Weight Loss & Diet Control Market By Product Type (Better For You, Meal Replacement, and Others), By Diet (Food & Beverages And Diet Supplements), By Equipment (Fitness Training Equipment And Surgical Equipment), By Services (Fitness Centers, Slimming Centers, And Others) By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

36244

-

April 2023

-

173

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

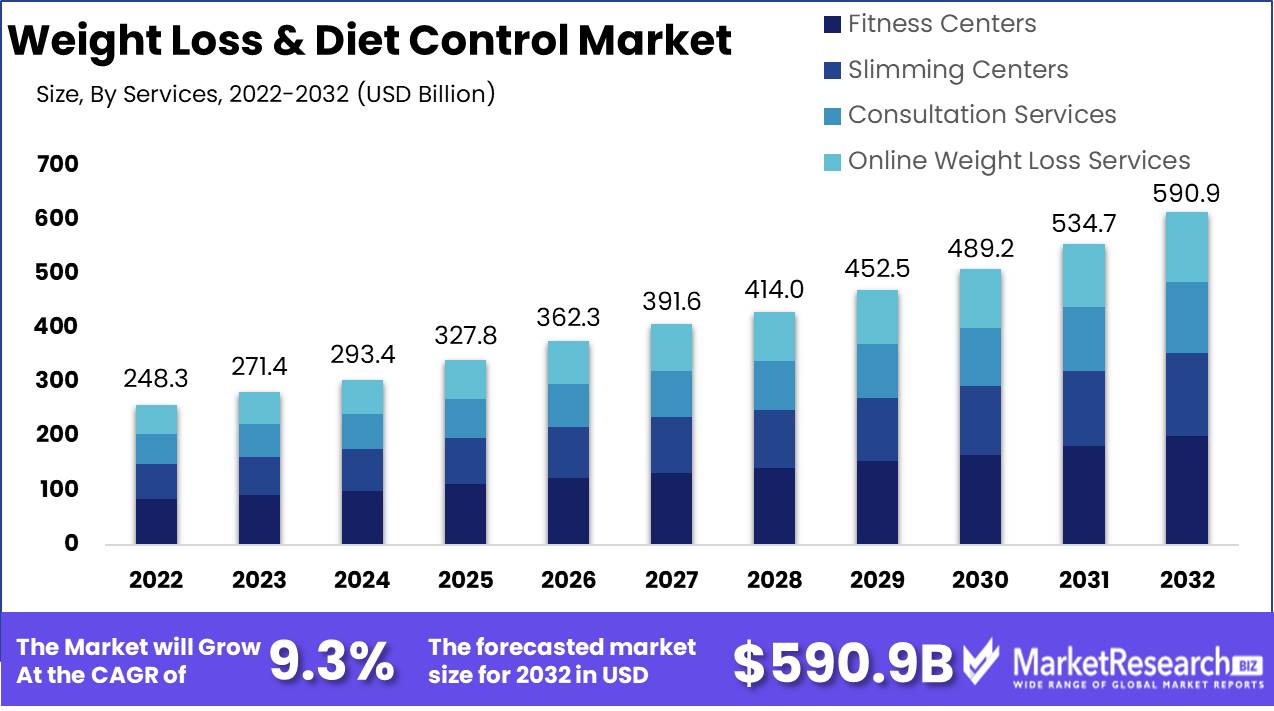

Weight Loss & Diet Control Market size is expected to be worth around USD 590.9 Bn by 2032 from USD 248.3 Bn in 2022, growing at a CAGR of 9.3% during the forecast period from 2023 to 2032.

The Market growth can be attributed mainly to rising bariatric surgery volumes, increased adoption of online weight loss and management programs, rising disposable income levels, government initiatives to create awareness about weight management, and an increase in obesity caused by sedentary lifestyles. According to the Institute of Health Metrics and Evaluation, (30.0%) of the global population is either overweight or obese; obesity poses a massive problem for both the rich and the poor.

Obese and overweight individuals tend to have higher rates of diabetes, hypertension, and other chronic illnesses. The market for bulky products is growing due to the rising number of obese people worldwide. Children, in particular, are becoming increasingly overweight due to unhealthy eating habits and inactivity; hormonal problems make up only a small portion of childhood obesity cases. According to Narayana Health's article, India had 14.4 million obese children - making it the second highest country with this number globally.

