Laundry Detergent Market By Product Type (Powder, Liquid, Gel, Pods/Tablets, Fabric softeners, Others), By Application (Household, Industrial), By Distribution channel (Online, Supermarket/Hypermarket, Convenience Stores, Independent Retailers, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

37012

-

July 2024

-

164

-

-

This report was compiled by Research Team Research team of over 50 passionate professionals leverages advanced research methodologies and analytical expertise to deliver insightful, data-driven market intelligence that empowers businesses across diverse industries to make strategic, well-informed Correspondence Research Team Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

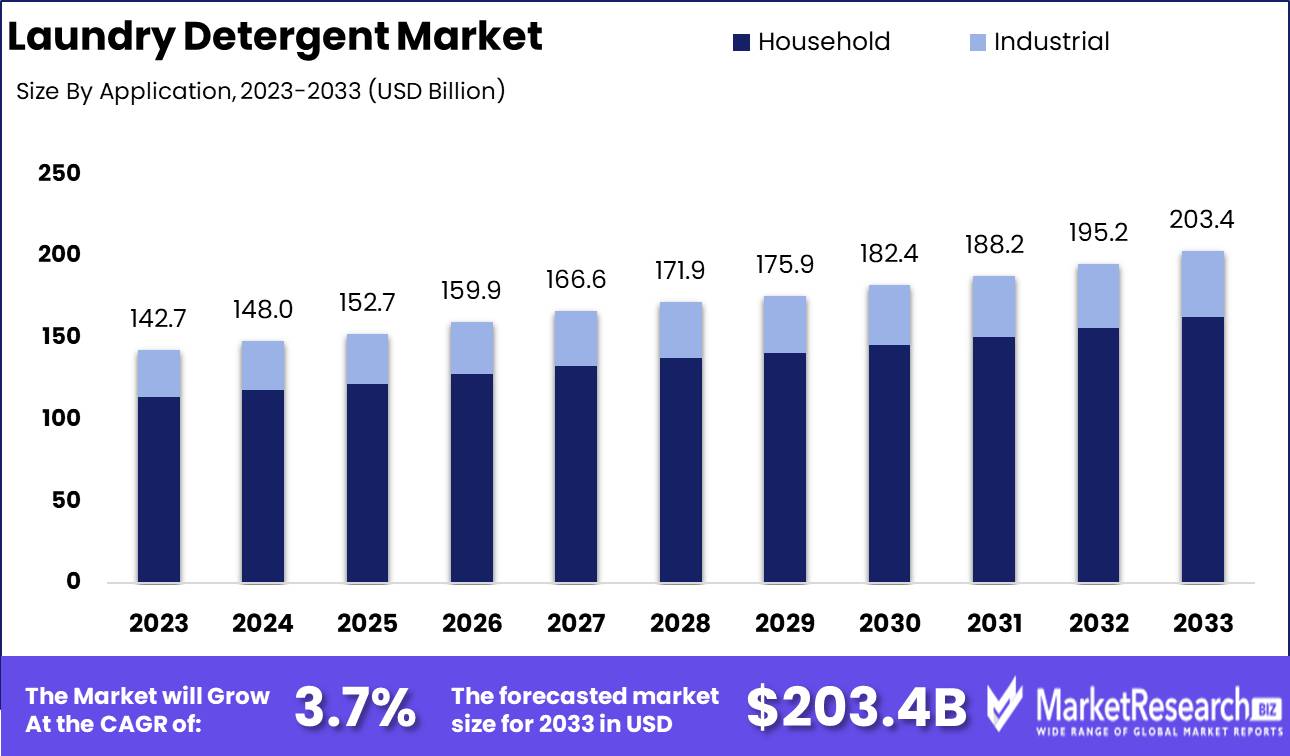

The Global Laundry Detergent Market was valued at USD 142.7 Bn in 2023. It is expected to reach USD 203.4 Bn by 2033, with a CAGR of 3.7% during the forecast period from 2024 to 2033.

The Laundry Detergent Market encompasses products formulated to clean fabrics, including liquids, powders, and pods used in both residential and commercial settings. These products are designed to remove stains, odors, and dirt while maintaining the quality of fabrics. The market includes various segments, such as high-efficiency detergents, eco-friendly options, and specialized formulations for different types of fabrics and washing conditions. Established brands and new entrants continuously innovate to meet consumer demand for effectiveness, convenience, and sustainability, making the laundry detergent market a dynamic and competitive sector in the broader home care industry.

