Food Flavors Market By Type(Natural flavors, Synthetic flavors), By Application(Beverages, Food industry), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

36969

-

Nov 2023

-

155

-

-

This report was compiled by Shreyas Rokade Shreyas Rokade is a seasoned Research Analyst with CMFE, bringing extensive expertise in market research and consulting, with a strong background in Chemical Engineering. Correspondence Team Lead-CMFE Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

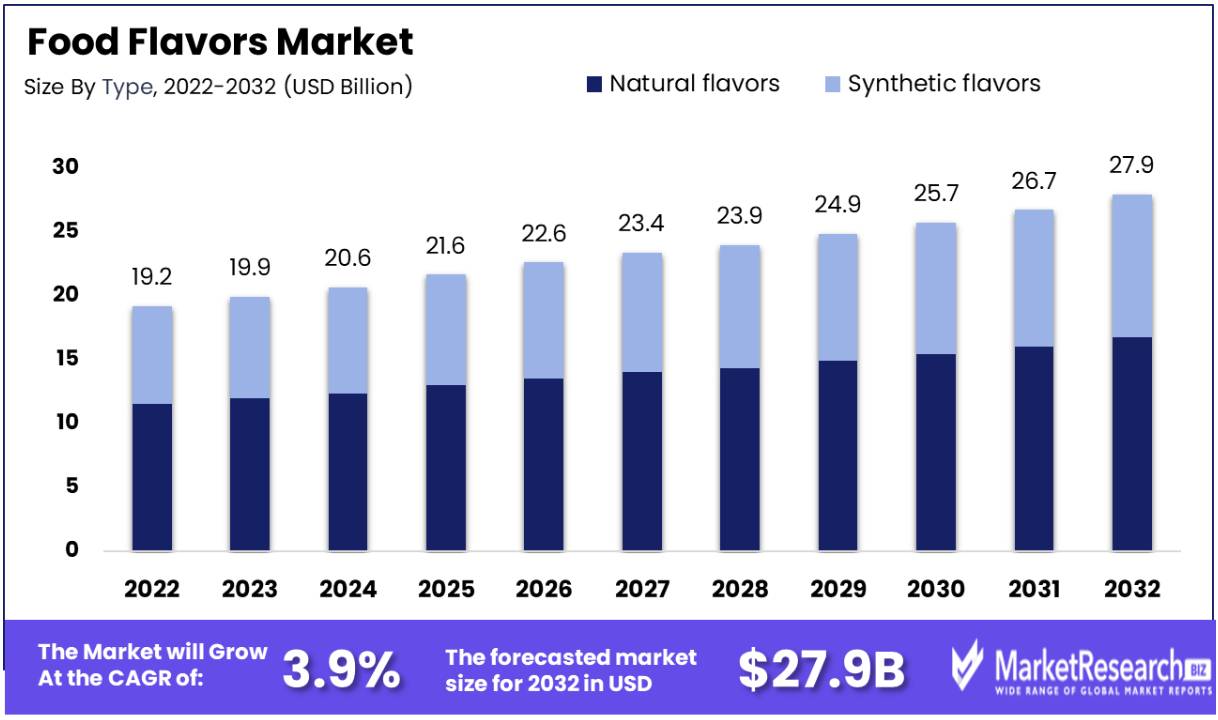

Food Flavors Market size is expected to be worth around USD 27.9 Mn by 2032 from USD 19.2 Mn in 2022, growing at a CAGR of 3.9% during the forecast period from 2023 to 2032. The surge in demand for various packaged food and beverage items, and the increase in popularity of the flavors are some of the major driving factors for the food flavor market. Food flavors are commonly used to enhance the food taste.

The flavor additives are of two types, natural and synthesized flavors. In the food and beverages sector, flavors play a vital role such as new product development, adding new product lines, and changing the taste of old products. The development of new flavors is done according to the customer’s requirements. The usage of advanced technologies offers new and enhanced taste in the product.

Synthetic flavors have harmful side effects on human beings. Natural food flavors are healthy as they don’t contain any synthetic chemicals. Natural flavors are good for health as they do not have any health effects.