Inactive hours have seen a dramatic rise due to an increase in time spent watching television and computers, leading to overweight or obesity among children. An unhealthy lifestyle with increased junk food consumption and physical inactivity are contributing factors for weight gain; people also become stressed from their busy lives when consuming fast food, which may have detrimental health effects. All these elements are driving market growth as digitalization, and rapid globalization makes it easier to find information regarding overweight-related risks.

Market Scope

By Product Type Analysis

In 2022, the Better for You segment was the leading weight loss and management segment. However, low-calorie sweeteners are expected to experience the highest compound annual growth rate over the analysis period. Premium quality food and beverages that promote better health include those with reduced fats, sodium, or sugar content. With rising obesity rates in North America and Europe, as well as increasing demand for these items because of rising economic inequality, emerging economies have witnessed a marked surge in this demand in recent years. This has further fueled the market growth through increasing investments in low-calorie items and beverages over the previous years.

By Diet Analysis

Dieting involves meals, drinks, and supplements. Diets are becoming increasingly popular across both developed and developing countries as means to shed pounds and maintain wellness. Eating meals that provide a sufficient amount of fiber and proteins, as well as fewer carbs, can help achieve these objectives. People are increasingly turning towards diet meals that can be tailored to their physiological requirements.

Green tea and slimming waters with catechins and oxidants help boost metabolism, leading to weight loss by improving metabolism. Because of their accessibility and acceptance by consumers, these beverages will continue to gain traction in the marketplace. Supplements in this segment include protein, powders, capsules, tablets, and herbal powders, which have become widely accessible because of the easy accessibility of these items.

By Service Analysis

According to the service, the global weight loss and weight management industry consist of slimming centers, online programs, consulting services, and fitness facilities. In 2022 fitness centers segment dominated the market after covid-19 lockdown with increased demand, more fitness facilities opened around the world online programs generated higher revenue, with 83 million people using weight management apps.

