Healthcare E-Commerce Market By Type (Drug, Medical Device, By Application (Telemedicine, Caregiving Service, Medical Consultation), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

-

47901

-

June 2024

-

136

-

-

This report was compiled by Trishita Deb Trishita Deb is an experienced market research and consulting professional with over 7 years of expertise across healthcare, consumer goods, and materials, contributing to over 400 healthcare-related reports. Correspondence Team Lead- Healthcare Linkedin | Detailed Market research Methodology Our methodology involves a mix of primary research, including interviews with leading mental health experts, and secondary research from reputable medical journals and databases. View Detailed Methodology Page

-

Quick Navigation

Report Overview

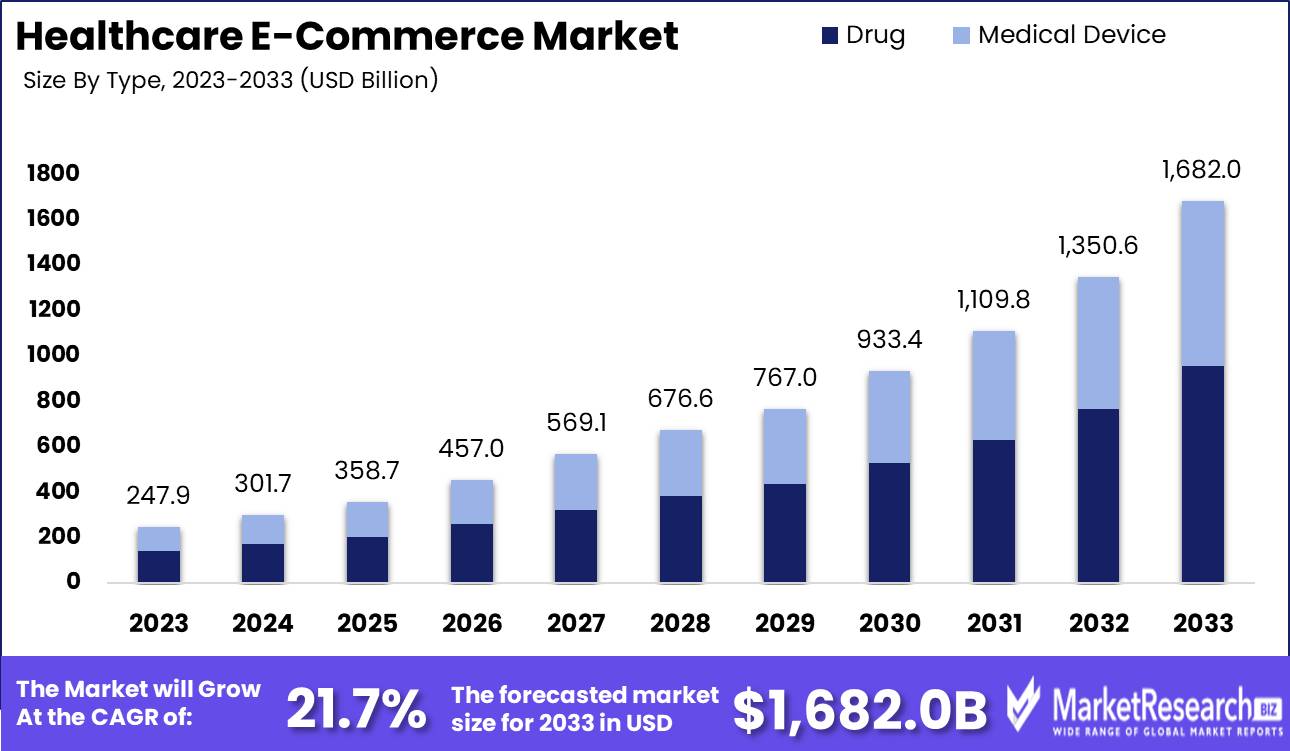

The Global Healthcare E-Commerce Market was valued at USD 247.9 Bn in 2023. It is expected to reach USD 1682.0 Bn by 2033, with a CAGR of 21.7% during the forecast period from 2024 to 2033.