Consumers today seek natural flavors free from any artificial chemicals. Natural flavors can enhance food products without adding extra sugar, fat, or calories; furthermore, they come from real fruits and vegetables which contain antioxidants and other vital nutrients that contribute to leading a healthy lifestyle.

Food flavors are widely utilized within the food and beverage industries. They can be found in products such as soft drinks, flavored drinks, snack food, baked food and cereals. When combined with natural ingredients such as spices or other aromatic materials, natural food flavors enhance not only taste but also color enhancement - creating more visual appeal to attract more customers.

For example, food flavors such as the natural vanilla flavor which is generally used in ice creams, cakes, and other food items. The rich essence of vanilla is the only preferred flavor among the customers, and additionally, it helps to improve the taste of the products.

Moreover, in the pharmaceutical industry, food flavors are used to turn the unpleasant taste in medicines and supplements into a pleasing taste. These food flavors are used in children’s medicines, as it is very tough to give them the bitter taste of medications. It is also used to provide a pleasant taste to chewable tablets and lozenges.

For example, natural mint flavoring is used in cough syrups and throat lozenges to provide them a cooling sensation that helps to calm and relax. As food flavors are important in various food, personal care, and pharmaceutical sectors, the demand will rapidly grow by expanding the food flavors market in the forecast period.

Driving factors

Rising Demand for Natural Ingredients/Flavors Drives Market Growth

The food flavors market is experiencing robust growth driven by the escalating consumer preference for natural ingredients. This shift is a response to heightened health consciousness and a growing understanding of the benefits associated with natural flavors, including nutritional value and safety.

The trend is propelling manufacturers to innovate and reformulate products, thus fueling research and development in natural flavor extraction and synthesis. The synergy between consumer preferences for healthier food options and industry innovation is creating a dynamic market environment. This sustained interest in natural flavors is poised to have lasting impacts on market composition, potentially leading to a gradual phasing out of artificial flavorings.

Growing Awareness of Decreasing Food Waste Drives Market Growth

Food waste awareness has emerged as a significant driving force for the growth of the food flavors market. Not only has this trend been driven by consumer preferences but also by global sustainability goals; as it drives exploration of novel flavoring agents derived from food byproducts to discover product development avenues; while rising demand for eco-friendly products leads to further explorations that promote innovation while simultaneously being environmentally responsible - ultimately leading to more circular economies within food industries where waste reduction and flavor innovation work hand in hand.

Increasing Investments in Research and Development Drives Market Growth

Investments in research and development are pivotal in driving the food flavors market forward. This factor signifies a commitment to innovation, enabling the exploration of novel flavors, enhancement of existing ones, and development of technologies for better flavor extraction and preservation.

R&D investments are often closely tied to consumer trends, such as the demand for natural and exotic flavors, and they enable the industry to adapt quickly to changing preferences. The long-term impact of this trend is likely to be a continually evolving market with diverse and sophisticated flavor offerings, keeping pace with global culinary trends and dietary shifts.

Preference for High-Quality and Eco-Friendly Products Drives Market Growth

The consumer inclination towards high-quality and eco-friendly products is a substantial growth driver for the food flavors market. This preference reflects a broader societal shift towards sustainability and health consciousness, influencing purchasing decisions.

It encourages manufacturers to prioritize quality and environmental impact in their product development, leading to innovations in sustainable flavor extraction and processing methods. This trend is synergistic with the demand for natural ingredients, as both emphasize quality and environmental stewardship. The long-term outlook suggests a market increasingly aligned with sustainable practices, potentially influencing regulatory frameworks and industry standards towards eco-friendliness and quality.

Restraining Factors

Stringent Regulations Restrain Market Growth

The food flavors industry faces significant growth limitations due to stringent regulations. Regulatory bodies worldwide enforce rigorous standards to ensure food safety and consumer health, often leading to extended product approval times and increased compliance costs. These regulations, although crucial for safety, can stymie innovation and slow down the market’s pace of introducing new flavors.

