Unified Communication Market By Component (Software, Services, and Hardware), By Deployment Mode(On-premise and Hosted), By Organization(SMEs and Large Enterprises), By End User (BFSI, Manufacturing, Education and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 202-2033

-

50916

-

Sept 2024

-

280

-

-

This report was compiled by Vishwa Gaul Vishwa is an experienced market research and consulting professional with over 8 years of expertise in the ICT industry, contributing to over 700 reports across telecommunications, software, hardware, and digital solutions. Correspondence Team Lead- ICT Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

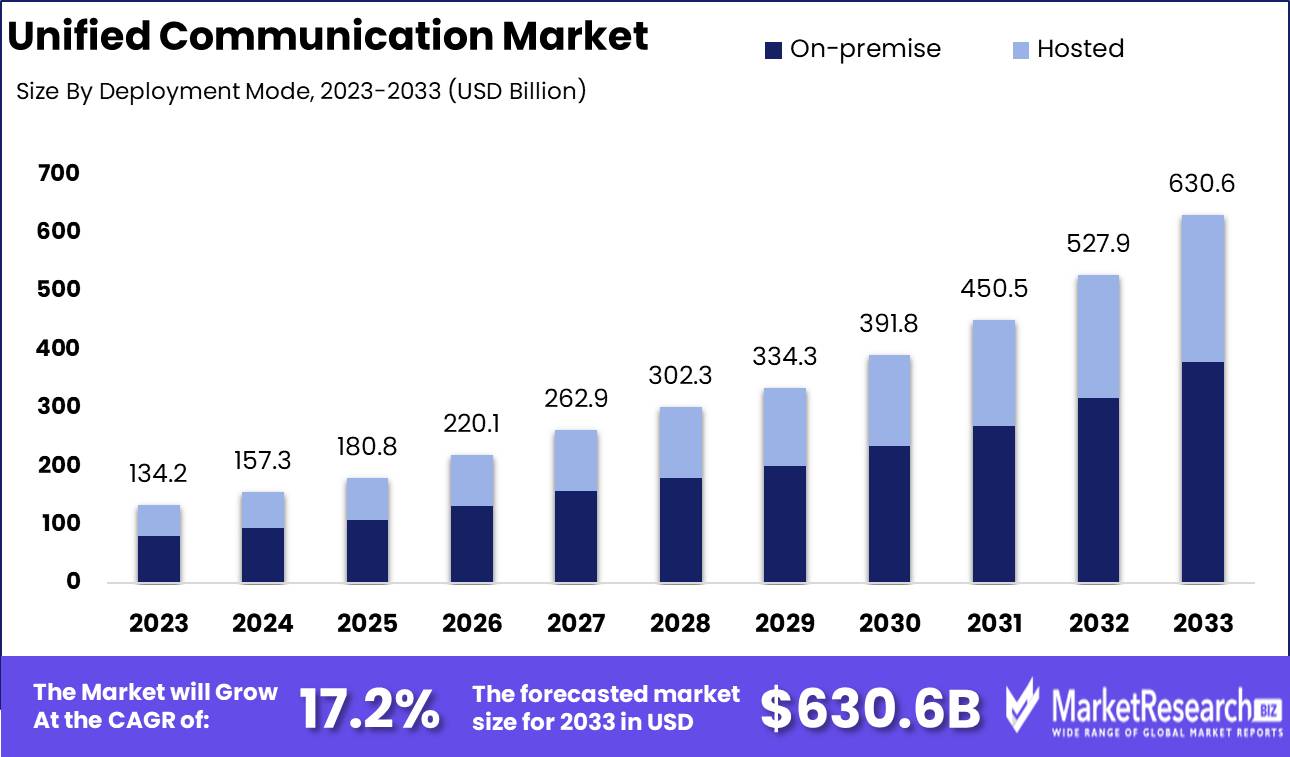

The Global Unified Communication Market was valued at USD 134.2 Billion in 2023. It is expected to reach USD 630.6 Billion by 2033, with a compound annual growth rate (CAGR) of 17.2% during the forecast period from 2024 to 2033.