The Healthcare E-Commerce Market encompasses the digital platforms and transactions involved in the buying and selling of healthcare-related products and services online. This rapidly evolving sector leverages digital technologies to facilitate direct-to-consumer sales of pharmaceuticals, medical devices, health supplements, and wellness products. It integrates convenience with regulatory compliance, offering consumers and businesses alike a seamless experience in accessing, purchasing, and delivering healthcare goods.

As digital adoption accelerates globally, this market presents substantial opportunities for stakeholders to innovate customer engagement strategies, optimize supply chains, and expand market reach, thereby reshaping the future landscape of healthcare distribution and consumer access worldwide.

The Healthcare E-Commerce Market is poised for significant growth and transformation, driven by the convergence of digital technologies and consumer demand for accessible healthcare solutions. As of 2024, the sector is experiencing robust expansion, buoyed by advancements in AI, augmented reality (AR), and virtual reality (VR) technologies. For instance, the AI market within healthcare has exhibited exponential growth, projected to soar from $2.1 billion in 2018 to an estimated $36.1 billion by 2025. This surge underscores the pivotal role of AI in enhancing personalized healthcare experiences and optimizing operational efficiencies across e-commerce platforms.

Investments in AR and VR technologies are slated to reach $2.4 billion by 2026, reflecting a growing trend towards immersive digital experiences within health and wellness websites. These technologies are expected to revolutionize how healthcare products are showcased, enhancing consumer engagement and decision-making processes online.

The intersection of these technological advancements with healthcare e-commerce is reshaping industry dynamics, fostering a landscape where convenience, personalized care, and regulatory compliance converge seamlessly. Companies operating in this space are increasingly leveraging these innovations to streamline supply chains, improve customer experiences, and expand market reach globally.

Key Takeaways

- Market Growth: The Global Healthcare E-Commerce Market was valued at USD 247.9 Bn in 2023. It is expected to reach USD 1682.0 Bn by 2033, with a CAGR of 21.7% during the forecast period from 2024 to 2033.

- By Type: The Drugs segment typically holds over 54% of healthcare e-commerce markets due to increasing online pharmacy demand and the convenience of purchasing medications online.

