Supply Chain Management Software Market By Type (Small & Medium-Sized Enterprises, Large Enterprises, and Other), Deployment Mode (On-Premises, Cloud), End Use Analysis(Healthcare, FMCG, And Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

-

26690

-

Jul 2023

-

160

-

-

This report was compiled by Correspondence Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Report Overview

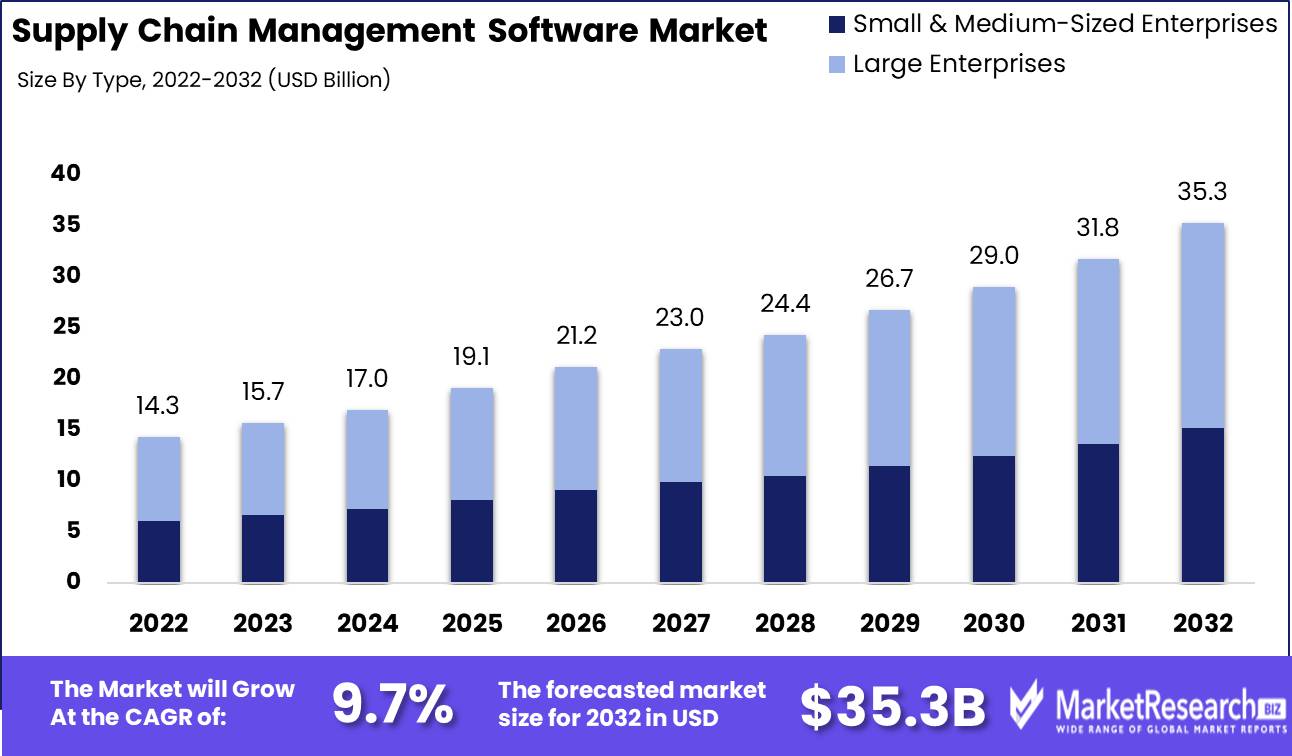

Supply Chain Management Software market size is expected to be worth around USD 35.3 Bn by 2032 from USD 14.3 Bn in 2022, growing at a CAGR of 9.7% during the forecast period from 2023 to 2032.

The supply chain management software market has experienced a meteoric rise in prominence in recent years, propelled by the rise of globalization and e-commerce. In the following discussion, we will engage in a comprehensive exploration of this multifaceted domain, delving into its myriad facets including the very definition and overarching objectives of supply chain management software, its profound significance, a plethora of benefits, notable waves of innovation that have permeated the market, significant investments and their subsequent incorporation into products and services, the meteoric growth trajectory, and various apprehensions.