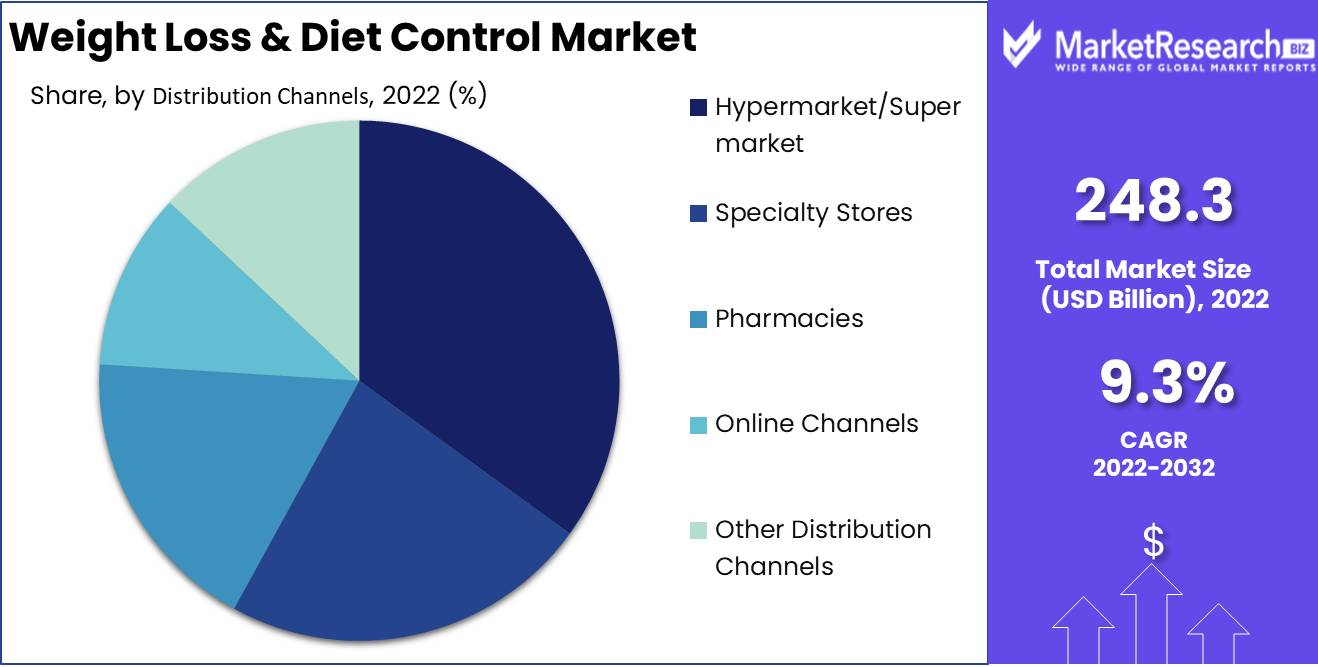

By Distribution Channel Analysis

On the basis of distribution channels, the hypermarket/supermarket segment leads the market share. However, online channels are projected to gain a greater share over the forecast period because of an increase in internet penetration rate. Nearly 54% have access to the web. As a result, online services have become an increasingly important trend within the weight loss and diet control markets.

Furthermore, the millennial generation is driving demand for third-party aggregator app on-demand food delivery through third-party aggregator apps. They seek convenience as well as high-quality food delivered directly via online channels.

Key Market Segments

By Product Type

- Better for you

- Meal replacement

- Weight loss supplement

- Green tea

- Low-calorie sweetener

By Diet

By Services

- Fitness Centers

- Slimming Centers

- Consultation Services

- Online Weight Loss Services

By Distribution Channels

- Hypermarket/Supermarket

- Specialty Stores

- Pharmacies

- Online Channels

- Other Distribution Channels

Market Dynamics

Drivers

Increasing Obesity Rates

Global obesity rates continue to climb, leading more people to seek ways to manage their weight - fueling the demand for weight loss and diet control products and services. There is increasing awareness about the health risks associated with being overweight or obese, leading many people to seek out weight loss and diet control solutions in order to enhance their well-being. Due to technological advancements, there have been created new weight loss and diet control products and services, such as wearable fitness trackers, apps, and online coaching programs.

Consumers are increasingly turning towards natural, organic, and plant-based weight loss and diet control products, fueling the growth of this segment of the market. With increased disposable income, people are willing to invest more in weight loss and diet control products and services such as gym memberships, personal trainers, and specialty food items. Fitness enthusiasts are increasingly turning towards weight loss and diet control products and services in order to reach their fitness objectives. Government initiatives to combat obesity, such as public health campaigns, have also contributed to the expansion of this market.

Restraints

Less Effective and Safety concerns

Many weight loss products and programs have proven ineffective at helping people reach their weight loss objectives, leading to dissatisfaction among customers and a decline in sales for companies offering these solutions. Certain weight loss products and programs may pose safety issues for consumers, particularly if they contain ingredients that have not been thoroughly researched or are known to have harmful side effects. The weight loss industry is heavily regulated, and companies must abide by stringent guidelines in order to market their products or services.

For new companies, this can be a significant obstacle to entry and hinder existing ones from innovating and bringing products to market. The weight loss and diet control market is highly competitive, with many players competing for a share in it. Price wars, aggressive marketing campaigns, and general saturation of the market may ensue if people who lose weight through diet and exercise programs eventually regain it; this poses an obstacle for companies relying on repeat business from satisfied customers.

Opportunity

Growing Demand for Personalized Weight Loss Solutions

People are becoming more health-conscious and seeking weight loss solutions tailored to their individual needs. Companies providing personalized diet and exercise plans, DNA testing, and coaching services are well-positioned to capitalize on this demand. Consumers are increasingly turning towards natural and organic weight loss products, such as supplements and meal replacements. Companies offering these items, along with those offering plant-based or gluten-free options, are expected to experience growth.

Technology like fitness trackers, mobile apps, and wearable devices is seeing a major surge in adoption within the weight loss and diet control market. Companies offering innovative tools to help individuals track their progress, set goals, and monitor health are poised for explosive growth. Weight loss and diet control are seeing a surge of growth in emerging markets such as Asia and Latin America, where there is an expanding middle class and increasing awareness about health issues.