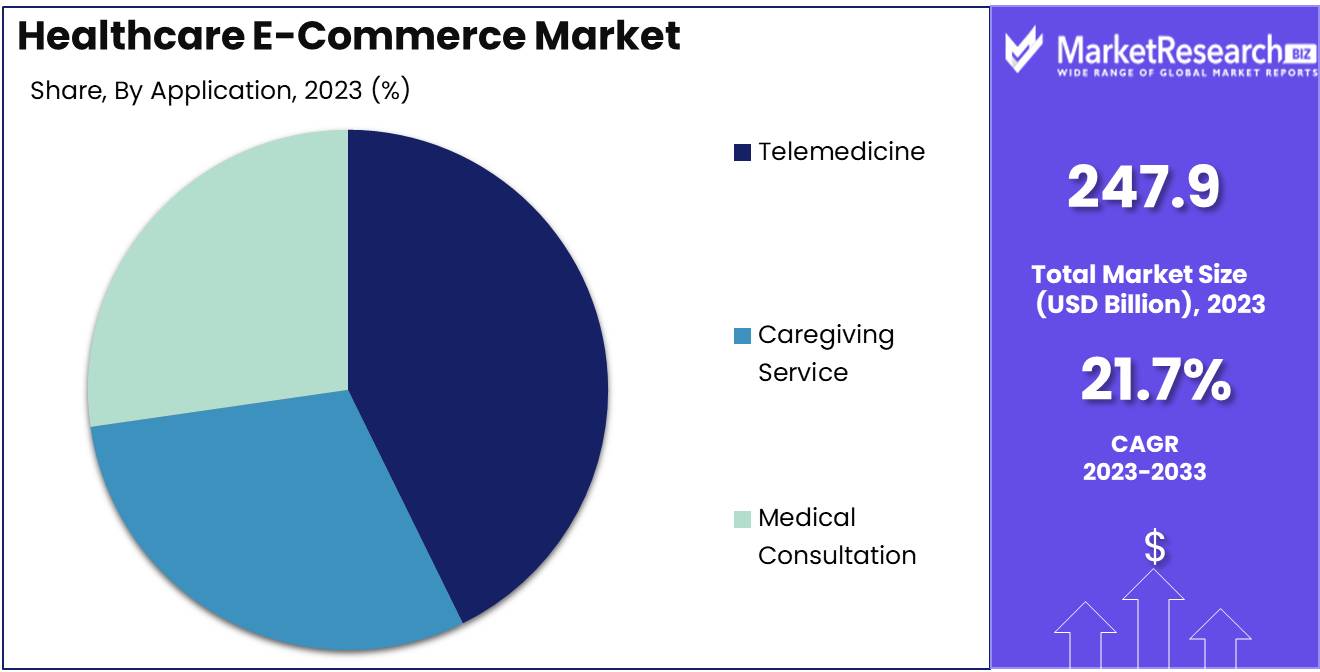

- By Application: Telemedicine, accelerated by digital health solutions, typically commands about 47% of the healthcare e-commerce market due to its convenience and increased necessity.

