Weight Loss Market Report By Diet Type (Meals, Beverages, Supplements), By Equipment Type (Fitness Equipment [Cardiovascular Training Equipment, Strength Training Equipment], Surgical Equipment), By Services (Fitness Centers and Health Clubs, Consulting Services, Online Weight Loss Programs, Slimming Centers, Others), By Age Group, By Gender, By Distribution Channel, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

36168

-

Feb 2025

-

325

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

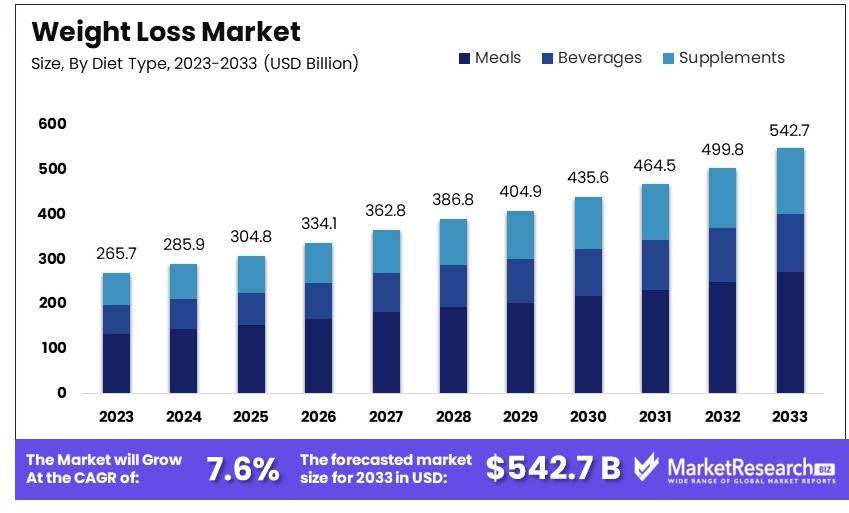

The Global Weight Loss Market size is expected to be worth around USD 542.7 Billion by 2033, from USD 265.7 Billion in 2023, growing at a CAGR of 7.6% during the forecast period from 2024 to 2033.

The weight loss market includes products and services designed to help individuals lose weight and maintain a healthy lifestyle. This market is driven by rising obesity rates and increasing health consciousness. Key players include diet planners, fitness centers, and supplement manufacturers.

The market has experienced substantial growth due to advancements in weight loss programs and products. Innovations such as personalized diet plans and fitness apps have fueled demand. Major trends include the popularity of plant-based diets and intermittent fasting. The market is competitive, with numerous options available to consumers.

The weight loss market is witnessing strong growth, driven by increasing awareness of health and fitness. Consumers are actively seeking products and programs that help them achieve and maintain a healthy weight. Weight loss products, including dietary supplements and fitness equipment, are seeing substantial international trade. The high demand for fitness equipment, particularly from China and the United States, underscores this trend. In 2022, the U.S. imported over USD 3.7 billion worth of fitness equipment, reflecting a significant global trade presence.

Programs like the Mayo Clinic Diet have gained popularity due to their structured approach to weight loss. The Mayo Clinic Diet promotes losing up to 10 pounds in the initial two weeks and then a steady 1-2 pounds per week thereafter. Such programs appeal to consumers looking for credible and manageable weight loss solutions.

The rise of e-commerce has made weight loss products more accessible, allowing consumers to purchase supplements and equipment online. This convenience has further fueled market growth. Additionally, technological advancements in fitness equipment, such as smart features and connectivity, are attracting tech-savvy consumers.

Moreover, the market is seeing innovation in dietary supplements with ingredients that claim to boost metabolism and reduce appetite. These products are marketed towards consumers looking for quick and effective weight loss solutions.

In conclusion, the weight loss market is poised for continued growth, driven by high consumer demand, international trade, and innovations in products and programs. The combination of structured diets, advanced fitness equipment, and accessible e-commerce platforms ensures a dynamic and expanding market landscape. This trend indicates a promising future for both consumers and manufacturers in the weight loss industry.

Key Takeaways

- Market Value: The Weight Loss Market was valued at USD 265.7 billion in 2023 and is expected to reach USD 542.7 billion by 2033, with a CAGR of 7.6%.

- By Diet Type Analysis: Supplements dominate by 50%; they are pivotal due to their accessibility and varied dietary support.

- By Equipment Type Analysis: Cardiovascular Training Equipment leads with 65%; essential for core fitness offerings.