Companies that can tailor their products and marketing strategies to these regions are likely to experience success. As the connection between obesity and chronic diseases becomes more established, healthcare providers are playing a more significant role in weight loss and diet control. Companies that collaborate with healthcare providers to offer weight loss programs and services will likely reap the benefits from this trend.

Trends

Personalized Nutrition and Meal Plans

More and more people are seeking personalized diet plans tailored to their individual requirements and preferences. Because of advances in technology, companies are now using AI to analyze data and create tailored meal plans that meet specific dietary requirements and objectives. Consumers are becoming more health-conscious, opting for plant-based or clean-label diets. This trend has resulted in the growth of vegan and vegetarian food products as well as plant-based meat alternatives. With the pandemic, there has been an uptick in demand for digital weight loss solutions, and this trend looks set to continue.

People are seeking online resources, apps, and tools that will enable them to track their progress, set objectives, and receive support from professionals or peers. People are becoming more conscious of the connection between food, emotions, and overall well-being. Mindful eating - which involves paying attention to one's food choices, feelings, and body sensations - is becoming increasingly popular.

This trend has created a demand for holistic wellness programs that address physical, mental, and emotional well-being. Furthermore, consumers are becoming increasingly concerned with the environmental impact and ethical practices in food production; thus, they are looking for sustainable and eco-friendly food packaging as well as products that have been ethically sourced and produced.