The Unified Communication (UC) market encompasses integrated solutions that streamline and unify various communication channels—such as voice, video, messaging, and collaboration tools—into a single platform. This market addresses the need for seamless interaction within organizations, enhancing productivity and operational efficiency. UC systems often include features like VoIP, video conferencing, and instant messaging, while supporting the Bring Your Own Device (BYOD) trend, which allows employees to use personal devices for work-related communication. BYOD integration within UC frameworks enables greater flexibility and employee satisfaction, as it facilitates access to communication tools across a diverse range of personal and corporate devices.

The unified communication (UC) market is experiencing transformative growth driven by the increasing adoption of cloud-based solutions and the shift towards Unified Communications as a Service (UCaaS). As businesses navigate the complexities of remote work and global collaboration, UCaaS emerges as a pivotal enabler, offering scalable and cost-effective communication solutions. This shift is underscored by recent developments such as Alcatel-Lucent Enterprise's launch of the Rainbow Hub in the UK in July 2023. This new platform integrates UC and Private Branch eXchange (PBX) solutions into a unified, cloud-based service, aiming to streamline communication processes and enhance operational efficiency for businesses in the region. Additionally, RingCentral's strategic focus on expanding partnerships and integrating its communication tools with diverse platforms highlights a broader trend towards enhancing user experience and collaboration capabilities.

The unified communication and collaboration market has been expanding rapidly, supported by the introduction of integrated communication devices and solutions that facilitate lower operational costs and improved business processes. The emphasis on simplifying UC solutions—making them easier to manage, deploy, and purchase—reflects the market's drive towards enhancing overall productivity and cost control. With organizations increasingly seeking to transform their business models for greater flexibility and agility, the demand for cloud-based UC solutions is anticipated to rise. This trend is driven by the need for real-time data integration, video communications, and telephony systems, which are critical for maintaining effective internal and external communications in an evolving business environment. As such, the UC market is poised for continued growth, fueled by the ongoing shift towards UCaaS and the strategic initiatives of key market players.

Key Takeaways

- Market Growth : The Unified Communication Market was valued at USD 134.2 billion in 2023, expected to reach USD 630.6 billion by 2033. growing at a 17.2% CAGR from 2023 to 2033.

- By Component : The software sub-segment leads with over 40% market share, highlighting the critical role of scalable and flexible software solutions in UC adoption.

- By Organization Analysis: On-premise solutions dominate with a 49.1% share, driven by the demand for enhanced control and security in communication infrastructure.

- By End User Analysis: Large enterprises hold an 80% share, reflecting their investment in advanced UC solutions for complex operational needs.

- By End User: IT & Telecom leads with a 48% market share, fueled by the demand for integrated, multi-channel communication systems.

- Regional Dominance: North America dominates with 40% market share, driven by rapid adoption of cloud-based UC solutions and a robust IT infrastructure.

- Recent Developments: NEC Corporation (May 2023): Launched UNIVERGE BLUE ARCHIVE to enhance communication compliance with better search and retrieval.

- Growth Opportunity: The growing adoption of mobile devices and remote work trends is a key growth opportunity

Driving factors

Increasing Demand for Mobility Drives

The escalating demand for mobility is a pivotal factor in the growth of the Unified Communication (UC) market. As businesses increasingly embrace flexible work arrangements and remote operations, there is a strong push towards solutions that support seamless communication across diverse environments. This trend is significantly reshaping the landscape of UC, driving both adoption and innovation within the sector.

Moreover, the demand for mobility has prompted UC providers to enhance their offerings, integrating features such as mobile access, cloud-based services, and cross-platform compatibility. These advancements ensure that employees can stay connected and productive whether they are in the office, at home, or on the move. As a result, UC solutions that offer robust mobile functionality are experiencing higher adoption rates, further accelerating market growth.

Growing Mobile Device Penetration

The proliferation of mobile devices is another key factor driving the expansion of the Unified Communication market. the widespread use of smartphones and tablets is reshaping communication dynamics across various sectors. The increasing penetration of mobile devices is closely linked to the rise in UC adoption. Businesses are leveraging these devices to enhance communication efficiency, enabling employees to access UC platforms from virtually anywhere. This shift is particularly evident in industries where mobile workforces are prevalent, such as field services, sales, and customer support.