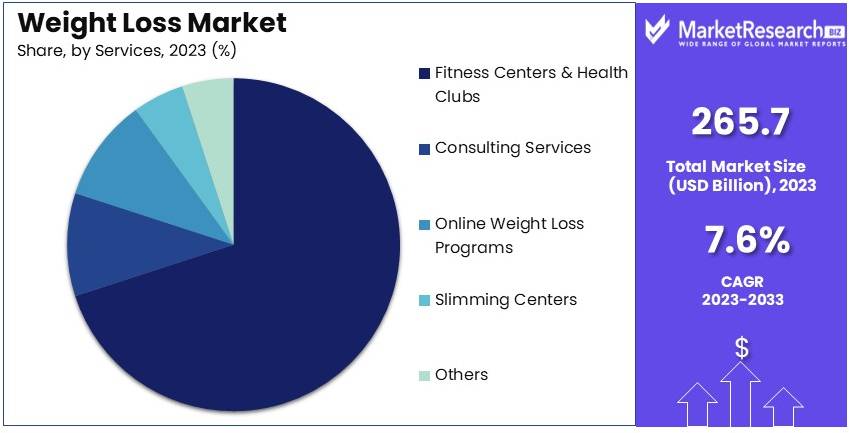

- By Services Analysis: Fitness Centers and Health Clubs take the largest share at 70%; they are central to sustainable weight management.

- By Age Group Analysis: The 31-50 years segment holds 45%; this group actively seeks weight loss solutions.

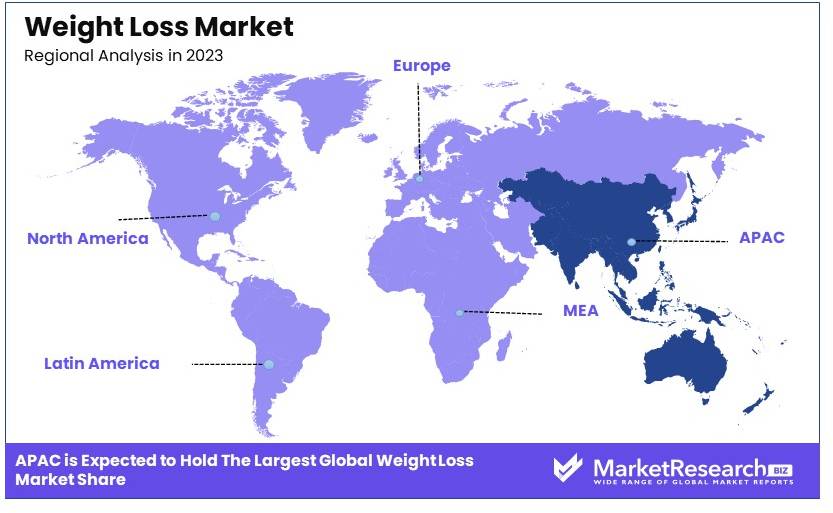

- Dominant Region: APAC dominates with 38.5%; a large population base drives demand in this region.

- Analyst Viewpoint: The Weight Loss Market shows moderate saturation with diverse competition; growth will be driven by innovative product offerings and enhanced service platforms.

- Growth Opportunities: Key players can leverage tailored fitness programs and personalized dietary supplements to differentiate and capture market share.

Driving Factors

Rising Obesity Rates and Health Awareness Drive Market Growth

The global increase in obesity rates is a significant driver for the weight loss market. According to the World Health Organization, worldwide obesity has nearly tripled since 1975, with 39% of adults overweight in 2016.

This alarming trend, coupled with growing awareness of obesity-related health risks such as diabetes, heart disease, and certain cancers, is pushing more individuals to seek weight loss & diet control solutions. For instance, the success of programs like Weight Watchers (now WW) can be attributed to this trend, with the company reporting 4.6 million subscribers in 2020. The rising obesity rates and health awareness are key factors driving demand in the weight loss market.

Technological Advancements in Fitness Tracking and Personalized Nutrition Drive Market Growth

The integration of technology into weight loss strategies has revolutionized the market. Wearable devices, smartphone apps, and AI-powered platforms are providing users with personalized fitness and clinical nutrition plans, making weight loss more accessible and engaging.

Fitbit, for example, has capitalized on this trend, selling over 120 million devices as of 2023. These technologies not only help users track their progress but also provide valuable data for companies to improve their products and services, driving further growth in the market. The combination of technological innovation and personalized health solutions is a significant growth driver in the weight loss industry.

Increasing Disposable Income and Willingness to Invest in Health Drive Market Growth

As global disposable income rises, particularly in emerging economies, more people are willing to spend on weight loss products and services. This includes gym memberships, personal training, specialized diet foods, and supplements.