For instance, the EU's Regulation (EC) No 1334/2008 and the FDA's flavor labeling requirements in the U.S. necessitate thorough testing and documentation, adding layers of complexity for manufacturers. This regulatory landscape can deter new entrants and limit the diversity of flavors available in the market.

Health Concerns Restrain Market Growth

Health concerns associated with artificial flavors and additives significantly restrain the food flavors market. Growing consumer awareness of potential health risks, such as allergies or long-term effects linked to artificial ingredients, has led to heightened scrutiny and hesitancy towards these products.

This skepticism is increasingly influencing purchasing decisions, prompting a shift towards natural and organic alternatives. However, the limited availability and higher cost of natural flavors compared to artificial counterparts pose challenges to market growth. Furthermore, the balance between flavor enhancement and health considerations continues to be a delicate and evolving aspect of product development in this sector.

Segmentation Analysis of the Food Flavor Market

By Type Analysis

Natural flavors dominate the food flavors market, reflecting a global shift toward health-conscious and environmentally friendly consumption. This surge is primarily driven by consumer demand for healthier, more authentic food experiences and increasing awareness of the environmental impact of synthetic flavors. Natural flavors, derived from fruits, vegetables, herbs, and spices, are perceived as safer and more nutritious, influencing purchase decisions across various demographics.

The market for natural flavors is bolstered by innovations in extraction and preservation technologies, allowing for more complex and longer-lasting flavor profiles. This technological advancement is critical in expanding the application range of natural flavors, previously limited by shelf-life and intensity challenges. Additionally, regulatory bodies favor natural flavors due to their safety profile, further reinforcing their market position. The market for food flavors is driven by the rising demand for natural food products. The growth rate, especially in organic products, is substantial. Key companies with the largest market share prioritize human health. Major players dominate the food flavors market.

The growth in the natural flavors segment is complemented by the synthetic flavors segment. Though facing a gradual decline in preference, synthetic flavors are still significant in applications where cost-effectiveness and consistency are paramount. They remain essential in certain food categories where replicating a specific flavor profile with natural extracts is challenging or economically unfeasible. The synergy between these two segments allows for a comprehensive range of flavors catering to diverse market needs and preferences.

By Application Analysis

The beverage segment leads the application of food flavors, driven by the ever-evolving consumer palate and the rapid introduction of new beverage products. This dominance is attributed to the increasing demand for flavored waters, health drinks, and specialty beverages like plant-based and functional drinks. The trend towards health and wellness, combined with the desire for novel taste experiences, has significantly influenced the development of new flavor combinations in beverages.

The food industry, as the other key application segment, also significantly contributes to the growth of the food flavors market. It encompasses a wide range of products, from snacks and confectionery to ready-to-eat food products, where flavor innovation is a critical differentiator.

While beverages lead in flavor innovation, the food segment provides a broad platform for the application of both natural and synthetic flavors, catering to global and regional taste preferences. The interplay between these two application segments ensures a dynamic and responsive market, aligned with changing consumer tastes and dietary trends. Dairy beverages exhibit the fastest growth potential and hold a major share in food flavor trends within the food flavors market.

Key Market Segments

By Type

- Natural flavors

- Synthetic flavors

By Application

- Beverages

- Food industry

Growth Opportunity

Natural Flavors Offer Growth Opportunity

The rising consumer demand for natural flavors opens substantial growth avenues in the food flavors market. This trend, driven by health consciousness and a preference for clean-label products, encourages manufacturers to innovate and diversify their natural flavor offerings.

The natural flavors segment benefits from technological advancements in extraction and synthesis, allowing for more complex and authentic taste profiles. This shift not only caters to evolving consumer preferences but also aligns with global sustainability goals, positioning natural flavors as a key growth driver in the industry.

Expansion in Emerging Markets Offers Growth Opportunity

Emerging markets offer promising growth prospects for the food flavors industry. These markets are experiencing rapid urbanization, increasing disposable incomes, and a growing middle class, leading to a surge in demand for processed and flavored foods.