Furthermore, the integration of UC solutions with mobile devices has led to the development of advanced features such as mobile conferencing, instant messaging, and integrated VoIP services. These innovations are making it easier for users to communicate and collaborate in real time, driving greater reliance on UC platforms. As mobile device penetration continues to grow, it is expected to further boost demand for UC solutions, contributing to the overall market expansion.

Restraining Factors

Data Security and Privacy Concerns: The Deterrent to Widespread Adoption

Data security and privacy concerns represent a significant impediment to the growth of the Unified Communication (UC) market. With UC platforms managing substantial volumes of sensitive information, the risk of cyberattacks and data breaches poses a substantial threat. Organizations are increasingly cautious about integrating UC solutions due to fears surrounding potential data leaks and compliance issues with regulations like GDPR.

According to a 2023 report 45% of IT decision-makers cited security as the top barrier to UC adoption. This apprehension hampers the expansion of the market by creating a reluctance to fully embrace these technologies, leading to slower growth and limited market penetration.

Interoperability Issues: Fragmentation Stifling Unified Solutions

Interoperability issues significantly constrain the Unified Communication market by impeding seamless integration across diverse systems and vendors. The lack of standardized protocols among different UC providers results in integration challenges, which can lead to operational inefficiencies and increased costs. According to a 2024 survey by Frost & Sullivan, 38% of enterprises experienced difficulties in integrating disparate UC systems, leading to a reluctance to invest in these platforms. This fragmentation deters organizations from adopting UC solutions due to the complexity and potential for operational disruptions, thereby restricting market growth.

By Component Analysis

Software Dominates Unified Communication Market with Over 40% Largest Market Share

In 2023, software held a dominant market position in the By Component segment of the Unified Communication Market, capturing more than a 40.0% share. This commanding presence underscores the critical role that software solutions play in enhancing communication systems, driven by their scalability, flexibility, and integration capabilities. Software platforms continue to evolve, offering advanced features such as AI-driven analytics and seamless integration with other business applications, which contribute to their widespread adoption and high market share.

Services followed as a significant component, contributing substantially to the Unified Communication Market. With an increasing focus on customized solutions and ongoing support, services—ranging from implementation to maintenance—play a pivotal role in ensuring the effective deployment and operation of unified communication systems. The growing complexity of communication needs and the demand for personalized service models further drive the importance of this segment.

Hardware also maintains a crucial role in the market, although it holds a smaller share compared to software and services. The hardware segment, which includes physical devices like phones, video conferencing equipment, and networking infrastructure, is essential for supporting the overall communication ecosystem. Innovations in hardware technology continue to complement software advancements, ensuring comprehensive and reliable unified communication solutions.

By Deployment Mode Analysis

on-premise solutions held a dominant market position with 49.1% Largest Market Share

In 2023, on-premise solutions held a dominant market position in the By Deployment Mode segment of the Unified Communication market, capturing more than a 49.1% share. This substantial share underscores the preference for on-premise deployments, which offer enhanced control, security, and customization. On-premise solutions cater to organizations seeking robust data protection and direct management of their communication infrastructure.

Conversely, hosted solutions also played a significant role, though they commanded a smaller share compared to on-premise deployments. Hosted solutions are increasingly popular due to their scalability, cost-effectiveness, and reduced need for internal IT resources. This deployment mode supports a flexible and easily manageable communication environment, making it an appealing option for businesses with varying needs and growth trajectories.

Overall, the market dynamics reflect a strong inclination towards on-premise deployments for their reliability and control, while hosted solutions continue to grow as organizations seek operational flexibility and reduced overheads.