For instance, the global health club industry was valued at USD 102.3 billion in 2023, with a significant portion attributed to weight loss-oriented memberships. The success of premium weight loss programs like Jenny Craig, which can cost over USD 600 per month, further illustrates consumers' willingness to invest in their health and appearance. The growing disposable income and prioritization of health expenditures are major drivers in the weight loss market.

Restraining Factors

Proliferation of Fad Diets and Skepticism Restrain Market Growth

The weight loss market is often crowded with quick-fix solutions and fad diets that promise rapid results but fail to deliver long-term success. This has led to increased consumer skepticism, making it difficult for legitimate weight loss products and services to gain trust.

For example, the Keto diet saw a massive surge in popularity, with the global keto market size reaching USD 11.2 billion in 2023. However, its sustainability and long-term health effects have been questioned by health professionals, potentially dampening consumer confidence in weight loss solutions overall.

Regulatory Challenges and Safety Concerns Restrain Market Growth

The weight loss industry faces strict regulations, particularly for dietary supplements and medical devices. Safety concerns and potential side effects of weight loss products can lead to market withdrawals and damage consumer trust.

A notable example is the FDA's ban on ephedra in dietary supplements in 2004 due to serious health risks. This significantly impacted the weight loss supplement market. Such regulatory actions and safety issues can restrain market growth and require companies to invest heavily in research and compliance.

Diet Type Analysis

Supplements dominate the diet segment of the weight loss market with a 50% share due to their convenience and effectiveness in supporting weight loss goals.

In the weight loss market, the diet type is a critical segment, consisting of meals, beverages, and supplements. Supplements lead this category, favored for their ease of use, effectiveness, and ability to provide targeted nutritional support for weight loss. These include a variety of products such as fat burners, meal replacement shakes, and metabolism boosters that help increase the efficiency of weight loss efforts.

Meals and beverages also play significant roles in the diet segment. Specialized weight loss meals often come pre-portioned and are calorie-counted to eliminate guesswork, making them a practical choice for individuals seeking structured diet plans. Beverages like iced tea, green tea and protein shakes are popular for their metabolism-boosting properties and convenience.

While supplements hold the largest market share, the growth of meal and beverage solutions continues to support the diversification of diet options available to consumers, catering to different preferences and lifestyle needs. This variety not only stimulates market growth but also helps maintain consumer interest and adherence to weight management programs.

Equipment Type Analysis

Cardiovascular training equipment leads the equipment segment with 65% due to its widespread use in both home and gym settings for effective calorie burn.

Weight loss equipment is categorized into fitness and surgical equipment, with fitness equipment further divided into cardiovascular and strength training devices. Cardiovascular training equipment, such as treadmills, stationary bikes, and ellipticals, occupies the dominant position in this segment. This equipment is favored for its efficiency in burning calories and enhancing cardiovascular health, making it a staple in both home and commercial gym settings.

Strength training equipment is also integral to weight loss and fitness regimens, aiding in muscle building and metabolic rate enhancement. Surgical weight loss equipment, including minimally invasive and non-invasive devices, caters to a niche market that opts for surgical interventions after conservative methods have failed.

The dominance of cardiovascular equipment is crucial as it addresses the broad needs of the market, from casual fitness enthusiasts to serious athletes, contributing significantly to the overall growth of the weight loss equipment market.

Services Analysis

Fitness centers and health clubs are the most utilized services in the weight loss industry, holding a 70% market share.

The services segment of the weight loss market includes fitness centers, health clubs, consulting services, online programs, and slimming centers. Fitness centers and health clubs lead this segment, providing an environment that supports a variety of weight loss activities and programs. These facilities often offer a range of services from group fitness classes and personal training to nutrition planning and wellness consultations.

Online weight loss programs are increasingly popular, offering convenience and accessibility for users with busy schedules or limited access to traditional fitness venues. Consulting services and slimming centers offer more personalized solutions, focusing on bespoke diet and exercise regimens tailored to individual needs.

The robust presence of fitness centers and health clubs is essential for market growth, providing a foundational element that supports the ongoing demand for weight loss services and encouraging sustained engagement in health and fitness activities.

Age Group Analysis

The 31-50 years age group dominates the weight loss market with 45%, driven by their higher disposable income and investment in health and wellness.

Weight loss efforts are significant across various age groups, but the 31-50 years segment stands out due to its combination of health awareness and economic capability. This age group typically has more disposable income and is at a stage where health concerns begin to increase, motivating a stronger commitment to weight loss and management.