The Laundry Detergent Market is witnessing steady growth, driven by the increasing emphasis on hygiene and cleanliness across both residential and commercial sectors. Established companies, some with roots dating back to 1976, continue to dominate the market by offering high-performance cleaning solutions tailored for specific applications, such as those used in restaurants and hotels. These long-standing brands are renowned for their reliability and effectiveness, which are crucial in maintaining high standards in commercial settings.

In the commercial sector, the self-service laundry segment has shown robust growth, with 71.4% of operators reporting an increase in gross dollar volume in 2022. Additionally, 53% of these operators indicated a 13.4% average increase in drop-off service business, highlighting a growing consumer preference for professional laundry services. This trend underscores the market's expansion beyond traditional household use, tapping into the commercial laundry sector's potential.

Innovations in product formulations, particularly eco-friendly and high-efficiency detergents, are key drivers of market growth. Consumers are increasingly seeking sustainable and effective cleaning solutions that align with their environmental values. This shift in consumer preference is prompting manufacturers to invest in research and development, resulting in a diverse range of products that cater to varying needs and preferences.

The residential segment also continues to grow, fueled by the ongoing demand for convenient and efficient cleaning solutions. The introduction of advanced products, such as pre-measured pods and concentrated detergents, has simplified the laundry process for consumers, enhancing product appeal.

Key Takeaways

- Market Value: The Global Laundry Detergent Market was valued at USD 142.7 Bn in 2023. It is expected to reach USD 203.4 Bn by 2033, with a CAGR of 3.7% during the forecast period from 2024 to 2033.

- By Product Type: Liquid detergents dominate with 40%, preferred for their ease of use and effectiveness at low temperatures.

- By Application: Household usage leads at 80%, essential for daily laundry needs.

- By Distribution Channel: Supermarket/Hypermarket sales comprise 45%, benefiting from wide accessibility and consumer trust.

- Regional Dominance: Asia Pacific holds a 45% market share, bolstered by rising living standards and population growth.

- Growth Opportunity: Innovating with formulas that are effective at lower temperatures can appeal to energy-conscious consumers, promoting environmental sustainability.

Driving factors

Increasing Awareness of Hygiene and Cleanliness

The growing awareness of hygiene and cleanliness has been a fundamental driver of the laundry detergent market. As consumers become more health-conscious, there is a heightened emphasis on maintaining cleanliness in daily life, which includes regular laundering of clothes and household textiles. This shift is particularly pronounced in the wake of global health concerns, where maintaining high hygiene standards has become imperative.

The increased frequency of washing clothes and the preference for high-quality detergents that ensure effective germ removal are direct outcomes of this heightened awareness. Consequently, this trend significantly boosts the demand for laundry detergents, propelling market growth.

Growth in the Hospitality and Healthcare Sectors

The expansion of the hospitality and healthcare sectors substantially contributes to the growth of the laundry detergent market. Hotels, resorts, and healthcare facilities such as hospitals and clinics require large quantities of laundry detergents to maintain the cleanliness and hygiene of linens, workwear uniforms, and other industrial fabric.

The hospitality industry, driven by rising tourism and travel, demands premium detergents that can handle frequent washing and tough stains while ensuring fabric longevity. Similarly, the healthcare sector's stringent hygiene standards necessitate the use of specialized detergents that can effectively disinfect and clean fabrics. The robust growth of these sectors directly correlates with increased consumption of laundry detergents, further fueling market expansion.

Advancements in Detergent Formulations

Innovations and advancements in detergent formulations have significantly impacted the laundry detergent market. Manufacturers are continually developing new products that offer enhanced cleaning performance, environmental benefits, and user convenience. For instance, the introduction of concentrated detergents, liquid pods, and eco-friendly formulas has revolutionized the market.

These advanced formulations cater to diverse consumer preferences, such as sensitivity to harsh chemicals, the need for hypoallergenic products, or the desire for sustainable options. The continuous improvement in detergent efficacy and variety not only attracts a broader customer base but also encourages more frequent purchases, thereby driving market growth.

Restraining Factors

High Competition from Local Brands

One of the primary restraining factors for the growth of the laundry detergent market is the intense competition from local brands. Local brands often offer similar products at lower prices, which can appeal to cost-conscious consumers. These brands may also have a strong understanding of regional preferences and consumer behavior, allowing them to tailor their marketing strategies effectively.