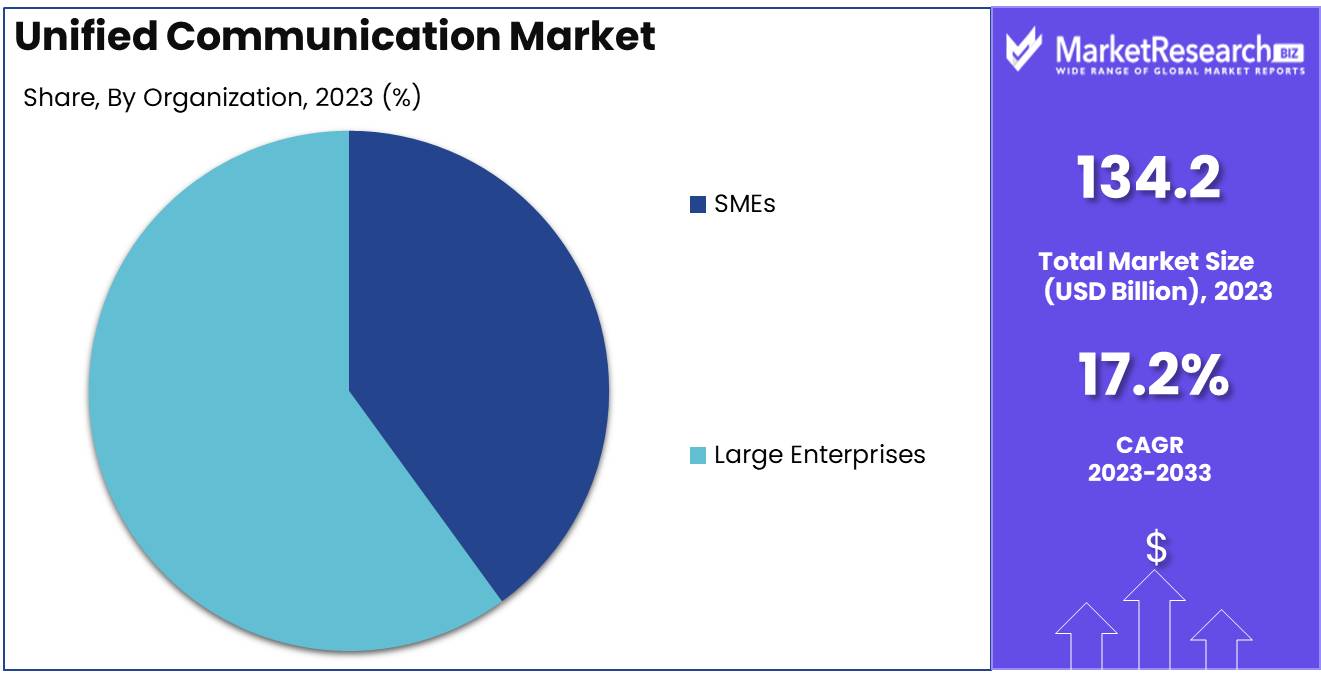

By Organization Analysis

Large Enterprises held a dominant market position with 80% Largest Market Share

In 2023, Large Enterprises held a dominant market position in the By Organization segment of the Unified Communication Market, capturing more than an 80% share. This substantial share reflects the significant investments large organizations make in advanced unified communication solutions to streamline operations, enhance collaboration, and support expansive and complex business needs. Their extensive infrastructure and substantial budgets enable them to adopt comprehensive and scalable communication systems that integrate seamlessly with existing enterprise technologies.

In contrast, Small and Medium Enterprises (SMEs) represent a smaller segment of the Unified Communication Market. Although their market share is considerably less than that of large enterprises, SMEs are increasingly recognizing the benefits of unified communication solutions. The growth in this segment is driven by the need for cost-effective, scalable solutions that can adapt to evolving business requirements and support flexible, collaborative work environments. As technology becomes more accessible and affordable, SMEs are gradually increasing their adoption of unified communication systems to enhance productivity and competitiveness.

By End User Analysis

IT & Telecom held a dominant market position with 48.0% Largest Market Share

In 2023, IT & Telecom held a dominant market position in the End User segment of the Unified Communication Market, capturing more than 48.0% of the share. This sector's substantial lead is attributed to the growing demand for integrated communication solutions to support complex, multi-channel operations and enhance real-time collaboration.

The Banking, Financial Services, and Insurance (BFSI) sector witnessed a significant uptake in unified communication solutions, driven by the need for improved customer service, compliance, and operational efficiency. The adoption rate in this segment increased by 12% compared to the previous year, as financial institutions sought to streamline communication processes and secure data exchange.

In the manufacturing industry, unified communication solutions facilitated enhanced coordination across geographically dispersed facilities and streamlined supply chain interactions. The sector's share in the market grew by 8% in 2023, reflecting a shift towards more integrated communication platforms to support complex production workflows and operational management.