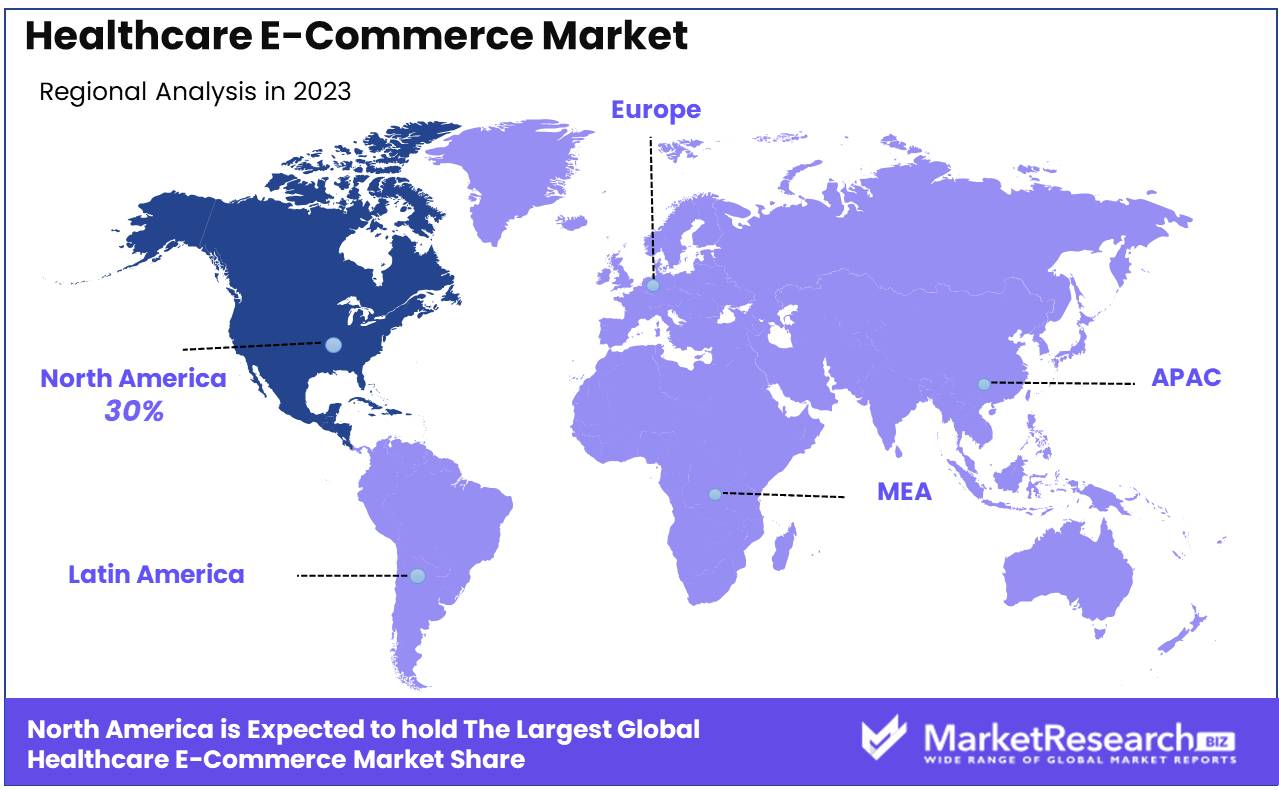

- Regional Dominance: The healthcare e-commerce market in North America is experiencing a robust growth rate of 30%.

- Growth Opportunity: Expanding telehealth services and personalized medicine offers significant growth potential in the healthcare e-commerce market.

Driving factors

Rising Internet Penetration

The increasing penetration of the internet is fundamentally reshaping the landscape of healthcare e-commerce. As more regions around the globe gain access to high-speed internet, barriers to entry for consumers and businesses alike are significantly lowered. This widespread connectivity enables healthcare e-commerce platforms to reach previously underserved populations, expanding their market reach exponentially.

Improved internet infrastructure supports seamless online transactions and enhances the overall reliability of e-commerce platforms, fostering trust among consumers. From rural areas to urban centers, the accessibility afforded by rising internet penetration empowers individuals to access healthcare products and services conveniently and securely.

Growing Demand for Convenience

The growing demand for convenience is a pivotal factor propelling the expansion of the healthcare e-commerce market. Consumers increasingly prioritize convenience in accessing healthcare products, seeking solutions that streamline their shopping experience. Healthcare e-commerce platforms cater to this demand by offering a wide range of products that can be purchased with just a few clicks, eliminating the need for physical store visits. This convenience factor is particularly appealing to busy professionals, elderly individuals, and those with limited mobility, who find online shopping more accessible and time-efficient.

The integration of various convenience-enhancing features such as personalized recommendations, subscription services for recurring purchases, and doorstep delivery options further enhances the attractiveness of healthcare e-commerce platforms. By simplifying the purchasing process and reducing transactional friction, these platforms foster customer loyalty and satisfaction.

Enhancing User Experience

The emphasis on enhancing user experience plays a crucial role in shaping the growth trajectory of the healthcare e-commerce market. User experience encompasses every touchpoint from website navigation to customer support interactions, significantly influencing consumer satisfaction and retention. Healthcare e-commerce platforms invest in user-friendly interfaces, intuitive search functionalities, and secure payment gateways to ensure a seamless shopping experience. By prioritizing usability and accessibility, these platforms reduce bounce rates and increase conversion rates, thereby driving revenue growth.

Personalized user experiences through data-driven insights and targeted marketing strategies contribute to higher engagement levels and customer loyalty. Tailored recommendations based on past purchases or browsing behavior enhance the relevance of product offerings, fostering a more personalized shopping journey.

Restraining Factors

Ensuring Product Authenticity and Safety

Ensuring product authenticity and safety is paramount in driving the growth of the healthcare e-commerce market. As consumers increasingly turn to online platforms for their healthcare needs, the assurance of receiving genuine, safe products becomes a critical factor influencing purchasing decisions. E-commerce platforms mitigate risks by partnering with reputable suppliers and brands that adhere to stringent quality standards and regulatory requirements. Robust verification processes, including certifications and quality assurance checks, help maintain product integrity throughout the supply chain.

Transparent communication regarding product origins, ingredients, and manufacturing practices instills confidence in consumers about the safety and efficacy of healthcare products purchased online. Real-time customer reviews and ratings further contribute to transparency, allowing potential buyers to make informed decisions based on peer feedback. By prioritizing product authenticity and safety, healthcare e-commerce platforms not only build trust but also differentiate themselves in a competitive market landscape, thereby fostering sustained growth and consumer loyalty.