Cultural diversity in these regions presents opportunities for localized flavor innovations, catering to regional taste preferences. The expanding retail infrastructure and growing acceptance of Western food habits also contribute to the market's potential in these areas.

Product Portfolio Expansion Offers Growth Opportunity

Expanding product portfolios is a key strategy for growth in the food flavors market. This involves introducing new flavors and applications, such as organic and ethnic flavors, catering to diverse consumer palates. Manufacturers leveraging this approach can tap into niche markets and address unmet consumer needs. Portfolio expansion often goes hand-in-hand with R&D investments, ensuring a continuous flow of innovative products. This strategy not only broadens market reach but also strengthens brand presence and adaptability in a competitive landscape

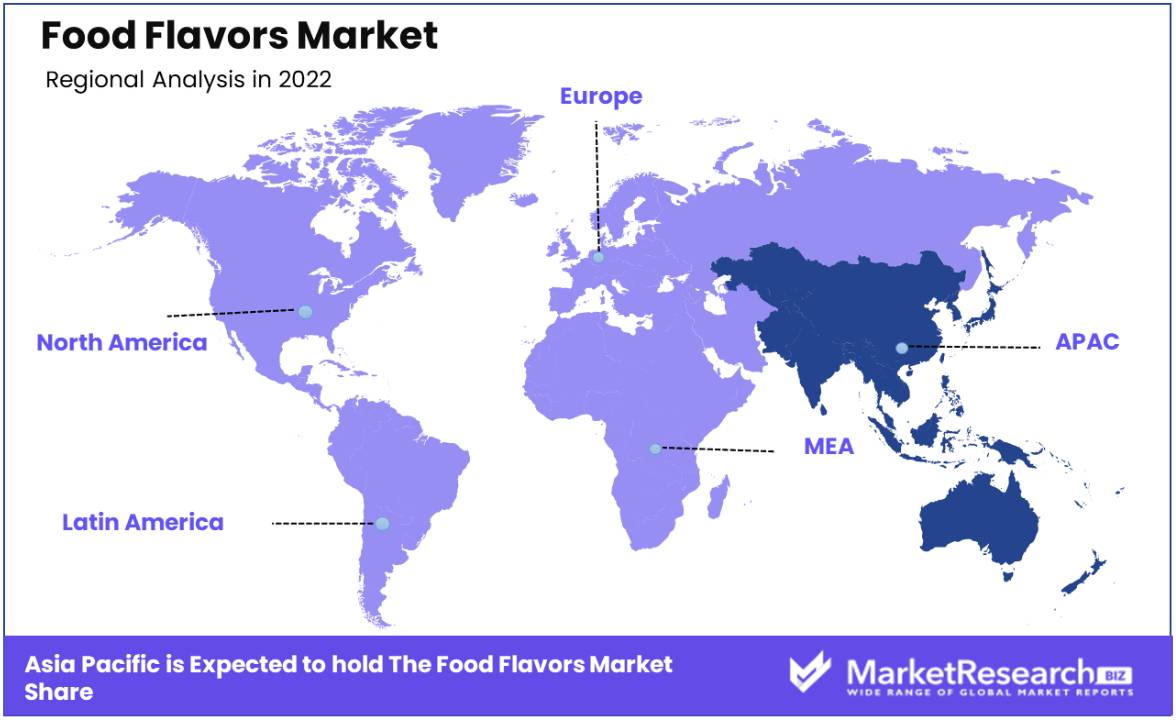

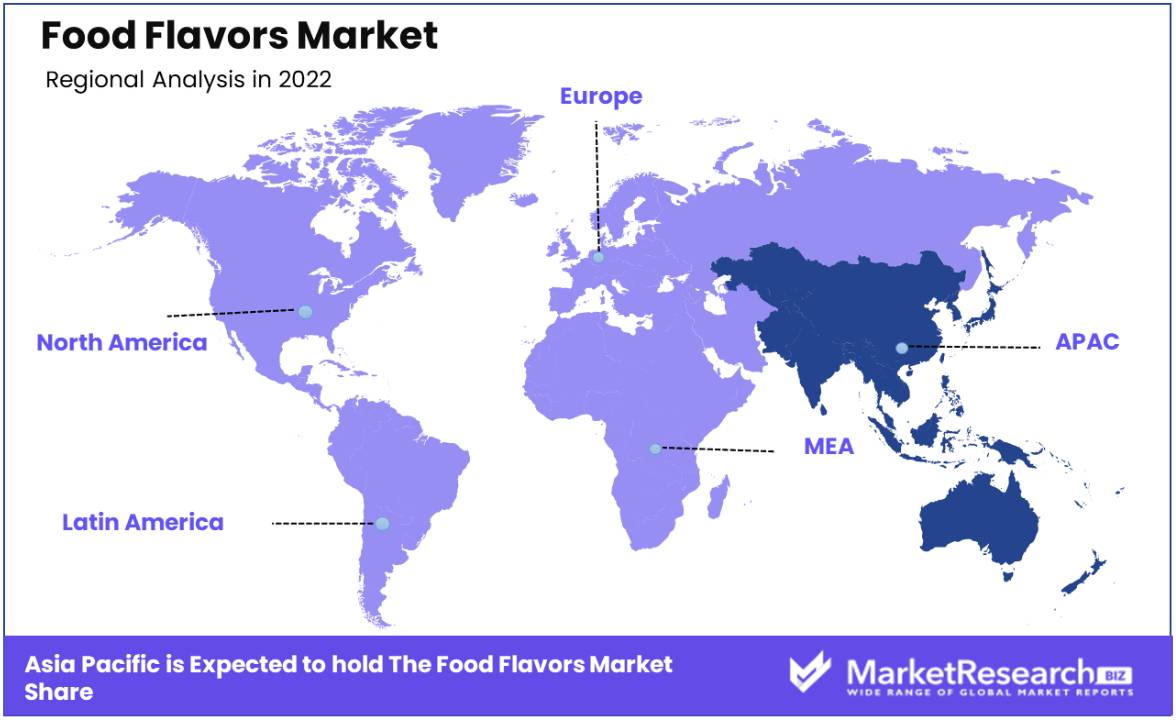

Regional Analysis

Asia Pacific Dominates with Significant Market Share

Asia Pacific stands as a dominant force in the food flavors market, attributed to several key factors. The region's large and growing population, coupled with increasing urbanization and disposable incomes, propels the demand for processed and flavored foods.

The cultural diversity across countries like China, India, and Japan drives a wide range of flavor preferences, fostering innovation and expansion in flavor offerings. The region's thriving food and beverage industry, including a robust market for traditional and Westernized food products, further amplifies this demand. Additionally, Asia Pacific's role as a major hub for natural flavor sources, such as spices and herbs, bolsters its market position.

Europe Maintains a Strong Market Presence

Europe holds a strong position in the food flavors market, driven by a sophisticated consumer base with a penchant for diverse and high-quality flavors. The region's stringent regulatory framework ensures a high standard of food safety and quality, influencing global trends in flavor innovation and product development.