Regional Analysis

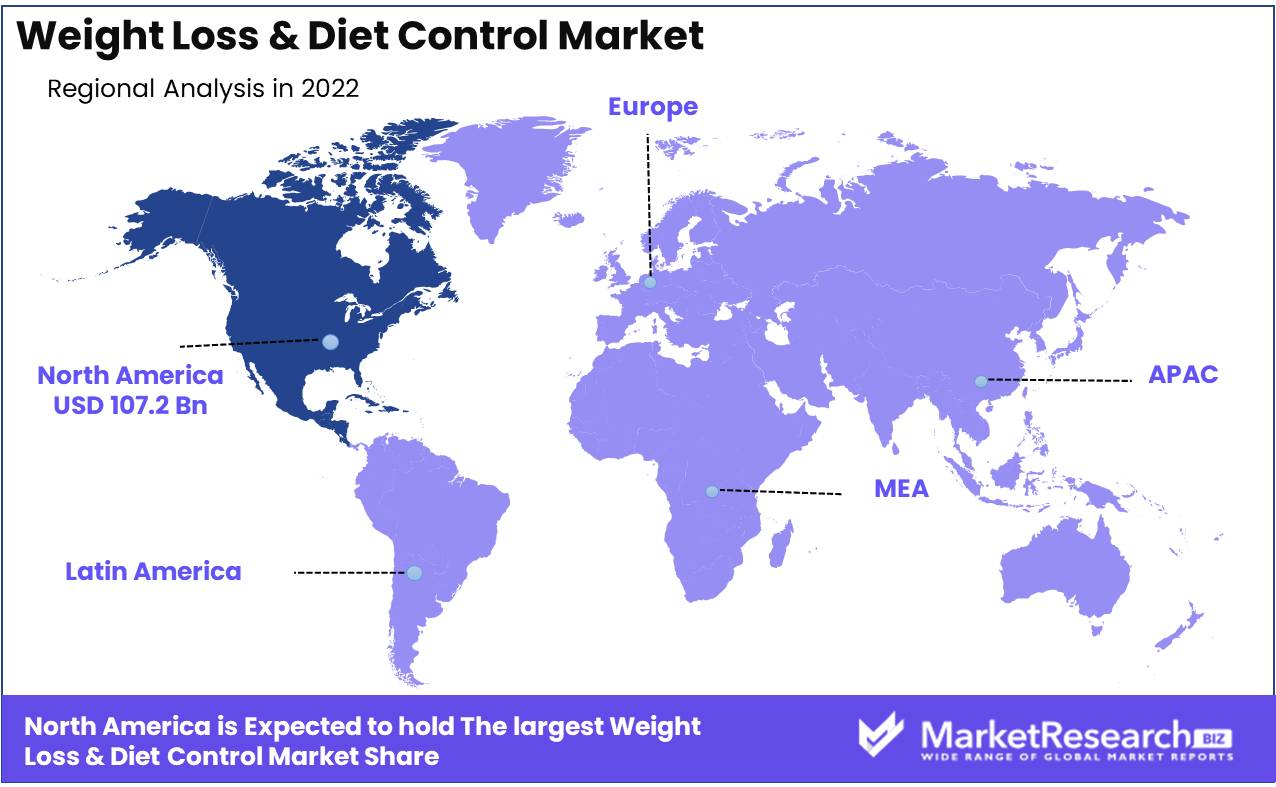

North America was the Prominent Market in 2022, Accounting for 43.2% Of Total Revenue.

North America was the leading market in 2022, accounting for 43.2% of total revenue. Forecasts suggest the region will continue to experience rapid growth over the forecast period due to increasing obesity and rising rates of hypertension and diabetes. Furthermore, there has been a paradigm shift towards minimally invasive and noninvasive procedures due to increasing awareness about weight loss and management options.

Regional market growth will also be driven by an exponential surge in diet plans. Asia Pacific, particularly, is projected to experience significant expansion over the coming years.

This has led to an increasing number of people opting for wellness centers and gyms. North America will remain a key influencer in this market due to the availability of high-quality products and the presence of large players in North America. Key manufacturers have an opportunity to create new products due to the increasing demand for natural, plant-based supplements in this region. In 2021, Europe held a significant revenue share, driven by increased consumer awareness and disposable income per capita in developed nations such as France, Germany, and the U.K. over the forecast period.

Key Regions

North America

- The US

- Canada

- Mexico

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

To increase their market presence and boost their competitive edge, key players in the market are undertaking various strategic initiatives. These include mergers & acquisitions, technological collaborations, partnerships, funding & investments, as well as innovative product development & launches to expand product portfolio. Cult. Fit recently acquired a majority share in Gold's Gym chain of fitness centers in India in February 2022 - just to name a few! These are some of the major players across global fitness center markets today.

Market Key Players

With the presence of many local and regional players, the market for weight loss & diet control is fragmented. Market players are subject to intense competition from top market players, particularly those with strong brand recognition and high distribution networks. To stay on top of the market, companies have gained various expansion strategies such as partnerships and product launches.

The following are some of the major players in the global weight loss & diet control industry

- Herbalife International Inc.

- NutriSystem Inc.

- Weight Watchers International Inc.

- com

- Brunswick Corporation

- Ethicon Endo-surgery Inc.

- Golds Gym International Inc.

- Amer Sports

- Technogym SPA

- Jenny Craig Inc.

- Medtronic Inc.

- Other Key Players

Recent Development

- In June 2021, The US Food and Drug Administration (FDA) recently approved Wegovy, an injectable treatment for chronic weight management. Adults who are obese and have at least one weight-related condition, such as type 2 diabetes or high cholesterol, can use the injection.

- In August 2022, Lilly's Tirzepatide showed promising results, enabling obese adults to lose up to 22.5% of their body weight.

Report Scope

Report Features Description Market Value (2022) USD 248.3 Bn Forecast Revenue (2032) USD 590.9 Bn CAGR (2023-2032) 9.3% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type - Better for you, Meal replacement, Weight loss supplement, Green tea, Low-calorie sweetener By Diet - Food & Beverages and Diet Supplements

By Services - Fitness Centers, Slimming Centers, Consultation Services, and Online Weight Loss Services

By Distribution Channels - Hypermarket/Supermarket, Specialty Stores, Pharmacies, Online Channels, and Other Distribution Channels

Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; the Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Herbalife International Inc., NutriSystem Inc., Weight Watchers, International Inc., eDiets.com, Brunswick Corporation, Ethicon Endo-surgery Inc., Golds Gym International Inc., Amer Sports, Technogym SPA, Jenny Craig Inc., Medtronic Inc., and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Herbalife International Inc.

- NutriSystem Inc.

- Weight Watchers International Inc.

- com

- Brunswick Corporation

- Ethicon Endo-surgery Inc.

- Golds Gym International Inc.

- Amer Sports

- Technogym SPA

- Jenny Craig Inc.

- Medtronic Inc.

- Other Key Players