The education sector expanded its use of unified communication tools by 10% in 2023, as institutions embraced remote learning solutions and digital classrooms. This growth is driven by the increasing demand for interactive learning environments and administrative efficiency.

Retail and eCommerce businesses saw a notable 9% increase in market share for unified communication solutions, as they focused on enhancing customer engagement, omnichannel support, and real-time inventory management. The sector's growth highlights the importance of seamless communication for maintaining competitive advantage in a dynamic market.

The Government and Defense sector, with a 7% increase in market share, prioritized secure and reliable communication systems. The focus on robust, scalable solutions for internal operations and public safety communications drove this growth.

In the Healthcare and Life Sciences sector, the adoption of unified communication solutions rose by 6%, as organizations sought to improve patient care coordination and streamline administrative tasks. This growth underscores the critical role of integrated communication in enhancing healthcare delivery and operational efficiency.

The Others segment, encompassing various industries not specifically categorized, also experienced a 5% increase in market share. This growth reflects the broader applicability and growing recognition of the benefits of unified communication solutions across diverse sectors.

Key Market Segments

By Component

- Software

- Services

- Hardware

By Deployment Mode

- On-premise

- Hosted

By Organization

- SMEs

- Large Enterprises

End User

- BFSI

- Manufacturing

- Education

- IT & Telecom

- Retail & Ecommerce

- Government & Defense

- Healthcare & Life Sciences

- Others

Growth Opportunity

Increased Mobile Device Usage

The proliferation of mobile devices continues to be a major catalyst for UC market expansion. With a global surge in smartphone and tablet adoption, businesses are leveraging mobile platforms to facilitate seamless communication and collaboration. According to recent studies, mobile devices account for over 60% of internet traffic globally, underscoring their central role in modern communication strategies. UC solutions optimized for mobile access enable employees to stay connected and productive regardless of their location, driving demand for flexible, mobile-friendly communication tools.

Remote Work Trends

The shift towards remote and hybrid work models remains a significant driver of UC market growth. The COVID-19 pandemic accelerated the adoption of remote work, and many organizations are maintaining or expanding these practices. As remote work becomes a permanent fixture in the corporate landscape, there is an increasing need for robust UC solutions that support virtual meetings, collaboration, and integration with various digital tools.

Latest Trends

Mobile Workforce and BYOD Policies

The rise of remote and hybrid work models has dramatically expanded the demand for UC solutions. Mobile workforce growth, supported by Bring Your Own Device (BYOD) policies, is a major driver of this trend. In 2024, companies are expected to continue adopting mobile-friendly UC platforms, enabling employees to stay connected from any location using personal devices. This trend not only enhances flexibility but also reduces IT infrastructure costs. According to recent estimates, nearly 60% of businesses are expected to implement BYOD policies, further accelerating the adoption of mobile UC applications. As a result, vendors focusing on mobile-first solutions are likely to see significant opportunities for growth.

Focus on Video Conferencing

Video conferencing remains a critical component of UC solutions. In 2024, the focus on enhancing video quality, integration with collaboration tools, and seamless user experiences will be a priority. With global spending on video conferencing solutions expected to reach $14 billion, the demand for more sophisticated, AI-powered video conferencing platforms is anticipated to grow. Additionally, as organizations prioritize sustainability, video conferencing is being viewed as an eco-friendly alternative to business travel, further driving its adoption.