The domain of supply chain management software encompasses a multitude of technological solutions ingeniously designed to improve the operational efficiency of companies' supply chains. This comprehensive scope incorporates inventory management, logistics, and sales and marketing operations. The primary objective of supply chain management software is the creation of a streamlined, cost-effective supply chain that can adapt quickly to market fluctuations, reflecting the growing need for operational agility and astute responsiveness.

Unquestionably, one of the most remarkable benefits of supply chain management software is its ability to give businesses a competitive edge, resulting in measurable enhancements to their supply chain operations. By leveraging software-driven automation and optimization, businesses will be able to achieve substantial cost reductions while concurrently enhancing their time-to-market efficiency, thereby fostering greater agility and enhancing their ability to effectively meet customer demands.

The field of supply chain management software has witnessed a staggering number of market-altering innovations. The rise of artificial intelligence and machine learning technologies is the most notable of these ground-breaking advances. AI and machine learning have the uncanny ability to analyze immense amounts of data and generate insightful predictions based on such analyses, thereby empowering businesses to optimize their supply chain operations in novel and unprecedented ways.

Driving factors

The ever-increasing importance of supply chain optimization

Many variables are contributing to the growth of the supply chain management software market. Optimisation of the supply chain is becoming an increasingly urgent necessity, to begin with. The expansion of firms and the growth of global trade both contribute to the complexity and unmanageability of supply chains. Companies can save expenses and increase efficiency by streamlining their processes with the aid of supply chain management software.

The ever increasing demand for cloud-based supply chain management solutions

The increasing adoption of SCM solutions that are hosted in the cloud is another factor that is helping to the expansion of the market. Because of these solutions, businesses are able to access their data from any location, which simplifies cooperation and increases visibility throughout the supply chain. As a result, this enables businesses to improve the quality of their judgements, enhance the efficiency of their logistics, and cut expenses.

Integration of technology related to the Internet of Things and automation

One further aspect that is driving growth in the supply chain management software market is the integration of the Internet of Things and automation technologies. These technologies for businesses to keep track of their products and activities in real time, which in turn improves the visibility of the supply chain and reduces expenses. In addition, a large numberjudgmentssses are embracing AI and machine learning in order to gain superior insights. These technologies can assist businesses in performing data analysis in a more effective manner, hence lowering costs and enhancing decision-making.

Adoption of artificial intelligence and machine learning for improved insights.

The growth of the e-commerce business as well as the increase of international trade are driving demand for supply chain management software. The supply chain is becoming more complicated as a result of the growing number of businesses that are conducting thetons online. Companies can keep track of their products, cut expenses, and increase efficiency with more effective on management software.

Restraining Factors

High Costs of Implementation and Maintenance:

SCM software's costly implementation and maintenance costs are one of the most significant factors inhibiting its growth. Today's businesses are searching for cost-effective supply chain management solutions. Numerous organisations are hesitant to employ SCM software due to the high implementation and maintenance costs.

Comprehensive SCM software implementation necessitates a substantial initial investment. This includes hardware, software, and licensing fees. Costs for maintenance, such as software updates, hardware enhancements, and user training, are recurring and will accumulate over time. Organizations must carefully consider the benefits and costs of SCM software implementation before investing in this technology.

Data Privacy Organizations concerns:

Data security and privacy concerns are additional market restraints for SCM software. Supplier and vendor information, consumer data, and financial transactions are stored by SCM software. This information is vulnerable to cyberattacks, theft, and improper use. Companies must ensure that their SCM software is equipped with robust security features that safeguard their data from unauthorised access, hacking, and other cyberattacks. In addition, businesses must comply with data privacy regulations such as GDPR and CCPA. The violation of these regulations may result in costly fines and legal issues.

Type Analysis

A continually changing sector, the supply chain management software market offers solutions to companies in numerous market categories. Large enterprises dominate this market segment because they need effective supply chain management to run their intricate operations. The need for supply chain management software solutions is rising as worldwide enterprises grow. Due to its strong organizational structure and effective management techniques, the major firm's segment is predicted to maintain its market dominance in the years to come.

The popularity of supply chain management software solutions has been fueled by the rise of developing economies like India, China, Brazil, and others. The economic expansion in these nations has given businesses opportunities, which has increased demand for effective supply chain management solutions, especially in the large corporations segment.

Consumer trends and behavior are changing as a result of consumers' increased purchasing awareness. There has been an increase in demand for supply chain management software solutions as customers desire faster shipping and delivery alternatives. Customers have been satisfied and have returned to businesses as a result of the large enterprises segment's assistance in providing prompt delivery to consumers. Especially in the segment of large organisations, this trend is predicted to drive demand for supply chain management software solutions.