Europe's market is characterized by a strong demand for natural and organic flavors, mirroring its emphasis on health and sustainability. This preference shapes the region's flavor offerings, aligning with global shifts towards cleaner and more transparent labeling. The established food and beverage industry in Europe, with its rich culinary heritage, also contributes to its significant market share.

North America: A Key Contributor to Market Growth

North America, particularly the United States, is a key contributor to the global food flavors market. The region's market dynamics are shaped by a diverse and experimental consumer base, continually seeking novel and exotic flavor experiences. The trend towards health-conscious eating and the increasing popularity of ethnic cuisines drive the demand for natural and innovative flavors.

North America's well-developed food processing industry and its penchant for convenience foods play a significant role in this demand. The region is also a leader in flavor research and technology, contributing to advancements in flavor extraction, synthesis, and application

Key Regions and Countries

North America

- The US

- Canada

- Rest of North America

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia-Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of Middle East & Africa

Key Players Analysis

In the food flavors market, the ensemble of companies listed represents a diverse and influential array of key players, each contributing uniquely to the industry's dynamism and growth. Givaudan SA and Firmenich SA, as industry leaders, are renowned for their extensive flavor portfolios and innovative approaches to taste solutions, significantly influencing market trends and consumer preferences. International Flavors & Fragrances, Inc. and Takasago International Corporation are pivotal in driving technological advancements and global expansion, leveraging their robust R&D capabilities and wide-reaching distribution networks.