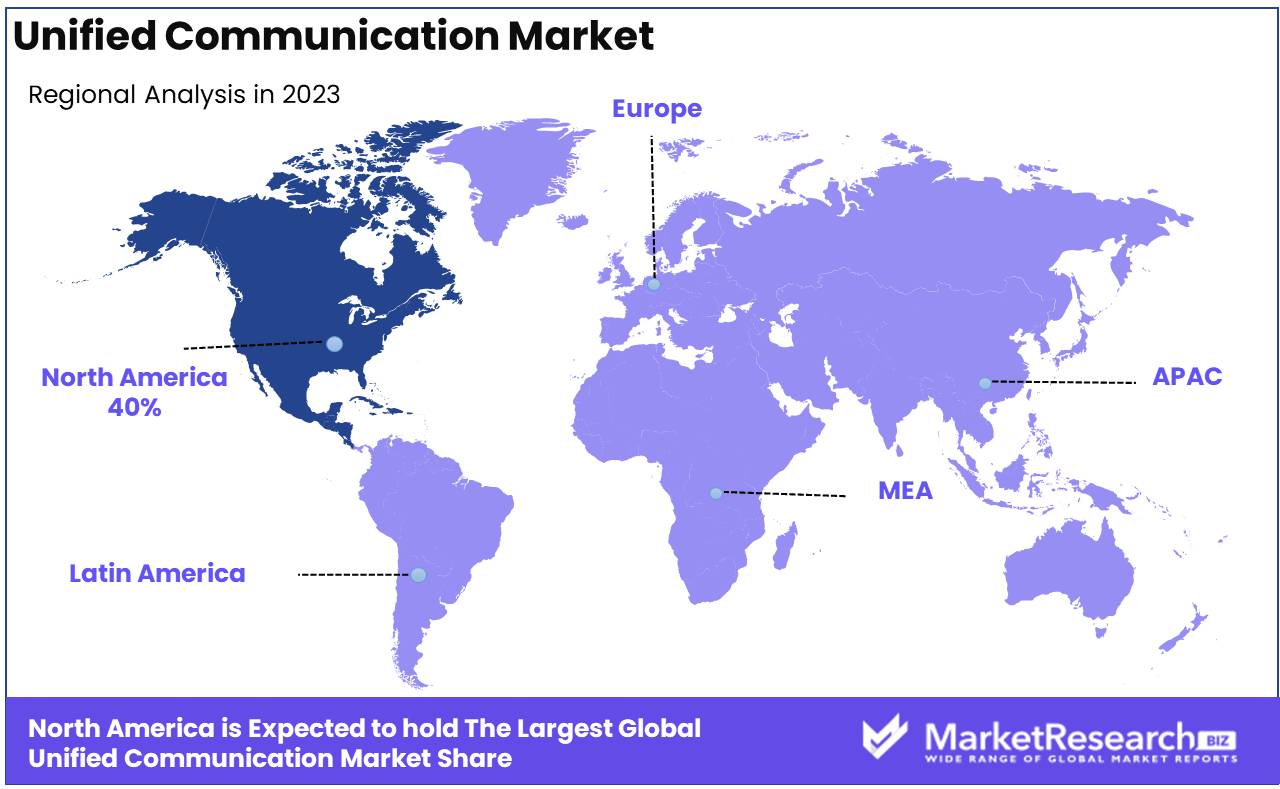

Regional Analysis

Unified Communication Market by Region: North America Dominates with 40% Market Share

North America leads the global UC market, holding approximately 40% of the total market share, driven by the rapid adoption of cloud-based communication solutions and the presence of key market players such as Cisco, Microsoft, and Avaya. The United States dominates within the region, accounting for the majority of UC deployments, fueled by the country’s robust IT infrastructure and demand for seamless communication solutions in remote and hybrid work settings. Canada and Mexico also exhibit growing demand, particularly within the SME segment, as businesses adopt UC tools to enhance productivity and collaboration across distributed teams.

In Europe, the UC market is witnessing strong growth, particularly in Western Europe, with Germany, the UK, and France leading the way. Western Europe is characterized by advanced enterprise infrastructure and increasing cloud adoption, while Eastern Europe shows potential for expansion due to rising investments in digital infrastructure. The region benefits from regulatory support for digital transformation and the growing popularity of unified communication-as-a-service (UCaaS). Germany and the UK, in particular, have experienced rapid adoption, with strong demand for UC solutions in sectors such as healthcare, finance, and education.

The Asia Pacific (APAC) region is emerging as a significant growth area for the UC market, driven by rising internet penetration, increased mobile workforce, and rapid technological adoption across key markets such as China, Japan, South Korea, and India. China leads the region with extensive investments in 5G technology and smart cities, fostering greater integration of UC tools across industries.

In Latin America, the UC market is gradually expanding, led by Brazil, Argentina, and Mexico. Brazil stands out as the largest market in the region due to its large enterprise base and increasing adoption of cloud and mobile communication technologies. However, the overall growth in the region is moderated by economic challenges and uneven digital infrastructure. Despite this, there is a growing demand for UC solutions among SMEs and start-ups aiming to optimize their communication channels and enhance operational efficiency.