Component Analysis

In the supply chain management software market, the solution segment dominates. From inventory management to transportation globalization chain software solutions are made to handle all the important parts of the supply chain. The solution segment offers enterprise-to-end solutions that can be tailored to fit certain corporate needs.

The adoption of supply chain management software solutions, particularly in the solution segment, has been sparked by the growth of emerging economies' economies. Businesses that want to expand need software that can efficiently manage a variety of operations. The desire for solutions that can manage the supply chain effectively has been further spurred by the expansion of e-commerce platforms.

Businesses now have a big challenge in maximizing their operations due to consumer demand for speedier shipping and delivery alternatives. By offering effective software solutions that can manage the supply chain from the point of origin to the point of sale, the solution segment enables businesses to successfully meet client requests.

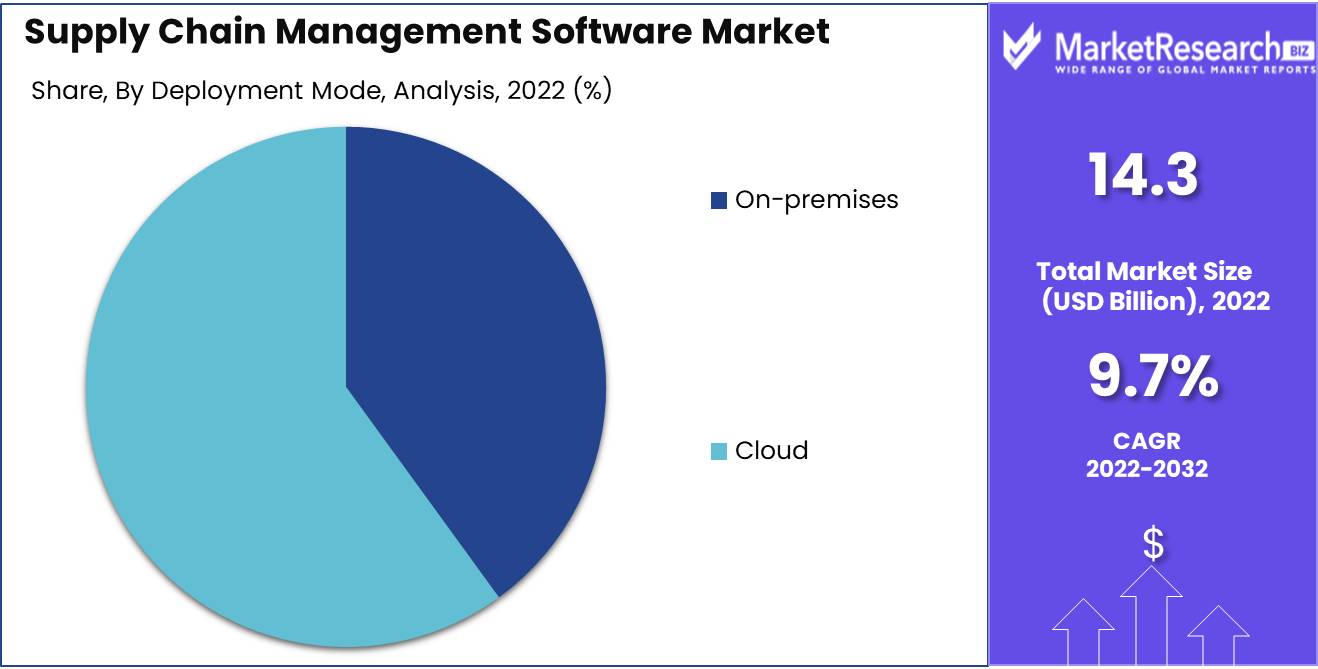

Deployment Mode Analysis

The supply chain management software market is dominated by the cloud segment. The cloud-based solution gives organizations the flexibility, scalability, and cost-effectiveness they need to efficiently manage their supply chain operations. Because the cloud-based solution is web-based, businesses may control their operations whenever and from wherever.

The use of cloud-based supply chain management software solutions is being driven by the economic growth of emerging economies. Businesses that want to expand need software that can efficiently manage a variety of operations. The demand for cloud-based solutions that can effectively manage the supply chain has increased as e-commerce platforms have grown.