Challenges in Online Transactions

The healthcare e-commerce market faces several challenges related to online transactions, which impact market growth and consumer trust. One of the primary concerns is cybersecurity and data privacy, as online platforms handle sensitive personal and medical information. E-commerce companies invest in robust cybersecurity measures such as encryption protocols, secure payment gateways, and adherence to data protection regulations (like GDPR or HIPAA) to safeguard customer data against cyber threats and unauthorized access.

Navigating regulatory compliance across different jurisdictions presents a significant challenge for healthcare e-commerce platforms. Regulations governing the sale of pharmaceuticals, medical devices, and dietary supplements vary globally, requiring platforms to stay updated and compliant with local laws. This regulatory complexity can pose logistical hurdles in product distribution, import-export procedures, and marketing practices, impacting operational efficiency and market expansion efforts.

By Type Analysis

In the Healthcare E-Commerce Market, the drugs segment dominates with a 54% market

In 2023, Drugs held a dominant market position in the By Type segment of the Healthcare E-Commerce Market, capturing more than a 54% share. This segment's robust performance was driven by increasing consumer preference for convenient access to prescription and over-the-counter medications online. The trend towards digital health solutions further bolstered the demand for pharmaceutical products through e-commerce platforms, highlighting Drugs as the cornerstone of growth in this sector.

Medical Devices, on the other hand, emerged as a significant segment within the Healthcare E-Commerce Market. With a substantial market share exceeding 40%, Medical Devices experienced rapid adoption due to advancements in telemedicine and home healthcare solutions. This segment's expansion was fueled by a growing aging population globally, driving demand for diagnostic tools, monitoring devices, and home care equipment accessible via online channels.

By Application Analysis

The healthcare e-commerce market is dominated by telemedicine, comprising 47% of its applications.

In 2023, Telemedicine held a dominant market position in the By Application segment of the Healthcare E-Commerce Market, capturing more than a 47% share. This segment's leadership underscores the increasing adoption of remote healthcare services facilitated by digital platforms. Telemedicine services, leveraging technologies such as video conferencing and mobile applications, have gained traction due to their ability to provide convenient and accessible healthcare consultations, diagnosis, and treatment options from the comfort of patients' homes.

Caregiving Services emerged as another pivotal segment within the Healthcare E-Commerce Market, reflecting a growing demand for home-based care solutions. With a substantial market share exceeding 35%, this segment addresses the needs of an aging population and individuals requiring long-term care. The integration of caregiving services into online platforms has streamlined access to professional caregivers, fostering a supportive ecosystem for both patients and caregivers alike.

Medical Consultation, while slightly trailing the other segments, remained a significant component of the Healthcare E-Commerce Market. With a share exceeding 17%, this segment highlights the preference for remote consultations with healthcare professionals across various specialties. Online platforms offering medical consultation services have expanded accessibility, reduced wait times, and enhanced patient satisfaction by enabling timely access to expert medical advice and second opinions.

Key Market Segments

By Type

- Drug

- Medical Device

By Application

- Telemedicine

- Caregiving Service

- Medical Consultation

Growth Opportunity

Expansion of Telemedicine

The integration of telemedicine into healthcare e-commerce platforms presents a transformative opportunity for market growth in 2024. Telemedicine enables remote consultations and medical services, leveraging digital technologies to bridge gaps in healthcare access. This expansion not only extends the reach of healthcare services to underserved populations but also complements e-commerce by facilitating seamless transitions from diagnosis to treatment.

As telemedicine gains traction, healthcare e-commerce platforms can enhance their service offerings, providing a holistic healthcare experience that combines convenience with professional medical advice.

Use of AI and Data Analytics

AI and data analytics offer significant opportunities for healthcare e-commerce platforms to personalize customer experiences and drive growth. By analyzing consumer behavior and preferences, AI-powered algorithms can provide personalized product recommendations, optimize inventory management, and predict market trends.