Bell Flavors & Fragrances and Kerry Group plc distinguish themselves with their focus on natural and organic flavor solutions, aligning with the growing consumer demand for clean-label products. V. Mane Fils SA and Sensient Technologies Corporation excel in offering customized and specialized flavor solutions, catering to specific market niches and consumer segments.

Danisco A/S and Frutarom Industries Ltd., known for their strategic mergers and acquisitions, have expanded their market presence and diversified their product offerings, enhancing their competitive edge in the global market. Robertet Group, with its emphasis on sustainability and natural ingredients, resonates with the industry's shift towards environmentally conscious practices.

Wild Flavors, Inc. and Symrise AG, with their broad geographic reach and innovative product lines, play crucial roles in shaping the global food flavors market, driving its expansion into new regions and application areas. Together, these companies' strategic positioning, ranging from innovation and natural product focus to global expansion, shapes the competitive landscape and the future trajectory of the food flavors market.

Top Key Players in the Food Flavors Market

- Givaudan SA

- Firmenich SA

- International Flavors & Fragrances, Inc.

- Takasago International Corporation

- Bell Flavors & Fragrances

- Kerry Group plc

- V. Mane Fils SA

- Sensient Technologies Corporation

- Danisco A/S

- Frutarom Industries Ltd.

- Robertet Group

- Wild Flavors, Inc.

- Symrise AG

- McCormick & Company, Inc.

- Koninklijke DSM NV

Recent Development

- In November 2023, The Hershey Co. introduced the Reese’s Caramel Big Cup, a new flavor innovation for the Reese’s brand. This treat combines the classic Reese’s peanut cup with a layer of caramel, all in the larger Big Cup format, for the first time. The Reese’s Caramel Big Cup contains 190 calories, 10 grams of total fat, and 3 grams of protein per serving of one cup. It was made available in standard and king-size packages at national retailers starting on Nov. 17.

- In October 2023, Whipnotic, a whipped cream brand, raised $2.5 million in seed funding to support its growth and retail distribution. The funding was led by GTM Investments, with participation from several other venture capitalists and family offices.

- In 2023, MadeGood introduced Drizzled Crunchy Oat Bites in Chocolate Drizzled Birthday Cake and Vanilla Drizzled Cookies & Crème varieties. These organic, allergy-friendly snacks are made without artificial flavors or synthetic colors.

- In 2023, Ferrero Group, known for its chocolates and packaged snacks, introduced its Black Forest fruity gummies to the Chinese market in September. These gummies are high in vitamin C and feature natural flavors, catering to the trend of functional snacking.

Report Scope

Report Features Description Market Value (2022) USD 19.2 Mn Forecast Revenue (2032) USD 27.9 Mn CAGR (2023-2032) 3.9% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Natural flavors, Synthetic flavors), By Application(Beverages, Food industry) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Givaudan SA, Firmenich SA, International Flavors & Fragrances, Inc., Takasago International Corporation, Bell Flavors & Fragrances, Kerry Group plc, V. Mane Fils SA, Sensient Technologies Corporation, Danisco A/S, Frutarom Industries Ltd., Robertet Group, Wild Flavors, Inc., Symrise AG, McCormick & Company, Inc., Koninklijke DSM NV Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Givaudan SA

- Firmenich SA

- International Flavors & Fragrances, Inc.

- Takasago International Corporation

- Bell Flavors & Fragrances

- Kerry Group plc

- V. Mane Fils SA

- Sensient Technologies Corporation

- Danisco A/S

- Frutarom Industries Ltd.

- Robertet Group

- Wild Flavors, Inc.

- Symrise AG

- McCormick & Company, Inc.

- Koninklijke DSM NV