Younger individuals (below 18 years) and those in the 18-30 years range are also key segments, often driven by aesthetic goals or the desire for a healthier lifestyle. The above 50 years age group focuses on weight loss primarily for health reasons, particularly to mitigate age-related conditions.

The market influence of the 31-50 years age group underscores the importance of targeted marketing and product development that addresses the specific health and lifestyle needs of this demographic, supporting sustained growth and diversification of the weight loss market.

Key Market Segments

By Diet Type

- Meals

- Beverages

- Supplements

By Equipment Type

- Fitness Equipment

- Cardiovascular Training Equipment

- Strength Training Equipment

- Surgical Equipment

- Minimally Invasive/Bariatric Equipment

- Non-Invasive Equipment

By Services

- Fitness Centers and Health Clubs

- Consulting Services

- Online Weight Loss Programs

- Slimming Centers

- Others

By Age Group

- Below 18 Years

- 18-30 Years

- 31-50 Years

- Above 50 Years

By Gender

- Male

- Female

By Distribution Channel

- Online Stores

- Offline Stores

- Hypermarkets/Supermarkets

- Specialty Stores

- Pharmacy Stores

- Others

Growth Opportunities

Personalized Nutrition and Genetic Testing Offer Growth Opportunity

The integration of genetic testing and personalized nutrition plans represents a significant growth opportunity in the weight loss market. Companies offering DNA-based diet recommendations are gaining traction, as they promise more effective, individualized weight loss solutions.

For example, DNAfit provides genetic testing that informs personalized diet and exercise plans. This trend towards hyper-personalization is likely to continue, with the global personalized nutrition market expected to reach USD 18.6 billion by 2027. Personalized nutrition can enhance the effectiveness of weight loss programs, appealing to consumers seeking tailored solutions.

Virtual and Augmented Reality Fitness Experiences Offer Growth Opportunity

The rise of VR and AR technologies presents an opportunity to create immersive, engaging weight loss experiences. These technologies can make exercise more enjoyable and accessible, potentially increasing adherence to fitness routines.

For instance, VR fitness games like "Beat Saber" have gained popularity, with Meta reporting that people have burned an estimated 200 billion calories playing VR games. This trend is likely to grow as VR technology becomes more affordable and widespread. The use of VR and AR in fitness can drive new engagement levels in weight loss programs, offering significant market growth potential.

Trending Factors

AI and Machine Learning for Predictive Weight Loss Are Trending Factors

The use of AI and machine learning to predict weight loss outcomes and provide more accurate, personalized recommendations is a growing trend. These technologies can analyze vast amounts of user data to identify patterns and optimize weight loss strategies.

For example, the AI-powered app Lark uses machine learning to provide personalized coaching and has partnered with 23andMe to incorporate genetic data into its recommendations. This trend towards personalized health solutions offers more effective weight loss plans, catering to individuals' specific needs and preferences, and driving market growth through innovative, tech-driven approaches.

Mindfulness and Mental Health Integration Are Trending Factors

There is a growing trend towards integrating mindfulness and mental health support into weight loss programs. This holistic approach addresses the psychological aspects of weight loss, potentially improving long-term success rates.

Meditation apps like Headspace have partnered with weight loss companies to offer mental health support, indicating the market's move towards more comprehensive solutions. By incorporating mental well-being into weight loss programs, companies can offer more effective and sustainable solutions, appealing to consumers looking for a balanced approach to health and wellness.

Regional Analysis

APAC Dominates with 38.5% Market Share in the Weight Loss Market

Asia-Pacific (APAC) commands a 38.5% share of the global weight loss market, driven by increasing health awareness and a growing middle class with disposable income. Factors such as rising obesity rates and the prevalence of lifestyle diseases have heightened the demand for weight management solutions. Additionally, cultural shifts towards Western dietary habits and fitness trends contribute to the expanding market.

The region benefits from diverse weight loss and management approaches, including traditional remedies, modern dietary supplements, and technological interventions like fitness apps. APAC's strong manufacturing base for dietary supplements and fitness equipment also supports its market dominance. Furthermore, government initiatives aimed at curbing obesity rates and promoting healthier lifestyles boost the market.

The future of APAC in the weight loss market looks promising. Continued economic growth and urbanization are expected to further drive the demand for weight management products and services. Innovations in personalized diet and fitness plans, fueled by advances in technology and data analytics, are likely to attract a larger consumer base, reinforcing APAC’s leadership in the market.

Regional Market Shares:

- North America: Holds about 35% of the market, driven by high health-conscious consumer behavior and advanced healthcare infrastructure focusing on preventive health measures.