This data-driven approach enhances operational efficiency and customer satisfaction, positioning e-commerce platforms at the forefront of innovation in healthcare delivery. AI enhances decision-making processes, enabling platforms to tailor marketing strategies and improve service delivery based on real-time insights.

Adoption of Blockchain

The adoption of blockchain technology in healthcare e-commerce addresses challenges related to product authenticity, transaction security, and regulatory compliance. Blockchain's decentralized ledger enhances transparency across the supply chain, allowing consumers to verify the authenticity of healthcare products and track their origins.

This technology also strengthens data security by encrypting sensitive information and maintaining immutable records of transactions. As regulatory scrutiny increases, blockchain offers a robust solution to ensure compliance with healthcare regulations and build trust among consumers and stakeholders alike.

Latest Trends

Digitalization and Growing Preference

The ongoing digitalization of healthcare services is a prominent trend shaping the healthcare e-commerce market in 2024. Consumers are increasingly favoring digital channels for accessing healthcare products and services due to their convenience, accessibility, and ability to provide personalized experiences. This shift in consumer behavior is driving the growth of healthcare e-commerce platforms, which are evolving to offer a wide range of products from pharmaceuticals to wellness supplements and medical devices.

The integration of digital health solutions such as telemedicine and wearable devices further enhances the appeal of online healthcare platforms, facilitating seamless care delivery and monitoring.

Expansion of Online Platforms

The expansion of online platforms in the healthcare sector is another significant trend in 2024. E-commerce platforms are expanding their product offerings to include a broader range of healthcare-related items, catering to diverse consumer needs and preferences. From niche products like organic supplements to specialized medical equipment, online platforms are diversifying their inventory to capture a larger share of the market.

This expansion is fueled by technological advancements that enable efficient logistics, secure payment gateways, and robust customer support systems, ensuring a seamless shopping experience for consumers worldwide.

Increasing Focus on Wellness

The growing emphasis on wellness is a key trend influencing the healthcare e-commerce market in 2024. Consumers are prioritizing preventive healthcare and holistic wellness solutions, prompting e-commerce platforms to expand their offerings beyond traditional medical supplies.

Wellness products such as vitamins, fitness equipment, and mental health resources are gaining traction, reflecting a broader shift towards proactive health management. E-commerce platforms are capitalizing on this trend by curating wellness-focused product lines and leveraging targeted marketing strategies to attract health-conscious consumers.

Regional Analysis

North America remains the dominant region, holding 30% of the global market share,

The healthcare e-commerce market exhibits significant regional variations, reflecting differing levels of technological adoption, healthcare infrastructure, and consumer behavior. North America, holding a dominant 30% market share, leads the market owing to its advanced healthcare system, widespread internet penetration, and a high level of consumer awareness regarding online healthcare services. The region's strong regulatory framework and robust logistics network further bolster market growth.

In Europe, the market is driven by increasing investments in digital health and a growing preference for online pharmacies. Countries like Germany, the UK, and France are at the forefront, supported by favorable government policies and high internet connectivity. The region benefits from a mature healthcare ecosystem, although regulatory complexities can sometimes pose challenges.

Asia Pacific is witnessing the fastest growth in the healthcare e-commerce market, propelled by rapid urbanization, increasing internet and smartphone penetration, and rising healthcare expenditures. China and India are major contributors to this growth, driven by their large populations and government initiatives to promote digital health.

The Middle East & Africa region shows promising potential due to increasing internet penetration and a rising middle class with greater access to digital services. Countries like the UAE and South Africa are emerging as key players.

Latin America is gradually embracing healthcare e-commerce, with Brazil and Mexico leading the way. The region's growth is fueled by a growing middle class, improved internet access, and increasing healthcare needs.