Businesses now have a big challenge in maximizing their operations due to consumer demand for speedier shipping and delivery alternatives. By offering effective software solutions that can manage the supply chain from the point of origin to the point of sale, the cloud-based solution enables businesses to successfully meet client requests. In the upcoming years, the market for cloud-based supply chain management software solutions is anticipated to expand at the highest rate as companies work to improve their supply chains and satisfy client demands.

Key Market Segments

By Type

- Small & Medium-Sized Enterprises

- Large Enterprises

By Component

- Solution

- Hardware

- Software

- Services

Deployment Mode

- On-premises

- Cloud

End Use Analysis

- Healthcare

- FMCG

- Retail and E-commerce

- Manufacturing

- Automotive

- Transportation and Logistics

- Others (Construction, Oil and Gas, Aerospace and Defense, and Agriculture)

Growth Opportunity

A growing demand for supply chain visibility and transparency

Supply chain management software is a potent instrument that enables businesses to consolidate operations, optimise processes, and save time and money. With the growing demand for supply chain transparency and visibility, the increasing adoption of cloud-based supply chain management solutions, the expansion of e-commerce and omnichannel retail, and the emergence of blockchain technology, the supply chain management software market has never had a greater growth potential.

In recent years, supply chain transparency and visibility have become a top priority for businesses. When making purchasing decisions, nearly 70% of a premium is on transparency. To meet these demands, providers of supply chain management software are implementing sophisticated tracking systems that provide real-time data on the location and status of products throughout the supply chain. This enables businesses to identify and eliminate potential bottlenecks and inefficiencies, thereby enhancing product quality and delivery times.

Increasing adoption of supply chain management solutions in the cloud

Increasing adoption of cloud-based supply chain management solutions also contributes to industry expansion. The advantages of cloud-based solutions over traditional on-premises software include lower costs, greater scalability, and enhanced security. Consequently, an increasing number of businesses are adopting cloud-based supply chain management solutions to enhance their operations.

Increasing emphasis on ethical and sustainable supply chain practices

Sustainability and ethical supply chain practices are gaining importance among businesses and consumers. Supply chain management software can aid businesses in monitoring and managing their environmental impact and ensuring their suppliers adhere to ethical labour and procurement practises. This is especially crucial in industries such as fashion and retail, where concerns about worker exploitation and environmental degradation are becoming more widespread.

The emergence of blockchain technology, the expansion of e-commerce, and the emergence of omnichannel retail are all predicted to occur in the near future.

The emergence of blockchain technology is one of the most significant technological trends influencing the supply chain management industry. Blockchain provides a liberalized, secure, method for recording and validating transactions, making it an ideal solution for administering complex supply chains. By utilising blockchain technology, businesses can create immutable records of transactions, monitor products and shipments, and ensure that all supply chain participants are held accshortlyrends

Influential Market Trends Affecting the Supply Chain Management Software Market

Supply chain management software has revolutionized the way businesses manage their supply chains. With an abundance of software solutions available on the market, businesses are increasingly employing this technology. Numerous factors are utilizing to the anticipated development of the supply chain management software market. Among the industry's most significant market trends.

Increasing emphasis on ethical and sustainable supply chain practices

Sustainability and ethical business practices are acquiring importance on a global scale. Consumers are becoming more cognizant of the impact their purchasing decisions have on the environment and communities in which businesses operate. This has led to a greater emphasis on sustainability and ethical supply chain practices, resulting in businesses pursuing supply chain management software that can assist them in achieving their goals. With these solutions, businesses can transition to a more sustainable and ethical supply chain, boosting their reputation and consumer confidence in the process.

Growing demand for comprehensive supply chain management solutions

End-to-end supply chain management solutions are gaining popularity as organizations strive to optimize their supply chains. These solutions provide an integrated view of the supply chain, from procurement to delivery, thereby eradicating the silos that frequently exist within the supply chain of a business. This improves supply chain visibility and transparency and allows businesses to optimize supply chain operations, saving time and money.

Emergence of Blockchain Technology in Supply Chain Management

Blockchain technology is progressively being adopted by the supply chain management industry due to its superior transparency, security, and accountability. The technology ensures that every supply chain transaction and interaction is recorded securely and transparently, making monitoring and verification straightforward. In response to the increasing demand for transparent and ethical supply chains, blockchain technology is gaining ground in the supply chain management software industry.

