & Lyle PLC, Jungbunzlauer Suisse AG, COFCO Biochemical (AnHui) Co., Ltd., Weifang Ensign Industry Co., Ltd., RZBC Group Co., Ltd., Gadot Biochemical Industries Ltd., Huangshi Xinghua Biochemical Co., Ltd., S.A. Citrique Belge N.V., Shandong Juxian Hongde Citric Acid Co., Ltd., Shandong TTCA Co., Ltd., Citrique Belge Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Archer Daniels Midland Company

- Cargill, Incorporated

- Tate & Lyle PLC

- Jungbunzlauer Suisse AG

- COFCO Biochemical (AnHui) Co., Ltd.

- Weifang Ensign Industry Co., Ltd.

- RZBC Group Co., Ltd.

- Gadot Biochemical Industries Ltd.

- Huangshi Xinghua Biochemical Co., Ltd.

- S.A. Citrique Belge N.V.

- Shandong Juxian Hongde Citric Acid Co., Ltd.

- Shandong TTCA Co., Ltd.

- Citrique Belge