The presence of numerous local players in the market increases the difficulty for larger, established brands to maintain market share and profitability. This competitive pressure can lead to price wars, reduced margins, and a need for constant innovation and differentiation, which can strain resources and impact overall market growth.

Environmental Concerns Regarding Chemical Ingredients

Environmental concerns about the chemical ingredients used in traditional laundry detergents pose another significant challenge for the market. Increasing consumer awareness of the environmental impact of phosphates, surfactants, and other harmful chemicals used in detergents has led to a growing demand for eco-friendly and biodegradable alternatives. Governments and regulatory bodies in many regions are also implementing stricter environmental regulations, pushing manufacturers to reformulate their products to meet new standards.

While this shift towards greener products presents opportunities for innovation, it also involves significant research and development costs. The higher production costs associated with eco-friendly ingredients can lead to higher prices, potentially limiting their adoption among price-sensitive consumers and thereby restraining market growth.

By Product Type Analysis

Liquid held a dominant market position in the By Product Type segment of the Laundry Detergent Market, capturing more than a 40% share.

In 2023, Liquid laundry detergent held a dominant market position in the By Product Type segment of the Laundry Detergent Market, capturing more than a 40% share. This dominance is driven by the widespread consumer preference for liquid detergents due to their ease of use, effectiveness in dissolving quickly, and superior stain removal capabilities. Liquid detergents are particularly favored for their ability to work well in both cold and hot water, making them versatile for various washing machines and laundry needs.

Powder detergents also maintain a significant presence, particularly in regions with traditional washing practices and where cost-effectiveness is a priority. Despite their utility, their market share is smaller compared to liquid detergents due to their bulkier packaging and potential for residue issues.

Gel detergents are emerging as a popular option due to their concentrated formulas and convenient dosing. However, their market share remains modest as they are still gaining consumer acceptance.

Pods/Tablets offer convenience and pre-measured doses, reducing waste and ensuring consistent cleaning performance. Their market share is growing but remains smaller compared to liquid detergents due to higher costs and occasional dissolving issues in certain washing conditions.

Fabric Softeners and Others, including specialty detergents for specific fabrics or needs, cater to niche markets. While important for certain consumer segments, their collective market share is less dominant compared to the primary detergent categories.

By Application Analysis

Household held a dominant market position in the By Application segment of the Laundry Detergent Market, capturing more than an 80% share.

In 2023, Household applications held a dominant market position in the By Application segment of the Laundry Detergent Market, capturing more than an 80% share. This overwhelming market share is driven by the pervasive use of laundry detergents in residential settings for regular clothing and linen washing. The increasing urbanization, rising disposable incomes, and growing awareness of hygiene and cleanliness contribute to the high demand for household laundry detergents.

Industrial applications, which include use in hotels, hospitals, and laundromats, are also significant but hold a smaller market share compared to household applications. The demand in this segment is driven by the need for bulk detergents capable of handling large volumes of laundry and tough stains.