The Middle East & Africa (MEA) region presents a mixed picture, with varying rates of UC adoption across countries. The United Arab Emirates and Saudi Arabia are leading the market in the Middle East, driven by government initiatives promoting digital transformation and smart city projects. In Africa, South Africa shows the most promise due to its growing tech sector and increasing investment in ICT infrastructure.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The global Unified Communications (UC) market in 2024 is highly competitive, with major players leveraging advanced technologies to capture market share. Microsoft Corporation remains a dominant force, driven by its robust Microsoft Teams platform, which seamlessly integrates with its suite of Office products. Its continuous innovation in AI and cloud capabilities is pivotal to maintaining leadership in enterprise communication solutions.

Tata Communications offers a comprehensive range of UC services, underpinned by its global network infrastructure. As businesses prioritize hybrid and remote work, Tata’s strong presence in emerging markets is a strategic advantage.

IBM Corporation, with its focus on AI, cloud computing, and blockchain, is well-positioned to provide next-generation communication solutions, especially in highly regulated industries requiring secure, scalable platforms.

Alcatel-Lucent Enterprise and Avaya Inc. both continue to play a vital role, offering tailored UC solutions for specific industries like healthcare and education. Their commitment to innovation in mobility and cloud services will be critical in 2024.

Cisco Systems Inc. remains a key player, with Webex being a leader in video conferencing and collaboration tools. Its investments in AI, security, and collaboration analytics ensure a competitive edge.

Market Key Players

- Microsoft Corporation

- Tata Communications

- IBM Corporation

- Alcatel-Lucent Enterprise

- Avaya Inc.

- Cisco Systems, Inc.

- Mitel Network Corporation

- NEC Corporation

- Poly Inc.

- Unify

- Verizon Communications Inc.

Recent Development

- In May 2023, NEC Corporation introduced UNIVERGE BLUE ARCHIVE in May 2023, a data retention solution integrated with its UC platform. This service enhances communication compliance by enabling better search and retrieval capabilities for business communications across different channels, such as voicemail and chat

- In January 2023 Microsoft Corporation partnered with Verizon Communications to launch Teams Phone Mobile, offering a seamless integration of mobile devices with Microsoft Teams for enhanced collaboration. This solution provides enterprises with the flexibility of mobile-first communication while maintaining strong security and compliance features

- In August 2023, Avaya Inc. signed a cooperative purchasing contract with Sourcewell. This contract allows U.S. and Canadian customers to easily procure Avaya's UC solutions through authorized partners, enhancing accessibility and flexibility in both private and public sectors

- In August 2023 Mitel Networks launched a new version of MiCollab. This tool focuses on enhancing collaboration with features like unified messaging and voice, meeting provider flexibility, and improved user experience, aimed at making communication more seamless for businesses

Report Scope

Report Features Description Market Value (2023) USD 134.2 Bn Forecast Revenue (2033) USD 630.6 Bn CAGR (2024-2032) 17.2% Base Year for Estimation 2023 Historic Period 2016-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component(Software,Services,Hardware), By Deployment Mode (On-premise, Hosted), By Organization (SMEs, Large Enterprises), End User(BFSI, Manufacturing, Education, IT & Telecom, Retail & Ecommerce, Government & Defense, Healthcare & Life Sciences, Others) Regional Analysis North America - The US, Canada, Rest of North America, Europe - Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe, Asia-Pacific - China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Latin America - Brazil, Mexico, Rest of Latin America, Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa Competitive Landscape Microsoft Corporation, Tata Communications, IBM Corporation, Alcatel-Lucent Enterprise, Avaya Inc., Cisco Systems Inc., Mitel Network Corporation, NEC Corporation, Poly Inc., Unify, Verizon Communications Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Microsoft Corporation

- Tata Communications

- IBM Corporation

- Alcatel-Lucent Enterprise

- Avaya Inc.

- Cisco Systems Inc.

- Mitel Network Corporation

- NEC Corporation

- Poly Inc.

- Unify

- Verizon Communications Inc.