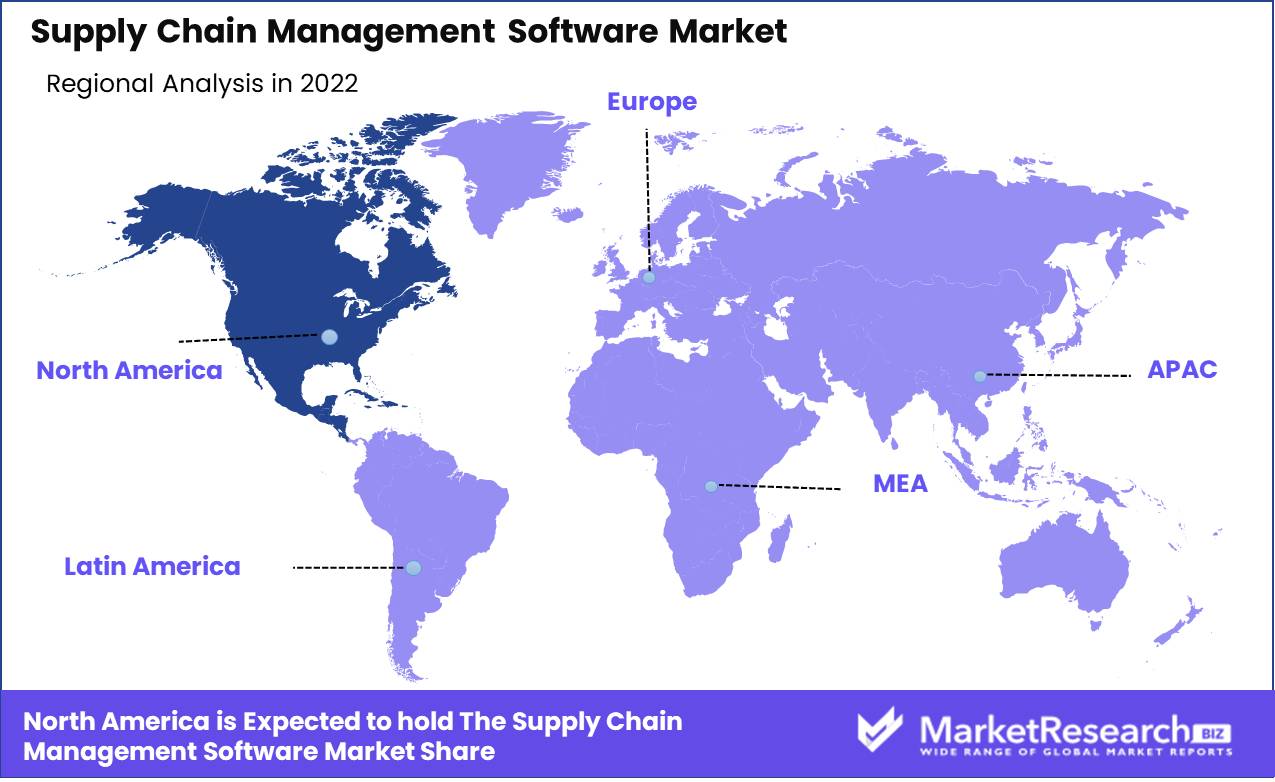

Regional Analysis

Supply chain management software is essential for organizations in the global economy. This technology streamlines supply chain coordination between suppliers, manufacturers, distributors, retailers, and consumers. Many regions have fast-growing supply chain management software markets. North America is dominating this market, according to the latest study, with a 34% revenue share. This post will examine why North America dominates supply chain management software. We'll also discuss why businesses need this technology to be competitive in a changing industry.

North America dominates supply chain management software for various reasons. First, the region has a strong transport and communication infrastructure. These variables have improved supply chain management in North America, cutting lead times and delivery times. North America dominates this market due to its high R&D spending. SAP, Oracle, and Microsoft are North American supply chain management software leaders. Top-tier organisations attract top talent from around the world, creating a highly trained and innovative workforce. Finally, supply chain management software firms may grow in North America's varied economy. A fertile environment for software companies to develop and improve their products is created by the region's numerous early adopters of technology. In today's global economy, supply chain management software is crucial. Previously, organisations could afford to manage their supply chains manually, but rising complexity and organizationsr real-time visibility have rendered this strategy obsolete.