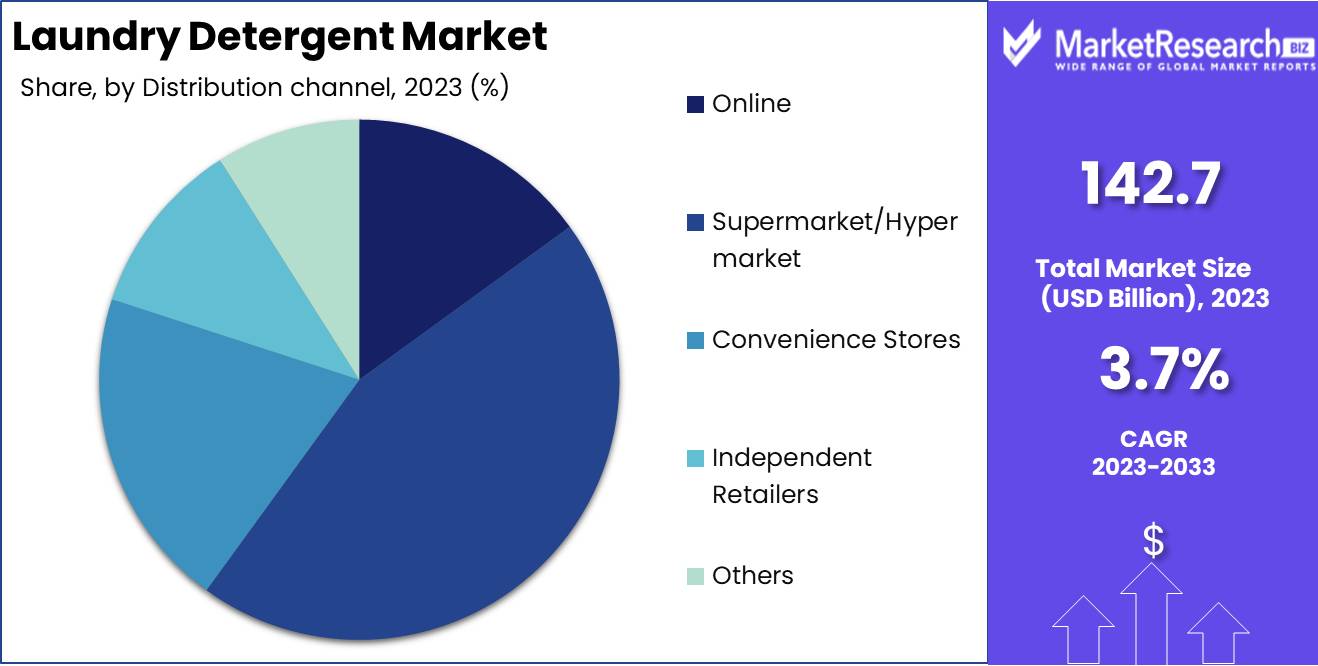

By Distribution Channel Analysis

Supermarket/Hypermarket held a dominant market position in the By Distribution Channel segment of the Laundry Detergent Market, capturing more than a 45% share.

In 2023, Supermarket/Hypermarket held a dominant market position in the By Distribution Channel segment of the Laundry Detergent Market, capturing more than a 45% share. This dominance is driven by the convenience and wide variety of products available in these large retail outlets. Supermarkets and hypermarkets provide consumers with the ability to compare different brands and types of detergents, often benefitting from promotional offers and discounts.

Online sales are growing rapidly, driven by the convenience of home delivery, easy price comparisons, and the availability of a wider range of products. Their market share remains smaller compared to traditional retail due to the established shopping habits of many consumers and the preference for physically inspecting products before purchase.

Convenience Stores offer quick and easy access to laundry detergents, particularly for emergency purchases or smaller quantities. Despite their importance, their market share is modest due to limited product variety and higher prices compared to larger retail formats.

Independent Retailers and Others, including direct sales and specialty stores, cater to niche markets and specific consumer needs. Their collective market share is smaller compared to supermarkets and hypermarkets, primarily due to their limited reach and lower economies of scale.

Key Market Segments

By Product Type

- Powder

- Liquid

- Gel

- Pods/Tablets

- Fabric softeners

- Others

By Application

- Household

- Industrial

By Distribution channel

- Online

- Supermarket/Hypermarket

- Convenience Stores

- Independent Retailers

- Others

Growth Opportunity

Development of Eco-Friendly and Biodegradable Detergents

The increasing environmental awareness among consumers presents a significant growth opportunity for the global laundry detergent market in 2024. The development and adoption of eco-friendly and biodegradable detergents are set to revolutionize the market. Consumers are actively seeking products that minimize their ecological footprint, leading to a surge in demand for detergents that use sustainable ingredients and packaging.

Manufacturers that invest in research and development to create effective, green alternatives will likely capture a larger share of the market. These products not only appeal to environmentally conscious consumers but also align with stringent regulatory requirements, ensuring compliance and fostering consumer trust. The shift towards eco-friendly detergents is expected to drive innovation and open new revenue streams, positioning companies that embrace this trend for substantial growth.

Expansion in Emerging Markets

The expansion into emerging markets represents another critical opportunity for the laundry detergent market in 2024. Rapid urbanization, increasing disposable incomes, and a growing middle class in regions such as Asia-Pacific, Latin America, and Africa are driving the demand for laundry detergents. As these regions develop, the demand for higher quality and branded detergents increases. Companies can capitalize on this by tailoring their products to meet the specific needs and preferences of these diverse markets.

Leveraging local distribution networks and engaging in culturally relevant marketing strategies can enhance market penetration and brand loyalty. The untapped potential in these emerging markets offers a lucrative avenue for growth, as the increasing urban population seeks reliable and effective laundry solutions.

Latest Trends

Rising Popularity of Liquid and Pod Detergents

In 2024, the global laundry detergent market is witnessing a notable shift towards liquid and pod detergents. These forms offer superior convenience, ease of use, and precise dosing compared to traditional powder detergents. Consumers are increasingly favoring liquid detergents for their ability to dissolve quickly in water and deliver efficient cleaning without residue.