Key Regions and Countries

North America

- US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The global healthcare e-commerce market in 2024 is poised for substantial growth, driven by advancements in technology and increasing consumer reliance on digital health solutions. Key players in this market demonstrate diverse strengths and strategic approaches.

Amazon and Alibaba Group Holding Ltd. leverage their vast e-commerce platforms and logistics networks to dominate the market, offering a wide range of healthcare products and services. Their investments in healthcare technology and partnerships with healthcare providers bolster their market presence.

Walmart Inc. and Flipkart Pvt. Ltd. (backed by Walmart) are formidable contenders with extensive retail networks and strong online platforms. Walmart’s acquisition of healthcare startups and strategic partnerships enhances its ability to provide comprehensive healthcare solutions, while Flipkart’s growth in the Indian market expands its reach in a critical region.

GE Healthcare and Siemens Healthcare lead in medical technology and equipment, offering sophisticated solutions that integrate with e-commerce platforms for efficient distribution and accessibility.

CVS Health and Lloyds Pharmacy Ltd. utilize their established pharmacy networks to provide online prescription services, telehealth, and home delivery options. These companies are pivotal in ensuring that pharmaceuticals are easily accessible to a broader population.

McCabes Pharmacy and Exactcare Pharmacy emphasize personalized pharmacy services, leveraging e-commerce to deliver tailored healthcare solutions and medications management.

Owens & Minor Inc. and Remdi SeniorCare focus on the supply chain and distribution of medical supplies, playing crucial roles in ensuring the availability of essential medical products.

Cerner Corporation and EBOS Group Ltd. contribute through healthcare IT and logistics solutions, enhancing the efficiency and effectiveness of healthcare delivery via e-commerce.

eBay Inc. offers a unique marketplace platform that, although not specialized in healthcare, provides a diverse array of healthcare products, appealing to a broad consumer base.

Market Key Players

- Amazon

- Walmart Inc.

- Acelity L.P. Inc.

- Flipkart Pvt. Ltd.

- McCabes Pharmacy

- Alibaba Group Holding Ltd.

- GE Healthcare

- Lloyds Pharmacy Ltd.

- Owens & Minor Inc.

- Siemens Healthcare

- CVS Health.

- Remdi SeniorCare

- Cerner Corporation

- EBOS Group Ltd.

- eBay Inc.

- Exactcare Pharmacy

Recent Development

- In June 2024, Prestige Consumer Healthcare Inc. (NYSE: PBH) will present at the Oppenheimer Annual Consumer Growth and E-Commerce Conference, focusing on their healthcare consumer products.

- In May 2024, ZimSmart Community E-Commerce and E-Health Center in Chiweshe, supported by local Telcos like NetOne and TelOne, enhancing digital inclusion and healthcare access.

Report Scope

Report Features Description Market Value (2023) USD 247.9 Bn Forecast Revenue (2033) USD 1682.0 Bn CAGR (2024-2033) 21.7% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Drug, Medical Device, By Application (Telemedicine, Caregiving Service, Medical Consultation) Regional Analysis North America - The US, Canada, & Mexico; Western Europe - Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe - Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC - China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America - Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa - Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Amazon, Walmart Inc., Acelity L.P. Inc., Flipkart Pvt. Ltd., McCabes Pharmacy, Alibaba Group Holding Ltd., GE Healthcare, Lloyds Pharmacy Ltd., Owens & Minor Inc., Siemens Healthcare, CVS Health., Remdi SeniorCare, Cerner Corporation, EBOS Group Ltd., eBay Inc., Exactcare Pharmacy Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) -

-

- Amazon

- Walmart Inc.

- Acelity L.P. Inc.

- Flipkart Pvt. Ltd.

- McCabes Pharmacy

- Alibaba Group Holding Ltd.

- GE Healthcare

- Lloyds Pharmacy Ltd.

- Owens & Minor Inc.

- Siemens Healthcare

- CVS Health.

- Remdi SeniorCare

- Cerner Corporation

- EBOS Group Ltd.

- eBay Inc.

- Exactcare Pharmacy