Supply chain management software gives companies real-time supply chain visibility. This visibility lets companies track their supply chain from procurement to delivery. It also helps organizations detect and resolve issues quickly, minimizing operational disruptions. Another benefit of supply chain management software is greater teamwork. Businesses may rorganizationsunication and delays by giving stakeholders real-time data. Finally, supply chain management software improves decision-making. Businesses may make informed decisions to be competitive and profitable with accurate and up-to-date supply chain data.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Market Share & Key Players Analysis

The numerous tools and technologies used to manage the flow of goods, services, and information from suppliers to customers are referred to as Supply Chain Management (SCM) software. Different approaches, features, and pricing models are utilised by a number of market leaders. This article will provide a concise overview of some of the most prominent SCM software vendors.SAP is the dominant player in the SCM software industry, offering solutions for a variety of industries, including retail, manufacturing, and logistics. It provides an extensive selection of software products and services, ranging from demand planning to logistics and transportation management.

Oracle is an additional prominent company that provides a vast array of SCM software solutioutilizedudinseveralfor demand planning, warehouse management, and transportation management. In addition, it offers cloud-based SCM services with an emphasis on supply chain visibility and collaboration.IBM is the industry champion in supply chain analytics and optimization. By analysing data and identifying inefficiencies, the company's AI-powered software enables businesses to optimise their supply chains. Microsoft's Dynamics 365 Supply Chain Management software optimizes supply chain management by means of intelligent automation, demand planning, and real-time insights. It integrates with Microsoft's Power BI and Azure, among others.

In addition, lesser competitors such as Manhattan Associates, JDA Software, and Infor offer SCM software solutions with distinctive features and strengths. In analyzingn, the SCM software market is highly competitive, and businesses have a vast selection of softoptimizeutions from which to optimise their supply chain management performance. Selecting the appropriate software can husingficant impact on a company's financial performance, regardless of whether it is an established entity or a newer business.

Top Key Players in the Supply Chain Management Software Market

- Comarch

- Aspen Technology Inc.

- IBM Corporation

- JDA Software Group Inc.

- Infor

- Oracle Corporation

- Kinaxis

- QAD Inc.

- Plex Manufacturing Cloud

- SAP SE

- Sage

- Vanguard Software.

Recent Development

- In 2021, DHL announced a partnership with supply provider BluJay Solutions in December 2021, signifying a significant step forward in DHL's digital transformation journey. Using real-time data analysis, automation, and predictive analytics, this partnership will allow DHL to optimise its planning and execution.

- In 2021, A few months earlier, in October 2021, E2open, a cloud-based supply chain software provider, acquired BluJay Solutions, expanding its portfolio to include transportation management and logistics optimisation capabilities.

- In September 2021, JAGGAER, a provider of supply chain software, announced its acquisition of Pool4Tool, a prominent provider of procurement software. This acquisition will strengthen JAGGAER's end-to-end source-to-pay capabilities, enabling clients to optimize efficiencies and reduce costs.

- In 2021, Descartes Systems Group, a provider of logistics software, announced its acquisition of Portrix Logistics Software, a prominent provider of global air freight rate management solutions, inoptimizationThis strategic step will allow Descartes to provide its customers with more comprehensive routing and pricing options for air freight.

Report Scope

Report Features Description Market Value (2022) USD 14.3 Bn Forecast Revenue (2032) USD 35.3 Bn CAGR (2023-2032) 9.7% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type: Small and medium-sized Enterprises, Large Enterprises, By Component: Solution, Hardware, Software, Services, Deployment Mode: On-premises, Cloud, End Analysis, Healthcare, FMCG, Retail and E-commerce, Healthcare, Manufacturing, Automotive, Transportation and Logistics, Others (Construction, Oil and Gas, Aerospace and Defense, and Agriculture) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Comarch, Aspen Technology Inc., IBM Corporation, JDA Software Group Inc., Infor, Oracle Corporation, Kinaxis, QAD Inc., Plex Manufacturing Cloud, SAP SE, Sage, Vanguard Software. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Comarch

- Aspen Technology Inc.

- IBM Corporation

- JDA Software Group Inc.

- Infor

- Oracle Corporation

- Kinaxis

- QAD Inc.

- Plex Manufacturing Cloud

- SAP SE

- Sage

- Vanguard Software.