Pod detergents, with their pre-measured doses and minimal mess, are particularly popular among busy households looking for time-saving solutions. This trend is driven by the demand for products that combine efficiency with convenience, reshaping consumer preferences and driving growth in these product segments.

Customization for Specific Fabric Types and Washing Machines

Customization is becoming a significant trend in the laundry detergent market, with manufacturers developing specialized products tailored for specific fabric types and washing machines. Consumers are seeking detergents that cater to delicate fabrics, sportswear, baby clothes, and other specialized laundry needs.

The growing adoption of high-efficiency (HE) washing machines is leading to the development of detergents specifically designed for these appliances. These customized products ensure optimal cleaning performance while protecting fabric integrity and enhancing the longevity of garments. The trend towards tailored solutions reflects a broader consumer desire for products that meet precise needs, driving innovation and market growth.

Regional Analysis

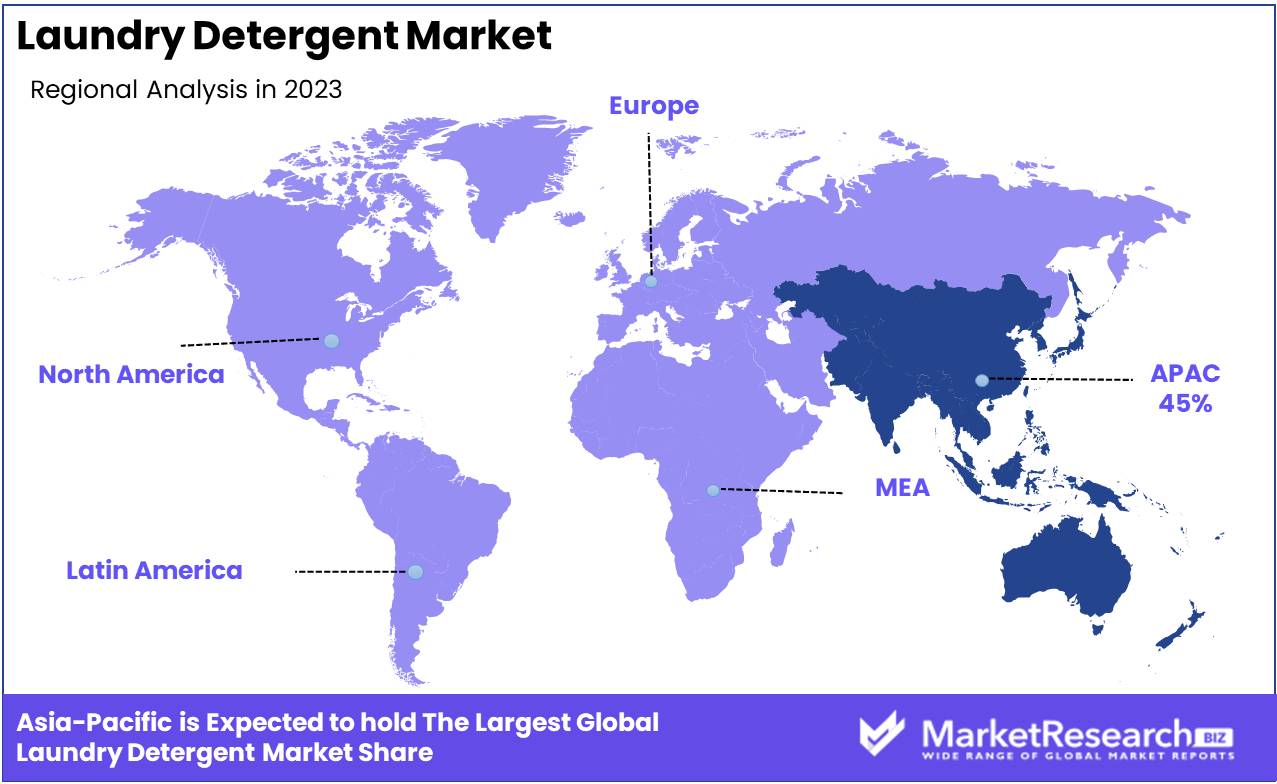

In 2023, Asia Pacific dominated the Laundry Detergent Market, capturing a significant market share.