- Europe: With approximately 20% of the market, Europe's growth is supported by increasing government policies aimed at reducing obesity levels and a strong presence of fitness and wellness centers.

- Middle East & Africa: This region captures around 3% of the market. While relatively smaller, the market is growing due to increasing urbanization and awareness of health issues related to weight gain.

- Latin America: Accounts for roughly 4% of the global market. Growth in this region is driven by improving economic conditions and a rising middle class that is increasingly adopting health and fitness regimes.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The weight loss market comprises several key players known for their impact and strategic positioning. Atkins Nutritionals, Inc. and Nutrisystem, Inc. lead with structured diet plans and meal replacements that appeal to consumers seeking convenience and effectiveness.

Weight Watchers International, Inc. utilizes a community-based approach, leveraging technology for personalized coaching. Herbalife Nutrition Ltd. and The Kellogg Company offer a wide range of nutritional products, focusing on protein-rich and low-calorie options.

Nestle SA and Kraft Heinz Company integrate weight management products into their extensive food portfolios. Jenny Craig, Inc. and SlimFast provide comprehensive weight loss programs, combining meal plans with support services.

Medifast, Inc. and Glanbia plc emphasize scientifically backed products, targeting health-conscious consumers. Amway Corporation and VLCC Health Care Limited leverage their direct selling models to reach a broad audience. GNC Holdings, Inc. and Beachbody, LLC focus on supplements and fitness programs, respectively.

These companies drive market growth through diverse product offerings, strategic partnerships, and innovative marketing approaches.

Market Key Players

- Atkins Nutritionals, Inc.

- Nutrisystem, Inc.

- Weight Watchers International, Inc.

- Herbalife Nutrition Ltd.

- The Kellogg Company

- Nestle

- Kraft Heinz Company

- Jenny Craig, Inc.

- SlimFast

- Medifast, Inc.

- Glanbia plc

- Amway Corporation

- VLCC Health Care Limited

- GNC Holdings, Inc.

- Beachbody, LLC

Recent Developments

2024: The Mayo Clinic Diet has been ranked as the number one commercial weight loss program in the "Best Diets Overall" category by U.S. News & World Report for 2024. This program emphasizes a balanced approach to food, sleep, exercise, and emotional health, and includes digital tools to help users track their food intake and discover nutritional information. It is designed to promote sustainable weight loss through lifelong healthy habits.

2024: KOS has introduced the Show Me the Greens Powder, a dietary supplement designed to support weight loss by promoting gut health. The powder includes a blend of organic superfoods and probiotics, aiming to enhance digestion and nutrient absorption, which are crucial for effective weight management. It is certified organic, non-GMO, and vegan, offering a low-calorie option for those looking to supplement their diet.

Report Scope

Report Features Description Market Value (2023) USD 265.7 Billion Forecast Revenue (2033) USD 542.7 Billion CAGR (2024-2033) 7.6% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Diet Type (Meals, Beverages, Supplements), By Equipment Type (Fitness Equipment [Cardiovascular Training Equipment, Strength Training Equipment], Surgical Equipment [Minimally Invasive/Bariatric Equipment, Non-Invasive Equipment]), By Services (Fitness Centers and Health Clubs, Consulting Services, Online Weight Loss Programs, Slimming Centers, Others), By Age Group (Below 18 Years, 18-30 Years, 31-50 Years, Above 50 Years), By Gender (Male, Female), By Distribution Channel (Online Stores, Offline Stores [Hypermarkets/Supermarkets, Specialty Stores, Pharmacy Stores, Others]) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Atkins Nutritionals, Inc., Nutrisystem, Inc., Weight Watchers International, Inc., Herbalife Nutrition Ltd., The Kellogg Company, Nestle SA, Kraft Heinz Company, Jenny Craig, Inc., SlimFast, Medifast, Inc., Glanbia plc, Amway Corporation, VLCC Health Care Limited, GNC Holdings, Inc., Beachbody, LLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Good Food Company

- Herbalife Nutrition Ltd.

- Nestle

- Glanbia plc

- Amway Corp

- Kellogg Company

- Abbott

- GlaxoSmithKline plc

- PepsiCo

- Atkins Nutrionals, Inc.

- Nutrisystem Inc.

- Jenny Caring Inc.

- Johnson Health Technology Co, Ltd

- Gold’s Gym International, Inc.

- Herbalife International, Inc.

- Brunswick Corp.

- Meticore

- Solace Nutrition

- Apollo Endosurgery Inc.

- Cargill Inc.

- Ingredion Inc.

- Brunswick Corporation

- Medifast Inc.

- Gold’s Gym International Inc.

- Other Key Players