In 2023, Asia Pacific dominated the Laundry Detergent Market, capturing a significant market share of around 45%. This dominance is driven by the region’s large and growing population, rapid urbanization, and increasing disposable incomes in countries such as China, India, and Japan. The rising middle class and the shift towards modern lifestyles contribute to higher demand for premium and specialized laundry detergents. The expanding retail sector and the proliferation of e-commerce platforms make laundry detergents more accessible to consumers across urban and rural areas.

North America holds a substantial share in the laundry detergent market, driven by high consumer spending power and brand loyalty, with key contributions from the US and Canada. Eco-friendly products and significant innovations from major players further support market growth.

Europe's significant share in the laundry detergent market is due to stringent environmental regulations and consumer preferences for sustainable products, particularly in Germany, the UK, and France. The rise of private labels and concentrated detergents also contribute to market growth.

Middle East & Africa show promising potential in the laundry detergent market, supported by urbanization, rising incomes, and a growing middle class in Saudi Arabia, UAE, and South Africa. However, economic disparities and limited rural penetration challenge growth.

Latin America's laundry detergent market is growing, led by Brazil and Mexico, due to urbanization, rising living standards, and increased hygiene awareness. While liquid detergents are on the rise, powder detergents remain popular, though market share is smaller due to economic variability.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In 2024, the global Laundry Detergent Market is set to be shaped by key players such as Procter & Gamble, Unilever Group, Church & Dwight Co., Inc., Henkel AG & Co. KGaA, Clorox Company, Reckitt Benckiser Group plc, Kao Corporation, S. C. Johnson & Son, Inc., Lion Group, and Amway Corporation. These companies are at the forefront of driving innovation, sustainability, and market expansion.

Procter & Gamble and Unilever Group lead the market with their extensive portfolios of well-known brands and their commitment to research and development. Their focus on creating more effective and environmentally friendly products caters to the rising demand for sustainable consumer goods.

Church & Dwight Co., Inc. and Henkel AG & Co. KGaA have carved out significant market shares through strategic acquisitions and product diversification. By expanding their product lines and enhancing the efficiency of their detergents, they meet the evolving needs of consumers for high-performance and versatile cleaning solutions.

The Clorox Company and Reckitt Benckiser Group plc emphasize the health and hygiene aspects of laundry detergents. Their marketing strategies highlight the germ-killing properties of their products, which resonates well with consumers' increased focus on cleanliness and health.

Kao Corporation and Lion Group, leading players in the Asia-Pacific region, are driving growth through innovative formulations and targeted marketing campaigns. Their deep understanding of regional consumer preferences allows them to tailor products that resonate with local markets, boosting their competitive advantage.

S. C. Johnson & Son, Inc. and Amway Corporation leverage their strong distribution networks and direct selling models to reach a wide consumer base. Their emphasis on customer relationships and personalized service enhances brand loyalty and market penetration.

Market Key Players

- Procter & Gamble

- Unilever Group

- Church & Dwight Co., Inc.

- Henkel AG & Co. KGaA

- Clorox Company

- Reckitt Benckiser Group plc

- Kao Corporation

- C. Johnson & Son, Inc.

- Lion Group

- Amway Corporation

Recent Development

- In February 2024, Procter & Gamble launched a new line of plant-based laundry detergents. This launch aims to cater to the growing demand for eco-friendly cleaning products, providing an alternative to traditional chemical-based detergents.

- In April 2024, Unilever Group announced the acquisition of a smaller, eco-friendly detergent company to expand their sustainable product offerings. This acquisition is expected to increase their market share by 15%.

Report Scope

Report Features Description Market Value (2023) USD 142.7 Bn Forecast Revenue (2033) USD 203.4 Bn CAGR (2024-2033) 3.7% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Powder, Liquid, Gel, Pods/Tablets, Fabric softeners, Others), By Application (Household, Industrial), By Distribution channel (Online, Supermarket/Hypermarket, Convenience Stores, Independent Retailers, Others) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Procter & Gamble, Unilever Group, Church & Dwight Co., Inc., Henkel AG & Co. KGaA, Clorox Company, Reckitt Benckiser Group plc, Kao Corporation, C. Johnson & Son, Inc., Lion Group, Amway Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Procter & Gamble

- Unilever Group

- Church & Dwight Co., Inc.

- Henkel AG & Co. KGaA

- Clorox Company

- Reckitt Benckiser Group plc

- Kao Corporation

- C. Johnson & Son, Inc.

- Lion Group

- Amway Corporation